Key Insights

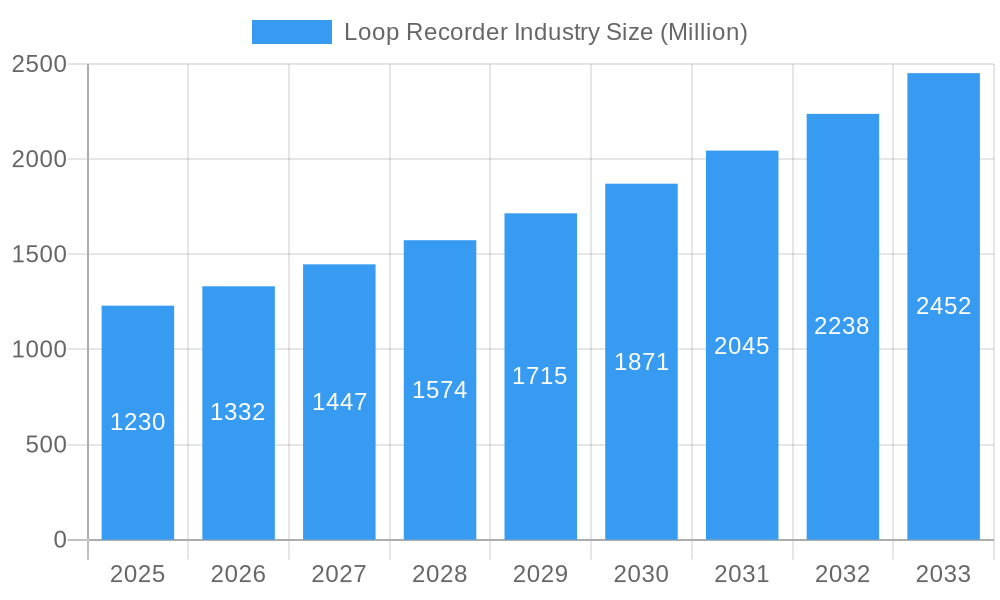

The global Loop Recorder Industry is poised for significant expansion, projected to reach a substantial $1.23 billion in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 8.6%, indicating a dynamic and expanding market over the forecast period of 2025-2033. The increasing prevalence of cardiac arrhythmias and atrial fibrillation, coupled with advancements in diagnostic technologies, are key drivers propelling this market forward. Cardiac syncope, a condition requiring accurate diagnosis, also contributes to the demand for these advanced monitoring devices. The expanding healthcare infrastructure, particularly in developed nations, and a growing awareness among patients and healthcare professionals about the benefits of early and continuous cardiac monitoring are further fueling market expansion. The integration of sophisticated algorithms and miniaturized designs in loop recorders is enhancing their diagnostic capabilities and patient comfort, thereby driving adoption.

Loop Recorder Industry Market Size (In Billion)

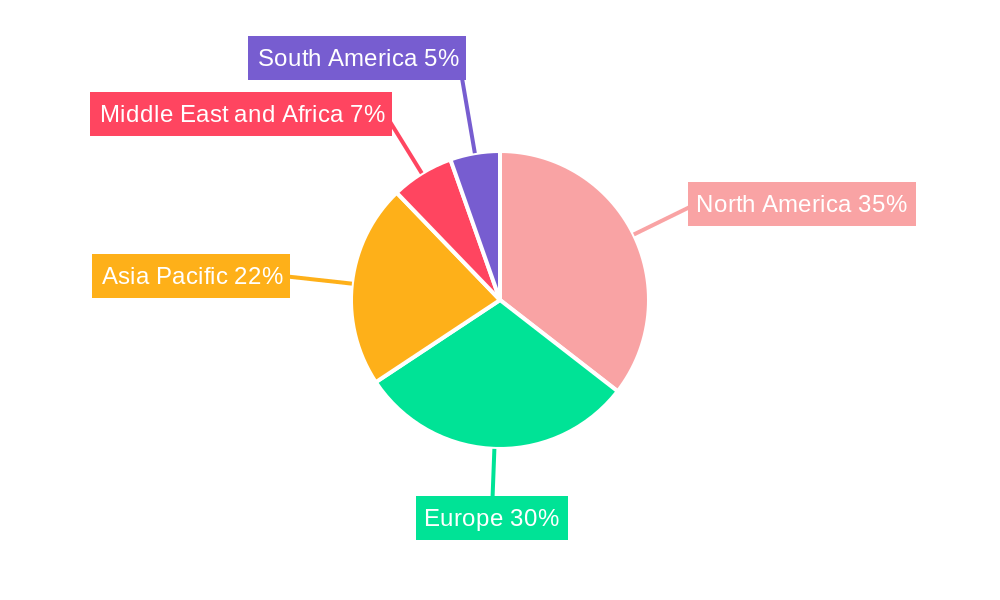

The market is segmented into critical applications such as Cardiac Arrhythmia, Atrial Fibrillation, and Cardiac Syncope, with the End User segment encompassing Hospitals, Cardiac Centers, and Other End Users. Leading companies like Medtronic, BIOTRONIK, Abbott, and Boston Scientific Corporation are actively innovating and competing, introducing advanced loop recorder solutions. Geographically, North America and Europe currently dominate the market, driven by high healthcare spending, advanced medical infrastructure, and a strong focus on cardiovascular disease management. However, the Asia Pacific region is expected to exhibit the fastest growth due to increasing healthcare investments, a rising burden of cardiovascular diseases, and improving access to advanced medical technologies. While the market benefits from strong drivers, potential restraints such as the high cost of advanced devices and reimbursement challenges in certain regions need to be addressed for sustained and equitable growth. Nevertheless, the overall trajectory points towards a thriving loop recorder market dedicated to improving cardiac patient outcomes through precise and continuous monitoring.

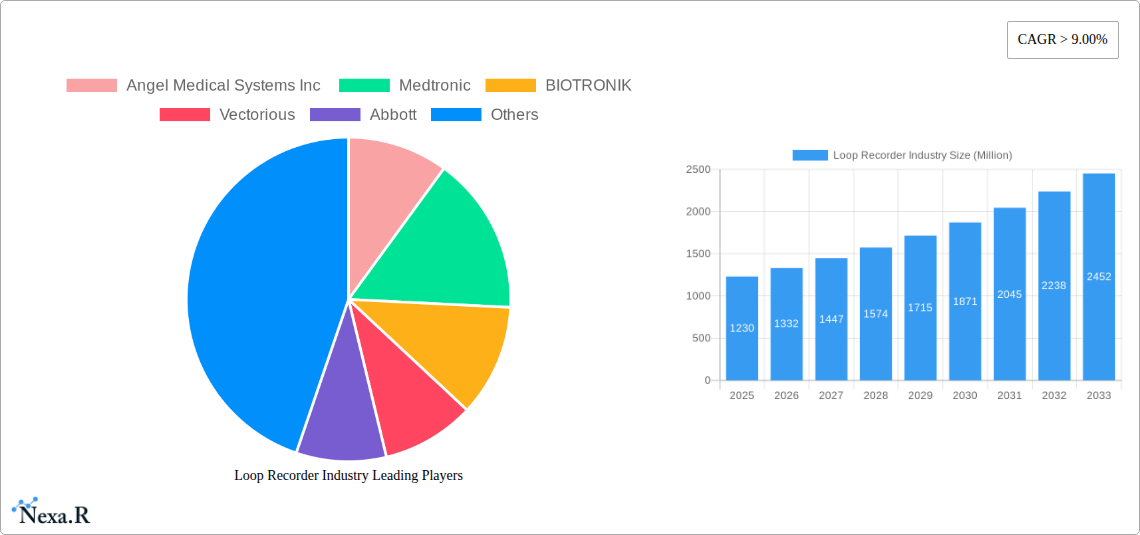

Loop Recorder Industry Company Market Share

Loop Recorder Industry Market Research Report: Forecast 2025-2033

This comprehensive report provides an in-depth analysis of the global Loop Recorder Industry, offering critical insights into market dynamics, growth trends, and future opportunities. With a detailed examination spanning the historical period of 2019-2024, a base year of 2025, and a robust forecast period from 2025-2033, this study is an indispensable resource for industry stakeholders seeking to navigate this rapidly evolving market. The report leverages high-traffic keywords such as "implantable loop recorder market," "cardiac monitoring devices," "atrial fibrillation detection," and "remote patient monitoring solutions" to maximize SEO visibility and attract a targeted audience of industry professionals, investors, and medical practitioners. We present all quantitative values in billion units for clarity and immediate comprehension.

Loop Recorder Industry Market Dynamics & Structure

The Loop Recorder Industry is characterized by a dynamic interplay of technological innovation, stringent regulatory frameworks, and evolving end-user needs. Market concentration is moderate, with key players like Medtronic, Abbott, Boston Scientific Corporation, BIOTRONIK, Angel Medical Systems Inc, and Vectorious vying for market share. Technological innovation is primarily driven by advancements in miniaturization, battery life, data transmission capabilities, and AI-powered diagnostic algorithms, exemplified by Implicity's recent FDA clearances for novel ECG analysis. Regulatory hurdles, particularly stringent FDA and CE marking processes, act as significant barriers to entry for new players. Competitive product substitutes include Holter monitors and event recorders, but implantable loop recorders (ILRs) offer superior long-term monitoring capabilities for elusive arrhythmias. End-user demographics are shifting towards an aging population with a higher prevalence of cardiac conditions, increasing the demand for continuous monitoring solutions. Mergers and acquisitions (M&A) trends are present, driven by the pursuit of synergistic technologies and expanded market reach, though specific M&A deal volumes remain a proprietary metric.

- Market Concentration: Moderate, with a few dominant global players.

- Technological Innovation Drivers: Miniaturization, AI-driven diagnostics, wireless connectivity, extended battery life.

- Regulatory Frameworks: Strict FDA, CE, and other regional approvals are critical.

- Competitive Product Substitutes: Holter monitors, event recorders, mobile ECG devices.

- End-User Demographics: Growing elderly population, individuals with a history of unexplained syncope or arrhythmias.

- M&A Trends: Driven by technological integration and market expansion.

Loop Recorder Industry Growth Trends & Insights

The global Loop Recorder Industry is poised for significant growth, propelled by the increasing incidence of cardiac arrhythmias and the growing adoption of remote patient monitoring (RPM) technologies. The market size evolution is a testament to the rising demand for accurate and continuous cardiac monitoring, with projected expansion fueled by technological advancements and a greater emphasis on preventative healthcare. Adoption rates are steadily increasing, particularly in developed economies, as healthcare providers recognize the diagnostic efficacy and patient convenience offered by implantable loop recorders (ILRs). Technological disruptions, such as the integration of artificial intelligence for real-time anomaly detection and predictive analytics, are further revolutionizing the industry. Consumer behavior shifts are also playing a crucial role, with patients increasingly seeking less invasive and more proactive approaches to managing their cardiac health. The market penetration of ILRs is expected to deepen as awareness grows and reimbursement policies become more favorable.

The CAGR for the Loop Recorder Industry is projected to be robust during the forecast period, reflecting the sustained demand for sophisticated cardiac diagnostic tools. This growth is intrinsically linked to the rising global burden of cardiovascular diseases, including atrial fibrillation, which remains a leading cause of stroke and other serious complications. The ability of loop recorders to capture infrequent but critical cardiac events that standard ECGs might miss makes them indispensable for accurate diagnosis and timely intervention. Furthermore, the ongoing development of smaller, more sophisticated devices with enhanced data transmission capabilities is making ILRs more appealing to both physicians and patients. The shift towards value-based healthcare models also favors technologies that can improve patient outcomes while reducing long-term healthcare costs, a niche that loop recorders are well-positioned to fill.

The increasing prevalence of chronic diseases, coupled with an aging global population, directly contributes to the expanding market for loop recorders. As individuals live longer, the likelihood of developing or experiencing cardiac arrhythmias increases, necessitating continuous and reliable monitoring solutions. The technological sophistication of modern loop recorders, allowing for prolonged monitoring periods (up to 3 years or more) and seamless data transmission to healthcare providers, is a key growth driver. This remote monitoring capability is particularly beneficial for patients residing in rural areas or those with mobility issues, bridging geographical gaps in healthcare access. The insights gained from ILRs are crucial for diagnosing conditions like syncope of unknown origin, bradycardia, and paroxysmal atrial fibrillation, leading to more personalized and effective treatment plans.

The ongoing research and development efforts are focused on enhancing the diagnostic accuracy and user experience of loop recorders. This includes the development of devices with improved sensitivity for detecting subtle arrhythmias, extended battery longevity to reduce the need for premature replacements, and enhanced cybersecurity measures to protect sensitive patient data. The integration of advanced algorithms, as seen with Implicity's AI-powered ECG analysis, promises to streamline the diagnostic process, enabling clinicians to focus on critical findings rather than sifting through vast amounts of data. The evolving reimbursement landscape in various countries, as healthcare systems increasingly recognize the cost-effectiveness of early and accurate diagnosis, will further accelerate market adoption.

Dominant Regions, Countries, or Segments in Loop Recorder Industry

North America, particularly the United States, currently dominates the Loop Recorder Industry, driven by a confluence of factors that foster innovation, adoption, and market penetration. The region boasts a high prevalence of cardiac arrhythmias, a well-established healthcare infrastructure, and a significant concentration of leading medical device manufacturers. The robust reimbursement policies for remote patient monitoring and diagnostic procedures further bolster market growth.

- North America (Dominant Region):

- Key Drivers: High incidence of cardiac conditions (Atrial Fibrillation, Cardiac Syncope), advanced healthcare infrastructure, strong R&D investment, favorable reimbursement policies for remote cardiac monitoring.

- Market Share: Holds a substantial portion of the global loop recorder market due to early adoption and technological leadership.

- Growth Potential: Continued expansion driven by an aging population and increasing awareness of the benefits of long-term cardiac monitoring.

Application Type: Cardiac Arrhythmia (Dominant Segment)

Within the application type segment, Cardiac Arrhythmia stands out as the primary driver of the Loop Recorder Industry. The inherent nature of arrhythmias, often presenting sporadically and without predictable patterns, necessitates the continuous monitoring capabilities offered by implantable loop recorders.

- Cardiac Arrhythmia (Dominant Application Type):

- Significance: Essential for diagnosing elusive arrhythmias that may not be detected by short-term monitoring methods.

- Sub-segments: Includes a broad spectrum of irregular heart rhythms, with Atrial Fibrillation being a major focus.

- Growth Factors: Increasing prevalence of Atrial Fibrillation globally, advancements in arrhythmia detection algorithms, and the need for precise diagnosis to prevent serious complications like stroke.

End User: Hospitals (Dominant Segment)

Hospitals represent the largest end-user segment for loop recorders. Their comprehensive diagnostic capabilities, established patient pathways for cardiac care, and the presence of specialized cardiology departments make them the primary channel for ILR implantation and management.

- Hospitals (Dominant End User):

- Role: Central hubs for cardiac diagnosis, treatment, and patient management, making them ideal for ILR deployment.

- Infrastructure: Equipped with cardiology units, electrophysiology labs, and the necessary expertise for implantation and follow-up.

- Demand Drivers: High patient volumes, the need for accurate diagnosis of complex cardiac conditions, and the integration of remote monitoring into hospital-based care.

Country-Specific Dominance: While North America leads, European countries like Germany, the UK, and France also exhibit significant market presence due to advanced healthcare systems and a proactive approach to cardiovascular disease management. Asia-Pacific is emerging as a high-growth region, driven by improving healthcare infrastructure and increasing awareness of advanced cardiac diagnostic tools.

Loop Recorder Industry Product Landscape

The Loop Recorder Industry product landscape is defined by continuous innovation focused on miniaturization, enhanced diagnostic accuracy, and extended device longevity. Modern implantable loop recorders (ILRs) are designed for discreet subcutaneous implantation, offering discreet and comfortable long-term cardiac monitoring. Key product advancements include increased memory capacity for capturing longer ECG durations, improved battery life extending up to three years, and wireless data transmission capabilities facilitating seamless remote monitoring. The integration of sophisticated algorithms further refines the detection and analysis of cardiac arrhythmias, offering unique selling propositions such as the ability to identify subtle changes in heart rhythm that may be missed by conventional monitoring methods. These technological leaps ensure the delivery of high-performance metrics essential for accurate diagnosis and effective patient management.

Key Drivers, Barriers & Challenges in Loop Recorder Industry

Key Drivers:

The Loop Recorder Industry is propelled by several key drivers. The increasing global prevalence of cardiovascular diseases, particularly Atrial Fibrillation and unexplained syncope, creates a substantial and growing demand for accurate diagnostic tools. Advancements in medical technology, including miniaturization, improved battery life, and sophisticated data analysis algorithms, are making implantable loop recorders (ILRs) more effective and patient-friendly. The growing adoption of remote patient monitoring (RPM) solutions by healthcare providers, driven by the potential for improved patient outcomes and cost efficiencies, further accelerates market growth. Favorable reimbursement policies in developed nations also play a crucial role in facilitating access to these advanced diagnostic devices.

Barriers & Challenges:

Despite robust growth drivers, the Loop Recorder Industry faces several significant barriers and challenges. The high cost of ILRs, coupled with complex reimbursement landscapes in certain regions, can limit widespread adoption, especially in emerging economies. Stringent regulatory approval processes from bodies like the FDA and EMA can be time-consuming and costly, acting as a barrier to entry for new manufacturers. The availability of alternative, albeit less comprehensive, diagnostic tools such as Holter monitors and event recorders presents a competitive challenge. Furthermore, physician education and training on the optimal use and interpretation of data from ILRs are crucial for maximizing their diagnostic utility. Supply chain disruptions and the potential for cybersecurity breaches also pose ongoing concerns for the industry.

Emerging Opportunities in Loop Recorder Industry

Emerging opportunities in the Loop Recorder Industry are centered around expanding into untapped geographical markets with growing healthcare infrastructure and increasing disposable incomes. The development of more cost-effective ILR solutions could significantly penetrate emerging economies. Innovations in AI-powered diagnostics that provide predictive analytics for cardiac events, rather than just retrospective analysis, present a significant opportunity to shift towards proactive cardiac care. Furthermore, the integration of ILRs with broader digital health ecosystems and electronic health records (EHRs) can enhance data interoperability and streamline patient management. Evolving consumer preferences for personalized and convenient healthcare solutions also present an opportunity for devices that offer continuous, unobtrusive monitoring.

Growth Accelerators in the Loop Recorder Industry Industry

Several catalysts are accelerating long-term growth in the Loop Recorder Industry. Technological breakthroughs in wireless data transmission and miniaturization are leading to smaller, more discreet, and longer-lasting devices, enhancing patient comfort and compliance. Strategic partnerships between device manufacturers, AI developers, and healthcare providers are crucial for developing integrated diagnostic and therapeutic solutions. Market expansion strategies, including targeting specific patient populations with high arrhythmia risk, are also driving growth. The increasing global focus on preventative healthcare and early disease detection further bolsters the demand for advanced diagnostic tools like loop recorders, positioning the industry for sustained and robust expansion.

Key Players Shaping the Loop Recorder Industry Market

- Angel Medical Systems Inc

- Medtronic

- BIOTRONIK

- Vectorious

- Abbott

- Boston Scientific Corporation

Notable Milestones in Loop Recorder Industry Sector

- Apr 2022: Implicity raised USD 23 million in Series A funding, signaling strong investor confidence in their AI-driven approach to loop recorder data analysis. This funding followed closely on the heels of FDA clearance for their novel AI algorithm.

- Jan 2022: Implicity received US FDA clearance for a novel medical algorithm designed to analyze ECG data from implantable loop recorders (ILRs). This advancement is a significant step towards automated and intelligent interpretation of cardiac event data.

In-Depth Loop Recorder Industry Market Outlook

The future market outlook for the Loop Recorder Industry is exceptionally promising, fueled by a powerful combination of escalating demand and relentless innovation. Growth accelerators, including the increasing global burden of cardiovascular diseases and the transformative impact of artificial intelligence on diagnostic capabilities, are set to redefine cardiac care. The continuous evolution of miniaturized devices with extended battery life ensures enhanced patient compliance and expanded utility. Strategic partnerships are pivotal, fostering the development of integrated ecosystems that leverage loop recorder data for predictive analytics and personalized treatment plans. As healthcare systems worldwide prioritize early intervention and remote patient monitoring, the Loop Recorder Industry is strategically positioned for significant expansion, offering substantial opportunities for market penetration and technological advancement.

Loop Recorder Industry Segmentation

-

1. Application Type

- 1.1. Cardiac Arrhythmia

- 1.2. Atrial Fibrillation

- 1.3. Cardiac Syncope

-

2. End User

- 2.1. Hospitals

- 2.2. Cardiac Centers

- 2.3. Other End Users

Loop Recorder Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Loop Recorder Industry Regional Market Share

Geographic Coverage of Loop Recorder Industry

Loop Recorder Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Prevalence of Cardiac Disorders; Recent Technological Advancements in Cardiac Monitoring Devices; Increasing Demand for Remote Patient Monitoring

- 3.3. Market Restrains

- 3.3.1. High Cost of the Device; Stringent Regulations

- 3.4. Market Trends

- 3.4.1. Cardiac Arrhythmia Segment Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Loop Recorder Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Cardiac Arrhythmia

- 5.1.2. Atrial Fibrillation

- 5.1.3. Cardiac Syncope

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Cardiac Centers

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America Loop Recorder Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Cardiac Arrhythmia

- 6.1.2. Atrial Fibrillation

- 6.1.3. Cardiac Syncope

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Cardiac Centers

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Europe Loop Recorder Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Cardiac Arrhythmia

- 7.1.2. Atrial Fibrillation

- 7.1.3. Cardiac Syncope

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Cardiac Centers

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Asia Pacific Loop Recorder Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Cardiac Arrhythmia

- 8.1.2. Atrial Fibrillation

- 8.1.3. Cardiac Syncope

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Cardiac Centers

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Middle East and Africa Loop Recorder Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Cardiac Arrhythmia

- 9.1.2. Atrial Fibrillation

- 9.1.3. Cardiac Syncope

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Cardiac Centers

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. South America Loop Recorder Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application Type

- 10.1.1. Cardiac Arrhythmia

- 10.1.2. Atrial Fibrillation

- 10.1.3. Cardiac Syncope

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Cardiac Centers

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Application Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Angel Medical Systems Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medtronic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BIOTRONIK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vectorious

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abbott

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Boston Scientific Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Angel Medical Systems Inc

List of Figures

- Figure 1: Global Loop Recorder Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Loop Recorder Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Loop Recorder Industry Revenue (undefined), by Application Type 2025 & 2033

- Figure 4: North America Loop Recorder Industry Volume (K Unit), by Application Type 2025 & 2033

- Figure 5: North America Loop Recorder Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Loop Recorder Industry Volume Share (%), by Application Type 2025 & 2033

- Figure 7: North America Loop Recorder Industry Revenue (undefined), by End User 2025 & 2033

- Figure 8: North America Loop Recorder Industry Volume (K Unit), by End User 2025 & 2033

- Figure 9: North America Loop Recorder Industry Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Loop Recorder Industry Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Loop Recorder Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Loop Recorder Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Loop Recorder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Loop Recorder Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Loop Recorder Industry Revenue (undefined), by Application Type 2025 & 2033

- Figure 16: Europe Loop Recorder Industry Volume (K Unit), by Application Type 2025 & 2033

- Figure 17: Europe Loop Recorder Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Europe Loop Recorder Industry Volume Share (%), by Application Type 2025 & 2033

- Figure 19: Europe Loop Recorder Industry Revenue (undefined), by End User 2025 & 2033

- Figure 20: Europe Loop Recorder Industry Volume (K Unit), by End User 2025 & 2033

- Figure 21: Europe Loop Recorder Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Loop Recorder Industry Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Loop Recorder Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Loop Recorder Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Loop Recorder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Loop Recorder Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Loop Recorder Industry Revenue (undefined), by Application Type 2025 & 2033

- Figure 28: Asia Pacific Loop Recorder Industry Volume (K Unit), by Application Type 2025 & 2033

- Figure 29: Asia Pacific Loop Recorder Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Asia Pacific Loop Recorder Industry Volume Share (%), by Application Type 2025 & 2033

- Figure 31: Asia Pacific Loop Recorder Industry Revenue (undefined), by End User 2025 & 2033

- Figure 32: Asia Pacific Loop Recorder Industry Volume (K Unit), by End User 2025 & 2033

- Figure 33: Asia Pacific Loop Recorder Industry Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Pacific Loop Recorder Industry Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia Pacific Loop Recorder Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Loop Recorder Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Loop Recorder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Loop Recorder Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Loop Recorder Industry Revenue (undefined), by Application Type 2025 & 2033

- Figure 40: Middle East and Africa Loop Recorder Industry Volume (K Unit), by Application Type 2025 & 2033

- Figure 41: Middle East and Africa Loop Recorder Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 42: Middle East and Africa Loop Recorder Industry Volume Share (%), by Application Type 2025 & 2033

- Figure 43: Middle East and Africa Loop Recorder Industry Revenue (undefined), by End User 2025 & 2033

- Figure 44: Middle East and Africa Loop Recorder Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Middle East and Africa Loop Recorder Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Middle East and Africa Loop Recorder Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Middle East and Africa Loop Recorder Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East and Africa Loop Recorder Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Loop Recorder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Loop Recorder Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Loop Recorder Industry Revenue (undefined), by Application Type 2025 & 2033

- Figure 52: South America Loop Recorder Industry Volume (K Unit), by Application Type 2025 & 2033

- Figure 53: South America Loop Recorder Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 54: South America Loop Recorder Industry Volume Share (%), by Application Type 2025 & 2033

- Figure 55: South America Loop Recorder Industry Revenue (undefined), by End User 2025 & 2033

- Figure 56: South America Loop Recorder Industry Volume (K Unit), by End User 2025 & 2033

- Figure 57: South America Loop Recorder Industry Revenue Share (%), by End User 2025 & 2033

- Figure 58: South America Loop Recorder Industry Volume Share (%), by End User 2025 & 2033

- Figure 59: South America Loop Recorder Industry Revenue (undefined), by Country 2025 & 2033

- Figure 60: South America Loop Recorder Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Loop Recorder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Loop Recorder Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Loop Recorder Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 2: Global Loop Recorder Industry Volume K Unit Forecast, by Application Type 2020 & 2033

- Table 3: Global Loop Recorder Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Loop Recorder Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Global Loop Recorder Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Loop Recorder Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Loop Recorder Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 8: Global Loop Recorder Industry Volume K Unit Forecast, by Application Type 2020 & 2033

- Table 9: Global Loop Recorder Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Global Loop Recorder Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Global Loop Recorder Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Loop Recorder Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Loop Recorder Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 20: Global Loop Recorder Industry Volume K Unit Forecast, by Application Type 2020 & 2033

- Table 21: Global Loop Recorder Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 22: Global Loop Recorder Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global Loop Recorder Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Loop Recorder Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: France Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Italy Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Spain Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Loop Recorder Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 38: Global Loop Recorder Industry Volume K Unit Forecast, by Application Type 2020 & 2033

- Table 39: Global Loop Recorder Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 40: Global Loop Recorder Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 41: Global Loop Recorder Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Loop Recorder Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: China Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Japan Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: India Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Australia Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: South Korea Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Loop Recorder Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 56: Global Loop Recorder Industry Volume K Unit Forecast, by Application Type 2020 & 2033

- Table 57: Global Loop Recorder Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 58: Global Loop Recorder Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 59: Global Loop Recorder Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Loop Recorder Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: GCC Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: South Africa Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Loop Recorder Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 68: Global Loop Recorder Industry Volume K Unit Forecast, by Application Type 2020 & 2033

- Table 69: Global Loop Recorder Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 70: Global Loop Recorder Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 71: Global Loop Recorder Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Global Loop Recorder Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Brazil Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Argentina Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Loop Recorder Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Loop Recorder Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Loop Recorder Industry?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Loop Recorder Industry?

Key companies in the market include Angel Medical Systems Inc , Medtronic, BIOTRONIK, Vectorious, Abbott, Boston Scientific Corporation.

3. What are the main segments of the Loop Recorder Industry?

The market segments include Application Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Prevalence of Cardiac Disorders; Recent Technological Advancements in Cardiac Monitoring Devices; Increasing Demand for Remote Patient Monitoring.

6. What are the notable trends driving market growth?

Cardiac Arrhythmia Segment Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of the Device; Stringent Regulations.

8. Can you provide examples of recent developments in the market?

Apr 2022: Implicity raised USD 23 million in Series A funding led by new investors. This new funding comes just months after Implicity received FDA clearance for a novel AI algorithm that analyzes ECG episodes from Implantable Loop Recorders (ILRs).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Loop Recorder Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Loop Recorder Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Loop Recorder Industry?

To stay informed about further developments, trends, and reports in the Loop Recorder Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence