Key Insights

The South Korean ophthalmic devices market is projected to achieve a market size of $7.25 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 13.71% from the base year 2025 through 2033. This significant growth is propelled by an increasing incidence of age-related eye diseases such as cataracts and glaucoma, a rapidly aging demographic, and elevated public awareness concerning eye health. Technological advancements are central to this expansion, with substantial demand for sophisticated diagnostic tools like Optical Coherence Tomography (OCT) scanners and advanced surgical devices, including lasers and specialized glaucoma implants. The market also benefits from strong government initiatives promoting healthcare accessibility and the growing adoption of minimally invasive surgical procedures, which improve patient outcomes and reduce recovery times. Key global players such as Johnson & Johnson, Alcon Inc., and Carl Zeiss Meditec AG, alongside domestic innovators, actively compete through product development and strategic alliances.

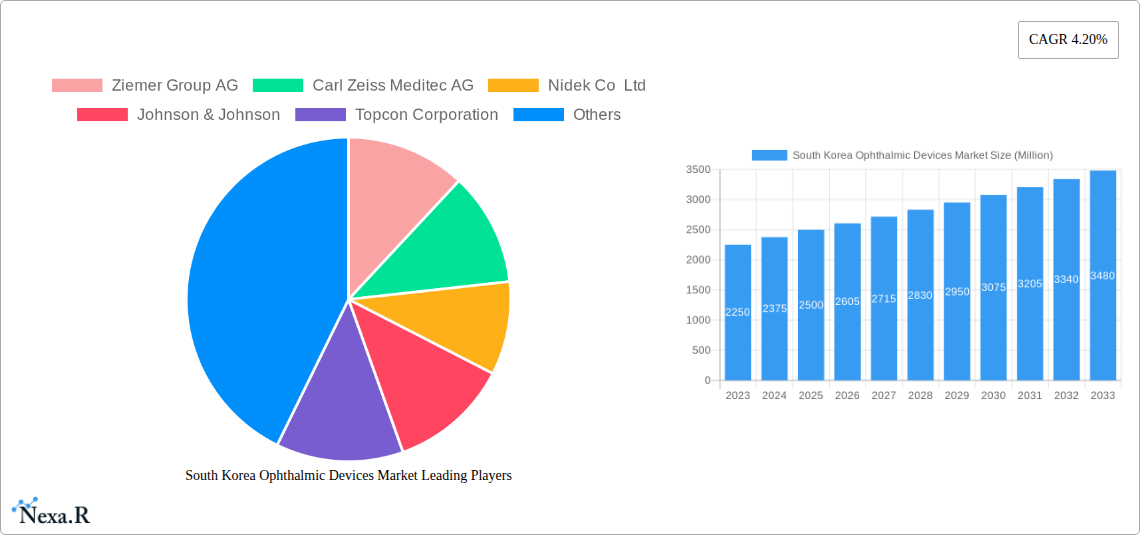

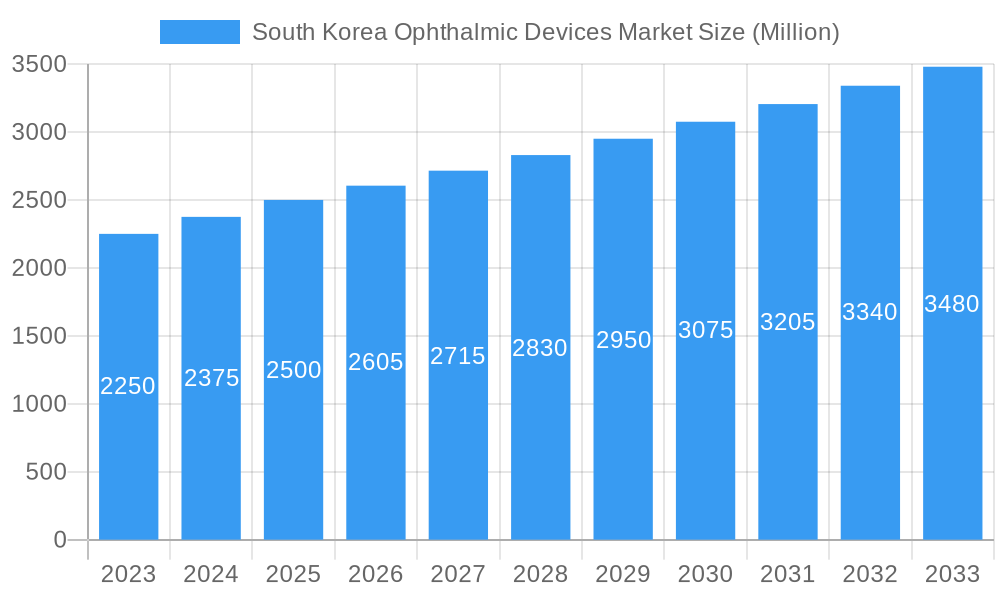

South Korea Ophthalmic Devices Market Market Size (In Billion)

Market segmentation highlights a balanced distribution between diagnostic and monitoring devices and surgical instruments. Within diagnostic offerings, OCT scanners and autorefractors are crucial for their accuracy in identifying subtle ocular structural changes and refractive errors. The surgical segment is led by intraocular lenses (IOLs) and lasers, reflecting the high volume of cataract surgeries. Emerging trends include the integration of artificial intelligence (AI) in diagnostic imaging for early and precise disease detection, and the development of advanced phacoemulsification machines for cataract procedures. However, market challenges include the high cost of advanced ophthalmic equipment, potentially limiting adoption in smaller facilities and emerging regions, and rigorous regulatory approval pathways for new medical devices. Despite these hurdles, the enduring influence of an aging population and continuous innovation are set to sustain the market's upward trajectory.

South Korea Ophthalmic Devices Market Company Market Share

This comprehensive report delivers an in-depth analysis of the South Korean Ophthalmic Devices Market, covering surgical and diagnostic devices. It focuses on key market dynamics, growth trends, regional leadership, product offerings, and competitive strategies. Covering a study period from 2019 to 2033, with 2025 designated as the base and estimated year and a forecast period extending from 2025 to 2033, this report offers strategic insights for stakeholders targeting opportunities within this dynamic sector. Prominent keywords utilized include "South Korea ophthalmic devices," "ophthalmology market," "intraocular lenses," "retina scanners," "ophthalmic lasers," "diabetic retinopathy screening," and "presbyopia treatment."

South Korea Ophthalmic Devices Market Market Dynamics & Structure

The South Korean ophthalmic devices market is characterized by a moderately concentrated structure, driven by continuous technological innovation and a robust healthcare infrastructure. Leading global players such as Ziemer Group AG, Carl Zeiss Meditec AG, Nidek Co Ltd, Johnson & Johnson, Topcon Corporation, Alcon Inc, and Hoya Corporation hold significant market share through their comprehensive portfolios of advanced ophthalmic solutions. Technological innovation is a primary driver, with significant investments in R&D for next-generation surgical devices like advanced intraocular lenses (IOLs) and sophisticated laser systems, as well as cutting-edge diagnostic and monitoring devices such as Optical Coherence Tomography (OCT) scanners and autorefractors.

- Technological Innovation Drivers: Development of AI-powered diagnostic tools, minimally invasive surgical technologies, and personalized treatment solutions.

- Regulatory Frameworks: Stringent but supportive regulatory environment by the Ministry of Food and Drug Safety (MFDS) ensuring product safety and efficacy, which also acts as a barrier for new entrants.

- Competitive Product Substitutes: Increasing adoption of advanced diagnostic imaging and novel treatment modalities are influencing the demand for traditional devices.

- End-User Demographics: A growing aging population, coupled with a high prevalence of lifestyle-related eye conditions like myopia and diabetic retinopathy, fuels market demand.

- M&A Trends: Strategic acquisitions and partnerships are observed as companies aim to expand their product offerings and market reach. While specific deal volumes for the South Korean market are proprietary, global M&A activity in the ophthalmic sector indicates a trend towards consolidation. Innovation barriers include the high cost of advanced R&D and the lengthy approval processes for novel medical devices.

South Korea Ophthalmic Devices Market Growth Trends & Insights

The South Korean ophthalmic devices market is poised for significant growth, driven by a confluence of demographic shifts, technological advancements, and increasing healthcare expenditure. The market size is expected to witness a healthy CAGR of approximately 8.5% during the forecast period (2025-2033), reflecting the rising adoption rates of both surgical and diagnostic ophthalmic equipment. The increasing prevalence of age-related eye conditions, such as cataracts and glaucoma, alongside a growing incidence of diabetic retinopathy due to lifestyle factors, are key determinants of this upward trajectory.

Technological disruptions are continuously reshaping the market. The demand for premium intraocular lenses (IOLs) with enhanced visual outcomes and multifocal capabilities is on the rise, driven by patient expectations for improved quality of life post-surgery. Similarly, advanced diagnostic and monitoring devices, particularly OCT scanners and retinal imaging systems, are witnessing accelerated adoption in ophthalmology clinics and hospitals for early detection and precise monitoring of various eye diseases. This is further amplified by government initiatives promoting preventative healthcare and early disease screening programs.

Consumer behavior is also playing a pivotal role. South Korean consumers are increasingly health-conscious and are willing to invest in advanced eye care solutions. This includes a greater demand for refractive error correction procedures and early intervention for vision-threatening diseases. The burgeoning elderly population, coupled with a generally high awareness of eye health, creates a fertile ground for the sustained growth of the ophthalmic devices market. The market penetration of advanced ophthalmic surgical devices is estimated to reach 65% by 2033, while diagnostic devices are projected to achieve a penetration rate of over 75%. This signifies a mature yet continuously expanding market, where innovation and patient-centric solutions will be paramount.

Dominant Regions, Countries, or Segments in South Korea Ophthalmic Devices Market

The South Korean Ophthalmic Devices Market is predominantly driven by Surgical Devices, with Intraocular Lenses (IOLs) and Lasers emerging as the most impactful sub-segments. Within the broader ophthalmic devices landscape, the sub-segment of Surgical Devices is significantly contributing to market growth, accounting for an estimated 55% of the total market value in 2025. This dominance is fueled by an increasing volume of cataract surgeries, a direct correlation with the aging demographic and heightened demand for improved visual acuity post-operation.

The Intraocular Lenses (IOLs) segment, a critical component of cataract surgery, is experiencing rapid expansion. Advancements in IOL technology, including the development of toric, multifocal, and extended depth of focus (EDOF) lenses, are driving higher adoption rates among patients seeking to correct refractive errors alongside their cataracts. This segment is projected to grow at a CAGR of approximately 9.2% during the forecast period. The market share of premium IOLs is expected to surpass 40% by 2030, reflecting patient willingness to invest in enhanced visual outcomes.

Ophthalmic Lasers, another significant contributor within surgical devices, are crucial for a range of procedures including refractive surgery (LASIK, PRK), glaucoma treatment (SLT, YAG capsulotomy), and retinal photocoagulation. The increasing preference for minimally invasive and precise laser-based treatments, coupled with technological refinements in laser systems for greater efficacy and reduced patient discomfort, propels this segment's growth. The segment is estimated to hold a market share of around 20% of the surgical devices market in 2025.

Diagnostic and Monitoring Devices, while secondary in current market value compared to surgical devices, exhibit robust growth potential, particularly Optical Coherence Tomography (OCT) scanners. These devices are indispensable for the early and accurate diagnosis of a wide spectrum of retinal diseases, including diabetic retinopathy and age-related macular degeneration (AMD). The increasing focus on preventative eye care and early disease detection, supported by government health initiatives, is a major growth catalyst for this segment. The market share for OCT scanners is expected to grow from 25% in 2025 to over 35% by 2033 within the diagnostic devices segment.

Economic policies supporting healthcare infrastructure development and technological adoption, coupled with a highly educated populace receptive to advanced medical treatments, underpin the dominance of these segments. The presence of leading global and domestic manufacturers investing heavily in R&D further solidifies the strong market position of advanced surgical and diagnostic ophthalmic devices in South Korea.

South Korea Ophthalmic Devices Market Product Landscape

The South Korean ophthalmic devices market boasts a sophisticated product landscape characterized by continuous innovation. Leading companies are introducing advanced surgical devices such as premium intraocular lenses offering extended depth of focus and astigmatism correction, alongside sophisticated femtosecond and excimer lasers for precise refractive surgery and glaucoma management. Diagnostic and monitoring devices are witnessing rapid advancements, with high-resolution Optical Coherence Tomography (OCT) scanners providing unparalleled visualization of ocular structures, and automated perimeters enhancing visual field testing. The integration of artificial intelligence in diagnostic software for early disease detection and treatment planning is a key unique selling proposition, improving diagnostic accuracy and treatment efficiency.

Key Drivers, Barriers & Challenges in South Korea Ophthalmic Devices Market

Key Drivers:

- Aging Population: The rapidly aging demographic in South Korea significantly drives the demand for treatments of age-related eye conditions like cataracts and glaucoma.

- Technological Advancements: Continuous innovation in surgical and diagnostic devices, including premium IOLs, advanced lasers, and high-resolution imaging systems, fuels market growth.

- Rising Healthcare Expenditure: Increased government and private spending on healthcare infrastructure and advanced medical technologies supports market expansion.

- Growing Awareness of Eye Health: Heightened public awareness regarding eye care and the importance of early disease detection, especially for conditions like diabetic retinopathy.

Barriers & Challenges:

- High Cost of Advanced Devices: The substantial investment required for state-of-the-art ophthalmic equipment can be a barrier for smaller clinics and hospitals.

- Stringent Regulatory Approvals: The rigorous approval process by the Ministry of Food and Drug Safety (MFDS) can lead to extended market entry timelines for new products.

- Intense Competition: The presence of established global players and a few domestic manufacturers leads to fierce price competition and a need for constant differentiation.

- Skilled Workforce Demand: A continuous need for well-trained ophthalmologists and technicians proficient in operating advanced ophthalmic equipment.

Emerging Opportunities in South Korea Ophthalmic Devices Market

Emerging opportunities in the South Korean ophthalmic devices market lie in the increasing demand for personalized treatment solutions and AI-driven diagnostics. The growing interest in telemedicine and remote patient monitoring for chronic eye conditions presents a significant avenue for growth, especially for diagnostic and monitoring devices. Furthermore, the unmet need for accessible and affordable diabetic retinopathy screening in primary care settings, as highlighted by the launch of innovative imaging devices, offers substantial untapped market potential. Investments in developing user-friendly, portable diagnostic equipment for wider deployment in rural or underserved areas could also unlock significant market share.

Growth Accelerators in the South Korea Ophthalmic Devices Market Industry

Several catalysts are accelerating long-term growth in the South Korean ophthalmic devices industry. Technological breakthroughs in areas like minimally invasive glaucoma surgery (MIGS) and advanced retinal imaging are creating new treatment paradigms and driving device adoption. Strategic partnerships between technology companies and healthcare providers are crucial for integrating AI into ophthalmic workflows, enhancing diagnostic capabilities and patient outcomes. Furthermore, market expansion strategies focusing on expanding the use of ophthalmic devices in preventative healthcare programs and addressing the backlog of elective eye surgeries post-pandemic will play a pivotal role in sustained market expansion.

Key Players Shaping the South Korea Ophthalmic Devices Market Market

- Ziemer Group AG

- Carl Zeiss Meditec AG

- Nidek Co Ltd

- Johnson & Johnson

- Topcon Corporation

- Alcon Inc

- Hoya Corporation

Notable Milestones in South Korea Ophthalmic Devices Market Sector

- July 2022: Baxter launched its Welch Allyn RetinaVue 100 Imager PRO in South Korea, designed for simple and affordable diabetic retinopathy screening in primary care settings.

- May 2022: Visus Therapeutics Inc. and Zhaoke Ophthalmology Limited announced an exclusive licensing agreement to commercialize BRIMOCHOL PF and Carbachol PF in South Korea for the treatment of presbyopia.

In-Depth South Korea Ophthalmic Devices Market Market Outlook

The future outlook for the South Korean ophthalmic devices market is exceptionally positive, driven by a robust demand for advanced treatments and diagnostics. Growth accelerators include the continuous innovation in AI-powered diagnostic tools, the expanding use of minimally invasive surgical techniques, and the increasing patient preference for premium ophthalmic solutions that enhance quality of life. Strategic opportunities lie in developing integrated platforms that seamlessly combine diagnostic imaging, surgical planning, and post-operative monitoring, fostering a comprehensive approach to eye care. The market's trajectory indicates sustained growth, presenting a compelling landscape for stakeholders focused on patient-centric innovation and technological integration in ophthalmology.

South Korea Ophthalmic Devices Market Segmentation

-

1. Devices

-

1.1. Surgical Devices

- 1.1.1. Glaucoma Devices

- 1.1.2. Intraocular Lenses

- 1.1.3. Lasers

- 1.1.4. Other Surgical Devices

-

1.2. Diagnostic and Monitoring Devices

- 1.2.1. Autorefractors and Keratometers

- 1.2.2. Ophthalmic Ultrasound Imaging Systems

- 1.2.3. Ophthalmoscopes

- 1.2.4. Optical Coherence Tomography Scanners

- 1.2.5. Other Diagnostic and Monitoring Devices

-

1.1. Surgical Devices

South Korea Ophthalmic Devices Market Segmentation By Geography

- 1. South Korea

South Korea Ophthalmic Devices Market Regional Market Share

Geographic Coverage of South Korea Ophthalmic Devices Market

South Korea Ophthalmic Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Eye Disorders; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Risk Associated with Ophthalmic Procedures

- 3.4. Market Trends

- 3.4.1. Lasers Segment is Expected to Show Better Growth during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Ophthalmic Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 5.1.1. Surgical Devices

- 5.1.1.1. Glaucoma Devices

- 5.1.1.2. Intraocular Lenses

- 5.1.1.3. Lasers

- 5.1.1.4. Other Surgical Devices

- 5.1.2. Diagnostic and Monitoring Devices

- 5.1.2.1. Autorefractors and Keratometers

- 5.1.2.2. Ophthalmic Ultrasound Imaging Systems

- 5.1.2.3. Ophthalmoscopes

- 5.1.2.4. Optical Coherence Tomography Scanners

- 5.1.2.5. Other Diagnostic and Monitoring Devices

- 5.1.1. Surgical Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ziemer Group AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carl Zeiss Meditec AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nidek Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson & Johnson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Topcon Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alcon Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hoya Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Ziemer Group AG

List of Figures

- Figure 1: South Korea Ophthalmic Devices Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Ophthalmic Devices Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Ophthalmic Devices Market Revenue billion Forecast, by Devices 2020 & 2033

- Table 2: South Korea Ophthalmic Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 3: South Korea Ophthalmic Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Korea Ophthalmic Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: South Korea Ophthalmic Devices Market Revenue billion Forecast, by Devices 2020 & 2033

- Table 6: South Korea Ophthalmic Devices Market Volume K Unit Forecast, by Devices 2020 & 2033

- Table 7: South Korea Ophthalmic Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: South Korea Ophthalmic Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Ophthalmic Devices Market?

The projected CAGR is approximately 13.71%.

2. Which companies are prominent players in the South Korea Ophthalmic Devices Market?

Key companies in the market include Ziemer Group AG, Carl Zeiss Meditec AG, Nidek Co Ltd, Johnson & Johnson, Topcon Corporation, Alcon Inc, Hoya Corporation.

3. What are the main segments of the South Korea Ophthalmic Devices Market?

The market segments include Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.25 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Eye Disorders; Technological Advancements.

6. What are the notable trends driving market growth?

Lasers Segment is Expected to Show Better Growth during the Forecast Period.

7. Are there any restraints impacting market growth?

Risk Associated with Ophthalmic Procedures.

8. Can you provide examples of recent developments in the market?

In July 2022, Baxter launched its Welch Allyn RetinaVue 100 Imager PRO in South Korea. The device was designed to make diabetic retinopathy screening simple and affordable in primary care settings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Ophthalmic Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Ophthalmic Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Ophthalmic Devices Market?

To stay informed about further developments, trends, and reports in the South Korea Ophthalmic Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence