Key Insights

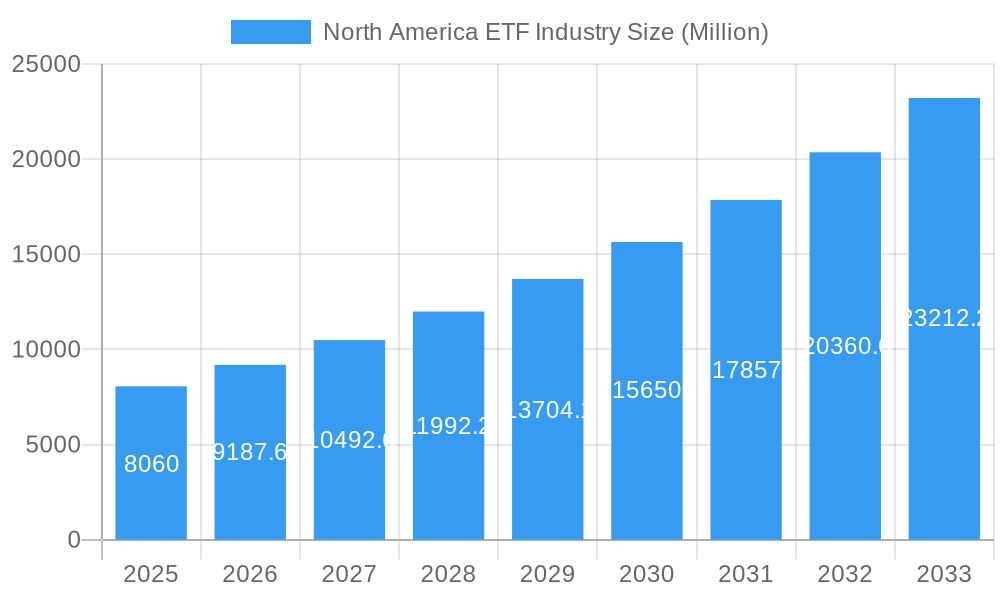

The North American exchange-traded fund (ETF) industry, valued at $8.06 billion in 2025, is poised for substantial growth, exhibiting a compound annual growth rate (CAGR) of 14% from 2025 to 2033. This robust expansion is fueled by several key drivers. Increasing investor interest in diversified, low-cost investment vehicles is a primary factor. The ease of access and transparency offered by ETFs compared to mutual funds and individual stock picking are attracting a wider range of investors, including retail and institutional players. Furthermore, the growing popularity of passive investment strategies, mirroring broader index performance, has significantly contributed to ETF adoption. Technological advancements, including improved trading platforms and mobile investment apps, have also streamlined ETF investing, broadening its appeal. Within the North American market, the United States forms the dominant segment, driven by its mature financial markets and high investor sophistication. Canada and Mexico also contribute significantly, albeit at a smaller scale, reflecting their growing economies and increasing investor participation in capital markets. The market segmentation reflects the diverse investment strategies available, encompassing fixed income, equity, commodity, currency, real estate, and specialty ETFs, catering to a broad spectrum of investment objectives and risk tolerances. Leading players like BlackRock (iShares), Vanguard, Invesco, and State Street hold significant market share, continuously innovating and introducing new products to cater to evolving investor preferences.

North America ETF Industry Market Size (In Billion)

The forecast period (2025-2033) suggests continued strong growth, driven by factors such as increasing ETF product diversification, the rise of thematic ETFs focusing on specific sectors or trends (e.g., sustainable investing, technology), and the ongoing adoption of ETFs by financial advisors. Regulatory developments supporting ETF accessibility are also expected to stimulate market expansion. While potential restraints such as market volatility and economic downturns exist, the fundamental appeal of ETFs—diversification, cost-effectiveness, and accessibility—should underpin continued growth, making the North American ETF market a compelling investment opportunity. The competitive landscape will remain fiercely contested, with established players and new entrants vying for market share through product innovation, competitive pricing, and enhanced investor services.

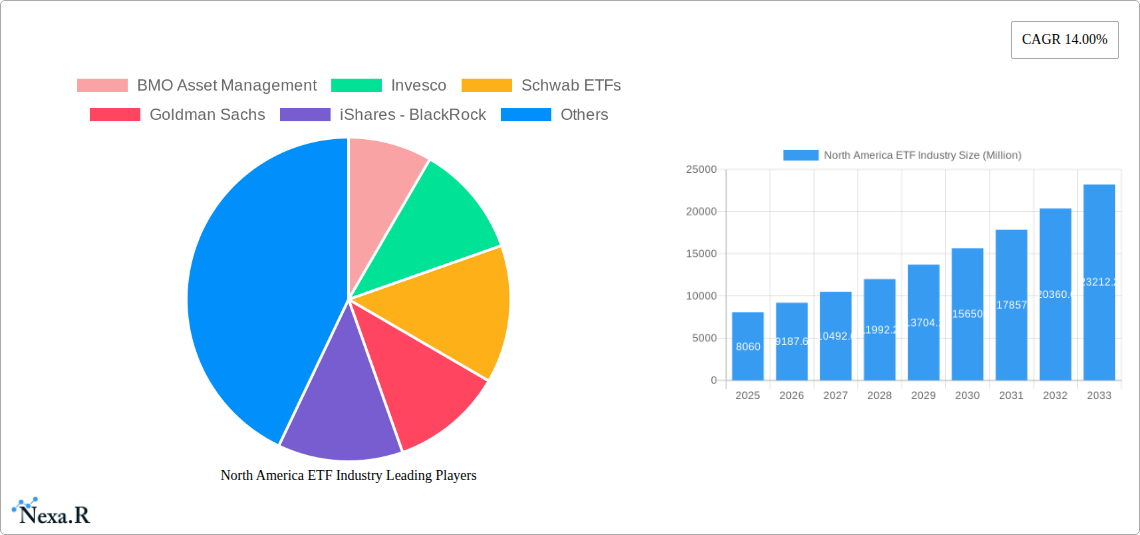

North America ETF Industry Company Market Share

This in-depth report provides a comprehensive analysis of the North America ETF industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on the evolving landscape of exchange-traded funds (ETFs) in North America.

North America ETF Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the North American ETF industry from 2019-2024. We delve into market concentration, examining the market share held by key players like BlackRock (iShares), Vanguard, State Street, and others. The analysis also explores the impact of technological innovations, such as AI-driven portfolio management and blockchain technology, on ETF development and trading. Furthermore, the report assesses the influence of regulatory frameworks, including those set by the SEC and other relevant bodies, on market growth and stability. The role of mergers and acquisitions (M&A) activity is also examined, including deal volumes and their implications for market consolidation.

- Market Concentration: BlackRock (iShares) holds a significant market share (xx%), followed by Vanguard (xx%), State Street (xx%), and others. The market is moderately concentrated, with several key players vying for dominance.

- Technological Innovation: AI-powered ETF management and robo-advisors are driving innovation, reducing costs, and enhancing portfolio diversification. However, data security and algorithmic bias remain challenges.

- Regulatory Framework: SEC regulations heavily influence market practices and investor protection, creating both opportunities and limitations for industry players. Compliance costs represent a substantial hurdle for smaller firms.

- Competitive Substitutes: Mutual funds and other investment vehicles compete directly with ETFs, but ETFs generally offer lower costs and greater transparency.

- M&A Trends: The past five years have seen xx M&A deals in the North American ETF industry, mostly driven by consolidation among smaller players to gain scale and market share.

- End-User Demographics: The ETF market caters to a broad range of investors, including retail, institutional, and high-net-worth individuals, though the retail segment exhibits significant growth.

North America ETF Industry Growth Trends & Insights

This section presents a detailed analysis of the North American ETF market's historical and projected growth, leveraging extensive data and expert insights. We examine market size evolution from 2019 to 2024, followed by a forecast from 2025 to 2033. This analysis considers various factors influencing growth, including changing investor preferences, technological disruptions, and macroeconomic conditions. Key metrics such as Compound Annual Growth Rate (CAGR), market penetration rates, and adoption trends are presented to provide comprehensive insights into the industry’s trajectory. The impact of factors like increased market volatility, regulatory changes, and evolving investor demand are discussed in detail. The narrative incorporates a granular overview of the adoption of ETFs across various investor segments and asset classes within the broader North American investment ecosystem.

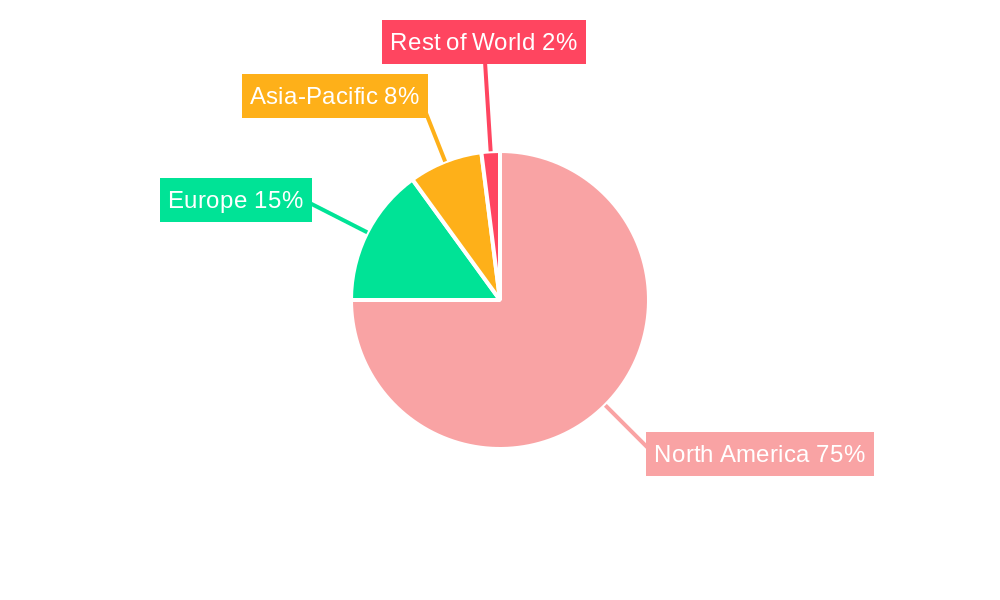

Dominant Regions, Countries, or Segments in North America ETF Industry

This section identifies the leading regions, countries, and ETF types driving market growth within North America. It analyzes the dominance of specific segments (Fixed Income ETFs, Equity ETFs, Commodity ETFs, Currency ETFs, Real Estate ETFs, and Specialty ETFs) and explores the underlying factors responsible for their success. Factors such as economic policies, infrastructure development, investor sentiment, and regulatory environment are analyzed using both qualitative and quantitative metrics.

- Equity ETFs: The US remains the dominant market for equity ETFs, driven by a large and sophisticated investor base and a robust capital market. Growth is further propelled by technological advancements within the space.

- Fixed Income ETFs: Canada's fixed income ETF market shows significant growth, supported by the country's strong financial system and government bonds.

- Other ETF Types: While Equity and Fixed income are dominant, significant growth is anticipated in specialty ETFs and niche markets which focus on factors like ESG and thematic investing.

North America ETF Industry Product Landscape

This section examines the product innovations, applications, and performance metrics of ETFs within the North American market. It highlights the unique selling propositions (USPs) of various ETF products, focusing on aspects such as low expense ratios, diversification benefits, tax efficiency, and tracking performance. Further examination of the underlying technological advancements impacting product development and the overall performance of ETFs is undertaken. Particular attention is paid to the ways in which innovation is influencing ETF structuring, portfolio management, and investor access.

Key Drivers, Barriers & Challenges in North America ETF Industry

This section identifies the key factors driving the growth of the North American ETF industry, such as technological advancements, favorable regulatory environments, and increasing investor awareness. It also analyzes the challenges and constraints hindering market expansion. Challenges such as regulatory scrutiny, competition from alternative investment products, and market volatility are quantitatively analyzed.

- Key Drivers: Low cost, transparency, diversification, and ease of access are primary drivers. Technological advancements, including AI and robo-advisors, further accelerate growth.

- Key Barriers & Challenges: Regulatory hurdles, competition from established asset managers, and market volatility are major challenges. Increased regulatory scrutiny may add compliance costs.

Emerging Opportunities in North America ETF Industry

This section explores emerging trends and opportunities within the North American ETF industry, including the growing demand for niche ETFs, the potential for ESG investing, and the rise of fractional share trading. It explores potential areas for new product development and geographic expansion. The focus is on untapped market segments and innovative applications that are expected to shape the industry’s future.

Growth Accelerators in the North America ETF Industry Industry

Technological advancements, strategic partnerships, and market expansion into underserved segments represent major catalysts for long-term growth in the North American ETF market. The potential impact of these accelerators and their individual contributions to future market expansion are discussed. Particular attention is paid to the significance of these changes on product differentiation, investor targeting, and market share gains for industry participants.

Key Players Shaping the North America ETF Industry Market

Notable Milestones in North America ETF Industry Sector

- August 2023: LG and Qraft Technologies launch a new US-listed ETF comprising approximately 100 large-cap companies, leveraging AI-powered portfolio management. This partnership marks a significant step towards integrating AI into ETF management.

- July 2023: Brompton Funds Limited introduces Canada's first ETF exclusively investing in preferred shares of split corporations, opening up a new investment avenue for Canadian investors.

In-Depth North America ETF Industry Market Outlook

The North American ETF market is poised for continued robust growth driven by technological innovation, increasing investor awareness, and the expansion of product offerings. Opportunities exist in areas like thematic ETFs, ESG investing, and active ETF strategies. Strategic partnerships and M&A activity will continue to reshape the competitive landscape, while regulatory changes will significantly influence market dynamics and growth trajectory in the coming years. The forecast period (2025-2033) predicts a healthy CAGR of xx%, indicating strong market potential for existing and emerging players.

North America ETF Industry Segmentation

-

1. Type

- 1.1. Fixed Income ETFs

- 1.2. Equity ETFs

- 1.3. Commodity ETFs

- 1.4. Currency ETFs

- 1.5. Real Estate ETFs

- 1.6. Specialty ETFs

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America ETF Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America ETF Industry Regional Market Share

Geographic Coverage of North America ETF Industry

North America ETF Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fund Inflows is Driving the ETF Market

- 3.3. Market Restrains

- 3.3.1. Underlying Fluctuations and Risks are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Rising Investment on Equity ETF

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America ETF Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Income ETFs

- 5.1.2. Equity ETFs

- 5.1.3. Commodity ETFs

- 5.1.4. Currency ETFs

- 5.1.5. Real Estate ETFs

- 5.1.6. Specialty ETFs

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America ETF Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed Income ETFs

- 6.1.2. Equity ETFs

- 6.1.3. Commodity ETFs

- 6.1.4. Currency ETFs

- 6.1.5. Real Estate ETFs

- 6.1.6. Specialty ETFs

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America ETF Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed Income ETFs

- 7.1.2. Equity ETFs

- 7.1.3. Commodity ETFs

- 7.1.4. Currency ETFs

- 7.1.5. Real Estate ETFs

- 7.1.6. Specialty ETFs

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America ETF Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed Income ETFs

- 8.1.2. Equity ETFs

- 8.1.3. Commodity ETFs

- 8.1.4. Currency ETFs

- 8.1.5. Real Estate ETFs

- 8.1.6. Specialty ETFs

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 BMO Asset Management

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Invesco

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Schwab ETFs

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Goldman Sachs

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 iShares - BlackRock

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 First Trust

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 WisdomTree

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 State Street

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Vanguard

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 JP Morgan**List Not Exhaustive

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 BMO Asset Management

List of Figures

- Figure 1: North America ETF Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America ETF Industry Share (%) by Company 2025

List of Tables

- Table 1: North America ETF Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America ETF Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: North America ETF Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America ETF Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: North America ETF Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America ETF Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: North America ETF Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America ETF Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: North America ETF Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: North America ETF Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: North America ETF Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America ETF Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America ETF Industry?

The projected CAGR is approximately 14.00%.

2. Which companies are prominent players in the North America ETF Industry?

Key companies in the market include BMO Asset Management, Invesco, Schwab ETFs, Goldman Sachs, iShares - BlackRock, First Trust, WisdomTree, State Street, Vanguard, JP Morgan**List Not Exhaustive.

3. What are the main segments of the North America ETF Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Fund Inflows is Driving the ETF Market.

6. What are the notable trends driving market growth?

Rising Investment on Equity ETF.

7. Are there any restraints impacting market growth?

Underlying Fluctuations and Risks are Restraining the Market.

8. Can you provide examples of recent developments in the market?

August 2023: LG collaborated with financial technology firm Qraft Technologies to launch an ETF in the United States. The collaboration was formed to form a strategic technological development alliance between LG and SoftBank-backed Qraft, which has four US-listed ETFs with AI-managed assets. The two companies established a new ETF that includes approximately 100 large-cap companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America ETF Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America ETF Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America ETF Industry?

To stay informed about further developments, trends, and reports in the North America ETF Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence