Key Insights

The Thai retail market is poised for significant expansion, projected to reach $150 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.9%. This growth is primarily driven by an expanding middle class with increasing disposable incomes, fueling higher consumer spending. The rapid adoption of e-commerce, facilitated by widespread internet and smartphone penetration, is transforming retail operations and opening new avenues for revenue. Convenience stores, including prominent brands like 7-Eleven, FamilyMart, and Tesco Lotus, hold a substantial market share, reflecting consumer demand for accessible shopping solutions. Nevertheless, the market faces intense competition from established domestic retailers such as The Mall Group and Central Group, alongside international powerhouses like Unilever and Procter & Gamble, necessitating strategic pricing and innovative marketing. Supply chain volatility and fluctuating global commodity prices also present ongoing challenges to profitability. The market is segmented across hypermarkets, supermarkets, convenience stores, and online retail, each addressing distinct consumer needs. Future trends indicate potential market consolidation as larger entities seek to expand their influence through strategic acquisitions.

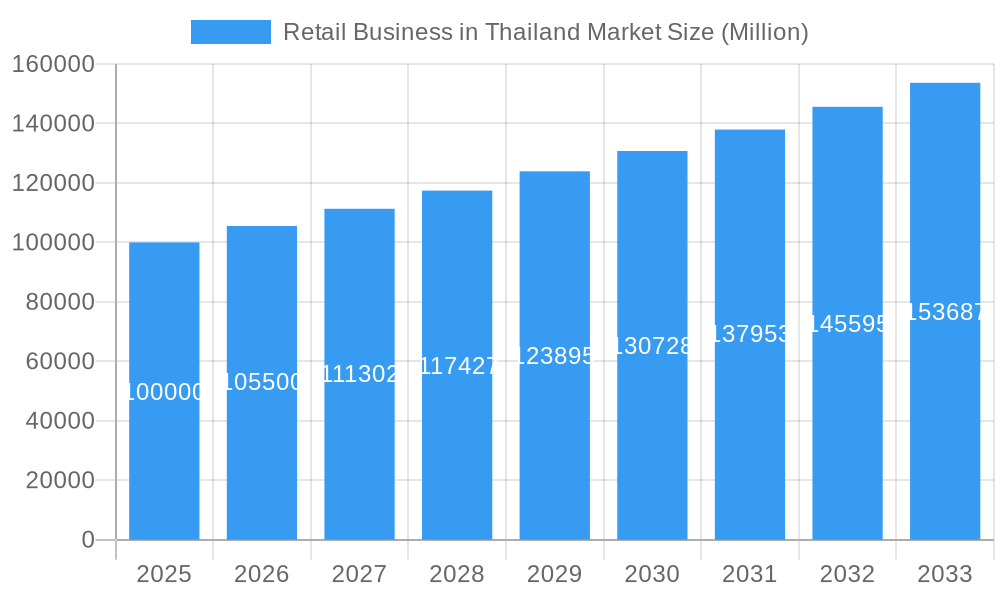

Retail Business in Thailand Market Market Size (In Billion)

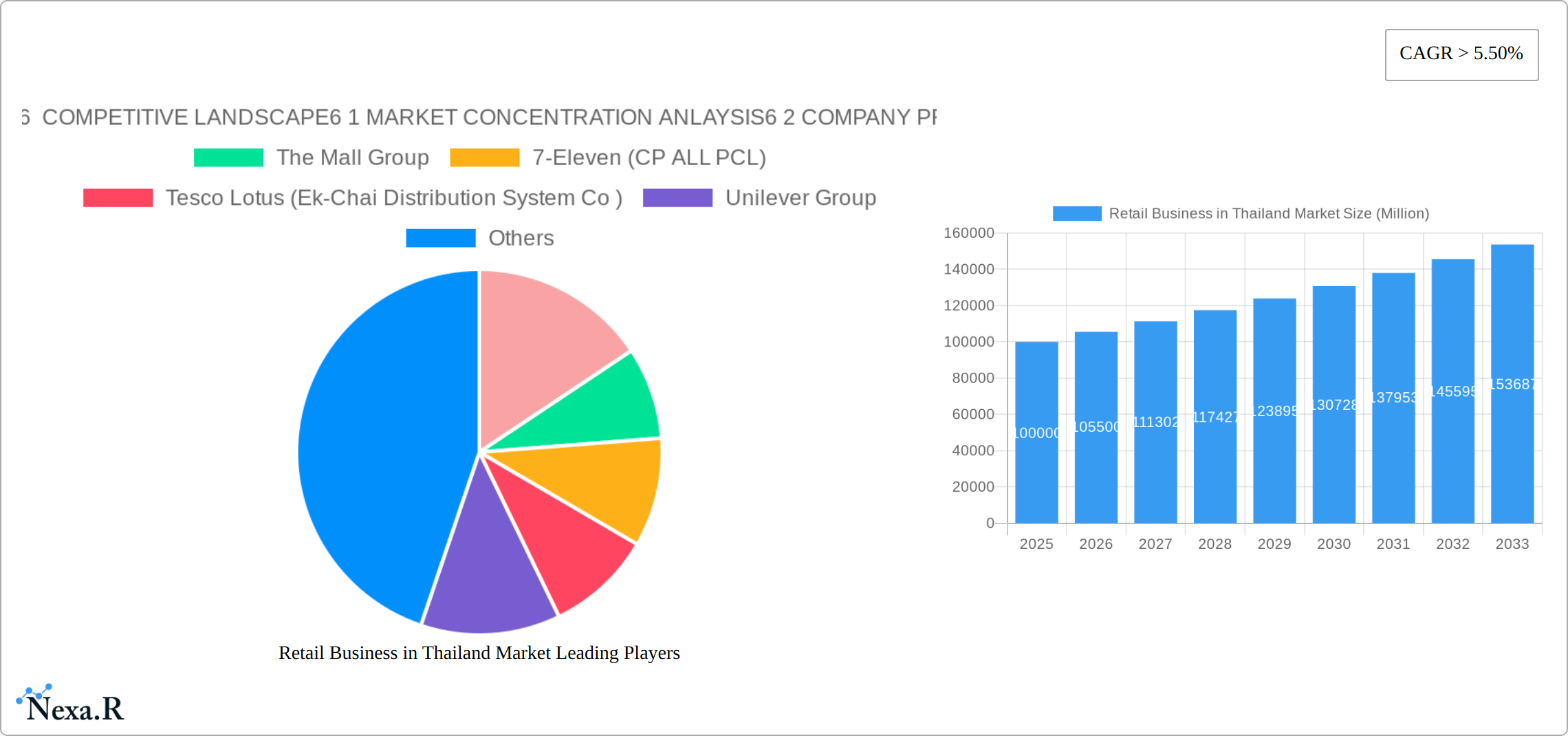

The Thai retail competitive landscape, while fragmented, is characterized by the dominance of a few major players. CP ALL PCL, via its extensive 7-Eleven network, maintains a strong market foothold. Alongside this, major conglomerates such as Central Group and Tesco Lotus continue to engage in aggressive competition. The presence of international brands like Unilever and Procter & Gamble underscores the market's appeal, further amplified by Alibaba's entry, highlighting the escalating significance of online retail in Thailand. Niche segments and regional markets are served by smaller entities like Foodland, Villa Market, and independent supermarkets, contributing to market diversity. Sustained future growth hinges on the effective implementation of omnichannel strategies that cater to evolving consumer demands, embrace technological advancements, and navigate the complexities of Thailand's regulatory framework.

Retail Business in Thailand Market Company Market Share

Retail Business in Thailand Market: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic retail landscape in Thailand, covering market size, growth trends, competitive dynamics, and future opportunities. With a focus on key segments and leading players, this report is an invaluable resource for industry professionals, investors, and strategic planners seeking to understand and capitalize on the evolving Thai retail market. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Retail Business in Thailand Market Dynamics & Structure

This section analyzes the structural elements and dynamic forces shaping the Thai retail market. We delve into market concentration, technological advancements, regulatory landscapes, competitive substitution, consumer demographics, and mergers & acquisitions (M&A) activity.

- Market Concentration: The Thai retail market exhibits a mix of large multinational corporations and smaller local players. The top five players hold approximately xx% of the market share (2024). This indicates a moderately concentrated market with opportunities for both established players and agile newcomers.

- Technological Innovation: E-commerce is rapidly transforming the retail landscape, driving innovation in logistics, payment systems, and customer engagement. However, challenges such as digital literacy and infrastructure limitations persist.

- Regulatory Framework: Government policies and regulations related to trade, foreign investment, and consumer protection significantly impact market operations. Recent policy changes focused on promoting digitalization and supporting SMEs are shaping the competitive landscape.

- Competitive Product Substitutes: The rise of online marketplaces and direct-to-consumer brands presents a growing competitive threat to traditional brick-and-mortar retailers. Competition is intense, particularly in the grocery and consumer goods sectors.

- End-User Demographics: Thailand's diverse demographics, characterized by a growing middle class and increasing urbanization, present significant opportunities for retailers catering to various consumer segments.

- M&A Trends: The retail sector has witnessed a significant number of M&A activities in recent years, primarily driven by consolidation efforts and expansion strategies. xx M&A deals were recorded in the 2019-2024 period, totaling xx Million Baht in value.

Retail Business in Thailand Market Growth Trends & Insights

The Thai retail market presents a dynamic landscape of growth and transformation. This analysis delves into the market's trajectory, leveraging robust quantitative and qualitative data to provide a comprehensive understanding of its past, present, and future. Our research reveals a Compound Annual Growth Rate (CAGR) of [Insert Precise CAGR]% during the period 2019-2024, projecting a market value of [Insert Precise Value] million units by 2033. Online retail penetration is estimated at [Insert Precise Percentage]% in 2025, with projections reaching [Insert Precise Percentage]% by 2033. This impressive growth is fueled by several key factors: a rising disposable income among consumers, a shift towards convenient online shopping, and proactive government initiatives promoting digitalization. The accelerating adoption of mobile payment systems and sophisticated digital marketing strategies further contributes to this upward trend. The influence of evolving consumer preferences, particularly a growing interest in sustainability and ethical sourcing, also significantly shapes market dynamics.

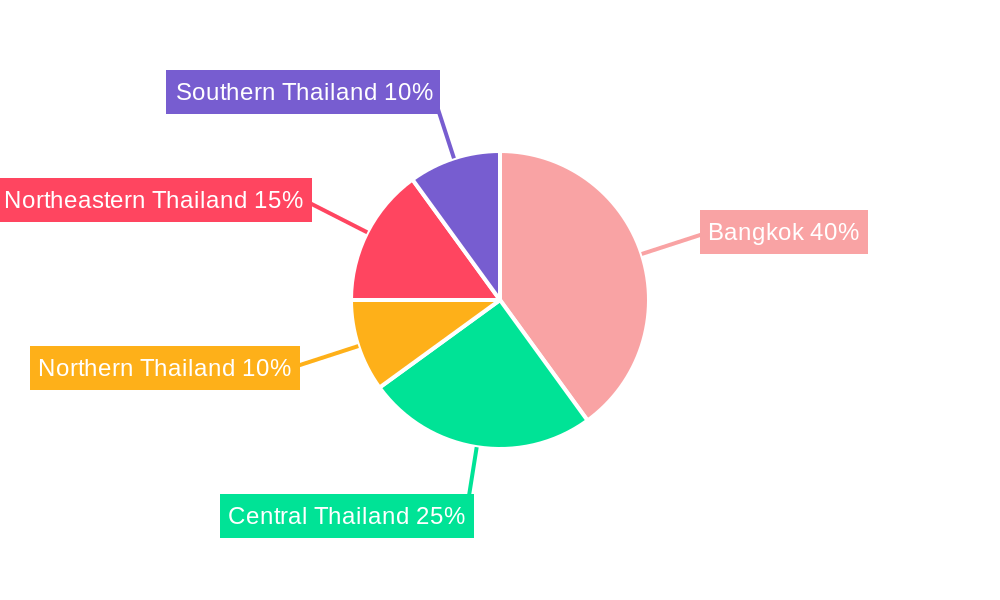

Dominant Regions, Countries, or Segments in Retail Business in Thailand Market

While Bangkok and other major urban areas remain the retail sales powerhouses, accounting for [Insert Precise Percentage]% of total sales in 2024, substantial growth is emerging in secondary cities and rural regions. This expansion is driven by improved infrastructure and increased disposable incomes in these previously underserved areas. Analyzing market segmentation reveals the grocery sector as the current leader, commanding [Insert Precise Percentage]% of the market share. The apparel and footwear segments follow closely, holding [Insert Precise Percentage]% and [Insert Precise Percentage]%, respectively. This highlights the diverse nature of the Thai retail landscape and the opportunities present across various sectors.

- Key Drivers:

- Economic Growth: Thailand's robust economic foundation, despite recent moderate slowdowns, continues to stimulate consumer spending and retail expansion. [Add specific data or context about the economic situation]

- Infrastructure Development: Significant investments in transportation and logistics are streamlining supply chains and improving market accessibility, particularly in previously remote areas. [Add specific examples of infrastructure projects]

- Government Initiatives: Supportive government policies and focused programs aimed at boosting Small and Medium-sized Enterprises (SMEs) foster a favorable business environment. [Add examples of relevant government policies]

Retail Business in Thailand Market Product Landscape

The Thai retail market offers a diverse range of products, from groceries and consumer electronics to apparel and fashion accessories. Innovation is visible in areas like omnichannel retailing, personalized shopping experiences, and sustainable product offerings. Retailers are actively integrating technology to enhance customer engagement, improve inventory management, and streamline operations. Unique selling propositions, such as loyalty programs and exclusive product lines, are becoming increasingly important for differentiation.

Key Drivers, Barriers & Challenges in Retail Business in Thailand Market

Key Drivers: The expanding middle class, rising disposable incomes, and increasing urbanization are major drivers. Technological advancements like e-commerce and digital payments further fuel market growth. Government initiatives to promote digitalization and support SMEs contribute significantly to market expansion.

Key Challenges: Intense competition, particularly from international players, presents a significant challenge. Supply chain disruptions, particularly during periods of economic uncertainty, can hinder operations. Regulatory complexities and infrastructure limitations in some areas create operational hurdles.

Emerging Opportunities in Retail Business in Thailand Market

The Thai retail market offers exciting prospects for growth and innovation. Expanding into less-developed regions presents significant untapped potential. The strategic use of technology to enhance the customer experience is paramount. Furthermore, focusing on niche markets and leveraging the increasing popularity of online marketplaces and social commerce platforms provides lucrative avenues for retailers to reach wider consumer bases. The growing consumer demand for sustainable and ethically sourced products represents a substantial and increasingly important growth opportunity, reflecting evolving consumer values.

Growth Accelerators in the Retail Business in Thailand Market Industry

Technological advancements, strategic partnerships, and expansion into new markets are key growth accelerators. Investments in digital infrastructure, particularly in underserved regions, are crucial. Strategic collaborations with technology providers and logistics companies can enhance efficiency and improve supply chain management. Expanding into neighboring countries can unlock new growth opportunities.

Key Players Shaping the Retail Business in Thailand Market Market

- The Mall Group

- 7-Eleven (CP ALL PCL)

- Tesco Lotus (Ek-Chai Distribution System Co)

- Unilever Group

- Big C (Central Group)

- Robinson (Central Group)

- FamilyMart (Central Group)

- Alibaba Group Holdings Limited

- Foodland

- Watsons

- Procter & Gamble

- Thai Samsung Electronics Ltd

- MaxValu

- Villa Market

- Other Players in the Country (Lawson 108, UFM Supermarket, Rimping Supermarket etc.) *List Not Exhaustive

Notable Milestones in Retail Business in Thailand Market Sector

- August 2020: Tesco Lotus partnered with DHL Supply Chain Thailand to manage warehouse operations in Surat Thani, enhancing logistics and supply chain efficiency in southern Thailand.

In-Depth Retail Business in Thailand Market Market Outlook

The Thai retail market is poised for continued growth, driven by robust economic fundamentals and technological advancements. Strategic investments in digital infrastructure, supply chain optimization, and targeted marketing campaigns will be crucial for success. Retailers who can effectively adapt to changing consumer preferences and leverage technology to enhance customer experience will be best positioned to capture market share and achieve long-term growth.

Retail Business in Thailand Market Segmentation

-

1. Product

- 1.1. Food and Beverage and Tobacco Products

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Supermar

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Retail Business in Thailand Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Retail Business in Thailand Market Regional Market Share

Geographic Coverage of Retail Business in Thailand Market

Retail Business in Thailand Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of the Tourism Industry in Thailand is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Business in Thailand Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverage and Tobacco Products

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermar

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Retail Business in Thailand Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Food and Beverage and Tobacco Products

- 6.1.2. Personal and Household Care

- 6.1.3. Apparel, Footwear, and Accessories

- 6.1.4. Furniture, Toys, and Hobby

- 6.1.5. Industrial and Automotive

- 6.1.6. Electronic and Household Appliances

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermar

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Retail Business in Thailand Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Food and Beverage and Tobacco Products

- 7.1.2. Personal and Household Care

- 7.1.3. Apparel, Footwear, and Accessories

- 7.1.4. Furniture, Toys, and Hobby

- 7.1.5. Industrial and Automotive

- 7.1.6. Electronic and Household Appliances

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermar

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Retail Business in Thailand Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Food and Beverage and Tobacco Products

- 8.1.2. Personal and Household Care

- 8.1.3. Apparel, Footwear, and Accessories

- 8.1.4. Furniture, Toys, and Hobby

- 8.1.5. Industrial and Automotive

- 8.1.6. Electronic and Household Appliances

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermar

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Retail Business in Thailand Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Food and Beverage and Tobacco Products

- 9.1.2. Personal and Household Care

- 9.1.3. Apparel, Footwear, and Accessories

- 9.1.4. Furniture, Toys, and Hobby

- 9.1.5. Industrial and Automotive

- 9.1.6. Electronic and Household Appliances

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermar

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Retail Business in Thailand Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Food and Beverage and Tobacco Products

- 10.1.2. Personal and Household Care

- 10.1.3. Apparel, Footwear, and Accessories

- 10.1.4. Furniture, Toys, and Hobby

- 10.1.5. Industrial and Automotive

- 10.1.6. Electronic and Household Appliances

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermar

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 6 COMPETITIVE LANDSCAPE6 1 MARKET CONCENTRATION ANLAYSIS6 2 COMPANY PROFILES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Mall Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 7-Eleven (CP ALL PCL)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tesco Lotus (Ek-Chai Distribution System Co )

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unilever Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Big C (Central Group)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Robinson (Central Group)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FamilyMart (Central Group)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alibaba Group Holdings Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Foodland

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Watsons

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CP ALL PCL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Procter & Gamble

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Thai Samsung Electronics Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 MaxValu

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Villa Market

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Other Players in the Country (Lawson 108 UFM Supermarket Rimping Supermarket etc )*List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 6 COMPETITIVE LANDSCAPE6 1 MARKET CONCENTRATION ANLAYSIS6 2 COMPANY PROFILES

List of Figures

- Figure 1: Global Retail Business in Thailand Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Retail Business in Thailand Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Retail Business in Thailand Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Retail Business in Thailand Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Retail Business in Thailand Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Retail Business in Thailand Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Retail Business in Thailand Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Retail Business in Thailand Market Revenue (billion), by Product 2025 & 2033

- Figure 9: South America Retail Business in Thailand Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Retail Business in Thailand Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Retail Business in Thailand Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Retail Business in Thailand Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Retail Business in Thailand Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Retail Business in Thailand Market Revenue (billion), by Product 2025 & 2033

- Figure 15: Europe Retail Business in Thailand Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Retail Business in Thailand Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Retail Business in Thailand Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Retail Business in Thailand Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Retail Business in Thailand Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Retail Business in Thailand Market Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East & Africa Retail Business in Thailand Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Retail Business in Thailand Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Retail Business in Thailand Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Retail Business in Thailand Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Retail Business in Thailand Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Retail Business in Thailand Market Revenue (billion), by Product 2025 & 2033

- Figure 27: Asia Pacific Retail Business in Thailand Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Retail Business in Thailand Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Retail Business in Thailand Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Retail Business in Thailand Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Retail Business in Thailand Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Business in Thailand Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Retail Business in Thailand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Retail Business in Thailand Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Retail Business in Thailand Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Retail Business in Thailand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Retail Business in Thailand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Retail Business in Thailand Market Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Retail Business in Thailand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Retail Business in Thailand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Retail Business in Thailand Market Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Retail Business in Thailand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Retail Business in Thailand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Retail Business in Thailand Market Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global Retail Business in Thailand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Retail Business in Thailand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Retail Business in Thailand Market Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Retail Business in Thailand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Retail Business in Thailand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Retail Business in Thailand Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Business in Thailand Market?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Retail Business in Thailand Market?

Key companies in the market include 6 COMPETITIVE LANDSCAPE6 1 MARKET CONCENTRATION ANLAYSIS6 2 COMPANY PROFILES, The Mall Group, 7-Eleven (CP ALL PCL), Tesco Lotus (Ek-Chai Distribution System Co ), Unilever Group, Big C (Central Group), Robinson (Central Group), FamilyMart (Central Group), Alibaba Group Holdings Limited, Foodland, Watsons, CP ALL PCL, Procter & Gamble, Thai Samsung Electronics Ltd, MaxValu, Villa Market, Other Players in the Country (Lawson 108 UFM Supermarket Rimping Supermarket etc )*List Not Exhaustive.

3. What are the main segments of the Retail Business in Thailand Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 150 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of the Tourism Industry in Thailand is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2020 - Tesco Lotus partnered with DHL Supply Chain Thailand. This partnership will see DHL Supply Chain manage Tesco Lotus's warehouse operations in Surat Thani, a 51,500 square meters (sqm) facility that houses its inventory of groceries that cater to consumers in Southern Thailand. The DHL team will handle the inbound and outbound activities, inventory management, and temperature-optimal storage of fresh and frozen food products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Business in Thailand Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Business in Thailand Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Business in Thailand Market?

To stay informed about further developments, trends, and reports in the Retail Business in Thailand Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence