Key Insights

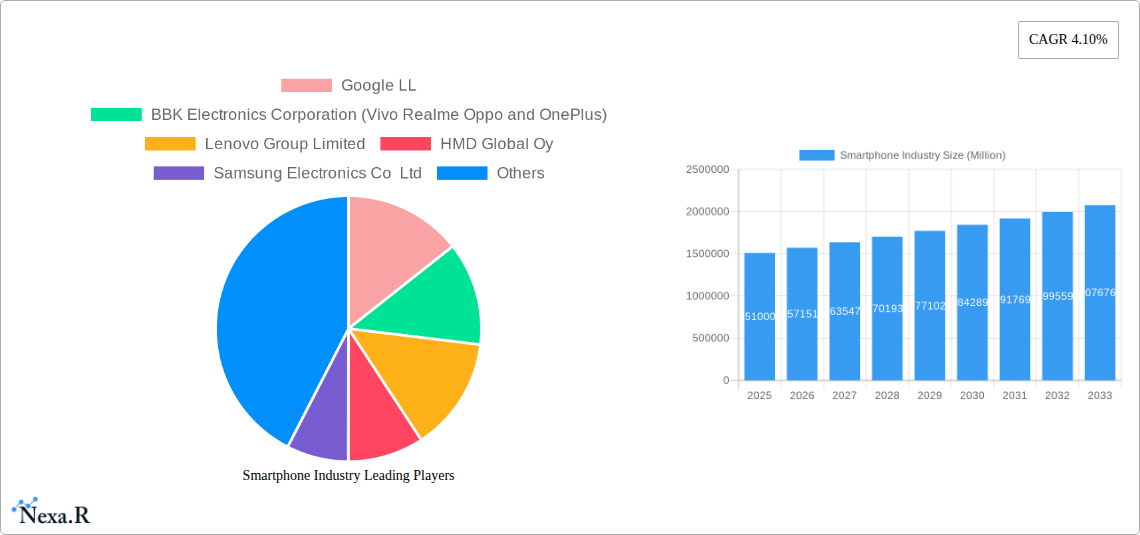

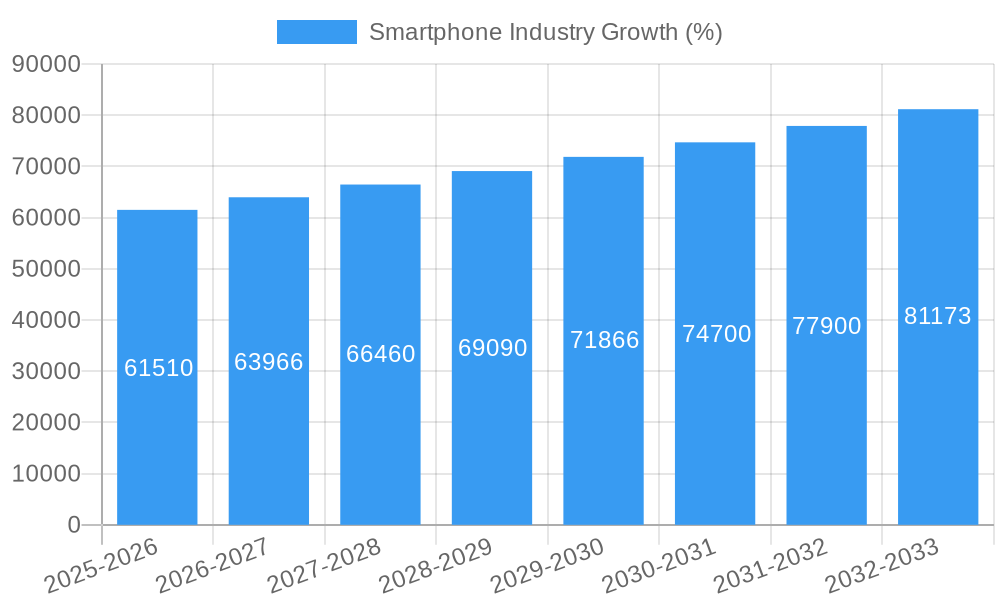

The global smartphone market, valued at $1.51 trillion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.10% from 2025 to 2033. This growth is driven by several key factors. Firstly, the continuous innovation in smartphone technology, including advancements in processing power, camera capabilities, and display technologies, fuels consumer demand for upgrades. Secondly, the expanding adoption of 5G networks globally is creating a significant impetus for smartphone sales, as consumers seek devices capable of leveraging the increased speed and bandwidth. Thirdly, the increasing affordability of smartphones in emerging markets is broadening the user base considerably. However, the market faces certain restraints. Concerns regarding data privacy and security, the saturation of developed markets, and the lengthening replacement cycles are factors tempering overall growth. The market segmentation, predominantly split between Android and iOS operating systems, reveals a strong dominance of Android, but Apple's iOS continues to hold a significant premium segment. Leading players like Samsung, Apple, Xiaomi, and BBK Electronics (encompassing Vivo, Realme, Oppo, and OnePlus) are fiercely competitive, constantly striving for market share through strategic product launches and aggressive marketing campaigns. Geographic variations exist, with North America and Europe representing mature markets, while Asia, particularly China, remains a significant growth engine.

The forecast for 2026-2033 anticipates continued, albeit moderated, growth. As the market matures, we can expect a shift towards higher average selling prices (ASPs) as innovation focuses on premium features and experiences. The competition will continue to intensify, with companies focusing on niche markets and specialized features to differentiate themselves. Sustained growth will depend on the successful navigation of evolving consumer preferences, technological advancements, and regulatory landscapes. The increasing emphasis on sustainability and ethical sourcing in the smartphone industry will also influence future market dynamics. Ultimately, the smartphone market is expected to remain a dynamic and lucrative sector, albeit with a more gradual expansion trajectory compared to its earlier, hyper-growth phases.

Smartphone Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global smartphone industry, covering market dynamics, growth trends, regional performance, product landscape, and future outlook. With a focus on key players like Apple, Samsung, and Xiaomi, this report is essential for industry professionals, investors, and strategists seeking to navigate this dynamic market. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. Market sizes are presented in million units.

Smartphone Industry Market Dynamics & Structure

The global smartphone market is characterized by high competition, rapid technological advancements, and evolving consumer preferences. Market concentration is relatively high, with a few major players controlling a significant share. The industry is driven by innovation in areas like processing power, camera technology, and display quality. Regulatory frameworks concerning data privacy and security significantly impact market operations. Competitive substitutes, such as feature phones and other smart devices, pose a threat, although limited. End-user demographics continue to evolve, with increasing smartphone penetration in emerging markets. Mergers and acquisitions (M&A) activity has been significant, shaping the competitive landscape.

- Market Concentration: Top 5 players hold xx% market share in 2025.

- Technological Innovation: Focus on 5G, foldable screens, AI-powered features, and improved camera capabilities.

- Regulatory Frameworks: GDPR, CCPA, and other data privacy regulations influence market strategies.

- M&A Activity: xx major M&A deals recorded between 2019 and 2024, totaling an estimated value of xx billion USD.

- Innovation Barriers: High R&D costs and intellectual property challenges hinder innovation.

- End-User Demographics: Growing adoption in developing economies, shifting towards premium segments in developed markets.

Smartphone Industry Growth Trends & Insights

The global smartphone market experienced significant growth during the historical period (2019-2024), with a CAGR of xx%. However, growth is expected to moderate in the forecast period (2025-2033), reaching a CAGR of xx%. This moderation is partially attributed to market saturation in developed countries and fluctuating economic conditions globally. The adoption rate has plateaued in mature markets but continues to rise in emerging economies. Technological disruptions such as 5G deployment and the emergence of foldable phones are reshaping the market. Consumer behavior shifts towards premium devices with advanced features and longer device lifespans are notable trends. Market penetration is expected to reach xx% globally by 2033, with significant regional variations. (Note: Replace "XXX" with the specific data source and analysis used).

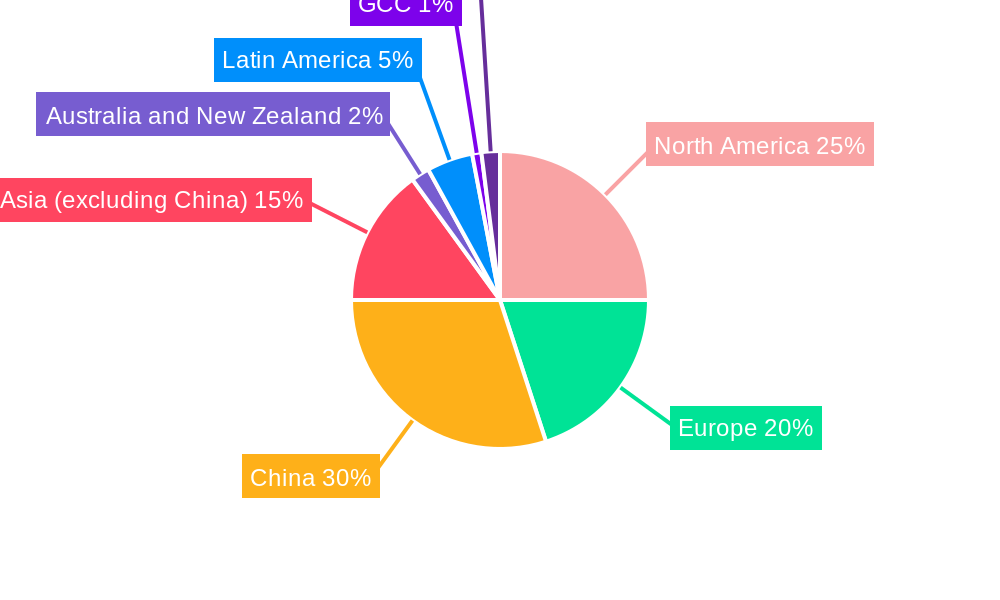

Dominant Regions, Countries, or Segments in Smartphone Industry

Asia, particularly China and India, remain the dominant regions for smartphone sales, accounting for xx% of the global market in 2025. The Android operating system continues to lead the market with xx% share, while iOS holds a xx% share.

- Key Drivers in Asia: Strong economic growth, increasing disposable incomes, expanding internet access, and favorable government policies.

- Android Dominance: Wider device availability at various price points, open-source nature, and extensive app ecosystem.

- iOS Market: Strong brand loyalty, premium pricing, and robust ecosystem, with significant penetration in developed markets like North America and Europe.

- Growth Potential: Africa and Latin America show significant untapped potential with growing smartphone adoption rates.

Smartphone Industry Product Landscape

Smartphone innovation continues to focus on enhanced camera systems, improved processing power, larger and higher-resolution displays, and more efficient batteries. Features like 5G connectivity, foldable designs, and advanced AI capabilities are driving premium segment growth. Unique selling propositions (USPs) now include advanced camera features (e.g., night mode, multi-lens systems), seamless integration with other devices (e.g., wearables, smart homes), and superior performance in demanding tasks.

Key Drivers, Barriers & Challenges in Smartphone Industry

Key Drivers:

- Technological advancements (5G, AI, improved processors).

- Growing demand from emerging markets.

- Increasing adoption of mobile applications and services.

Challenges & Restraints:

- Intense competition and price wars (impacting profit margins).

- Supply chain disruptions (affecting production and availability).

- Regulatory hurdles and data privacy concerns.

- Fluctuating component costs (impacting manufacturing costs).

Emerging Opportunities in Smartphone Industry

- Expansion into untapped markets (Africa, rural areas).

- Development of specialized devices for niche markets (e.g., rugged phones, medical applications).

- Leveraging AI and IoT for innovative applications (e.g., smart homes, smart cities).

- Focus on sustainability and eco-friendly manufacturing.

Growth Accelerators in the Smartphone Industry Industry

Long-term growth will be fueled by technological breakthroughs in areas like augmented reality (AR), virtual reality (VR), and extended reality (XR), alongside strategic partnerships that leverage ecosystem expansion and market penetration. Expansion into new markets and development of innovative applications will drive further growth.

Key Players Shaping the Smartphone Industry Market

- Google LL

- BBK Electronics Corporation (Vivo, Realme, Oppo, and OnePlus)

- Lenovo Group Limited

- HMD Global Oy

- Samsung Electronics Co Ltd

- Xiaomi Corporation

- Huawei Technologies Co Ltd

- ZTE Corporation

- Apple Inc

- HTC Corporation

- Sony Corporation

Notable Milestones in Smartphone Industry Sector

- 2019: 5G rollout begins in several countries.

- 2020: Increased focus on foldable smartphones.

- 2021: Global chip shortage impacts production.

- 2022: Growth in demand for premium smartphones with advanced camera features.

- 2023: Focus on software and services ecosystem development.

- 2024: Continued M&A activity in the industry.

- 2025: XX (add significant event).

In-Depth Smartphone Industry Market Outlook

The smartphone market is expected to continue its evolution, driven by technological innovation and expanding adoption in emerging economies. Strategic partnerships, targeted marketing, and the development of innovative applications will be crucial for companies to succeed in this competitive environment. The long-term potential for growth remains substantial, particularly in areas like augmented reality, artificial intelligence integration, and the development of new use cases beyond basic communication.

Smartphone Industry Segmentation

-

1. Operating Segment

- 1.1. Android

- 1.2. iOS

Smartphone Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. China

- 4. Asia

- 5. Australia and New Zealand

- 6. Latin America

- 7. GCC

- 8. Africa

Smartphone Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Launch of 5G Devices

- 3.2.2 Services

- 3.2.3 and Technologies; Increasing Demand in the Emerging Markets

- 3.3. Market Restrains

- 3.3.1. Stagnating Demand

- 3.4. Market Trends

- 3.4.1. Android Operating System is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operating Segment

- 5.1.1. Android

- 5.1.2. iOS

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. China

- 5.2.4. Asia

- 5.2.5. Australia and New Zealand

- 5.2.6. Latin America

- 5.2.7. GCC

- 5.2.8. Africa

- 5.1. Market Analysis, Insights and Forecast - by Operating Segment

- 6. North America Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Operating Segment

- 6.1.1. Android

- 6.1.2. iOS

- 6.1. Market Analysis, Insights and Forecast - by Operating Segment

- 7. Europe Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Operating Segment

- 7.1.1. Android

- 7.1.2. iOS

- 7.1. Market Analysis, Insights and Forecast - by Operating Segment

- 8. China Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Operating Segment

- 8.1.1. Android

- 8.1.2. iOS

- 8.1. Market Analysis, Insights and Forecast - by Operating Segment

- 9. Asia Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Operating Segment

- 9.1.1. Android

- 9.1.2. iOS

- 9.1. Market Analysis, Insights and Forecast - by Operating Segment

- 10. Australia and New Zealand Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Operating Segment

- 10.1.1. Android

- 10.1.2. iOS

- 10.1. Market Analysis, Insights and Forecast - by Operating Segment

- 11. Latin America Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Operating Segment

- 11.1.1. Android

- 11.1.2. iOS

- 11.1. Market Analysis, Insights and Forecast - by Operating Segment

- 12. GCC Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Operating Segment

- 12.1.1. Android

- 12.1.2. iOS

- 12.1. Market Analysis, Insights and Forecast - by Operating Segment

- 13. Africa Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Operating Segment

- 13.1.1. Android

- 13.1.2. iOS

- 13.1. Market Analysis, Insights and Forecast - by Operating Segment

- 14. North America Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Europe Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. China Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Asia Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Australia and New Zealand Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 18.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 18.1.1.

- 19. Latin America Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 19.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 19.1.1.

- 20. GCC Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 20.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 20.1.1.

- 21. Africa Smartphone Industry Analysis, Insights and Forecast, 2019-2031

- 21.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 21.1.1.

- 22. Competitive Analysis

- 22.1. Market Share Analysis 2024

- 22.2. Company Profiles

- 22.2.1 Google LL

- 22.2.1.1. Overview

- 22.2.1.2. Products

- 22.2.1.3. SWOT Analysis

- 22.2.1.4. Recent Developments

- 22.2.1.5. Financials (Based on Availability)

- 22.2.2 BBK Electronics Corporation (Vivo Realme Oppo and OnePlus)

- 22.2.2.1. Overview

- 22.2.2.2. Products

- 22.2.2.3. SWOT Analysis

- 22.2.2.4. Recent Developments

- 22.2.2.5. Financials (Based on Availability)

- 22.2.3 Lenovo Group Limited

- 22.2.3.1. Overview

- 22.2.3.2. Products

- 22.2.3.3. SWOT Analysis

- 22.2.3.4. Recent Developments

- 22.2.3.5. Financials (Based on Availability)

- 22.2.4 HMD Global Oy

- 22.2.4.1. Overview

- 22.2.4.2. Products

- 22.2.4.3. SWOT Analysis

- 22.2.4.4. Recent Developments

- 22.2.4.5. Financials (Based on Availability)

- 22.2.5 Samsung Electronics Co Ltd

- 22.2.5.1. Overview

- 22.2.5.2. Products

- 22.2.5.3. SWOT Analysis

- 22.2.5.4. Recent Developments

- 22.2.5.5. Financials (Based on Availability)

- 22.2.6 Xiaomi Corporation

- 22.2.6.1. Overview

- 22.2.6.2. Products

- 22.2.6.3. SWOT Analysis

- 22.2.6.4. Recent Developments

- 22.2.6.5. Financials (Based on Availability)

- 22.2.7 Huawei Technologies Co Ltd

- 22.2.7.1. Overview

- 22.2.7.2. Products

- 22.2.7.3. SWOT Analysis

- 22.2.7.4. Recent Developments

- 22.2.7.5. Financials (Based on Availability)

- 22.2.8 ZTE Corporation

- 22.2.8.1. Overview

- 22.2.8.2. Products

- 22.2.8.3. SWOT Analysis

- 22.2.8.4. Recent Developments

- 22.2.8.5. Financials (Based on Availability)

- 22.2.9 Apple Inc

- 22.2.9.1. Overview

- 22.2.9.2. Products

- 22.2.9.3. SWOT Analysis

- 22.2.9.4. Recent Developments

- 22.2.9.5. Financials (Based on Availability)

- 22.2.10 HTC Corporation

- 22.2.10.1. Overview

- 22.2.10.2. Products

- 22.2.10.3. SWOT Analysis

- 22.2.10.4. Recent Developments

- 22.2.10.5. Financials (Based on Availability)

- 22.2.11 Sony Corporation

- 22.2.11.1. Overview

- 22.2.11.2. Products

- 22.2.11.3. SWOT Analysis

- 22.2.11.4. Recent Developments

- 22.2.11.5. Financials (Based on Availability)

- 22.2.1 Google LL

List of Figures

- Figure 1: Smartphone Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Smartphone Industry Share (%) by Company 2024

List of Tables

- Table 1: Smartphone Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 3: Smartphone Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Smartphone Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 21: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 23: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 25: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 27: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 29: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 31: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 33: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Smartphone Industry Revenue Million Forecast, by Operating Segment 2019 & 2032

- Table 35: Smartphone Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smartphone Industry?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Smartphone Industry?

Key companies in the market include Google LL, BBK Electronics Corporation (Vivo Realme Oppo and OnePlus), Lenovo Group Limited, HMD Global Oy, Samsung Electronics Co Ltd, Xiaomi Corporation, Huawei Technologies Co Ltd, ZTE Corporation, Apple Inc, HTC Corporation, Sony Corporation.

3. What are the main segments of the Smartphone Industry?

The market segments include Operating Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Launch of 5G Devices. Services. and Technologies; Increasing Demand in the Emerging Markets.

6. What are the notable trends driving market growth?

Android Operating System is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Stagnating Demand.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smartphone Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smartphone Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smartphone Industry?

To stay informed about further developments, trends, and reports in the Smartphone Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence