Key Insights

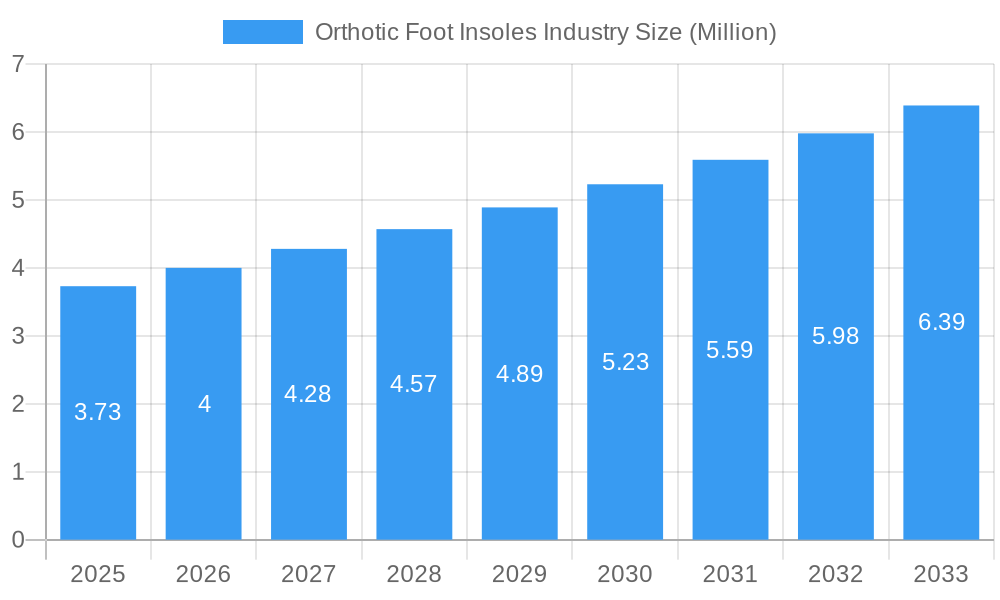

The Orthotic Foot Insoles market is poised for substantial growth, projected to reach a valuation of $3.73 Million by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 6.90% through 2033. This upward trajectory is primarily fueled by a growing awareness of foot health and the increasing prevalence of foot-related conditions such as plantar fasciitis, diabetes, and arthritis. The demand for orthotic insoles is further propelled by the rising participation in sports and athletic activities, where enhanced comfort, injury prevention, and performance optimization are paramount. Moreover, the personal comfort segment is experiencing significant traction as individuals increasingly seek solutions for everyday foot pain and fatigue, driven by sedentary lifestyles and prolonged standing or walking. The medical sector also represents a crucial driver, with a growing adoption of custom and prefabricated orthotics for managing chronic foot ailments and improving mobility in elderly populations and individuals with specific medical needs.

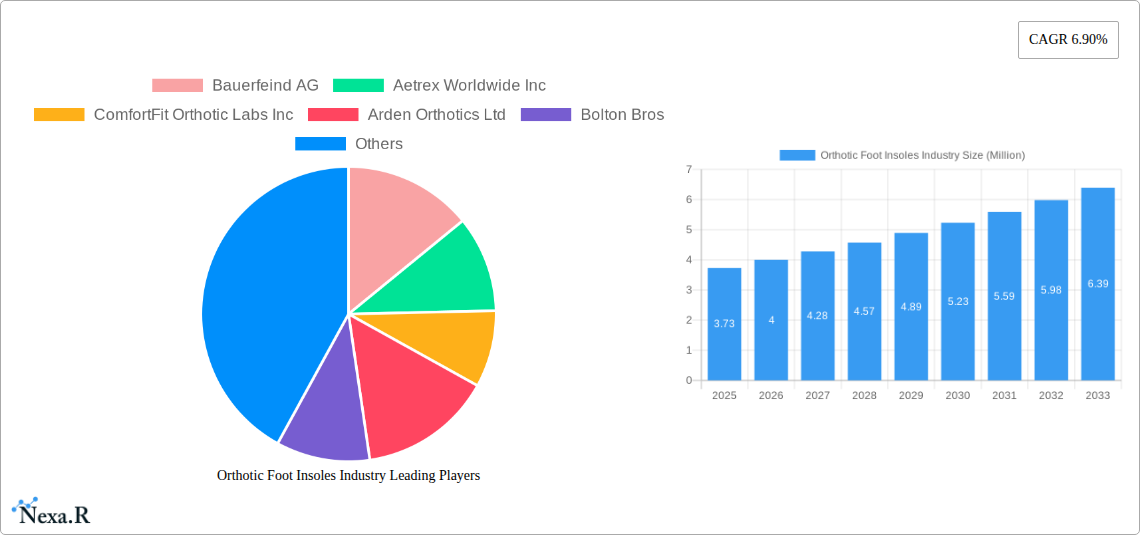

Orthotic Foot Insoles Industry Market Size (In Million)

Key market drivers include advancements in material science, leading to the development of more comfortable, durable, and personalized orthotic solutions. Innovations in prefabricated insoles, offering readily available and cost-effective options, are democratizing access to foot support. Simultaneously, the demand for customized orthotics, tailored to individual biomechanical needs, continues to grow, particularly in the medical and high-performance athletic segments. Thermoplastics and polyethylene foams are emerging as dominant materials due to their lightweight, cushioning, and moldable properties. However, the market also faces certain restraints, including the high cost associated with custom-made orthotics and a lack of widespread consumer awareness regarding the benefits of orthotic insoles, particularly in developing regions. Despite these challenges, the overarching trend towards preventative healthcare and an aging global population ensures a positive outlook for the orthotic foot insoles industry.

Orthotic Foot Insoles Industry Company Market Share

Orthotic Foot Insoles Industry: Comprehensive Market Analysis 2019-2033

This comprehensive report offers an in-depth analysis of the global Orthotic Foot Insoles market, providing critical insights for stakeholders navigating this dynamic sector. Covering the historical period from 2019-2024, base year 2025, and a robust forecast period extending to 2033, this study delves into market size, growth trends, competitive landscapes, and emerging opportunities. With a focus on key segments such as prefabricated and customized insoles, and materials like thermoplastics and ethyl-vinyl acetates (EVAs), this report is an indispensable resource for understanding market evolution and strategic positioning. All presented values are in Million units.

Orthotic Foot Insoles Industry Market Dynamics & Structure

The Orthotic Foot Insoles market is characterized by a moderate to high degree of market concentration, with key players investing heavily in technological innovation and product development. Driven by increasing awareness of foot health and the growing prevalence of foot-related ailments, the demand for advanced orthotic solutions is on an upward trajectory. Regulatory frameworks, while largely supportive of medical device standards, can influence market entry and product approvals, particularly for medical-grade orthotics. Competitive product substitutes, ranging from basic cushioning insoles to specialized medical footwear, present a dynamic competitive environment. End-user demographics are expanding beyond traditional athletic and medical applications to include a growing segment of individuals seeking personal comfort and preventative foot care. Mergers and acquisitions (M&A) are observed as companies seek to expand their product portfolios, gain market share, and integrate new technologies.

- Technological Innovation Drivers: Advanced materials, 3D printing, and AI-driven customization technologies are transforming the orthotic insole landscape.

- Regulatory Frameworks: Compliance with medical device regulations (e.g., FDA, CE marking) is crucial for market access and credibility.

- End-User Demographics: Growing elderly population, increased participation in sports, and the rise of sedentary lifestyles contribute to diverse end-user needs.

- M&A Trends: Strategic acquisitions aim to consolidate market presence and leverage synergistic capabilities in research, manufacturing, and distribution.

Orthotic Foot Insoles Industry Growth Trends & Insights

The Orthotic Foot Insoles market is poised for substantial growth over the forecast period, driven by a confluence of factors including rising healthcare expenditure, increasing prevalence of chronic conditions affecting foot health, and a growing consumer focus on wellness and preventative care. Market size evolution is marked by consistent year-on-year expansion, with an anticipated Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. Adoption rates for both prefabricated and customized insoles are steadily increasing, reflecting greater consumer awareness and improved product accessibility. Technological disruptions, such as the integration of artificial intelligence in the manufacturing process of customized insoles and the development of advanced sensor technologies for biomechanical analysis, are significantly enhancing product efficacy and personalization. Consumer behavior shifts are evident, with a growing preference for evidence-based solutions and a willingness to invest in high-quality, durable orthotic products that offer long-term benefits for foot health and overall well-being. The "personal comfort" segment is experiencing particularly robust growth, as individuals increasingly seek solutions for everyday aches and pains associated with prolonged standing or walking. The medical segment continues to be a strong performer, fueled by the management of conditions like plantar fasciitis, diabetes-related foot complications, and biomechanical deformities. The sports and athletics segment remains a significant contributor, with athletes at all levels utilizing orthotics to enhance performance, prevent injuries, and manage existing conditions. The penetration of orthotic insoles is projected to deepen across all age groups, with a notable surge in demand from younger demographics adopting active lifestyles and seeking to mitigate potential future foot problems.

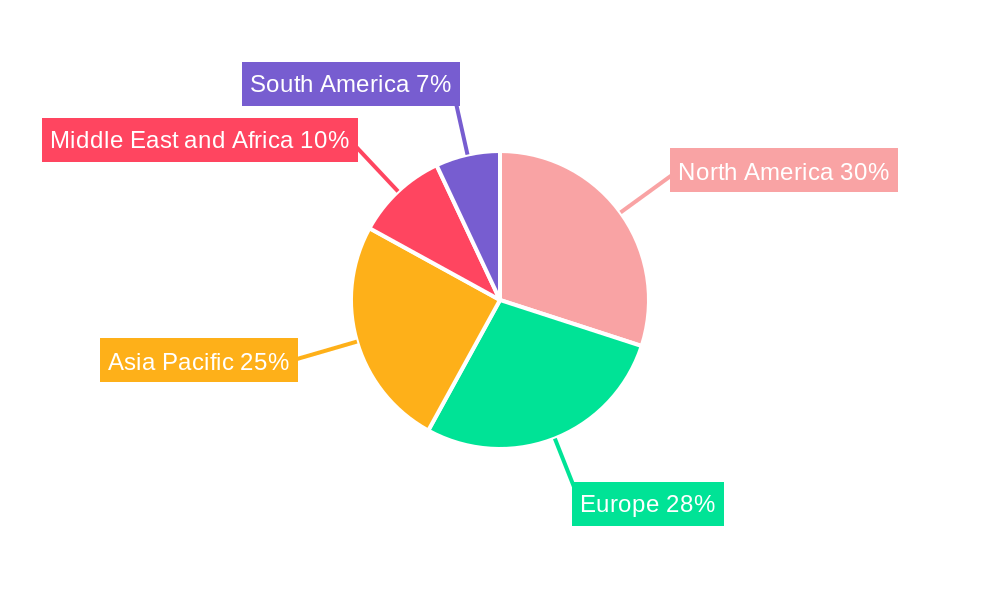

Dominant Regions, Countries, or Segments in Orthotic Foot Insoles Industry

North America currently dominates the global Orthotic Foot Insoles market, driven by a highly developed healthcare infrastructure, a large aging population, high disposable incomes, and a strong emphasis on sports and physical fitness. The United States, in particular, accounts for a significant share due to high healthcare spending and widespread adoption of preventative health measures. Europe follows closely, with countries like Germany and the United Kingdom exhibiting substantial market penetration, fueled by supportive healthcare policies and a growing awareness of biomechanical health. The Asia-Pacific region is emerging as a high-growth market, propelled by increasing disposable incomes, rapid urbanization, a growing middle class, and a rising incidence of lifestyle-related diseases that impact foot health.

Dominant Segments:

- Product: Customized Orthotic Insoles: This segment is experiencing accelerated growth due to advancements in 3D scanning and printing technologies, allowing for highly personalized solutions that cater to individual biomechanical needs. The ability to precisely address specific foot conditions and provide superior comfort and support makes customized insoles a preferred choice for many.

- Material: Ethyl-Vinyl Acetates (EVAs): EVAs remain a dominant material due to their excellent cushioning properties, durability, lightweight nature, and cost-effectiveness, making them ideal for a wide range of orthotic applications, from athletic to everyday wear. Thermoplastics also hold a significant share, particularly in semi-custom and custom applications requiring specific structural support.

- Application: Sports and Athletics: This segment consistently drives significant market demand. Athletes across various disciplines rely on orthotic insoles to improve performance, enhance stability, reduce impact forces, and prevent common sports-related injuries such as plantar fasciitis, shin splints, and stress fractures.

Key Drivers for Dominance:

- Economic Policies: Government initiatives supporting healthcare access and subsidies for medical devices in developed regions bolster market growth.

- Infrastructure: Advanced healthcare and retail infrastructure facilitate the distribution and accessibility of orthotic foot insoles.

- Consumer Awareness: Increasing public understanding of foot health issues and the benefits of orthotic intervention directly correlates with market demand.

- Technological Advancements: Innovations in materials science and manufacturing processes enable the creation of more effective, comfortable, and affordable orthotic solutions, particularly in the customized segment.

Orthotic Foot Insoles Industry Product Landscape

The orthotic foot insole product landscape is characterized by continuous innovation aimed at enhancing comfort, performance, and therapeutic efficacy. Products range from basic cushioning insoles designed for everyday wear to highly specialized, medically engineered inserts for specific conditions. Key applications span sports and athletics, personal comfort, and medical interventions for conditions like plantar fasciitis, overpronation, and diabetic foot care. Unique selling propositions often revolve around advanced material compositions, biomechanical design principles, and customizable features. Technological advancements are evident in the integration of shock-absorbing technologies, antimicrobial properties, and the development of insoles tailored for specific sports or activities. The trend towards smarter insoles with embedded sensors for gait analysis and performance monitoring is also emerging.

Key Drivers, Barriers & Challenges in Orthotic Foot Insoles Industry

Key Drivers: The Orthotic Foot Insoles industry is propelled by a confluence of factors. Growing global incidence of foot-related ailments such as plantar fasciitis, diabetes-related foot complications, and biomechanical deformities directly fuels demand for therapeutic insoles. An aging population, more prone to mobility issues and foot pain, further expands the consumer base. Increased participation in sports and fitness activities, coupled with a heightened awareness of injury prevention, drives the adoption of performance-enhancing orthotics. Technological advancements, including 3D printing and AI-driven customization, are making personalized insoles more accessible and effective.

Barriers & Challenges: Despite robust growth, the industry faces several hurdles. High manufacturing costs for customized orthotics can be a barrier for some consumers, limiting market penetration in price-sensitive regions. Stringent regulatory approvals for medical-grade insoles can slow down product launches and market entry. Intense competition from a wide array of insole brands and alternative solutions, such as supportive footwear, poses a continuous challenge. Supply chain disruptions, particularly for specialized raw materials, can impact production and lead times. Moreover, a lack of widespread consumer education regarding the benefits and proper use of orthotic insoles can hinder adoption rates.

Emerging Opportunities in Orthotic Foot Insoles Industry

Emerging opportunities in the Orthotic Foot Insoles industry are abundant, driven by evolving consumer needs and technological advancements. The untapped potential in emerging economies, where disposable incomes are rising and awareness of foot health is growing, presents a significant growth avenue. Innovative applications, such as smart insoles integrated with wearable technology for real-time gait analysis and health monitoring, are gaining traction. The development of specialized orthotics for niche sports and activities, or for specific occupational demands, offers further scope for market expansion. Evolving consumer preferences for sustainable and eco-friendly materials in product manufacturing also presents an opportunity for brands that can align with these values.

Growth Accelerators in the Orthotic Foot Insoles Industry Industry

Several catalysts are accelerating the long-term growth of the Orthotic Foot Insoles industry. Breakthroughs in materials science are leading to the development of lighter, more durable, and more bio-compatible insoles with enhanced shock absorption and energy return properties. Strategic partnerships between orthotic manufacturers and healthcare providers, podiatrists, and sports physiotherapists are crucial for driving product adoption and expanding market reach. Market expansion strategies, including global outreach into underserved regions and the development of direct-to-consumer (DTC) channels, are vital for capturing new customer segments. Furthermore, the increasing integration of digital technologies, such as online gait analysis tools and virtual consultations, simplifies the process of obtaining personalized orthotics, thus boosting accessibility and demand.

Key Players Shaping the Orthotic Foot Insoles Industry Market

- Bauerfeind AG

- Aetrex Worldwide Inc

- ComfortFit Orthotic Labs Inc

- Arden Orthotics Ltd

- Bolton Bros

- Dr Scholl's

- DJO Global Inc

- Acor Orthopedic Inc

- Algeo Limited

- KLM Laboratories Inc

Notable Milestones in Orthotic Foot Insoles Industry Sector

- November 2022: Insoles company Upstep launched the first technology system of its kind with artificial intelligence, which enables a 50% reduction in the time it takes to manufacture customized insoles.

- July 2022: Foot Levelers, the provider of hand-crafted custom orthotics serving multi-disciplinary professionals and clinicians, introduced their most advanced custom orthotic. InMotion+ is a meticulously crafted and rigorously tested orthotic incorporating premium performance, stability, and comfort features.

In-Depth Orthotic Foot Insoles Industry Market Outlook

The future outlook for the Orthotic Foot Insoles industry is exceptionally promising, driven by a sustained increase in demand for personalized healthcare solutions and preventative wellness products. Growth accelerators such as ongoing advancements in 3D printing and AI for bespoke insole creation will continue to enhance product customization and affordability. Strategic partnerships with healthcare professionals and sports organizations will solidify market penetration and consumer trust. The expansion into untapped geographical markets and the growing adoption of e-commerce platforms will further broaden the industry's reach. As consumer awareness of the critical role of foot health in overall well-being continues to rise, the market is poised for robust, long-term expansion, creating significant opportunities for innovation and strategic investment.

Orthotic Foot Insoles Industry Segmentation

-

1. Product

- 1.1. Prefabricated

- 1.2. Customized

-

2. Material

- 2.1. Thermoplastics

- 2.2. Polyethylene Foams

- 2.3. Leather

- 2.4. Ethyl-Vinyl Acetates (EVAs)

- 2.5. Other Materials

-

3. Application

- 3.1. Sports and Athletics

- 3.2. Personal Comfort

- 3.3. Medical

Orthotic Foot Insoles Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Orthotic Foot Insoles Industry Regional Market Share

Geographic Coverage of Orthotic Foot Insoles Industry

Orthotic Foot Insoles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Customized Orthotic Insoles to Reduce Pain; Significant Rise in Geriatric Population and Prevalence of Diabetes; Increasing Health Issues Coupled with Increasing Incidence of Chronic Pain

- 3.3. Market Restrains

- 3.3.1. Limited Awareness About Orthotics Among Population

- 3.4. Market Trends

- 3.4.1. Sports and Athletics by End-User Segment is Expected to Witness Significant Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Orthotic Foot Insoles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Prefabricated

- 5.1.2. Customized

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Thermoplastics

- 5.2.2. Polyethylene Foams

- 5.2.3. Leather

- 5.2.4. Ethyl-Vinyl Acetates (EVAs)

- 5.2.5. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Sports and Athletics

- 5.3.2. Personal Comfort

- 5.3.3. Medical

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Orthotic Foot Insoles Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Prefabricated

- 6.1.2. Customized

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Thermoplastics

- 6.2.2. Polyethylene Foams

- 6.2.3. Leather

- 6.2.4. Ethyl-Vinyl Acetates (EVAs)

- 6.2.5. Other Materials

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Sports and Athletics

- 6.3.2. Personal Comfort

- 6.3.3. Medical

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Orthotic Foot Insoles Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Prefabricated

- 7.1.2. Customized

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Thermoplastics

- 7.2.2. Polyethylene Foams

- 7.2.3. Leather

- 7.2.4. Ethyl-Vinyl Acetates (EVAs)

- 7.2.5. Other Materials

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Sports and Athletics

- 7.3.2. Personal Comfort

- 7.3.3. Medical

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Orthotic Foot Insoles Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Prefabricated

- 8.1.2. Customized

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Thermoplastics

- 8.2.2. Polyethylene Foams

- 8.2.3. Leather

- 8.2.4. Ethyl-Vinyl Acetates (EVAs)

- 8.2.5. Other Materials

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Sports and Athletics

- 8.3.2. Personal Comfort

- 8.3.3. Medical

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Orthotic Foot Insoles Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Prefabricated

- 9.1.2. Customized

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Thermoplastics

- 9.2.2. Polyethylene Foams

- 9.2.3. Leather

- 9.2.4. Ethyl-Vinyl Acetates (EVAs)

- 9.2.5. Other Materials

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Sports and Athletics

- 9.3.2. Personal Comfort

- 9.3.3. Medical

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Orthotic Foot Insoles Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Prefabricated

- 10.1.2. Customized

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Thermoplastics

- 10.2.2. Polyethylene Foams

- 10.2.3. Leather

- 10.2.4. Ethyl-Vinyl Acetates (EVAs)

- 10.2.5. Other Materials

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Sports and Athletics

- 10.3.2. Personal Comfort

- 10.3.3. Medical

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bauerfeind AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aetrex Worldwide Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ComfortFit Orthotic Labs Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Arden Orthotics Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bolton Bros

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dr Scholl's

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DJO Global Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Acor Orthopedic Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Algeo Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KLM Laboratories Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bauerfeind AG

List of Figures

- Figure 1: Global Orthotic Foot Insoles Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Orthotic Foot Insoles Industry Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Orthotic Foot Insoles Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Orthotic Foot Insoles Industry Revenue (Million), by Material 2025 & 2033

- Figure 5: North America Orthotic Foot Insoles Industry Revenue Share (%), by Material 2025 & 2033

- Figure 6: North America Orthotic Foot Insoles Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Orthotic Foot Insoles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Orthotic Foot Insoles Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Orthotic Foot Insoles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Orthotic Foot Insoles Industry Revenue (Million), by Product 2025 & 2033

- Figure 11: Europe Orthotic Foot Insoles Industry Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Orthotic Foot Insoles Industry Revenue (Million), by Material 2025 & 2033

- Figure 13: Europe Orthotic Foot Insoles Industry Revenue Share (%), by Material 2025 & 2033

- Figure 14: Europe Orthotic Foot Insoles Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Orthotic Foot Insoles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Orthotic Foot Insoles Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Orthotic Foot Insoles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Orthotic Foot Insoles Industry Revenue (Million), by Product 2025 & 2033

- Figure 19: Asia Pacific Orthotic Foot Insoles Industry Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific Orthotic Foot Insoles Industry Revenue (Million), by Material 2025 & 2033

- Figure 21: Asia Pacific Orthotic Foot Insoles Industry Revenue Share (%), by Material 2025 & 2033

- Figure 22: Asia Pacific Orthotic Foot Insoles Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Orthotic Foot Insoles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Orthotic Foot Insoles Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Orthotic Foot Insoles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Orthotic Foot Insoles Industry Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East and Africa Orthotic Foot Insoles Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Orthotic Foot Insoles Industry Revenue (Million), by Material 2025 & 2033

- Figure 29: Middle East and Africa Orthotic Foot Insoles Industry Revenue Share (%), by Material 2025 & 2033

- Figure 30: Middle East and Africa Orthotic Foot Insoles Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: Middle East and Africa Orthotic Foot Insoles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East and Africa Orthotic Foot Insoles Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Orthotic Foot Insoles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Orthotic Foot Insoles Industry Revenue (Million), by Product 2025 & 2033

- Figure 35: South America Orthotic Foot Insoles Industry Revenue Share (%), by Product 2025 & 2033

- Figure 36: South America Orthotic Foot Insoles Industry Revenue (Million), by Material 2025 & 2033

- Figure 37: South America Orthotic Foot Insoles Industry Revenue Share (%), by Material 2025 & 2033

- Figure 38: South America Orthotic Foot Insoles Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: South America Orthotic Foot Insoles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Orthotic Foot Insoles Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Orthotic Foot Insoles Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 3: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 7: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 14: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 23: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 24: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 33: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 34: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 40: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 41: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 42: Global Orthotic Foot Insoles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Orthotic Foot Insoles Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Orthotic Foot Insoles Industry?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the Orthotic Foot Insoles Industry?

Key companies in the market include Bauerfeind AG, Aetrex Worldwide Inc, ComfortFit Orthotic Labs Inc, Arden Orthotics Ltd, Bolton Bros, Dr Scholl's, DJO Global Inc, Acor Orthopedic Inc, Algeo Limited, KLM Laboratories Inc.

3. What are the main segments of the Orthotic Foot Insoles Industry?

The market segments include Product, Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Customized Orthotic Insoles to Reduce Pain; Significant Rise in Geriatric Population and Prevalence of Diabetes; Increasing Health Issues Coupled with Increasing Incidence of Chronic Pain.

6. What are the notable trends driving market growth?

Sports and Athletics by End-User Segment is Expected to Witness Significant Growth in the Market.

7. Are there any restraints impacting market growth?

Limited Awareness About Orthotics Among Population.

8. Can you provide examples of recent developments in the market?

November 2022: Insoles company Upstep launched the first technology system of its kind with artificial intelligence, which enables a 50% reduction in the time it takes to manufacture customized insoles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Orthotic Foot Insoles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Orthotic Foot Insoles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Orthotic Foot Insoles Industry?

To stay informed about further developments, trends, and reports in the Orthotic Foot Insoles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence