Key Insights

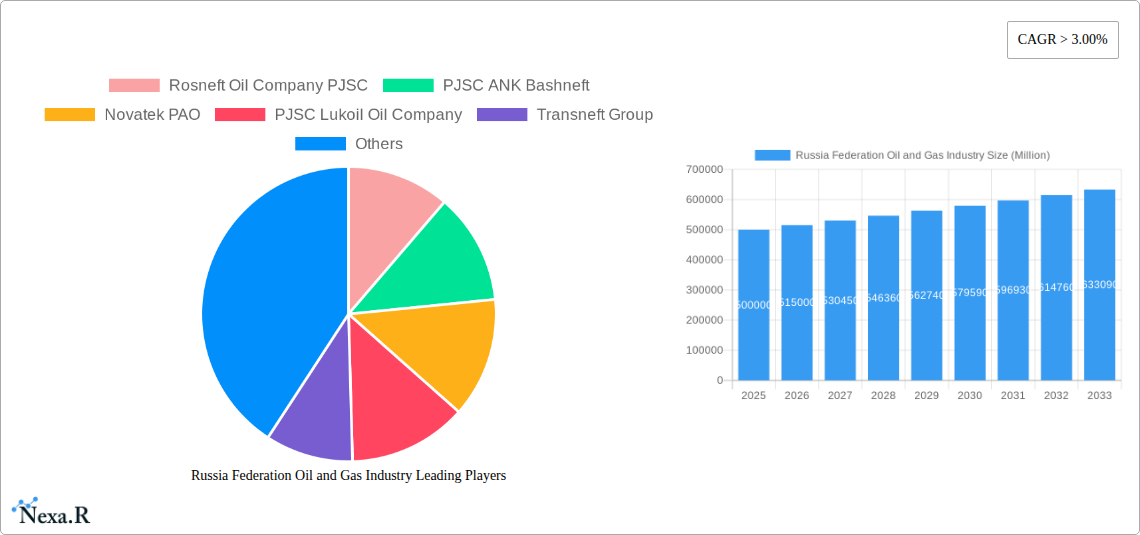

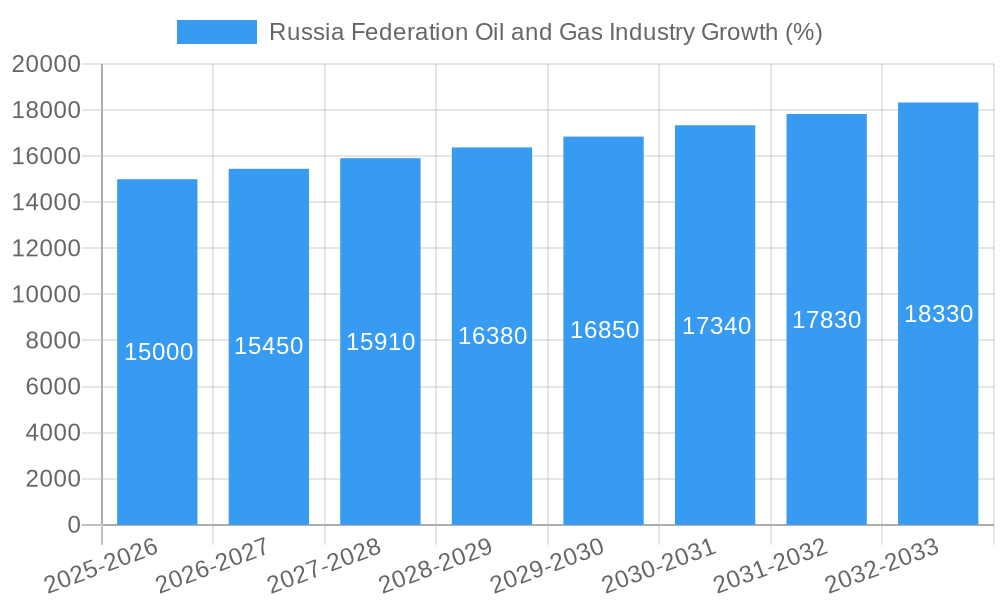

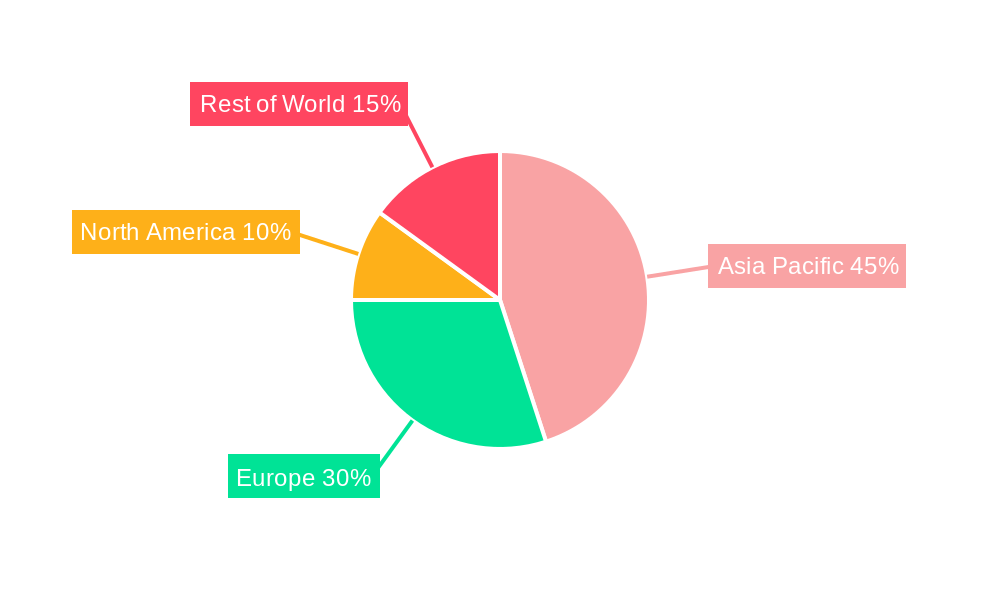

The Russia Federation Oil and Gas Industry, a cornerstone of the national economy, is projected to experience sustained growth over the forecast period (2025-2033), driven by robust domestic demand and strategic export opportunities. While geopolitical factors and sanctions pose challenges, the industry's inherent strength, coupled with ongoing investments in exploration and production, is expected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.00% in value terms. Key growth drivers include increasing energy consumption within the rapidly developing Asian markets and continued reliance on fossil fuels globally. The dominance of state-owned giants like Gazprom, Rosneft, and Lukoil shapes the industry landscape, influencing production, distribution, and pricing strategies. Furthermore, the diverse product portfolio encompassing crude oil, natural gas, LNG, and refined products caters to varied applications across power generation, transportation, industrial processes, and residential and commercial sectors. The reliance on pipelines, tankers, rail, and trucks for distribution highlights the complexities inherent in the logistical infrastructure. Significant growth is anticipated in the Asia-Pacific region, particularly in countries like China, India, and Japan, further solidifying the sector's global relevance.

Despite the positive outlook, the industry faces significant restraints. Sanctions imposed on Russia have impacted its export capabilities and foreign investment. Fluctuations in global oil and gas prices continue to introduce volatility, demanding sophisticated risk management strategies. Furthermore, the increasing focus on renewable energy sources globally presents a longer-term challenge, although the current high demand for fossil fuels remains a powerful offsetting force. The industry's future trajectory will depend on its adaptability to evolving global energy dynamics, efficient resource management, and sustained investment in technological advancements to optimize production and reduce environmental impact. The segmentation of the market across product types (crude oil, natural gas, LNG, refined products), applications, distribution channels, and industrial sectors provides granular insights for strategic decision-making.

Russia Federation Oil & Gas Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Russia Federation oil and gas industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and policymakers seeking to understand the complexities and opportunities within this crucial sector.

Russia Federation Oil and Gas Industry Market Dynamics & Structure

This section analyzes the market concentration, technological innovation, regulatory landscape, competitive dynamics, and M&A activity within the Russian oil and gas industry. The Russian Federation oil and gas market is dominated by a few large, vertically integrated companies, creating a highly concentrated market structure. This concentration is further reinforced by stringent government regulations and licensing procedures. However, technological advancements, particularly in areas like enhanced oil recovery (EOR) and LNG production, are driving some diversification and innovation.

- Market Concentration: Gazprom and Rosneft hold significant market share, with estimates placing them at approximately xx% and xx% respectively in 2025. Other major players, including Lukoil and Novatek, contribute substantially to the remaining market.

- Technological Innovation: Adoption of advanced technologies in exploration, extraction, and processing varies across the industry. While major players are investing in new technologies, smaller companies face significant barriers to entry due to capital intensity and regulatory complexities.

- Regulatory Framework: Stringent government regulations govern exploration, production, transportation, and export of oil and gas, impacting market dynamics and investment decisions. These regulations also hinder the entry of new players and influence market consolidation.

- Competitive Product Substitutes: The primary competitive pressures stem from the global energy market, particularly from other major gas and oil producers. Increasingly, renewable energy sources present a long-term challenge to market dominance.

- End-User Demographics: The key end-users are primarily industrial sectors, power generation companies, and residential consumers, with transportation being another critical user segment. Changes in energy demand patterns, driven by economic growth and government policies, will affect future market growth.

- M&A Trends: The historical period (2019-2024) witnessed consolidation amongst major players, particularly amongst companies within the Natural Gas and Crude Oil segments. This trend shows a total deal value of approximately xx million in the analyzed historical period. However, recent geopolitical events (detailed in the "Notable Milestones" section) have significantly altered the M&A landscape.

Russia Federation Oil and Gas Industry Growth Trends & Insights

The Russian oil and gas industry experienced significant growth in the historical period (2019-2024) followed by moderate decline starting in 2022, driven by a complex interplay of factors including fluctuating global oil prices, government policies, technological advancements, and geopolitical events. The analysis suggests a Compound Annual Growth Rate (CAGR) of xx% for the historical period and a projected CAGR of xx% for the forecast period (2025-2033), primarily driven by the expected increase in domestic demand and strategic export plans. Market penetration will likely remain high in the country's core regions.

Dominant Regions, Countries, or Segments in Russia Federation Oil and Gas Industry

The Western Siberian region remains the dominant producer of crude oil and natural gas, driven by extensive reserves and established infrastructure. However, the Eastern Siberian regions are increasingly gaining significance due to ongoing investment in resource exploration and development. While Gazprom and Rosneft operate across multiple regions and segments, Gazprom has dominant market share in natural gas production and distribution, while Rosneft leads in crude oil and refined products.

Key Drivers:

- Extensive Reserves: The significant reserves of crude oil and natural gas are fundamental drivers of regional dominance.

- Existing Infrastructure: Well-established pipeline networks and processing facilities facilitate efficient production and transportation of hydrocarbons.

- Government Support: Government policies and investments in infrastructure development continue to support industry growth in key regions.

Dominant Segments:

- Crude Oil: Continues to be the leading segment, due to its substantial reserves and established export markets.

- Natural Gas: Plays a vital role in domestic energy consumption and maintains a strong export market.

- Pipelines: The primary distribution channel for both crude oil and natural gas, emphasizing their central role in market dynamics.

Russia Federation Oil and Gas Industry Product Landscape

The Russian oil and gas industry offers a range of products, including crude oil, natural gas, LNG, and refined petroleum products. Technological advancements are focused on enhancing oil recovery rates and improving the efficiency of gas processing facilities and LNG plants, aiming to reduce emissions and improve product quality. This includes innovations in EOR technologies, automation, and digitalization across the value chain.

Key Drivers, Barriers & Challenges in Russia Federation Oil and Gas Industry

Key Drivers: Growing domestic energy demand, significant hydrocarbon reserves, and existing export infrastructure all serve as key drivers. Government initiatives to modernize the sector, and investments in exploration and production also fuel growth.

Key Challenges: Sanctions imposed on Russia following the Ukraine crisis significantly impact oil and gas trade and investments. This includes disruptions to supply chains, price volatility, restrictions on technological imports and access to international finance. Regulatory uncertainty and environmental concerns also pose significant hurdles. The projected impact on GDP is estimated to be a negative xx% impact in 2025 compared to the pre-sanctions baseline.

Emerging Opportunities in Russia Federation Oil and Gas Industry

Opportunities exist in expanding the development of Eastern Siberian reserves. Focus on increasing LNG exports and developing downstream processing industries could further bolster growth. Exploration of Arctic resources presents a long-term opportunity, though access presents significant environmental and technological challenges.

Growth Accelerators in the Russia Federation Oil and Gas Industry Industry

Long-term growth hinges on efficient utilization of existing resources, effective modernization strategies, and attracting international investments (despite current sanctions). Strategic partnerships, technological innovations aimed at reducing emissions, and diversification into new markets will accelerate expansion.

Key Players Shaping the Russia Federation Oil and Gas Industry Market

- Rosneft Oil Company PJSC

- PJSC ANK Bashneft

- Novatek PAO

- PJSC Lukoil Oil Company

- Transneft Group

- PJSC Gazprom

Notable Milestones in Russia Federation Oil and Gas Industry Sector

- October 2022: ExxonMobil Corp. completely exits Russia following the expropriation of its assets.

- September 2022: Shell PLC withdraws from the Sakhalin-2 LNG project, and ExxonMobil's sale of its Sakhalin-1 stake is blocked.

In-Depth Russia Federation Oil and Gas Industry Market Outlook

The future of the Russian oil and gas industry is contingent on navigating geopolitical complexities and adapting to evolving global energy markets. While facing significant near-term challenges, the country's vast reserves and existing infrastructure will continue to be a major factor in global energy supply. Successful diversification, technological progress, and strategic partnerships will determine long-term growth potential. The forecast suggests a gradual recovery and moderate growth in the medium to long term, subject to the easing of sanctions and the evolution of global energy policies.

Russia Federation Oil and Gas Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Russia Federation Oil and Gas Industry Segmentation By Geography

- 1. Russia

Russia Federation Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Upstream Segment Expected to be the Fastest-growing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Federation Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Russia Federation Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Russia Federation Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Russia Federation Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Russia Federation Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Russia Federation Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Russia Federation Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Russia Federation Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Rosneft Oil Company PJSC

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 PJSC ANK Bashneft

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Novatek PAO

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 PJSC Lukoil Oil Company

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Transneft Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 PJSC Gazprom

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 Rosneft Oil Company PJSC

List of Figures

- Figure 1: Russia Federation Oil and Gas Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Federation Oil and Gas Industry Share (%) by Company 2024

List of Tables

- Table 1: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Region 2019 & 2032

- Table 3: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Production Analysis 2019 & 2032

- Table 5: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Region 2019 & 2032

- Table 15: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Country 2019 & 2032

- Table 17: China Russia Federation Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: China Russia Federation Oil and Gas Industry Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 19: Japan Russia Federation Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Russia Federation Oil and Gas Industry Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 21: India Russia Federation Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Russia Federation Oil and Gas Industry Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 23: South Korea Russia Federation Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Russia Federation Oil and Gas Industry Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 25: Taiwan Russia Federation Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Taiwan Russia Federation Oil and Gas Industry Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 27: Australia Russia Federation Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Russia Federation Oil and Gas Industry Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 29: Rest of Asia-Pacific Russia Federation Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia-Pacific Russia Federation Oil and Gas Industry Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 31: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 32: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Production Analysis 2019 & 2032

- Table 33: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 34: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Consumption Analysis 2019 & 2032

- Table 35: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 38: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 39: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 40: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Price Trend Analysis 2019 & 2032

- Table 41: Russia Federation Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Russia Federation Oil and Gas Industry Volume Tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Federation Oil and Gas Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Russia Federation Oil and Gas Industry?

Key companies in the market include Rosneft Oil Company PJSC, PJSC ANK Bashneft, Novatek PAO, PJSC Lukoil Oil Company, Transneft Group, PJSC Gazprom.

3. What are the main segments of the Russia Federation Oil and Gas Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Upstream Segment Expected to be the Fastest-growing Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

In October 2022, ExxonMobil Corp. announced that it left Russia completely after President Vladimir Putin expropriated its properties following seven months of discussions over an orderly transfer of its 30% stake in a major oil project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Federation Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Federation Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Federation Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Russia Federation Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence