Key Insights

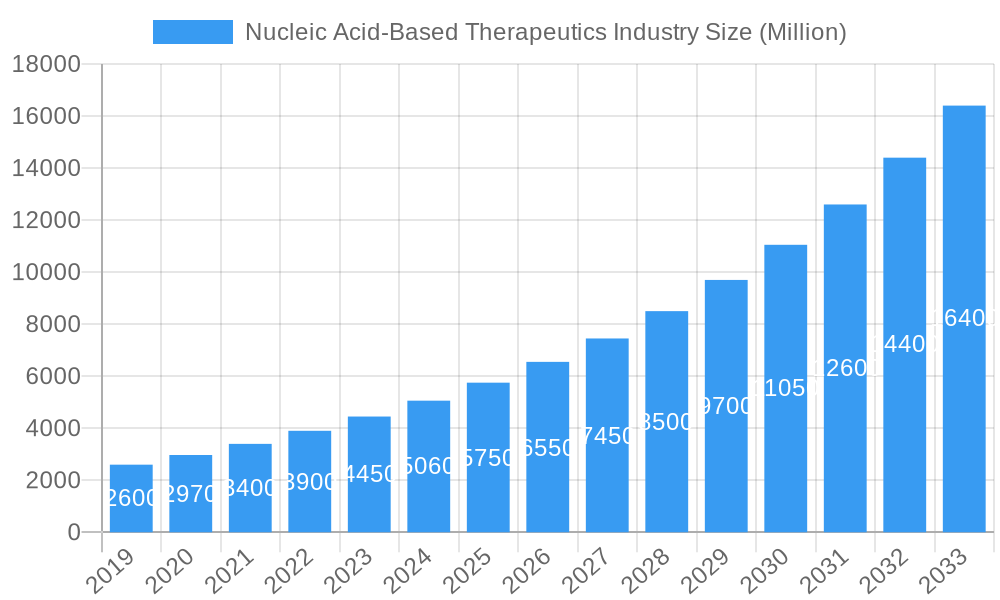

The Nucleic Acid-Based Therapeutics market is poised for exceptional growth, projected to reach approximately \$5.59 billion by 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 14.29% through 2033. This rapid expansion is fueled by a convergence of factors, including significant advancements in gene editing technologies, a deeper understanding of disease mechanisms at the molecular level, and an increasing pipeline of promising drug candidates. Key drivers for this market surge include the growing prevalence of genetic disorders, chronic autoimmune conditions, and infectious diseases, for which nucleic acid therapies offer novel and targeted treatment approaches. The increasing demand for personalized medicine, where treatments are tailored to an individual's genetic makeup, further accelerates adoption. Furthermore, substantial investments in research and development by leading pharmaceutical and biotechnology companies, alongside supportive regulatory frameworks for innovative therapies, are critical enablers.

Nucleic Acid-Based Therapeutics Industry Market Size (In Billion)

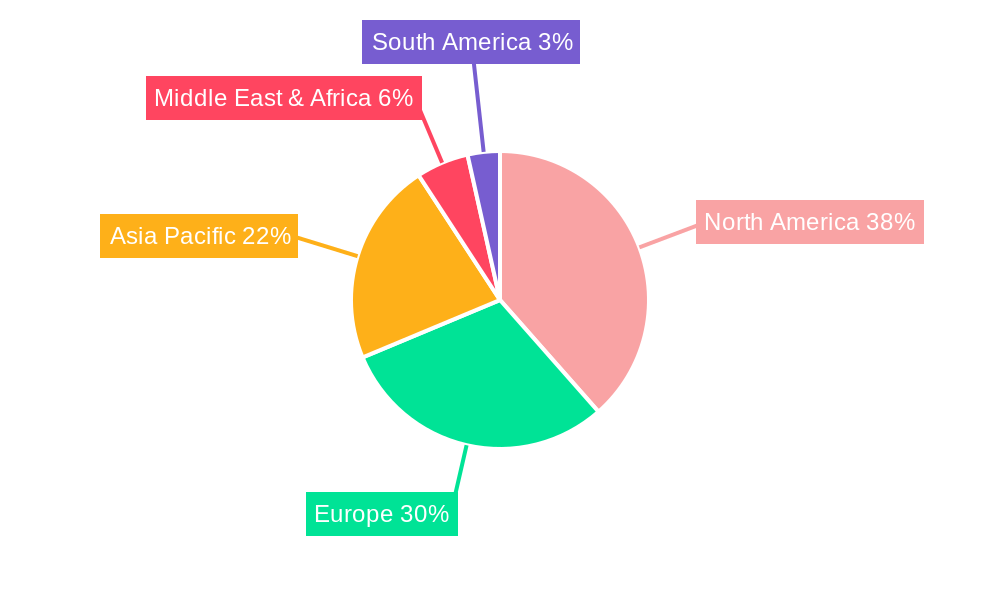

The market's segmentation reveals distinct growth areas. Product types like RNA interference (RNAi) and Antisense Oligonucleotides (ASOs) are leading the charge due to their proven efficacy and versatility in targeting a wide range of diseases. Applications in oncology, autoimmune disorders, and genetic diseases are experiencing particularly strong demand, driven by the unmet medical needs and the potential for curative or disease-modifying treatments. Academic and research institutes, along with hospitals and clinics, are key end-users, actively involved in research, clinical trials, and the administration of these advanced therapies. Regionally, North America, particularly the United States, is expected to maintain its dominant position due to advanced healthcare infrastructure, significant R&D expenditure, and a high rate of adoption for novel treatments. Europe and the Asia Pacific region are also anticipated to witness substantial growth, driven by increasing healthcare spending, a rising burden of chronic diseases, and expanding research capabilities. While restraints such as high development costs and complex manufacturing processes exist, the overwhelming therapeutic potential and a growing market acceptance are expected to outweigh these challenges, paving the way for sustained market expansion.

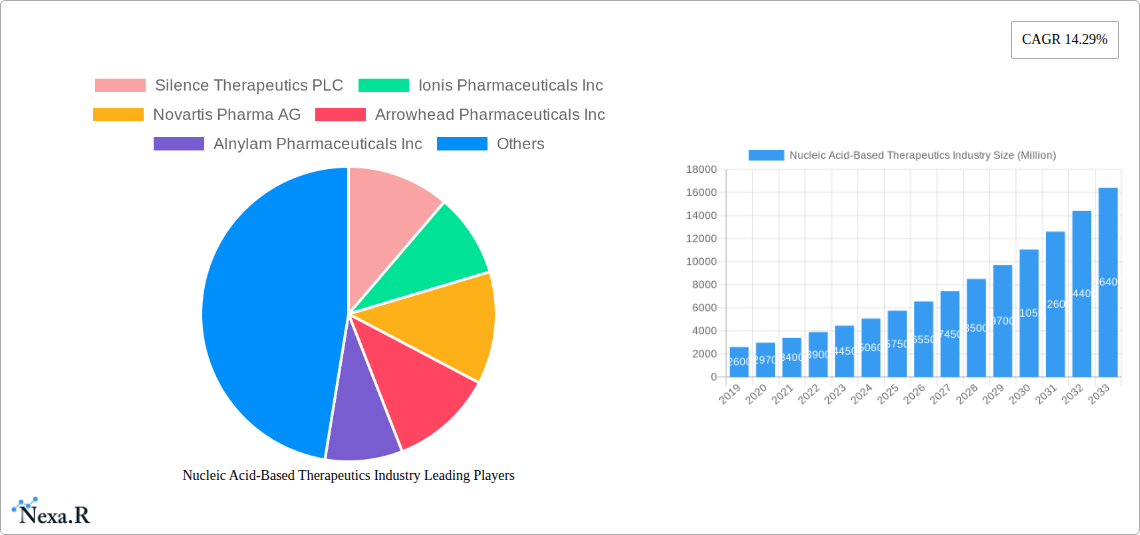

Nucleic Acid-Based Therapeutics Industry Company Market Share

This in-depth report provides a definitive analysis of the global Nucleic Acid-Based Therapeutics Market, offering critical insights into market dynamics, growth trajectories, and future opportunities from 2019 to 2033. Leveraging a robust research methodology, this report delves into the intricate landscape of RNA therapeutics, antisense oligonucleotides (ASOs), and other emerging nucleic acid drug delivery modalities. We meticulously examine key market segments, including applications in genetic disorders, rare diseases, oncology, and infectious diseases, as well as end-user landscapes encompassing hospitals and clinics and academic and research institutes. With a focus on quantitative data and strategic qualitative analysis, this report equips stakeholders with the intelligence needed to navigate this rapidly evolving and high-growth sector.

Nucleic Acid-Based Therapeutics Industry Market Dynamics & Structure

The Nucleic Acid-Based Therapeutics Industry is characterized by intense technological innovation and a dynamic competitive landscape. The market is driven by the unparalleled potential of gene silencing therapies, RNA interference (RNAi), and messenger RNA (mRNA) technologies to address previously intractable diseases. Market concentration is observed among a few leading players, including Silence Therapeutics PLC, Ionis Pharmaceuticals Inc., Alnylam Pharmaceuticals Inc., and Moderna Inc., who are at the forefront of research and development. Key drivers include advancements in drug delivery systems, increased understanding of disease genomics, and a growing demand for targeted therapies. Regulatory frameworks, while evolving, are generally supportive of innovative nucleic acid therapies, particularly for rare and unmet medical needs. The presence of robust patent protection for novel sequences and delivery mechanisms acts as both a driver and a barrier to entry. Competitive product substitutes are gradually emerging from traditional small molecule drugs and biologics, but nucleic acid-based therapeutics offer a unique modality for disease intervention. End-user demographics are increasingly sophisticated, with a strong emphasis on clinical efficacy and patient outcomes. Merger and acquisition (M&A) trends reflect the industry's maturity, with larger pharmaceutical companies actively acquiring innovative smaller biotechs to expand their portfolios in RNA therapeutics. Barriers to innovation include the high cost of R&D, complex manufacturing processes, and the need for extensive clinical trials to demonstrate safety and efficacy.

- Market Concentration: Dominated by key innovators with strong R&D pipelines.

- Technological Innovation Drivers: Breakthroughs in RNA synthesis, delivery vehicles (e.g., lipid nanoparticles), and gene editing technologies.

- Regulatory Frameworks: Evolving but generally favorable for novel nucleic acid therapies, with emphasis on accelerated approval pathways for critical unmet needs.

- Competitive Product Substitutes: Traditional pharmaceuticals and biologics, but with limited ability to address genetic defects at the mRNA level.

- End-User Demographics: Increasing demand for personalized medicine and highly effective treatments for genetic and rare diseases.

- M&A Trends: Strategic acquisitions by large pharmaceutical companies to gain access to cutting-edge nucleic acid technologies and pipelines.

- Innovation Barriers: High R&D costs, manufacturing scalability challenges, and complex regulatory pathways for novel modalities.

Nucleic Acid-Based Therapeutics Industry Growth Trends & Insights

The Nucleic Acid-Based Therapeutics Industry is poised for significant expansion, driven by a confluence of scientific breakthroughs, increasing clinical validation, and burgeoning market demand. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR), fueled by the expanding therapeutic applications beyond rare genetic disorders. The adoption rates of these advanced therapies are steadily increasing as more products gain regulatory approval and demonstrate tangible clinical benefits in diverse patient populations. Technological disruptions are a constant feature, with ongoing advancements in CRISPR-based gene editing, improved delivery mechanisms like novel lipid nanoparticles and viral vectors, and refined antisense oligonucleotide (ASO) designs enhancing efficacy and reducing off-target effects. Consumer behavior shifts are also playing a crucial role, with patients and healthcare providers actively seeking more targeted and potentially curative treatment options. The success of early mRNA vaccines has significantly boosted confidence and investment in RNA-based platforms, accelerating research into therapeutic applications. Market penetration is expected to deepen as these therapies become more accessible and cost-effective, moving from niche applications to broader indications. The forecast period (2025-2033) will likely witness a substantial acceleration in market growth, supported by a growing pipeline of investigational drugs and a more streamlined regulatory environment for nucleic acid-based interventions. The increasing investment in biotechnology research and development by both public and private entities further underpins this optimistic growth trajectory. The development of platforms for in vivo gene editing and RNA editing technologies is set to revolutionize treatment paradigms for a wide array of diseases, from inherited conditions to acquired chronic illnesses.

Dominant Regions, Countries, or Segments in Nucleic Acid-Based Therapeutics Industry

The global Nucleic Acid-Based Therapeutics Industry is witnessing significant growth across various regions and segments, with North America consistently leading in market share and innovation. The United States stands out as the dominant country due to its robust healthcare infrastructure, substantial investment in research and development, favorable regulatory environment (FDA approvals), and a high concentration of leading biotechnology companies. The strong presence of academic and research institutes conducting cutting-edge genomics research further bolsters its position.

Product Type Dominance:

- Antisense Oligonucleotides (ASOs): Currently hold a significant market share, driven by approvals for genetic disorders like Spinal Muscular Atrophy (SMA) and Huntington's disease. Companies like Ionis Pharmaceuticals Inc. and Sarepta Therapeutics Inc. are key players in this segment.

- RNA interference (RNAi): Rapidly gaining traction with advancements in delivery systems. Alnylam Pharmaceuticals Inc. is a prominent leader, with approved therapies for rare genetic conditions.

- Other Product Types (including mRNA therapeutics): This segment is experiencing explosive growth, largely propelled by the success of mRNA vaccines and ongoing research into mRNA therapeutics for various diseases, including cancer and infectious diseases. Moderna Inc. and BioNTech SE are at the forefront of this revolution.

Application Dominance:

- Genetic Disorders: This remains a primary application area, accounting for a substantial portion of the market. Nucleic acid therapies offer a unique advantage in addressing the root cause of inherited diseases.

- Cancer: A rapidly expanding application, with ongoing research and clinical trials exploring RNA-based therapies for various oncological indications, including immunotherapy and targeted cancer treatments.

- Infectious Diseases: While vaccines have been a major success, there is growing interest in therapeutic RNA-based interventions for chronic viral infections and emerging infectious threats.

End User Dominance:

- Hospitals and Clinics: These are the primary end-users, as they administer and manage the treatment of patients receiving nucleic acid-based therapies. The specialized nature of these treatments necessitates expert medical care.

- Academic and Research Institutes: These institutions are crucial for driving innovation through fundamental research, drug discovery, and early-stage clinical development, contributing to the overall growth and advancement of the sector.

The dominance of these segments and regions is further amplified by strategic investments in manufacturing capabilities, supportive government policies promoting biopharmaceutical innovation, and a growing awareness of the therapeutic potential of nucleic acid-based medicines among healthcare providers and patients.

Nucleic Acid-Based Therapeutics Industry Product Landscape

The nucleic acid-based therapeutics landscape is characterized by groundbreaking product innovations designed to precisely target genetic defects and disease pathways. Key product types include Antisense Oligonucleotides (ASOs), which function by binding to specific messenger RNA (mRNA) molecules to prevent protein synthesis or modulate gene expression, and RNA interference (RNAi) therapeutics that utilize small interfering RNAs (siRNAs) to degrade target mRNA. Emerging technologies like mRNA therapeutics, exemplified by the success of COVID-19 vaccines, are expanding into novel indications such as cancer vaccines and protein replacement therapies. These products offer unique selling propositions, including high specificity, potential for treating previously untreatable conditions, and the ability to address diseases at the genetic level. Technological advancements in delivery systems, such as lipid nanoparticles (LNPs) and adeno-associated viruses (AAVs), are crucial for improving cellular uptake, biodistribution, and therapeutic efficacy while minimizing off-target effects. The performance metrics of these therapies are continuously being refined, focusing on improved half-life, enhanced target engagement, and reduced immunogenicity, paving the way for broader clinical adoption.

Key Drivers, Barriers & Challenges in Nucleic Acid-Based Therapeutics Industry

Key Drivers: The Nucleic Acid-Based Therapeutics Industry is propelled by several powerful drivers. Technological advancements in RNA synthesis, gene editing, and delivery systems (e.g., lipid nanoparticles) are expanding therapeutic possibilities. The increasing understanding of genomics and disease mechanisms allows for the development of highly targeted therapies. Favorable regulatory pathways, particularly for rare and life-threatening diseases, accelerate product approvals. A growing pipeline of investigational therapies for various indications, including genetic disorders, cancer, and infectious diseases, signifies robust innovation. Furthermore, increasing patient demand for effective and potentially curative treatments and substantial investments from venture capital and large pharmaceutical companies are critical accelerators.

Barriers & Challenges: Despite its promise, the industry faces significant barriers and challenges. The high cost of research and development, coupled with lengthy and complex clinical trial processes, presents a considerable financial hurdle. Manufacturing scalability and complexity for highly pure and stable nucleic acid products remain a challenge. Delivery system limitations, including potential toxicity and off-target effects, require continuous innovation. Regulatory hurdles for novel modalities, although improving, can still be complex and time-consuming. Supply chain complexities for raw materials and specialized manufacturing also pose challenges. Reimbursement challenges and market access for expensive novel therapies can hinder widespread adoption. Competition from established therapeutic modalities and the need to demonstrate superior efficacy and safety profiles are ongoing pressures.

Emerging Opportunities in Nucleic Acid-Based Therapeutics Industry

Emerging opportunities in the Nucleic Acid-Based Therapeutics Industry are vast and continue to expand. The development of personalized nucleic acid therapies tailored to individual genetic profiles represents a significant frontier, particularly in oncology and rare diseases. The application of RNA-based therapeutics for neurodegenerative diseases is gaining momentum, with promising research into Alzheimer's, Parkinson's, and ALS. Furthermore, there's a growing opportunity in infectious disease prevention and treatment beyond vaccines, exploring therapeutic RNA for chronic viral infections and novel antiviral agents. The exploration of in vivo gene editing and RNA editing technologies opens doors to potentially curative treatments for a wider range of genetic conditions. Untapped markets in developing nations also present significant growth potential as awareness and access to advanced therapies increase. Evolving consumer preferences towards more targeted and less invasive treatments further fuel the demand for these innovative modalities.

Growth Accelerators in the Nucleic Acid-Based Therapeutics Industry Industry

Several key catalysts are accelerating the long-term growth of the Nucleic Acid-Based Therapeutics Industry. Technological breakthroughs in areas like synthetic biology, advanced CRISPR systems, and novel delivery vehicles are continuously expanding the therapeutic toolbox and improving drug efficacy. Strategic partnerships between academic institutions, biotech startups, and large pharmaceutical companies are fostering innovation and accelerating the transition from lab to clinic. Market expansion strategies, including targeting new indications and geographical regions, are crucial for sustained growth. The increasing focus on translational research and the development of robust preclinical and clinical validation models are essential for de-risking investments and expediting drug development timelines. Furthermore, supportive government initiatives and funding for biotechnology research play a vital role in nurturing this ecosystem.

Key Players Shaping the Nucleic Acid-Based Therapeutics Industry Market

- Silence Therapeutics PLC

- Ionis Pharmaceuticals Inc.

- Novartis Pharma AG

- Arrowhead Pharmaceuticals Inc.

- Alnylam Pharmaceuticals Inc.

- Sarepta Therapeutics Inc.

- Biogen Inc.

- Wave Life Sciences

- Moderna Inc.

- Stoke Therapeutics Inc.

Notable Milestones in Nucleic Acid-Based Therapeutics Industry Sector

- March 2023: Ionis Pharmaceutical received a unanimous vote from the Food and Drug Administration (FDA) advisory committee for the potential accelerated approval of Tofersen for SOD1-ALS. Tofersen is an antisense oligonucleotide that mediates the degradation of superoxide dismutase 1 (SOD1) messenger RNA to reduce SOD1 protein synthesis.

- February 2023: Myeloid Therapeutics Inc. collaborated with New South Wales (NSW) Government in Australia to develop a state-of-the-art GMP manufacturing facility focused on RNA immunotherapies. The new facility would accelerate the commercialization of Myceloid's RNA therapeutics and the construction of an RNA ecosystem in the NSW.

In-Depth Nucleic Acid-Based Therapeutics Industry Market Outlook

The Nucleic Acid-Based Therapeutics Industry is poised for substantial growth, driven by a robust pipeline of innovative therapies and expanding therapeutic applications. Growth accelerators include ongoing technological breakthroughs in RNA synthesis and delivery, fostering new therapeutic modalities for a wider range of diseases. Strategic partnerships and collaborations are crucial for de-risking development and accelerating market entry. Furthermore, increasing investments from venture capital and large pharmaceutical companies underscore the sector's immense potential. Future market potential is significant, particularly in areas like gene editing, RNA editing, and personalized medicine. Strategic opportunities lie in addressing unmet medical needs in rare genetic disorders, neurodegenerative diseases, oncology, and infectious diseases, offering a promising outlook for sustained expansion and innovation.

Nucleic Acid-Based Therapeutics Industry Segmentation

-

1. Product Type

- 1.1. RNA inte

- 1.2. Antisense Oligonucleotides (ASOs)

- 1.3. Other Product Types

-

2. Application

- 2.1. Autoimmune Disorders

- 2.2. Infectious Diseases

- 2.3. Genetic Disorders

- 2.4. Cancer

- 2.5. Other Applications

-

3. End User

- 3.1. Hospitals and Clinics

- 3.2. Academic and Research Institutes

Nucleic Acid-Based Therapeutics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Nucleic Acid-Based Therapeutics Industry Regional Market Share

Geographic Coverage of Nucleic Acid-Based Therapeutics Industry

Nucleic Acid-Based Therapeutics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Prevalence of Genetic Diseases; Growing Investments in Healthcare Sector; Rapid Shift of the Pharmaceutical Industry Toward Innovative Biologics

- 3.3. Market Restrains

- 3.3.1. High Cost of Nucleic Acid Research

- 3.4. Market Trends

- 3.4.1. Antisense Oligonucleotides (ASOs) Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nucleic Acid-Based Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. RNA inte

- 5.1.2. Antisense Oligonucleotides (ASOs)

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Autoimmune Disorders

- 5.2.2. Infectious Diseases

- 5.2.3. Genetic Disorders

- 5.2.4. Cancer

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals and Clinics

- 5.3.2. Academic and Research Institutes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East

- 5.4.5. GCC

- 5.4.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Nucleic Acid-Based Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. RNA inte

- 6.1.2. Antisense Oligonucleotides (ASOs)

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Autoimmune Disorders

- 6.2.2. Infectious Diseases

- 6.2.3. Genetic Disorders

- 6.2.4. Cancer

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals and Clinics

- 6.3.2. Academic and Research Institutes

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Nucleic Acid-Based Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. RNA inte

- 7.1.2. Antisense Oligonucleotides (ASOs)

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Autoimmune Disorders

- 7.2.2. Infectious Diseases

- 7.2.3. Genetic Disorders

- 7.2.4. Cancer

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals and Clinics

- 7.3.2. Academic and Research Institutes

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Nucleic Acid-Based Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. RNA inte

- 8.1.2. Antisense Oligonucleotides (ASOs)

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Autoimmune Disorders

- 8.2.2. Infectious Diseases

- 8.2.3. Genetic Disorders

- 8.2.4. Cancer

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals and Clinics

- 8.3.2. Academic and Research Institutes

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East Nucleic Acid-Based Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. RNA inte

- 9.1.2. Antisense Oligonucleotides (ASOs)

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Autoimmune Disorders

- 9.2.2. Infectious Diseases

- 9.2.3. Genetic Disorders

- 9.2.4. Cancer

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals and Clinics

- 9.3.2. Academic and Research Institutes

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. GCC Nucleic Acid-Based Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. RNA inte

- 10.1.2. Antisense Oligonucleotides (ASOs)

- 10.1.3. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Autoimmune Disorders

- 10.2.2. Infectious Diseases

- 10.2.3. Genetic Disorders

- 10.2.4. Cancer

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals and Clinics

- 10.3.2. Academic and Research Institutes

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. South America Nucleic Acid-Based Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. RNA inte

- 11.1.2. Antisense Oligonucleotides (ASOs)

- 11.1.3. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Autoimmune Disorders

- 11.2.2. Infectious Diseases

- 11.2.3. Genetic Disorders

- 11.2.4. Cancer

- 11.2.5. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Hospitals and Clinics

- 11.3.2. Academic and Research Institutes

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Silence Therapeutics PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ionis Pharmaceuticals Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Novartis Pharma AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Arrowhead Pharmaceuticals Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Alnylam Pharmaceuticals Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Sarepta Therapeutics Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Biogen Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Wave Life Sciences

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Moderna Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Stoke Therapeutics Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Silence Therapeutics PLC

List of Figures

- Figure 1: Global Nucleic Acid-Based Therapeutics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Nucleic Acid-Based Therapeutics Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Nucleic Acid-Based Therapeutics Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Nucleic Acid-Based Therapeutics Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Nucleic Acid-Based Therapeutics Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: GCC Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 35: GCC Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: GCC Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: GCC Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: GCC Nucleic Acid-Based Therapeutics Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: GCC Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: GCC Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: GCC Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 43: South America Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: South America Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Application 2025 & 2033

- Figure 45: South America Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Nucleic Acid-Based Therapeutics Industry Revenue (Million), by End User 2025 & 2033

- Figure 47: South America Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 48: South America Nucleic Acid-Based Therapeutics Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: South America Nucleic Acid-Based Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 25: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 37: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 39: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: South Africa Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 43: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global Nucleic Acid-Based Therapeutics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Brazil Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Argentina Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of South America Nucleic Acid-Based Therapeutics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nucleic Acid-Based Therapeutics Industry?

The projected CAGR is approximately 14.29%.

2. Which companies are prominent players in the Nucleic Acid-Based Therapeutics Industry?

Key companies in the market include Silence Therapeutics PLC, Ionis Pharmaceuticals Inc, Novartis Pharma AG, Arrowhead Pharmaceuticals Inc, Alnylam Pharmaceuticals Inc, Sarepta Therapeutics Inc, Biogen Inc, Wave Life Sciences, Moderna Inc, Stoke Therapeutics Inc.

3. What are the main segments of the Nucleic Acid-Based Therapeutics Industry?

The market segments include Product Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Prevalence of Genetic Diseases; Growing Investments in Healthcare Sector; Rapid Shift of the Pharmaceutical Industry Toward Innovative Biologics.

6. What are the notable trends driving market growth?

Antisense Oligonucleotides (ASOs) Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Nucleic Acid Research.

8. Can you provide examples of recent developments in the market?

In March 2023, Ionis Pharmaceutical received a unanimous vote from the Food and Drug Administration (FDA) advisory committee for the potential accelerated approval of Tofersen for SOD1-ALS. Tofersen is an antisense oligonucleotide that mediates the degradation of superoxide dismutase 1 (SOD1) messenger RNA to reduce SOD1 protein synthesis.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nucleic Acid-Based Therapeutics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nucleic Acid-Based Therapeutics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nucleic Acid-Based Therapeutics Industry?

To stay informed about further developments, trends, and reports in the Nucleic Acid-Based Therapeutics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence