Key Insights

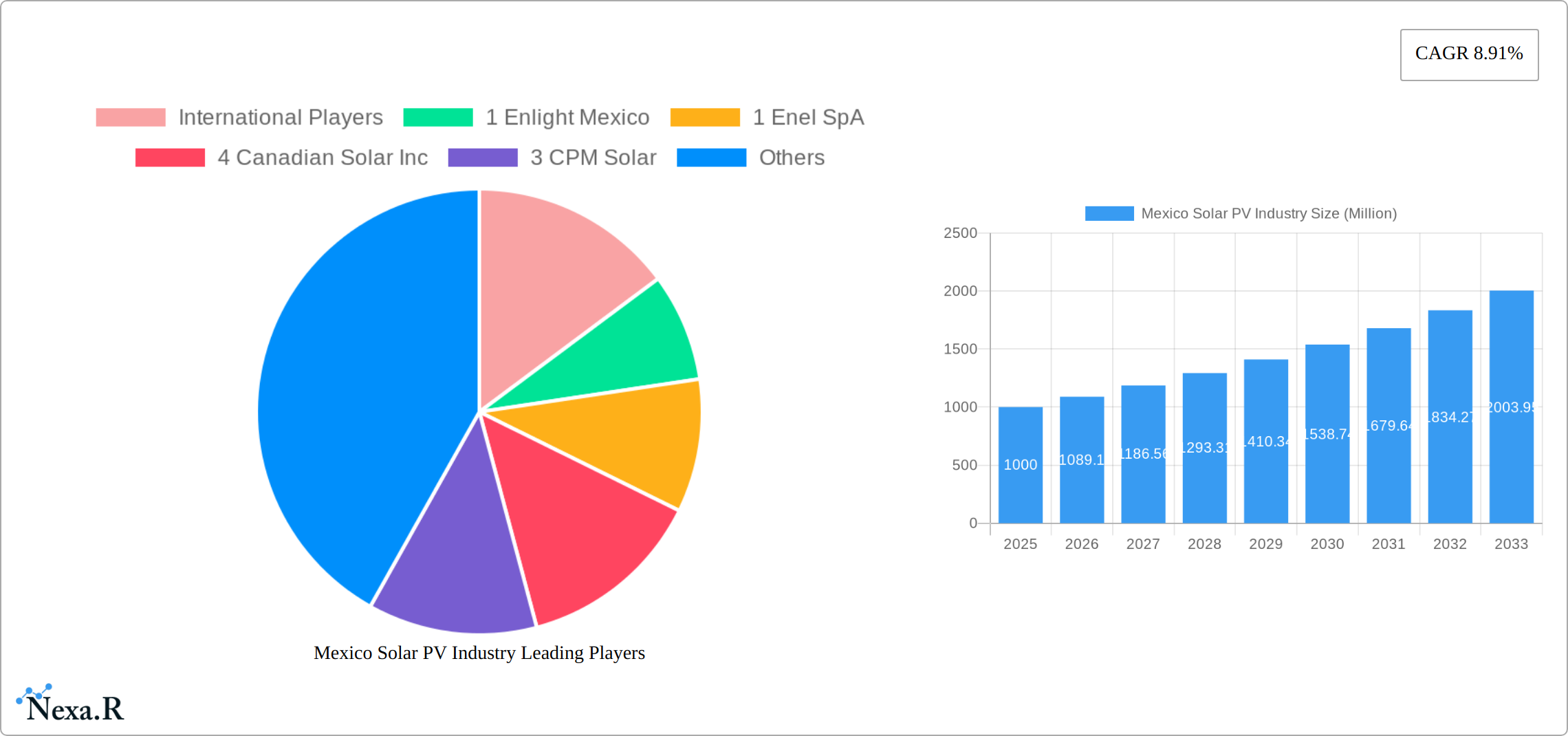

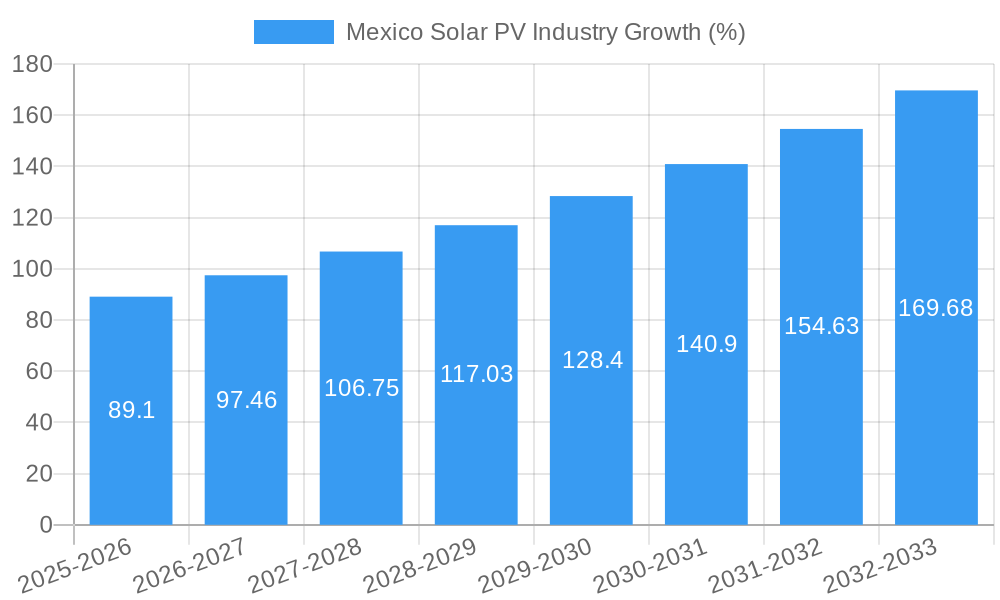

The Mexico solar PV industry is experiencing robust growth, driven by increasing government support for renewable energy, declining solar panel costs, and rising electricity demand. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 8.91% and the study period), is projected to expand significantly over the forecast period (2025-2033). Key drivers include Mexico's ambitious renewable energy targets, incentives for solar energy adoption, and the country's abundant solar resources, particularly in the northern regions. The market is segmented by deployment type, encompassing utility-scale projects that contribute significantly to the national grid and distributed generation across residential, commercial, and industrial sectors. International players like Canadian Solar, Enel SpA, and Risen Energy, alongside domestic companies such as Hanwha Q Cells and 3TekSolar, are actively shaping the market landscape, engaging in fierce competition and fostering innovation. While challenges such as regulatory hurdles and grid infrastructure limitations exist, the overall growth trajectory remains positive, indicating substantial investment opportunities and a promising future for solar energy in Mexico.

The consistent CAGR of 8.91% suggests a sustained expansion in the Mexican solar PV market. This growth is further supported by the increasing awareness of environmental sustainability and the push towards energy independence. The ongoing development of large-scale solar projects coupled with the growing adoption of rooftop solar systems across different sectors will continue to drive market expansion. While the exact market size in 2025 remains unspecified, projecting from the known CAGR and the stated historical and forecast periods allows for reasonable estimations of future market value. This growth, however, isn't without its limitations. Potential restraints include intermittency issues related to solar energy generation, land acquisition challenges, and the necessity for continuous grid modernization to accommodate the increasing influx of renewable energy sources. Nevertheless, the overall optimistic outlook indicates a promising and expanding market for solar PV technology in Mexico throughout the forecast period.

Mexico Solar PV Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico solar PV industry, covering market dynamics, growth trends, key players, and future outlook. The report leverages extensive data and insights to provide a clear understanding of this rapidly evolving sector, focusing on both the parent market (Renewable Energy in Mexico) and the child market (Solar PV). The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and policymakers seeking to navigate the complexities and opportunities within the Mexican solar PV market.

Mexico Solar PV Industry Market Dynamics & Structure

This section analyzes the market concentration, technological innovation, regulatory landscape, competitive dynamics, and M&A activity within the Mexican solar PV industry. The market is characterized by a mix of international and domestic players, with varying levels of market share. The analysis includes quantitative data on market share percentages and M&A deal volumes, as well as qualitative assessments of innovation barriers and regulatory hurdles. Market concentration is currently moderate, with xx% market share held by the top 5 players.

- Market Concentration: Moderate, with top 5 players holding xx% market share (2024).

- Technological Innovation: Driven by advancements in PV cell efficiency and energy storage solutions. Innovation barriers include high upfront capital costs and limited access to financing.

- Regulatory Framework: Undergoing evolution, with ongoing efforts to streamline permitting processes and incentivize renewable energy adoption. Policy uncertainties remain a challenge.

- Competitive Product Substitutes: Primarily wind energy and other renewable sources; however, solar PV holds a competitive advantage in certain applications.

- End-User Demographics: Primarily utility-scale projects, followed by commercial and industrial segments. Residential adoption is growing but remains relatively low compared to other segments.

- M&A Trends: A moderate level of M&A activity is observed, driven by consolidation efforts and strategic expansion by international and domestic players. The total value of M&A deals in the historical period (2019-2024) was approximately $xx million.

Mexico Solar PV Industry Growth Trends & Insights

This section details the evolution of the Mexican solar PV market size, adoption rates, technological advancements, and shifting consumer behaviors from 2019 to 2033. We use rigorous methodologies to project market growth and penetration rates, highlighting key trends influencing market expansion. The market is expected to experience significant growth driven by supportive government policies, decreasing technology costs, and increasing electricity demand.

The Mexican solar PV market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx million USD by 2033. Market penetration is expected to increase from xx% in 2024 to xx% by 2033, driven by substantial investments in large-scale solar projects and increasing adoption in the distributed generation segment. Technological disruptions, such as advancements in PV technology and battery storage, will continue to drive down costs and improve efficiency, accelerating market growth. Consumer behavior shifts, including rising environmental awareness and a growing preference for renewable energy sources, further bolster the positive outlook for the market.

Dominant Regions, Countries, or Segments in Mexico Solar PV Industry

This section pinpoints the leading regions and segments driving growth within the Mexican solar PV market. A detailed analysis is presented, focusing on market share, growth potential, and key drivers of dominance.

Dominant Segment: Utility-scale solar projects currently dominate the market, accounting for xx% of total installed capacity in 2024. This is primarily driven by the scale of projects and favorable government policies aimed at increasing renewable energy generation capacity. However, the distributed generation segment (residential, commercial, and industrial) is projected to exhibit the fastest growth rate in the forecast period.

Key Drivers:

- Supportive government policies and regulations promoting renewable energy adoption.

- Abundant solar resources and favorable geographical conditions.

- Decreasing solar PV technology costs.

- Increasing demand for electricity and the need to diversify energy sources.

- Growing investor interest and access to financing for solar projects.

The dominance of utility-scale solar is attributed to the substantial economies of scale achievable with large projects, enabling lower costs per kilowatt-hour compared to distributed generation. However, the distributed generation segment shows strong growth potential, driven by decreasing technology costs and increasing awareness of the environmental and economic benefits of on-site solar power generation.

Mexico Solar PV Industry Product Landscape

The Mexican solar PV market showcases a diverse range of products, encompassing various PV module technologies (crystalline silicon, thin-film), inverters, trackers, and mounting systems. Technological advancements focus on enhancing efficiency, durability, and reducing manufacturing costs. Key innovations include the development of higher-efficiency PV cells, advanced energy storage solutions, and smart grid integration capabilities. These advancements translate into improved performance metrics, such as higher energy yield, longer lifespan, and reduced operation & maintenance costs. Unique selling propositions include specialized products tailored to specific climatic conditions and customized solutions to meet diverse customer requirements.

Key Drivers, Barriers & Challenges in Mexico Solar PV Industry

Key Drivers:

- Government support: Mexico's energy transition plan and renewable energy targets drive significant investments and policy support.

- Decreasing costs: Technological advancements and economies of scale continue to lower the cost of solar PV systems.

- Abundant solar resources: Mexico's high solar irradiance provides a favorable environment for solar energy generation.

Key Barriers and Challenges:

- Regulatory uncertainty: Changes in energy policy and permitting processes can create uncertainty and delays for projects.

- Grid infrastructure limitations: The existing grid infrastructure needs upgrades and expansion to accommodate increasing renewable energy generation.

- Financing challenges: Securing project financing, particularly for smaller-scale projects, can be difficult.

- Supply chain disruptions: Global supply chain disruptions can impact the availability and cost of solar PV components. The impact of these disruptions on the market was estimated at xx% during the historical period (2019-2024).

Emerging Opportunities in Mexico Solar PV Industry

- Untapped market segments: Significant opportunities exist in the residential and agricultural sectors, as well as in off-grid applications.

- Innovative applications: Integration of solar PV with energy storage systems and smart grid technologies presents new market opportunities.

- Evolving consumer preferences: Growing consumer demand for renewable energy sources drives the adoption of rooftop solar systems and community solar projects.

Growth Accelerators in the Mexico Solar PV Industry

Technological breakthroughs in PV cell efficiency and battery storage, coupled with strategic partnerships between international and domestic players, are key growth accelerators. Expanding market access through financing initiatives and streamlining permitting processes will further stimulate market growth. A focus on developing local manufacturing capabilities and workforce training will enhance long-term sustainability and competitiveness.

Key Players Shaping the Mexico Solar PV Industry Market

- Enlight Mexico

- Enel SpA

- Canadian Solar Inc

- CPM Solar

- Risen Energy Co Ltd

- Hanwha Q Cells Co Ltd

- 3TekSolar

- Engie SA

Notable Milestones in Mexico Solar PV Industry Sector

- November 2022: Completion of the 300 MW La Pimienta solar plant by Atlas Renewable Energy in Campeche, Mexico.

- February 2023: Sowitec secures agreements for three solar power projects with a combined capacity of 570 MW in Mexico. Commissioning is expected to start in 2025.

In-Depth Mexico Solar PV Industry Market Outlook

The Mexican solar PV market holds substantial long-term growth potential, driven by continued policy support, decreasing technology costs, and increasing demand for renewable energy. Strategic opportunities exist for companies focusing on innovative technologies, expanding into untapped market segments, and establishing robust supply chains. Further investments in grid infrastructure and workforce development are crucial to ensuring the sustained growth and integration of solar PV into Mexico's energy system.

Mexico Solar PV Industry Segmentation

-

1. Deployment

- 1.1. Utility-scale

- 1.2. Distribu

Mexico Solar PV Industry Segmentation By Geography

- 1. Mexico

Mexico Solar PV Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Costs of Solar Technologies4.; Demand for Decentralized Solar Energy Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Absence of Any New Initiatives in the Country

- 3.4. Market Trends

- 3.4.1. Increasing Deployment of Utility-scale Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Solar PV Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Utility-scale

- 5.1.2. Distribu

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 International Players

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 1 Enlight Mexico

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 1 Enel SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 4 Canadian Solar Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3 CPM Solar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 3 Risen Energy Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Domestic Players

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 5 Hanwha Q Cells Co Ltd *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 2 3TekSolar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 2 Engie SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 International Players

List of Figures

- Figure 1: Mexico Solar PV Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Solar PV Industry Share (%) by Company 2024

List of Tables

- Table 1: Mexico Solar PV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Solar PV Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Mexico Solar PV Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Mexico Solar PV Industry Volume gigawatt Forecast, by Deployment 2019 & 2032

- Table 5: Mexico Solar PV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mexico Solar PV Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 7: Mexico Solar PV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Mexico Solar PV Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 9: Mexico Solar PV Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 10: Mexico Solar PV Industry Volume gigawatt Forecast, by Deployment 2019 & 2032

- Table 11: Mexico Solar PV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Mexico Solar PV Industry Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Solar PV Industry?

The projected CAGR is approximately 8.91%.

2. Which companies are prominent players in the Mexico Solar PV Industry?

Key companies in the market include International Players, 1 Enlight Mexico, 1 Enel SpA, 4 Canadian Solar Inc, 3 CPM Solar, 3 Risen Energy Co Ltd, Domestic Players, 5 Hanwha Q Cells Co Ltd *List Not Exhaustive, 2 3TekSolar, 2 Engie SA.

3. What are the main segments of the Mexico Solar PV Industry?

The market segments include Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Costs of Solar Technologies4.; Demand for Decentralized Solar Energy Systems.

6. What are the notable trends driving market growth?

Increasing Deployment of Utility-scale Projects.

7. Are there any restraints impacting market growth?

4.; Absence of Any New Initiatives in the Country.

8. Can you provide examples of recent developments in the market?

February 2023: German renewable energy developer Sowitec announced that it has signed agreements to trade three solar power projects with a integrated capacity of 570 MW in Mexico. At present, the three projects are at an advanced stage of development with land and all environmental permits in place. Commissioning is expected to start in 2025

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Solar PV Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Solar PV Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Solar PV Industry?

To stay informed about further developments, trends, and reports in the Mexico Solar PV Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence