Key Insights

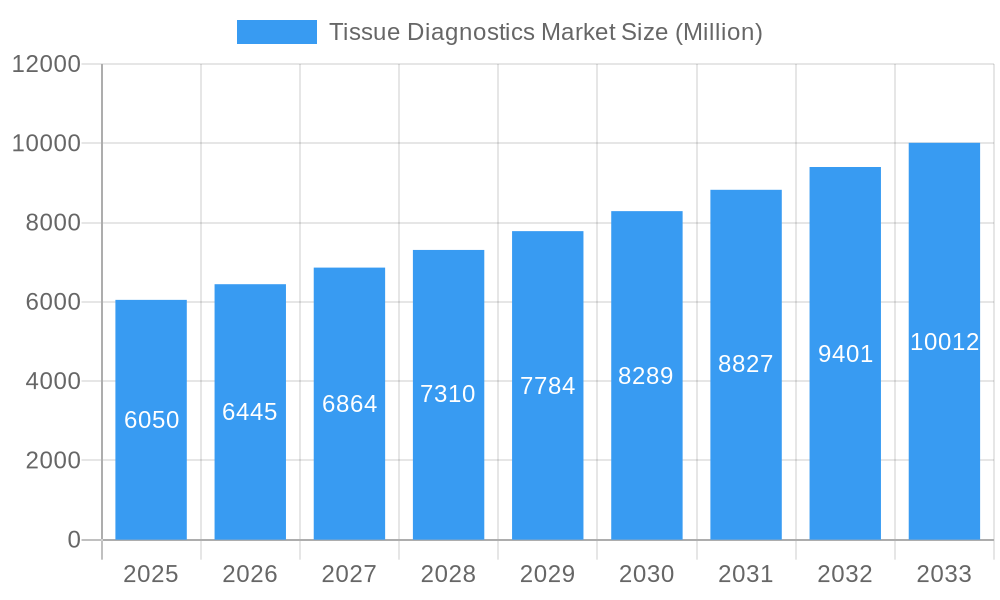

The global tissue diagnostics market is poised for substantial growth, projected to reach approximately USD 9,500 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.64% during the forecast period of 2025-2033. This expansion is fundamentally driven by an increasing incidence of chronic diseases, particularly various cancers, which necessitates accurate and timely diagnosis. Advances in diagnostic technologies, including the growing adoption of immunohistochemistry (IHC) and in-situ hybridization (ISH) techniques, are playing a pivotal role in enhancing diagnostic precision and efficiency. Furthermore, the burgeoning field of digital pathology, with its potential for streamlined workflow management and remote consultation, is emerging as a significant catalyst for market acceleration. The rising demand for personalized medicine and companion diagnostics, especially in oncology, further fuels the need for sophisticated tissue-based diagnostic solutions.

Tissue Diagnostics Market Market Size (In Billion)

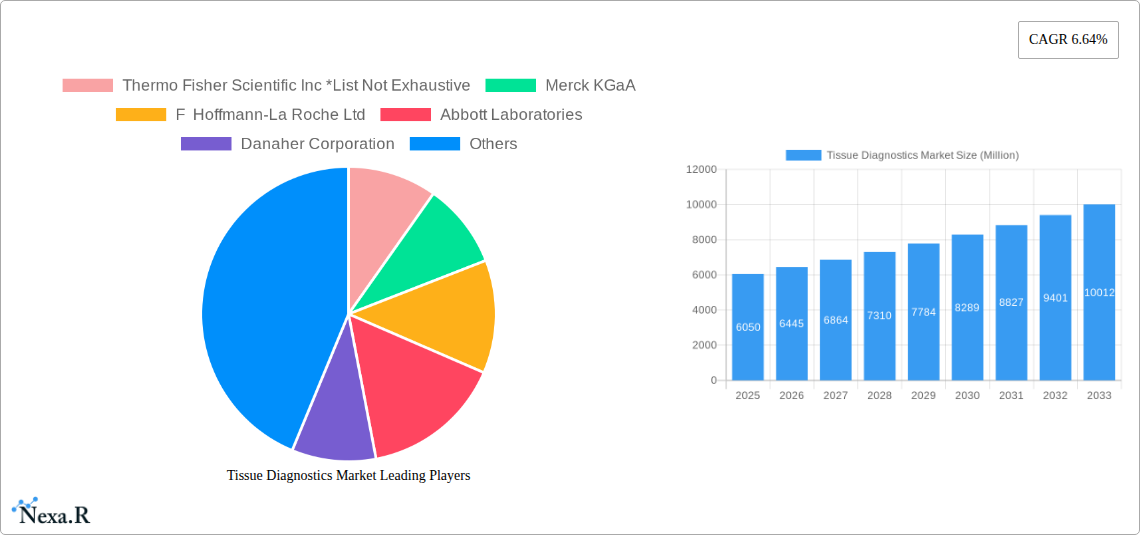

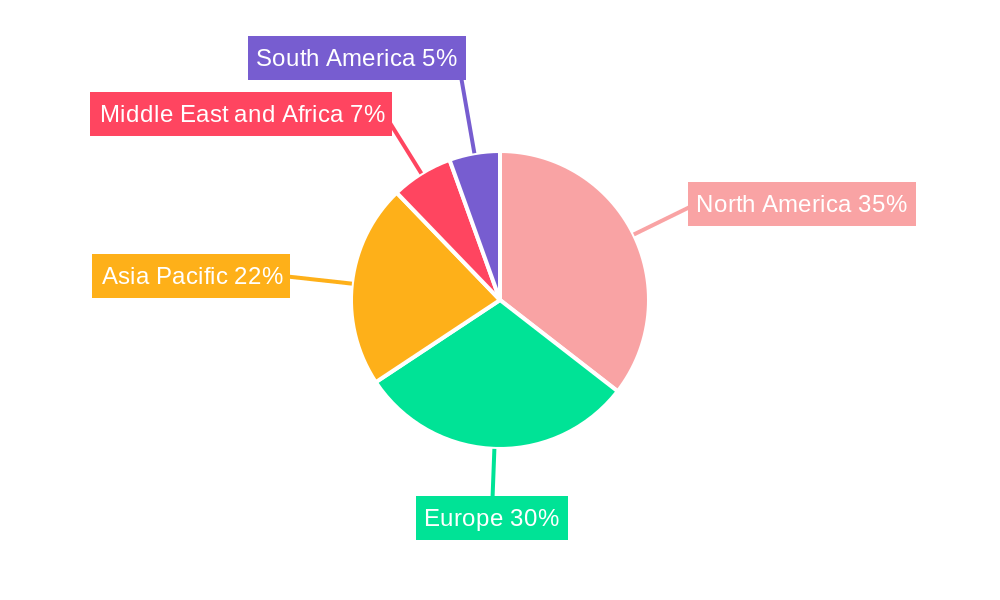

The market is segmented across a variety of crucial areas. In terms of products, instruments, reagents, and consumables form the backbone of tissue diagnostics, with continuous innovation in these segments driving market value. Technology-wise, immunohistochemistry and in-situ hybridization remain dominant, while digital pathology and advanced workflow management solutions are rapidly gaining traction. Application-wise, the market is heavily influenced by the prevalence of key cancers such as breast, prostate, and gastric cancers, with a growing focus on expanding diagnostic capabilities for a broader spectrum of oncological conditions. Geographically, North America currently leads the market, attributed to its advanced healthcare infrastructure and high adoption rates of new technologies. However, the Asia Pacific region is expected to witness the fastest growth, driven by increasing healthcare expenditure, a rising patient pool, and growing awareness of early disease detection. Key players like Thermo Fisher Scientific Inc., Merck KGaA, and F. Hoffmann-La Roche Ltd. are actively engaged in research and development, strategic collaborations, and acquisitions to capitalize on these burgeoning opportunities.

Tissue Diagnostics Market Company Market Share

This in-depth report offers a panoramic view of the global Tissue Diagnostics Market, a critical sector driving advancements in disease identification, personalized medicine, and treatment efficacy. Spanning a comprehensive Study Period of 2019–2033, with a Base Year and Estimated Year of 2025, this analysis provides unparalleled insights into the market's trajectory, segment dynamics, and the strategic imperatives of leading organizations. Explore the intricate landscape of tissue diagnostics, encompassing digital pathology, immunohistochemistry (IHC), and in-situ hybridization (ISH), as we dissect the cancer diagnostics market and its pivotal role in modern healthcare. Our research delves into the evolving workflow management solutions and the increasing demand for advanced diagnostic instruments, reagents, and consumables. With a keen focus on applications in breast cancer, prostate cancer, and gastric cancer diagnostics, this report equips industry professionals, investors, and researchers with the actionable intelligence needed to navigate this dynamic and rapidly expanding market.

Tissue Diagnostics Market Market Dynamics & Structure

The Tissue Diagnostics Market is characterized by a moderate to high market concentration, with key players like Thermo Fisher Scientific Inc, Merck KGaA, F Hoffmann-La Roche Ltd, Abbott Laboratories, and Danaher Corporation holding significant market shares. Technological innovation is a primary driver, fueled by continuous advancements in molecular biology, imaging, and artificial intelligence, leading to the development of more sensitive and specific diagnostic tools. The regulatory landscape, overseen by bodies such as the FDA and EMA, plays a crucial role in market entry and product approval, emphasizing safety and efficacy. Competitive product substitutes exist, particularly in early-stage detection and risk assessment, but the definitive diagnostic power of tissue analysis remains paramount. End-user demographics are shifting towards an aging global population with a higher prevalence of chronic diseases, particularly cancers, increasing the demand for robust diagnostic solutions. Mergers and acquisitions (M&A) are a significant trend, with companies consolidating to enhance their product portfolios, expand geographical reach, and acquire cutting-edge technologies. For instance, the acquisition of smaller biotech firms with novel biomarker discovery capabilities is a recurring strategy to maintain a competitive edge.

- Market Concentration: Dominated by a few large players, but with increasing fragmentation from specialized technology providers.

- Technological Innovation Drivers: Advancements in AI for image analysis, multiplexing techniques for biomarker identification, and liquid biopsy integration.

- Regulatory Frameworks: Strict but evolving guidelines for IVD devices, with increasing focus on data privacy and interoperability.

- Competitive Product Substitutes: Rise of non-invasive diagnostic methods, though tissue analysis offers definitive confirmation.

- End-User Demographics: Growing elderly population, increasing cancer incidence rates globally, and demand for personalized treatment.

- M&A Trends: Strategic acquisitions for technology integration and market consolidation, with over xx M&A deals recorded in the past three years.

Tissue Diagnostics Market Growth Trends & Insights

The global Tissue Diagnostics Market is poised for substantial growth, driven by escalating cancer incidence rates, technological innovations, and a growing emphasis on personalized medicine. The market is projected to expand from an estimated USD 4,500 million in 2025 to over USD 8,000 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This expansion is underpinned by the increasing adoption of advanced diagnostic technologies such as digital pathology, which offers enhanced efficiency, accuracy, and remote collaboration capabilities for pathologists. The shift towards targeted therapies necessitates precise molecular diagnostics, making immunohistochemistry and in-situ hybridization indispensable tools.

The market penetration of tissue diagnostics is steadily increasing across both developed and developing economies. In developed regions, the demand is driven by an aging population and the availability of advanced healthcare infrastructure. In developing nations, growing awareness about cancer screening, coupled with improving healthcare access, is fueling market expansion. Technological disruptions, including the development of novel biomarkers and the integration of artificial intelligence (AI) into diagnostic workflows, are further accelerating market adoption. AI-powered image analysis platforms are demonstrating remarkable accuracy in identifying subtle pathological features, improving diagnostic turnaround times, and reducing human error.

Consumer behavior shifts are also influencing the market. Patients are becoming more informed and are increasingly seeking early and accurate cancer diagnoses, prompting healthcare providers to invest in cutting-edge tissue diagnostic solutions. Furthermore, the increasing focus on precision oncology, where treatment strategies are tailored to the individual genetic and molecular profile of a patient's tumor, relies heavily on the detailed information provided by tissue diagnostics. The ability to identify specific mutations, protein expressions, and cellular characteristics allows for the selection of the most effective therapies, leading to improved patient outcomes and reduced healthcare costs associated with ineffective treatments.

The integration of workflow management systems within pathology labs is another key trend, streamlining the entire diagnostic process from sample accessioning to report generation. This efficiency gain is crucial in managing the increasing volume of tissue samples and meeting the demand for faster diagnostic turnaround times. The development of automated IHC platforms further contributes to this efficiency, reducing manual labor and ensuring consistency in staining results.

- Market Size Evolution: From USD 4,500 million in 2025 to over USD 8,000 million by 2033.

- CAGR: Approximately 7.5% during the forecast period (2025-2033).

- Adoption Rates: Steadily increasing, particularly in oncology and precision medicine.

- Technological Disruptions: AI in image analysis, multiplexing, automated IHC, and digital pathology.

- Consumer Behavior Shifts: Growing demand for early detection, personalized treatment, and informed healthcare decisions.

- Market Penetration: High in developed regions, with significant growth potential in emerging economies.

Dominant Regions, Countries, or Segments in Tissue Diagnostics Market

North America currently dominates the global Tissue Diagnostics Market, driven by a confluence of factors including advanced healthcare infrastructure, high cancer incidence rates, significant R&D investments, and the early adoption of cutting-edge technologies. The United States, in particular, is a powerhouse in this sector, boasting a high prevalence of breast cancer, prostate cancer, and gastric cancer, which are key application areas for tissue diagnostics. The country's robust reimbursement policies for advanced diagnostic procedures and the presence of leading research institutions foster a fertile ground for innovation and market growth.

Within the product segment, Reagents and Consumables are projected to hold the largest market share, estimated at USD 2,500 million in 2025. This is attributed to the recurring nature of their use in diagnostic procedures and the continuous development of novel reagents for targeted therapies and biomarker detection. Instruments, while requiring a higher initial investment, also represent a substantial segment, driven by the demand for advanced automated staining platforms and digital scanners.

In terms of technology, Immunohistochemistry (IHC) remains the dominant segment, valued at approximately USD 1,800 million in 2025. IHC's versatility in detecting a wide array of protein biomarkers essential for cancer diagnosis, prognosis, and treatment selection solidifies its position. Digital Pathology is the fastest-growing technology segment, exhibiting a CAGR of over 9%, as it offers significant advantages in terms of workflow efficiency, remote consultation, and AI integration. In-situ Hybridization (ISH) also plays a crucial role, particularly for detecting specific nucleic acid sequences.

Geographically, the United States is the leading country, commanding a market share of over 35% in 2025, followed by Germany and Japan. The Asia Pacific region, particularly China and India, is emerging as a significant growth driver due to increasing healthcare expenditure, a growing awareness of cancer screening, and improving accessibility to diagnostic services.

Key drivers for dominance in the North American region include:

- Economic Policies: Favorable reimbursement policies and government funding for cancer research.

- Infrastructure: Well-established healthcare systems and advanced laboratory facilities.

- Technological Adoption: High rate of adoption for new diagnostic platforms and AI-driven solutions.

- Research & Development: Significant investments in academic and industrial R&D leading to continuous innovation.

The Breast Cancer application segment, estimated at USD 1,200 million in 2025, continues to be a primary driver, reflecting the high global incidence and the critical need for accurate diagnostic and prognostic markers. Prostate Cancer diagnostics also hold a substantial share, with ongoing developments in biomarker discovery to differentiate aggressive forms.

Tissue Diagnostics Market Product Landscape

The tissue diagnostics market is characterized by a dynamic product landscape focused on enhancing diagnostic accuracy, efficiency, and the ability to detect specific disease markers. Key innovations include advanced Instruments such as automated immunohistochemistry stainers and high-resolution digital slide scanners, which streamline workflows and improve staining consistency. The Reagents and Consumables segment is witnessing the development of novel antibodies, multiplexing reagents for simultaneous biomarker detection, and advanced staining solutions for improved signal amplification. These products are crucial for precisely identifying protein expressions and cellular characteristics essential for cancer diagnosis, prognosis, and personalized treatment selection, particularly in applications like breast cancer and prostate cancer. The unique selling propositions of these products lie in their sensitivity, specificity, and integration into digital pathology workflows, offering enhanced diagnostic performance and therapeutic guidance.

Key Drivers, Barriers & Challenges in Tissue Diagnostics Market

The Tissue Diagnostics Market is propelled by several key drivers, including the escalating global incidence of cancer, which necessitates more accurate and early diagnostic tools. Technological advancements, such as the integration of artificial intelligence (AI) in digital pathology for image analysis and the development of multiplexing techniques for detecting multiple biomarkers simultaneously, are significant growth catalysts. Furthermore, the growing trend towards personalized medicine, requiring detailed molecular profiling of tumors, heavily relies on precise tissue diagnostics. Increased healthcare expenditure and government initiatives to promote cancer screening programs further bolster market growth.

Conversely, the market faces several barriers and challenges. High initial investment costs for advanced instrumentation and workflow integration can be a significant hurdle, especially for smaller pathology labs. Stringent regulatory approval processes for new diagnostic devices and reagents can lead to prolonged market entry times. The shortage of skilled pathologists and laboratory technicians trained in advanced tissue diagnostic techniques poses another challenge. Moreover, the ongoing development of non-invasive diagnostic methods, like liquid biopsies, presents a competitive substitute, although tissue diagnostics remain the gold standard for definitive diagnosis. Supply chain disruptions for specialized reagents and consumables can also impact market stability.

Emerging Opportunities in Tissue Diagnostics Market

Emerging opportunities in the Tissue Diagnostics Market are primarily driven by the expansion of personalized medicine and the increasing adoption of digital pathology. The development of novel biomarkers for early cancer detection and prediction of treatment response presents a significant untapped market. AI-powered diagnostic solutions, including automated tumor detection and grading systems, offer immense potential for improving efficiency and accuracy in pathology. Furthermore, the growing demand for companion diagnostics, which help identify patients most likely to benefit from specific targeted therapies, is creating new avenues for growth. The expansion of healthcare infrastructure in emerging economies also presents opportunities for market penetration and increased access to advanced tissue diagnostic tools.

Growth Accelerators in the Tissue Diagnostics Market Industry

Several factors are accelerating the growth of the Tissue Diagnostics Market. Technological breakthroughs in areas like multiplex immunohistochemistry and advanced in-situ hybridization are enabling more comprehensive molecular profiling of tumors. Strategic partnerships between diagnostic companies and pharmaceutical firms for the development of companion diagnostics are a major growth accelerator. Furthermore, the increasing focus on value-based healthcare and the proven efficacy of tissue diagnostics in guiding treatment decisions contribute to market expansion. The continuous refinement and adoption of digital pathology platforms are also enhancing workflow efficiency and enabling greater collaboration among pathologists, driving overall market growth.

Key Players Shaping the Tissue Diagnostics Market Market

- Thermo Fisher Scientific Inc

- Merck KGaA

- F Hoffmann-La Roche Ltd

- Abbott Laboratories

- Danaher Corporation

- BioGenex Laboratories

- Agilent Technologies Inc

- ILLUMINA Inc

- Qiagen NV

Notable Milestones in Tissue Diagnostics Market Sector

- July 2023: Quest Diagnostics launched a novel tissue-based prostate cancer biomarker test, AmeriPath, through its subspecialty pathology business. This new test, developed in collaboration with Australia-based Envision Sciences, addresses the clinical need for improved identification and differentiation of potentially aggressive prostate cancer cases.

- March 2023: Aptamer Group developed a new reagent, Optimer-Fc, designed for automated immunohistochemistry (IHC) workflows, aiding in the detection of cancer and other disease markers in cells.

In-Depth Tissue Diagnostics Market Market Outlook

The Tissue Diagnostics Market is set for sustained growth, driven by the relentless pursuit of precision oncology and the imperative for early and accurate disease detection. The market's future is intrinsically linked to technological innovation, particularly in AI-driven image analysis and the development of highly specific multiplexing assays. Strategic collaborations between diagnostic providers, pharmaceutical companies, and academic institutions will be critical in translating research breakthroughs into clinically actionable tools. As digital pathology infrastructure becomes more widespread, it will further streamline diagnostic workflows, enhance accessibility, and foster a collaborative environment for global pathology expertise. The increasing emphasis on companion diagnostics and the growing demand for personalized treatment strategies will continue to fuel innovation and market expansion, positioning tissue diagnostics as an indispensable component of modern healthcare delivery.

Tissue Diagnostics Market Segmentation

-

1. Product

- 1.1. Instruments

- 1.2. Reagents and Consumables

-

2. Technology

- 2.1. Immunohistochemistry

- 2.2. In-situ Hybridization

- 2.3. Digital Pathology and Workflow Management

- 2.4. Other Technologies

-

3. Application

- 3.1. Breast Cancer

- 3.2. Prostate Cancer

- 3.3. Gastric Cancer

- 3.4. Other Cancers

Tissue Diagnostics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Tissue Diagnostics Market Regional Market Share

Geographic Coverage of Tissue Diagnostics Market

Tissue Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Cancer; Growing Healthcare Expenditure; Technological Advancements in Tissue Diagnostics

- 3.3. Market Restrains

- 3.3.1. High Cost of Diagnosis and Reimbursement Issues

- 3.4. Market Trends

- 3.4.1. Breast Cancer Segment is Expected to Register a Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tissue Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Instruments

- 5.1.2. Reagents and Consumables

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Immunohistochemistry

- 5.2.2. In-situ Hybridization

- 5.2.3. Digital Pathology and Workflow Management

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Breast Cancer

- 5.3.2. Prostate Cancer

- 5.3.3. Gastric Cancer

- 5.3.4. Other Cancers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Tissue Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Instruments

- 6.1.2. Reagents and Consumables

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Immunohistochemistry

- 6.2.2. In-situ Hybridization

- 6.2.3. Digital Pathology and Workflow Management

- 6.2.4. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Breast Cancer

- 6.3.2. Prostate Cancer

- 6.3.3. Gastric Cancer

- 6.3.4. Other Cancers

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Tissue Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Instruments

- 7.1.2. Reagents and Consumables

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Immunohistochemistry

- 7.2.2. In-situ Hybridization

- 7.2.3. Digital Pathology and Workflow Management

- 7.2.4. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Breast Cancer

- 7.3.2. Prostate Cancer

- 7.3.3. Gastric Cancer

- 7.3.4. Other Cancers

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Tissue Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Instruments

- 8.1.2. Reagents and Consumables

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Immunohistochemistry

- 8.2.2. In-situ Hybridization

- 8.2.3. Digital Pathology and Workflow Management

- 8.2.4. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Breast Cancer

- 8.3.2. Prostate Cancer

- 8.3.3. Gastric Cancer

- 8.3.4. Other Cancers

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Tissue Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Instruments

- 9.1.2. Reagents and Consumables

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Immunohistochemistry

- 9.2.2. In-situ Hybridization

- 9.2.3. Digital Pathology and Workflow Management

- 9.2.4. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Breast Cancer

- 9.3.2. Prostate Cancer

- 9.3.3. Gastric Cancer

- 9.3.4. Other Cancers

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Tissue Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Instruments

- 10.1.2. Reagents and Consumables

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Immunohistochemistry

- 10.2.2. In-situ Hybridization

- 10.2.3. Digital Pathology and Workflow Management

- 10.2.4. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Breast Cancer

- 10.3.2. Prostate Cancer

- 10.3.3. Gastric Cancer

- 10.3.4. Other Cancers

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thermo Fisher Scientific Inc *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck KGaA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 F Hoffmann-La Roche Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbott Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Danaher Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BioGenex Laboratories

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Agilent Technologies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ILLUMINA Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Qiagen NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Thermo Fisher Scientific Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Tissue Diagnostics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Tissue Diagnostics Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Tissue Diagnostics Market Revenue (Million), by Product 2025 & 2033

- Figure 4: North America Tissue Diagnostics Market Volume (K Units), by Product 2025 & 2033

- Figure 5: North America Tissue Diagnostics Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Tissue Diagnostics Market Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Tissue Diagnostics Market Revenue (Million), by Technology 2025 & 2033

- Figure 8: North America Tissue Diagnostics Market Volume (K Units), by Technology 2025 & 2033

- Figure 9: North America Tissue Diagnostics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: North America Tissue Diagnostics Market Volume Share (%), by Technology 2025 & 2033

- Figure 11: North America Tissue Diagnostics Market Revenue (Million), by Application 2025 & 2033

- Figure 12: North America Tissue Diagnostics Market Volume (K Units), by Application 2025 & 2033

- Figure 13: North America Tissue Diagnostics Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Tissue Diagnostics Market Volume Share (%), by Application 2025 & 2033

- Figure 15: North America Tissue Diagnostics Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Tissue Diagnostics Market Volume (K Units), by Country 2025 & 2033

- Figure 17: North America Tissue Diagnostics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Tissue Diagnostics Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Tissue Diagnostics Market Revenue (Million), by Product 2025 & 2033

- Figure 20: Europe Tissue Diagnostics Market Volume (K Units), by Product 2025 & 2033

- Figure 21: Europe Tissue Diagnostics Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Europe Tissue Diagnostics Market Volume Share (%), by Product 2025 & 2033

- Figure 23: Europe Tissue Diagnostics Market Revenue (Million), by Technology 2025 & 2033

- Figure 24: Europe Tissue Diagnostics Market Volume (K Units), by Technology 2025 & 2033

- Figure 25: Europe Tissue Diagnostics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 26: Europe Tissue Diagnostics Market Volume Share (%), by Technology 2025 & 2033

- Figure 27: Europe Tissue Diagnostics Market Revenue (Million), by Application 2025 & 2033

- Figure 28: Europe Tissue Diagnostics Market Volume (K Units), by Application 2025 & 2033

- Figure 29: Europe Tissue Diagnostics Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Tissue Diagnostics Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Tissue Diagnostics Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Tissue Diagnostics Market Volume (K Units), by Country 2025 & 2033

- Figure 33: Europe Tissue Diagnostics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Tissue Diagnostics Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Tissue Diagnostics Market Revenue (Million), by Product 2025 & 2033

- Figure 36: Asia Pacific Tissue Diagnostics Market Volume (K Units), by Product 2025 & 2033

- Figure 37: Asia Pacific Tissue Diagnostics Market Revenue Share (%), by Product 2025 & 2033

- Figure 38: Asia Pacific Tissue Diagnostics Market Volume Share (%), by Product 2025 & 2033

- Figure 39: Asia Pacific Tissue Diagnostics Market Revenue (Million), by Technology 2025 & 2033

- Figure 40: Asia Pacific Tissue Diagnostics Market Volume (K Units), by Technology 2025 & 2033

- Figure 41: Asia Pacific Tissue Diagnostics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Asia Pacific Tissue Diagnostics Market Volume Share (%), by Technology 2025 & 2033

- Figure 43: Asia Pacific Tissue Diagnostics Market Revenue (Million), by Application 2025 & 2033

- Figure 44: Asia Pacific Tissue Diagnostics Market Volume (K Units), by Application 2025 & 2033

- Figure 45: Asia Pacific Tissue Diagnostics Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Asia Pacific Tissue Diagnostics Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Asia Pacific Tissue Diagnostics Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Tissue Diagnostics Market Volume (K Units), by Country 2025 & 2033

- Figure 49: Asia Pacific Tissue Diagnostics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Tissue Diagnostics Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Tissue Diagnostics Market Revenue (Million), by Product 2025 & 2033

- Figure 52: Middle East and Africa Tissue Diagnostics Market Volume (K Units), by Product 2025 & 2033

- Figure 53: Middle East and Africa Tissue Diagnostics Market Revenue Share (%), by Product 2025 & 2033

- Figure 54: Middle East and Africa Tissue Diagnostics Market Volume Share (%), by Product 2025 & 2033

- Figure 55: Middle East and Africa Tissue Diagnostics Market Revenue (Million), by Technology 2025 & 2033

- Figure 56: Middle East and Africa Tissue Diagnostics Market Volume (K Units), by Technology 2025 & 2033

- Figure 57: Middle East and Africa Tissue Diagnostics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 58: Middle East and Africa Tissue Diagnostics Market Volume Share (%), by Technology 2025 & 2033

- Figure 59: Middle East and Africa Tissue Diagnostics Market Revenue (Million), by Application 2025 & 2033

- Figure 60: Middle East and Africa Tissue Diagnostics Market Volume (K Units), by Application 2025 & 2033

- Figure 61: Middle East and Africa Tissue Diagnostics Market Revenue Share (%), by Application 2025 & 2033

- Figure 62: Middle East and Africa Tissue Diagnostics Market Volume Share (%), by Application 2025 & 2033

- Figure 63: Middle East and Africa Tissue Diagnostics Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Tissue Diagnostics Market Volume (K Units), by Country 2025 & 2033

- Figure 65: Middle East and Africa Tissue Diagnostics Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Tissue Diagnostics Market Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Tissue Diagnostics Market Revenue (Million), by Product 2025 & 2033

- Figure 68: South America Tissue Diagnostics Market Volume (K Units), by Product 2025 & 2033

- Figure 69: South America Tissue Diagnostics Market Revenue Share (%), by Product 2025 & 2033

- Figure 70: South America Tissue Diagnostics Market Volume Share (%), by Product 2025 & 2033

- Figure 71: South America Tissue Diagnostics Market Revenue (Million), by Technology 2025 & 2033

- Figure 72: South America Tissue Diagnostics Market Volume (K Units), by Technology 2025 & 2033

- Figure 73: South America Tissue Diagnostics Market Revenue Share (%), by Technology 2025 & 2033

- Figure 74: South America Tissue Diagnostics Market Volume Share (%), by Technology 2025 & 2033

- Figure 75: South America Tissue Diagnostics Market Revenue (Million), by Application 2025 & 2033

- Figure 76: South America Tissue Diagnostics Market Volume (K Units), by Application 2025 & 2033

- Figure 77: South America Tissue Diagnostics Market Revenue Share (%), by Application 2025 & 2033

- Figure 78: South America Tissue Diagnostics Market Volume Share (%), by Application 2025 & 2033

- Figure 79: South America Tissue Diagnostics Market Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Tissue Diagnostics Market Volume (K Units), by Country 2025 & 2033

- Figure 81: South America Tissue Diagnostics Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Tissue Diagnostics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tissue Diagnostics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Tissue Diagnostics Market Volume K Units Forecast, by Product 2020 & 2033

- Table 3: Global Tissue Diagnostics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global Tissue Diagnostics Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 5: Global Tissue Diagnostics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Tissue Diagnostics Market Volume K Units Forecast, by Application 2020 & 2033

- Table 7: Global Tissue Diagnostics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Tissue Diagnostics Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Global Tissue Diagnostics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Global Tissue Diagnostics Market Volume K Units Forecast, by Product 2020 & 2033

- Table 11: Global Tissue Diagnostics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Tissue Diagnostics Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 13: Global Tissue Diagnostics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Tissue Diagnostics Market Volume K Units Forecast, by Application 2020 & 2033

- Table 15: Global Tissue Diagnostics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Tissue Diagnostics Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: United States Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Canada Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Mexico Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 23: Global Tissue Diagnostics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 24: Global Tissue Diagnostics Market Volume K Units Forecast, by Product 2020 & 2033

- Table 25: Global Tissue Diagnostics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 26: Global Tissue Diagnostics Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 27: Global Tissue Diagnostics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Tissue Diagnostics Market Volume K Units Forecast, by Application 2020 & 2033

- Table 29: Global Tissue Diagnostics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Tissue Diagnostics Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Germany Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: France Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Italy Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Spain Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Global Tissue Diagnostics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 44: Global Tissue Diagnostics Market Volume K Units Forecast, by Product 2020 & 2033

- Table 45: Global Tissue Diagnostics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 46: Global Tissue Diagnostics Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 47: Global Tissue Diagnostics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 48: Global Tissue Diagnostics Market Volume K Units Forecast, by Application 2020 & 2033

- Table 49: Global Tissue Diagnostics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Tissue Diagnostics Market Volume K Units Forecast, by Country 2020 & 2033

- Table 51: China Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Japan Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: India Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Australia Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Australia Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 59: South Korea Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Global Tissue Diagnostics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 64: Global Tissue Diagnostics Market Volume K Units Forecast, by Product 2020 & 2033

- Table 65: Global Tissue Diagnostics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 66: Global Tissue Diagnostics Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 67: Global Tissue Diagnostics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 68: Global Tissue Diagnostics Market Volume K Units Forecast, by Application 2020 & 2033

- Table 69: Global Tissue Diagnostics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Tissue Diagnostics Market Volume K Units Forecast, by Country 2020 & 2033

- Table 71: GCC Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: GCC Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: South Africa Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Global Tissue Diagnostics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 78: Global Tissue Diagnostics Market Volume K Units Forecast, by Product 2020 & 2033

- Table 79: Global Tissue Diagnostics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 80: Global Tissue Diagnostics Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 81: Global Tissue Diagnostics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 82: Global Tissue Diagnostics Market Volume K Units Forecast, by Application 2020 & 2033

- Table 83: Global Tissue Diagnostics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Tissue Diagnostics Market Volume K Units Forecast, by Country 2020 & 2033

- Table 85: Brazil Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: Argentina Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Tissue Diagnostics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Tissue Diagnostics Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tissue Diagnostics Market?

The projected CAGR is approximately 6.64%.

2. Which companies are prominent players in the Tissue Diagnostics Market?

Key companies in the market include Thermo Fisher Scientific Inc *List Not Exhaustive, Merck KGaA, F Hoffmann-La Roche Ltd, Abbott Laboratories, Danaher Corporation, BioGenex Laboratories, Agilent Technologies Inc, ILLUMINA Inc, Qiagen NV.

3. What are the main segments of the Tissue Diagnostics Market?

The market segments include Product, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Cancer; Growing Healthcare Expenditure; Technological Advancements in Tissue Diagnostics.

6. What are the notable trends driving market growth?

Breast Cancer Segment is Expected to Register a Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Diagnosis and Reimbursement Issues.

8. Can you provide examples of recent developments in the market?

July 2023: Quest Diagnostics launched a novel tissue-based prostate cancer biomarker test, AmeriPath, through its subspecialty pathology business. As per the company, the new, tissue-based test was developed in collaboration with Australia-based Envision Sciences. It is intended to address the pressing clinical need for tests to help identify and differentiate potentially aggressive cases of prostate cancer in men.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tissue Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tissue Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tissue Diagnostics Market?

To stay informed about further developments, trends, and reports in the Tissue Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence