Key Insights

The North America Biguanide Drugs Industry is projected to experience steady growth, reaching an estimated market size of $1,360 million by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 2.59% from 2019 to 2033, indicating a consistent upward trajectory for this crucial segment of diabetes management. The primary drivers fueling this expansion include the increasing prevalence of Type 2 diabetes across North America, the growing awareness and adoption of biguanide therapies as a first-line treatment, and ongoing advancements in pharmaceutical formulations that enhance efficacy and patient compliance. The market is segmented by product type, with Metformin dominating the landscape due to its established safety profile and widespread use. Buformin and Phenformin, while historically significant, represent a smaller share of the current market. In terms of applications, Type 2 diabetes treatment is the most substantial segment, followed by Gestational Diabetes management.

North America Biguanide Drugs Industry Market Size (In Billion)

Looking ahead, the industry is poised to benefit from emerging trends such as the development of extended-release formulations and combination therapies that offer improved glycemic control and reduced side effects. Increased investment in research and development by key players like Takeda, Boehringer Ingelheim Pharmaceuticals, GlaxoSmithKline, Sanofi, and Merck is expected to introduce novel biguanide-based drugs and treatment protocols. However, the market also faces restraints, including the emergence of newer classes of antidiabetic drugs and evolving regulatory landscapes that may influence market access and prescribing patterns. Despite these challenges, the established efficacy, affordability, and supportive clinical guidelines for biguanides ensure their continued importance in managing the growing diabetes epidemic across the United States, Canada, and Mexico, as well as the broader North American region.

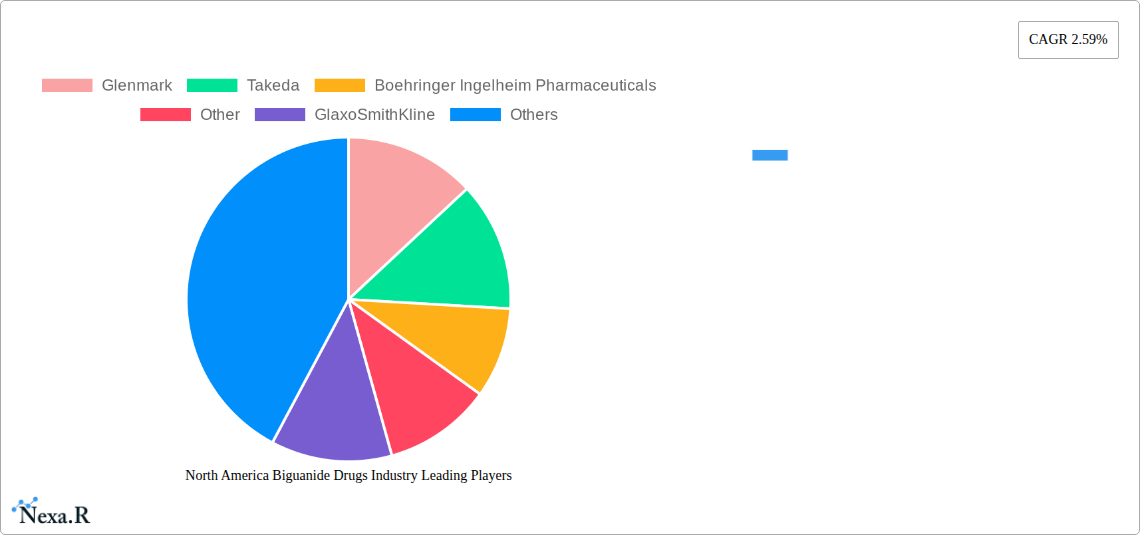

North America Biguanide Drugs Industry Company Market Share

Unlock critical insights into the North America Biguanide Drugs market with this comprehensive report. Spanning from 2019 to 2033, this analysis delves into the intricate market dynamics, growth trajectory, and future potential of biguanide drugs, primarily focusing on Metformin, Buformin, and Phenformin, for the treatment of Type 2 Diabetes and Gestational Diabetes. Our data-driven approach provides actionable intelligence for pharmaceutical manufacturers, investors, and healthcare stakeholders.

North America Biguanide Drugs Industry Market Dynamics & Structure

The North America biguanide drugs market exhibits a moderate to high concentration, with established pharmaceutical giants dominating the landscape. Key players continuously innovate through strategic R&D to enhance efficacy and safety profiles, while technological advancements in drug delivery systems are also shaping product development. Regulatory frameworks, particularly stringent FDA approvals, act as both a barrier to entry for new players and a quality assurance for existing products. Competitive product substitutes, including other oral antidiabetic agents and newer classes like GLP-1 receptor agonists and SGLT2 inhibitors, exert significant pressure, necessitating continuous product differentiation and value-added services. End-user demographics are increasingly influenced by aging populations and rising obesity rates, driving demand for effective diabetes management solutions. Mergers and acquisitions (M&A) remain a critical strategy for market consolidation and portfolio expansion, with recent activities reflecting a trend towards acquiring specialized diabetes care assets.

- Market Concentration: Dominated by a few large pharmaceutical companies, but with a growing presence of generic manufacturers.

- Technological Innovation Drivers: Focus on combination therapies, improved bioavailability, and extended-release formulations.

- Regulatory Frameworks: Strict FDA oversight ensures product quality and safety, impacting R&D timelines and market access.

- Competitive Product Substitutes: Intense competition from other oral antidiabetics and novel injectable therapies.

- End-User Demographics: Driven by the increasing prevalence of Type 2 Diabetes and Gestational Diabetes in aging and obese populations.

- M&A Trends: Strategic acquisitions to expand product portfolios and gain market share.

North America Biguanide Drugs Industry Growth Trends & Insights

The North America biguanide drugs market is poised for steady growth, driven by the persistent and increasing prevalence of diabetes across the continent. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 4.5% between 2025 and 2033, reaching an estimated market value of $7,500 million units by the end of the forecast period. Adoption rates for biguanide therapies, especially Metformin, remain exceptionally high due to their established efficacy, safety profile, and affordability. Technological disruptions, such as advancements in personalized medicine and the development of novel drug combinations, are subtly influencing treatment paradigms. Consumer behavior shifts are also evident, with patients increasingly seeking convenient and effective treatment options that integrate seamlessly into their lifestyle. The growing awareness campaigns about diabetes management and the proactive approach of healthcare providers are further accelerating market penetration.

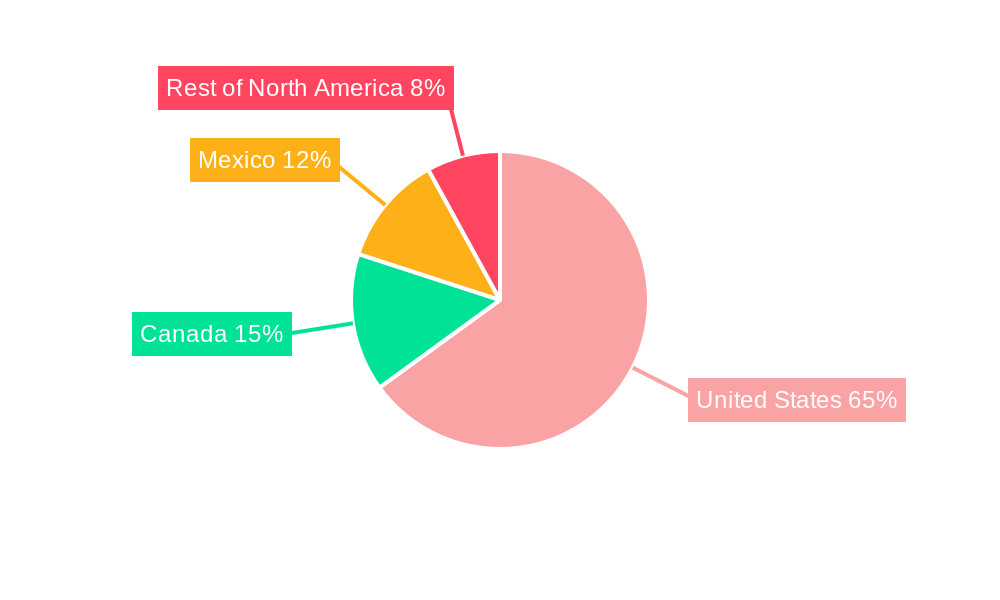

Dominant Regions, Countries, or Segments in North America Biguanide Drugs Industry

Within the North America biguanide drugs industry, the United States unequivocally stands as the dominant country, largely due to its advanced healthcare infrastructure, higher healthcare expenditure, and the significant burden of diabetes. The Type 2 Diabetes application segment is the primary growth driver, accounting for over 85% of the market share, fueled by the epidemic of obesity and sedentary lifestyles. Metformin, as a Product Type, commands the lion's share, representing approximately 90% of the biguanide market due to its first-line status in Type 2 Diabetes management and its established safety and efficacy.

- Dominant Country: United States - characterized by high diabetes prevalence, robust healthcare spending, and advanced pharmaceutical R&D.

- Primary Application Segment: Type 2 Diabetes - driven by demographic shifts, lifestyle factors, and increasing diagnostic rates.

- Leading Product Type: Metformin - favored for its efficacy, safety, affordability, and role as a foundational therapy.

- Growth Potential: Significant, with an aging population and continued rise in metabolic disorders.

- Market Share: Metformin for Type 2 Diabetes holds the largest segment share, estimated at over 80% of the total North America biguanide drug market.

North America Biguanide Drugs Industry Product Landscape

The product landscape of the North America biguanide drugs industry is characterized by a strong focus on Metformin in various formulations, including immediate-release and extended-release tablets, aimed at improving patient compliance and reducing gastrointestinal side effects. Combination therapies integrating Metformin with other antidiabetic agents, such as SGLT2 inhibitors and DPP-4 inhibitors, are gaining traction, offering enhanced glycemic control and potentially cardiovascular benefits. Buformin and Phenformin have largely been relegated to niche or historical applications due to safety concerns. Performance metrics are primarily evaluated on HbA1c reduction, with an emphasis on minimizing adverse events like lactic acidosis and vitamin B12 deficiency.

Key Drivers, Barriers & Challenges in North America Biguanide Drugs Industry

Key Drivers: The North America biguanide drugs market is propelled by the escalating prevalence of Type 2 Diabetes and Gestational Diabetes, a direct consequence of rising obesity rates and sedentary lifestyles. The established efficacy, favorable safety profile, and cost-effectiveness of Metformin, the leading biguanide, make it a cornerstone of diabetes management guidelines. Furthermore, continuous advancements in pharmaceutical manufacturing and the development of novel combination therapies are expanding treatment options and enhancing patient outcomes. Growing awareness campaigns and proactive healthcare policies further fuel market growth.

Barriers & Challenges: Despite strong drivers, the market faces challenges. Competition from newer drug classes, such as GLP-1 receptor agonists and SGLT2 inhibitors, which offer additional benefits like weight loss and cardiovascular protection, presents a significant restraint. Regulatory hurdles and the lengthy approval processes for new formulations or combinations can impede market entry. Supply chain disruptions and the increasing demand for high-quality manufacturing can also pose operational challenges. Moreover, the potential for adverse events, though rare, necessitates careful patient selection and monitoring, adding to healthcare system complexity.

Emerging Opportunities in North America Biguanide Drugs Industry

Emerging opportunities lie in the development of novel fixed-dose combination therapies that offer enhanced efficacy and convenience for patients. The growing focus on personalized medicine presents an avenue for stratifying patients and tailoring biguanide treatments based on individual genetic profiles and metabolic responses. Expansion into underdiagnosed or underserved populations within North America, particularly in regions with limited access to advanced diabetes care, also represents a significant growth frontier. Furthermore, research into the broader therapeutic applications of biguanides beyond diabetes, such as in oncology or for metabolic syndrome, could unlock new market potential.

Growth Accelerators in the North America Biguanide Drugs Industry Industry

Several catalysts are accelerating the growth of the North America biguanide drugs industry. Technological breakthroughs in drug formulation, leading to improved patient adherence and reduced side effects, are a major driver. Strategic partnerships between pharmaceutical companies and healthcare providers facilitate wider adoption and better patient management. The increasing focus on value-based healthcare models incentivizes the use of cost-effective and proven therapies like Metformin. Furthermore, aggressive market expansion strategies by key players, including robust marketing campaigns and the development of integrated diabetes care solutions, are contributing to sustained growth.

Key Players Shaping the North America Biguanide Drugs Industry Market

- Glenmark

- Takeda

- Boehringer Ingelheim Pharmaceuticals

- GlaxoSmithKline

- Sanofi

- Merck

- Zydus Cadila

- Bristol-Myers Squibb

- Other

Notable Milestones in North America Biguanide Drugs Industry Sector

- February 2023: Zydus Lifesciences Limited received tentative approval from the USFDA for Invokamet tablets (canagliflozin and metformin hydrochloride combination). Canagliflozin and metformin combination products are indicated as an adjunct to diet and exercise. It is to improve glycemic control in adults with type 2 diabetes mellitus who are not adequately controlled on a regimen containing metformin or canagliflozin. It is also used in patients already treated with canagliflozin and metformin.

- July 2022: Zydus Lifesciences announced that it had received final approval from the USFDA to market Empagliflozin and Metformin Hydrochloride tablets in multiple strengths. Empagliflozin and Metformin Hydrochloride tablets are used with proper diet and exercise to improve glycemic control in adults with type 2 diabetes mellitus. They are also used to lower the risk of cardiovascular death in patients with type 2 diabetes mellitus and established cardiovascular disease.

In-Depth North America Biguanide Drugs Industry Market Outlook

The North America biguanide drugs industry is set for a robust future, driven by persistent diabetes prevalence and the unwavering efficacy of Metformin. Growth accelerators include innovations in combination therapies, the potential for personalized treatment approaches, and strategic market expansion into underserved regions. The industry is expected to witness sustained demand due to the cost-effectiveness and well-established safety profile of biguanides, making them a cornerstone in the management of Type 2 and Gestational Diabetes. Strategic collaborations and a focus on patient-centric solutions will further solidify market growth, presenting significant opportunities for stakeholders.

North America Biguanide Drugs Industry Segmentation

-

1. Product Type

- 1.1. Metformin

- 1.2. Buformin

- 1.3. Phenformin

-

2. Application

- 2.1. Type 2 Diabetes

- 2.2. Gestational Diabetes

North America Biguanide Drugs Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Biguanide Drugs Industry Regional Market Share

Geographic Coverage of North America Biguanide Drugs Industry

North America Biguanide Drugs Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancement in the Technology of Chromatography Instruments; Significance of Chromatography Based Studies in Drug Approval

- 3.3. Market Restrains

- 3.3.1. Rising Price of Equipment

- 3.4. Market Trends

- 3.4.1. Rising diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Biguanide Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Metformin

- 5.1.2. Buformin

- 5.1.3. Phenformin

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Type 2 Diabetes

- 5.2.2. Gestational Diabetes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Biguanide Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Metformin

- 6.1.2. Buformin

- 6.1.3. Phenformin

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Type 2 Diabetes

- 6.2.2. Gestational Diabetes

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Biguanide Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Metformin

- 7.1.2. Buformin

- 7.1.3. Phenformin

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Type 2 Diabetes

- 7.2.2. Gestational Diabetes

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Biguanide Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Metformin

- 8.1.2. Buformin

- 8.1.3. Phenformin

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Type 2 Diabetes

- 8.2.2. Gestational Diabetes

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Biguanide Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Metformin

- 9.1.2. Buformin

- 9.1.3. Phenformin

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Type 2 Diabetes

- 9.2.2. Gestational Diabetes

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Glenmark

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Takeda

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Boehringer Ingelheim Pharmaceuticals

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Other

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 GlaxoSmithKline

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sanofi

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Merck

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Zydus Cadila

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bristol-Myers Squibb

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Glenmark

List of Figures

- Figure 1: North America Biguanide Drugs Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Biguanide Drugs Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Biguanide Drugs Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Biguanide Drugs Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: North America Biguanide Drugs Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: North America Biguanide Drugs Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: North America Biguanide Drugs Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Biguanide Drugs Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: North America Biguanide Drugs Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: North America Biguanide Drugs Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: North America Biguanide Drugs Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: North America Biguanide Drugs Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: North America Biguanide Drugs Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Biguanide Drugs Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: North America Biguanide Drugs Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: North America Biguanide Drugs Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 15: North America Biguanide Drugs Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: North America Biguanide Drugs Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 17: North America Biguanide Drugs Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: North America Biguanide Drugs Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: North America Biguanide Drugs Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: North America Biguanide Drugs Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 21: North America Biguanide Drugs Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: North America Biguanide Drugs Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: North America Biguanide Drugs Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: North America Biguanide Drugs Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: North America Biguanide Drugs Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: North America Biguanide Drugs Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 27: North America Biguanide Drugs Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: North America Biguanide Drugs Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: North America Biguanide Drugs Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: North America Biguanide Drugs Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Biguanide Drugs Industry?

The projected CAGR is approximately 2.59%.

2. Which companies are prominent players in the North America Biguanide Drugs Industry?

Key companies in the market include Glenmark, Takeda, Boehringer Ingelheim Pharmaceuticals, Other, GlaxoSmithKline, Sanofi, Merck, Zydus Cadila, Bristol-Myers Squibb.

3. What are the main segments of the North America Biguanide Drugs Industry?

The market segments include Product Type , Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Advancement in the Technology of Chromatography Instruments; Significance of Chromatography Based Studies in Drug Approval.

6. What are the notable trends driving market growth?

Rising diabetes prevalence.

7. Are there any restraints impacting market growth?

Rising Price of Equipment.

8. Can you provide examples of recent developments in the market?

February 2023: Zydus Lifesciences Limited received tentative approval from the USFDA for Invokamet tablets (canagliflozin and metformin hydrochloride combination). Canagliflozin and metformin combination products are indicated as an adjunct to diet and exercise. It is to improve glycemic control in adults with type 2 diabetes mellitus who are not adequately controlled on a regimen containing metformin or canagliflozin. It is also used in patients already treated with canagliflozin and metformin.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Biguanide Drugs Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Biguanide Drugs Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Biguanide Drugs Industry?

To stay informed about further developments, trends, and reports in the North America Biguanide Drugs Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence