Key Insights

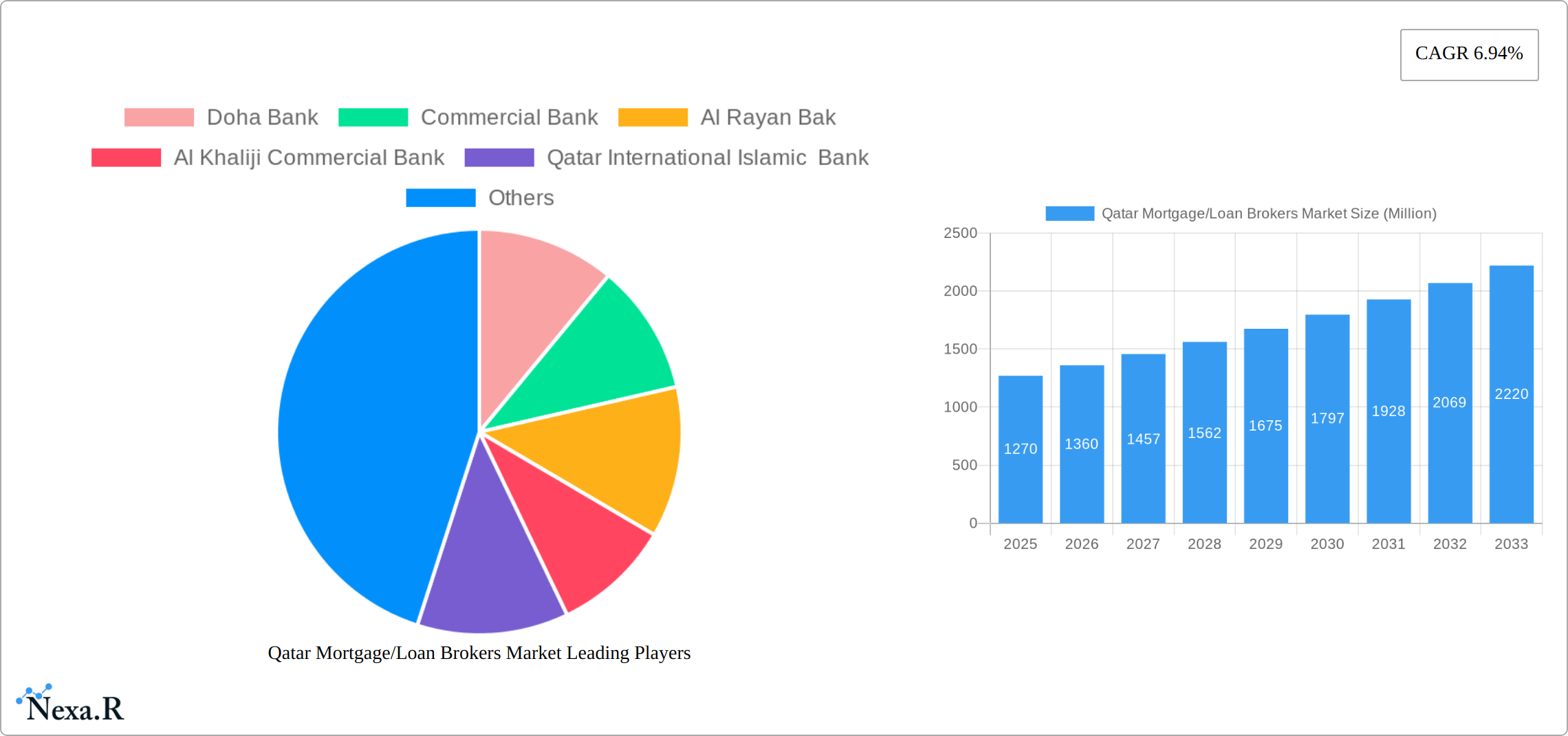

The Qatar mortgage/loan broker market, valued at $1.27 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.94% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Qatar's burgeoning real estate sector, spurred by significant infrastructure development and government initiatives promoting homeownership, creates a consistently high demand for mortgage services. Secondly, increasing awareness among consumers about the benefits of utilizing mortgage brokers – such as access to a wider range of loan options, expert negotiation, and streamlined application processes – is driving market adoption. Furthermore, the growing number of expatriates in Qatar, many seeking home financing, further contributes to the market's expansion. Competition among established players like Qatar National Bank, Doha Bank, and Commercial Bank, alongside Islamic banks like Qatar Islamic Bank and Al Rayan Bank, is intense, leading to innovative product offerings and competitive pricing. However, potential regulatory changes and fluctuations in interest rates pose challenges to sustained growth.

Despite these challenges, the long-term outlook for the Qatar mortgage/loan broker market remains positive. The projected CAGR suggests a considerable increase in market value by 2033. The continued growth of the Qatari economy, coupled with supportive government policies and an expanding population, will likely maintain strong demand for mortgage brokerage services. The diversification of products and services offered by brokers, including tailored solutions for different customer segments and increased use of technology for a more efficient application process, will be crucial for companies to maintain their competitive edge. The market will likely see further consolidation, with larger players acquiring smaller firms and enhancing their technological capabilities to provide a superior customer experience.

Qatar Mortgage/Loan Brokers Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Qatar Mortgage/Loan Brokers Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. This report is invaluable for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market. The report segments the market to provide a granular view and better understand the nuances of each area. The parent market is the financial services sector in Qatar, while the child market focuses specifically on mortgage and loan brokerage services.

Qatar Mortgage/Loan Brokers Market Market Dynamics & Structure

This section analyzes the structure and dynamics of the Qatar Mortgage/Loan Brokers market (2019-2024). The market is characterized by a moderate level of concentration, with key players like Qatar National Bank (QNB), Commercial Bank, and Doha Bank holding significant market share (estimated at xx% combined in 2024). However, the entry of fintech companies and the increasing adoption of digital platforms are fostering competition.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2024.

- Technological Innovation: Digitalization, AI-powered credit scoring, and online platforms are driving innovation. However, regulatory hurdles and data security concerns pose barriers.

- Regulatory Framework: The Qatar Central Bank's regulations significantly impact market operations. Compliance costs and licensing requirements influence market entry and growth.

- Competitive Product Substitutes: Direct lending from banks and online lending platforms pose competition to brokers.

- End-User Demographics: The growing young population and rising disposable incomes are key drivers of demand for mortgages and loans.

- M&A Trends: The volume of M&A deals in the sector has been relatively low (xx deals in 2019-2024) but an increase in consolidation is expected in the forecast period.

Qatar Mortgage/Loan Brokers Market Growth Trends & Insights

The Qatar Mortgage/Loan Brokers Market experienced steady growth during the historical period (2019-2024), driven primarily by government initiatives promoting homeownership and infrastructure development. The market size reached an estimated xx million in 2024, registering a CAGR of xx% during this period. The adoption rate of digital brokerage services is increasing, with xx% of transactions expected to be online by 2025. This trend is further amplified by changing consumer behavior, with a preference for convenient and transparent online services. The forecast period (2025-2033) is projected to witness continued growth driven by factors such as the increasing demand for affordable housing and supportive government policies. Market penetration is estimated to reach xx% by 2033. Technological disruptions, such as the use of blockchain for secure transactions and AI for personalized loan recommendations, will shape market growth.

Dominant Regions, Countries, or Segments in Qatar Mortgage/Loan Brokers Market

Doha, as the capital and commercial hub, dominates the Qatar Mortgage/Loan Brokers Market, accounting for approximately xx% of the total market value in 2024. This dominance is attributed to higher disposable incomes, increased construction activity, and the concentration of major financial institutions in the city.

- Key Drivers:

- Favorable government policies promoting homeownership.

- Robust infrastructure development in Doha and surrounding areas.

- High concentration of financial institutions and brokers in Doha.

- Growing demand for housing due to population increase.

- Dominance Factors:

- Higher transaction volumes compared to other regions.

- Significant presence of major banks and financial institutions.

- Advanced digital infrastructure supporting online brokerage services.

Qatar Mortgage/Loan Brokers Market Product Landscape

The market offers a range of brokerage services, including assistance with mortgage applications, loan refinancing, and financial advisory services. Recent product innovations focus on enhancing digital accessibility and personalized service offerings. Key features include online application portals, AI-powered credit scoring, and customized financial planning tools. These innovations aim to streamline the mortgage application process and provide better transparency for consumers. The focus is on improving customer experience and efficiency while adhering to strict regulatory standards.

Key Drivers, Barriers & Challenges in Qatar Mortgage/Loan Brokers Market

Key Drivers:

- Government initiatives to stimulate the real estate sector.

- Increasing disposable incomes among the population.

- Growing demand for affordable housing.

- Technological advancements improving service efficiency.

Key Barriers & Challenges:

- Stringent regulatory requirements and compliance costs.

- Competition from banks offering direct lending services.

- Dependence on the fluctuating real estate market.

- Cybersecurity risks associated with online platforms.

Emerging Opportunities in Qatar Mortgage/Loan Brokers Market

Untapped markets include niche segments like green mortgages and affordable housing loans. Opportunities lie in providing specialized services, tailored to the needs of specific customer segments, and creating innovative financial solutions, like Islamic finance-compliant mortgage products. Leveraging fintech solutions and adopting sustainable practices are other opportunities to expand the market.

Growth Accelerators in the Qatar Mortgage/Loan Brokers Market Industry

Strategic partnerships between banks and fintech companies, the development of innovative digital solutions, and expansion into new segments will be key growth accelerators. Government support, continuous technological advancements and focus on customer experience are major contributors to long-term growth in this dynamic market.

Key Players Shaping the Qatar Mortgage/Loan Brokers Market Market

- Doha Bank

- Commercial Bank

- Al Rayan Bank

- Al Khaliji Commercial Bank

- Qatar International Islamic Bank

- Ahli Bank

- Qatar National Bank

- Barwa Bank

- Qatar Islamic Bank

- HSBC Bank Middle East

- List Not Exhaustive

Notable Milestones in Qatar Mortgage/Loan Brokers Market Sector

- February 2024: QNB launched a revolutionary digital onboarding service, streamlining the mortgage application process.

- January 2024: Qatar Islamic Bank (QIB) launched QIB Marketplace, a unique e-commerce platform accessible through its mobile banking app, expanding its financial services offering.

In-Depth Qatar Mortgage/Loan Brokers Market Market Outlook

The Qatar Mortgage/Loan Brokers Market is poised for continued growth over the forecast period (2025-2033), driven by favorable government policies, increasing urbanization, and technological advancements. Strategic opportunities lie in leveraging digital technologies, fostering strategic partnerships, and catering to the evolving needs of a diverse consumer base. The market's future potential is significant, with ample opportunities for growth and innovation for established and emerging players alike.

Qatar Mortgage/Loan Brokers Market Segmentation

-

1. Type of Mortgage Loan

- 1.1. Conventional Mortgage Loan

- 1.2. Jumbo Loans

- 1.3. Government-insured Mortgage Loans

- 1.4. Other Types of Mortgage Loan

-

2. Mortgage Loan terms

- 2.1. 30- years Mortgage

- 2.2. 20-year Mortgage

- 2.3. 15-year Mortgage

- 2.4. Other Mortgage Loan Terms

-

3. Interest Rate

- 3.1. Fixed-Rate

- 3.2. Adjustable-Rate

-

4. Provider

- 4.1. Primary Mortgage Lender

- 4.2. Secondary Mortgage Lender

Qatar Mortgage/Loan Brokers Market Segmentation By Geography

- 1. Qatar

Qatar Mortgage/Loan Brokers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Qatar household Wealth; Increasing Penetration rate of brokerage services

- 3.3. Market Restrains

- 3.3.1. Surge in Qatar household Wealth; Increasing Penetration rate of brokerage services

- 3.4. Market Trends

- 3.4.1. Rising Homeownership Aspirations and Government Initiatives Drive Qatar's Mortgage Broker Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Mortgage Loan

- 5.1.1. Conventional Mortgage Loan

- 5.1.2. Jumbo Loans

- 5.1.3. Government-insured Mortgage Loans

- 5.1.4. Other Types of Mortgage Loan

- 5.2. Market Analysis, Insights and Forecast - by Mortgage Loan terms

- 5.2.1. 30- years Mortgage

- 5.2.2. 20-year Mortgage

- 5.2.3. 15-year Mortgage

- 5.2.4. Other Mortgage Loan Terms

- 5.3. Market Analysis, Insights and Forecast - by Interest Rate

- 5.3.1. Fixed-Rate

- 5.3.2. Adjustable-Rate

- 5.4. Market Analysis, Insights and Forecast - by Provider

- 5.4.1. Primary Mortgage Lender

- 5.4.2. Secondary Mortgage Lender

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Type of Mortgage Loan

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Doha Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Commercial Bank

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Rayan Bak

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al Khaliji Commercial Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Qatar International Islamic Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ahli Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Qatar National Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Barwa Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qatar Islamic Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HSBC Bank Middle East**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Doha Bank

List of Figures

- Figure 1: Qatar Mortgage/Loan Brokers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Mortgage/Loan Brokers Market Share (%) by Company 2024

List of Tables

- Table 1: Qatar Mortgage/Loan Brokers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Mortgage/Loan Brokers Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Qatar Mortgage/Loan Brokers Market Revenue Million Forecast, by Type of Mortgage Loan 2019 & 2032

- Table 4: Qatar Mortgage/Loan Brokers Market Volume Billion Forecast, by Type of Mortgage Loan 2019 & 2032

- Table 5: Qatar Mortgage/Loan Brokers Market Revenue Million Forecast, by Mortgage Loan terms 2019 & 2032

- Table 6: Qatar Mortgage/Loan Brokers Market Volume Billion Forecast, by Mortgage Loan terms 2019 & 2032

- Table 7: Qatar Mortgage/Loan Brokers Market Revenue Million Forecast, by Interest Rate 2019 & 2032

- Table 8: Qatar Mortgage/Loan Brokers Market Volume Billion Forecast, by Interest Rate 2019 & 2032

- Table 9: Qatar Mortgage/Loan Brokers Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 10: Qatar Mortgage/Loan Brokers Market Volume Billion Forecast, by Provider 2019 & 2032

- Table 11: Qatar Mortgage/Loan Brokers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Qatar Mortgage/Loan Brokers Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: Qatar Mortgage/Loan Brokers Market Revenue Million Forecast, by Type of Mortgage Loan 2019 & 2032

- Table 14: Qatar Mortgage/Loan Brokers Market Volume Billion Forecast, by Type of Mortgage Loan 2019 & 2032

- Table 15: Qatar Mortgage/Loan Brokers Market Revenue Million Forecast, by Mortgage Loan terms 2019 & 2032

- Table 16: Qatar Mortgage/Loan Brokers Market Volume Billion Forecast, by Mortgage Loan terms 2019 & 2032

- Table 17: Qatar Mortgage/Loan Brokers Market Revenue Million Forecast, by Interest Rate 2019 & 2032

- Table 18: Qatar Mortgage/Loan Brokers Market Volume Billion Forecast, by Interest Rate 2019 & 2032

- Table 19: Qatar Mortgage/Loan Brokers Market Revenue Million Forecast, by Provider 2019 & 2032

- Table 20: Qatar Mortgage/Loan Brokers Market Volume Billion Forecast, by Provider 2019 & 2032

- Table 21: Qatar Mortgage/Loan Brokers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Qatar Mortgage/Loan Brokers Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Mortgage/Loan Brokers Market?

The projected CAGR is approximately 6.94%.

2. Which companies are prominent players in the Qatar Mortgage/Loan Brokers Market?

Key companies in the market include Doha Bank, Commercial Bank, Al Rayan Bak, Al Khaliji Commercial Bank, Qatar International Islamic Bank, Ahli Bank, Qatar National Bank, Barwa Bank, Qatar Islamic Bank, HSBC Bank Middle East**List Not Exhaustive.

3. What are the main segments of the Qatar Mortgage/Loan Brokers Market?

The market segments include Type of Mortgage Loan, Mortgage Loan terms, Interest Rate, Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Qatar household Wealth; Increasing Penetration rate of brokerage services.

6. What are the notable trends driving market growth?

Rising Homeownership Aspirations and Government Initiatives Drive Qatar's Mortgage Broker Market.

7. Are there any restraints impacting market growth?

Surge in Qatar household Wealth; Increasing Penetration rate of brokerage services.

8. Can you provide examples of recent developments in the market?

In February 2024, QNB, the leading financial institution has launched of its revolutionary digital onboarding service.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Mortgage/Loan Brokers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Mortgage/Loan Brokers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Mortgage/Loan Brokers Market?

To stay informed about further developments, trends, and reports in the Qatar Mortgage/Loan Brokers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence