Key Insights

The Mexico Spinal Surgery Devices Market is poised for significant expansion, projected to reach an estimated $13.5 billion in 2025 with a robust Compound Annual Growth Rate (CAGR) of 7.8%. This upward trajectory is propelled by a confluence of factors, including a growing aging population susceptible to spinal conditions, increasing prevalence of spinal deformities and degenerative diseases, and a rising demand for minimally invasive surgical techniques that offer faster recovery times and reduced patient trauma. Technological advancements in spinal implants, such as bio-compatible materials and improved designs for spinal fusion and decompression procedures, are further fueling market growth. Furthermore, a greater awareness among healthcare professionals and patients regarding the benefits of advanced spinal interventions is contributing to higher adoption rates. The market's growth is also being supported by increasing healthcare expenditure and government initiatives aimed at improving access to advanced medical technologies.

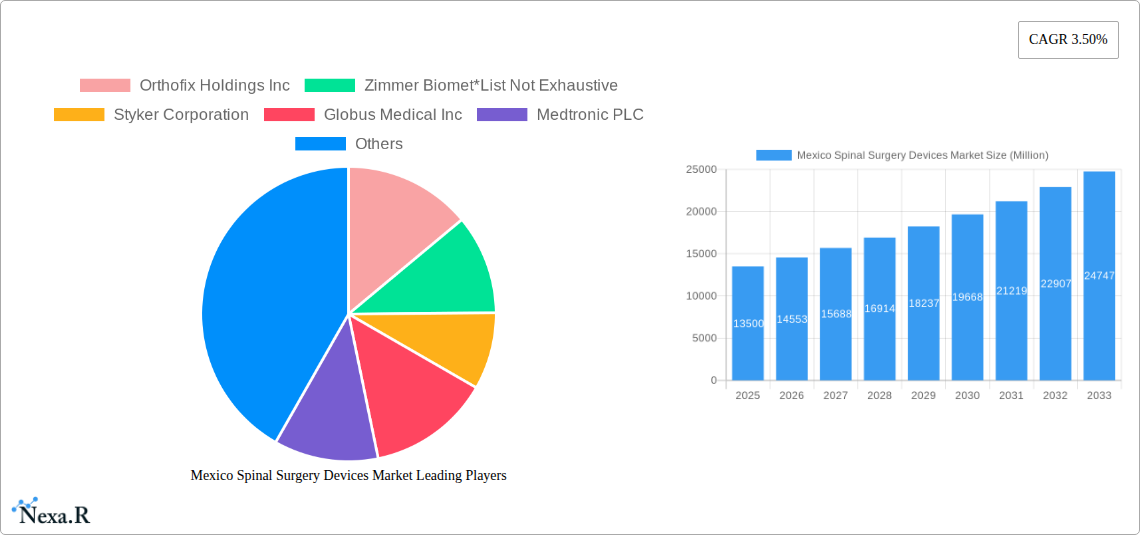

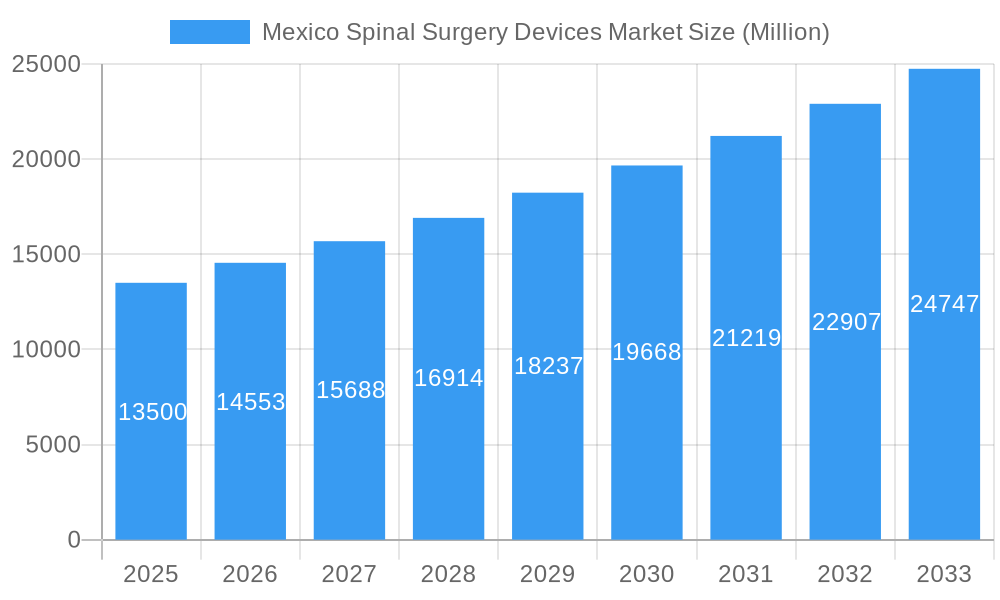

Mexico Spinal Surgery Devices Market Market Size (In Billion)

Key market drivers include the increasing incidence of sports-related injuries and accidents leading to spinal trauma requiring immediate surgical intervention, alongside a rising concern for spinal health among the general population. The market is segmented into crucial areas such as Spinal Decompression (encompassing Corpectomy, Discectomy, and Laminotomy), Spinal Fusion (including Cervical, Interbody, and ThoracoLumbar fusion), Fracture Repair Devices, and other specialized device types. Leading global players like Medtronic PLC, Johnson & Johnson, Stryker Corporation, Zimmer Biomet, and Globus Medical Inc. are actively participating in this dynamic market, driving innovation and competition. Emerging trends point towards greater adoption of robotic-assisted spinal surgeries and personalized treatment approaches. However, the market may face challenges such as high costs associated with advanced spinal devices and the need for specialized surgical training, which could act as potential restraints.

Mexico Spinal Surgery Devices Market Company Market Share

This report provides an in-depth analysis of the Mexico Spinal Surgery Devices Market, exploring its dynamics, growth trends, product landscape, and key players from 2019 to 2033. We leverage extensive data and expert insights to deliver a comprehensive overview of this rapidly evolving sector. The study period spans from 2019 to 2033, with a base year of 2025, an estimated year of 2025, and a forecast period of 2025–2033, building upon the historical period of 2019–2024.

Mexico Spinal Surgery Devices Market Market Dynamics & Structure

The Mexico Spinal Surgery Devices Market is characterized by a moderate level of concentration, with a few dominant players holding significant market share, including Medtronic PLC, Johnson & Johnson, and Stryker Corporation. Technological innovation is a key driver, with advancements in minimally invasive surgical techniques and biocompatible materials constantly emerging. The regulatory framework, overseen by agencies like COFEPRIS, plays a crucial role in ensuring product safety and efficacy, though it can also present adoption hurdles. Competitive product substitutes, such as non-surgical treatments and alternative therapies, exist, but the demand for advanced surgical devices remains robust. End-user demographics are shifting, with an aging population and a rising prevalence of spinal conditions driving increased demand for spinal surgery. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios and market reach. For instance, the past few years have seen 3 significant M&A deals, totaling approximately $0.5 billion in value, indicating consolidation and strategic expansion within the market. Barriers to innovation include high research and development costs and the lengthy process of regulatory approval for new medical devices.

Mexico Spinal Surgery Devices Market Growth Trends & Insights

The Mexico Spinal Surgery Devices Market is poised for substantial growth, driven by an escalating burden of spinal disorders and an increasing acceptance of surgical interventions. The market size is projected to expand from approximately $1.2 billion in 2025 to reach an estimated $2.8 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period. This growth trajectory is underpinned by a steady increase in the adoption rates of advanced spinal fusion and spinal decompression devices, fueled by technological disruptions like robotic-assisted surgery and 3D-printed implants. Consumer behavior shifts are also playing a pivotal role; patients are becoming more informed and actively seek advanced treatment options that promise faster recovery and improved outcomes. The rising incidence of degenerative disc disease, scoliosis, and spinal trauma among the working-age population and the elderly is a significant demographic catalyst. Furthermore, growing healthcare expenditure in Mexico, coupled with an expanding private healthcare sector, is improving access to sophisticated spinal surgical procedures and, consequently, driving demand for high-quality spinal surgery devices. The market penetration of minimally invasive spinal surgery techniques, which require specialized instruments and implants, is also on the rise, contributing to the overall market expansion.

Dominant Regions, Countries, or Segments in Mexico Spinal Surgery Devices Market

Within the vast landscape of the Mexico Spinal Surgery Devices Market, Spinal Fusion emerges as the dominant segment, accounting for an estimated 45% market share in 2025. This segment's leadership is propelled by the growing prevalence of degenerative spinal conditions, such as herniated discs and spinal stenosis, which frequently necessitate fusion procedures for stabilization and pain relief. The ThoracoLumbar Fusion sub-segment, in particular, is a significant contributor, driven by the high incidence of lower back pain and the increasing adoption of fusion techniques in this region. Key drivers for this dominance include favorable economic policies that encourage investment in healthcare infrastructure and the availability of skilled surgeons proficient in performing complex fusion surgeries. The Interbody Fusion sub-segment also exhibits strong growth, supported by the development of innovative cage designs and biologics that enhance fusion rates and patient recovery.

Spinal Fusion Dominance Factors:

- High Prevalence of Degenerative Spinal Conditions: Age-related wear and tear on the spine leads to conditions like spondylolisthesis and degenerative disc disease, requiring fusion.

- Advancements in Fusion Technologies: Development of interbody devices, pedicle screws, and bone graft substitutes offering improved biomechanical stability and fusion success.

- Minimally Invasive Techniques: Growing preference for MIS approaches in spinal fusion procedures, leading to reduced trauma, shorter hospital stays, and faster patient recovery.

- Increasing Healthcare Expenditure: Enhanced government and private sector investment in healthcare infrastructure and advanced medical technologies.

- Growing Awareness and Patient Demand: Increased patient awareness regarding the benefits of spinal fusion for chronic back pain and neurological deficits.

Other Key Segments:

- Spinal Decompression (including Discectomy and Laminotomy) represents another significant segment, driven by the need to alleviate nerve root compression.

- Fracture Repair Devices are crucial for treating spinal trauma, which is a concern in the region.

The market's growth potential within the Spinal Fusion segment remains substantial, bolstered by ongoing research into novel biomaterials and surgical techniques aimed at further improving outcomes and reducing complications.

Mexico Spinal Surgery Devices Market Product Landscape

The product landscape of the Mexico Spinal Surgery Devices Market is dynamic, marked by continuous innovation. Key product advancements include the introduction of highly biocompatible PEEK (polyetheretherketone) implants for spinal fusion, offering superior radiolucency and biomechanical properties. Navigation systems and robotic-assisted surgical platforms are increasingly being integrated, enabling surgeons to perform complex procedures with greater precision and minimal invasiveness. The application of 3D printing technology is revolutionizing implant design, allowing for customized solutions tailored to individual patient anatomy, thereby enhancing surgical outcomes. Performance metrics are continuously improving, with focus on achieving higher fusion rates, reducing revision surgeries, and minimizing patient recovery times. Unique selling propositions for leading products often lie in their ease of use for surgeons, superior bone integration, and comprehensive clinical trial data demonstrating efficacy.

Key Drivers, Barriers & Challenges in Mexico Spinal Surgery Devices Market

Key Drivers:

- Aging Population and Rising Prevalence of Spinal Disorders: A growing elderly population, coupled with increased sedentary lifestyles, is driving a surge in degenerative spinal conditions like osteoarthritis and herniated discs.

- Technological Advancements: Continuous innovation in minimally invasive surgical techniques, robotics, navigation systems, and advanced implant materials is improving surgical outcomes and patient recovery.

- Increasing Healthcare Expenditure and Infrastructure Development: Expanding public and private healthcare investments are enhancing access to advanced medical procedures and devices.

- Growing Awareness and Demand for Effective Pain Management: Patients are increasingly seeking surgical interventions for chronic back and neck pain, driving demand for sophisticated spinal surgery devices.

Key Barriers & Challenges:

- High Cost of Advanced Devices: The premium pricing of cutting-edge spinal surgery devices can limit their adoption, especially in resource-constrained settings.

- Regulatory Hurdles and Approval Processes: Stringent regulatory requirements for medical device approval can lead to extended timelines and significant costs for manufacturers.

- Shortage of Skilled Surgeons: A limited pool of highly trained spinal surgeons capable of performing complex procedures can bottleneck market growth.

- Reimbursement Policies: Inconsistent or unfavorable reimbursement policies from insurance providers can impact the affordability and accessibility of certain spinal surgeries.

- Economic Volatility: Fluctuations in the Mexican economy can affect healthcare spending and investment in new technologies.

Emerging Opportunities in Mexico Spinal Surgery Devices Market

Emerging opportunities in the Mexico Spinal Surgery Devices Market lie in the expansion of minimally invasive surgery (MIS) technologies, which offer reduced patient trauma and faster recovery times. The development and adoption of personalized implants, facilitated by 3D printing, present a significant avenue for growth, catering to the unique anatomical needs of individual patients. Furthermore, there is a growing demand for integrated solutions that combine surgical instrumentation, implants, and digital health platforms for pre- and post-operative patient management. Untapped markets in smaller cities and rural areas, with targeted outreach and education initiatives, could unlock substantial growth potential. The increasing focus on value-based healthcare is also creating opportunities for manufacturers offering cost-effective and outcome-driven spinal surgery devices.

Growth Accelerators in the Mexico Spinal Surgery Devices Market Industry

Several catalysts are accelerating the growth of the Mexico Spinal Surgery Devices Market. Technological breakthroughs in biocompatible materials and regenerative medicine are paving the way for enhanced fusion rates and bone regeneration. The increasing adoption of artificial intelligence (AI) and data analytics in surgical planning and execution promises to optimize surgical outcomes and personalize treatments. Strategic partnerships between device manufacturers and healthcare institutions are crucial for facilitating the adoption of new technologies and conducting clinical research. Market expansion strategies, including targeted marketing campaigns and educational programs for surgeons, are also playing a vital role in driving demand. The growing trend of medical tourism in Mexico further presents an opportunity for market expansion by attracting international patients seeking advanced spinal surgeries.

Key Players Shaping the Mexico Spinal Surgery Devices Market Market

- Orthofix Holdings Inc

- Zimmer Biomet

- Stryker Corporation

- Globus Medical Inc

- Medtronic PLC

- Johnson & Johnson

- B Braun Melsungen AG

Notable Milestones in Mexico Spinal Surgery Devices Market Sector

- 2019: Introduction of next-generation expandable cages for lumbar fusion, improving surgical flexibility.

- 2020: Launch of advanced robotic-assisted spinal surgery systems, enhancing precision in complex procedures.

- 2021: Regulatory approval for novel biodegradable bone graft substitutes, promoting faster bone fusion.

- 2022: Significant increase in M&A activity, with key players acquiring smaller innovative companies to expand product portfolios.

- 2023: Enhanced adoption of 3D-printed implants for patient-specific spinal fusion solutions.

- 2024: Introduction of AI-powered navigation tools for spinal surgery, improving surgical planning and execution.

In-Depth Mexico Spinal Surgery Devices Market Market Outlook

The future outlook for the Mexico Spinal Surgery Devices Market is exceptionally promising, driven by persistent demographic shifts and a relentless pace of technological innovation. Growth accelerators such as the widespread adoption of minimally invasive techniques, the integration of AI and robotics, and the burgeoning field of personalized medicine will continue to shape the market's trajectory. Strategic collaborations and the expanding healthcare infrastructure will further bolster market accessibility and penetration. The increasing patient awareness and demand for effective solutions to spinal disorders, coupled with favorable economic conditions and government support for healthcare advancements, will collectively propel the market towards sustained and robust growth in the coming years.

Mexico Spinal Surgery Devices Market Segmentation

-

1. Device Type

-

1.1. Spinal Decompression

- 1.1.1. Corpectomy

- 1.1.2. Discectomy

- 1.1.3. Laminotomy

- 1.1.4. Other Spinal Decompressions

-

1.2. Spinal Fusion

- 1.2.1. Cervical Fusion

- 1.2.2. Interbody Fusion

- 1.2.3. ThoracoLumbar Fusion

- 1.2.4. Other Spinal Fusions

- 1.3. Fracture Repair Devices

- 1.4. Other Device Types

-

1.1. Spinal Decompression

Mexico Spinal Surgery Devices Market Segmentation By Geography

- 1. Mexico

Mexico Spinal Surgery Devices Market Regional Market Share

Geographic Coverage of Mexico Spinal Surgery Devices Market

Mexico Spinal Surgery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Adoption of Minimally Invasive Surgeries; Technological Advancements in Spinal Surgery

- 3.3. Market Restrains

- 3.3.1. ; High Treatment Cost; Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Interbody Fusion Sub-segment is Expected to Show Better Growth over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Spinal Surgery Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Spinal Decompression

- 5.1.1.1. Corpectomy

- 5.1.1.2. Discectomy

- 5.1.1.3. Laminotomy

- 5.1.1.4. Other Spinal Decompressions

- 5.1.2. Spinal Fusion

- 5.1.2.1. Cervical Fusion

- 5.1.2.2. Interbody Fusion

- 5.1.2.3. ThoracoLumbar Fusion

- 5.1.2.4. Other Spinal Fusions

- 5.1.3. Fracture Repair Devices

- 5.1.4. Other Device Types

- 5.1.1. Spinal Decompression

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Orthofix Holdings Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zimmer Biomet*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Styker Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Globus Medical Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson & Johnson

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 B Braun Melsungen AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Orthofix Holdings Inc

List of Figures

- Figure 1: Mexico Spinal Surgery Devices Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Mexico Spinal Surgery Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Spinal Surgery Devices Market Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 2: Mexico Spinal Surgery Devices Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Mexico Spinal Surgery Devices Market Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 4: Mexico Spinal Surgery Devices Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Spinal Surgery Devices Market?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Mexico Spinal Surgery Devices Market?

Key companies in the market include Orthofix Holdings Inc, Zimmer Biomet*List Not Exhaustive, Styker Corporation, Globus Medical Inc, Medtronic PLC, Johnson & Johnson, B Braun Melsungen AG.

3. What are the main segments of the Mexico Spinal Surgery Devices Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Adoption of Minimally Invasive Surgeries; Technological Advancements in Spinal Surgery.

6. What are the notable trends driving market growth?

Interbody Fusion Sub-segment is Expected to Show Better Growth over the Forecast Period.

7. Are there any restraints impacting market growth?

; High Treatment Cost; Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Spinal Surgery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Spinal Surgery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Spinal Surgery Devices Market?

To stay informed about further developments, trends, and reports in the Mexico Spinal Surgery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence