Key Insights

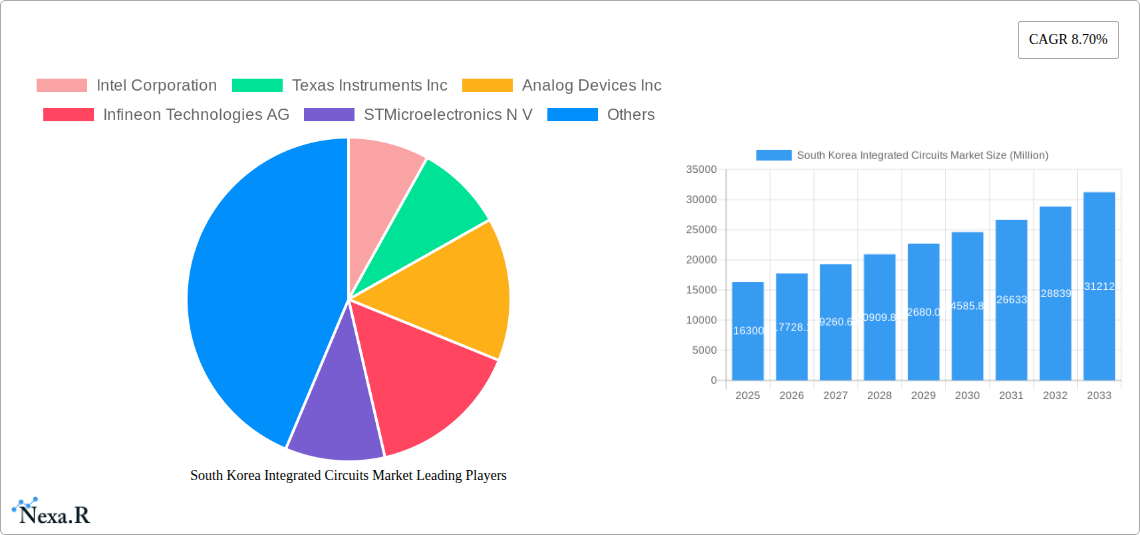

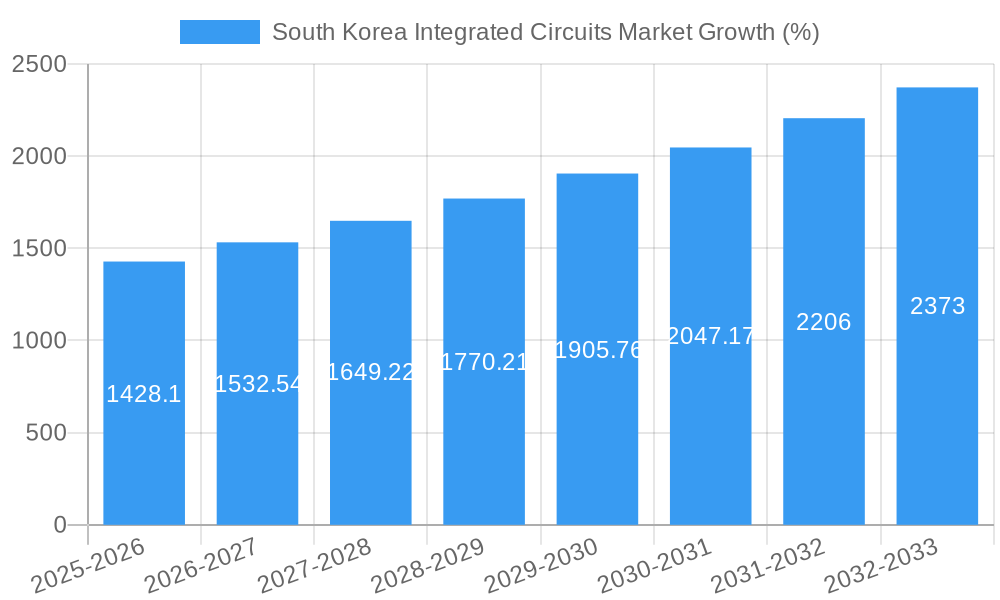

The South Korea integrated circuits (IC) market, valued at $16.30 billion in 2025, is projected to experience robust growth, driven by the nation's leading role in global electronics manufacturing and a strong emphasis on technological innovation. The 8.70% compound annual growth rate (CAGR) from 2025 to 2033 indicates significant expansion, fueled primarily by increasing demand for memory chips (DRAM and NAND Flash) from the burgeoning data center and mobile device sectors. Advancements in semiconductor technology, including the rise of 5G and AI applications, further stimulate market growth. While supply chain disruptions and global economic uncertainties pose potential restraints, South Korea's robust government support for the semiconductor industry and its strategic partnerships with leading global players mitigate these risks. The market segmentation is likely dominated by memory chips, with significant contributions from logic ICs and analog ICs. Key players like Samsung Electronics, SK Hynix, and others leverage their advanced manufacturing capabilities and technological prowess to maintain a competitive edge in this rapidly evolving market.

The projected market size for 2033 can be estimated by applying the CAGR. Considering the 8.70% CAGR and a 2025 market value of $16.30 billion, the market is expected to significantly increase over the forecast period. The presence of major global players like Intel, Texas Instruments, and others in South Korea strengthens the market's global competitiveness and reinforces its pivotal role in the global semiconductor landscape. Furthermore, continuous investments in research and development, coupled with government initiatives to support the industry's growth, will likely accelerate the market expansion beyond the projected figures. The market's future trajectory will largely depend on global economic conditions, technological advancements, and geopolitical factors.

This in-depth report provides a comprehensive analysis of the South Korea Integrated Circuits (IC) market, encompassing market dynamics, growth trends, key players, and future outlook. The study covers the period 2019-2033, with 2025 as the base year. This report is essential for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic market. The South Korea IC market, a key segment of the broader Asia-Pacific semiconductor landscape, is further segmented into Memory ICs (DRAM, NAND Flash, etc.) and Logic ICs (Microprocessors, Microcontrollers, etc.), providing granular insights into specific market niches. Market values are presented in Million units.

South Korea Integrated Circuits Market Dynamics & Structure

This section delves into the intricate structure and dynamics of the South Korea integrated circuits market. We analyze market concentration, revealing the dominance of key players like Samsung and SK Hynix, and explore the technological innovations driving growth. The regulatory landscape, including government support for the semiconductor industry, is examined, alongside the competitive pressures from product substitutes and the influence of mergers and acquisitions (M&A). End-user demographics, spanning from consumer electronics to automotive and industrial applications, are also considered.

- Market Concentration: The South Korean IC market exhibits high concentration, with Samsung Electronics and SK Hynix holding a significant market share (xx%). Other key players such as Intel, Texas Instruments, and Micron contribute to the remaining market share (xx%).

- Technological Innovation: Continuous advancements in memory technologies (e.g., DDR5, V-NAND) and logic ICs are key drivers. However, high R&D costs and the complexity of manufacturing processes present significant innovation barriers.

- Regulatory Framework: The South Korean government actively supports the semiconductor industry through tax incentives and investment programs, fostering a favorable environment for growth.

- M&A Activity: The number of M&A deals within the South Korean IC sector has shown a (xx)% increase in the last five years. This reflects increasing consolidation in the industry.

- Competitive Substitutes: The presence of alternative technologies, such as optical storage, poses a competitive threat.

- End-User Demographics: The primary end-users include the consumer electronics, automotive, and industrial sectors.

South Korea Integrated Circuits Market Growth Trends & Insights

This section provides a detailed analysis of the South Korea IC market's growth trajectory, leveraging extensive data to project future trends. We examine market size evolution, adoption rates of new technologies, and the impact of technological disruptions on consumer behavior. Specific metrics, such as the Compound Annual Growth Rate (CAGR) and market penetration rates, are presented. We've considered various factors influencing the market trends during the study period (2019-2024) and forecast period (2025-2033). This report uses xx as a predicted value in the instances where certain data is unavailable. The historical period (2019-2024) showcases a (xx)% CAGR, while the forecast period (2025-2033) projects a (xx)% CAGR, indicating steady growth.

Dominant Regions, Countries, or Segments in South Korea Integrated Circuits Market

This section identifies the leading regions, countries, or segments driving market growth within South Korea. Detailed analysis focuses on market share, growth potential, and key drivers. We will explore the reasons behind the dominance of particular regions or segments.

- Key Drivers:

- Strong government support for the semiconductor industry.

- A well-established manufacturing base.

- High technological expertise.

- The presence of major global players.

South Korea Integrated Circuits Market Product Landscape

This section will provide a concise overview of the product landscape within the South Korean Integrated Circuits market. It will cover details on recent product innovations in areas like memory and logic chips, highlighting unique selling propositions and improvements in performance. Emerging applications and their impact on the market will be briefly touched upon.

Key Drivers, Barriers & Challenges in South Korea Integrated Circuits Market

This section outlines the key factors that are accelerating or hindering the growth of the South Korea Integrated Circuits market.

Key Drivers:

- Strong government support and investments.

- Increasing demand from consumer electronics and automotive industries.

- Advancements in semiconductor technology.

Key Barriers and Challenges:

- Intense competition from global players.

- Fluctuations in global demand for semiconductors.

- Potential geopolitical risks and supply chain disruptions.

Emerging Opportunities in South Korea Integrated Circuits Market

This section will highlight emerging trends and untapped market segments within the South Korean IC sector. Opportunities related to new applications, evolving consumer preferences, and technological advancements will be detailed.

Growth Accelerators in the South Korea Integrated Circuits Market Industry

This section will discuss long-term growth catalysts for the South Korean IC market. The focus will be on technological breakthroughs, strategic collaborations, and market expansion strategies.

Key Players Shaping the South Korea Integrated Circuits Market Market

- Intel Corporation

- Texas Instruments Inc

- Analog Devices Inc

- Infineon Technologies AG

- STMicroelectronics N V

- Sk Hynix Inc

- NXP Semiconductors N V

- On Semiconductor Corporation

- Microchip Technology Inc

- Samsung Electronics Inc

- Renesas Electronics Corporation

- MediaTek Inc

Notable Milestones in South Korea Integrated Circuits Market Sector

- May 2024: Micron Technology Inc. announced the validation and shipping of its high-capacity 128 GB DDR5 RDIMM memory, boasting improved bit density, energy efficiency, and lower latency. This signifies significant advancements in DRAM technology.

- April 2024: Samsung initiated mass production of its one-terabit (Tb) 9th-generation V-NAND, representing a substantial leap in NAND flash memory density and solidifying its market leadership.

In-Depth South Korea Integrated Circuits Market Market Outlook

The South Korea Integrated Circuits market exhibits promising long-term growth potential, driven by continuous technological innovations, robust government support, and increasing demand from diverse end-user sectors. Strategic partnerships and market expansion strategies by key players will further fuel this growth. The market is expected to witness significant expansion in the coming years, presenting substantial opportunities for businesses and investors.

South Korea Integrated Circuits Market Segmentation

-

1. Type

- 1.1. Analog IC

- 1.2. Logic IC

- 1.3. Memory

-

1.4. Micro

- 1.4.1. Microprocessors (MPU)

- 1.4.2. Microcontrollers (MCU)

- 1.4.3. Digital Signal Processors

-

2. End-user Industry

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. IT & Telecommunications

- 2.4. Manufacturing & Automation

- 2.5. Other En

South Korea Integrated Circuits Market Segmentation By Geography

- 1. South Korea

South Korea Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Penetration of Smartphones

- 3.2.2 Tablets and Other Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.3. Market Restrains

- 3.3.1 Increasing Penetration of Smartphones

- 3.3.2 Tablets and Other Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.4. Market Trends

- 3.4.1. The Memory Segment is Expected to Register the Highest CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Integrated Circuits Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog IC

- 5.1.2. Logic IC

- 5.1.3. Memory

- 5.1.4. Micro

- 5.1.4.1. Microprocessors (MPU)

- 5.1.4.2. Microcontrollers (MCU)

- 5.1.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. IT & Telecommunications

- 5.2.4. Manufacturing & Automation

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Intel Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texas Instruments Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Analog Devices Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infineon Technologies AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics N V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sk Hynix Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NXP Semiconductors N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 On Semiconductor Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Microchip Technology Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung Electronics Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Renesas Electronics Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 MediaTek Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Intel Corporation

List of Figures

- Figure 1: South Korea Integrated Circuits Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Integrated Circuits Market Share (%) by Company 2024

List of Tables

- Table 1: South Korea Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: South Korea Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: South Korea Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: South Korea Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: South Korea Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: South Korea Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Korea Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: South Korea Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: South Korea Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: South Korea Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: South Korea Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: South Korea Integrated Circuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South Korea Integrated Circuits Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Integrated Circuits Market?

The projected CAGR is approximately 8.70%.

2. Which companies are prominent players in the South Korea Integrated Circuits Market?

Key companies in the market include Intel Corporation, Texas Instruments Inc, Analog Devices Inc, Infineon Technologies AG, STMicroelectronics N V, Sk Hynix Inc, NXP Semiconductors N V, On Semiconductor Corporation, Microchip Technology Inc, Samsung Electronics Inc, Renesas Electronics Corporation, MediaTek Inc.

3. What are the main segments of the South Korea Integrated Circuits Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Smartphones. Tablets and Other Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

6. What are the notable trends driving market growth?

The Memory Segment is Expected to Register the Highest CAGR.

7. Are there any restraints impacting market growth?

Increasing Penetration of Smartphones. Tablets and Other Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

8. Can you provide examples of recent developments in the market?

May 2024: Micron Technology Inc. announced validating and shipping its high-capacity monolithic 32 GB DRAM die-based 128 GB DDR5 RDIMM memory at speeds up to 5,600 MT/s on prominent server platforms. Powered by Micron's 1β (1-beta) technology, the 128 GB DDR5 RDIMM memory is claimed to deliver more than 45% improved bit density, up to 22% improved energy efficiency, and up to 16% lower latency over competitive 3DS through-silicon via (TSV) products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the South Korea Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence