Key Insights

The South American pet diet market, projected to reach $2.22 billion by 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 9.11% from 2025 to 2033. This significant expansion is propelled by increasing pet ownership in key urban centers of Brazil and Argentina, alongside the growing trend of pet humanization, which drives demand for premium and specialized nutrition. Enhanced awareness of pet health and nutrition is also a key driver, fostering adoption of therapeutic diets for specific health conditions. The market is segmented by pet type (cats, dogs, others), sub-product (diabetes, digestive sensitivity, oral care, renal, urinary tract disease, other veterinary diets), and distribution channels (convenience stores, online, specialty stores, supermarkets/hypermarkets, others). Brazil and Argentina lead the market, with considerable growth potential in other South American regions as awareness and pet ownership rise. Intense competition from domestic and international players, including ADM, Nestlé (Purina), and Mars Incorporated, is spurring innovation and new product development. Challenges include regional economic volatility and the need for affordable therapeutic diet options.

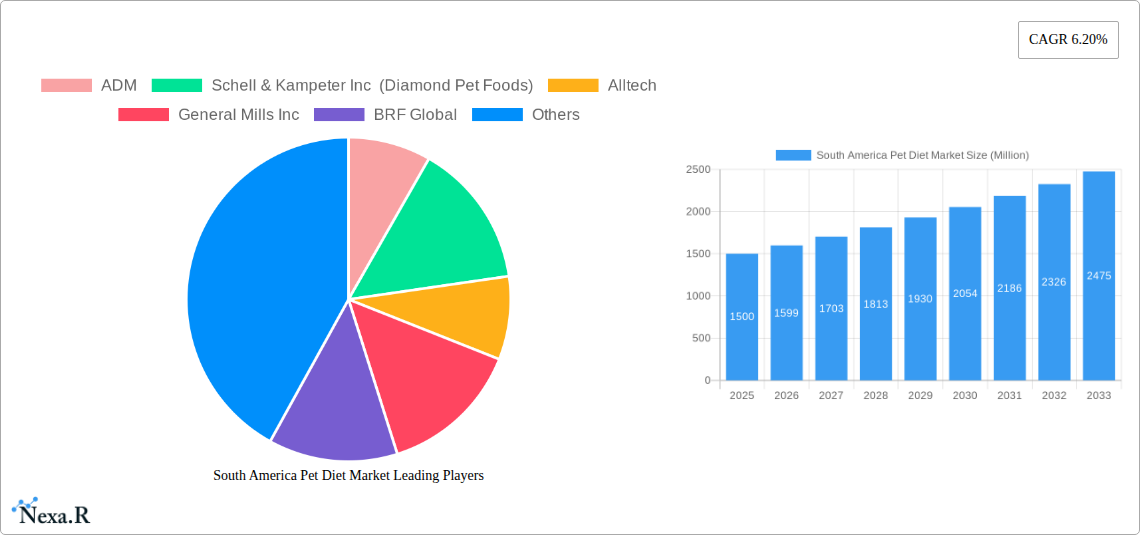

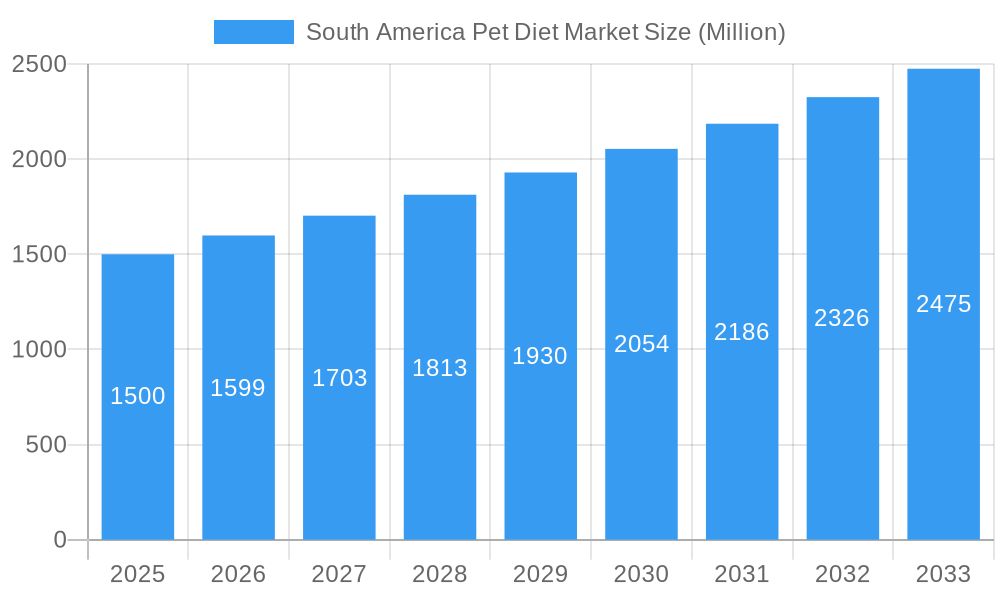

South America Pet Diet Market Market Size (In Billion)

Opportunities abound within market segmentation. The rapidly growing online channel facilitates direct-to-consumer sales and brand engagement. Specialty stores also offer a promising avenue for premium and specialized diet offerings. Future market trajectory will be influenced by advancements in pet nutrition science, increasing consumer preference for natural and organic ingredients, and the proliferation of subscription-based pet food delivery services. Strategic focus on product innovation, targeted marketing, and efficient supply chain management will be crucial for companies to capitalize on market potential. Rising disposable incomes and a growing middle class in several South American nations are expected to further fuel market expansion.

South America Pet Diet Market Company Market Share

This comprehensive report provides an in-depth analysis of the South America Pet Diet market, offering critical insights for industry professionals, investors, and stakeholders. Covering market dynamics, growth trends, and key players from 2019 to 2033, with a base year of 2025, the report employs a robust methodology combining qualitative and quantitative data for a holistic market view. This detailed analysis will equip you to make informed strategic decisions and leverage emerging opportunities in the South American pet food sector. Granular insights are provided through segmentation by sub-product, pet type, distribution channel, and country.

South America Pet Diet Market Dynamics & Structure

The South America Pet Diet market is characterized by a moderate level of concentration, with key players like Mars Incorporated and Nestlé (Purina) holding significant market share (estimated at xx% combined in 2025). Technological innovation, particularly in areas like personalized nutrition and functional diets, is a significant driver. Regulatory frameworks vary across countries, influencing product formulations and labeling requirements. Competitive substitutes include homemade diets and generic pet foods, posing a challenge to premium brands. The market is significantly influenced by growing pet ownership, particularly in urban areas, with a rising middle class increasing disposable income for pet care. M&A activity has been moderate in recent years (xx deals recorded between 2019-2024), with larger players consolidating their position through acquisitions of smaller, specialized brands.

- Market Concentration: Moderately concentrated, with xx% market share held by top 5 players in 2025.

- Technological Innovation: Focus on personalized nutrition, functional ingredients (e.g., probiotics, prebiotics), and sustainable sourcing.

- Regulatory Framework: Varied across countries, impacting product labeling and ingredient approvals.

- Competitive Substitutes: Homemade diets and generic pet foods pose a competitive threat.

- End-User Demographics: Growing pet ownership, particularly in urban areas with rising middle class.

- M&A Trends: Moderate activity (xx deals 2019-2024), driven by consolidation and expansion.

South America Pet Diet Market Growth Trends & Insights

The South America Pet Diet market is experiencing robust growth, driven by factors such as increasing pet ownership, rising disposable incomes, and greater awareness of pet health and nutrition. The market size is projected to reach xx million units by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the adoption of premium and specialized pet diets catering to specific health needs, such as diabetes, digestive sensitivity, and renal issues. Technological advancements in pet food formulation and manufacturing are also contributing to market expansion. Consumer behavior is shifting towards more natural, organic, and functional pet foods, creating opportunities for brands that align with these preferences. Market penetration of premium diets is increasing steadily, with a projected xx% penetration rate by 2033.

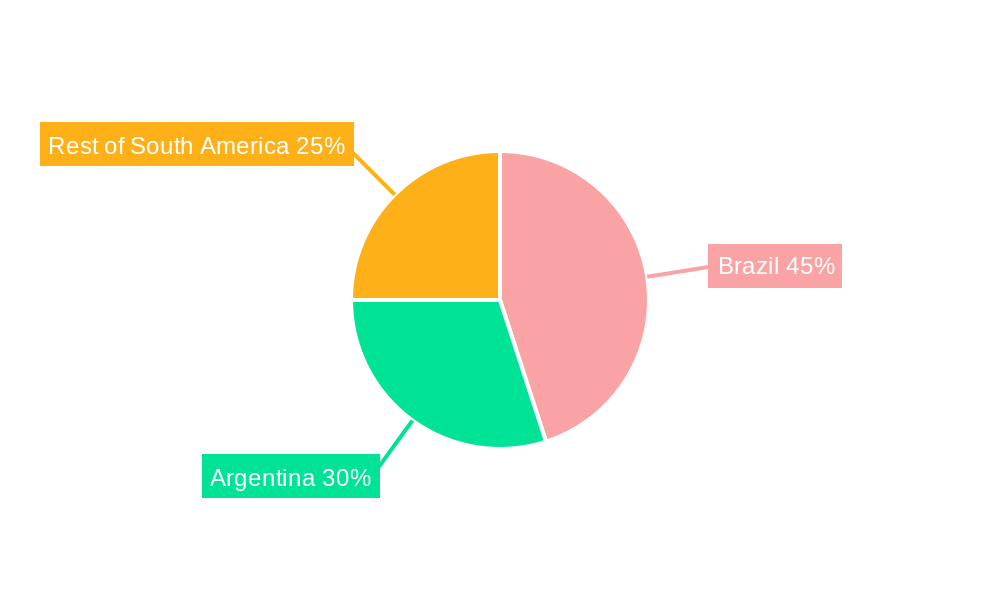

Dominant Regions, Countries, or Segments in South America Pet Diet Market

Brazil continues to be the powerhouse of the South America Pet Diet market, commanding a significant share estimated at **[Insert specific percentage, e.g., 35%]%** in 2025. This dominance is fueled by its expansive pet population, a growing middle class with increased disposable income, and a well-established pet food industry. Argentina also holds a substantial position, showcasing consistent demand for quality pet nutrition. The "Rest of South America" is not to be underestimated, exhibiting robust growth potential as pet ownership and awareness of specialized diets steadily rise across the region. Within product segments, there's a notable surge in demand for diets addressing **digestive sensitivities, allergies, and specific health conditions such as renal issues**. This trend is directly linked to heightened pet owner awareness regarding preventative care and the long-term well-being of their companions. Canine nutrition remains the largest segment by volume, reflecting the widespread popularity of dogs as pets. Supermarkets and hypermarkets continue to be the preferred distribution channel due to their accessibility, convenience, and ability to offer a wide array of brands and product types, making them a one-stop shop for pet owners.

- Dominant Country: Brazil (projected **[Insert specific percentage, e.g., 35%]**% market share in 2025)

- Fastest-growing Segments: Diets for digestive sensitivity, allergy management, and renal health are experiencing accelerated growth.

- Leading Distribution Channel: Supermarkets/Hypermarkets, due to convenience and product variety.

- Emerging Distribution Channels: Online retail and specialty pet stores are gaining traction, offering specialized products and personalized service.

- Key Drivers for Segment Growth: Increased focus on pet health and wellness, owner education on specific dietary needs, and the availability of targeted formulations.

South America Pet Diet Market Product Landscape

The South American pet diet market showcases a wide range of products, including dry and wet food, treats, and supplements. Product innovation focuses on functional diets addressing specific health needs, such as diabetes, weight management, and allergies. The incorporation of natural ingredients, novel protein sources, and advanced nutritional formulations is also prominent. Performance metrics focus on digestibility, nutrient bioavailability, and overall pet health outcomes. Many brands are highlighting unique selling propositions based on sustainability, ethical sourcing, and traceability.

Key Drivers, Barriers & Challenges in South America Pet Diet Market

Key Drivers:

- Pet Humanization: The deep emotional bond between owners and their pets is transforming pets into family members, leading to increased investment in their health and well-being, including premium and specialized diets.

- Growing Disposable Incomes: A rising middle class across South America has more discretionary spending power, which is increasingly allocated towards higher-quality pet food.

- Enhanced Pet Health Awareness: Greater access to information through digital platforms and veterinary guidance is making pet owners more proactive about their pets' nutritional needs and potential health issues.

- Advancements in Pet Nutrition Science: Ongoing research and development are leading to more sophisticated and scientifically formulated pet foods that cater to specific life stages, breeds, and health conditions.

- Expansion of Retail Infrastructure: The growing presence of modern retail formats and e-commerce platforms is improving accessibility to a wider range of pet food products.

Key Barriers & Challenges:

- Economic Volatility and Currency Fluctuations: Unstable economic conditions and fluctuating exchange rates in some South American countries can impact consumer purchasing power and the cost of imported pet food ingredients.

- Logistical Complexities and Import Tariffs: Navigating diverse regulatory landscapes, high import duties, and complex supply chain networks can pose significant challenges for manufacturers and distributors, affecting product availability and pricing.

- Intense Market Competition: The market is characterized by a dynamic competitive landscape featuring established multinational corporations, regional players, and a growing number of emerging brands vying for market share.

- Regulatory Variations: Differing food safety standards, labeling requirements, and import/export regulations across various South American nations can create complexities for market entry and product compliance.

- Price Sensitivity: Despite a growing demand for premium products, a segment of the consumer base remains price-sensitive, especially in regions with lower average incomes.

Emerging Opportunities in South America Pet Diet Market

- Untapped Rural and Secondary Market Potential: Significant opportunities exist in expanding reach to less saturated urban centers and rural areas where pet ownership is rising but access to specialized pet nutrition is limited.

- Surge in Demand for Organic and Natural Pet Food: Consumers are increasingly seeking pet food products made with natural, organic, and ethically sourced ingredients, reflecting a broader trend towards healthier and more sustainable consumption.

- Personalized Nutrition and Customization: The growing interest in tailored diets that cater to individual pet needs (based on breed, age, activity level, allergies, and health conditions) presents a significant avenue for innovation and market differentiation.

- Breed-Specific Formulations: Developing pet food formulations designed to address the unique nutritional requirements and predispositions of specific dog and cat breeds can capture a dedicated consumer base.

- Functional Foods and Supplements: The market is ripe for innovative functional pet foods and dietary supplements that offer targeted health benefits, such as joint support, skin and coat health, and cognitive function enhancement.

- Sustainable and Eco-Friendly Packaging: With a growing global emphasis on sustainability, brands offering eco-friendly packaging solutions are likely to resonate with environmentally conscious consumers.

Growth Accelerators in the South America Pet Diet Market Industry

The long-term growth of the South America Pet Diet market is projected to be driven by continued expansion of the pet owner base, the introduction of innovative pet food products, strategic partnerships between pet food brands and veterinary clinics, and expansion of e-commerce channels.

Key Players Shaping the South America Pet Diet Market Market

- ADM

- Schell & Kampeter Inc (Diamond Pet Foods)

- Alltech

- General Mills Inc

- BRF Global

- FARMINA PET FOODS

- Mars Incorporated

- Nestle (Purina)

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc)

- Virba

Notable Milestones in South America Pet Diet Market Sector

- August 2022: Hill's Pet Nutrition introduced two specialized puppy and kitten foods designed to support digestive health and address specific needs post-sterilization, underscoring a focus on early life nutrition and targeted life stage support.

- January 2023: Mars Incorporated, a major player in the pet care industry, announced a significant partnership with the Broad Institute to leverage advancements in genomic research for the betterment of pet health, indicating a commitment to cutting-edge scientific innovation in pet nutrition.

- March 2023: Hill's Pet Nutrition expanded its prescription diet line with the launch of Diet ONC Care, a specialized therapeutic food developed to support pets undergoing cancer treatment. This highlights the growing demand for veterinary-exclusive diets addressing critical health issues.

- [Insert Date]: [Insert Company Name] launched [Insert Product Name/Initiative], a new range of [describe product/initiative, e.g., plant-based pet foods] targeting the growing demand for [describe key benefit, e.g., sustainable and hypoallergenic options] in the [specific South American country] market.

- [Insert Date]: A significant investment was made by [Insert Investor Type, e.g., Venture Capital Firm] into [Insert Company Name], a South American startup focused on [describe focus, e.g., developing personalized pet nutrition subscription services], signaling strong investor confidence in the region's pet food innovation.

In-Depth South America Pet Diet Market Market Outlook

The South America Pet Diet market is poised for robust and sustained growth in the coming years, driven by a powerful confluence of demographic shifts, evolving consumer behaviors, and increasing veterinary influence. The persistent trend of pet humanization, coupled with rising disposable incomes and a growing consciousness around pet health and preventative care, is fundamentally reshaping consumer purchasing decisions. Pet owners are increasingly viewing their pets as integral family members, leading to a greater willingness to invest in high-quality, specialized, and even premium pet food options. Strategic imperatives for companies operating in this dynamic market will revolve around innovation, sustainability, and the cultivation of deep consumer trust. Opportunities abound for brands that can effectively leverage technological advancements to offer personalized nutrition solutions tailored to individual pet needs, encompassing everything from breed-specific requirements to life-stage diets and therapeutic formulations. Furthermore, embracing sustainable practices in sourcing, manufacturing, and packaging will be crucial for resonating with an increasingly environmentally aware consumer base. Expansion into underserved geographical markets, such as rural areas and smaller cities, and fostering strong collaborative relationships with veterinary professionals will be paramount for achieving widespread market penetration and ensuring long-term, sustainable success in this vibrant and growing sector.

South America Pet Diet Market Segmentation

-

1. Sub Product

- 1.1. Diabetes

- 1.2. Digestive Sensitivity

- 1.3. Oral Care Diets

- 1.4. Renal

- 1.5. Urinary tract disease

- 1.6. Other Veterinary Diets

-

2. Pets

- 2.1. Cats

- 2.2. Dogs

- 2.3. Other Pets

-

3. Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Channel

- 3.3. Specialty Stores

- 3.4. Supermarkets/Hypermarkets

- 3.5. Other Channels

South America Pet Diet Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Pet Diet Market Regional Market Share

Geographic Coverage of South America Pet Diet Market

South America Pet Diet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Pet Diet Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 5.1.1. Diabetes

- 5.1.2. Digestive Sensitivity

- 5.1.3. Oral Care Diets

- 5.1.4. Renal

- 5.1.5. Urinary tract disease

- 5.1.6. Other Veterinary Diets

- 5.2. Market Analysis, Insights and Forecast - by Pets

- 5.2.1. Cats

- 5.2.2. Dogs

- 5.2.3. Other Pets

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Channel

- 5.3.3. Specialty Stores

- 5.3.4. Supermarkets/Hypermarkets

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Schell & Kampeter Inc (Diamond Pet Foods)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alltech

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BRF Global

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FARMINA PET FOODS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mars Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nestle (Purina)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Colgate-Palmolive Company (Hill's Pet Nutrition Inc )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Virba

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADM

List of Figures

- Figure 1: South America Pet Diet Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Pet Diet Market Share (%) by Company 2025

List of Tables

- Table 1: South America Pet Diet Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 2: South America Pet Diet Market Revenue billion Forecast, by Pets 2020 & 2033

- Table 3: South America Pet Diet Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Pet Diet Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Pet Diet Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 6: South America Pet Diet Market Revenue billion Forecast, by Pets 2020 & 2033

- Table 7: South America Pet Diet Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: South America Pet Diet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Brazil South America Pet Diet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Argentina South America Pet Diet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Chile South America Pet Diet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Colombia South America Pet Diet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Peru South America Pet Diet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Venezuela South America Pet Diet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Ecuador South America Pet Diet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Bolivia South America Pet Diet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Paraguay South America Pet Diet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Uruguay South America Pet Diet Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Pet Diet Market?

The projected CAGR is approximately 9.11%.

2. Which companies are prominent players in the South America Pet Diet Market?

Key companies in the market include ADM, Schell & Kampeter Inc (Diamond Pet Foods), Alltech, General Mills Inc, BRF Global, FARMINA PET FOODS, Mars Incorporated, Nestle (Purina), Colgate-Palmolive Company (Hill's Pet Nutrition Inc ), Virba.

3. What are the main segments of the South America Pet Diet Market?

The market segments include Sub Product, Pets, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.22 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023: Colgate-Palmolive Company's pet care subsidiary Hill’s Pet Nutrition launched its new line of prescription diets to support pets diagnosed with cancer. This prescription line, Diet ONC Care, offers complete and balanced formulas in both dry and wet forms for cats and dogs.January 2023: Mars Incorporated partnered with the Broad Institute to create an open-access database of dog and cat genomes to advance preventive pet care. It is aimed at developing more effective precision medicines and diets that lead to scientific breakthroughs for the future of pet health.August 2022: Hill's Pet Nutrition launched two new puppy and kitten foods: Hill's Science Plan Perfect Digestion Range for Puppies and Hill's Science Plan Sterilised Kitten Chicken for Kittens. These diets help in optimal growth and development.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Pet Diet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Pet Diet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Pet Diet Market?

To stay informed about further developments, trends, and reports in the South America Pet Diet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence