Key Insights

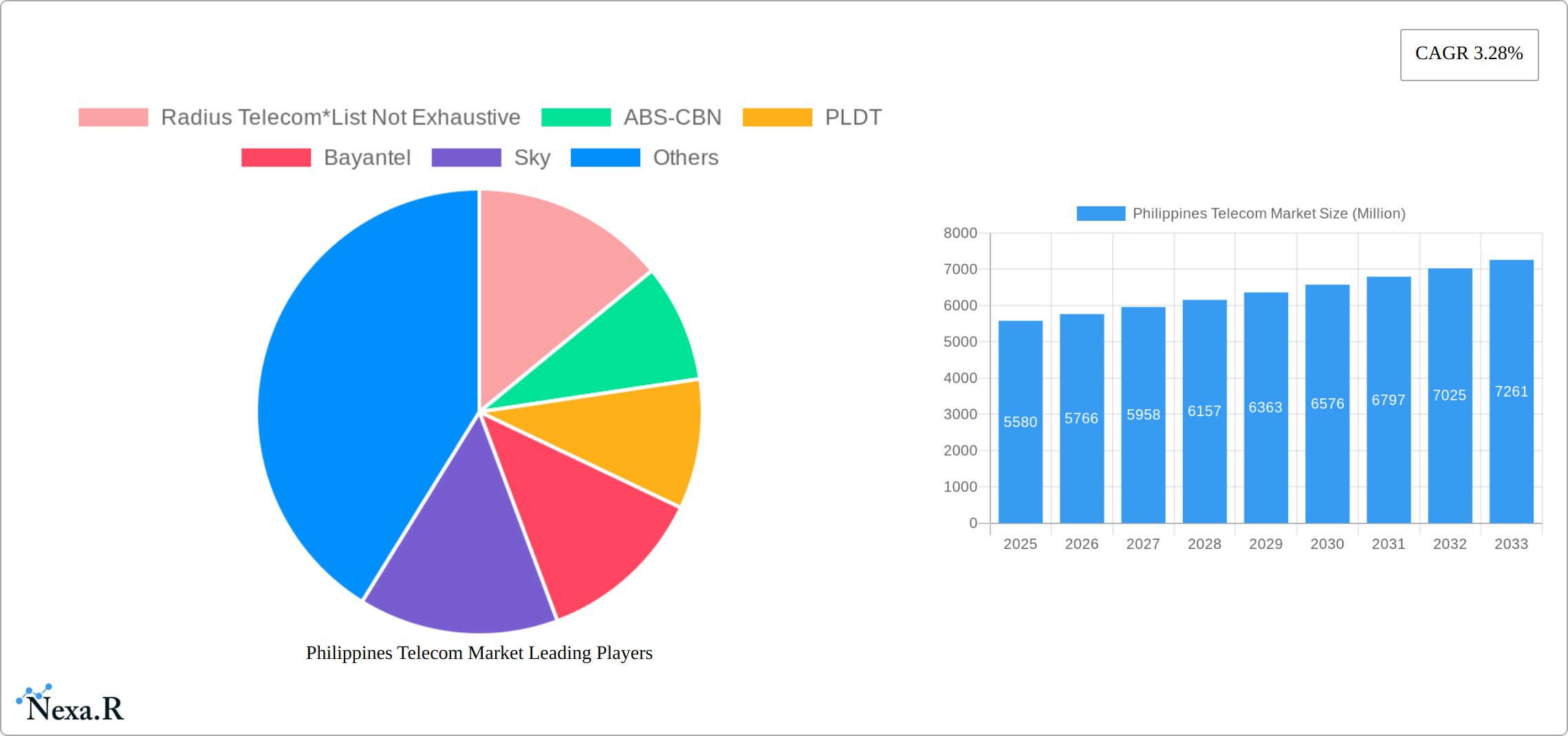

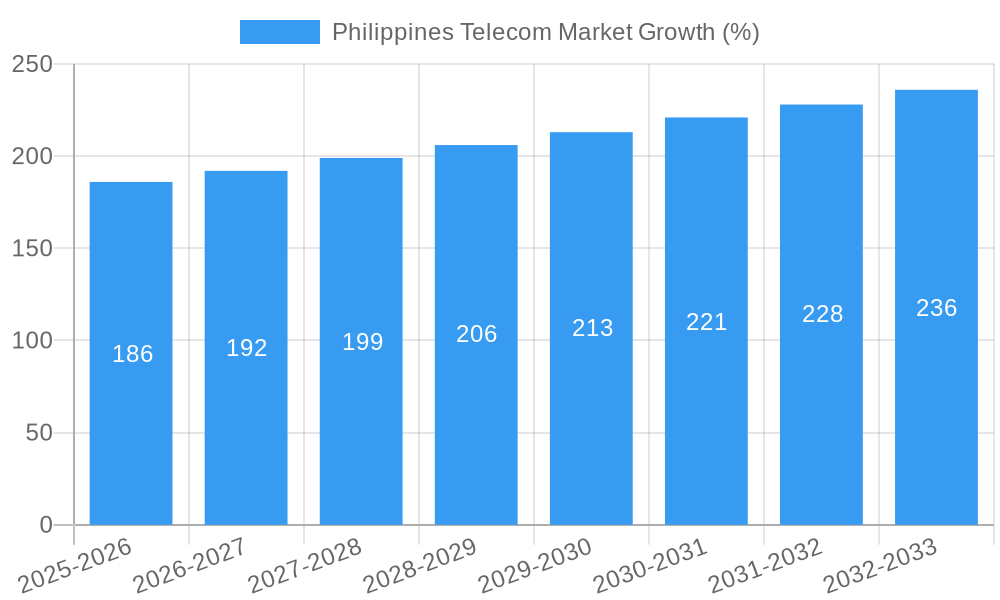

The Philippines telecom market, valued at $5.58 billion in 2025, is projected to experience steady growth, driven by increasing smartphone penetration, rising internet usage, and the expanding adoption of digital services. The Compound Annual Growth Rate (CAGR) of 3.28% from 2025 to 2033 indicates a consistent market expansion, primarily fueled by the growing demand for mobile data and broadband services. Key growth drivers include the government's initiatives to improve digital infrastructure, the rising popularity of over-the-top (OTT) platforms and streaming services, and the increasing affordability of mobile devices and data plans. Competition among major players like Globe Telecom, Smart Communications, PLDT, DITO Telecommunity, and others is intensifying, leading to innovative service offerings and price wars, benefiting consumers. However, challenges such as infrastructure limitations in remote areas and the digital divide remain hurdles to overcome for sustained market expansion. The market segmentation, encompassing voice, wireless data & messaging (including internet and handset data packages), OTT, and Pay-TV services, showcases diverse revenue streams and opportunities for strategic investment. The continued expansion of 4G and the rollout of 5G networks will be crucial in driving future growth.

The market's segmentation offers further insights. The wireless data and messaging segment is expected to be the most significant contributor to market revenue, given the increasing demand for high-speed internet access and mobile data consumption. The OTT and Pay-TV services segment is experiencing rapid growth driven by the rise in streaming services and video-on-demand platforms. While voice services still hold a considerable share, their growth rate is anticipated to be slower compared to data services. Maintaining network reliability, expanding coverage to underserved areas, and continuous investment in network infrastructure are crucial for sustained growth and market leadership. This necessitates significant capital expenditure by the telecom operators. The market's future will be shaped by the players' ability to adapt to evolving consumer needs, technological advancements, and the ongoing regulatory landscape.

Philippines Telecom Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Philippines telecom market, covering market dynamics, growth trends, key players, and future outlook. With a focus on both parent and child markets, this report is an essential resource for industry professionals, investors, and strategic planners seeking to understand and capitalize on opportunities within this dynamic sector. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Philippines Telecom Market Dynamics & Structure

This section analyzes the intricate structure of the Philippines telecom market, encompassing market concentration, technological advancements, regulatory landscapes, competitive dynamics, end-user demographics, and merger & acquisition (M&A) activities. The Philippines telecom market is characterized by a high degree of concentration, with a few dominant players controlling a significant market share. However, the emergence of new entrants like DITO Telecommunity is disrupting this established order.

- Market Concentration: PLDT and Globe Telecom hold the largest market share, estimated at xx% and xx% respectively in 2025, while DITO Telecommunity is rapidly gaining ground. Other players such as Smart Communications, Bayantel, and others contribute to the remaining share.

- Technological Innovation: The market is driven by the rapid adoption of 5G technology, fiber optic infrastructure, and the increasing demand for high-speed internet access. However, challenges remain in ensuring nationwide coverage and affordability.

- Regulatory Framework: The National Telecommunications Commission (NTC) plays a vital role in regulating the sector. The regulatory framework impacts market entry, pricing, and service quality.

- Competitive Landscape: Intense competition among existing players and the emergence of new players are driving innovation and price wars. The competition is primarily focused on data services and 5G network expansion.

- End-User Demographics: The Philippines' young and growing population fuels a high demand for mobile data and internet services. This demographic trend is a key driver of market growth.

- M&A Activity: The past five years have witnessed xx M&A deals, primarily focused on infrastructure expansion and service diversification.

Philippines Telecom Market Growth Trends & Insights

This section provides a detailed analysis of the Philippines telecom market's evolution, growth trajectory, adoption rates of new technologies, and shifts in consumer behavior. The market has exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is attributed to several factors, including the increasing penetration of smartphones, rising internet usage, and the government's initiatives to improve digital infrastructure. Key trends include the increasing adoption of 5G, the rise of over-the-top (OTT) services, and the growing demand for bundled packages. Market penetration of mobile services is nearing saturation, while fixed broadband penetration still has significant growth potential. Consumer behavior is shifting towards data-centric plans and value-added services.

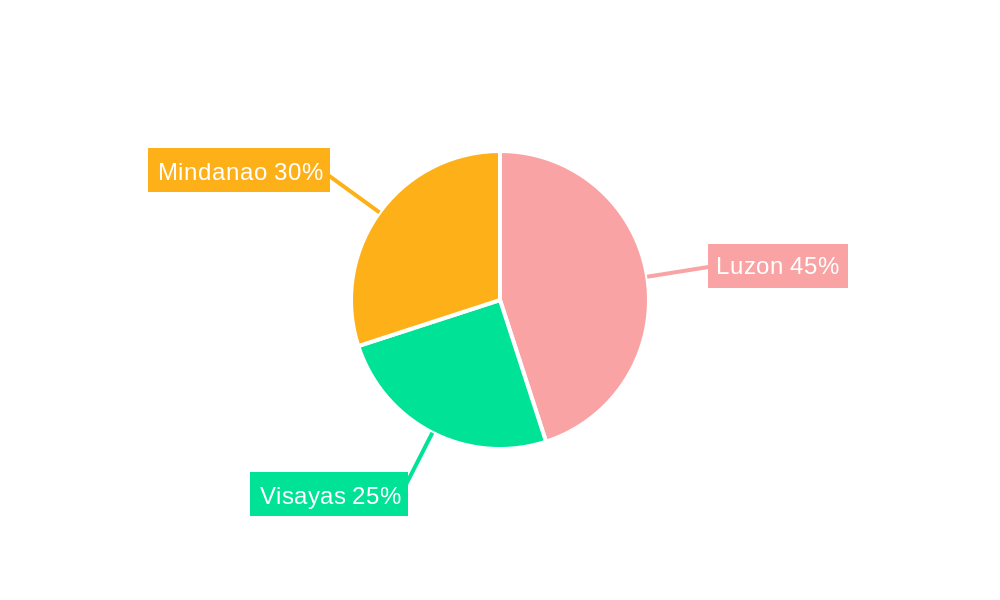

Dominant Regions, Countries, or Segments in Philippines Telecom Market

National Capital Region (NCR) and other major urban centers are leading the market growth due to high population density and strong demand for advanced telecom services. Data and messaging services (including internet and handset data packages) comprise the largest segment, followed by OTT and Pay-TV services. Voice services are experiencing declining growth as data services become more prevalent.

- Key Drivers:

- Economic growth: The rising disposable incomes are fueling demand for telecom services.

- Government initiatives: Government investments in infrastructure development are supporting network expansion.

- Technological advancements: The introduction of 5G and fiber optics is driving service quality improvements.

- Dominance Factors:

- High population density: Urban areas are characterized by high mobile and broadband penetration rates.

- Strong economic activity: These areas have higher disposable incomes, leading to greater spending on telecom services.

- Advanced infrastructure: Investment in network infrastructure ensures high-quality services, leading to market leadership.

Philippines Telecom Market Product Landscape

The Philippines telecom market offers a diverse range of products and services, including voice, data, messaging, OTT, and Pay-TV. Key innovations include the deployment of 5G networks, offering faster speeds and lower latency, and the introduction of fiber optic broadband services, providing increased bandwidth and improved reliability. Many operators are offering bundled packages that combine various services at discounted prices to enhance customer value. Competition is driving the development of innovative value-added services such as cloud-based storage, cybersecurity solutions, and e-commerce platforms.

Key Drivers, Barriers & Challenges in Philippines Telecom Market

Key Drivers:

- Growing smartphone penetration.

- Increasing demand for high-speed internet.

- Government initiatives to promote digital inclusion.

- Investment in 5G and fiber optic infrastructure.

Key Challenges:

- Infrastructure limitations in rural areas.

- Affordability concerns for a significant portion of the population.

- Regulatory hurdles and licensing processes.

- Intense competition impacting profitability.

Emerging Opportunities in Philippines Telecom Market

- Expansion into underserved rural areas.

- Development of innovative digital services for specific sectors (e.g., agriculture, healthcare).

- Leveraging IoT and AI to enhance service offerings.

- Growth in the demand for cybersecurity solutions.

Growth Accelerators in the Philippines Telecom Market Industry

Technological breakthroughs in 5G and fiber optics, strategic partnerships between telecom operators and technology companies, and the expansion into underserved markets are key growth catalysts. Government policies promoting digitalization and initiatives to bridge the digital divide will further accelerate market growth.

Key Players Shaping the Philippines Telecom Market Market

- Radius Telecom

- ABS-CBN

- PLDT

- Bayantel

- Sky

- Globe Telecom

- Cignal

- NOW Telecom

- Smart Communications

- DITO Telecommunity

Notable Milestones in Philippines Telecom Market Sector

- March 2022: DITO Telecommunity launched a wireless home broadband service in select areas in the NCR, Metro Manila.

- May 2022: PLDT announced plans to migrate to full fiber broadband by 2023.

- October 2022: Globe Telecom deployed 252 5G-ready base stations in Mindanao.

In-Depth Philippines Telecom Market Market Outlook

The Philippines telecom market is poised for continued growth, driven by technological advancements, increasing demand for data services, and government initiatives. The expansion of 5G networks and fiber optic infrastructure will unlock significant opportunities for growth. Strategic partnerships and investments in innovative technologies will shape the future of the sector. The focus on affordability and expanding coverage to rural areas will be crucial for achieving inclusive growth.

Philippines Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and Pay-TV Services

-

1.1. Voice Services

Philippines Telecom Market Segmentation By Geography

- 1. Philippines

Philippines Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for Fixed Broadband Services; Rising demand for 5G; Growth of IoT usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Relatively Low Levels of Awareness and Regulatory Challenges

- 3.4. Market Trends

- 3.4.1. Growing Demand for Fixed Broadband Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and Pay-TV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Radius Telecom*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABS-CBN

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PLDT

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayantel

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sky

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Globe Telecom

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cignal

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NOW Telecom

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Smart Communications

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DITO Telecommunity

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Radius Telecom*List Not Exhaustive

List of Figures

- Figure 1: Philippines Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Philippines Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Philippines Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Philippines Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 3: Philippines Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Philippines Telecom Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Philippines Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 6: Philippines Telecom Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Telecom Market?

The projected CAGR is approximately 3.28%.

2. Which companies are prominent players in the Philippines Telecom Market?

Key companies in the market include Radius Telecom*List Not Exhaustive, ABS-CBN, PLDT, Bayantel, Sky, Globe Telecom, Cignal, NOW Telecom, Smart Communications, DITO Telecommunity.

3. What are the main segments of the Philippines Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for Fixed Broadband Services; Rising demand for 5G; Growth of IoT usage in Telecom.

6. What are the notable trends driving market growth?

Growing Demand for Fixed Broadband Services.

7. Are there any restraints impacting market growth?

Relatively Low Levels of Awareness and Regulatory Challenges.

8. Can you provide examples of recent developments in the market?

March 2022: DITO Telecommunity launched a wireless home broadband service in select areas in the National Capital Region (NCR), Metro Manila. The 5G infrastructure will improve the revenue of the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Telecom Market?

To stay informed about further developments, trends, and reports in the Philippines Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence