Key Insights

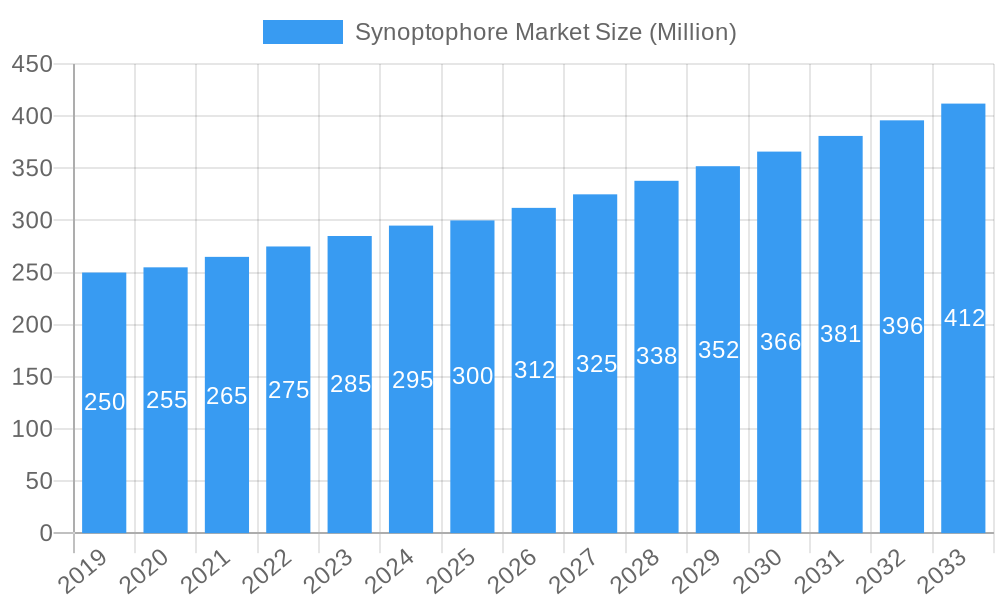

The global Synoptophore Market is poised for robust growth, projected to reach approximately $300 million in market size by 2025, with a steady Compound Annual Growth Rate (CAGR) of 4.00% through 2033. This expansion is primarily driven by the increasing prevalence of visual disorders, including strabismus, amblyopia, and convergence insufficiency, which necessitate early and accurate diagnosis. The growing demand for advanced diagnostic tools and therapeutic solutions in ophthalmology is a significant catalyst. Furthermore, technological advancements in synoptophore devices, leading to more precise and user-friendly instruments, are contributing to market traction. The shift towards automated synoptophores, offering enhanced efficiency and data accuracy for clinicians, is a key trend. Moreover, increasing healthcare expenditure and improved access to specialized eye care services, particularly in emerging economies, are further fueling market adoption.

Synoptophore Market Market Size (In Million)

The market is segmented across various applications, with diagnostic applications holding a dominant share due to the fundamental role of synoptophores in identifying binocular vision anomalies. Therapeutic applications are also gaining momentum as these devices are integrated into vision therapy programs. In terms of instrument type, the market is witnessing a gradual shift from manual to automatic synoptophores, driven by the advantages of automation in terms of speed, consistency, and reduced user dependency. The end-user landscape is primarily dominated by hospitals and specialized eye clinics, owing to the sophisticated nature of these diagnostic tools and the need for trained personnel. The "Rest of the World" and Asia Pacific regions are expected to exhibit significant growth opportunities, driven by an expanding patient pool, rising awareness of eye health, and increasing investments in healthcare infrastructure. While the market exhibits strong growth potential, factors such as the high initial cost of advanced automated devices and the availability of alternative diagnostic methods could pose moderate restraints.

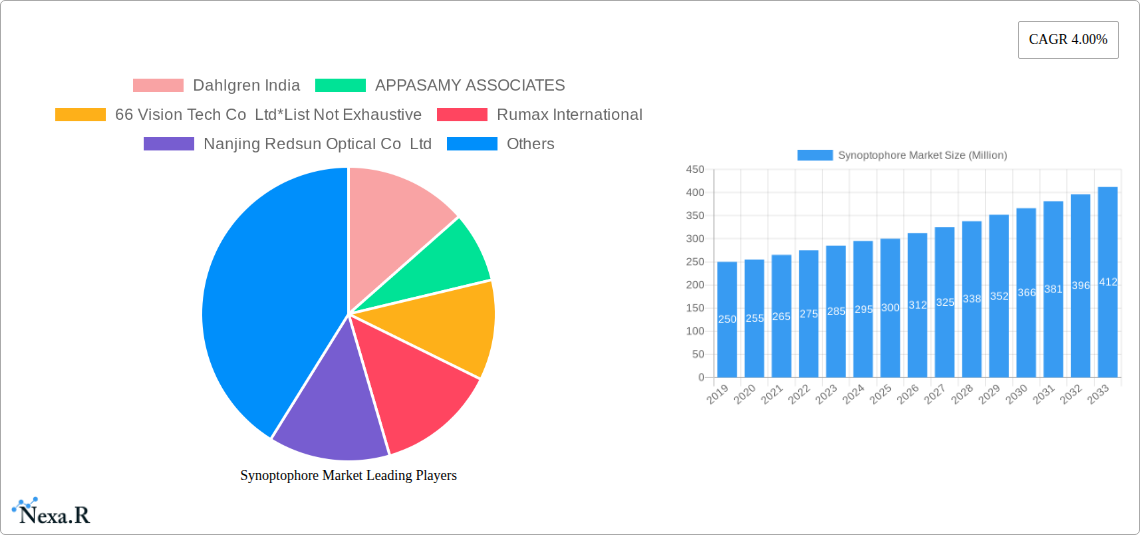

Synoptophore Market Company Market Share

Synoptophore Market Report: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth Synoptophore market report provides a granular analysis of the global Synoptophore market, encompassing market size, growth drivers, segmentation, competitive landscape, and future projections. With a study period spanning from 2019 to 2033, including a base and estimated year of 2025 and a forecast period of 2025–2033, this report offers unparalleled insights for industry stakeholders. The report focuses on high-traffic keywords such as "synoptophore market," "ophthalmic diagnostic devices," "vision testing equipment," "orthoptic instruments," and "strabismus diagnosis," ensuring maximum search engine visibility. We delve into the parent and child markets of this specialized ophthalmic segment, providing a holistic view of market dynamics and opportunities. All values are presented in Million units for clarity and ease of comparison.

Synoptophore Market Dynamics & Structure

The global Synoptophore market exhibits a moderately concentrated structure, with a few key players dominating a significant portion of the market share. Technological innovation serves as a primary driver, with ongoing advancements focused on enhancing diagnostic accuracy, improving user interface, and integrating digital capabilities. Regulatory frameworks, particularly those governing medical devices and data privacy, play a crucial role in shaping market entry and product development. Competitive product substitutes, such as automated perimeters and retinal imaging devices, pose a challenge, necessitating continuous innovation and differentiation for synoptophore manufacturers. End-user demographics are shifting towards an aging global population, increasing the prevalence of age-related eye conditions requiring accurate diagnosis and management. Merger and acquisition (M&A) trends are also observed, as larger companies seek to consolidate their market position and expand their product portfolios.

- Market Concentration: Dominated by a handful of leading manufacturers.

- Technological Innovation: Focus on digital integration, AI-powered diagnostics, and enhanced accuracy.

- Regulatory Landscape: Stringent approvals required, influencing product lifecycles and market access.

- Competitive Substitutes: Automated visual field analyzers and advanced imaging technologies.

- End-User Demographics: Growing demand driven by an aging population and increasing eye disorder prevalence.

- M&A Activity: Strategic acquisitions to broaden market reach and technological capabilities.

Synoptophore Market Growth Trends & Insights

The Synoptophore market is poised for robust growth, driven by a confluence of factors including increasing awareness of eye health, rising incidence of visual impairments, and technological advancements in ophthalmic diagnostic equipment. The market size has witnessed consistent expansion throughout the historical period (2019–2024), with projections indicating sustained growth for the forecast period (2025–2033). Adoption rates of advanced synoptophore systems are escalating, particularly in developed economies, owing to their superior diagnostic capabilities and efficiency. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) algorithms for automated analysis and personalized treatment recommendations, are significantly reshaping the market. Consumer behavior shifts are also playing a vital role, with a growing emphasis on early detection and preventative eye care, leading to increased demand for sophisticated diagnostic tools like synoptophores. The CAGR for the Synoptophore market is estimated to be robust, reflecting a dynamic and expanding industry. Market penetration is expected to deepen as awareness campaigns and healthcare infrastructure improvements gain traction globally. The increasing prevalence of strabismus, amblyopia, and other binocular vision disorders are key drivers fueling the demand for effective diagnostic solutions. Furthermore, the growing preference for non-invasive diagnostic methods contributes to the positive market trajectory.

Dominant Regions, Countries, or Segments in Synoptophore Market

North America currently holds a dominant position in the global Synoptophore market, driven by a well-established healthcare infrastructure, high disposable income, and a strong emphasis on advanced medical technologies. The United States, in particular, leads in terms of market share and adoption of sophisticated ophthalmic diagnostic devices. The Diagnostic application segment is the primary growth engine within the Synoptophore market. This dominance is attributed to the increasing prevalence of eye conditions requiring precise diagnosis, such as strabismus and amblyopia, especially in pediatric populations.

- North America: Leading region due to advanced healthcare infrastructure and high adoption of cutting-edge medical technology.

- United States: Spearheads market growth with significant investments in ophthalmic research and development.

- Diagnostic Application: The most dominant segment, driven by the rising incidence of vision disorders requiring accurate diagnosis.

- Key Drivers: Increasing prevalence of strabismus, amblyopia, and other binocular vision anomalies.

- Growth Potential: High demand from ophthalmology departments and eye care clinics for early and accurate detection.

- Hospitals: Major end-users contributing significantly to market demand due to specialized eye care units.

- Market Share: Hospitals account for a substantial portion of synoptophore sales.

- Infrastructure: Presence of advanced diagnostic facilities and skilled professionals.

- Automatic Instrument Type: Gaining traction over manual counterparts due to efficiency, consistency, and reduced user dependency.

- Technological Advancements: Integration of digital features and automated protocols.

- Adoption Rate: Increasing preference in high-volume clinical settings.

Synoptophore Market Product Landscape

The Synoptophore market is characterized by continuous product innovation aimed at enhancing diagnostic precision and patient comfort. Manufacturers are focusing on developing compact, portable, and user-friendly devices that integrate advanced imaging capabilities. Key product innovations include automated measurement features, digital patient data management systems, and AI-driven diagnostic assistance. These advancements not only improve the efficiency of clinical workflows but also contribute to more accurate and objective assessments of binocular vision disorders. The performance metrics of modern synoptophores are continuously being refined, focusing on reduced test durations and improved accuracy in detecting subtle deviations. Unique selling propositions often revolve around superior resolution, customizable testing protocols, and seamless integration with electronic health records (EHRs).

Key Drivers, Barriers & Challenges in Synoptophore Market

Key Drivers:

- Rising prevalence of visual impairments: Increasing cases of strabismus, amblyopia, and other binocular vision disorders worldwide.

- Technological advancements: Integration of AI, digital imaging, and automated features enhancing diagnostic accuracy and efficiency.

- Growing awareness of eye health: Increased focus on early detection and management of ophthalmic conditions, particularly in pediatric populations.

- Aging global population: Higher incidence of age-related eye conditions necessitating regular vision assessments.

Barriers & Challenges:

- High cost of advanced synoptophores: Significant capital investment required for purchasing sophisticated diagnostic equipment.

- Limited access in developing economies: Inadequate healthcare infrastructure and affordability issues in certain regions hinder widespread adoption.

- Availability of alternative diagnostic tools: Competition from other vision testing devices and imaging technologies.

- Stringent regulatory approvals: Lengthy and complex approval processes can delay market entry for new products.

- Shortage of skilled ophthalmic professionals: A lack of trained personnel to operate and interpret results from advanced synoptophores can be a restraint.

Emerging Opportunities in Synoptophore Market

Emerging opportunities in the Synoptophore market lie in the development of AI-powered diagnostic platforms that can provide real-time analysis and personalized treatment recommendations. The untapped potential of emerging economies in Asia-Pacific and Latin America presents a significant opportunity for market expansion, driven by improving healthcare expenditure and increasing awareness of eye care. Furthermore, the development of integrated tele-ophthalmology solutions, allowing for remote diagnosis and consultation using synoptophore data, is a burgeoning area. Innovative applications for early detection of neurological disorders through precise visual field analysis also represent a promising avenue.

Growth Accelerators in the Synoptophore Market Industry

Growth accelerators in the Synoptophore market industry are predominantly fueled by ongoing technological breakthroughs, strategic partnerships between manufacturers and research institutions, and proactive market expansion strategies targeting underserved regions. The integration of AI and machine learning for predictive diagnostics and personalized treatment planning is a significant catalyst. Furthermore, strategic alliances that facilitate knowledge sharing and co-development of novel technologies are pivotal. Government initiatives promoting eye care awareness and the inclusion of advanced diagnostic tools in public healthcare programs are also contributing to sustained growth.

Key Players Shaping the Synoptophore Market Market

- Dahlgren India

- APPASAMY ASSOCIATES

- 66 Vision Tech Co Ltd

- Rumax International

- Nanjing Redsun Optical Co Ltd

- Prkamya Visions

- Gem Optical Instruments Industries

- HAAG-STREIT GROUP

Notable Milestones in Synoptophore Market Sector

- May 2021: Haag-Streit UK announced the launch of the Eyestar 900 in the United Kingdom. The Eyestar 900 is a swept-source OCT-based eye analyzer. The swept-source technology enables precise measurement of the entire eye and the topographic assessment of the front and back corneal surface and the anterior chamber, including the lens.

In-Depth Synoptophore Market Market Outlook

The Synoptophore market outlook is exceptionally positive, driven by sustained technological innovation and an increasing global focus on comprehensive eye health management. Growth accelerators such as AI integration for enhanced diagnostic precision and the expansion into emerging markets are poised to redefine the industry landscape. Strategic collaborations and the development of user-centric, portable devices will further solidify market growth. The future holds immense potential for synoptophores to become indispensable tools in routine ophthalmic examinations, contributing significantly to early disease detection and improved patient outcomes across diverse demographic segments.

Synoptophore Market Segmentation

-

1. Application

- 1.1. Diagnostic

- 1.2. Therapeutic

-

2. Instrument Type

- 2.1. Manual

- 2.2. Automatic

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End Users

Synoptophore Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Synoptophore Market Regional Market Share

Geographic Coverage of Synoptophore Market

Synoptophore Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Visual Acuity Disorders; Growing Awareness on the Early Diagnosis of Visual Acuity Disorder; Rising Demand for Non-invasive Procedures

- 3.3. Market Restrains

- 3.3.1. High Cost of Synoptophore Device; Access to Alternative Treatments

- 3.4. Market Trends

- 3.4.1. Therapeutic Application is Expected to Witness a Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Synoptophore Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Diagnostic

- 5.1.2. Therapeutic

- 5.2. Market Analysis, Insights and Forecast - by Instrument Type

- 5.2.1. Manual

- 5.2.2. Automatic

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Synoptophore Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Diagnostic

- 6.1.2. Therapeutic

- 6.2. Market Analysis, Insights and Forecast - by Instrument Type

- 6.2.1. Manual

- 6.2.2. Automatic

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Clinics

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Synoptophore Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Diagnostic

- 7.1.2. Therapeutic

- 7.2. Market Analysis, Insights and Forecast - by Instrument Type

- 7.2.1. Manual

- 7.2.2. Automatic

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Clinics

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Synoptophore Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Diagnostic

- 8.1.2. Therapeutic

- 8.2. Market Analysis, Insights and Forecast - by Instrument Type

- 8.2.1. Manual

- 8.2.2. Automatic

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Clinics

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Synoptophore Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Diagnostic

- 9.1.2. Therapeutic

- 9.2. Market Analysis, Insights and Forecast - by Instrument Type

- 9.2.1. Manual

- 9.2.2. Automatic

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Clinics

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Dahlgren India

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 APPASAMY ASSOCIATES

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 66 Vision Tech Co Ltd*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Rumax International

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nanjing Redsun Optical Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Prkamya Visions

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Gem Optical Instruments Industries

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 HAAG-STREIT GROUP

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Dahlgren India

List of Figures

- Figure 1: Global Synoptophore Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Synoptophore Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Synoptophore Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Synoptophore Market Revenue (undefined), by Instrument Type 2025 & 2033

- Figure 5: North America Synoptophore Market Revenue Share (%), by Instrument Type 2025 & 2033

- Figure 6: North America Synoptophore Market Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America Synoptophore Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Synoptophore Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Synoptophore Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Synoptophore Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Synoptophore Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Synoptophore Market Revenue (undefined), by Instrument Type 2025 & 2033

- Figure 13: Europe Synoptophore Market Revenue Share (%), by Instrument Type 2025 & 2033

- Figure 14: Europe Synoptophore Market Revenue (undefined), by End User 2025 & 2033

- Figure 15: Europe Synoptophore Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Synoptophore Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Synoptophore Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Synoptophore Market Revenue (undefined), by Application 2025 & 2033

- Figure 19: Asia Pacific Synoptophore Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific Synoptophore Market Revenue (undefined), by Instrument Type 2025 & 2033

- Figure 21: Asia Pacific Synoptophore Market Revenue Share (%), by Instrument Type 2025 & 2033

- Figure 22: Asia Pacific Synoptophore Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Asia Pacific Synoptophore Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Synoptophore Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Synoptophore Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Synoptophore Market Revenue (undefined), by Application 2025 & 2033

- Figure 27: Rest of the World Synoptophore Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Rest of the World Synoptophore Market Revenue (undefined), by Instrument Type 2025 & 2033

- Figure 29: Rest of the World Synoptophore Market Revenue Share (%), by Instrument Type 2025 & 2033

- Figure 30: Rest of the World Synoptophore Market Revenue (undefined), by End User 2025 & 2033

- Figure 31: Rest of the World Synoptophore Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Rest of the World Synoptophore Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Rest of the World Synoptophore Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Synoptophore Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Synoptophore Market Revenue undefined Forecast, by Instrument Type 2020 & 2033

- Table 3: Global Synoptophore Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Synoptophore Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Synoptophore Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Synoptophore Market Revenue undefined Forecast, by Instrument Type 2020 & 2033

- Table 7: Global Synoptophore Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global Synoptophore Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Synoptophore Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 13: Global Synoptophore Market Revenue undefined Forecast, by Instrument Type 2020 & 2033

- Table 14: Global Synoptophore Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Synoptophore Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Synoptophore Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Synoptophore Market Revenue undefined Forecast, by Instrument Type 2020 & 2033

- Table 24: Global Synoptophore Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global Synoptophore Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Synoptophore Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Synoptophore Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 33: Global Synoptophore Market Revenue undefined Forecast, by Instrument Type 2020 & 2033

- Table 34: Global Synoptophore Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 35: Global Synoptophore Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Synoptophore Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Synoptophore Market?

Key companies in the market include Dahlgren India, APPASAMY ASSOCIATES, 66 Vision Tech Co Ltd*List Not Exhaustive, Rumax International, Nanjing Redsun Optical Co Ltd, Prkamya Visions, Gem Optical Instruments Industries, HAAG-STREIT GROUP.

3. What are the main segments of the Synoptophore Market?

The market segments include Application, Instrument Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Visual Acuity Disorders; Growing Awareness on the Early Diagnosis of Visual Acuity Disorder; Rising Demand for Non-invasive Procedures.

6. What are the notable trends driving market growth?

Therapeutic Application is Expected to Witness a Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Synoptophore Device; Access to Alternative Treatments.

8. Can you provide examples of recent developments in the market?

In May 2021, Haag-Streit UK announced the launch of the Eyestar 900 in the United Kingdom. The Eyestar 900 is a swept-source OCT-based eye analyzer. The swept-source technology enables precise measurement of the entire eye and the topographic assessment of the front and back corneal surface and the anterior chamber, including the lens.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Synoptophore Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Synoptophore Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Synoptophore Market?

To stay informed about further developments, trends, and reports in the Synoptophore Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence