Key Insights

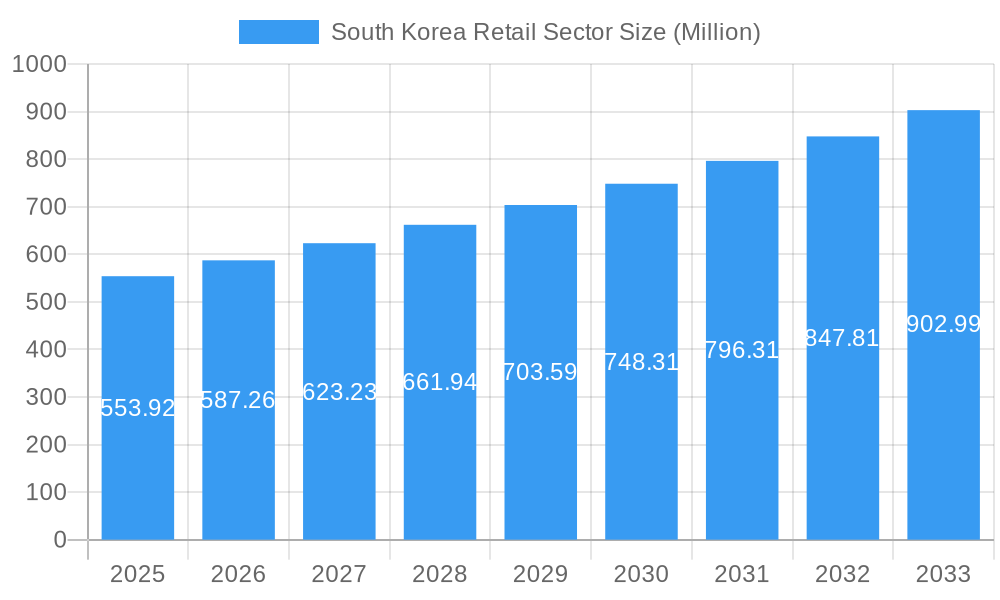

The South Korean retail sector, valued at $553.92 million in 2025, is projected to experience robust growth, driven by a rising middle class with increasing disposable incomes and a shift towards e-commerce and omnichannel strategies. Key drivers include the expanding popularity of online shopping platforms, the increasing adoption of mobile payment systems, and a growing preference for convenient, personalized retail experiences. The market's expansion is further fueled by the increasing penetration of foreign retail giants alongside the continuous innovation and expansion of domestic players. Competition is fierce, with established players like Lotte Mart, E-Mart, and Homeplus vying for market share alongside smaller, specialized retailers and burgeoning e-commerce businesses. However, challenges such as high real estate costs in major urban areas and evolving consumer preferences represent potential restraints on market growth. The sector is segmented by various retail formats, including hypermarkets, supermarkets, convenience stores, department stores, and online retailers, each catering to specific consumer needs and preferences. Future growth will likely depend on the ability of retailers to adapt to shifting consumer demographics, leverage technological advancements, and enhance customer experience to maintain a competitive edge.

South Korea Retail Sector Market Size (In Million)

The forecast period (2025-2033) anticipates a consistent Compound Annual Growth Rate (CAGR) of 5.68%, indicating a steady expansion of the South Korean retail market. This growth will be shaped by the continuous evolution of consumer behavior, technological advancements impacting retail operations and customer engagement, and ongoing investments in logistics and infrastructure. While the dominance of established players is expected to continue, emerging trends, such as the rise of social commerce and the growing importance of sustainability in retail practices, present both opportunities and challenges for both established and new entrants. Successful navigation of these factors will determine the future landscape of the South Korean retail sector.

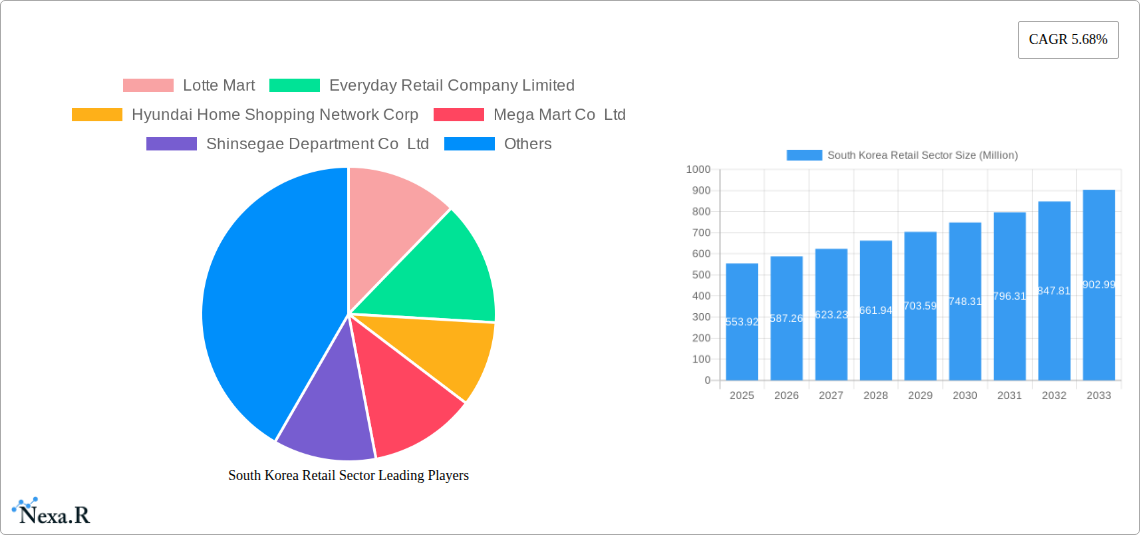

South Korea Retail Sector Company Market Share

South Korea Retail Sector: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the South Korean retail sector, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for businesses operating in or seeking to enter the dynamic South Korean retail landscape. It leverages extensive market research and data analysis to provide actionable insights across various retail segments, including supermarkets, department stores, convenience stores, and e-commerce.

South Korea Retail Sector Market Dynamics & Structure

The South Korean retail market is characterized by a complex interplay of factors, including high market concentration among major players, rapid technological innovation, a robust regulatory framework, and increasing competitive pressures from both domestic and international brands. The market is segmented into supermarkets, hypermarkets, department stores, convenience stores, e-commerce, and specialty retail. M&A activity has been moderate in recent years, primarily focused on consolidation within specific segments.

- Market Concentration: The top five players (Lotte Mart, E-Mart Inc, Homeplus Co Ltd, Shinsegae Department Co Ltd, and Hyundai Home Shopping Network Corp) hold an estimated xx% market share in 2025, indicating a moderately concentrated market.

- Technological Innovation: The adoption of e-commerce, omnichannel strategies, and advanced analytics is driving significant innovation. However, barriers remain, including high initial investment costs and a reliance on established infrastructure.

- Regulatory Framework: The government actively regulates various aspects of retail operations, impacting pricing, product standards, and business practices. These regulations can present both opportunities and challenges for businesses.

- Competitive Product Substitutes: The rise of e-commerce and online marketplaces presents a significant competitive threat to traditional brick-and-mortar retailers.

- End-User Demographics: South Korea's aging population and changing consumer preferences are influencing retail strategies, favoring convenience, online shopping, and personalized experiences.

- M&A Trends: While significant M&A activity is not prevalent, strategic partnerships and joint ventures are common, particularly in the expansion of e-commerce and omnichannel strategies. The number of deals in the historical period (2019-2024) was approximately xx, with a total value of xx million USD.

South Korea Retail Sector Growth Trends & Insights

The South Korean retail market is poised for significant expansion, projecting robust growth throughout the forecast period (2025-2033). This upward trajectory is fueled by a confluence of factors, including consistently rising disposable incomes, increasing urbanization, and a dynamic evolution in consumer preferences. The market size is anticipated to reach an impressive [Insert Projected Market Size in Million Units] million units by 2033, demonstrating a compelling Compound Annual Growth Rate (CAGR) of [Insert Projected CAGR]% from 2025. The digital transformation of retail is accelerating, with the adoption rate of e-commerce continuing its upward climb, fundamentally reshaping the market landscape. Furthermore, technological innovations, such as sophisticated mobile payment systems and AI-driven personalization engines, are profoundly influencing consumer behavior. Today's South Korean consumers are actively seeking heightened convenience, highly personalized shopping experiences, and seamless omnichannel journeys that bridge the gap between online and offline retail channels.

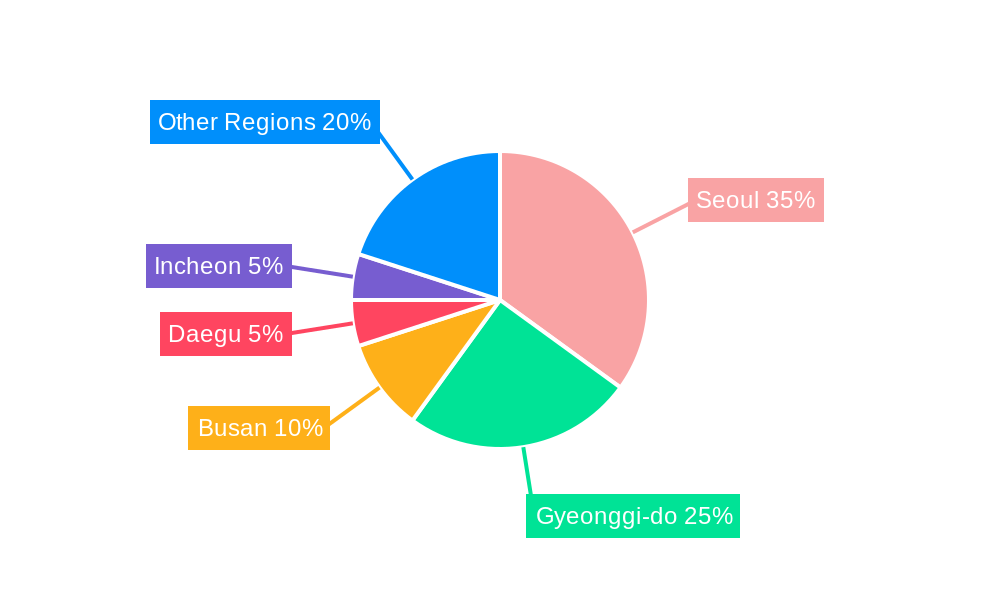

Dominant Regions, Countries, or Segments in South Korea Retail Sector

The Seoul metropolitan area continues to solidify its position as the undisputed epicenter of South Korean retail activity. This dominance is attributed to its high population density, robust consumer spending power, and an exceptionally developed and sophisticated infrastructure that supports seamless retail operations. Beyond Seoul, other major urban centers across the nation are also making substantial contributions to the overall market growth.

- Key Drivers of Regional Dominance: The region benefits from sustained strong economic growth, substantial investment in infrastructure development, a high concentration of consumers with significant spending power, and proactive government policies that actively encourage and support retail expansion.

- Factors Contributing to Dominance: The concentration of population, combined with high purchasing power, well-established and efficient supply chains, and ready access to cutting-edge retail technologies, all contribute to Seoul's leading role.

- Growth Potential Beyond the Core: While Seoul will undoubtedly remain a powerhouse, smaller cities and emerging regions present considerable untapped growth opportunities. This is particularly true with the ongoing expansion of e-commerce and the successful implementation of innovative omnichannel strategies that extend reach and accessibility. The projected market size for the Seoul region alone in 2033 is estimated at [Insert Seoul Region Market Size in Million Units] million units, representing approximately [Insert Seoul Region Percentage]% of the national market.

South Korea Retail Sector Product Landscape

The South Korean retail sector is characterized by an exceptionally diverse and dynamic product landscape, catering to every consumer need and desire. This spectrum ranges from essential everyday groceries and cutting-edge consumer electronics to exclusive luxury goods and the latest in fashion apparel. Product innovation is a constant, driven by an unceasing consumer demand for enhanced convenience, superior quality, and exceptional value for money. Technological advancements are actively integrated to optimize retail operations; for instance, smart shelves are revolutionizing inventory management, and RFID tracking is enhancing supply chain efficiency. To thrive in this highly competitive environment, many retailers are differentiating themselves through unique selling propositions. These often include forging exclusive partnerships with renowned international brands, offering highly personalized shopping experiences tailored to individual preferences, and implementing sophisticated loyalty programs designed to foster customer retention and engagement.

Key Drivers, Barriers & Challenges in South Korea Retail Sector

Key Drivers:

- Sustained increase in disposable incomes and a consistent rise in overall consumer spending.

- Ongoing urbanization and the resulting concentration of population in major metropolitan areas.

- Rapid technological advancements, driving the widespread adoption of e-commerce and sophisticated omnichannel retail strategies.

- Supportive government policies aimed at stimulating economic growth and facilitating retail sector expansion.

Key Challenges & Restraints:

- Intense and escalating competition from a wide array of both domestic and prominent international retailers.

- Elevated operating costs, encompassing significant expenditures on prime retail rents, labor, and complex logistics.

- Vulnerability to economic fluctuations and geopolitical uncertainties, which can adversely impact consumer confidence and spending patterns.

- Potential for supply chain disruptions, exacerbated by global economic volatility and the risk of geopolitical instability. For example, supply chain issues led to a notable [Insert Percentage]% increase in import costs in 2022.

Emerging Opportunities in South Korea Retail Sector

- Expansion of e-commerce and omnichannel strategies into smaller cities and regions.

- Growth of niche markets and specialized retail formats.

- Increasing adoption of mobile payments and other digital technologies.

- Focus on personalization and customized shopping experiences.

- Growing demand for sustainable and eco-friendly products.

Growth Accelerators in the South Korea Retail Sector Industry

Continued technological innovation, particularly in e-commerce, omnichannel retailing, and AI-powered personalization, will be crucial growth drivers. Strategic partnerships and joint ventures between domestic and international retailers will also contribute to market expansion. Furthermore, investment in infrastructure, particularly logistics and supply chain enhancements, will create further efficiencies and boost overall growth.

Key Players Shaping the South Korea Retail Sector Market

- Lotte Mart

- Everyday Retail Company Limited

- Hyundai Home Shopping Network Corp

- Mega Mart Co Ltd

- Shinsegae Department Co Ltd

- 7-Eleven

- E-Mart Inc

- Costco Wholesale Korea Ltd

- Homeplus Co Ltd

- Grand Department Store Co Ltd*

- Five Guys

*List Not Exhaustive

Notable Milestones in South Korea Retail Sector

- September 2023: Lotte Mart unveiled the creation of specialized shopping zones meticulously designed for non-Korean tourists at select store locations. This strategic initiative aims to tap into a growing segment of international consumers and significantly enhance the retailer's global appeal.

- June 2023: The renowned US burger chain, Five Guys, celebrated the grand opening of its inaugural South Korean store in Seoul. This landmark entry signifies the expansion of a prominent international player into the market, further intensifying the competition within the quick-service restaurant (QSR) segment.

In-Depth South Korea Retail Sector Market Outlook

The South Korean retail market is poised for continued growth, fueled by technological advancements, evolving consumer preferences, and strategic investments by both domestic and international players. Opportunities abound in e-commerce, omnichannel strategies, and niche market segments. Retailers who embrace innovation, personalize the shopping experience, and prioritize efficient supply chains will be best positioned to capitalize on future market potential. The long-term outlook is positive, with significant growth projected throughout the forecast period, offering substantial opportunities for investors and businesses alike.

South Korea Retail Sector Segmentation

-

1. Product Type

- 1.1. Food, Beverage, and Tobacco Products

- 1.2. Personal Care and Household

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

- 1.7. Pharmaceuticals and Luxury Goods

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

South Korea Retail Sector Segmentation By Geography

- 1. South Korea

South Korea Retail Sector Regional Market Share

Geographic Coverage of South Korea Retail Sector

South Korea Retail Sector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products

- 3.3. Market Restrains

- 3.3.1. Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products

- 3.4. Market Trends

- 3.4.1. Growing E-Commerce is Driving the Retail Market in South Korea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Retail Sector Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food, Beverage, and Tobacco Products

- 5.1.2. Personal Care and Household

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.1.7. Pharmaceuticals and Luxury Goods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lotte Mart

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Everyday Retail Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Home Shopping Network Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mega Mart Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shinsegae Department Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 7-Eleven

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 E-Mart Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Costco Wholesale Korea Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Homeplus Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grand Department Store Co Ltd*

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Five Guys**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Lotte Mart

List of Figures

- Figure 1: South Korea Retail Sector Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Retail Sector Share (%) by Company 2025

List of Tables

- Table 1: South Korea Retail Sector Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: South Korea Retail Sector Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: South Korea Retail Sector Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South Korea Retail Sector Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: South Korea Retail Sector Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South Korea Retail Sector Volume Billion Forecast, by Region 2020 & 2033

- Table 7: South Korea Retail Sector Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: South Korea Retail Sector Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: South Korea Retail Sector Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: South Korea Retail Sector Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South Korea Retail Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South Korea Retail Sector Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Retail Sector?

The projected CAGR is approximately 5.68%.

2. Which companies are prominent players in the South Korea Retail Sector?

Key companies in the market include Lotte Mart, Everyday Retail Company Limited, Hyundai Home Shopping Network Corp, Mega Mart Co Ltd, Shinsegae Department Co Ltd, 7-Eleven, E-Mart Inc, Costco Wholesale Korea Ltd, Homeplus Co Ltd, Grand Department Store Co Ltd*, Five Guys**List Not Exhaustive.

3. What are the main segments of the South Korea Retail Sector?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 553.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products.

6. What are the notable trends driving market growth?

Growing E-Commerce is Driving the Retail Market in South Korea.

7. Are there any restraints impacting market growth?

Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products.

8. Can you provide examples of recent developments in the market?

September 2023: Lotte Mart, a South Korean supermarket retail store chain, announced that it will create a unique shopping zone for non-Korean tourists at its stores that travelers and tourists frequently visit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Retail Sector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Retail Sector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Retail Sector?

To stay informed about further developments, trends, and reports in the South Korea Retail Sector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence