Key Insights

The global monoclonal antibodies (mAbs) market is projected for significant growth, expected to reach a market size of $286.6 billion by 2025, driven by a compound annual growth rate (CAGR) of 12.44%. This expansion is primarily attributed to the rising incidence of chronic diseases such as cancer, autoimmune disorders, and infectious diseases, where mAbs excel as targeted therapeutic agents. Innovations in biotechnology and genetic engineering are facilitating the creation of advanced, personalized mAb treatments. Increased adoption of scalable and cost-effective in vitro production methods further bolsters market expansion. The continuous development of novel mAbs for diverse indications, supported by extensive clinical trials and expanding regulatory approvals, presents substantial opportunities.

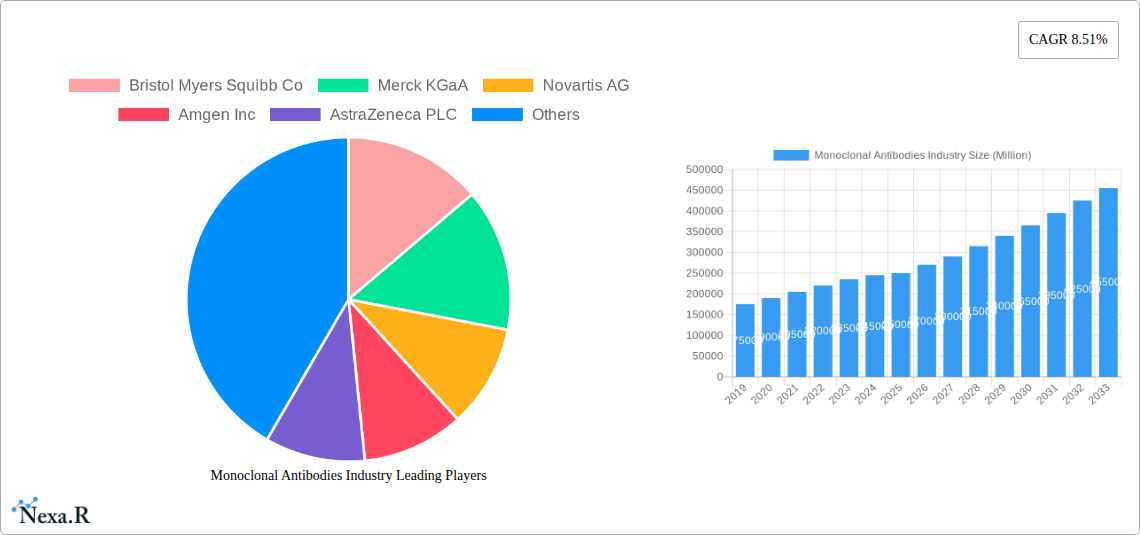

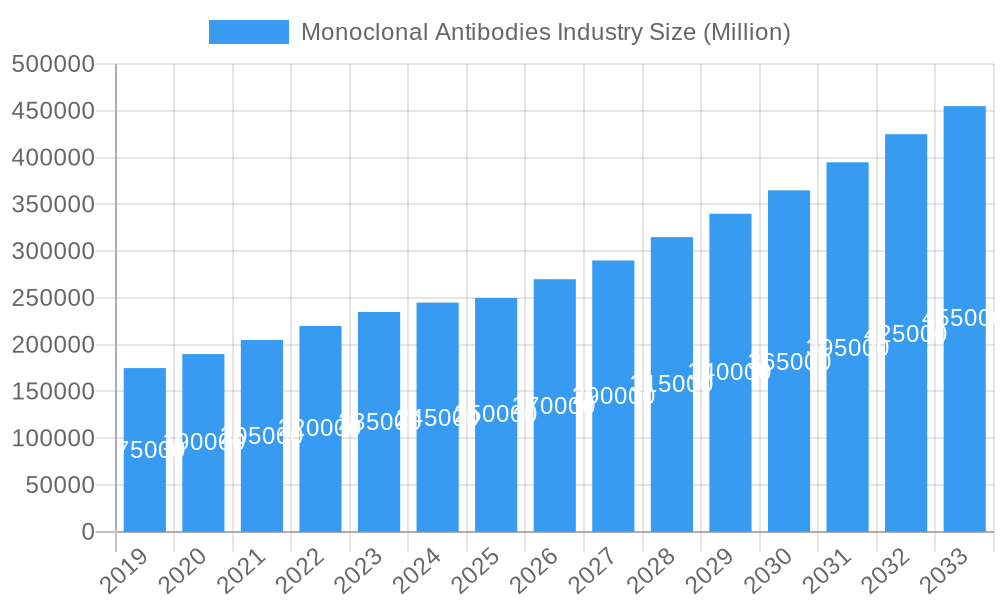

Monoclonal Antibodies Industry Market Size (In Billion)

The market features prominent pharmaceutical and biotechnology leaders including Bristol Myers Squibb, Merck KGaA, Novartis AG, Amgen Inc., AstraZeneca PLC, Eli Lilly and Company, AbbVie Inc., F. Hoffmann-La-Roche Ltd., Johnson & Johnson, GlaxoSmithKline PLC, and Pfizer Inc. These entities are actively pursuing R&D, strategic partnerships, and acquisitions to enhance their offerings and market presence. Key challenges include the high costs associated with mAb development and manufacturing, rigorous regulatory pathways, and increasing biosimilar competition. North America currently leads the market, supported by robust healthcare infrastructure and significant R&D investments, while Europe and Asia Pacific also demonstrate strong growth potential.

Monoclonal Antibodies Industry Company Market Share

Monoclonal Antibodies Industry Market Analysis & Forecast (2019-2033)

This comprehensive report delves into the dynamic global monoclonal antibodies market, providing an in-depth analysis of its structure, growth trajectory, and future outlook from 2019 to 2033, with a specific focus on the base year 2025 and the forecast period 2025-2033. Leveraging high-traffic keywords such as monoclonal antibody drugs, biologics market, therapeutic antibodies, cancer immunotherapy, and autoimmune disease treatment, this report is meticulously designed to attract and inform industry professionals, researchers, and investors. We meticulously examine the parent market and its key child markets, offering granular insights into segments like Production Methods (In Vivo, In Vitro), Source (Chimeric, Human, Humanized, Murine), Indications (Cancer, Autoimmune Diseases, Infectious Diseases, Inflammatory Diseases, Other Indications), and End Users (Hospitals, Research Institutes, Other End Users). All quantitative values are presented in Million Units.

Monoclonal Antibodies Industry Market Dynamics & Structure

The global monoclonal antibodies market is characterized by a high level of market concentration, with a few leading biopharmaceutical giants dominating innovation and production. Technological advancements in recombinant DNA technology and cell culture techniques are key drivers, enabling the development of highly specific and potent therapeutic antibodies. Stringent regulatory frameworks from bodies like the FDA and EMA govern drug approval, impacting market entry and development timelines. Competitive product substitutes, primarily small molecule drugs, exist but are increasingly being outmaneuvered by the targeted efficacy of mAbs. End-user demographics are shifting, with an aging global population and a rising prevalence of chronic diseases fueling demand. Mergers and acquisitions (M&A) trends are significant, as larger companies acquire innovative startups to bolster their pipelines and expand their market share. The historical period (2019-2024) witnessed significant R&D investments and product approvals, laying the groundwork for robust future growth. The estimated market size for 2025 is XX Million Units, with ongoing research in areas like bispecific antibodies and antibody-drug conjugates (ADCs) poised to redefine therapeutic landscapes.

- Market Concentration: Dominated by key players, but with increasing opportunities for niche players and biosimilar developers.

- Technological Innovation Drivers: Advancements in antibody engineering, conjugation technologies, and delivery systems.

- Regulatory Frameworks: Strict but essential for ensuring drug safety and efficacy.

- Competitive Landscape: Monoclonal antibodies offer superior specificity compared to traditional small molecules for many indications.

- End-User Demographics: Growing demand driven by aging populations and increasing prevalence of chronic and autoimmune diseases.

- M&A Trends: Strategic acquisitions to gain access to novel targets and therapeutic platforms.

Monoclonal Antibodies Industry Growth Trends & Insights

The monoclonal antibodies market size is projected for substantial growth, driven by a confluence of factors detailed in this section. The adoption rates of mAb therapies are escalating across various therapeutic areas, particularly in oncology and immunology, due to their superior efficacy and targeted action compared to conventional treatments. Technological disruptions, such as the refinement of in vitro production methods and the development of more efficient expression systems, are making mAbs more accessible and cost-effective. Consumer behavior shifts towards personalized medicine and biologic therapies further bolster market expansion.

The monoclonal antibody market CAGR is expected to be robust throughout the forecast period. Increased R&D spending by major pharmaceutical companies like Bristol Myers Squibb Co, Merck KGaA, and Novartis AG, coupled with significant investments in cancer immunotherapy and autoimmune disease treatment, are critical growth accelerators. The market penetration of monoclonal antibodies is expanding beyond major indications into rare diseases and novel therapeutic targets. Furthermore, the ongoing research and development of novel antibody formats, such as antibody fragments and bispecific antibodies, are opening up new avenues for treatment and contributing to market dynamism. The impact of global health events, like the COVID-19 pandemic, has also highlighted the critical role of monoclonal antibodies in combating infectious diseases, spurring accelerated development and approval pathways.

The evolution of biologics manufacturing is also a key trend, with companies like Lonza investing heavily in capacity expansion to meet the surging demand. The increasing focus on the development of humanized and fully human antibodies minimizes immunogenicity, leading to better patient outcomes and greater therapeutic success. The market is also witnessing a surge in biosimilar development, which, while posing a competitive challenge, also expands accessibility to these life-saving treatments for a broader patient population. The base year 2025 serves as a critical inflection point, reflecting a mature yet still rapidly expanding market segment with significant potential for innovation and commercial success. The forecast period 2025-2033 is poised to witness further breakthroughs, including advancements in antibody engineering and the application of mAbs in previously untreatable conditions.

Dominant Regions, Countries, or Segments in Monoclonal Antibodies Industry

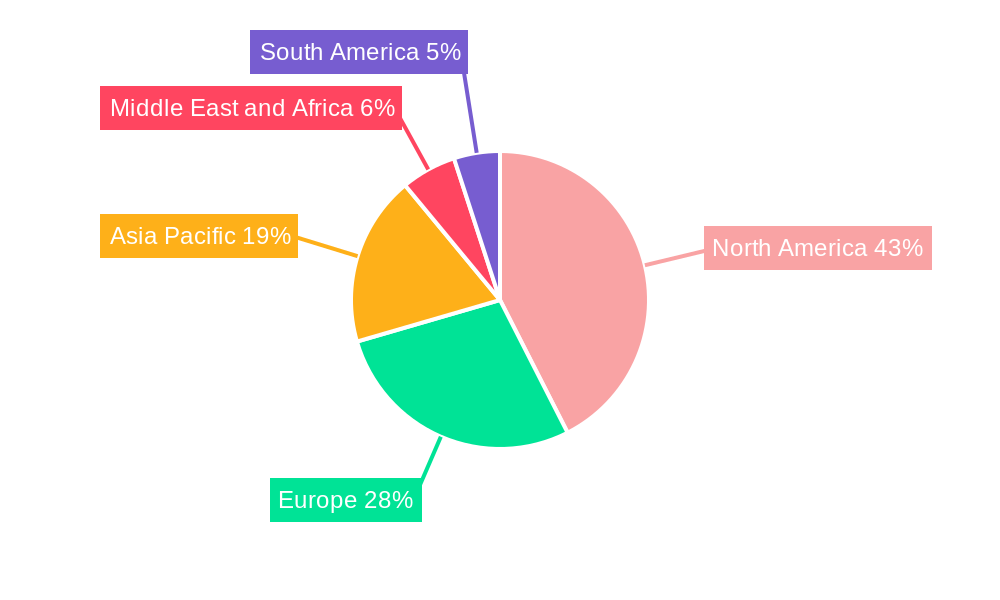

The North America region, particularly the United States, stands as a dominant force in the monoclonal antibodies industry, driven by substantial healthcare expenditure, a strong presence of leading pharmaceutical companies, and a robust regulatory environment that facilitates innovation and market access. The Indications segment of Cancer is the largest and most influential, commanding a significant market share due to the extensive research, development, and widespread clinical application of mAbs in treating various malignancies. This dominance is fueled by breakthroughs in cancer immunotherapy, where monoclonal antibodies play a pivotal role in activating the immune system against cancer cells.

- Dominant Region: North America (especially the USA) – driven by high healthcare spending, advanced research infrastructure, and favorable regulatory policies.

- Leading Segment (Indications): Cancer – continuous innovation in targeted therapies and immunotherapies.

- Key Drivers in Cancer Segment:

- Rising cancer incidence rates globally.

- Advancements in personalized medicine and biomarker-driven therapies.

- Extensive clinical trials and FDA approvals for novel oncology mAbs.

- Strong pipeline of investigational mAbs for various cancer types.

- Dominant Production Method: While In Vitro production methods are more prevalent and scalable for commercial manufacturing, In Vivo methods, particularly hybridoma technology, historically played a crucial role in initial discovery. The industry continues to refine and optimize in vitro systems for higher yields and quality control.

- Dominant Source: Humanized and Human antibodies lead the market due to their reduced immunogenicity and improved safety profiles, offering a significant advantage over Murine and Chimeric antibodies in long-term therapeutic applications.

- Dominant End User: Hospitals are the primary end-users, accounting for the largest share of mAb consumption due to inpatient and outpatient treatments for a wide array of indications.

- Market Share & Growth Potential: The cancer indication segment is projected to continue its upward trajectory, with significant growth potential driven by the expanding therapeutic applications and the development of next-generation antibodies. The focus on early detection and improved treatment outcomes further solidifies its dominance.

Monoclonal Antibodies Industry Product Landscape

The product landscape of the monoclonal antibodies industry is marked by continuous innovation and diversification. Key product advancements include the development of bispecific antibodies capable of targeting multiple antigens simultaneously, enhancing therapeutic efficacy and overcoming resistance mechanisms. Antibody-drug conjugates (ADCs) represent another significant innovation, combining the targeted delivery of antibodies with the potent cytotoxic effect of small molecule drugs, particularly in oncology. Companies are also focusing on optimizing antibody engineering to improve pharmacokinetic profiles, reduce immunogenicity, and enhance target engagement. The performance metrics of these products are evaluated based on efficacy, safety, patient response rates, and overall survival benefits, with leading products demonstrating substantial improvements over existing treatment paradigms.

Key Drivers, Barriers & Challenges in Monoclonal Antibodies Industry

Key Drivers:

- Technological Advancements: Innovations in antibody engineering, cell culture, and bioprocessing are continuously improving efficacy and reducing production costs.

- Increasing Prevalence of Chronic Diseases: The rising incidence of cancer, autoimmune disorders, and inflammatory diseases fuels the demand for targeted therapies like mAbs.

- Growing Healthcare Expenditure: Increased investments in healthcare infrastructure and R&D by governments and private entities support market expansion.

- Personalized Medicine: The trend towards personalized treatment approaches favors the highly specific action of monoclonal antibodies.

Barriers & Challenges:

- High Development and Manufacturing Costs: The complex nature of mAb development and large-scale biomanufacturing leads to substantial financial investments and prolonged timelines.

- Regulatory Hurdles: Stringent and lengthy approval processes by regulatory bodies can delay market entry and increase R&D risks.

- Biosimilar Competition: The emergence of biosimilars, while increasing accessibility, can lead to price erosion and impact the revenue of originator products.

- Supply Chain Complexities: Ensuring a stable and scalable supply of critical raw materials and finished products globally presents logistical challenges.

- Immunogenicity and Side Effects: Despite advancements, some patients may still experience adverse reactions, requiring careful monitoring and management.

Emerging Opportunities in Monoclonal Antibodies Industry

Emerging opportunities in the monoclonal antibodies industry are vast and largely driven by unmet medical needs and novel therapeutic strategies. The application of mAbs in rare diseases, such as specific genetic disorders and orphan cancers, presents a significant untapped market. Furthermore, the development of antibodies for neurodegenerative diseases like Alzheimer's and Parkinson's is gaining momentum, promising new treatment avenues. The integration of AI and machine learning in drug discovery and development is accelerating the identification of novel targets and the design of highly effective antibodies. The expansion of therapeutic antibodies into infectious disease prevention and treatment beyond the COVID-19 pandemic also represents a growing area.

Growth Accelerators in the Monoclonal Antibodies Industry Industry

Several growth accelerators are propelling the monoclonal antibodies industry forward. Technological breakthroughs in areas such as single-domain antibodies and engineered protein scaffolds are expanding the therapeutic potential. Strategic partnerships between large pharmaceutical companies and smaller biotech firms are fostering innovation and accelerating drug development timelines by pooling resources and expertise. Market expansion strategies, including the penetration of emerging economies and the development of biosimilars to increase accessibility, are also crucial growth catalysts. The increasing focus on preventative therapies and the potential of prophylactic antibody treatments for infectious diseases further contribute to long-term market expansion.

Key Players Shaping the Monoclonal Antibodies Industry Market

- Bristol Myers Squibb Co

- Merck KGaA

- Novartis AG

- Amgen Inc

- AstraZeneca PLC

- Eli Lilly and Company

- AbbVie Inc

- F Hoffmann-La-Roche Ltd

- Johnson & Johnson

- GlaxoSmithKline PLC

- Pfizer Inc

Notable Milestones in Monoclonal Antibodies Industry Sector

- February 2022: Eli Lilly and Company announced that the United States Food and Drug Administration (FDA) issued an Emergency Use Authorization (EUA) for bebtelovimab, an antibody demonstrating neutralization against the Omicron variant of SARS-CoV-2.

- January 2022: HaemaLogiX Ltd (HaemaLogiX) and Lonza entered into an agreement to manufacture the next clinical batch (cGMP) of HaemaLogiX's lead multiple myeloma drug candidate, KappaMab, a monoclonal antibody that targets the kappa myeloma antigen (KMA) found exclusively on myeloma cancer cells.

In-Depth Monoclonal Antibodies Industry Market Outlook

The future outlook for the monoclonal antibodies industry remains exceptionally positive, driven by continuous scientific innovation and an expanding range of therapeutic applications. The ongoing research into advanced antibody formats, such as bispecific and trispecific antibodies, alongside the refinement of antibody-drug conjugates, promises to unlock new treatment paradigms for complex diseases. Strategic collaborations and significant investments in R&D infrastructure will accelerate the pipeline of novel therapies. The increasing adoption of these targeted biologics in both developed and emerging markets, coupled with the evolving understanding of disease mechanisms, signals substantial future growth potential and ongoing market expansion.

Monoclonal Antibodies Industry Segmentation

-

1. Production Methods

- 1.1. In Vivo

- 1.2. In Vitro

-

2. Source

- 2.1. Chimeric

- 2.2. Human

- 2.3. Humanized

- 2.4. Murine

-

3. Indications

- 3.1. Cancer

- 3.2. Autoimmune Diseases

- 3.3. Infectious Diseases

- 3.4. Inflammatory Diseases

- 3.5. Other Indications

-

4. End Users

- 4.1. Hospitals

- 4.2. Research Institutes

- 4.3. Other End Users

Monoclonal Antibodies Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Monoclonal Antibodies Industry Regional Market Share

Geographic Coverage of Monoclonal Antibodies Industry

Monoclonal Antibodies Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Technological Advancements; Increasing Burden of Cancer and Other Chronic Diseases; Huge Funding by Government for the Research and Development

- 3.3. Market Restrains

- 3.3.1. High Cost Pertaining to the Method Involved in the Production of Monoclonal Antibodies; Loss of Patents

- 3.4. Market Trends

- 3.4.1. Cancer Monoclonal Antibodies is Estimated to Occupy a Significant Share in the Market over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Monoclonal Antibodies Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Methods

- 5.1.1. In Vivo

- 5.1.2. In Vitro

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Chimeric

- 5.2.2. Human

- 5.2.3. Humanized

- 5.2.4. Murine

- 5.3. Market Analysis, Insights and Forecast - by Indications

- 5.3.1. Cancer

- 5.3.2. Autoimmune Diseases

- 5.3.3. Infectious Diseases

- 5.3.4. Inflammatory Diseases

- 5.3.5. Other Indications

- 5.4. Market Analysis, Insights and Forecast - by End Users

- 5.4.1. Hospitals

- 5.4.2. Research Institutes

- 5.4.3. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Methods

- 6. North America Monoclonal Antibodies Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Methods

- 6.1.1. In Vivo

- 6.1.2. In Vitro

- 6.2. Market Analysis, Insights and Forecast - by Source

- 6.2.1. Chimeric

- 6.2.2. Human

- 6.2.3. Humanized

- 6.2.4. Murine

- 6.3. Market Analysis, Insights and Forecast - by Indications

- 6.3.1. Cancer

- 6.3.2. Autoimmune Diseases

- 6.3.3. Infectious Diseases

- 6.3.4. Inflammatory Diseases

- 6.3.5. Other Indications

- 6.4. Market Analysis, Insights and Forecast - by End Users

- 6.4.1. Hospitals

- 6.4.2. Research Institutes

- 6.4.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Production Methods

- 7. Europe Monoclonal Antibodies Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Methods

- 7.1.1. In Vivo

- 7.1.2. In Vitro

- 7.2. Market Analysis, Insights and Forecast - by Source

- 7.2.1. Chimeric

- 7.2.2. Human

- 7.2.3. Humanized

- 7.2.4. Murine

- 7.3. Market Analysis, Insights and Forecast - by Indications

- 7.3.1. Cancer

- 7.3.2. Autoimmune Diseases

- 7.3.3. Infectious Diseases

- 7.3.4. Inflammatory Diseases

- 7.3.5. Other Indications

- 7.4. Market Analysis, Insights and Forecast - by End Users

- 7.4.1. Hospitals

- 7.4.2. Research Institutes

- 7.4.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Production Methods

- 8. Asia Pacific Monoclonal Antibodies Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Methods

- 8.1.1. In Vivo

- 8.1.2. In Vitro

- 8.2. Market Analysis, Insights and Forecast - by Source

- 8.2.1. Chimeric

- 8.2.2. Human

- 8.2.3. Humanized

- 8.2.4. Murine

- 8.3. Market Analysis, Insights and Forecast - by Indications

- 8.3.1. Cancer

- 8.3.2. Autoimmune Diseases

- 8.3.3. Infectious Diseases

- 8.3.4. Inflammatory Diseases

- 8.3.5. Other Indications

- 8.4. Market Analysis, Insights and Forecast - by End Users

- 8.4.1. Hospitals

- 8.4.2. Research Institutes

- 8.4.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Production Methods

- 9. Middle East and Africa Monoclonal Antibodies Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Methods

- 9.1.1. In Vivo

- 9.1.2. In Vitro

- 9.2. Market Analysis, Insights and Forecast - by Source

- 9.2.1. Chimeric

- 9.2.2. Human

- 9.2.3. Humanized

- 9.2.4. Murine

- 9.3. Market Analysis, Insights and Forecast - by Indications

- 9.3.1. Cancer

- 9.3.2. Autoimmune Diseases

- 9.3.3. Infectious Diseases

- 9.3.4. Inflammatory Diseases

- 9.3.5. Other Indications

- 9.4. Market Analysis, Insights and Forecast - by End Users

- 9.4.1. Hospitals

- 9.4.2. Research Institutes

- 9.4.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Production Methods

- 10. South America Monoclonal Antibodies Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Methods

- 10.1.1. In Vivo

- 10.1.2. In Vitro

- 10.2. Market Analysis, Insights and Forecast - by Source

- 10.2.1. Chimeric

- 10.2.2. Human

- 10.2.3. Humanized

- 10.2.4. Murine

- 10.3. Market Analysis, Insights and Forecast - by Indications

- 10.3.1. Cancer

- 10.3.2. Autoimmune Diseases

- 10.3.3. Infectious Diseases

- 10.3.4. Inflammatory Diseases

- 10.3.5. Other Indications

- 10.4. Market Analysis, Insights and Forecast - by End Users

- 10.4.1. Hospitals

- 10.4.2. Research Institutes

- 10.4.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Production Methods

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bristol Myers Squibb Co

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck KGaA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novartis AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amgen Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AstraZeneca PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eli Lilly and Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AbbVie Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 F Hoffmann-La-Roche Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GlaxoSmithKline PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pfizer Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Bristol Myers Squibb Co

List of Figures

- Figure 1: Global Monoclonal Antibodies Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Monoclonal Antibodies Industry Revenue (billion), by Production Methods 2025 & 2033

- Figure 3: North America Monoclonal Antibodies Industry Revenue Share (%), by Production Methods 2025 & 2033

- Figure 4: North America Monoclonal Antibodies Industry Revenue (billion), by Source 2025 & 2033

- Figure 5: North America Monoclonal Antibodies Industry Revenue Share (%), by Source 2025 & 2033

- Figure 6: North America Monoclonal Antibodies Industry Revenue (billion), by Indications 2025 & 2033

- Figure 7: North America Monoclonal Antibodies Industry Revenue Share (%), by Indications 2025 & 2033

- Figure 8: North America Monoclonal Antibodies Industry Revenue (billion), by End Users 2025 & 2033

- Figure 9: North America Monoclonal Antibodies Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 10: North America Monoclonal Antibodies Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Monoclonal Antibodies Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Monoclonal Antibodies Industry Revenue (billion), by Production Methods 2025 & 2033

- Figure 13: Europe Monoclonal Antibodies Industry Revenue Share (%), by Production Methods 2025 & 2033

- Figure 14: Europe Monoclonal Antibodies Industry Revenue (billion), by Source 2025 & 2033

- Figure 15: Europe Monoclonal Antibodies Industry Revenue Share (%), by Source 2025 & 2033

- Figure 16: Europe Monoclonal Antibodies Industry Revenue (billion), by Indications 2025 & 2033

- Figure 17: Europe Monoclonal Antibodies Industry Revenue Share (%), by Indications 2025 & 2033

- Figure 18: Europe Monoclonal Antibodies Industry Revenue (billion), by End Users 2025 & 2033

- Figure 19: Europe Monoclonal Antibodies Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 20: Europe Monoclonal Antibodies Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Monoclonal Antibodies Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Monoclonal Antibodies Industry Revenue (billion), by Production Methods 2025 & 2033

- Figure 23: Asia Pacific Monoclonal Antibodies Industry Revenue Share (%), by Production Methods 2025 & 2033

- Figure 24: Asia Pacific Monoclonal Antibodies Industry Revenue (billion), by Source 2025 & 2033

- Figure 25: Asia Pacific Monoclonal Antibodies Industry Revenue Share (%), by Source 2025 & 2033

- Figure 26: Asia Pacific Monoclonal Antibodies Industry Revenue (billion), by Indications 2025 & 2033

- Figure 27: Asia Pacific Monoclonal Antibodies Industry Revenue Share (%), by Indications 2025 & 2033

- Figure 28: Asia Pacific Monoclonal Antibodies Industry Revenue (billion), by End Users 2025 & 2033

- Figure 29: Asia Pacific Monoclonal Antibodies Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 30: Asia Pacific Monoclonal Antibodies Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Monoclonal Antibodies Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Monoclonal Antibodies Industry Revenue (billion), by Production Methods 2025 & 2033

- Figure 33: Middle East and Africa Monoclonal Antibodies Industry Revenue Share (%), by Production Methods 2025 & 2033

- Figure 34: Middle East and Africa Monoclonal Antibodies Industry Revenue (billion), by Source 2025 & 2033

- Figure 35: Middle East and Africa Monoclonal Antibodies Industry Revenue Share (%), by Source 2025 & 2033

- Figure 36: Middle East and Africa Monoclonal Antibodies Industry Revenue (billion), by Indications 2025 & 2033

- Figure 37: Middle East and Africa Monoclonal Antibodies Industry Revenue Share (%), by Indications 2025 & 2033

- Figure 38: Middle East and Africa Monoclonal Antibodies Industry Revenue (billion), by End Users 2025 & 2033

- Figure 39: Middle East and Africa Monoclonal Antibodies Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 40: Middle East and Africa Monoclonal Antibodies Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Monoclonal Antibodies Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Monoclonal Antibodies Industry Revenue (billion), by Production Methods 2025 & 2033

- Figure 43: South America Monoclonal Antibodies Industry Revenue Share (%), by Production Methods 2025 & 2033

- Figure 44: South America Monoclonal Antibodies Industry Revenue (billion), by Source 2025 & 2033

- Figure 45: South America Monoclonal Antibodies Industry Revenue Share (%), by Source 2025 & 2033

- Figure 46: South America Monoclonal Antibodies Industry Revenue (billion), by Indications 2025 & 2033

- Figure 47: South America Monoclonal Antibodies Industry Revenue Share (%), by Indications 2025 & 2033

- Figure 48: South America Monoclonal Antibodies Industry Revenue (billion), by End Users 2025 & 2033

- Figure 49: South America Monoclonal Antibodies Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 50: South America Monoclonal Antibodies Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: South America Monoclonal Antibodies Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Production Methods 2020 & 2033

- Table 2: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 3: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Indications 2020 & 2033

- Table 4: Global Monoclonal Antibodies Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 5: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Production Methods 2020 & 2033

- Table 7: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 8: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Indications 2020 & 2033

- Table 9: Global Monoclonal Antibodies Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 10: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Production Methods 2020 & 2033

- Table 15: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 16: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Indications 2020 & 2033

- Table 17: Global Monoclonal Antibodies Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 18: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Germany Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Production Methods 2020 & 2033

- Table 26: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 27: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Indications 2020 & 2033

- Table 28: Global Monoclonal Antibodies Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 29: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: China Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Japan Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: India Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Australia Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: South Korea Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Production Methods 2020 & 2033

- Table 37: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 38: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Indications 2020 & 2033

- Table 39: Global Monoclonal Antibodies Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 40: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 41: GCC Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: South Africa Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Production Methods 2020 & 2033

- Table 45: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 46: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Indications 2020 & 2033

- Table 47: Global Monoclonal Antibodies Industry Revenue billion Forecast, by End Users 2020 & 2033

- Table 48: Global Monoclonal Antibodies Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 49: Brazil Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Argentina Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Rest of South America Monoclonal Antibodies Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Monoclonal Antibodies Industry?

The projected CAGR is approximately 12.44%.

2. Which companies are prominent players in the Monoclonal Antibodies Industry?

Key companies in the market include Bristol Myers Squibb Co, Merck KGaA, Novartis AG, Amgen Inc, AstraZeneca PLC, Eli Lilly and Company, AbbVie Inc, F Hoffmann-La-Roche Ltd, Johnson & Johnson, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Monoclonal Antibodies Industry?

The market segments include Production Methods, Source, Indications, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 286.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Technological Advancements; Increasing Burden of Cancer and Other Chronic Diseases; Huge Funding by Government for the Research and Development.

6. What are the notable trends driving market growth?

Cancer Monoclonal Antibodies is Estimated to Occupy a Significant Share in the Market over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost Pertaining to the Method Involved in the Production of Monoclonal Antibodies; Loss of Patents.

8. Can you provide examples of recent developments in the market?

In February 2022, Eli Lilly and Company announced that United States Food and Drug Administration (FDA) has issued an Emergency Use Authorization (EUA) for bebtelovimab, an antibody that demonstrates neutralization against the Omicron variant. Bebtelovimab is a neutralizing IgG1 monoclonal antibody (mAb) directed against the spike protein of SARS-CoV-2.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Monoclonal Antibodies Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Monoclonal Antibodies Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Monoclonal Antibodies Industry?

To stay informed about further developments, trends, and reports in the Monoclonal Antibodies Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence