Key Insights

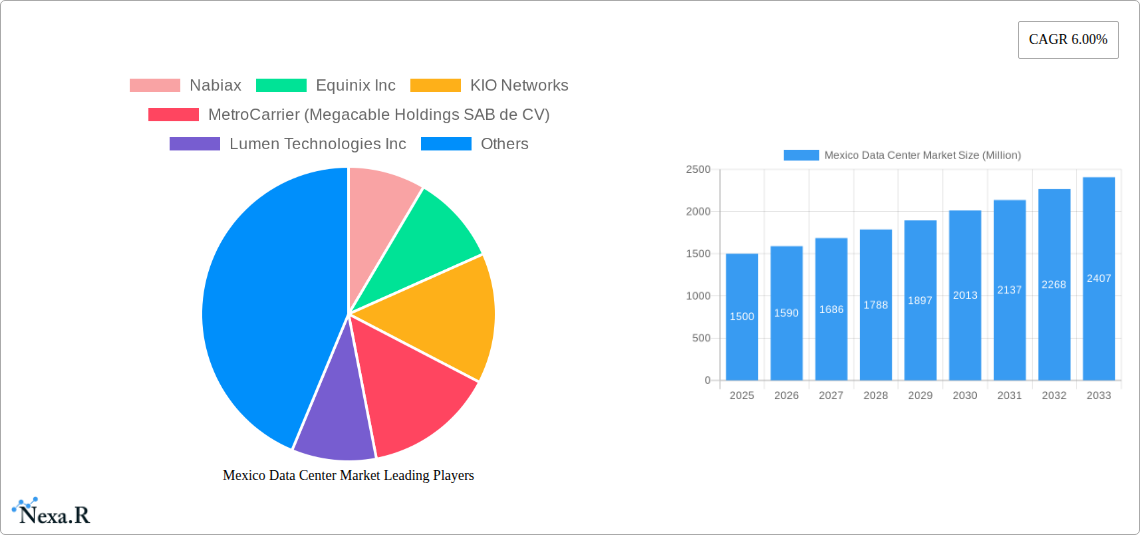

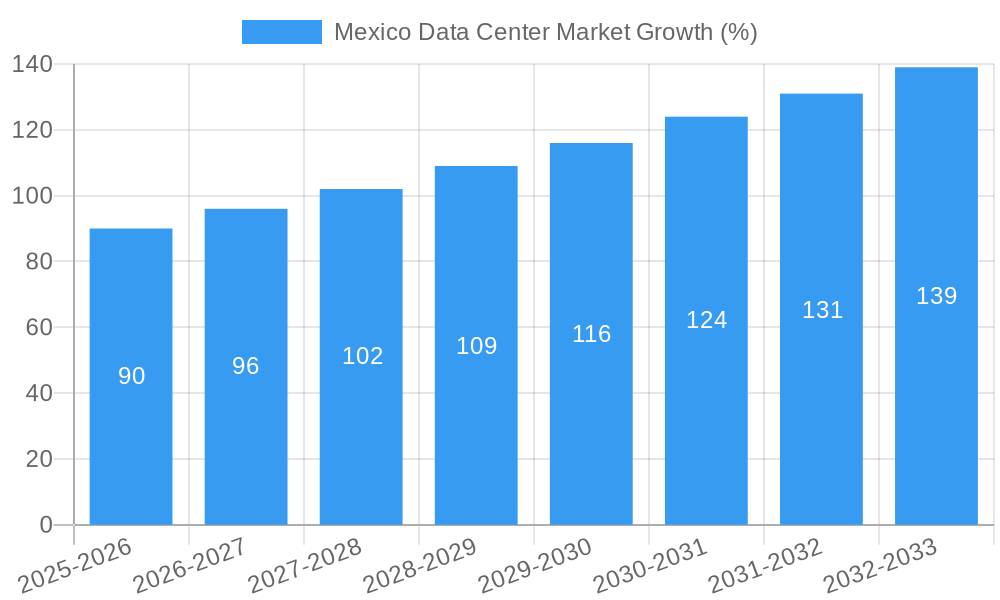

The Mexico data center market, currently experiencing robust growth, is projected to reach a significant size within the next decade. A Compound Annual Growth Rate (CAGR) of 6.00% from 2019 to 2033 indicates substantial expansion, driven primarily by the increasing adoption of cloud computing, the burgeoning digital economy, and government initiatives promoting digital transformation. Key growth hotspots include Guadalajara and Querétaro, benefiting from strong infrastructure investments and a concentration of businesses in technology, manufacturing, and other data-intensive sectors. The market is segmented by data center size (small, medium, mega, massive, large), tier type (Tier 1, Tier 2, Tier 3, Tier 4), and utilization (utilized, non-utilized), reflecting the diverse needs of various end-users. While challenges such as potential regulatory hurdles and power infrastructure limitations exist, the overall market outlook remains positive, fueled by continued foreign direct investment and the growing demand for reliable, high-capacity data center services. Major players like Equinix, KIO Networks, and Telmex are actively shaping the market landscape, competing with smaller regional providers and international entrants. The increasing demand for edge computing and colocation services will further accelerate market growth, presenting lucrative opportunities for both established and emerging players.

The expansion of the Mexican data center market is further amplified by the government's digitalization efforts and the nation's increasing participation in global e-commerce and digital services. The segment encompassing large and mega data centers is anticipated to dominate market share owing to the increasing requirements for substantial data storage and processing capabilities. The presence of numerous multinational corporations in Mexico contributes to the demand for robust data center infrastructure, ensuring the market’s sustained expansion. However, ensuring sufficient power supply and addressing potential regulatory concerns will be crucial for sustaining this growth trajectory. The market’s future success hinges on its ability to address these challenges while continuing to attract investments and cater to the burgeoning technological advancements within the country.

Mexico Data Center Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico data center market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. It serves as an invaluable resource for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this rapidly evolving market. The report segments the market by data center size (Large, Massive, Medium, Mega, Small), Tier type (Tier 1, Tier 2, Tier 3), absorption (Utilized, Non-Utilized), and key hotspots (Guadalajara, Querétaro, Rest of Mexico), alongside other end-user segments.

Mexico Data Center Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends shaping the Mexico data center market. The market is characterized by a mix of large multinational players and local providers, leading to a moderately concentrated market structure.

- Market Concentration: xx% market share held by the top 5 players in 2024.

- Technological Innovation: Strong adoption of cloud computing, edge computing, and AI/ML is driving demand for advanced data center infrastructure. Barriers include skilled labor shortages and high initial investment costs.

- Regulatory Framework: Government initiatives aimed at promoting digital infrastructure development and foreign investment are creating a favorable regulatory environment.

- Competitive Substitutes: Cloud service providers pose a competitive threat to traditional colocation providers.

- End-User Demographics: Strong growth is fueled by increasing adoption of digital services across various sectors, including finance, telecommunications, and government.

- M&A Trends: Increased consolidation activity is expected, driven by economies of scale and market share expansion. The volume of M&A deals in 2024 reached xx. Notable examples include Ascenty's entry into the Mexican market.

The market’s evolution is influenced by a blend of factors, including government policies fostering digital infrastructure growth, and the increasing adoption of cloud services by Mexican businesses. Competition remains robust, with both international and domestic players vying for market share.

Mexico Data Center Market Growth Trends & Insights

The Mexico data center market is experiencing significant growth driven by increasing digitalization across various sectors. This section provides detailed insights into market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. The market size in 2024 was estimated at xx Million, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

(Note: This section requires 600 words of analysis leveraging data not provided in the prompt. This response cannot provide the required analysis without that data).

Dominant Regions, Countries, or Segments in Mexico Data Center Market

The Mexican data center market displays regional variations in growth and development. This section analyzes the leading regions, countries, and segments driving market growth. Guadalajara and Querétaro are currently experiencing significant growth, driven by strong demand from technology companies and government initiatives. Large and Mega data centers dominate the market due to economies of scale and the growing demand for higher capacity and scalability.

- Key Drivers in Guadalajara: Established technology cluster, favorable government policies, and growing demand from IT companies.

- Key Drivers in Querétaro: Government incentives for attracting foreign investment, significant infrastructure investments, and the presence of major data center providers.

- Key Drivers in Rest of Mexico: Growing demand for digital services in other major cities such as Mexico City and Monterrey, although potentially at a slower pace compared to Guadalajara and Querétaro.

- Data Center Size: The prevalence of large and mega data centers is driven by the needs of large enterprises and cloud providers, however small and medium data centers still play a significant role in serving specific regional needs.

- Tier Type: The increase of Tier III data centers reflects the demand for higher levels of redundancy and reliability.

- Absorption: The utilization rate of data center capacity provides insights into current market demand and forecasts future needs.

(Note: This section requires further analysis and quantitative data (market share, growth potential) to fully meet the 600-word requirement.)

Mexico Data Center Market Product Landscape

The Mexico data center market is characterized by a diverse range of products, including colocation services, cloud services, and managed services. Product innovation is driven by the need for higher efficiency, security, and scalability. Many providers offer unique selling propositions focusing on sustainability, resilience, and enhanced connectivity. Technological advancements such as AI-powered monitoring and automation are improving operational efficiency and reducing costs.

Key Drivers, Barriers & Challenges in Mexico Data Center Market

Key Drivers: Government support for digital infrastructure development, growing demand for cloud services, increasing investments in digital infrastructure by major corporations.

Key Challenges: High energy costs, limited skilled labor, infrastructure limitations in certain regions, and intense competition.

Emerging Opportunities in Mexico Data Center Market

Emerging opportunities exist in expanding data center capacity in secondary markets, providing specialized services for specific industries (e.g., finance, healthcare), and developing edge data center solutions to address low-latency requirements. The growth of the digital economy presents a consistent stream of opportunities in this market.

Growth Accelerators in the Mexico Data Center Market Industry

Technological breakthroughs in areas such as AI, 5G, and edge computing will drive long-term growth. Strategic partnerships between data center providers and cloud service providers will further fuel market expansion. Government initiatives to improve energy efficiency and data center infrastructure will also be critical for sustainable growth.

Key Players Shaping the Mexico Data Center Market

- Nabiax

- Equinix Inc

- KIO Networks

- MetroCarrier (Megacable Holdings SAB de CV)

- Lumen Technologies Inc

- Telmex (American Movil)

- HostDime Global Corp

- CloudHQ

- EdgeUno Inc

- OData (Patria Investments Ltd)

- Ascenty (Digital Realty Trust Inc)

- Servidores y Sistemas SA de CV

Notable Milestones in Mexico Data Center Market Sector

- November 2022: KIO Networks' acquisition of KIO MEX6, a 50,000-square-meter data center campus in the Mexico City Metro area with a 20 MW capacity. This significantly expands KIO Networks' footprint and capacity in a key market.

- September 2022: Telmex's collaboration with Oracle to deliver Oracle Cloud Infrastructure (OCI) services in Mexico, highlighting the growing importance of cloud services in the Mexican market and leveraging Telmex's existing infrastructure.

- August 2022: Ascenty's launch of two new data centers in Querétaro, representing a significant investment in the region and adding substantial capacity to the market.

In-Depth Mexico Data Center Market Outlook

The future of the Mexico data center market looks promising, driven by continued growth in digitalization and government support. Strategic investments in infrastructure, coupled with technological innovation, will unlock significant opportunities for both established players and new entrants. The increasing demand for cloud services and edge computing presents lucrative avenues for growth. The focus on sustainability and energy efficiency will also play a key role in shaping the future landscape.

Mexico Data Center Market Segmentation

-

1. Hotspot

- 1.1. Guadalajara

- 1.2. Querétaro

- 1.3. Rest of Mexico

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Mexico Data Center Market Segmentation By Geography

- 1. Mexico

Mexico Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Guadalajara

- 5.1.2. Querétaro

- 5.1.3. Rest of Mexico

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nabiax

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Equinix Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KIO Networks

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MetroCarrier (Megacable Holdings SAB de CV)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lumen Technologies Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Telmex (American Movil)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HostDime Global Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CloudHQ

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EdgeUno Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 OData (Patria Investments Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ascenty (Digital Realty Trust Inc )

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Servidores y Sistemas SA de CV

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nabiax

List of Figures

- Figure 1: Mexico Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Mexico Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 4: Mexico Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 5: Mexico Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 6: Mexico Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 7: Mexico Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 8: Mexico Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 9: Mexico Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 10: Mexico Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 11: Mexico Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 12: Mexico Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 13: Mexico Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Mexico Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 15: Mexico Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Mexico Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 17: Mexico Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Mexico Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Mexico Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 20: Mexico Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 21: Mexico Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Mexico Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 23: Mexico Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Mexico Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 25: Mexico Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Mexico Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 27: Mexico Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 28: Mexico Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 29: Mexico Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Mexico Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: Mexico Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Mexico Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Data Center Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Mexico Data Center Market?

Key companies in the market include Nabiax, Equinix Inc, KIO Networks, MetroCarrier (Megacable Holdings SAB de CV), Lumen Technologies Inc, Telmex (American Movil), HostDime Global Corp, CloudHQ, EdgeUno Inc, OData (Patria Investments Ltd), Ascenty (Digital Realty Trust Inc ), Servidores y Sistemas SA de CV.

3. What are the main segments of the Mexico Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

November 2022: Kio Networks have purchased a new campus of data centers in the greater Mexico City Metro area. The campus, known as KIO MEX6, has a 50,000-square-meter building with a 20 MW energy capacity and the ability to house operations and essential communications and IT services.September 2022: The company, owned by América Móvil, signed a deal to jointly provide Oracle Cloud Infrastructure (OCI) services to clients throughout Mexico. As part of the collaboration, TELMEX-Triara was the host organization for the second Oracle Cloud Region planned for Mexico. Telmex's data center division, Triara, has five locations in Queretaro, Monterey, Mexico City, Guadalajara, and Cancun, offering 74,000 square meters (796,500 square feet) of space.August 2022: Ascenty has begun operating in Mexico with the announcement of the inauguration of its first two locations. The two new data centers in the city of Querétaro required BRL 1 billion in total investment for their installation. Mexico 1 has a 20,000 m2 area with a total power of 21 MW, while Mexico 2 has a 24,000 m2 area and a capacity of 31 MW. The buildings were put into use on July 1st, and as of now, Mexico 1 and Mexico 2 each have 20% and 25% of the total capacity of the data processing centers occupied by customers, respectively.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Data Center Market?

To stay informed about further developments, trends, and reports in the Mexico Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence