Key Insights

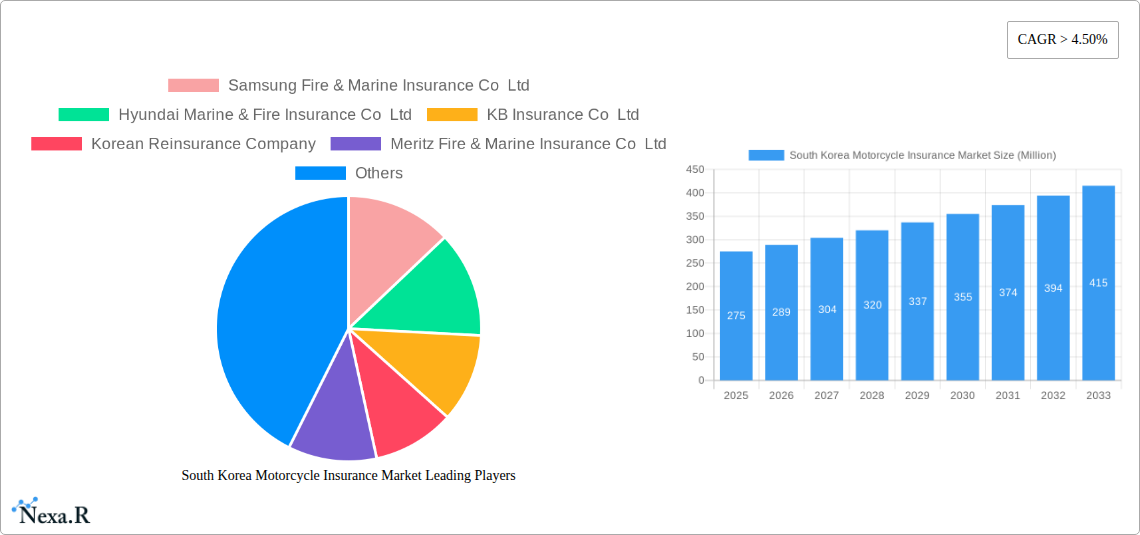

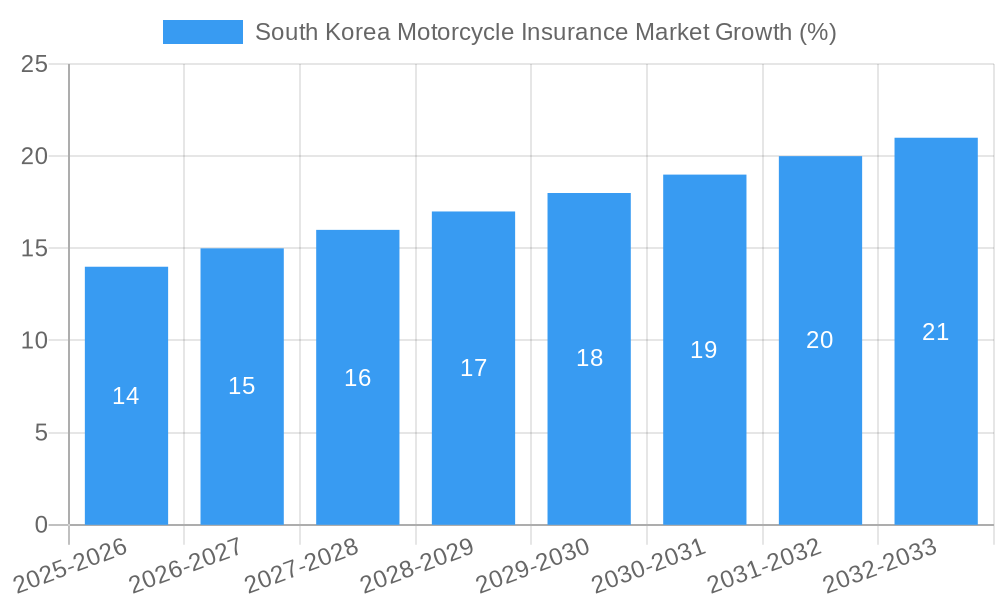

The South Korean motorcycle insurance market exhibits robust growth, driven by increasing motorcycle ownership and a rising middle class with disposable income for leisure activities, including motorcycle riding. The market's Compound Annual Growth Rate (CAGR) exceeding 4.50% from 2019 to 2024 indicates a consistently expanding market. This positive trajectory is expected to continue through 2033, fueled by government initiatives promoting safer riding practices and stricter enforcement of insurance regulations. While specific market size figures are unavailable, a logical estimation based on a similar-sized Asian market with a comparable CAGR suggests a 2025 market value in the range of $250-300 million USD. This range considers factors like South Korea's higher GDP per capita and the penetration of insurance products in the country. Key players like Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, and KB Insurance are likely to dominate the market, vying for market share through competitive pricing and enhanced service offerings such as rider training programs and telematics-based insurance. Growth may also be constrained by economic downturns that could reduce consumer spending on discretionary items like motorcycle insurance.

However, the market faces potential restraints from factors such as fluctuating fuel prices that can impact motorcycle usage and the economic sensitivity of motorcycle purchases, thus impacting insurance demand. The segmentation of the market likely includes various policy types (liability, collision, comprehensive), rider demographics (age, experience), and geographic regions reflecting varying risk profiles and insurance needs within South Korea. Further analysis will be necessary to identify the exact proportions of these segments and potential opportunities for niche players. Growth strategies for market players will likely involve targeted advertising, strategic partnerships with motorcycle dealers and clubs, and expansion of digital channels for both sales and customer service. The increasing use of data analytics and telematics offers opportunities for personalized risk assessment and more competitive insurance pricing.

South Korea Motorcycle Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Korea motorcycle insurance market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033. This detailed analysis is crucial for industry professionals, investors, and stakeholders seeking a clear understanding of this dynamic market segment within the broader South Korean insurance sector. The report utilizes data from the historical period (2019-2024), the base year (2025), and the estimated year (2025) to provide a robust forecast. Market values are presented in million units.

South Korea Motorcycle Insurance Market Dynamics & Structure

The South Korean motorcycle insurance market is characterized by a moderately concentrated landscape, with several dominant players competing for market share. The market's structure is influenced by a combination of factors, including stringent regulatory frameworks, technological advancements in insurance technology (Insurtech), and the evolving demographics of motorcycle owners. Mergers and acquisitions (M&A) activity, while not excessively frequent, plays a role in shaping the competitive dynamics.

- Market Concentration: The top 5 insurers control approximately xx% of the market share (2024). This indicates a moderately consolidated market.

- Technological Innovation: The adoption of telematics and data analytics is gradually transforming the industry, offering opportunities for personalized pricing and risk assessment. However, data privacy concerns and the integration of new technologies pose challenges.

- Regulatory Framework: Strict government regulations concerning insurance policies and pricing influence market dynamics and create both opportunities and barriers to entry for new players.

- Competitive Product Substitutes: The absence of significant substitutes for traditional motorcycle insurance limits market disruption, but innovative product offerings by insurers are driving competitiveness.

- End-User Demographics: The increasing number of young motorcycle owners, coupled with rising disposable incomes, positively impacts market growth. However, shifts in demographics may influence risk profiles.

- M&A Trends: The number of M&A deals within the motorcycle insurance segment in South Korea between 2019 and 2024 averaged xx per year, signaling a moderate level of consolidation.

South Korea Motorcycle Insurance Market Growth Trends & Insights

The South Korean motorcycle insurance market exhibits a steady growth trajectory, driven by factors such as increasing motorcycle ownership, rising incomes, and government initiatives promoting road safety. The market size has witnessed significant growth during the historical period, exhibiting a compound annual growth rate (CAGR) of xx% from 2019 to 2024. This growth is expected to continue during the forecast period (2025-2033), albeit at a potentially moderated pace due to economic factors and market saturation. Technological disruptions, including the rise of Insurtech companies, are altering customer expectations and creating new market opportunities. Consumer behavior is shifting towards digital platforms and personalized insurance solutions, impacting the way insurers operate.

Market penetration rates remain relatively low, indicating significant untapped potential. Further growth will be contingent on adapting to evolving consumer preferences and leveraging technological advancements. Increased usage of telematics promises further growth potential by improving risk assessment and developing innovative pricing models.

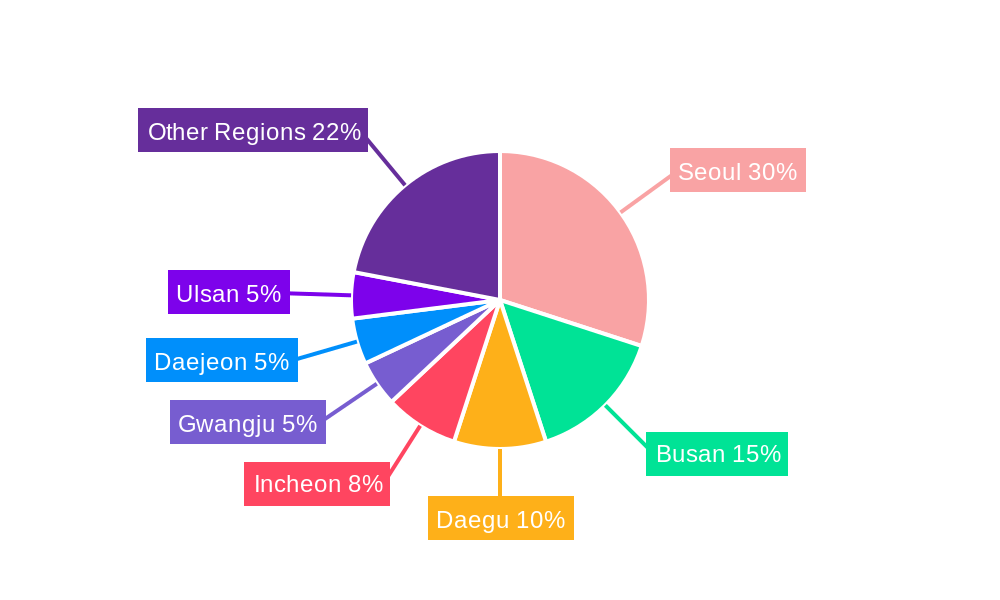

Dominant Regions, Countries, or Segments in South Korea Motorcycle Insurance Market

The South Korea motorcycle insurance market is relatively concentrated geographically, with the highest concentration in major metropolitan areas like Seoul and Busan. These regions benefit from higher motorcycle ownership rates and higher disposable incomes. Market growth in these areas is being driven by factors such as:

- Economic Factors: High levels of economic activity in these regions directly translate to increased motorcycle sales and thus, greater demand for insurance.

- Infrastructure: Developed road infrastructure, while posing safety challenges, creates a base for increased motorcycle usage, generating greater demand for insurance.

- Government Policies: Government policies promoting safe driving and motorcycle ownership influence market growth in different regions.

The dominance of these regions is primarily due to their higher motorcycle ownership numbers and the economic strength of their populations. Rural areas, while exhibiting slower growth, represent a potential area for market expansion as infrastructure improves and motorcycle ownership increases.

South Korea Motorcycle Insurance Market Product Landscape

The South Korean motorcycle insurance market offers a range of products catering to diverse customer needs and risk profiles. These products vary in coverage, premiums, and additional benefits. Recent innovations have focused on integrating telematics technology to offer usage-based insurance, which provides more accurate risk assessments and personalized pricing. Insurers are also developing add-on services to improve customer engagement and provide broader protection.

Key Drivers, Barriers & Challenges in South Korea Motorcycle Insurance Market

Key Drivers:

- Increased motorcycle ownership fueled by rising disposable incomes.

- Government initiatives promoting road safety and responsible riding.

- Technological advancements leading to innovative insurance products and services.

Key Challenges:

- Intense competition among established insurers and the emergence of Insurtech firms.

- Stringent regulatory requirements and compliance costs.

- Economic fluctuations affecting consumer spending patterns and influencing insurance purchasing decisions. This translates into potential volatility in demand and pricing.

Emerging Opportunities in South Korea Motorcycle Insurance Market

- Expansion into untapped rural markets.

- Development of specialized insurance products for niche motorcycle segments (e.g., electric motorcycles).

- Leveraging AI and machine learning for enhanced risk assessment and fraud detection.

- Adoption of personalized pricing models and bundling of services with other financial products.

Growth Accelerators in the South Korea Motorcycle Insurance Market Industry

Strategic partnerships between insurers and technology providers will be essential for driving innovation and expanding market reach. The continued development and adoption of Insurtech solutions offer a significant pathway for future growth. Moreover, the implementation of usage-based insurance models allows for better risk management and targeted pricing, opening new market segments and attracting customers.

Key Players Shaping the South Korea Motorcycle Insurance Market Market

- Samsung Fire & Marine Insurance Co Ltd

- Hyundai Marine & Fire Insurance Co Ltd

- KB Insurance Co Ltd

- Korean Reinsurance Company

- Meritz Fire & Marine Insurance Co Ltd

- Lotte Non Life Insurance Co Ltd

- DB Insurance Co Ltd

- Hanwha General Insurance Co Ltd

- AXA General Insurance Co Ltd

- Heungkuk Fire & Marine Insurance Co Ltd

- Carrot General Insurance Corp.

List Not Exhaustive

Notable Milestones in South Korea Motorcycle Insurance Market Sector

- December 2022: Korean Re entered into a coinsurance agreement with Samsung Life for KRW 500 billion in liabilities. This highlights increased collaboration and risk-sharing within the insurance sector.

- May 2022: Carrot General Insurance Corp. signed an MoU with the Korea Transportation Safety Authority (TS), signifying a public-private partnership to enhance road safety and leverage technology in the insurance sector.

In-Depth South Korea Motorcycle Insurance Market Market Outlook

The South Korean motorcycle insurance market presents a promising outlook for the forecast period, driven by a confluence of factors including technological advancements, increasing motorcycle ownership, and a supportive regulatory environment. Opportunities exist for insurers to leverage data analytics, personalize offerings, and expand into underserved segments. Strategic partnerships and investment in technology will be key to achieving long-term success in this growing market. The continued growth of the motorcycle market and the adoption of innovative insurance models pave the way for significant expansion in the coming years.

South Korea Motorcycle Insurance Market Segmentation

-

1. Insurance Product

- 1.1. Private Automobile Insurance

- 1.2. Busines Automobile Insurance

- 1.3. Commercial Automobile insurance

- 1.4. Motorcycle Insurance

-

2. Insurance Coverage

- 2.1. Compulsory

- 2.2. Voluntary

-

3. Distribution Channel

- 3.1. Agents

- 3.2. Brokers

- 3.3. Banks

- 3.4. Other Distribution Channels

South Korea Motorcycle Insurance Market Segmentation By Geography

- 1. South Korea

South Korea Motorcycle Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Adoption of EV Vehicles; Growing Digital Platforms

- 3.3. Market Restrains

- 3.3.1. Rise in Adoption of EV Vehicles; Growing Digital Platforms

- 3.4. Market Trends

- 3.4.1. Rises in adoption of electric vehicles is driving the growth of the motor insurance industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Motorcycle Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Product

- 5.1.1. Private Automobile Insurance

- 5.1.2. Busines Automobile Insurance

- 5.1.3. Commercial Automobile insurance

- 5.1.4. Motorcycle Insurance

- 5.2. Market Analysis, Insights and Forecast - by Insurance Coverage

- 5.2.1. Compulsory

- 5.2.2. Voluntary

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Agents

- 5.3.2. Brokers

- 5.3.3. Banks

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Insurance Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Samsung Fire & Marine Insurance Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Marine & Fire Insurance Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KB Insurance Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Korean Reinsurance Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Meritz Fire & Marine Insurance Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lotte Non Life Insurance Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DB Insurance Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hanwha General Insurance Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AXA General Insurance Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Heungkuk Fire & Marine Insurance Co Ltd**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Samsung Fire & Marine Insurance Co Ltd

List of Figures

- Figure 1: South Korea Motorcycle Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Motorcycle Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Insurance Product 2019 & 2032

- Table 3: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Insurance Coverage 2019 & 2032

- Table 4: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Insurance Product 2019 & 2032

- Table 7: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Insurance Coverage 2019 & 2032

- Table 8: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 9: South Korea Motorcycle Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Motorcycle Insurance Market?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the South Korea Motorcycle Insurance Market?

Key companies in the market include Samsung Fire & Marine Insurance Co Ltd, Hyundai Marine & Fire Insurance Co Ltd, KB Insurance Co Ltd, Korean Reinsurance Company, Meritz Fire & Marine Insurance Co Ltd, Lotte Non Life Insurance Co Ltd, DB Insurance Co Ltd, Hanwha General Insurance Co Ltd, AXA General Insurance Co Ltd, Heungkuk Fire & Marine Insurance Co Ltd**List Not Exhaustive.

3. What are the main segments of the South Korea Motorcycle Insurance Market?

The market segments include Insurance Product, Insurance Coverage, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Adoption of EV Vehicles; Growing Digital Platforms.

6. What are the notable trends driving market growth?

Rises in adoption of electric vehicles is driving the growth of the motor insurance industry.

7. Are there any restraints impacting market growth?

Rise in Adoption of EV Vehicles; Growing Digital Platforms.

8. Can you provide examples of recent developments in the market?

December 2022: Korean Re entered into a coinsurance agreement with Samsung Life concerning the life insurer's liabilities worth KRW 500 billion on October 28, 2022. The agreement came after the two parties discussed and analyzed the merits and effects of the deal for about a year. The recent agreement with Samsung Life marked Korean Re's second coinsurance business following the deal with Shinhan Life in January 2022, which went to prove how much competitive edge we had in the domestic market over other global reinsurers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Motorcycle Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Motorcycle Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Motorcycle Insurance Market?

To stay informed about further developments, trends, and reports in the South Korea Motorcycle Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence