Key Insights

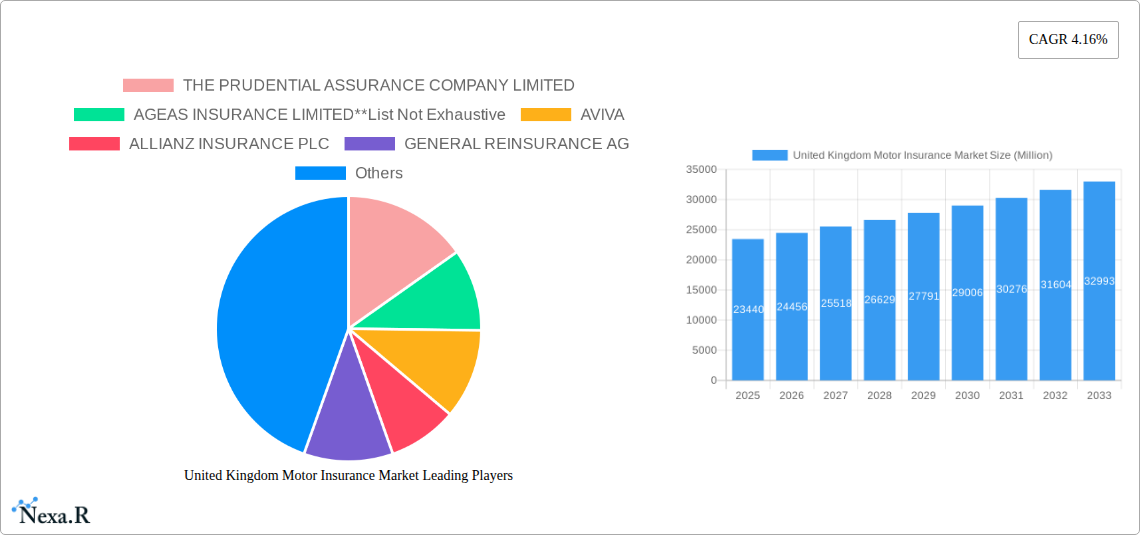

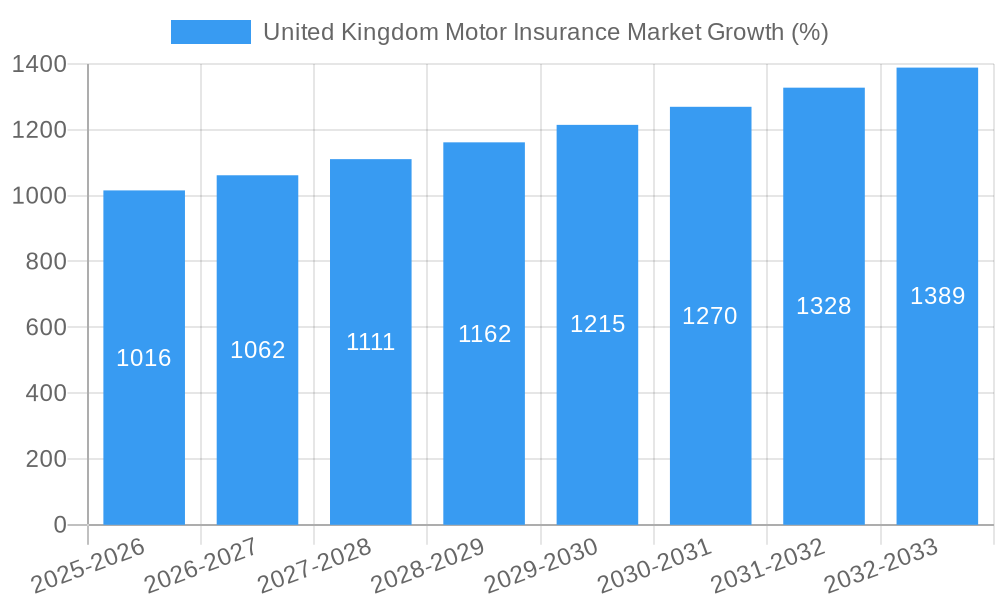

The United Kingdom motor insurance market, valued at £23.44 billion in 2025, exhibits a steady growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.16% from 2025 to 2033. This growth is driven by several factors. Rising vehicle ownership, particularly within younger demographics adopting new technologies and car-sharing models, fuels demand. Increasing awareness of comprehensive coverage and the associated financial protection against accidents and theft also contributes. Furthermore, stringent government regulations on minimum insurance requirements and stricter enforcement enhance market penetration. The market is segmented by product type (Third-Party, Third-Party Fire & Theft, Comprehensive) and distribution channel (Direct, Agency, Banks, Others). While direct channels are gaining traction due to online convenience and competitive pricing, traditional agency networks remain significant, particularly for complex policies or specialized needs. Competition among established players like Aviva, Allianz, and Zurich, alongside smaller insurers, is fierce, leading to innovative product offerings and competitive pricing strategies. The market's growth is, however, tempered by economic fluctuations impacting consumer spending and potential increases in claims costs driven by rising repair expenses and vehicle prices.

The forecast period (2025-2033) anticipates a continued, albeit moderate, expansion. The adoption of telematics and usage-based insurance is expected to reshape the landscape, offering personalized premiums based on driving behavior and potentially reducing costs for safer drivers. This technological advancement, alongside a greater focus on fraud detection and prevention, will influence future market dynamics. Regional variations within the UK are expected, with areas exhibiting higher vehicle density and accident rates potentially showing higher premiums and growth. The dominance of larger insurance companies is likely to persist, although smaller, niche players specializing in specific market segments might carve out their share. Overall, the UK motor insurance market presents a stable, albeit competitive, investment opportunity within a constantly evolving regulatory and technological environment.

United Kingdom Motor Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United Kingdom motor insurance market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and navigate this dynamic market. The report utilizes a parent market approach focusing on the UK insurance sector, with a child market deep-dive into the motor insurance segment. Market values are presented in millions.

United Kingdom Motor Insurance Market Dynamics & Structure

The UK motor insurance market is a highly competitive landscape characterized by a mix of large multinational players and smaller, specialized insurers. Market concentration is moderate, with the top five insurers holding an estimated xx% market share in 2024. Technological innovation, driven by telematics and AI-powered risk assessment, is reshaping the industry, but adoption rates remain varied across insurers. Stringent regulatory frameworks imposed by the Financial Conduct Authority (FCA) heavily influence pricing and product offerings. Competitive substitutes, such as peer-to-peer insurance platforms, are gaining traction, putting pressure on traditional players. End-user demographics, especially the growing number of younger drivers and the increasing adoption of electric vehicles, further influence market dynamics. M&A activity has been significant, with notable deals like AXA's acquisition of Ageas UK's commercial operations significantly altering the competitive landscape.

- Market Concentration: Top 5 insurers hold xx% market share (2024).

- Technological Innovation: Telematics, AI-powered risk assessment.

- Regulatory Framework: FCA regulations significantly impact pricing and product design.

- Competitive Substitutes: Peer-to-peer insurance platforms gaining market share.

- M&A Activity: High deal volume in recent years; AXA’s acquisition of Ageas’ commercial operations.

- End-User Demographics: Shifting demographics with increasing EV adoption impacting insurance needs.

United Kingdom Motor Insurance Market Growth Trends & Insights

The UK motor insurance market exhibited a CAGR of xx% during the historical period (2019-2024), reaching a market size of £xx million in 2024. Growth is expected to continue at a CAGR of xx% during the forecast period (2025-2033), driven by factors such as increasing vehicle ownership, rising claims costs, and technological advancements. Market penetration is high, with almost all vehicle owners holding insurance. However, technological disruptions, like the rise of usage-based insurance (UBI), are reshaping consumer behavior, leading to a greater focus on personalized pricing and risk assessment. Increased awareness of environmental concerns and the growth of electric vehicles are also influencing consumer choices.

Dominant Regions, Countries, or Segments in United Kingdom Motor Insurance Market

While the UK motor insurance market is nationwide, certain segments and distribution channels demonstrate stronger growth. The comprehensive insurance segment maintains the largest market share, driven by consumer preference for broader coverage. The direct distribution channel continues to dominate, thanks to ease of access and often competitive pricing. London and other major urban areas exhibit higher insurance premiums due to higher risk profiles.

- Dominant Segment: Comprehensive insurance (xx% market share in 2024).

- Dominant Distribution Channel: Direct sales (xx% market share in 2024).

- High-Premium Regions: London and other major urban centers.

- Growth Drivers: Rising vehicle ownership, increasing claims costs, technological advancements.

United Kingdom Motor Insurance Market Product Landscape

The UK motor insurance market offers a wide range of products, from basic third-party liability to comprehensive coverage. Innovations include telematics-based insurance, offering personalized premiums based on driving behavior, and add-on services like breakdown cover. These products cater to diverse consumer needs and risk profiles, with technological advancements continually enhancing their capabilities. Unique selling propositions (USPs) focus on price competitiveness, personalized customer service, and value-added benefits.

Key Drivers, Barriers & Challenges in United Kingdom Motor Insurance Market

Key Drivers:

- Increasing vehicle ownership.

- Rising claims costs due to increased road traffic and repair expenses.

- Technological advancements enabling more accurate risk assessment and personalized pricing.

Key Challenges:

- Intense competition leading to price pressure.

- Regulatory changes impacting pricing and product design.

- Fraudulent claims and rising insurance costs.

- Supply chain disruptions impacting repair costs and timelines.

Emerging Opportunities in United Kingdom Motor Insurance Market

- Expansion of telematics and usage-based insurance (UBI).

- Growth of electric vehicle (EV) insurance specialized products.

- Development of innovative risk assessment models using AI and big data.

- Adoption of new technologies, such as blockchain, to improve efficiency and transparency.

Growth Accelerators in the United Kingdom Motor Insurance Market Industry

Strategic partnerships and mergers & acquisitions (M&A) continue to fuel growth. Technological innovations, such as advanced analytics and AI-powered fraud detection, are improving operational efficiency and enhancing customer experiences. Expanding into niche markets and offering specialized insurance products cater to evolving consumer needs.

Key Players Shaping the United Kingdom Motor Insurance Market Market

- THE PRUDENTIAL ASSURANCE COMPANY LIMITED

- AGEAS INSURANCE LIMITED

- AVIVA

- ALLIANZ INSURANCE PLC

- GENERAL REINSURANCE AG

- ZURICH ASSURANCE LTD

- AXA INSURANCE UK PLC

- DL INSURANCE SERVICES LIMITED

- ROYAL & SUN ALLIANCE INSURANCE PLC

Notable Milestones in United Kingdom Motor Insurance Market Sector

- February 2022: AXA UK&I acquired Ageas UK's commercial operations for GBP 47.5 million, expanding its market share and strengthening its commercial business offerings.

- January 2022: Comprehensive car insurance premiums rose by 5% in the final quarter of 2021, reaching an average of GBP 539, reflecting increased driving activity post-COVID-19 restrictions.

In-Depth United Kingdom Motor Insurance Market Market Outlook

The UK motor insurance market is poised for continued growth, driven by technological advancements, shifting consumer preferences, and evolving regulatory landscapes. Strategic partnerships, product innovation, and expansion into emerging segments will be crucial for success. The market presents significant opportunities for insurers who can adapt to changing market dynamics and leverage technological advancements to provide efficient, customer-centric insurance solutions.

United Kingdom Motor Insurance Market Segmentation

-

1. Product Type

- 1.1. Third-Party

- 1.2. Third-party Fire and Theft

- 1.3. Comprehensive

-

2. Distribution channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Others

United Kingdom Motor Insurance Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Motor Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.16% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Data Privacy Regulations; Business Interruption

- 3.3. Market Restrains

- 3.3.1. Complexity and Lack of Understanding; Cost of Coverage

- 3.4. Market Trends

- 3.4.1. High Volatility in Car Insurance Premiums During the Past Few Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Third-Party

- 5.1.2. Third-party Fire and Theft

- 5.1.3. Comprehensive

- 5.2. Market Analysis, Insights and Forecast - by Distribution channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China United Kingdom Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. India United Kingdom Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Singapore United Kingdom Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia United Kingdom Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Rest Asia Pacific United Kingdom Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 THE PRUDENTIAL ASSURANCE COMPANY LIMITED

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AGEAS INSURANCE LIMITED**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AVIVA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ALLIANZ INSURANCE PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GENERAL REINSURANCE AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ZURICH ASSURANCE LTD

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AXA INSURANCE UK PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DL INSURANCE SERVICES LIMITED

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ROYAL & SUN ALLIANCE INSURANCE PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 THE PRUDENTIAL ASSURANCE COMPANY LIMITED

List of Figures

- Figure 1: United Kingdom Motor Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Motor Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Motor Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Motor Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: United Kingdom Motor Insurance Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 4: United Kingdom Motor Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United Kingdom Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United Kingdom Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United Kingdom Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Motor Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: United Kingdom Motor Insurance Market Revenue Million Forecast, by Distribution channel 2019 & 2032

- Table 17: United Kingdom Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Motor Insurance Market?

The projected CAGR is approximately 4.16%.

2. Which companies are prominent players in the United Kingdom Motor Insurance Market?

Key companies in the market include THE PRUDENTIAL ASSURANCE COMPANY LIMITED, AGEAS INSURANCE LIMITED**List Not Exhaustive, AVIVA, ALLIANZ INSURANCE PLC, GENERAL REINSURANCE AG, ZURICH ASSURANCE LTD, AXA INSURANCE UK PLC, DL INSURANCE SERVICES LIMITED, ROYAL & SUN ALLIANCE INSURANCE PLC.

3. What are the main segments of the United Kingdom Motor Insurance Market?

The market segments include Product Type, Distribution channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Data Privacy Regulations; Business Interruption.

6. What are the notable trends driving market growth?

High Volatility in Car Insurance Premiums During the Past Few Years.

7. Are there any restraints impacting market growth?

Complexity and Lack of Understanding; Cost of Coverage.

8. Can you provide examples of recent developments in the market?

Feb 2022: For an initial payment of GBP 47.5 million, AXA UK&I purchased the renewal rights to Ageas UK's commercial operations. This acquisition reinforces AXA's growth strategy and dedication to its commercial business clients and broker alliances, particularly in the SME and Schemes market sectors. About 100 Ageas UK personnel will transfer to AXA Commercial as part of the arrangement to provide continued support and service delivery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Motor Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Motor Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Motor Insurance Market?

To stay informed about further developments, trends, and reports in the United Kingdom Motor Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence