Key Insights

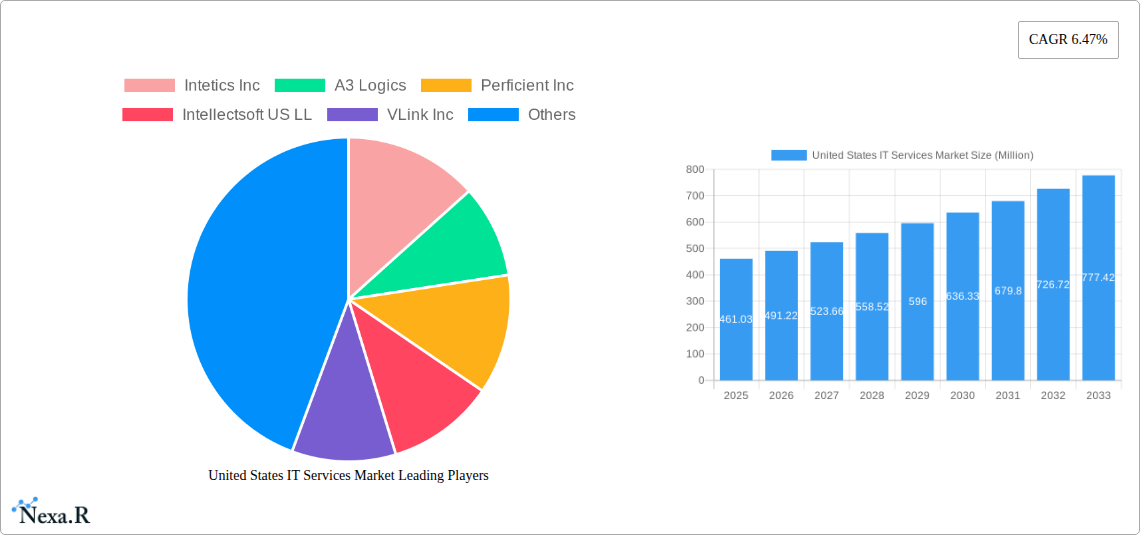

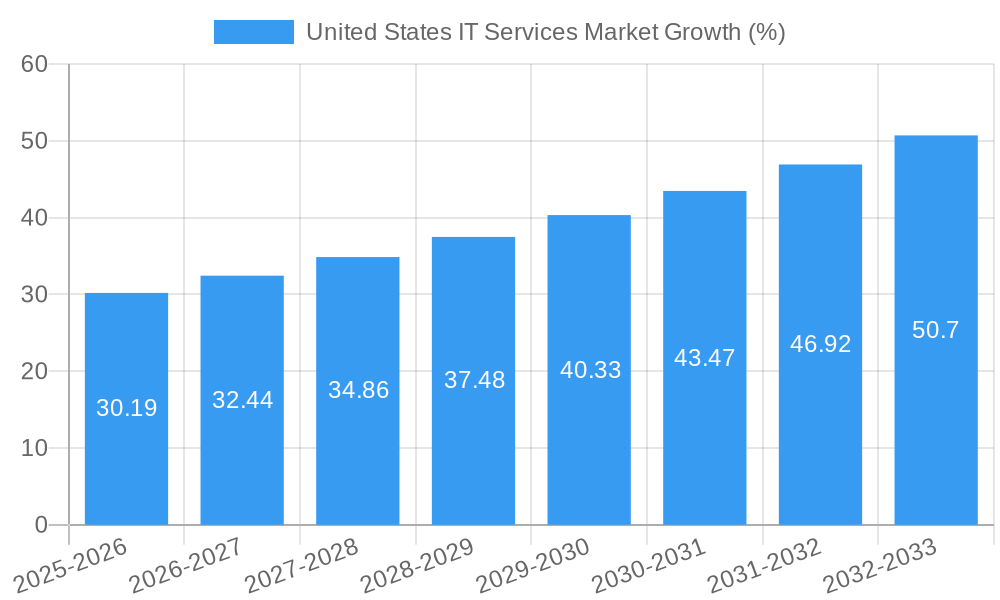

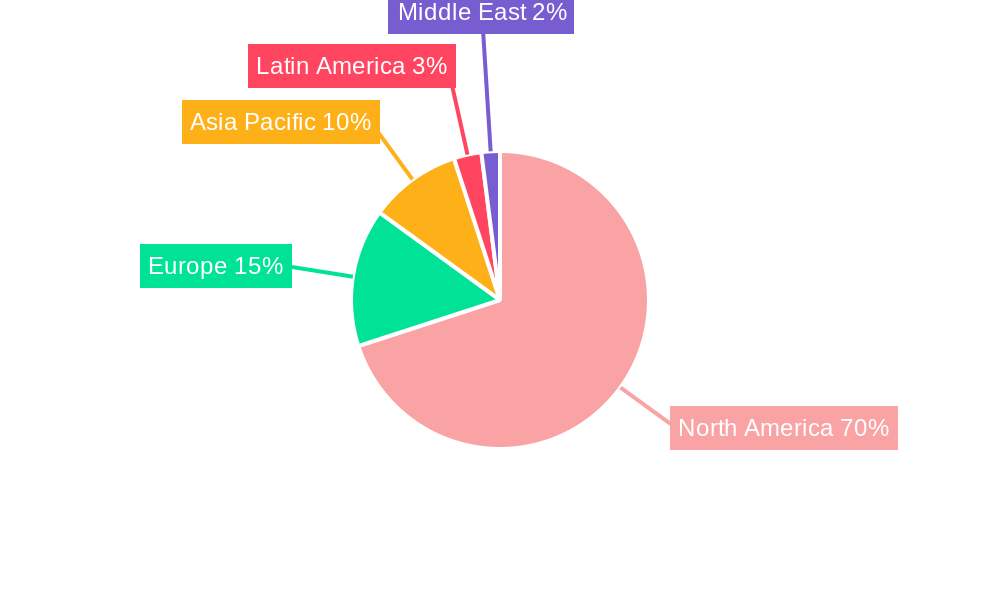

The United States IT services market, valued at $461.03 million in 2025, is projected to experience robust growth, driven by increasing digital transformation initiatives across various sectors and the escalating demand for cloud-based solutions, cybersecurity enhancements, and data analytics capabilities. The market's Compound Annual Growth Rate (CAGR) of 6.47% from 2025 to 2033 indicates a significant expansion, with substantial opportunities for both established players and emerging technology firms. Key growth drivers include the rising adoption of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) across industries like BFSI (Banking, Financial Services, and Insurance), healthcare, and manufacturing. Furthermore, government initiatives promoting digital infrastructure and cybersecurity are further bolstering market expansion. The market is segmented by type (IT Consulting & Implementation, IT Outsourcing, Business Process Outsourcing, Other) and end-user (Manufacturing, Government, BFSI, Healthcare, Retail & Consumer Goods, Logistics, Other). While the exact regional breakdown is unavailable, it's reasonable to assume North America commands a significant share, given the data's focus on the US market. However, the growth trajectory is expected to be influenced by factors like fluctuating economic conditions, skilled labor shortages, and the intensifying competition within the industry. The market's expansion will likely be punctuated by strategic mergers and acquisitions, technology advancements, and an ongoing focus on providing innovative and cost-effective solutions.

The competitive landscape is highly fragmented, with numerous large multinational corporations and smaller specialized firms vying for market share. Companies like Accenture, IBM, Infosys, Wipro, and others, along with several smaller, agile businesses, are contributing to the market's dynamism. The success of individual players will hinge on their ability to adapt to evolving technological landscapes, deliver customized solutions, and build strong client relationships. Future growth will depend on the effective implementation of innovative strategies that address emerging business needs, the rising adoption of hybrid work models, and the ongoing demand for secure and reliable IT infrastructure. The market's trajectory suggests a significant opportunity for investment and growth, albeit with challenges presented by maintaining competitive pricing and talent acquisition.

United States IT Services Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States IT services market, encompassing market size, growth trends, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The market is segmented by type (IT Consulting and Implementation, IT Outsourcing, Business Process Outsourcing, Other Types) and end-user (Manufacturing, Government, BFSI, Healthcare, Retail and Consumer Goods, Logistics, Other End-Users). The report features key players including Intetics Inc, A3 Logics, Perficient Inc, Intellectsoft US LL, VLink Inc, MAS Global Consulting, Kanda Software, Infosys Limited, Wipro Limited, Edafio Technology Partners, Accenture PLC, Innowise Group, Algoworks Solutions Inc, Intersog, IBM Corporation, Premier BPO LLC, TATA Consultancy Services Limited, Ardem Incorporated, Accedia, Capgemini SE, Peak Support LLC, Synoptek LLC, Sphere Partners LLC, Centricsit LLC, Microsoft Corporation, Integris, VATES S A, Fingent Corp, Wave Access USA, Unity Communications, Velvetech LLC, Bottle Rocket LLC, DevDigital LLC, Atos SE, Progent Corporation, Icreon Holdings Inc, Leidos Holdings Inc, Galaxy Weblinks LTD, Slalom Inc, Sumerge, CHI Software, Simform, Computer Solution East Inc, HCL Technologies Limited, and Sciencesoft USA Corporation.

United States IT Services Market Dynamics & Structure

The US IT services market is characterized by a moderately concentrated landscape with several large players holding significant market share. However, a large number of smaller, specialized firms also contribute significantly. Technological innovation, particularly in areas like cloud computing, AI, and cybersecurity, is a key driver of market growth. Regulatory frameworks, including data privacy regulations (like CCPA and GDPR impact), influence market practices and investments. The market experiences competitive pressure from product substitutes, including open-source software and offshoring options. End-user demographics are shifting towards increased digital adoption across all sectors. M&A activity is frequent, driven by the pursuit of scale, technological capabilities, and geographic expansion.

- Market Concentration: The top 10 players hold approximately xx% of the market share in 2025 (estimated).

- M&A Deal Volume: An estimated xx deals were concluded in the historical period (2019-2024).

- Innovation Barriers: High initial investment costs, talent acquisition challenges, and integration complexities hinder innovation.

- Regulatory Impact: Compliance with data privacy regulations increases operational costs and necessitates specialized expertise.

United States IT Services Market Growth Trends & Insights

The US IT services market exhibited strong growth during the historical period (2019-2024), driven by factors like increasing digital transformation initiatives, rising cloud adoption, and the growing need for cybersecurity solutions. The market is expected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Market size is projected to reach xx Million by 2033 from xx Million in 2025. Increased adoption of SaaS and PaaS solutions, coupled with the growing demand for IT outsourcing, is expected to accelerate market growth. Consumer behavior is shifting towards a preference for flexible, on-demand IT services. Technological disruptions like the rise of AI and blockchain are reshaping the market landscape.

Dominant Regions, Countries, or Segments in United States IT Services Market

The California, New York, and Texas regions are expected to dominate the US IT services market, primarily due to the presence of major technology hubs and a high concentration of businesses across various sectors. The BFSI and Healthcare segments exhibit the highest growth potential driven by stringent regulatory requirements for data security and increasing need for digital transformation within these industries. The IT Outsourcing segment is expected to maintain its dominance, primarily driven by cost optimization and access to specialized talent.

- Key Drivers (California): High concentration of tech companies, strong venture capital funding, and a robust talent pool.

- Key Drivers (BFSI): Stringent regulatory compliance requirements, increased adoption of fintech solutions, and the need to enhance customer experience.

- Market Share: California is projected to hold xx% market share by 2033. The BFSI segment will hold an estimated xx% of the total market in 2033.

United States IT Services Market Product Landscape

The US IT services market offers a diverse range of products and services, encompassing cloud computing, cybersecurity, data analytics, AI, and blockchain solutions. These products and services address diverse business needs, ranging from IT infrastructure management to digital transformation strategies. Key performance indicators include service level agreements (SLAs), customer satisfaction, and cost optimization metrics. Unique selling propositions frequently center on specialized expertise, innovative solutions, and strong customer relationships. Ongoing technological advancements continue to improve the efficiency and effectiveness of these offerings.

Key Drivers, Barriers & Challenges in United States IT Services Market

Key Drivers: Increasing adoption of cloud computing, the growing need for cybersecurity solutions, rising demand for data analytics, and government initiatives promoting digital transformation. These factors are expected to drive market growth in the coming years.

Key Challenges: Intense competition, skilled labor shortages, economic downturns potentially impacting IT spending, and evolving regulatory landscapes can restrain market growth. Supply chain disruptions in technology components could impact project timelines and budgets.

Emerging Opportunities in United States IT Services Market

Untapped markets like edge computing and IoT offer significant growth opportunities. The increasing demand for AI-powered solutions across industries and evolving consumer preferences for personalized services present further growth potential. Expansion into niche market segments with specific technological needs, such as cybersecurity, presents a lucrative pathway.

Growth Accelerators in the United States IT Services Market Industry

Technological breakthroughs, particularly in AI and cloud computing, and the increasing strategic partnerships between IT service providers and enterprise clients will significantly boost the market. Furthermore, proactive expansion strategies targeting under-served sectors, coupled with investments in talent development and training, are crucial growth accelerators.

Key Players Shaping the United States IT Services Market Market

- Intetics Inc

- A3 Logics

- Perficient Inc

- Intellectsoft US LL

- VLink Inc

- MAS Global Consulting

- Kanda Software

- Infosys Limited

- Wipro Limited

- Edafio Technology Partners

- Accenture PLC

- Innowise Group

- Algoworks Solutions Inc

- Intersog

- IBM Corporation

- Premier BPO LLC

- TATA Consultancy Services Limited

- Ardem Incorporated

- Accedia

- Capgemini SE

- Peak Support LLC

- Synoptek LLC

- Sphere Partners LLC

- Centricsit LLC

- Microsoft Corporation

- Integris

- VATES S A

- Fingent Corp

- Wave Access USA

- Unity Communications

- Velvetech LLC

- Bottle Rocket LLC

- DevDigital LLC

- Atos SE

- Progent Corporation

- Icreon Holdings Inc

- Leidos Holdings Inc

- Galaxy Weblinks LTD

- Slalom Inc

- Sumerge

- CHI Software

- Simform

- Computer Solution East Inc

- HCL Technologies Limited

- Sciencesoft USA Corporation

Notable Milestones in United States IT Services Market Sector

- June 2023: Genpact partners with Walmart to support its North American finance and accounting operations, boosting Genpact's growth and contributing to overall market expansion.

- March 2023: Virtusa Corporation partners with Aecon Group Inc. for cloud migration services, demonstrating the increasing demand for cloud-based solutions in the construction sector.

In-Depth United States IT Services Market Market Outlook

The US IT services market is poised for sustained growth, driven by continuous technological advancements, increasing digital adoption across all sectors, and the growing need for specialized IT expertise. Strategic partnerships, investments in R&D, and expansion into new markets will further shape the industry's trajectory, presenting substantial opportunities for both established players and emerging firms. The focus will remain on delivering innovative, cost-effective, and scalable IT solutions to cater to the dynamic needs of various industries.

United States IT Services Market Segmentation

-

1. Type

- 1.1. IT Consulting and Implementation

- 1.2. IT Outsourcing

- 1.3. Business Process Outsourcing

- 1.4. Other Types

-

2. End-User

- 2.1. Manufacturing

- 2.2. Government

- 2.3. BFSI

- 2.4. Healthcare

- 2.5. Retail and Consumer Goods

- 2.6. Logistics

- 2.7. Other End-Users

United States IT Services Market Segmentation By Geography

- 1. United States

United States IT Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Acceleration of Digital Transformation Across Industries and Adoption of New Technologies; Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations

- 3.3. Market Restrains

- 3.3.1 Data Security

- 3.3.2 Customization

- 3.3.3 and Data Migration

- 3.4. Market Trends

- 3.4.1. IT Outsourcing to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States IT Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. IT Consulting and Implementation

- 5.1.2. IT Outsourcing

- 5.1.3. Business Process Outsourcing

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing

- 5.2.2. Government

- 5.2.3. BFSI

- 5.2.4. Healthcare

- 5.2.5. Retail and Consumer Goods

- 5.2.6. Logistics

- 5.2.7. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America United States IT Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States IT Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States IT Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America United States IT Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East United States IT Services Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Intetics Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 A3 Logics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Perficient Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intellectsoft US LL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 VLink Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MAS Global Consulting

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kanda Software

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Infosys Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wipro Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Edafio Technology Partners

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Accenture PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Innowise Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Algoworks Solutions Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Intersog

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 IBM Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Premier BPO LLC

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 TATA Consultancy Services Limited

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ardem Incorporated

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Accedia

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Capgemini SE

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Peak Support LLC

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Synoptek LLC

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Sphere Partners LLC

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Centricsit LLC

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Microsoft Corporation

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Integris

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 VATES S A

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Fingent Corp

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Wave Access USA

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Unity Communications

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 Velvetech LLC

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 Bottle Rocket LLC

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.33 DevDigital LLC

- 11.2.33.1. Overview

- 11.2.33.2. Products

- 11.2.33.3. SWOT Analysis

- 11.2.33.4. Recent Developments

- 11.2.33.5. Financials (Based on Availability)

- 11.2.34 Atos SE

- 11.2.34.1. Overview

- 11.2.34.2. Products

- 11.2.34.3. SWOT Analysis

- 11.2.34.4. Recent Developments

- 11.2.34.5. Financials (Based on Availability)

- 11.2.35 Progent Corporation

- 11.2.35.1. Overview

- 11.2.35.2. Products

- 11.2.35.3. SWOT Analysis

- 11.2.35.4. Recent Developments

- 11.2.35.5. Financials (Based on Availability)

- 11.2.36 Icreon Holdings Inc

- 11.2.36.1. Overview

- 11.2.36.2. Products

- 11.2.36.3. SWOT Analysis

- 11.2.36.4. Recent Developments

- 11.2.36.5. Financials (Based on Availability)

- 11.2.37 Leidos Holdings Inc

- 11.2.37.1. Overview

- 11.2.37.2. Products

- 11.2.37.3. SWOT Analysis

- 11.2.37.4. Recent Developments

- 11.2.37.5. Financials (Based on Availability)

- 11.2.38 Galaxy Weblinks LTD

- 11.2.38.1. Overview

- 11.2.38.2. Products

- 11.2.38.3. SWOT Analysis

- 11.2.38.4. Recent Developments

- 11.2.38.5. Financials (Based on Availability)

- 11.2.39 Slalom Inc

- 11.2.39.1. Overview

- 11.2.39.2. Products

- 11.2.39.3. SWOT Analysis

- 11.2.39.4. Recent Developments

- 11.2.39.5. Financials (Based on Availability)

- 11.2.40 Sumerge

- 11.2.40.1. Overview

- 11.2.40.2. Products

- 11.2.40.3. SWOT Analysis

- 11.2.40.4. Recent Developments

- 11.2.40.5. Financials (Based on Availability)

- 11.2.41 CHI Software

- 11.2.41.1. Overview

- 11.2.41.2. Products

- 11.2.41.3. SWOT Analysis

- 11.2.41.4. Recent Developments

- 11.2.41.5. Financials (Based on Availability)

- 11.2.42 Simform

- 11.2.42.1. Overview

- 11.2.42.2. Products

- 11.2.42.3. SWOT Analysis

- 11.2.42.4. Recent Developments

- 11.2.42.5. Financials (Based on Availability)

- 11.2.43 Computer Solution East Inc

- 11.2.43.1. Overview

- 11.2.43.2. Products

- 11.2.43.3. SWOT Analysis

- 11.2.43.4. Recent Developments

- 11.2.43.5. Financials (Based on Availability)

- 11.2.44 HCL Technologies Limited

- 11.2.44.1. Overview

- 11.2.44.2. Products

- 11.2.44.3. SWOT Analysis

- 11.2.44.4. Recent Developments

- 11.2.44.5. Financials (Based on Availability)

- 11.2.45 Sciencesoft USA Corporation

- 11.2.45.1. Overview

- 11.2.45.2. Products

- 11.2.45.3. SWOT Analysis

- 11.2.45.4. Recent Developments

- 11.2.45.5. Financials (Based on Availability)

- 11.2.1 Intetics Inc

List of Figures

- Figure 1: United States IT Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States IT Services Market Share (%) by Company 2024

List of Tables

- Table 1: United States IT Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States IT Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States IT Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: United States IT Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States IT Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United States IT Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States IT Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States IT Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States IT Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United States IT Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: United States IT Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: United States IT Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States IT Services Market?

The projected CAGR is approximately 6.47%.

2. Which companies are prominent players in the United States IT Services Market?

Key companies in the market include Intetics Inc, A3 Logics, Perficient Inc, Intellectsoft US LL, VLink Inc, MAS Global Consulting, Kanda Software, Infosys Limited, Wipro Limited, Edafio Technology Partners, Accenture PLC, Innowise Group, Algoworks Solutions Inc, Intersog, IBM Corporation, Premier BPO LLC, TATA Consultancy Services Limited, Ardem Incorporated, Accedia, Capgemini SE, Peak Support LLC, Synoptek LLC, Sphere Partners LLC, Centricsit LLC, Microsoft Corporation, Integris, VATES S A, Fingent Corp, Wave Access USA, Unity Communications, Velvetech LLC, Bottle Rocket LLC, DevDigital LLC, Atos SE, Progent Corporation, Icreon Holdings Inc, Leidos Holdings Inc, Galaxy Weblinks LTD, Slalom Inc, Sumerge, CHI Software, Simform, Computer Solution East Inc, HCL Technologies Limited, Sciencesoft USA Corporation.

3. What are the main segments of the United States IT Services Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 461.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Acceleration of Digital Transformation Across Industries and Adoption of New Technologies; Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations.

6. What are the notable trends driving market growth?

IT Outsourcing to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Data Security. Customization. and Data Migration.

8. Can you provide examples of recent developments in the market?

June 2023: Genpact, an IT service firm dedicated to driving transformative outcomes for businesses, proudly revealed its new partnership with Walmart. This strategic collaboration will see Genpact continue its unwavering support for Walmart's North American finance and accounting operations, with a particular focus on the USA market. This initiative is poised to not only propel Genpact's growth in the IT service sector but also contribute significantly to the overall expansion of the IT service market in the USA.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States IT Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States IT Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States IT Services Market?

To stay informed about further developments, trends, and reports in the United States IT Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence