Key Insights

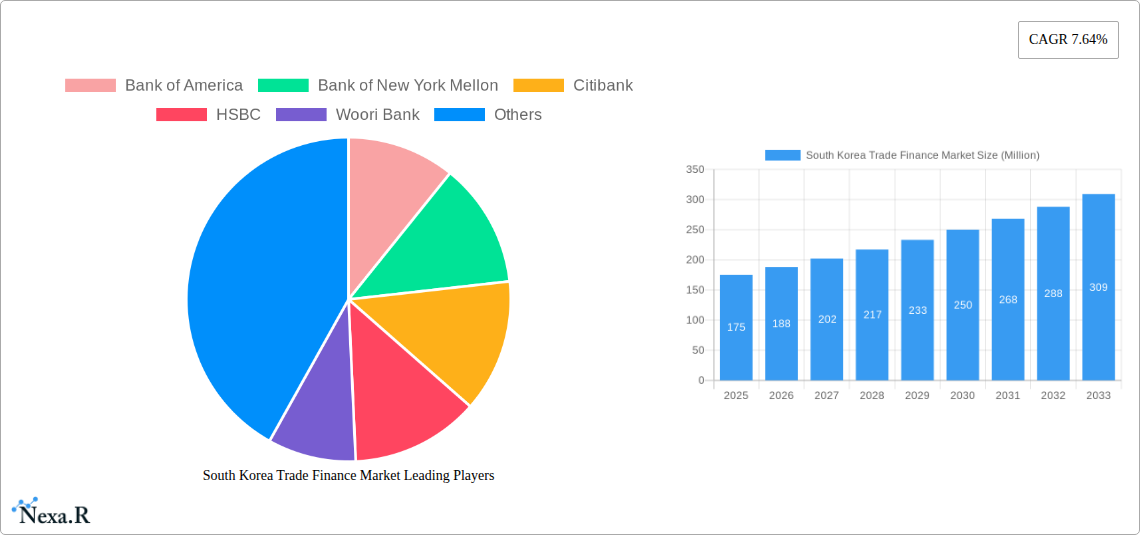

The South Korean trade finance market is projected for significant expansion, driven by a strong Compound Annual Growth Rate (CAGR) of 5.63% from 2025 to 2033. With an estimated market size of $1.1 billion in 2025, growth is fueled by South Korea's dynamic export-driven economy, increasing integration into global supply chains, and government support for SMEs in international trade. Technological advancements, including blockchain and fintech solutions, are enhancing transaction speed and security, further contributing to market development. Key drivers include South Korea's robust export performance and its increasing role in global trade networks. Challenges include global economic volatility and potential shifts in export demand. The market is segmented by financial instruments, transaction types, and customer segments. Leading players include international institutions like Bank of America, Bank of New York Mellon, Citibank, and HSBC, alongside prominent Korean banks such as Woori Bank, Hana Bank, Nonghyup Bank, Shinhan Bank, and KB Kookmin Bank.

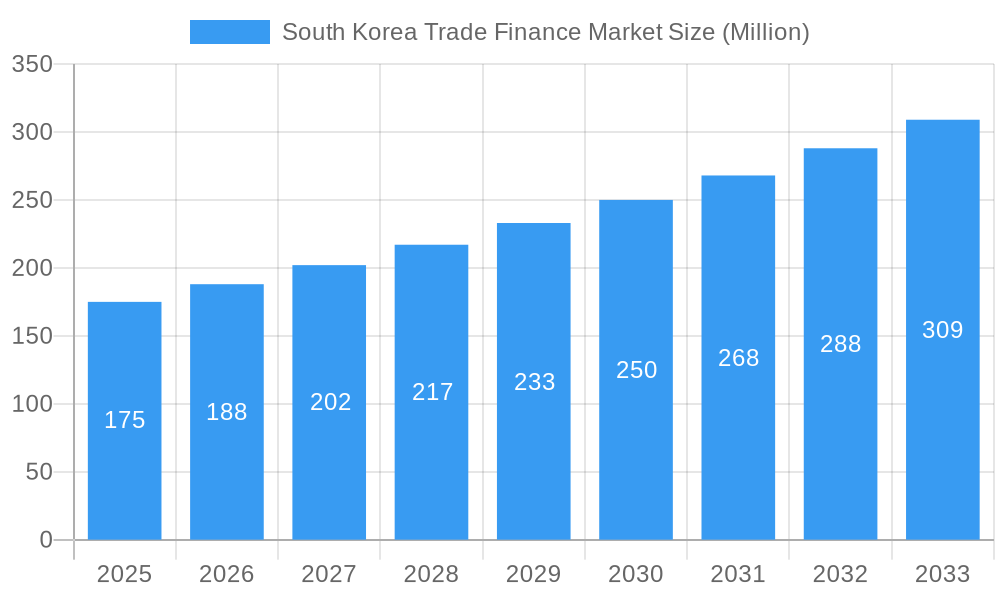

South Korea Trade Finance Market Market Size (In Billion)

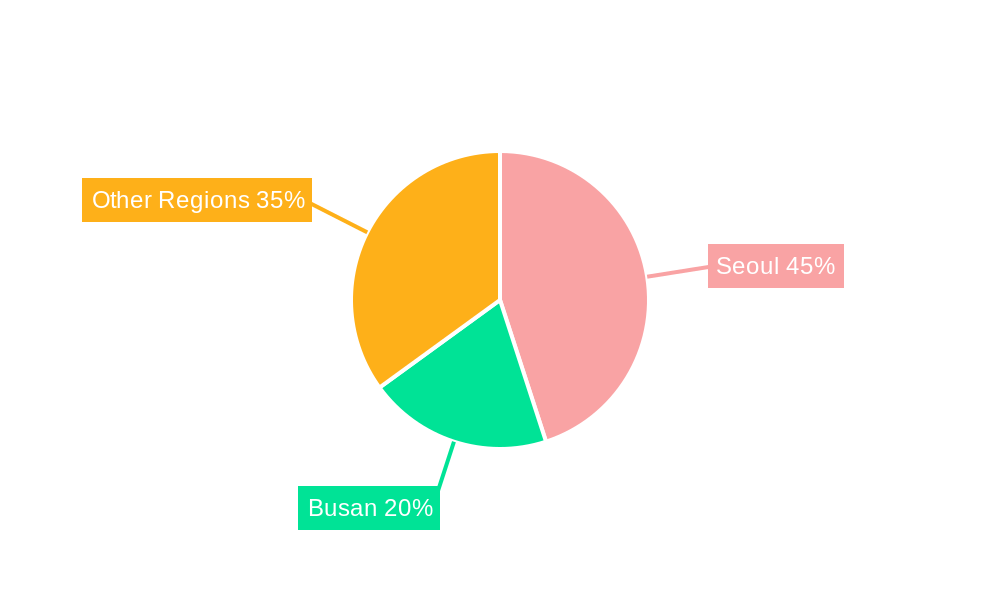

Market presence is expected to remain concentrated in major trade hubs like Seoul and Busan. The competitive environment features both international and domestic banks, with local institutions leveraging their understanding of the Korean market and established business relationships. The forecast period anticipates continued growth powered by rising cross-border transactions, trade facilitation initiatives, and the digital transformation of trade finance. Strategic collaborations between financial institutions and technology providers will be pivotal in shaping the market's future.

South Korea Trade Finance Market Company Market Share

South Korea Trade Finance Market: 2019-2033 Forecast & Analysis

This comprehensive report provides a detailed analysis of the South Korea trade finance market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this dynamic market. The report leverages extensive primary and secondary research to deliver actionable insights into the parent market (Financial Services) and its child market (Trade Finance) in South Korea.

South Korea Trade Finance Market Dynamics & Structure

The South Korea trade finance market is characterized by a moderate level of concentration, with both domestic and international players vying for market share. Key factors influencing market dynamics include technological innovation, stringent regulatory frameworks, the emergence of competitive substitutes (e.g., fintech solutions), evolving end-user demographics (particularly among SMEs), and ongoing M&A activity. The market's structure reflects a blend of traditional banking models and the increasing adoption of digital solutions.

- Market Concentration: The top 5 banks (Woori Bank, Hana Bank, Nonghyup Bank, Shinhan Bank, KB Kookmin Bank) collectively hold an estimated 60% market share in 2025.

- Technological Innovation: Blockchain technology and AI are gradually being integrated, but adoption remains relatively slow due to regulatory hurdles and legacy systems.

- Regulatory Framework: Stringent regulations, particularly concerning AML/KYC compliance, significantly impact operational costs and market entry barriers.

- Competitive Product Substitutes: Fintech companies are offering innovative solutions, creating competitive pressure for traditional banks.

- M&A Trends: The number of M&A deals in the sector averaged 5 per year during 2019-2024, with deal values ranging from xx Million to xx Million.

- End-User Demographics: SMEs represent a significant but underserved segment, presenting both opportunities and challenges.

South Korea Trade Finance Market Growth Trends & Insights

The South Korea trade finance market experienced robust growth during the historical period (2019-2024), driven by increasing international trade and government initiatives to support export-oriented industries. The market size reached xx Million in 2024 and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is fueled by the increasing adoption of digital trade finance solutions, expanding e-commerce activities, and government support for SMEs' international expansion. However, global economic uncertainties and geopolitical risks could pose potential headwinds. Market penetration of digital solutions is expected to increase from xx% in 2024 to xx% by 2033. Technological disruptions, such as the rising use of blockchain and AI, are reshaping the competitive landscape, while shifting consumer behavior towards digital platforms continues to drive adoption rates.

Dominant Regions, Countries, or Segments in South Korea Trade Finance Market

The Seoul metropolitan area dominates the South Korea trade finance market, accounting for approximately 65% of the total market value in 2025. This dominance is attributed to the high concentration of businesses, financial institutions, and international trade activities in the region. Other key regions include Busan and Incheon, which benefit from their strategic port locations.

- Key Drivers:

- Robust export-oriented economy.

- Well-developed financial infrastructure.

- Government initiatives promoting trade and investment.

- Presence of major international banks and financial institutions.

- Dominance Factors: Seoul's concentration of businesses and financial institutions, coupled with its advanced infrastructure, contributes significantly to its market leadership.

South Korea Trade Finance Market Product Landscape

The South Korea trade finance market offers a range of products, including letters of credit, documentary collections, guarantees, and supply chain finance solutions. Recent innovations have focused on integrating digital technologies, such as blockchain and AI, to enhance efficiency, security, and transparency. These digital solutions offer faster processing times, reduced costs, and improved risk management. Key selling propositions include enhanced security, automation, and streamlined workflows.

Key Drivers, Barriers & Challenges in South Korea Trade Finance Market

Key Drivers:

- Increasing international trade volume.

- Government support for export-oriented industries.

- Technological advancements (e.g., blockchain, AI).

- Growing adoption of digital trade finance solutions.

Key Challenges & Restraints:

- Stringent regulations and compliance requirements (e.g., AML/KYC).

- Competition from Fintech companies offering disruptive solutions.

- Potential economic slowdown impacting trade activity.

- Supply chain disruptions impacting trade finance transactions. These disruptions reduced trade finance volume by an estimated 10% in 2022.

Emerging Opportunities in South Korea Trade Finance Market

- Growth of e-commerce and cross-border transactions.

- Increasing demand for supply chain finance solutions.

- Untapped potential in the SME segment.

- Opportunities for innovative fintech solutions that offer enhanced security and efficiency.

Growth Accelerators in the South Korea Trade Finance Market Industry

Strategic partnerships between banks and Fintech companies will play a crucial role in driving long-term growth, alongside technological innovation focused on enhancing the efficiency and security of trade finance transactions. Government initiatives promoting digitalization and financial inclusion will further accelerate market expansion.

Key Players Shaping the South Korea Trade Finance Market Market

- Bank of America

- Bank of New York Mellon

- Citibank

- HSBC

- Woori Bank

- Hana Bank

- Nonghyup Bank

- Shinhan Bank

- BNP Paribas

- KB Kookmin Bank

Notable Milestones in South Korea Trade Finance Market Sector

- May 2022: Shinhan Bank launches S-TBML, a big data-driven AML system to enhance competitiveness in the global trade finance market.

- 2021: UK exporters secured over £70 million in sales to South Korea through government-supported trade fairs, showcasing goods like offshore wind technologies and hydrogen fuel cells.

In-Depth South Korea Trade Finance Market Market Outlook

The South Korea trade finance market is poised for sustained growth, driven by the increasing adoption of digital technologies and government support for trade and investment. Strategic partnerships and technological innovation will be crucial for companies to thrive in this competitive landscape. The market's potential lies in leveraging digitalization to cater to the growing needs of SMEs and further enhancing the efficiency and security of trade finance transactions.

South Korea Trade Finance Market Segmentation

-

1. Service Provider

- 1.1. Banks

- 1.2. Trade Finance Companies

- 1.3. Insurance Companies

- 1.4. Others

-

2. Application

- 2.1. Domestic

- 2.2. International

South Korea Trade Finance Market Segmentation By Geography

- 1. South Korea

South Korea Trade Finance Market Regional Market Share

Geographic Coverage of South Korea Trade Finance Market

South Korea Trade Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Exports Activities Is Booming the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Trade Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Provider

- 5.1.1. Banks

- 5.1.2. Trade Finance Companies

- 5.1.3. Insurance Companies

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Service Provider

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bank of America

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bank of New York Mellon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Citibank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HSBC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Woori Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hana Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nonghyup Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shinhan Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BNP Paribas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 KB Kookmin Bank**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bank of America

List of Figures

- Figure 1: South Korea Trade Finance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Trade Finance Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Trade Finance Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 2: South Korea Trade Finance Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: South Korea Trade Finance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Korea Trade Finance Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 5: South Korea Trade Finance Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: South Korea Trade Finance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Trade Finance Market?

The projected CAGR is approximately 5.63%.

2. Which companies are prominent players in the South Korea Trade Finance Market?

Key companies in the market include Bank of America, Bank of New York Mellon, Citibank, HSBC, Woori Bank, Hana Bank, Nonghyup Bank, Shinhan Bank, BNP Paribas, KB Kookmin Bank**List Not Exhaustive.

3. What are the main segments of the South Korea Trade Finance Market?

The market segments include Service Provider, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.1 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Exports Activities Is Booming the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2022, To increase its competitiveness in the global trade finance market, Korea's Shinhan Bank introduces S-TBML. A big data-driven anti-money laundering (AML) system has been implemented by Shinhan Bank in South Korea to identify questionable trade transactions and boost its competitiveness in the global trade financing market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Trade Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Trade Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Trade Finance Market?

To stay informed about further developments, trends, and reports in the South Korea Trade Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence