Key Insights

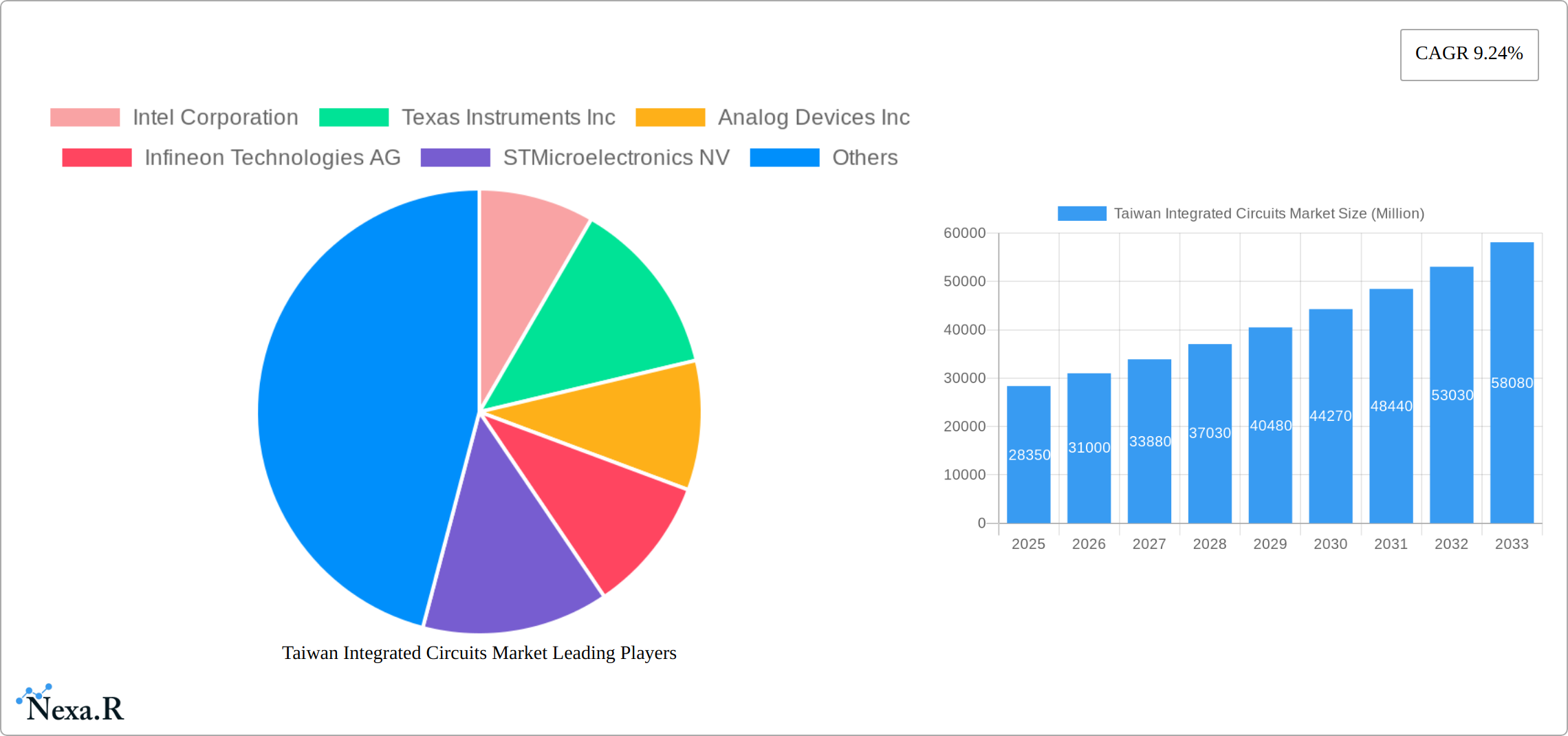

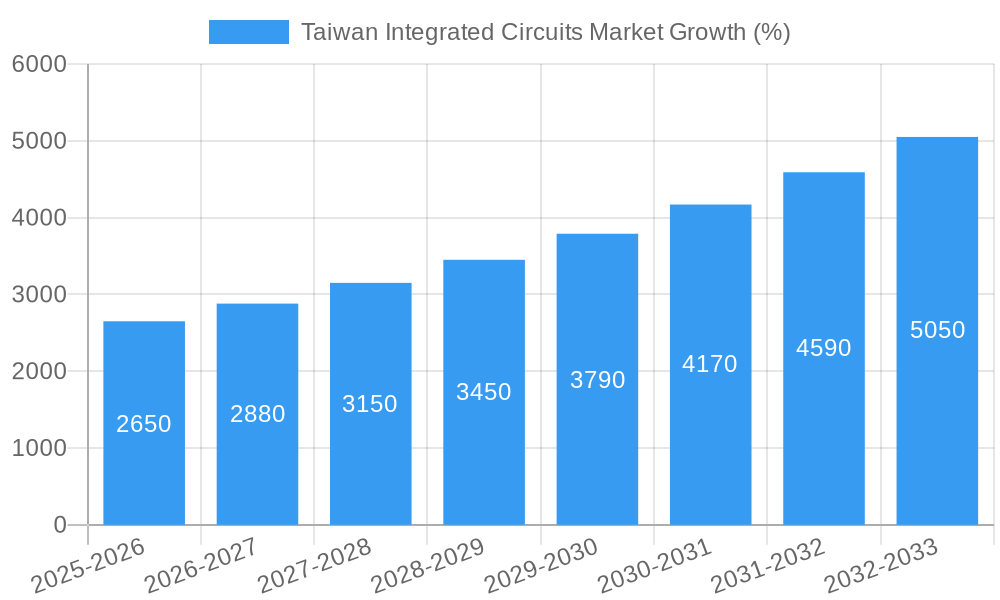

The Taiwan Integrated Circuits (IC) market, valued at $28.35 billion in 2025, is projected to experience robust growth, driven by increasing demand for electronics across various sectors. A Compound Annual Growth Rate (CAGR) of 9.24% from 2025 to 2033 indicates a significant expansion of this market. This growth is fueled by several key factors. The burgeoning adoption of advanced technologies such as 5G, Artificial Intelligence (AI), and the Internet of Things (IoT) is significantly boosting the demand for high-performance ICs. Furthermore, Taiwan's strong position in the global semiconductor manufacturing landscape, with its advanced fabrication facilities and skilled workforce, provides a significant competitive advantage, attracting substantial foreign investment and fostering innovation. However, the market faces certain challenges including geopolitical uncertainties, potential supply chain disruptions, and the increasing cost of advanced manufacturing technologies. Nevertheless, the long-term outlook remains positive, with sustained growth anticipated across diverse IC segments, including memory chips, logic chips, and analog ICs. Major players like Intel, Texas Instruments, and TSMC (though not explicitly listed, a key player in Taiwan's IC market) are expected to continue dominating the market, driving further innovation and competition.

The competitive landscape within Taiwan's IC market is highly concentrated, with leading global players vying for market share. The continuous advancements in semiconductor technology, coupled with the government's support for the industry, ensures sustained competitiveness. However, maintaining this edge requires ongoing investments in research and development, talent acquisition, and infrastructure development. Furthermore, proactive strategies to mitigate potential risks associated with global economic fluctuations and geopolitical factors are crucial for maintaining long-term growth. Segmentation analysis, while not explicitly provided, is likely to reveal strong growth in specific high-demand IC types, such as those used in high-performance computing, automotive electronics, and consumer electronics. This suggests opportunities for specialized manufacturers to carve out significant market share in the coming years. A deeper dive into regional data would highlight specific growth pockets within Taiwan itself, informing strategic investment and market entry decisions.

This in-depth report provides a comprehensive analysis of the Taiwan Integrated Circuits (IC) market, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategic decision-makers seeking a detailed understanding of this vital sector. The report covers both the parent market (Semiconductor Market) and child market (Integrated Circuits).

Taiwan Integrated Circuits Market Market Dynamics & Structure

This section analyzes the intricate dynamics shaping the Taiwan IC market. We delve into market concentration, revealing the share held by leading players and exploring the impact of mergers and acquisitions (M&A) activity. Technological innovation, regulatory landscapes, and the presence of competitive substitutes are examined to understand their influence on market competition. End-user demographics and their evolving demands are also thoroughly investigated.

- Market Concentration: The Taiwan IC market exhibits a moderately concentrated structure, with the top 5 players holding approximately xx% of the market share in 2024. M&A activity has been steadily increasing, with xx deals recorded in the past five years, leading to market consolidation.

- Technological Innovation: Continuous advancements in process technology (e.g., FinFET, GAAFET) and the rise of specialized ICs (e.g., AI accelerators, high-bandwidth memory) are driving market growth. However, high R&D costs and intellectual property protection pose significant innovation barriers.

- Regulatory Framework: Government policies aimed at fostering technological advancement and attracting foreign investment play a crucial role in shaping the market's trajectory. Stringent environmental regulations also influence manufacturing processes and sustainability initiatives.

- Competitive Product Substitutes: The emergence of alternative technologies presents competitive pressure. However, the specialized nature of many ICs limits the extent of substitution.

- End-User Demographics: The increasing demand for electronic devices across various sectors (consumer electronics, automotive, industrial automation) fuels the growth of the IC market.

Taiwan Integrated Circuits Market Growth Trends & Insights

This section provides a detailed analysis of the Taiwan IC market's growth trajectory, utilizing both qualitative and quantitative data to deliver comprehensive insights. We examine the evolution of market size, adoption rates across different segments, and the impact of technological disruptions. The influence of shifting consumer behaviors and preferences are also explored. Specific metrics, including Compound Annual Growth Rate (CAGR) and market penetration rates, are included to provide a clear picture of market growth. The analysis will leverage extensive secondary research and proprietary data models for a precise forecasting of future growth. Expected CAGR for the forecast period (2025-2033) is projected at xx%.

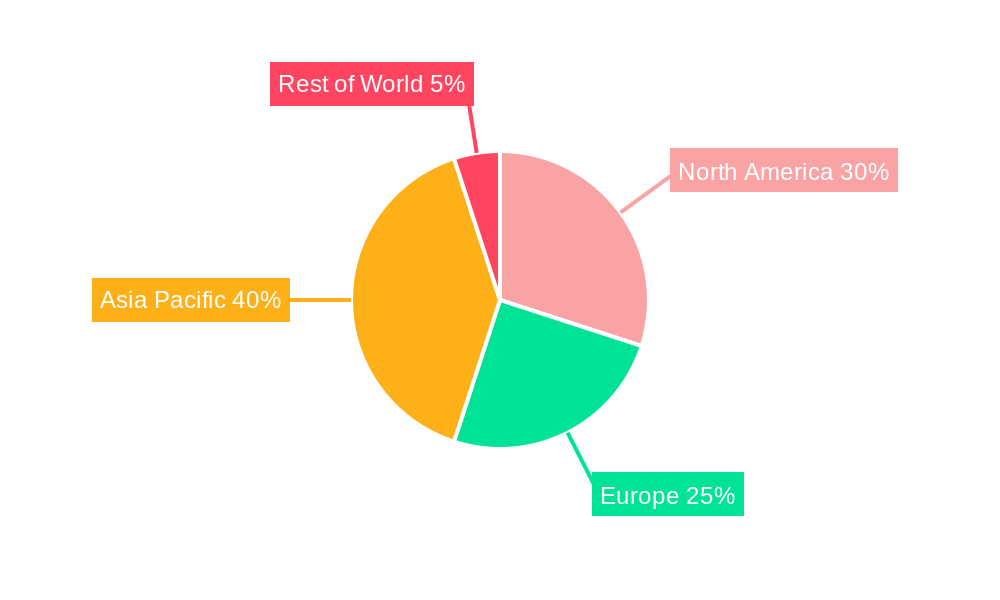

Dominant Regions, Countries, or Segments in Taiwan Integrated Circuits Market

This section identifies the leading regions, countries, or segments driving market growth within Taiwan. We analyze dominance factors such as market share, growth potential, economic policies, and infrastructure development. Bullet points highlight key drivers, while paragraphs provide deeper insights into the reasons behind the dominance of specific areas.

- Key Driver: Government support for the semiconductor industry, including substantial investment in R&D and infrastructure development, significantly contributes to Taiwan's dominance in IC manufacturing.

- Dominance Factor: Taiwan boasts a highly skilled workforce, robust supply chains, and advanced manufacturing capabilities, leading to its strong position in the global IC market.

- Growth Potential: The continued expansion of the global electronics market and increasing demand for high-performance ICs presents substantial growth opportunities for Taiwan.

Taiwan Integrated Circuits Market Product Landscape

The Taiwan IC market is characterized by continuous product innovation, driven by advancements in semiconductor technology. New products demonstrate enhanced performance metrics, including higher speeds, lower power consumption, and increased integration. These improvements cater to a wide range of applications, from high-end smartphones to sophisticated automotive systems. Unique selling propositions often center on power efficiency and advanced features, ensuring a competitive edge.

Key Drivers, Barriers & Challenges in Taiwan Integrated Circuits Market

Key Drivers:

- The escalating demand for electronics across diverse sectors is a primary driver.

- Advancements in semiconductor technology, particularly in process nodes and specialized ICs, propel market growth.

- Government support and investment in the semiconductor industry create a favorable environment for expansion.

Key Barriers and Challenges:

- Geopolitical uncertainties and trade tensions create supply chain disruptions, impacting production and costs. These disruptions led to a xx% increase in production costs in 2024.

- Intense competition from other major IC manufacturing hubs poses a significant challenge.

- Maintaining a skilled workforce and attracting top talent is crucial for sustained growth.

Emerging Opportunities in Taiwan Integrated Circuits Market

The Taiwan IC market presents exciting opportunities for growth. These include:

- The burgeoning demand for AI-powered devices and the increasing adoption of 5G technology create new avenues for IC innovation.

- The automotive industry's transition towards electric vehicles and autonomous driving systems presents significant market potential for specialized ICs.

- The expansion of the Internet of Things (IoT) generates considerable demand for low-power, high-efficiency ICs.

Growth Accelerators in the Taiwan Integrated Circuits Market Industry

Several factors are poised to accelerate growth in the long term. Technological breakthroughs, particularly in advanced packaging technologies and new materials, promise to enhance performance and efficiency. Strategic partnerships and collaborations across the value chain will foster innovation and market expansion.

Key Players Shaping the Taiwan Integrated Circuits Market Market

- Intel Corporation

- Texas Instruments Inc

- Analog Devices Inc

- Infineon Technologies AG

- STMicroelectronics NV

- NXP Semiconductors NV

- On Semiconductor Corporation

- Microchip Technology Inc

- Renesas Electronics Corporation

- Samsung Electronics Co Ltd

- SK Hynix Inc

Notable Milestones in Taiwan Integrated Circuits Market Sector

- December 2023: Asahi Kasei Microdevices Corporation launched its AK7018 and AK7017 audio DSPs, enhancing in-car audio experiences and collaborating with DSP Concepts, Inc. for broader application development.

- December 2023: Infineon unveiled its PSoCEdge series microcontrollers with integrated AI capabilities, utilizing both Arm Cortex-M55 and M33 cores for optimized performance.

In-Depth Taiwan Integrated Circuits Market Market Outlook

The Taiwan IC market is projected to experience robust growth in the coming years, driven by technological advancements, strategic partnerships, and increasing demand across various sectors. The continued focus on innovation and the development of specialized ICs will unlock significant market potential, creating opportunities for both established players and new entrants. Strategic investments in R&D, expansion into high-growth markets, and effective supply chain management will be key to success.

Taiwan Integrated Circuits Market Segmentation

-

1. Type

- 1.1. Analog IC

- 1.2. Logic IC

- 1.3. Memory

-

1.4. Micro

- 1.4.1. Microprocessors (MPU)

- 1.4.2. Microcontrollers (MCU)

-

2. End-user Industry

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. IT & Telecommunications

- 2.4. Manufacturing & Automation

- 2.5. Other En

Taiwan Integrated Circuits Market Segmentation By Geography

- 1. Taiwan

Taiwan Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Penetration of Smartphones

- 3.2.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.3. Market Restrains

- 3.3.1 Increasing Penetration of Smartphones

- 3.3.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.4. Market Trends

- 3.4.1. The Logic Segment is Anticipated to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Integrated Circuits Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog IC

- 5.1.2. Logic IC

- 5.1.3. Memory

- 5.1.4. Micro

- 5.1.4.1. Microprocessors (MPU)

- 5.1.4.2. Microcontrollers (MCU)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. IT & Telecommunications

- 5.2.4. Manufacturing & Automation

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Intel Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texas Instruments Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Analog Devices Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infineon Technologies AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NXP Semiconductors NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 On Semiconductor Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microchip Technology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Renesas Electronics Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung Electronics Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SK Hynix Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Intel Corporation

List of Figures

- Figure 1: Taiwan Integrated Circuits Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Taiwan Integrated Circuits Market Share (%) by Company 2024

List of Tables

- Table 1: Taiwan Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Taiwan Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Taiwan Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Taiwan Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Taiwan Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Taiwan Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: Taiwan Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Taiwan Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Taiwan Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Taiwan Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Taiwan Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: Taiwan Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: Taiwan Integrated Circuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Taiwan Integrated Circuits Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Integrated Circuits Market?

The projected CAGR is approximately 9.24%.

2. Which companies are prominent players in the Taiwan Integrated Circuits Market?

Key companies in the market include Intel Corporation, Texas Instruments Inc, Analog Devices Inc, Infineon Technologies AG, STMicroelectronics NV, NXP Semiconductors NV, On Semiconductor Corporation, Microchip Technology Inc, Renesas Electronics Corporation, Samsung Electronics Co Ltd, SK Hynix Inc.

3. What are the main segments of the Taiwan Integrated Circuits Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

6. What are the notable trends driving market growth?

The Logic Segment is Anticipated to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

8. Can you provide examples of recent developments in the market?

December 2023 - Asahi Kasei Microdevices Corporation unveiled its AK7018 and AK7017 audio DSPs with dual and single HiFi 4 CPUs, respectively, both pin-compatible. These new additions to the AK701x series aim to elevate the in-car audio and voice experience. In a strategic move, AKM collaborated with DSP Concepts, Inc., enabling the AK701x lineup to leverage the Audio Weaver platform. This collaboration fosters a versatile and expandable audio and voice application development environment and taps into the diverse array of 3rd party audio algorithms already available on Audio Weaver.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the Taiwan Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence