Key Insights

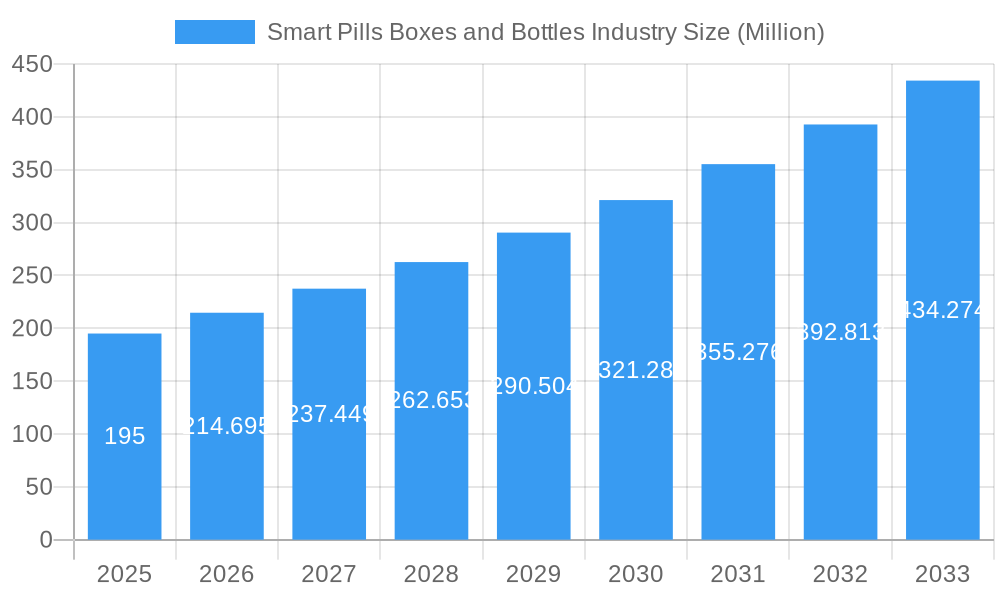

The global Smart Pill Boxes and Bottles market is poised for significant expansion, projected to reach $195 million in 2025, with a robust CAGR of 10.1% anticipated through 2033. This impressive growth is propelled by a confluence of factors, primarily the increasing prevalence of chronic diseases such as diabetes and cancer, which necessitate diligent medication adherence. The burgeoning elderly population, particularly those managing conditions like dementia, further fuels demand for innovative solutions that simplify medication management and enhance patient safety. Smart pill devices offer a compelling answer to the challenges of missed doses, incorrect dosages, and medication non-adherence, providing timely reminders and dispensing mechanisms. The shift towards home care settings, driven by cost-effectiveness and patient preference, creates a fertile ground for these smart devices, enabling individuals to manage their health independently with greater confidence. Furthermore, advancements in IoT and wearable technology are integrating seamlessly with smart pill management solutions, offering enhanced connectivity and data-driven insights for both patients and healthcare providers.

Smart Pills Boxes and Bottles Industry Market Size (In Million)

The market's trajectory is further shaped by evolving healthcare landscapes and technological integrations. The increasing adoption of remote patient monitoring (RPM) solutions by hospitals and long-term care centers plays a crucial role in driving the demand for smart pill boxes and bottles, allowing for centralized oversight and improved patient outcomes. The innovation landscape is characterized by a strong focus on user-friendly interfaces, tamper-proof designs, and advanced features such as automated refills and integration with electronic health records. While the market exhibits strong growth potential, certain restraints like the initial cost of adoption and the need for greater consumer awareness regarding the benefits of smart medication management solutions need to be addressed. However, the compelling advantages of improved medication adherence, reduced healthcare costs associated with non-compliance, and enhanced quality of life for patients are expected to outweigh these challenges, solidifying the market's upward momentum. Key players are actively investing in research and development to introduce sophisticated and affordable solutions, catering to a diverse range of patient needs and indications.

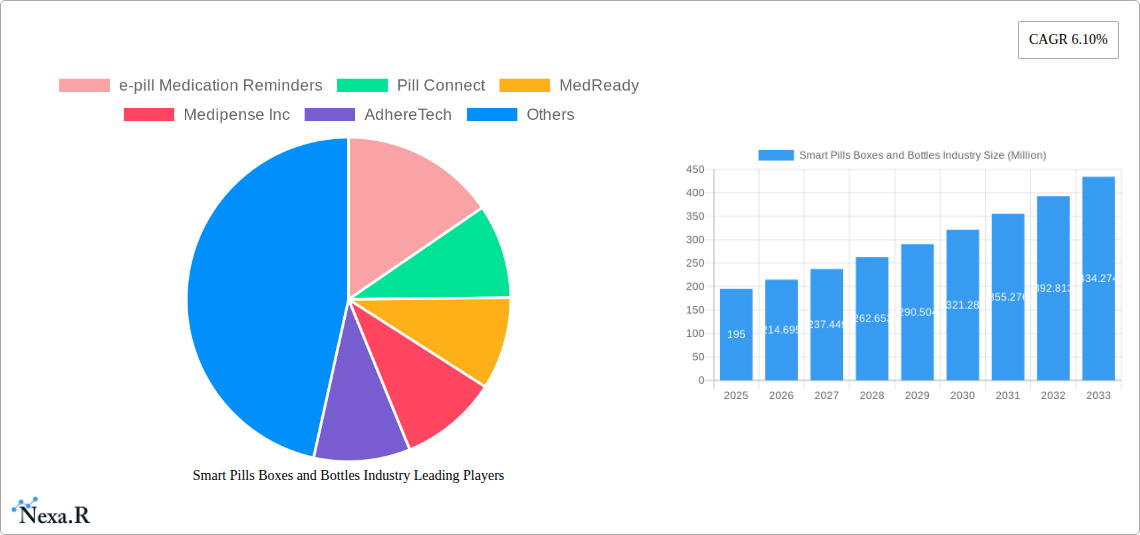

Smart Pills Boxes and Bottles Industry Company Market Share

Smart Pills Boxes and Bottles Industry: Comprehensive Market Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Smart Pills Boxes and Bottles Market, a rapidly evolving sector within the healthcare technology landscape. With a projected CAGR of xx%, driven by increasing chronic disease prevalence and the growing demand for remote patient monitoring, this market is poised for significant expansion. Our research covers the period from 2019 to 2033, with a base year of 2025 and a detailed forecast period from 2025 to 2033, building upon historical data from 2019-2024. Discover critical insights into market dynamics, growth trends, dominant regions, product landscapes, key drivers, challenges, opportunities, and the strategic moves of major players shaping this crucial industry. This report is your essential guide to understanding the current state and future trajectory of smart medication management solutions.

Smart Pills Boxes and Bottles Industry Market Dynamics & Structure

The Smart Pills Boxes and Bottles Industry exhibits a dynamic market structure influenced by rapid technological innovation and a growing patient-centric approach to healthcare. Market concentration is moderate, with a blend of established players and emerging startups vying for market share. Key drivers of technological innovation include advancements in IoT connectivity, AI-powered adherence tracking, and miniaturization of sensor technology. Regulatory frameworks, particularly concerning data privacy and medical device certifications, play a crucial role in shaping market entry and product development. Competitive product substitutes, such as traditional pill organizers and manual reminder systems, are gradually being outpaced by the superior functionality and data-driven insights offered by smart solutions. End-user demographics are shifting towards an aging population and individuals managing chronic conditions, demanding more sophisticated and accessible medication management tools. Mergers and acquisitions (M&A) trends are on the rise as larger healthcare technology companies seek to integrate innovative smart pill solutions into their broader digital health ecosystems.

- Market Concentration: Moderate, with increasing consolidation anticipated.

- Technological Innovation Drivers: IoT, AI, sensor technology, mobile integration.

- Regulatory Frameworks: FDA, CE marking, data privacy regulations (e.g., GDPR, HIPAA).

- Competitive Product Substitutes: Traditional pill organizers, manual reminders, pharmacy blister packs.

- End-User Demographics: Aging population, chronic disease patients, caregivers, remote healthcare providers.

- M&A Trends: Strategic acquisitions to enhance product portfolios and market reach.

Smart Pills Boxes and Bottles Industry Growth Trends & Insights

The Smart Pills Boxes and Bottles Market is experiencing robust growth, fueled by a confluence of factors that are reshaping medication adherence and patient care. The market size is projected to reach a substantial value by 2025, with continued expansion driven by increasing adoption rates across various healthcare settings. Technological disruptions, including the integration of AI for personalized reminders and predictive adherence analytics, are revolutionizing how patients manage their medications. Consumer behavior is shifting towards proactive health management and a greater reliance on digital tools for convenience and efficacy. The parent market for smart medication management solutions encompasses a broader range of adherence technologies, with smart pill boxes and bottles representing a significant and rapidly growing child market segment.

Key growth trends include:

- Rising Chronic Disease Prevalence: Conditions like diabetes, cardiovascular diseases, and cancer necessitate consistent medication regimens, making smart solutions highly desirable. The increasing prevalence of dementia also drives demand for aids that simplify medication schedules.

- Aging Population: As the global population ages, the need for assistive technologies that support independent living and ensure medication adherence becomes paramount.

- Focus on Remote Patient Monitoring (RPM): The push towards telehealth and remote patient monitoring solutions positions smart pill devices as critical components for collecting real-time adherence data, enabling healthcare providers to intervene proactively.

- Technological Advancements: Integration of advanced features such as GPS tracking for lost devices, secure medication dispensing, and companion mobile applications with reporting functionalities are enhancing product appeal.

- Increased Awareness of Medication Non-Adherence Costs: Healthcare systems are increasingly recognizing the significant economic burden associated with medication non-adherence, driving investments in solutions that improve compliance.

- Government Initiatives and Reimbursement Policies: Growing support from governments and evolving reimbursement policies for digital health solutions are further accelerating market penetration.

- Personalized Medicine and Precision Dosing: The trend towards personalized medicine aligns with the capabilities of smart pill devices to manage complex dosing schedules tailored to individual patient needs.

The market penetration of smart pill boxes and bottles is steadily increasing, particularly in developed economies where technological adoption is high and healthcare infrastructure supports digital integration. The CAGR is expected to remain strong throughout the forecast period, reflecting the enduring demand for solutions that improve patient outcomes and reduce healthcare costs. The evolution of smart pill technology is not just about storing pills; it's about creating a comprehensive ecosystem for medication management that empowers patients and informs caregivers and healthcare professionals. The child market for smart pill bottles, while often integrated with smart box functionalities, is also seeing independent growth due to specific needs in liquid medication management and precise dosing.

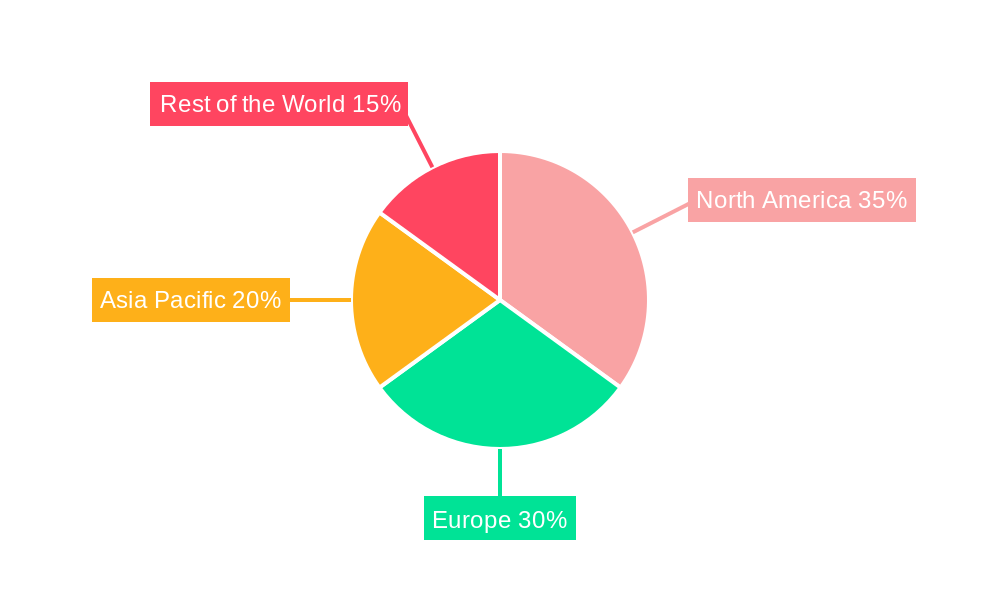

Dominant Regions, Countries, or Segments in Smart Pills Boxes and Bottles Industry

The Smart Pills Boxes and Bottles Industry is experiencing significant growth across various regions, with North America currently leading the market due to its advanced healthcare infrastructure, high adoption of digital health technologies, and a substantial elderly population. The United States stands out as the dominant country within this region, driven by extensive research and development, a favorable regulatory environment for innovative medical devices, and a high prevalence of chronic diseases requiring consistent medication management.

Key Drivers of Dominance in North America:

- High Healthcare Expenditure: Significant investment in healthcare technology and patient care solutions.

- Technological Savvy Population: High adoption rates of smart devices and digital health applications.

- Aging Demographics: A large segment of the population requiring assistance with medication adherence.

- Strong R&D Ecosystem: Presence of leading technology and pharmaceutical companies investing in innovation.

- Supportive Regulatory Environment: Streamlined approval processes for innovative medical devices.

Within the Product Type segment, Smart Pill Boxes currently hold a larger market share. This is attributed to their widespread application in managing multiple daily medications for chronic conditions, as well as their appeal to individuals managing complex drug regimens. However, Smart Pill Bottles are witnessing rapid growth, particularly for managing liquid medications and in scenarios where precise dosing is critical, such as in pediatric care or specific cancer treatments.

In terms of Indication, Diabetes Care is a major driver of market growth. Patients with diabetes often manage multiple oral medications and injectables, making smart adherence solutions invaluable. Cancer Management is another significant segment, as cancer patients often have complex, time-sensitive medication schedules and require close monitoring. The increasing prevalence of Dementia is also a crucial growth catalyst, as individuals with cognitive impairments and their caregivers benefit immensely from automated reminders and dispensing mechanisms.

The End User segment of Home Care Settings is experiencing the most substantial growth. As healthcare shifts towards home-based care, smart pill solutions are becoming essential for enabling patients to manage their treatment independently and safely. Long Term Care Centers also represent a significant market, where these devices can optimize medication delivery, reduce errors, and free up nursing staff time. While Hospitals are increasingly adopting smart solutions for post-discharge patient management and to reduce readmission rates, their primary focus remains on acute care.

The global market landscape is continually evolving, with emerging economies in Asia-Pacific showing promising growth potential due to increasing healthcare awareness and a growing middle class. Strategic investments in digital health infrastructure and a rising incidence of lifestyle-related diseases are expected to fuel this expansion in the coming years.

Smart Pills Boxes and Bottles Industry Product Landscape

The product landscape of the Smart Pills Boxes and Bottles Industry is characterized by continuous innovation, focusing on enhancing user experience, improving accuracy, and integrating seamlessly with existing healthcare ecosystems. Key product innovations include advanced tracking and reminder systems, secure dispensing mechanisms, and companion mobile applications offering detailed adherence reports and personalized insights. For example, products are now featuring tamper-proof designs and spill-resistant features for liquid medications in smart bottles. Performance metrics emphasize improved medication adherence rates, reduced missed doses, and enhanced patient engagement. Unique selling propositions often revolve around features like IoT connectivity for remote monitoring by caregivers or physicians, long battery life, and intuitive user interfaces designed for a broad range of users, including the elderly and those with limited technical proficiency.

Key Drivers, Barriers & Challenges in Smart Pills Boxes and Bottles Industry

The Smart Pills Boxes and Bottles Industry is propelled by several key drivers. The escalating prevalence of chronic diseases globally necessitates improved medication adherence, which smart devices directly address. Technological advancements, particularly in IoT, AI, and mobile connectivity, enable more sophisticated and user-friendly solutions. The growing aging population and the desire for independent living further boost demand for assistive technologies. Government initiatives promoting digital health and telehealth also act as significant accelerators.

- Drivers:

- Rising chronic disease burden (diabetes, cardiovascular, cancer).

- Aging global population and demand for elderly care solutions.

- Advancements in IoT, AI, and mobile health technologies.

- Shift towards home-based and remote patient monitoring.

- Government support for digital health adoption.

However, the industry faces notable barriers and challenges. The high initial cost of some smart pill devices can be a deterrent for a segment of the population, impacting market penetration, especially in price-sensitive regions. Regulatory hurdles and the need for stringent data privacy compliance can slow down product development and market entry. Furthermore, user adoption can be hindered by a lack of digital literacy among certain demographics and concerns about the complexity of operation. Supply chain disruptions and the ongoing need for robust cybersecurity measures also present ongoing challenges.

- Barriers & Challenges:

- High upfront cost of advanced devices.

- Data privacy and cybersecurity concerns.

- User adoption challenges due to digital literacy.

- Complex regulatory approval processes.

- Supply chain vulnerabilities and manufacturing complexities.

Emerging Opportunities in Smart Pills Boxes and Bottles Industry

Emerging opportunities within the Smart Pills Boxes and Bottles Industry lie in the burgeoning field of personalized medicine and the integration of AI for predictive adherence analytics. Untapped markets in developing economies, with a growing middle class and increasing healthcare awareness, present significant growth potential. Innovative applications, such as smart pill dispensers integrated with pharmacy refill services and diagnostic sensors, are gaining traction. Evolving consumer preferences are leaning towards more aesthetically pleasing, discreet, and user-friendly devices that seamlessly fit into daily routines. The increasing use of these devices in clinical trials to gather real-world adherence data also represents a significant opportunity for market expansion and data monetization.

Growth Accelerators in the Smart Pills Boxes and Bottles Industry Industry

Several catalysts are accelerating long-term growth in the Smart Pills Boxes and Bottles Industry. Technological breakthroughs, such as the miniaturization of sensors and the development of more sophisticated AI algorithms for patient behavior analysis, are leading to smarter, more effective devices. Strategic partnerships between technology companies, pharmaceutical firms, and healthcare providers are crucial for expanding market reach and developing integrated care solutions. Market expansion strategies, including the development of affordable, accessible product lines and targeted marketing campaigns for specific patient demographics, are vital. Furthermore, the increasing focus on value-based care models, where adherence to treatment plans is paramount for reimbursement, is a powerful growth accelerator.

Key Players Shaping the Smart Pills Boxes and Bottles Industry Market

- e-pill Medication Reminders

- Pill Connect

- MedReady

- Medipense Inc

- AdhereTech

- Group Medical Supply LLC

- Pillo Inc

- PillDrill Inc

- Koninklijke Philips NV

- Medminder Inc

- PharmRight Corporation

Notable Milestones in Smart Pills Boxes and Bottles Industry Sector

- January 2023: Oxfordshire County Council's Innovation Hub team launched a smart box that reminds people to take their medication on time and a mobile device with a fall sensor in the United Kingdom.

- January 2022: Vancouver-based company introduced Loba, its first smart pillbox, a fusion of aesthetics and functionality featuring a sleek design with detachable compartments for a week's worth of pills, split into AM/PM sections.

In-Depth Smart Pills Boxes and Bottles Industry Market Outlook

The Smart Pills Boxes and Bottles Industry is on an upward trajectory, driven by an increasing need for improved medication adherence and the widespread adoption of digital health solutions. Future market potential is significant, fueled by advancements in AI for personalized adherence nudges and predictive analytics. Strategic opportunities abound in forging deeper collaborations with healthcare providers for seamless integration into electronic health records and in developing patient-centric solutions that address diverse needs, from managing complex polypharmacy to supporting individuals with cognitive impairments. The growing emphasis on preventative care and the reduction of hospital readmissions further positions smart medication management as an indispensable tool for the future of healthcare delivery.

Smart Pills Boxes and Bottles Industry Segmentation

-

1. Product Type

- 1.1. Smart Pill Boxes

- 1.2. Smart Pill Bottles

-

2. Indication

- 2.1. Dementia

- 2.2. Cancer Management

- 2.3. Diabetes Care

- 2.4. Other Indications

-

3. End User

- 3.1. Home Care Settings

- 3.2. Long Term Care Centers

- 3.3. Hospitals

Smart Pills Boxes and Bottles Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Smart Pills Boxes and Bottles Industry Regional Market Share

Geographic Coverage of Smart Pills Boxes and Bottles Industry

Smart Pills Boxes and Bottles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Chronic Disorders and Geriatric Population; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost Issues

- 3.4. Market Trends

- 3.4.1. Long-term Care Centers Segment is Expected to Witness Considerable Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Pills Boxes and Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Smart Pill Boxes

- 5.1.2. Smart Pill Bottles

- 5.2. Market Analysis, Insights and Forecast - by Indication

- 5.2.1. Dementia

- 5.2.2. Cancer Management

- 5.2.3. Diabetes Care

- 5.2.4. Other Indications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Home Care Settings

- 5.3.2. Long Term Care Centers

- 5.3.3. Hospitals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Smart Pills Boxes and Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Smart Pill Boxes

- 6.1.2. Smart Pill Bottles

- 6.2. Market Analysis, Insights and Forecast - by Indication

- 6.2.1. Dementia

- 6.2.2. Cancer Management

- 6.2.3. Diabetes Care

- 6.2.4. Other Indications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Home Care Settings

- 6.3.2. Long Term Care Centers

- 6.3.3. Hospitals

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Smart Pills Boxes and Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Smart Pill Boxes

- 7.1.2. Smart Pill Bottles

- 7.2. Market Analysis, Insights and Forecast - by Indication

- 7.2.1. Dementia

- 7.2.2. Cancer Management

- 7.2.3. Diabetes Care

- 7.2.4. Other Indications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Home Care Settings

- 7.3.2. Long Term Care Centers

- 7.3.3. Hospitals

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Smart Pills Boxes and Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Smart Pill Boxes

- 8.1.2. Smart Pill Bottles

- 8.2. Market Analysis, Insights and Forecast - by Indication

- 8.2.1. Dementia

- 8.2.2. Cancer Management

- 8.2.3. Diabetes Care

- 8.2.4. Other Indications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Home Care Settings

- 8.3.2. Long Term Care Centers

- 8.3.3. Hospitals

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Smart Pills Boxes and Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Smart Pill Boxes

- 9.1.2. Smart Pill Bottles

- 9.2. Market Analysis, Insights and Forecast - by Indication

- 9.2.1. Dementia

- 9.2.2. Cancer Management

- 9.2.3. Diabetes Care

- 9.2.4. Other Indications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Home Care Settings

- 9.3.2. Long Term Care Centers

- 9.3.3. Hospitals

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 e-pill Medication Reminders

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Pill Connect

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MedReady

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Medipense Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 AdhereTech

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Group Medical Supply LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Pillo Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 PillDrill Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Koninklijke Philips NV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Medminder Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 PharmRight Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 e-pill Medication Reminders

List of Figures

- Figure 1: Global Smart Pills Boxes and Bottles Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Smart Pills Boxes and Bottles Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Smart Pills Boxes and Bottles Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 4: North America Smart Pills Boxes and Bottles Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Smart Pills Boxes and Bottles Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Smart Pills Boxes and Bottles Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Smart Pills Boxes and Bottles Industry Revenue (undefined), by Indication 2025 & 2033

- Figure 8: North America Smart Pills Boxes and Bottles Industry Volume (K Unit), by Indication 2025 & 2033

- Figure 9: North America Smart Pills Boxes and Bottles Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 10: North America Smart Pills Boxes and Bottles Industry Volume Share (%), by Indication 2025 & 2033

- Figure 11: North America Smart Pills Boxes and Bottles Industry Revenue (undefined), by End User 2025 & 2033

- Figure 12: North America Smart Pills Boxes and Bottles Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Smart Pills Boxes and Bottles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Smart Pills Boxes and Bottles Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Smart Pills Boxes and Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Smart Pills Boxes and Bottles Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Smart Pills Boxes and Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Smart Pills Boxes and Bottles Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Smart Pills Boxes and Bottles Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 20: Europe Smart Pills Boxes and Bottles Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 21: Europe Smart Pills Boxes and Bottles Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Smart Pills Boxes and Bottles Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Europe Smart Pills Boxes and Bottles Industry Revenue (undefined), by Indication 2025 & 2033

- Figure 24: Europe Smart Pills Boxes and Bottles Industry Volume (K Unit), by Indication 2025 & 2033

- Figure 25: Europe Smart Pills Boxes and Bottles Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 26: Europe Smart Pills Boxes and Bottles Industry Volume Share (%), by Indication 2025 & 2033

- Figure 27: Europe Smart Pills Boxes and Bottles Industry Revenue (undefined), by End User 2025 & 2033

- Figure 28: Europe Smart Pills Boxes and Bottles Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Smart Pills Boxes and Bottles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Smart Pills Boxes and Bottles Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Smart Pills Boxes and Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Europe Smart Pills Boxes and Bottles Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Smart Pills Boxes and Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Smart Pills Boxes and Bottles Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Smart Pills Boxes and Bottles Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Smart Pills Boxes and Bottles Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue (undefined), by Indication 2025 & 2033

- Figure 40: Asia Pacific Smart Pills Boxes and Bottles Industry Volume (K Unit), by Indication 2025 & 2033

- Figure 41: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 42: Asia Pacific Smart Pills Boxes and Bottles Industry Volume Share (%), by Indication 2025 & 2033

- Figure 43: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue (undefined), by End User 2025 & 2033

- Figure 44: Asia Pacific Smart Pills Boxes and Bottles Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Smart Pills Boxes and Bottles Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Asia Pacific Smart Pills Boxes and Bottles Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Smart Pills Boxes and Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Smart Pills Boxes and Bottles Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Smart Pills Boxes and Bottles Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 52: Rest of the World Smart Pills Boxes and Bottles Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Rest of the World Smart Pills Boxes and Bottles Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Rest of the World Smart Pills Boxes and Bottles Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Rest of the World Smart Pills Boxes and Bottles Industry Revenue (undefined), by Indication 2025 & 2033

- Figure 56: Rest of the World Smart Pills Boxes and Bottles Industry Volume (K Unit), by Indication 2025 & 2033

- Figure 57: Rest of the World Smart Pills Boxes and Bottles Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 58: Rest of the World Smart Pills Boxes and Bottles Industry Volume Share (%), by Indication 2025 & 2033

- Figure 59: Rest of the World Smart Pills Boxes and Bottles Industry Revenue (undefined), by End User 2025 & 2033

- Figure 60: Rest of the World Smart Pills Boxes and Bottles Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: Rest of the World Smart Pills Boxes and Bottles Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Rest of the World Smart Pills Boxes and Bottles Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Rest of the World Smart Pills Boxes and Bottles Industry Revenue (undefined), by Country 2025 & 2033

- Figure 64: Rest of the World Smart Pills Boxes and Bottles Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Rest of the World Smart Pills Boxes and Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Smart Pills Boxes and Bottles Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Indication 2020 & 2033

- Table 4: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 5: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Indication 2020 & 2033

- Table 12: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 13: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 14: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Mexico Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 24: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 25: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Indication 2020 & 2033

- Table 26: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 27: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 28: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: France Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Italy Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Spain Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 44: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 45: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Indication 2020 & 2033

- Table 46: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 47: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 48: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 49: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: China Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Japan Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: India Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Australia Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: South Korea Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Smart Pills Boxes and Bottles Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Smart Pills Boxes and Bottles Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 64: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 65: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Indication 2020 & 2033

- Table 66: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Indication 2020 & 2033

- Table 67: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 68: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 69: Global Smart Pills Boxes and Bottles Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Global Smart Pills Boxes and Bottles Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Pills Boxes and Bottles Industry?

The projected CAGR is approximately 10.1%.

2. Which companies are prominent players in the Smart Pills Boxes and Bottles Industry?

Key companies in the market include e-pill Medication Reminders, Pill Connect, MedReady, Medipense Inc, AdhereTech, Group Medical Supply LLC, Pillo Inc, PillDrill Inc, Koninklijke Philips NV, Medminder Inc, PharmRight Corporation.

3. What are the main segments of the Smart Pills Boxes and Bottles Industry?

The market segments include Product Type, Indication, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Chronic Disorders and Geriatric Population; Technological Advancements.

6. What are the notable trends driving market growth?

Long-term Care Centers Segment is Expected to Witness Considerable Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost Issues.

8. Can you provide examples of recent developments in the market?

In January 2023, Oxfordshire County Council's Innovation Hub team launched a smart box that reminds people to take their medication on time and a mobile device with a fall sensor in United Kindom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Pills Boxes and Bottles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Pills Boxes and Bottles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Pills Boxes and Bottles Industry?

To stay informed about further developments, trends, and reports in the Smart Pills Boxes and Bottles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence