Key Insights

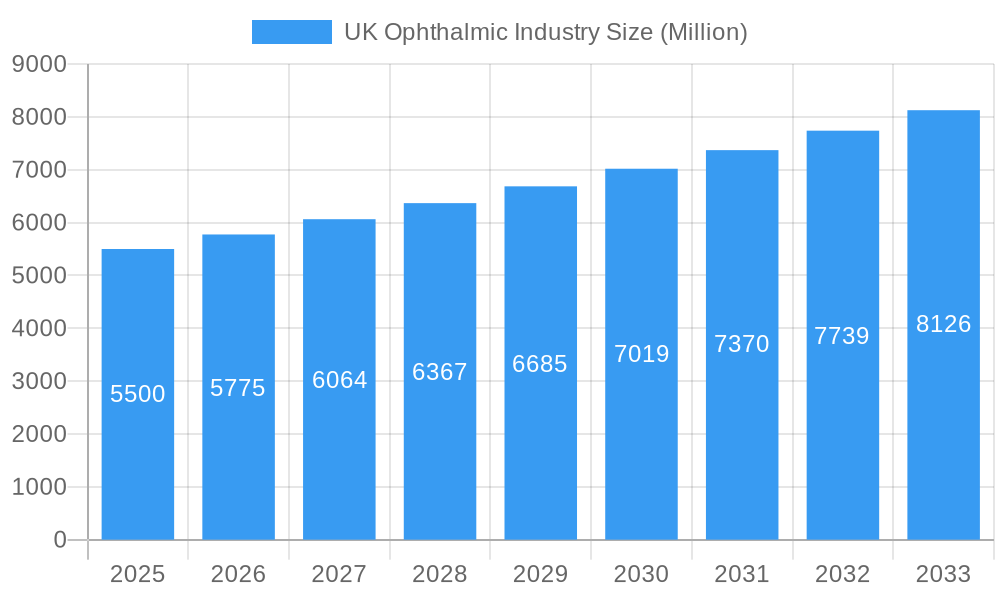

The United Kingdom ophthalmic market is projected for substantial growth, with an estimated market size of 2779.67 million by 2024. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 6.1% through 2032. This upward trend is primarily driven by the increasing prevalence of age-related eye conditions due to an aging global population, which elevates the demand for sophisticated ophthalmic treatments and corrective solutions. Heightened healthcare spending and growing consumer awareness regarding vision health further bolster market expansion. Innovations in ophthalmic technology, such as minimally invasive surgical procedures, advanced diagnostic imaging like Optical Coherence Tomography (OCT), and novel contact lens designs, are also pivotal contributors.

UK Ophthalmic Industry Market Size (In Billion)

Key growth catalysts for the United Kingdom ophthalmic sector include the rising incidence of eye diseases, the swift integration of advanced technologies by healthcare facilities, and governmental efforts to enhance eye care access. Conversely, significant barriers include the high cost of cutting-edge ophthalmic equipment and restrictive reimbursement policies in some healthcare frameworks. The market is segmented into ophthalmic devices, which include surgical, diagnostic, and vision correction equipment. Within surgical devices, intraocular lenses and glaucoma drainage devices are experiencing robust demand. Diagnostic and monitoring devices, particularly OCT scanners and ophthalmic ultrasound imaging systems, are essential for early disease detection and tailored patient care. Vision correction devices, such as spectacles and contact lenses, remain crucial segments, with continuous innovation improving their performance and desirability. Leading global entities including Alcon Inc., Johnson & Johnson, and Carl Zeiss Meditec AG are instrumental in shaping the UK ophthalmic landscape through product innovation and strategic alliances.

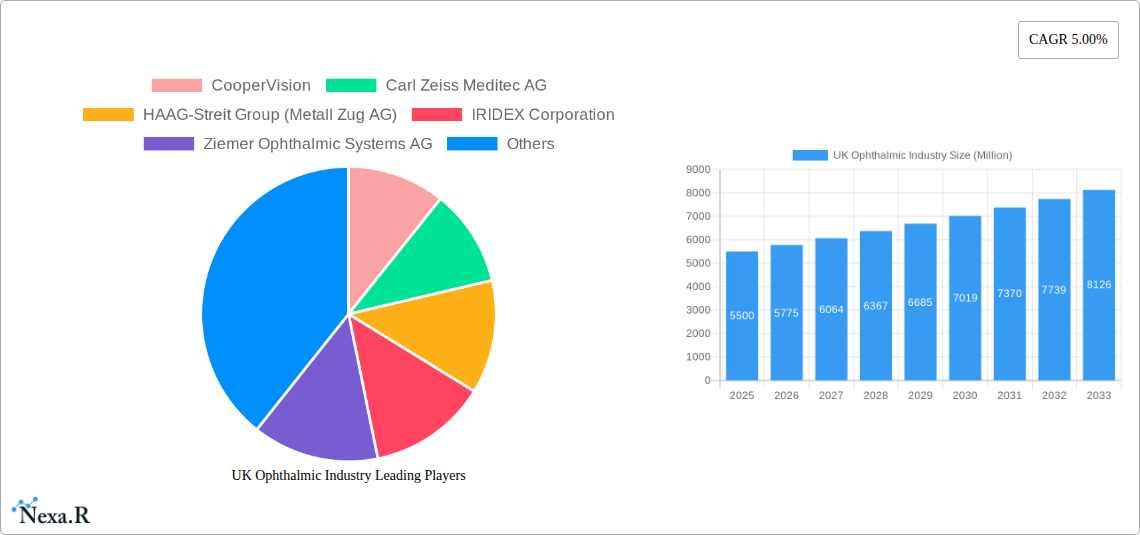

UK Ophthalmic Industry Company Market Share

Unveiling the UK Ophthalmic Industry: A Comprehensive Market Analysis and Growth Forecast

This in-depth report provides a definitive analysis of the UK ophthalmic industry, a rapidly evolving sector driven by an aging population, increasing prevalence of eye conditions, and groundbreaking technological advancements. We dissect the market dynamics, growth trends, regional dominance, product landscape, and key players, offering unparalleled insights for stakeholders. With meticulous research covering the historical period of 2019–2024, a base year of 2025, and a robust forecast period extending to 2033, this report is your indispensable guide to navigating and capitalizing on the opportunities within the UK’s ophthalmic market.

UK Ophthalmic Industry Market Dynamics & Structure

The UK ophthalmic industry is characterized by a moderately concentrated market, with a few major players dominating various segments. Technological innovation is a primary driver, fueled by significant investment in R&D for advanced surgical devices and diagnostics. Regulatory frameworks, overseen by bodies like the MHRA, ensure product safety and efficacy, influencing market entry and product development. Competitive product substitutes exist, particularly in vision correction, with advancements in both spectacles and contact lenses constantly challenging established norms. End-user demographics are shifting, with an increasing demand from an aging population requiring age-related eye disease treatments and a growing younger demographic seeking vision correction solutions. Mergers and acquisitions (M&A) activity, while moderate, plays a crucial role in market consolidation and technology acquisition.

- Market Concentration: High concentration in specialized surgical equipment and advanced diagnostic imaging.

- Technological Innovation Drivers: Increased prevalence of chronic eye diseases, demand for minimally invasive procedures, and advancements in AI and data analytics for diagnostics.

- Regulatory Frameworks: Stringent approval processes for medical devices and pharmaceuticals impacting product timelines.

- Competitive Product Substitutes: Ongoing innovation in contact lens materials and spectacle lens technology provides constant substitution pressure.

- End-User Demographics: Growing elderly population with higher incidence of cataracts, glaucoma, and AMD; increasing adoption of multifocal and toric contact lenses among younger demographics.

- M&A Trends: Strategic acquisitions focused on acquiring novel technologies and expanding market reach, with an estimated xx M&A deals recorded in the historical period.

UK Ophthalmic Industry Growth Trends & Insights

The UK ophthalmic industry is projected for substantial growth, driven by increasing public awareness of eye health, an aging demographic susceptible to age-related macular degeneration (AMD), glaucoma, and cataracts, and the continuous introduction of innovative ophthalmic devices and treatments. The adoption rate of advanced surgical techniques, such as femtosecond laser-assisted cataract surgery and minimally invasive glaucoma surgery (MIGS), is steadily rising, contributing to market expansion. Technological disruptions, including the integration of artificial intelligence (AI) in diagnostics and the development of smart contact lenses, are reshaping patient care pathways and opening new avenues for market penetration. Consumer behavior is shifting towards personalized vision correction solutions and preventative eye care, with a greater emphasis on early detection and management of ocular conditions. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. The penetration of advanced diagnostic tools like Optical Coherence Tomography (OCT) scanners is increasing, estimated at xx% in the base year 2025, reflecting a growing emphasis on early disease detection.

Dominant Regions, Countries, or Segments in UK Ophthalmic Industry

Within the UK ophthalmic industry, Surgical Devices stand out as a dominant segment, significantly outpacing other categories in market share and growth potential. This dominance is largely attributed to the increasing incidence of age-related eye conditions such as cataracts, necessitating a high volume of surgical interventions. The Intraocular Lenses (IOLs) sub-segment, specifically, is a major revenue generator, propelled by advancements in multifocal and toric IOLs that offer improved visual outcomes and patient satisfaction, with an estimated market share of xx% within Surgical Devices. The market for Lasers used in ophthalmic surgery, including refractive and glaucoma procedures, also exhibits robust growth, driven by their precision and minimal invasiveness.

- Surgical Devices Dominance: Driven by the high prevalence of age-related eye diseases, particularly cataracts and glaucoma, leading to sustained demand for surgical interventions.

- Intraocular Lenses (IOLs): Expected to account for xx% of the surgical devices market in 2025, with a strong preference for premium, advanced technology lenses.

- Lasers: Growing adoption in cataract surgery and refractive procedures, contributing xx% to the surgical segment's revenue.

- Glaucoma Drainage Devices & Glaucoma Stents and Implants: Experiencing significant growth due to an increasing glaucoma patient base and the demand for effective intraocular pressure management solutions.

- Diagnostic and Monitoring Devices: While not as dominant as surgical devices, this segment is experiencing rapid expansion, particularly with the uptake of advanced technologies.

- Optical Coherence Tomography (OCT) Scanners: Crucial for early detection and monitoring of retinal diseases, showing an upward trend in adoption across primary care and specialist settings.

- Corneal Topography Systems: Essential for diagnosing and managing conditions like keratoconus and fitting specialized contact lenses.

- Vision Correction Devices: This segment remains a significant contributor, though growth is more incremental compared to surgical and diagnostic advancements.

- Contact Lenses: Driven by lifestyle factors and the demand for convenience and aesthetics, particularly daily disposable and specialized lenses.

The UK's healthcare infrastructure, with its National Health Service (NHS) and private healthcare providers, plays a pivotal role in ensuring access to a wide range of ophthalmic treatments and devices. Government initiatives promoting preventative healthcare and early screening programs further bolster the demand for diagnostic and monitoring equipment. Economic policies that support medical technology innovation and reimbursement frameworks for advanced procedures also contribute to the overall growth and dominance of the surgical devices segment.

UK Ophthalmic Industry Product Landscape

The UK ophthalmic product landscape is defined by a relentless pursuit of enhanced visual acuity and therapeutic efficacy. Innovations in Intraocular Lenses (IOLs) have revolutionized cataract surgery, with the introduction of premium multifocal and toric lenses significantly improving patient outcomes. Surgical devices are seeing advancements in minimally invasive techniques, such as the development of sophisticated Glaucoma Drainage Devices and Stents designed for superior intraocular pressure control. In diagnostics, Optical Coherence Tomography (OCT) scanners continue to evolve, offering higher resolution and faster scanning times for earlier and more accurate detection of retinal diseases. Furthermore, the contact lens market is witnessing a surge in materials science advancements, leading to increased comfort, breathability, and specialized lenses for astigmatism and presbyopia correction.

Key Drivers, Barriers & Challenges in UK Ophthalmic Industry

Key Drivers: The UK ophthalmic industry is propelled by an aging population, leading to a higher incidence of age-related eye conditions like cataracts and AMD. Technological advancements in surgical techniques and diagnostic imaging, coupled with growing patient awareness of eye health and the availability of advanced vision correction options, are also significant growth drivers. Government initiatives promoting early detection and treatment further fuel market expansion.

Key Barriers & Challenges: Significant challenges include the high cost of advanced ophthalmic technologies and treatments, which can limit accessibility, particularly within the public healthcare system. Stringent regulatory approval processes for new devices and pharmaceuticals can lead to prolonged market entry timelines. Reimbursement policies and the ongoing pressure on healthcare budgets can also impact the adoption rates of innovative solutions. Furthermore, a shortage of skilled ophthalmic professionals, especially in specialized surgical fields, poses a constraint. The supply chain for certain niche components can also experience disruptions, impacting production.

Emerging Opportunities in UK Ophthalmic Industry

Emerging opportunities lie in the expanding market for telehealth and remote patient monitoring in ophthalmology, facilitated by advancements in digital imaging and connectivity. The development of AI-powered diagnostic tools for early disease detection, particularly for conditions like diabetic retinopathy and glaucoma, presents a significant growth area. Furthermore, the increasing demand for personalized vision correction solutions, including advanced contact lenses and refractive surgery options, caters to evolving consumer preferences. Untapped potential exists in preventative eye care strategies and the development of novel treatments for currently intractable eye diseases, offering substantial long-term growth prospects.

Growth Accelerators in the UK Ophthalmic Industry Industry

Technological breakthroughs, such as the integration of artificial intelligence in diagnostic imaging and surgical robotics, are key growth accelerators, promising enhanced precision and efficiency. Strategic partnerships between technology developers, pharmaceutical companies, and healthcare providers are fostering collaborative innovation and accelerating the translation of research into clinical practice. Market expansion strategies, including increased penetration into underserved regions and the development of cost-effective solutions, are also vital for sustained growth. Furthermore, the growing emphasis on preventative eye care and early intervention programs is creating a continuous demand for advanced diagnostic and therapeutic solutions.

Key Players Shaping the UK Ophthalmic Industry Market

- CooperVision

- Carl Zeiss Meditec AG

- HAAG-Streit Group (Metall Zug AG)

- IRIDEX Corporation

- Ziemer Ophthalmic Systems AG

- Nidek Co Ltd

- Johnson and Johnson

- Topcon Corporation

- Alcon Inc

- Bausch Health Companies Inc

Notable Milestones in UK Ophthalmic Industry Sector

- August 2022: Alcon launched Dailies Total 1 contact lens for astigmatism.

- September 2022: Alcon made the Dailies Total 1 contact lens for astigmatism available to patients in the United Kingdom and Ireland.

- June 2022: Johnson & Johnson Vision completed CE Mark activities for the Acuvue Oasys MAX 1-Day and Acuvue Oasys MAX 1-Day multifocal contact lenses.

In-Depth UK Ophthalmic Industry Market Outlook

The future outlook for the UK ophthalmic industry is exceptionally promising, fueled by a confluence of demographic shifts and technological advancements. The persistent rise in age-related eye diseases will continue to drive demand for surgical interventions and advanced therapeutic solutions. Innovations in AI-driven diagnostics are poised to revolutionize early disease detection and personalized treatment planning, creating new market niches. Furthermore, the increasing consumer demand for premium vision correction and the growing emphasis on preventative eye care will accelerate the adoption of innovative products and services. Strategic investments in research and development, coupled with collaborations across the healthcare ecosystem, will be crucial in capitalizing on these burgeoning opportunities and maintaining the UK's position as a leader in ophthalmic innovation.

UK Ophthalmic Industry Segmentation

-

1. Devices

-

1.1. Surgical Devices

- 1.1.1. Glaucoma Drainage Devices

- 1.1.2. Glaucoma Stents and Implants

- 1.1.3. Intraocular Lenses

- 1.1.4. Lasers

- 1.1.5. Other Surgical Devices

-

1.2. Diagnostic and Monitoring Devices

- 1.2.1. Autorefractors and Keratometers

- 1.2.2. Corneal Topography Systems

- 1.2.3. Ophthalmic Ultrasound Imaging Systems

- 1.2.4. Ophthalmoscopes

- 1.2.5. Optical Coherence Tomography Scanners

- 1.2.6. Other Diagnostic and Monitoring Devices

-

1.3. Vision Correction Devices

- 1.3.1. Spectacles

- 1.3.2. Contact Lenses

-

1.1. Surgical Devices

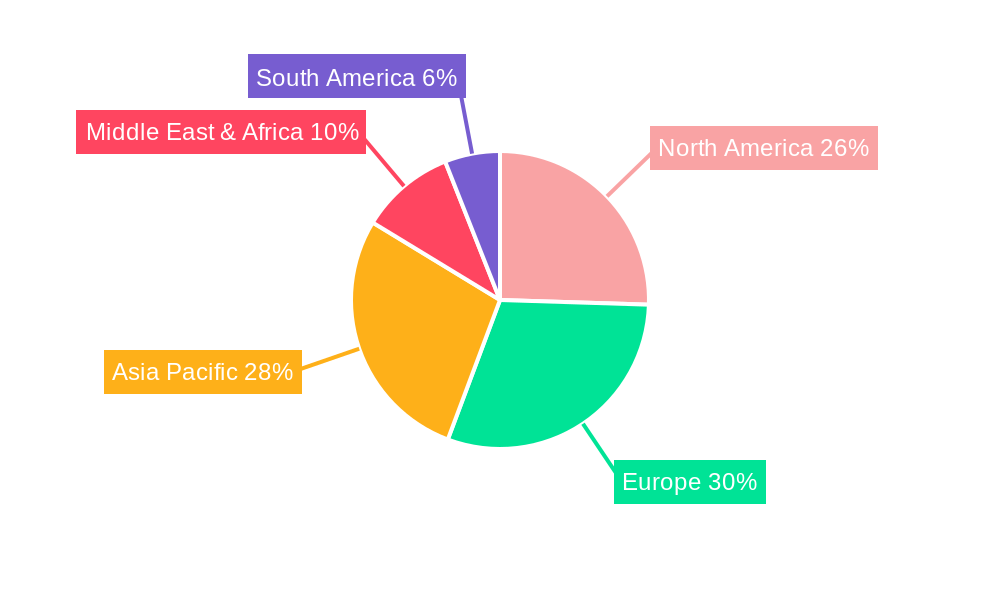

UK Ophthalmic Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Ophthalmic Industry Regional Market Share

Geographic Coverage of UK Ophthalmic Industry

UK Ophthalmic Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demographic Shift and Increasing Prevalence of Eye Diseases; Technological Advancements in Ophthalmic Devices

- 3.3. Market Restrains

- 3.3.1. Risk Associated with Ophthalmic Procedures

- 3.4. Market Trends

- 3.4.1. Optical Coherence Tomography Scanners under Diagnostic and Monitoring Devices Segment is Expected to Register Significant CAGR over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Ophthalmic Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 5.1.1. Surgical Devices

- 5.1.1.1. Glaucoma Drainage Devices

- 5.1.1.2. Glaucoma Stents and Implants

- 5.1.1.3. Intraocular Lenses

- 5.1.1.4. Lasers

- 5.1.1.5. Other Surgical Devices

- 5.1.2. Diagnostic and Monitoring Devices

- 5.1.2.1. Autorefractors and Keratometers

- 5.1.2.2. Corneal Topography Systems

- 5.1.2.3. Ophthalmic Ultrasound Imaging Systems

- 5.1.2.4. Ophthalmoscopes

- 5.1.2.5. Optical Coherence Tomography Scanners

- 5.1.2.6. Other Diagnostic and Monitoring Devices

- 5.1.3. Vision Correction Devices

- 5.1.3.1. Spectacles

- 5.1.3.2. Contact Lenses

- 5.1.1. Surgical Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 6. North America UK Ophthalmic Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Devices

- 6.1.1. Surgical Devices

- 6.1.1.1. Glaucoma Drainage Devices

- 6.1.1.2. Glaucoma Stents and Implants

- 6.1.1.3. Intraocular Lenses

- 6.1.1.4. Lasers

- 6.1.1.5. Other Surgical Devices

- 6.1.2. Diagnostic and Monitoring Devices

- 6.1.2.1. Autorefractors and Keratometers

- 6.1.2.2. Corneal Topography Systems

- 6.1.2.3. Ophthalmic Ultrasound Imaging Systems

- 6.1.2.4. Ophthalmoscopes

- 6.1.2.5. Optical Coherence Tomography Scanners

- 6.1.2.6. Other Diagnostic and Monitoring Devices

- 6.1.3. Vision Correction Devices

- 6.1.3.1. Spectacles

- 6.1.3.2. Contact Lenses

- 6.1.1. Surgical Devices

- 6.1. Market Analysis, Insights and Forecast - by Devices

- 7. South America UK Ophthalmic Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Devices

- 7.1.1. Surgical Devices

- 7.1.1.1. Glaucoma Drainage Devices

- 7.1.1.2. Glaucoma Stents and Implants

- 7.1.1.3. Intraocular Lenses

- 7.1.1.4. Lasers

- 7.1.1.5. Other Surgical Devices

- 7.1.2. Diagnostic and Monitoring Devices

- 7.1.2.1. Autorefractors and Keratometers

- 7.1.2.2. Corneal Topography Systems

- 7.1.2.3. Ophthalmic Ultrasound Imaging Systems

- 7.1.2.4. Ophthalmoscopes

- 7.1.2.5. Optical Coherence Tomography Scanners

- 7.1.2.6. Other Diagnostic and Monitoring Devices

- 7.1.3. Vision Correction Devices

- 7.1.3.1. Spectacles

- 7.1.3.2. Contact Lenses

- 7.1.1. Surgical Devices

- 7.1. Market Analysis, Insights and Forecast - by Devices

- 8. Europe UK Ophthalmic Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Devices

- 8.1.1. Surgical Devices

- 8.1.1.1. Glaucoma Drainage Devices

- 8.1.1.2. Glaucoma Stents and Implants

- 8.1.1.3. Intraocular Lenses

- 8.1.1.4. Lasers

- 8.1.1.5. Other Surgical Devices

- 8.1.2. Diagnostic and Monitoring Devices

- 8.1.2.1. Autorefractors and Keratometers

- 8.1.2.2. Corneal Topography Systems

- 8.1.2.3. Ophthalmic Ultrasound Imaging Systems

- 8.1.2.4. Ophthalmoscopes

- 8.1.2.5. Optical Coherence Tomography Scanners

- 8.1.2.6. Other Diagnostic and Monitoring Devices

- 8.1.3. Vision Correction Devices

- 8.1.3.1. Spectacles

- 8.1.3.2. Contact Lenses

- 8.1.1. Surgical Devices

- 8.1. Market Analysis, Insights and Forecast - by Devices

- 9. Middle East & Africa UK Ophthalmic Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Devices

- 9.1.1. Surgical Devices

- 9.1.1.1. Glaucoma Drainage Devices

- 9.1.1.2. Glaucoma Stents and Implants

- 9.1.1.3. Intraocular Lenses

- 9.1.1.4. Lasers

- 9.1.1.5. Other Surgical Devices

- 9.1.2. Diagnostic and Monitoring Devices

- 9.1.2.1. Autorefractors and Keratometers

- 9.1.2.2. Corneal Topography Systems

- 9.1.2.3. Ophthalmic Ultrasound Imaging Systems

- 9.1.2.4. Ophthalmoscopes

- 9.1.2.5. Optical Coherence Tomography Scanners

- 9.1.2.6. Other Diagnostic and Monitoring Devices

- 9.1.3. Vision Correction Devices

- 9.1.3.1. Spectacles

- 9.1.3.2. Contact Lenses

- 9.1.1. Surgical Devices

- 9.1. Market Analysis, Insights and Forecast - by Devices

- 10. Asia Pacific UK Ophthalmic Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Devices

- 10.1.1. Surgical Devices

- 10.1.1.1. Glaucoma Drainage Devices

- 10.1.1.2. Glaucoma Stents and Implants

- 10.1.1.3. Intraocular Lenses

- 10.1.1.4. Lasers

- 10.1.1.5. Other Surgical Devices

- 10.1.2. Diagnostic and Monitoring Devices

- 10.1.2.1. Autorefractors and Keratometers

- 10.1.2.2. Corneal Topography Systems

- 10.1.2.3. Ophthalmic Ultrasound Imaging Systems

- 10.1.2.4. Ophthalmoscopes

- 10.1.2.5. Optical Coherence Tomography Scanners

- 10.1.2.6. Other Diagnostic and Monitoring Devices

- 10.1.3. Vision Correction Devices

- 10.1.3.1. Spectacles

- 10.1.3.2. Contact Lenses

- 10.1.1. Surgical Devices

- 10.1. Market Analysis, Insights and Forecast - by Devices

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CooperVision

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carl Zeiss Meditec AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HAAG-Streit Group (Metall Zug AG)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IRIDEX Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ziemer Ophthalmic Systems AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nidek Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson and Johnson

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Topcon Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alcon Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bausch Health Companies Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CooperVision

List of Figures

- Figure 1: Global UK Ophthalmic Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global UK Ophthalmic Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America UK Ophthalmic Industry Revenue (million), by Devices 2025 & 2033

- Figure 4: North America UK Ophthalmic Industry Volume (K Unit), by Devices 2025 & 2033

- Figure 5: North America UK Ophthalmic Industry Revenue Share (%), by Devices 2025 & 2033

- Figure 6: North America UK Ophthalmic Industry Volume Share (%), by Devices 2025 & 2033

- Figure 7: North America UK Ophthalmic Industry Revenue (million), by Country 2025 & 2033

- Figure 8: North America UK Ophthalmic Industry Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America UK Ophthalmic Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America UK Ophthalmic Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: South America UK Ophthalmic Industry Revenue (million), by Devices 2025 & 2033

- Figure 12: South America UK Ophthalmic Industry Volume (K Unit), by Devices 2025 & 2033

- Figure 13: South America UK Ophthalmic Industry Revenue Share (%), by Devices 2025 & 2033

- Figure 14: South America UK Ophthalmic Industry Volume Share (%), by Devices 2025 & 2033

- Figure 15: South America UK Ophthalmic Industry Revenue (million), by Country 2025 & 2033

- Figure 16: South America UK Ophthalmic Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: South America UK Ophthalmic Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America UK Ophthalmic Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe UK Ophthalmic Industry Revenue (million), by Devices 2025 & 2033

- Figure 20: Europe UK Ophthalmic Industry Volume (K Unit), by Devices 2025 & 2033

- Figure 21: Europe UK Ophthalmic Industry Revenue Share (%), by Devices 2025 & 2033

- Figure 22: Europe UK Ophthalmic Industry Volume Share (%), by Devices 2025 & 2033

- Figure 23: Europe UK Ophthalmic Industry Revenue (million), by Country 2025 & 2033

- Figure 24: Europe UK Ophthalmic Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe UK Ophthalmic Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe UK Ophthalmic Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa UK Ophthalmic Industry Revenue (million), by Devices 2025 & 2033

- Figure 28: Middle East & Africa UK Ophthalmic Industry Volume (K Unit), by Devices 2025 & 2033

- Figure 29: Middle East & Africa UK Ophthalmic Industry Revenue Share (%), by Devices 2025 & 2033

- Figure 30: Middle East & Africa UK Ophthalmic Industry Volume Share (%), by Devices 2025 & 2033

- Figure 31: Middle East & Africa UK Ophthalmic Industry Revenue (million), by Country 2025 & 2033

- Figure 32: Middle East & Africa UK Ophthalmic Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Ophthalmic Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa UK Ophthalmic Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific UK Ophthalmic Industry Revenue (million), by Devices 2025 & 2033

- Figure 36: Asia Pacific UK Ophthalmic Industry Volume (K Unit), by Devices 2025 & 2033

- Figure 37: Asia Pacific UK Ophthalmic Industry Revenue Share (%), by Devices 2025 & 2033

- Figure 38: Asia Pacific UK Ophthalmic Industry Volume Share (%), by Devices 2025 & 2033

- Figure 39: Asia Pacific UK Ophthalmic Industry Revenue (million), by Country 2025 & 2033

- Figure 40: Asia Pacific UK Ophthalmic Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Ophthalmic Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UK Ophthalmic Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Ophthalmic Industry Revenue million Forecast, by Devices 2020 & 2033

- Table 2: Global UK Ophthalmic Industry Volume K Unit Forecast, by Devices 2020 & 2033

- Table 3: Global UK Ophthalmic Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global UK Ophthalmic Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global UK Ophthalmic Industry Revenue million Forecast, by Devices 2020 & 2033

- Table 6: Global UK Ophthalmic Industry Volume K Unit Forecast, by Devices 2020 & 2033

- Table 7: Global UK Ophthalmic Industry Revenue million Forecast, by Country 2020 & 2033

- Table 8: Global UK Ophthalmic Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: United States UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Canada UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Mexico UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Mexico UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global UK Ophthalmic Industry Revenue million Forecast, by Devices 2020 & 2033

- Table 16: Global UK Ophthalmic Industry Volume K Unit Forecast, by Devices 2020 & 2033

- Table 17: Global UK Ophthalmic Industry Revenue million Forecast, by Country 2020 & 2033

- Table 18: Global UK Ophthalmic Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Brazil UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Brazil UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Argentina UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Argentina UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Global UK Ophthalmic Industry Revenue million Forecast, by Devices 2020 & 2033

- Table 26: Global UK Ophthalmic Industry Volume K Unit Forecast, by Devices 2020 & 2033

- Table 27: Global UK Ophthalmic Industry Revenue million Forecast, by Country 2020 & 2033

- Table 28: Global UK Ophthalmic Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Germany UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: France UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Italy UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Italy UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Spain UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Spain UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Russia UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Russia UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Benelux UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Benelux UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Nordics UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Nordics UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Global UK Ophthalmic Industry Revenue million Forecast, by Devices 2020 & 2033

- Table 48: Global UK Ophthalmic Industry Volume K Unit Forecast, by Devices 2020 & 2033

- Table 49: Global UK Ophthalmic Industry Revenue million Forecast, by Country 2020 & 2033

- Table 50: Global UK Ophthalmic Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Turkey UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Turkey UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Israel UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Israel UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: GCC UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 56: GCC UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: North Africa UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 58: North Africa UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Africa UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 60: South Africa UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global UK Ophthalmic Industry Revenue million Forecast, by Devices 2020 & 2033

- Table 64: Global UK Ophthalmic Industry Volume K Unit Forecast, by Devices 2020 & 2033

- Table 65: Global UK Ophthalmic Industry Revenue million Forecast, by Country 2020 & 2033

- Table 66: Global UK Ophthalmic Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 67: China UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 68: China UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: India UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 70: India UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Japan UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 72: Japan UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Korea UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 74: South Korea UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: ASEAN UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 76: ASEAN UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Oceania UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 78: Oceania UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific UK Ophthalmic Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific UK Ophthalmic Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Ophthalmic Industry?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the UK Ophthalmic Industry?

Key companies in the market include CooperVision, Carl Zeiss Meditec AG, HAAG-Streit Group (Metall Zug AG), IRIDEX Corporation, Ziemer Ophthalmic Systems AG, Nidek Co Ltd, Johnson and Johnson, Topcon Corporation, Alcon Inc, Bausch Health Companies Inc.

3. What are the main segments of the UK Ophthalmic Industry?

The market segments include Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 2779.67 million as of 2022.

5. What are some drivers contributing to market growth?

Demographic Shift and Increasing Prevalence of Eye Diseases; Technological Advancements in Ophthalmic Devices.

6. What are the notable trends driving market growth?

Optical Coherence Tomography Scanners under Diagnostic and Monitoring Devices Segment is Expected to Register Significant CAGR over the Forecast Period.

7. Are there any restraints impacting market growth?

Risk Associated with Ophthalmic Procedures.

8. Can you provide examples of recent developments in the market?

August 2022- Alcon launched Dailies Total 1 contact lens for astigmatism. The company made this new contact lens available for patients with astigmatism in the United Kingdom and Ireland in September 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Ophthalmic Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Ophthalmic Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Ophthalmic Industry?

To stay informed about further developments, trends, and reports in the UK Ophthalmic Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence