Key Insights

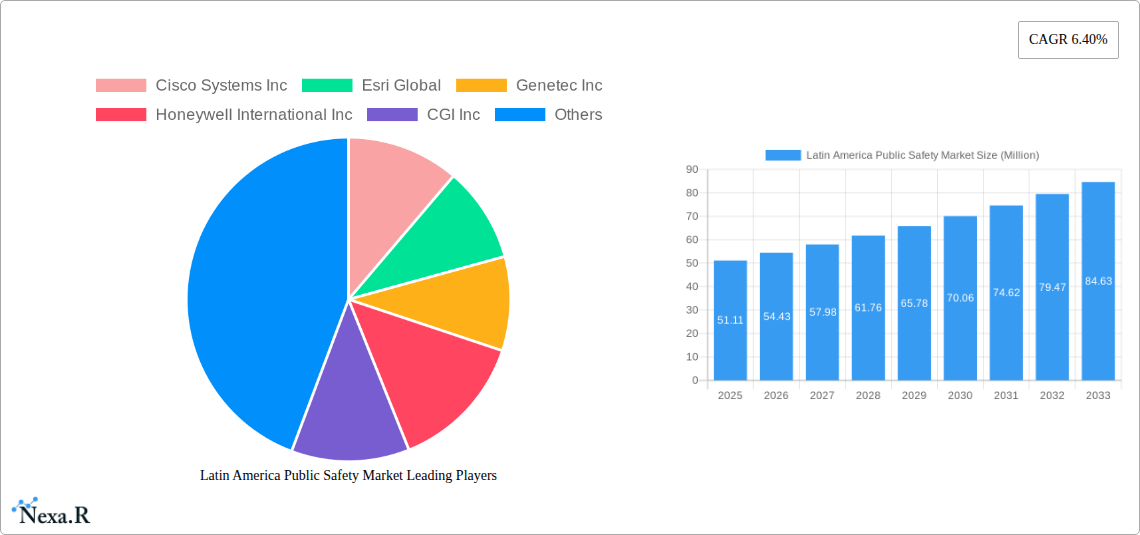

The Latin American Public Safety Market is experiencing robust growth, projected to reach \$51.11 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.40% from 2025 to 2033. This expansion is fueled by several key factors. Increasing crime rates across major Latin American cities are driving significant investments in advanced surveillance technologies, such as CCTV systems, facial recognition software, and predictive policing analytics. Furthermore, governments are prioritizing public safety infrastructure modernization, spurred by a growing awareness of the need for efficient emergency response systems and improved crime prevention strategies. The rising adoption of smart city initiatives is also contributing to market growth, as integrated public safety platforms are being implemented to enhance situational awareness and resource allocation. Key players like Cisco Systems, Esri, and Motorola Solutions are strategically expanding their presence in the region, offering comprehensive solutions tailored to the unique needs of Latin American countries.

However, the market also faces challenges. Budgetary constraints in some nations and a lack of technological infrastructure in certain areas can hinder wider adoption. Data privacy concerns and the potential for misuse of surveillance technologies also represent significant headwinds. To overcome these obstacles, successful market players will need to focus on developing cost-effective solutions, prioritizing data security, and fostering collaboration with local governments and communities to build trust and ensure ethical implementation. The market segmentation within Latin America is likely diverse, reflecting the varying levels of economic development and public safety needs across different countries and regions. The continued focus on improving cybersecurity measures within public safety systems will also be a vital element for sustained growth.

Latin America Public Safety Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America Public Safety Market, encompassing market size, growth trends, key players, and future outlook. With a focus on both parent (Public Safety) and child markets (e.g., video surveillance, emergency response systems), this report equips industry professionals with actionable insights for strategic decision-making. The study period covers 2019-2033, with 2025 as the base and estimated year.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

Latin America Public Safety Market Dynamics & Structure

The Latin American public safety market is characterized by a moderately fragmented landscape, with a mix of multinational corporations and regional players. Market concentration is relatively low, presenting opportunities for both established players and new entrants. Technological innovation, driven by increasing adoption of AI, IoT, and cloud-based solutions, is a key driver of market expansion. However, varying regulatory frameworks across different countries and the prevalence of legacy systems pose challenges. The market also faces competition from product substitutes, such as improved community policing strategies. M&A activity is moderate, with a focus on strategic acquisitions to enhance product portfolios and expand regional presence. The end-user demographic primarily comprises government agencies (national and local), law enforcement, emergency services, and private security firms.

- Market Concentration: Low to Moderate (xx%)

- Technological Innovation: Strong focus on AI, IoT, and cloud solutions

- Regulatory Frameworks: Variable across countries, creating complexities

- M&A Activity: Moderate (xx deals in the last 5 years)

- End-User Demographics: Government agencies, law enforcement, emergency services, and private security firms.

Latin America Public Safety Market Growth Trends & Insights

The Latin America Public Safety Market is experiencing robust growth, driven by increasing crime rates, rising government investments in security infrastructure, and a growing demand for advanced technologies to improve public safety. The market size is projected to reach xx million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Adoption rates for advanced technologies, such as AI-powered video analytics and predictive policing systems, are steadily increasing. The market is witnessing a significant shift towards cloud-based solutions, driven by the need for scalability, accessibility, and cost-effectiveness. Consumer behavior is evolving towards increased demand for transparency and accountability from public safety agencies.

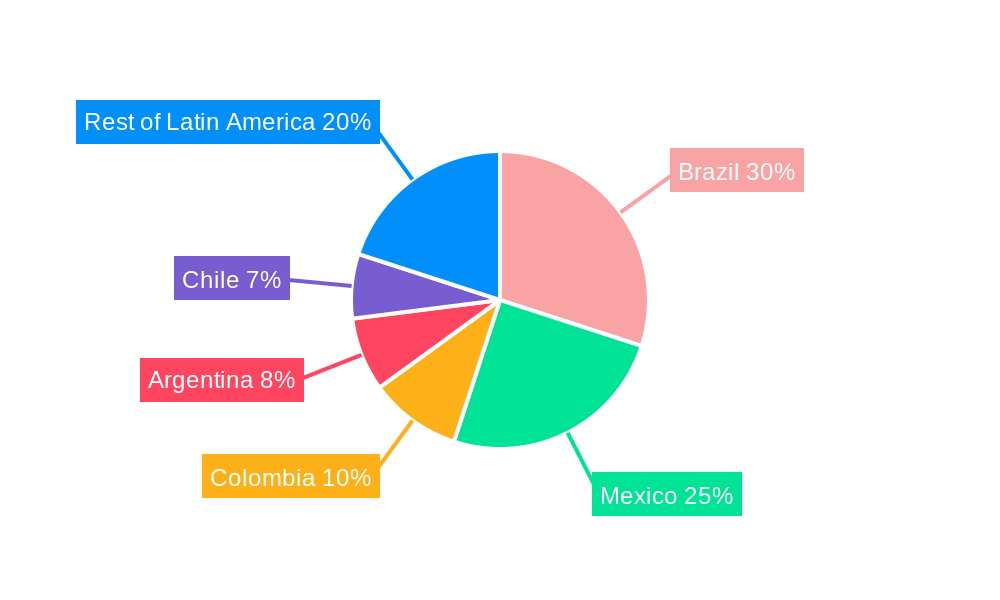

Dominant Regions, Countries, or Segments in Latin America Public Safety Market

Mexico and Brazil are the dominant markets within the Latin America Public Safety sector, accounting for a combined xx% of the total market share in 2025. Their dominance stems from a combination of factors, including larger populations, higher crime rates, greater government spending on public safety, and comparatively developed technological infrastructure. Other key countries include Colombia, Argentina, and Chile. The fastest-growing segments are those focused on intelligent transportation systems and smart city initiatives.

- Key Drivers in Mexico and Brazil:

- High crime rates

- Significant government investment in public safety

- Increasing adoption of advanced technologies

- Development of smart city initiatives

Latin America Public Safety Market Product Landscape

The market offers a diverse range of products, including video surveillance systems, command and control centers, body-worn cameras, biometric identification systems, and emergency response solutions. These products are constantly evolving, incorporating advanced features such as AI-powered analytics, cloud connectivity, and enhanced data security. Many vendors differentiate themselves through unique selling propositions, such as ease of integration, superior analytics capabilities, or specialized features tailored to specific regional needs.

Key Drivers, Barriers & Challenges in Latin America Public Safety Market

Key Drivers:

- Rising crime rates and security concerns

- Government initiatives to modernize public safety infrastructure

- Increasing adoption of advanced technologies (AI, IoT)

- Growing demand for enhanced situational awareness and predictive policing

Key Challenges:

- Budget constraints faced by many governments

- Lack of interoperability between different systems

- Cybersecurity risks associated with connected devices

- Limited digital infrastructure in some regions. This results in a xx% reduction in market penetration for advanced technologies.

Emerging Opportunities in Latin America Public Safety Market

Significant opportunities exist in expanding smart city initiatives, integrating emerging technologies like drones and facial recognition, and improving cybersecurity measures. Untapped potential lies in providing tailored solutions to specific regional needs and fostering public-private partnerships to fund and implement large-scale projects. The growing demand for data-driven insights will further drive market growth in predictive policing and crime prevention.

Growth Accelerators in the Latin America Public Safety Market Industry

Strategic partnerships between technology vendors and government agencies are crucial for accelerating market growth. Technological breakthroughs, specifically in AI-powered analytics and predictive policing, are transforming the industry. The ongoing expansion of 4G and 5G networks is enabling broader adoption of connected technologies. Market expansion into smaller, underserved regions will also contribute significantly to long-term growth.

Key Players Shaping the Latin America Public Safety Market Market

- Cisco Systems Inc

- Esri Global

- Genetec Inc

- Honeywell International Inc

- CGI Inc

- Thales Group

- ALE International

- Motorola Solutions Inc

- NEC Corporation

- Atos SE

- Idemia

- Kroll LLC

- Hexagon AB

- SAAB

- Central Squar

Notable Milestones in Latin America Public Safety Market Sector

- June 2023: Hexagon AB launched its Citizen Reporting portal, improving citizen-law enforcement interaction.

- February 2024: Irisity increased investment in Latin America, expanding its presence across multiple countries and partnering with local firms.

In-Depth Latin America Public Safety Market Market Outlook

The future of the Latin America Public Safety Market is bright. Continued technological advancements, coupled with increasing government investment and a growing focus on smart city initiatives, will drive substantial market expansion. Strategic partnerships, a robust pipeline of innovative solutions, and the increasing adoption of data-driven approaches will further fuel market growth, offering significant opportunities for both established and emerging players.

Latin America Public Safety Market Segmentation

-

1. Component

-

1.1. Software

- 1.1.1. Location Management

- 1.1.2. Record Management

- 1.1.3. Investigation Management

- 1.1.4. Crime Analysis

- 1.1.5. Criminal Intelligence

- 1.1.6. Other Software

- 1.2. Services

-

1.1. Software

-

2. Mode of Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Industry

- 3.1. Medical

- 3.2. Transportation

- 3.3. Law Enforcement

- 3.4. Firefighting

- 3.5. Other End-user Industries

Latin America Public Safety Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Public Safety Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data

- 3.2.2 Critical Infrastructure; Stringent Government Regulations to Invest in Safety Measures to Enhance Safety

- 3.3. Market Restrains

- 3.3.1 Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data

- 3.3.2 Critical Infrastructure; Stringent Government Regulations to Invest in Safety Measures to Enhance Safety

- 3.4. Market Trends

- 3.4.1. Software Component to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Public Safety Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Software

- 5.1.1.1. Location Management

- 5.1.1.2. Record Management

- 5.1.1.3. Investigation Management

- 5.1.1.4. Crime Analysis

- 5.1.1.5. Criminal Intelligence

- 5.1.1.6. Other Software

- 5.1.2. Services

- 5.1.1. Software

- 5.2. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Medical

- 5.3.2. Transportation

- 5.3.3. Law Enforcement

- 5.3.4. Firefighting

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cisco Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Esri Global

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Genetec Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CGI Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thales Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALE International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Motorola Solutions Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NEC Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Atos SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Idemia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kroll LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hexagon AB

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 SAAB

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Central Squar

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Cisco Systems Inc

List of Figures

- Figure 1: Latin America Public Safety Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Public Safety Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Public Safety Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Public Safety Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Latin America Public Safety Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Latin America Public Safety Market Volume Billion Forecast, by Component 2019 & 2032

- Table 5: Latin America Public Safety Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 6: Latin America Public Safety Market Volume Billion Forecast, by Mode of Deployment 2019 & 2032

- Table 7: Latin America Public Safety Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Latin America Public Safety Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 9: Latin America Public Safety Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Latin America Public Safety Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Latin America Public Safety Market Revenue Million Forecast, by Component 2019 & 2032

- Table 12: Latin America Public Safety Market Volume Billion Forecast, by Component 2019 & 2032

- Table 13: Latin America Public Safety Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 14: Latin America Public Safety Market Volume Billion Forecast, by Mode of Deployment 2019 & 2032

- Table 15: Latin America Public Safety Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Latin America Public Safety Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 17: Latin America Public Safety Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Latin America Public Safety Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Brazil Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Brazil Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Argentina Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Chile Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Chile Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Colombia Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Colombia Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Mexico Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Mexico Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Peru Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Peru Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Venezuela Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Venezuela Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Ecuador Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Ecuador Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Bolivia Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Bolivia Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Paraguay Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Paraguay Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Public Safety Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the Latin America Public Safety Market?

Key companies in the market include Cisco Systems Inc, Esri Global, Genetec Inc, Honeywell International Inc, CGI Inc, Thales Group, ALE International, Motorola Solutions Inc, NEC Corporation, Atos SE, Idemia, Kroll LLC, Hexagon AB, SAAB, Central Squar.

3. What are the main segments of the Latin America Public Safety Market?

The market segments include Component, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data. Critical Infrastructure; Stringent Government Regulations to Invest in Safety Measures to Enhance Safety.

6. What are the notable trends driving market growth?

Software Component to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data. Critical Infrastructure; Stringent Government Regulations to Invest in Safety Measures to Enhance Safety.

8. Can you provide examples of recent developments in the market?

February 2024: Irisity, a Swedish AI and video analytics software provider, increased investments in Latin America, focusing on public security, transportation, and mission-critical infrastructure. The company supplies technology in countries like Mexico and Argentina and supports emergency services in Ecuador and the Dominican Republic. Additionally, Irisity collaborates with the Uruguayan security firm Grupo Securitas. The regional strategy includes bolstering brand recognition, expanding the team, and fostering partnerships with integrators, resellers, and camera manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Public Safety Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Public Safety Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Public Safety Market?

To stay informed about further developments, trends, and reports in the Latin America Public Safety Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence