Key Insights

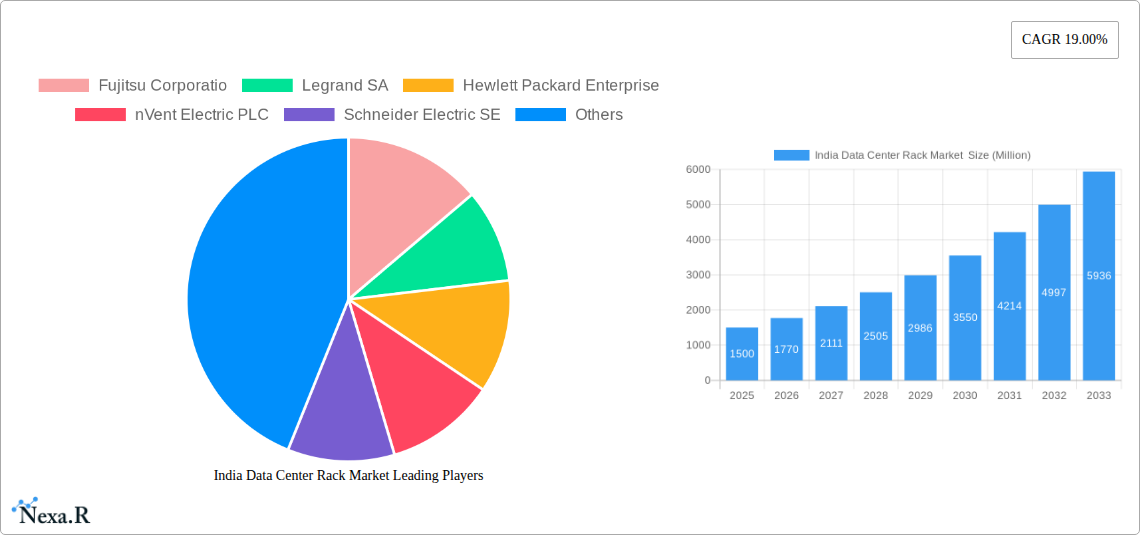

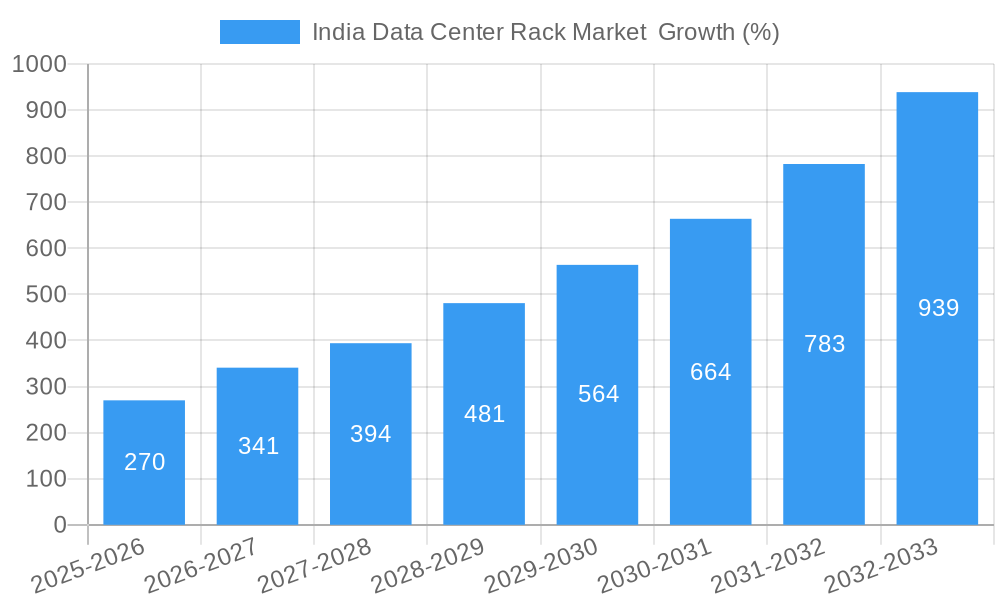

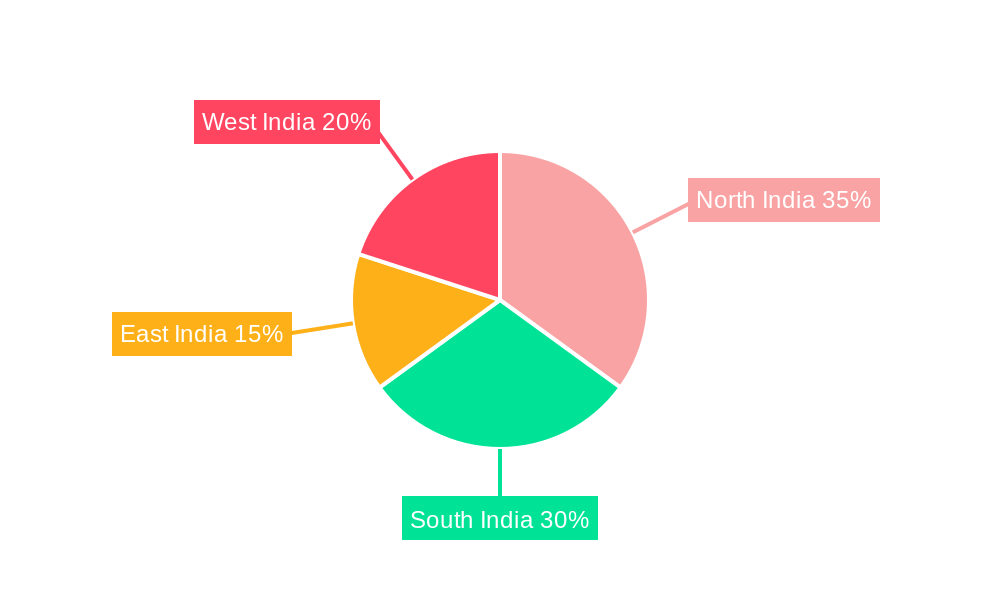

The India data center rack market is experiencing robust growth, fueled by the rapid expansion of the IT and telecommunications sector, increasing digitalization across various industries, and the government's initiatives to promote digital infrastructure. A compound annual growth rate (CAGR) of 19% from 2019 to 2024 suggests a significant market expansion. This growth is driven by the rising demand for cloud computing services, big data analytics, and the increasing adoption of 5G technology. The market is segmented by rack size (quarter, half, and full racks) and end-user industries (IT & Telecommunications, BFSI, Government, Media & Entertainment, and Others). The full rack segment is likely the largest, driven by the needs of large data centers and cloud providers. Within end-users, the IT and telecommunications sector dominates, contributing significantly to the market's overall value. Regional variations exist, with potentially higher growth in regions like South India, due to the concentration of IT hubs. Key players such as Fujitsu, Legrand, Hewlett Packard Enterprise, and Schneider Electric are driving innovation and competition, offering a wide range of rack solutions to cater to diverse customer requirements. The market's future growth will be influenced by factors such as government regulations, investments in data center infrastructure, and the evolving needs of various industries.

The forecast period (2025-2033) anticipates continued strong growth, although the CAGR might slightly moderate due to market saturation effects. However, emerging technologies like edge computing and the Internet of Things (IoT) are likely to present new opportunities, fostering further demand for data center racks. The ongoing digital transformation across all sectors, including BFSI and government initiatives for digital infrastructure development, ensures sustained market expansion. Competition among established players and new entrants is expected to intensify, leading to further innovation and price optimization, benefiting consumers. The market's success will also depend on the availability of skilled labor and effective management of energy consumption in data centers.

India Data Center Rack Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the India data center rack market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by rack size (Quarter Rack, Half Rack, Full Rack) and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other End Users). The total market value is projected to reach xx Million units by 2033.

India Data Center Rack Market Dynamics & Structure

The Indian data center rack market is characterized by moderate concentration, with key players such as Fujitsu Corporation, Legrand SA, Hewlett Packard Enterprise, nVent Electric PLC, Schneider Electric SE, Dell Inc, Black Box Corporation, Rittal GMBH & Co KG, Vertic Group Corp, and Eaton Corporation competing for market share. Technological advancements, particularly in edge computing and modular data centers, are significant drivers. Government initiatives promoting digitalization and infrastructure development further boost market growth.

- Market Concentration: The market exhibits moderate concentration, with the top five players holding approximately xx% market share in 2024.

- Technological Innovation: Advancements in cooling technologies, power management, and intelligent rack solutions are driving market growth. Innovation barriers include high R&D costs and the need for standardized interoperability.

- Regulatory Framework: Government regulations concerning data security and localization influence market dynamics.

- Competitive Landscape: Intense competition based on pricing, product features, and service offerings. Substitutes include customized rack solutions from smaller vendors.

- M&A Activity: The number of M&A deals in the Indian data center rack market has increased moderately in the past five years, with approximately xx deals recorded between 2019 and 2024.

- End-User Demographics: The IT & Telecommunication sector is the largest end-user segment, followed by BFSI and Government.

India Data Center Rack Market Growth Trends & Insights

The Indian data center rack market has witnessed significant growth over the historical period (2019-2024), with a CAGR of xx%. This growth is primarily fueled by the increasing adoption of cloud computing, big data analytics, and the expanding digital economy. The market is expected to maintain robust growth during the forecast period (2025-2033), driven by continued investments in data center infrastructure and rising demand for high-performance computing. The adoption rate of data center racks is expected to increase steadily, driven by increased digitalization across sectors and government initiatives promoting digital infrastructure development. Technological disruptions, such as the rise of edge computing and AI, are creating new opportunities for data center rack vendors.

Dominant Regions, Countries, or Segments in India Data Center Rack Market

The IT & Telecommunication sector is the dominant end-user segment, accounting for approximately xx% of the total market in 2024. This is driven by the high demand for data center infrastructure from large technology companies and telecom providers. Metropolitan areas like Mumbai, Delhi, Bengaluru, and Hyderabad are leading regions in terms of market size and growth potential.

- Key Drivers:

- Rapid growth of the IT & Telecom sector.

- Increasing adoption of cloud computing and data analytics.

- Government initiatives promoting digital infrastructure development.

- Expanding e-commerce and digital payments.

- Dominance Factors: High concentration of data centers, robust digital infrastructure, and a large pool of skilled IT professionals.

- Growth Potential: Continued expansion of data center facilities in tier-II and tier-III cities presents significant growth opportunities.

The Full Rack segment dominates the market by rack size due to its larger capacity and suitability for large data centers, accounting for approximately xx% of the market.

India Data Center Rack Market Product Landscape

The Indian data center rack market offers a range of products, including quarter, half, and full-rack solutions. Innovation focuses on improving power efficiency, cooling capabilities, and network connectivity. Intelligent racks with integrated monitoring and management features are gaining popularity. Unique selling propositions include features like optimized cable management, adaptable configurations, and enhanced security measures. Technological advancements are leading to lighter, more efficient, and easily deployable racks.

Key Drivers, Barriers & Challenges in India Data Center Rack Market

Key Drivers:

- Increasing adoption of cloud computing and big data analytics.

- Growth of the digital economy and e-commerce.

- Government initiatives promoting digital infrastructure development.

- Rising demand for high-performance computing.

Key Challenges and Restraints:

- High initial investment costs for data center infrastructure.

- Power outages and unreliable power supply in certain regions.

- Lack of skilled workforce in some areas.

- Competition from international and domestic vendors.

- Supply chain disruptions leading to increased lead times and material costs (estimated impact of xx% on market growth in 2024).

Emerging Opportunities in India Data Center Rack Market

- Growing demand for edge computing solutions.

- Increasing adoption of AI and machine learning.

- Expansion of 5G networks.

- Growth of the Internet of Things (IoT).

- Untapped markets in smaller cities and towns.

Growth Accelerators in the India Data Center Rack Market Industry

The long-term growth of the Indian data center rack market will be accelerated by several factors including continued investment in data center infrastructure by both private and public sector entities, technological advancements in areas such as AI and edge computing, and strategic partnerships between data center operators and IT vendors. Government initiatives focused on promoting digital India will further drive expansion into underserved regions.

Key Players Shaping the India Data Center Rack Market Market

- Fujitsu Corporation

- Legrand SA

- Hewlett Packard Enterprise

- nVent Electric PLC

- Schneider Electric SE

- Dell Inc

- Black Box Corporation

- Rittal GMBH & Co KG

- Vertic Group Corp

- Eaton Corporation

Notable Milestones in India Data Center Rack Market Sector

- October 2022: NetRack launched iRack Block, a large-scale rack solution incorporating self-cooling, self-powering, and self-contained capabilities, signifying a move towards intelligent infra capsules and modular data centers.

- June 2022: Schneider Electric partnered with Stratus Technologies and Avnet Integrated to deliver streamlined, zero-touch edge computing solutions, enhancing data center capabilities and industrial innovation.

In-Depth India Data Center Rack Market Market Outlook

The Indian data center rack market is poised for significant growth over the forecast period, driven by the factors mentioned above. The increasing adoption of advanced technologies and government support for digital infrastructure will create numerous opportunities for vendors to expand their market share. Strategic partnerships and investments in research and development will be crucial for success in this dynamic market. The focus on sustainable and energy-efficient data center solutions will become increasingly important, creating opportunities for innovative product development.

India Data Center Rack Market Segmentation

-

1. Rack Size

- 1.1. Quarter Rack

- 1.2. Half Rack

- 1.3. Full Rack

-

2. End User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End Users

India Data Center Rack Market Segmentation By Geography

- 1. India

India Data Center Rack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Deployment of Data Center Facilities; Growing Cloud Computing Adoption Leading to Investment in Hyperscale Data Centers; BFSI Sector Expected to Hold a Significant Share

- 3.3. Market Restrains

- 3.3.1. Presence of cheap and counterfeit racks affecting the organized Data Center Racks sales

- 3.4. Market Trends

- 3.4.1. BFSI to have significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 5.1.1. Quarter Rack

- 5.1.2. Half Rack

- 5.1.3. Full Rack

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 6. North India India Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Fujitsu Corporatio

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Legrand SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hewlett Packard Enterprise

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 nVent Electric PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Schneider Electric SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Dell Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Black Box Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rittal GMBH & Co KG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vertic Group Corp

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Eaton Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Fujitsu Corporatio

List of Figures

- Figure 1: India Data Center Rack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Data Center Rack Market Share (%) by Company 2024

List of Tables

- Table 1: India Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 3: India Data Center Rack Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: India Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 11: India Data Center Rack Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: India Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Data Center Rack Market ?

The projected CAGR is approximately 19.00%.

2. Which companies are prominent players in the India Data Center Rack Market ?

Key companies in the market include Fujitsu Corporatio, Legrand SA, Hewlett Packard Enterprise, nVent Electric PLC, Schneider Electric SE, Dell Inc, Black Box Corporation, Rittal GMBH & Co KG, Vertic Group Corp, Eaton Corporation.

3. What are the main segments of the India Data Center Rack Market ?

The market segments include Rack Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Deployment of Data Center Facilities; Growing Cloud Computing Adoption Leading to Investment in Hyperscale Data Centers; BFSI Sector Expected to Hold a Significant Share.

6. What are the notable trends driving market growth?

BFSI to have significant market share.

7. Are there any restraints impacting market growth?

Presence of cheap and counterfeit racks affecting the organized Data Center Racks sales.

8. Can you provide examples of recent developments in the market?

October 2022: In contrast to the smaller installations provided by the iRack solution, NetRack created iRack Block to cater to large requirements primarily. The rack was a step toward intelligent infra capsules or modular data centers because it includes self-cooking, self-powered, and self-contained capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Data Center Rack Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Data Center Rack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Data Center Rack Market ?

To stay informed about further developments, trends, and reports in the India Data Center Rack Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence