Key Insights

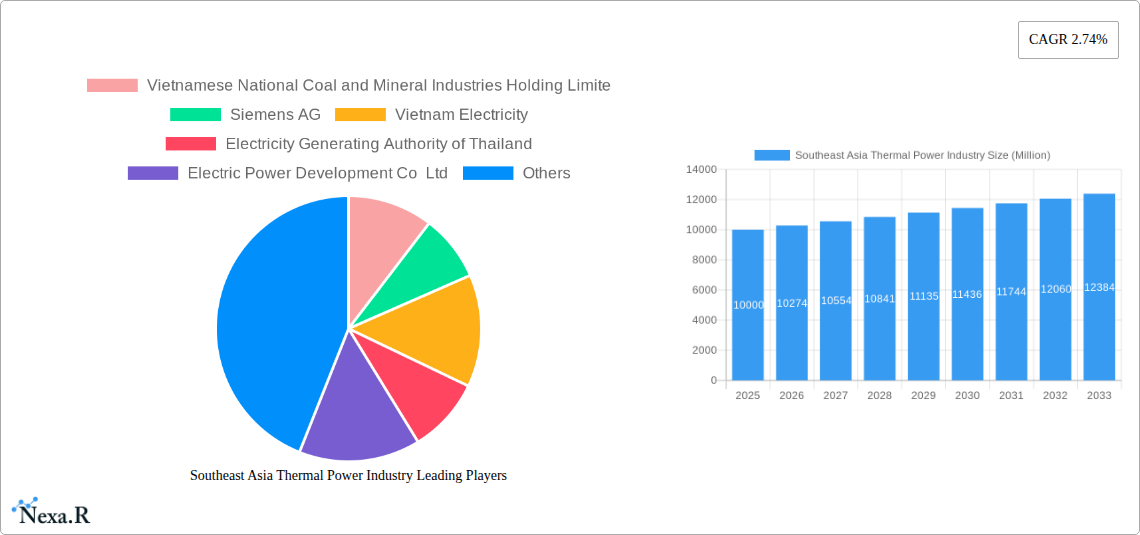

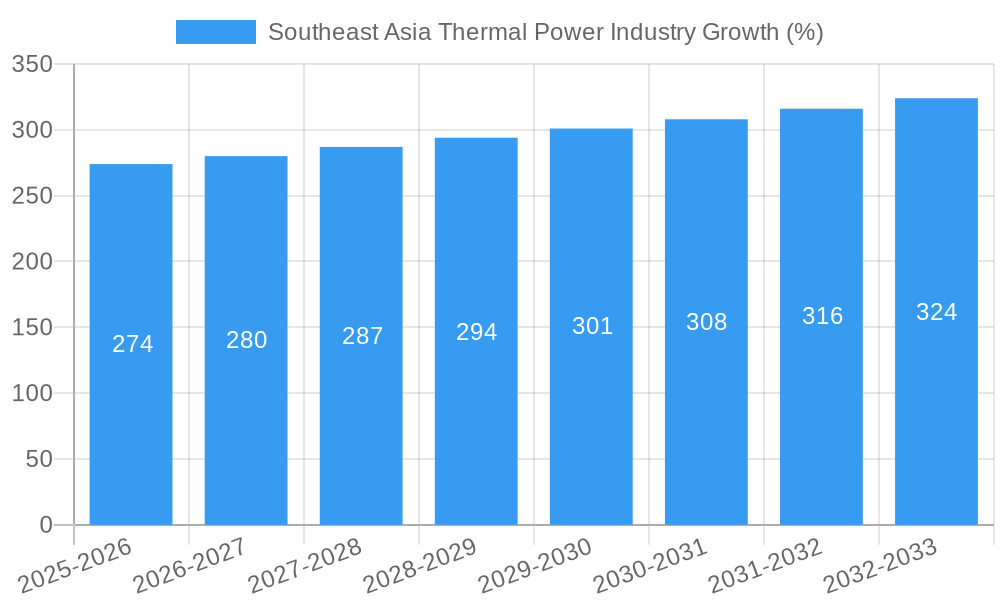

The Southeast Asia thermal power industry, currently valued at approximately $XX million (estimated based on provided CAGR and market trends), is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 2.74% from 2025 to 2033. This growth is driven primarily by increasing energy demand fueled by rapid industrialization and urbanization across the region, particularly in countries like China, India, and Indonesia. Furthermore, the region's ongoing infrastructure development projects necessitate a reliable and readily available energy source, making thermal power plants a crucial component of the energy mix. However, growing environmental concerns surrounding greenhouse gas emissions and air pollution are placing significant pressure on the industry. The transition towards cleaner energy sources like renewables is a major restraining factor, alongside increasing regulatory scrutiny and stricter environmental standards. The market is segmented by fuel source (oil, natural gas, coal, bioenergy, and nuclear) and cycle type (open and closed cycle), with coal currently dominating the fuel mix but gradually losing market share to natural gas and, increasingly, renewable sources. Key players like Vietnam Electricity, Electricity Generating Authority of Thailand, and others are navigating this dynamic landscape, balancing the need for reliable power generation with the imperative of environmental sustainability through investments in higher-efficiency technologies and exploring diversification strategies.

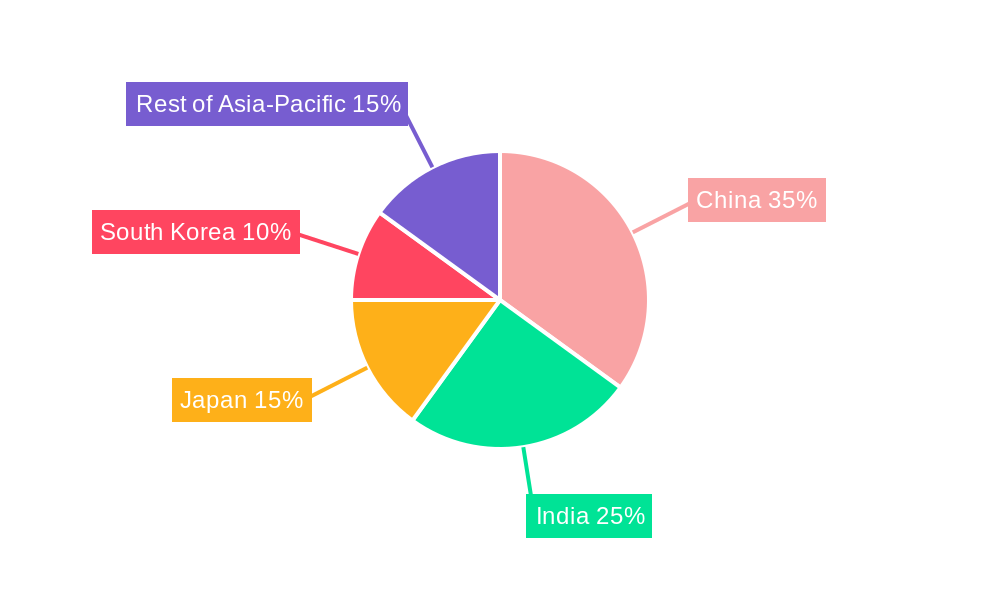

The Asia-Pacific region, specifically countries like China, India, Japan, and South Korea, accounts for a significant portion of the Southeast Asian thermal power market. The competitive landscape involves both domestic and international players, including Siemens AG and General Electric, reflecting the significant investment and technological advancements necessary within this sector. Future market projections indicate a continued albeit slower growth rate, reflecting the intensifying global push towards decarbonization. Strategies focused on improving efficiency, incorporating carbon capture technologies, and integrating renewable energy sources within existing thermal power plants are likely to gain prominence in shaping the industry's future trajectory. The balance between meeting the region's energy demands and mitigating the environmental impact of thermal power generation will be a critical factor determining the sector's long-term growth and profitability.

Southeast Asia Thermal Power Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Southeast Asia thermal power industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and policymakers seeking insights into this dynamic and crucial sector.

Keywords: Southeast Asia thermal power, thermal power plants, coal power, gas power, renewable energy, power generation, electricity generation, energy market, power sector, Vietnam electricity, Thailand electricity, Indonesia power, power plant capacity, energy infrastructure, market analysis, market forecast, Vietnam National Coal and Mineral Industries Holding Limite, Siemens AG, Electricity Generating Authority of Thailand, Electric Power Development Co Ltd, Malakoff Corporation Berhad, General Electric Company, Indonesia Power PT.

Parent Market: Southeast Asia Energy Market Child Market: Thermal Power Generation

Southeast Asia Thermal Power Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Southeast Asia thermal power industry. The market is characterized by a mix of state-owned and privately held companies, with varying levels of market concentration across different countries.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players in each country, alongside numerous smaller independent power producers (IPPs). Market share data for key players will be provided in the full report. For example, in Vietnam, Vietnam Electricity holds a significant market share.

- Technological Innovation: The industry is witnessing a gradual shift towards more efficient technologies like combined cycle gas turbines (CCGTs), driven by factors such as improving fuel efficiency and reducing emissions. However, innovation is challenged by high upfront capital costs and limited technological expertise in some regions.

- Regulatory Frameworks: Each country in Southeast Asia has its own regulatory framework governing the power sector, leading to variations in licensing, pricing, and environmental standards. This complexity affects investment decisions and market entry for new players.

- Competitive Product Substitutes: The increasing adoption of renewable energy sources like solar and wind poses a significant challenge to thermal power. The pace of renewable energy integration varies across the region.

- End-User Demographics: The demand for thermal power is driven primarily by industrial and residential consumers, with industrial users having higher consumption. The demand growth rate varies depending on the economic development of each country.

- M&A Trends: The industry has witnessed a moderate level of M&A activity in recent years, driven by consolidation among IPPs and efforts to secure fuel supply chains. An estimated xx million USD worth of M&A deals occurred between 2019 and 2024.

Southeast Asia Thermal Power Industry Growth Trends & Insights

The Southeast Asia thermal power market experienced substantial growth during the historical period (2019-2024), driven by rising energy demands and increasing industrialization. The market size is expected to continue growing, although at a moderating pace, during the forecast period (2025-2033). Specific CAGR and penetration rates will be detailed in the complete report. Factors such as the increasing adoption of renewable energy sources, government policies promoting energy efficiency, and the fluctuating prices of fossil fuels significantly influence this growth. The report uses proprietary data and analysis to project future market size and adoption rates across various segments and countries.

Dominant Regions, Countries, or Segments in Southeast Asia Thermal Power Industry

Indonesia, Vietnam, and Thailand are the leading countries in the Southeast Asia thermal power market, primarily due to their larger populations, higher energy demand, and significant industrial activity. Coal historically held the largest market share among energy sources; however, Natural Gas is seeing rapid adoption for new power plants.

By Source:

- Coal: Remains a dominant source, especially in Indonesia and Vietnam. However, its share is expected to decline gradually due to environmental concerns and policy shifts toward cleaner energy sources.

- Natural Gas: Experiencing significant growth, particularly in Thailand and countries with better access to natural gas resources. The October 2022 commissioning of the Gulf SRC power plant in Thailand highlights this trend.

- Oil: Its share in thermal power generation is relatively small compared to coal and natural gas.

- Other Sources: Bioenergy and nuclear power contribute a small but growing percentage to the overall thermal power generation mix.

By Cycle:

- Combined Cycle: The most efficient technology, showing significant growth, particularly in newer power plants.

- Open Cycle: While still in use, it's expected to decline as more efficient combined cycle plants are installed.

Southeast Asia Thermal Power Industry Product Landscape

The thermal power industry in Southeast Asia is characterized by a variety of power generation technologies, primarily focused on improving efficiency and reducing environmental impact. Recent innovations include advanced combined cycle gas turbines, high-efficiency coal plants with carbon capture technologies (though still limited adoption), and optimized boiler designs for improved fuel utilization. These advancements aim to enhance efficiency and reduce emissions, aligning with global sustainability goals.

Key Drivers, Barriers & Challenges in Southeast Asia Thermal Power Industry

Key Drivers:

- Rising Energy Demand: driven by economic growth and population increase.

- Industrialization: particularly in manufacturing and processing sectors.

- Government Investments: in energy infrastructure development.

Key Challenges:

- Fuel Price Volatility: impacting project economics and power pricing.

- Environmental Regulations: imposing stricter emission limits and driving investment in cleaner technologies. The January 2022 Indonesian coal export ban underscores the supply chain risks and the need for diversification.

- Competition from Renewables: increasing pressure on the market share of thermal power.

Emerging Opportunities in Southeast Asia Thermal Power Industry

- CCGT Adoption: Expansion of combined cycle gas turbine plants driven by efficiency and lower emissions.

- Technological Advancements: Adoption of more advanced and efficient technologies like carbon capture utilization and storage (CCUS) where economically feasible.

- Regional Cooperation: Collaboration on cross-border power trade and infrastructure development.

Growth Accelerators in the Southeast Asia Thermal Power Industry Industry

Technological breakthroughs in CCGT efficiency, strategic partnerships to secure fuel supplies, and government support for infrastructure development are key catalysts for long-term growth in the Southeast Asia thermal power industry. These factors, coupled with continued economic growth and industrialization across the region, will create sustained demand for efficient and reliable power generation.

Key Players Shaping the Southeast Asia Thermal Power Industry Market

- Vietnamese National Coal and Mineral Industries Holding Limite

- Siemens AG

- Vietnam Electricity

- Electricity Generating Authority of Thailand

- Electric Power Development Co Ltd

- Malakoff Corporation Berhad

- General Electric Company

- Indonesia Power PT

Notable Milestones in Southeast Asia Thermal Power Industry Sector

- January 2022: Indonesia bans coal exports, impacting power plant operations and highlighting supply chain vulnerabilities.

- October 2022: The 2.7-GW Gulf SRC (GSRC) combined cycle gas-fired power plant commences operations in Thailand, demonstrating a shift towards cleaner fuel sources.

In-Depth Southeast Asia Thermal Power Industry Market Outlook

The Southeast Asia thermal power industry is poised for continued growth, albeit at a moderated pace compared to previous years. The increasing adoption of CCGTs, strategic investments in energy infrastructure, and government policies aiming to balance energy security with environmental sustainability will shape the market's trajectory. Opportunities exist for companies that can adapt to evolving regulatory landscapes, embrace technological advancements, and form strategic partnerships to secure fuel supplies. The forecast period will see a focus on efficiency improvements, diversification of fuel sources, and reduced emissions to meet increasing regional environmental concerns. The market is expected to witness a xx million unit increase in capacity during the forecast period.

Southeast Asia Thermal Power Industry Segmentation

-

1. Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Coal

- 1.4. Other Sources (Bioenergy and Nuclear)

-

2. Cycle

- 2.1. Open Cycle

- 2.2. Closed Cycle

-

3. Geography

- 3.1. Indonesia

- 3.2. Thailand

- 3.3. Malaysia

- 3.4. Vietnam

- 3.5. Philippines

- 3.6. Rest of South East Asia

Southeast Asia Thermal Power Industry Segmentation By Geography

- 1. Indonesia

- 2. Thailand

- 3. Malaysia

- 4. Vietnam

- 5. Philippines

- 6. Rest of South East Asia

Southeast Asia Thermal Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Prominence of Gas in Power Generation4.; Increasing Investments in the Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Volatility of Crude Oil and Natural Gas Prices

- 3.4. Market Trends

- 3.4.1. Coal-Based Thermal Power Plants to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Coal

- 5.1.4. Other Sources (Bioenergy and Nuclear)

- 5.2. Market Analysis, Insights and Forecast - by Cycle

- 5.2.1. Open Cycle

- 5.2.2. Closed Cycle

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Indonesia

- 5.3.2. Thailand

- 5.3.3. Malaysia

- 5.3.4. Vietnam

- 5.3.5. Philippines

- 5.3.6. Rest of South East Asia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.4.2. Thailand

- 5.4.3. Malaysia

- 5.4.4. Vietnam

- 5.4.5. Philippines

- 5.4.6. Rest of South East Asia

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Indonesia Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Oil

- 6.1.2. Natural Gas

- 6.1.3. Coal

- 6.1.4. Other Sources (Bioenergy and Nuclear)

- 6.2. Market Analysis, Insights and Forecast - by Cycle

- 6.2.1. Open Cycle

- 6.2.2. Closed Cycle

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Indonesia

- 6.3.2. Thailand

- 6.3.3. Malaysia

- 6.3.4. Vietnam

- 6.3.5. Philippines

- 6.3.6. Rest of South East Asia

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Thailand Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Oil

- 7.1.2. Natural Gas

- 7.1.3. Coal

- 7.1.4. Other Sources (Bioenergy and Nuclear)

- 7.2. Market Analysis, Insights and Forecast - by Cycle

- 7.2.1. Open Cycle

- 7.2.2. Closed Cycle

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Indonesia

- 7.3.2. Thailand

- 7.3.3. Malaysia

- 7.3.4. Vietnam

- 7.3.5. Philippines

- 7.3.6. Rest of South East Asia

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Malaysia Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Oil

- 8.1.2. Natural Gas

- 8.1.3. Coal

- 8.1.4. Other Sources (Bioenergy and Nuclear)

- 8.2. Market Analysis, Insights and Forecast - by Cycle

- 8.2.1. Open Cycle

- 8.2.2. Closed Cycle

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Indonesia

- 8.3.2. Thailand

- 8.3.3. Malaysia

- 8.3.4. Vietnam

- 8.3.5. Philippines

- 8.3.6. Rest of South East Asia

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Vietnam Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Oil

- 9.1.2. Natural Gas

- 9.1.3. Coal

- 9.1.4. Other Sources (Bioenergy and Nuclear)

- 9.2. Market Analysis, Insights and Forecast - by Cycle

- 9.2.1. Open Cycle

- 9.2.2. Closed Cycle

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Indonesia

- 9.3.2. Thailand

- 9.3.3. Malaysia

- 9.3.4. Vietnam

- 9.3.5. Philippines

- 9.3.6. Rest of South East Asia

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Philippines Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Oil

- 10.1.2. Natural Gas

- 10.1.3. Coal

- 10.1.4. Other Sources (Bioenergy and Nuclear)

- 10.2. Market Analysis, Insights and Forecast - by Cycle

- 10.2.1. Open Cycle

- 10.2.2. Closed Cycle

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Indonesia

- 10.3.2. Thailand

- 10.3.3. Malaysia

- 10.3.4. Vietnam

- 10.3.5. Philippines

- 10.3.6. Rest of South East Asia

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Rest of South East Asia Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Source

- 11.1.1. Oil

- 11.1.2. Natural Gas

- 11.1.3. Coal

- 11.1.4. Other Sources (Bioenergy and Nuclear)

- 11.2. Market Analysis, Insights and Forecast - by Cycle

- 11.2.1. Open Cycle

- 11.2.2. Closed Cycle

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Indonesia

- 11.3.2. Thailand

- 11.3.3. Malaysia

- 11.3.4. Vietnam

- 11.3.5. Philippines

- 11.3.6. Rest of South East Asia

- 11.1. Market Analysis, Insights and Forecast - by Source

- 12. China Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 13. Japan Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 14. India Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 15. South Korea Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 16. Taiwan Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 17. Australia Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Asia-Pacific Southeast Asia Thermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Vietnamese National Coal and Mineral Industries Holding Limite

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Siemens AG

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Vietnam Electricity

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Electricity Generating Authority of Thailand

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Electric Power Development Co Ltd

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Malakoff Corporation Berhad

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 General Electric Company

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Indonesia Power PT

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.1 Vietnamese National Coal and Mineral Industries Holding Limite

List of Figures

- Figure 1: Southeast Asia Thermal Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Southeast Asia Thermal Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 4: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2019 & 2032

- Table 5: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Cycle 2019 & 2032

- Table 6: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2019 & 2032

- Table 7: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 9: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 11: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 13: China Southeast Asia Thermal Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Southeast Asia Thermal Power Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Japan Southeast Asia Thermal Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Southeast Asia Thermal Power Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 17: India Southeast Asia Thermal Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Southeast Asia Thermal Power Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 19: South Korea Southeast Asia Thermal Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Southeast Asia Thermal Power Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Taiwan Southeast Asia Thermal Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Taiwan Southeast Asia Thermal Power Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 23: Australia Southeast Asia Thermal Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Southeast Asia Thermal Power Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia-Pacific Southeast Asia Thermal Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Asia-Pacific Southeast Asia Thermal Power Industry Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 27: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 28: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2019 & 2032

- Table 29: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Cycle 2019 & 2032

- Table 30: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2019 & 2032

- Table 31: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 33: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 35: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 36: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2019 & 2032

- Table 37: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Cycle 2019 & 2032

- Table 38: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2019 & 2032

- Table 39: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 41: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 43: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 44: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2019 & 2032

- Table 45: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Cycle 2019 & 2032

- Table 46: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2019 & 2032

- Table 47: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 48: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 49: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 51: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 52: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2019 & 2032

- Table 53: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Cycle 2019 & 2032

- Table 54: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2019 & 2032

- Table 55: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 56: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 57: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 59: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 60: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2019 & 2032

- Table 61: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Cycle 2019 & 2032

- Table 62: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2019 & 2032

- Table 63: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 64: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 65: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 67: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 68: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Source 2019 & 2032

- Table 69: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Cycle 2019 & 2032

- Table 70: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Cycle 2019 & 2032

- Table 71: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 72: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Geography 2019 & 2032

- Table 73: Southeast Asia Thermal Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 74: Southeast Asia Thermal Power Industry Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Thermal Power Industry?

The projected CAGR is approximately 2.74%.

2. Which companies are prominent players in the Southeast Asia Thermal Power Industry?

Key companies in the market include Vietnamese National Coal and Mineral Industries Holding Limite, Siemens AG, Vietnam Electricity, Electricity Generating Authority of Thailand, Electric Power Development Co Ltd, Malakoff Corporation Berhad, General Electric Company, Indonesia Power PT.

3. What are the main segments of the Southeast Asia Thermal Power Industry?

The market segments include Source, Cycle, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Prominence of Gas in Power Generation4.; Increasing Investments in the Sector.

6. What are the notable trends driving market growth?

Coal-Based Thermal Power Plants to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatility of Crude Oil and Natural Gas Prices.

8. Can you provide examples of recent developments in the market?

In January 2022, Indonesia banned the export of coal due to concerns that low supplies at domestic power plants could lead to widespread blackouts. The Indonesian Government justified the ban as it could lead almost 20 power plants with a power capacity of 10,850 megawatts to run out of coal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Thermal Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Thermal Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Thermal Power Industry?

To stay informed about further developments, trends, and reports in the Southeast Asia Thermal Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence