Key Insights

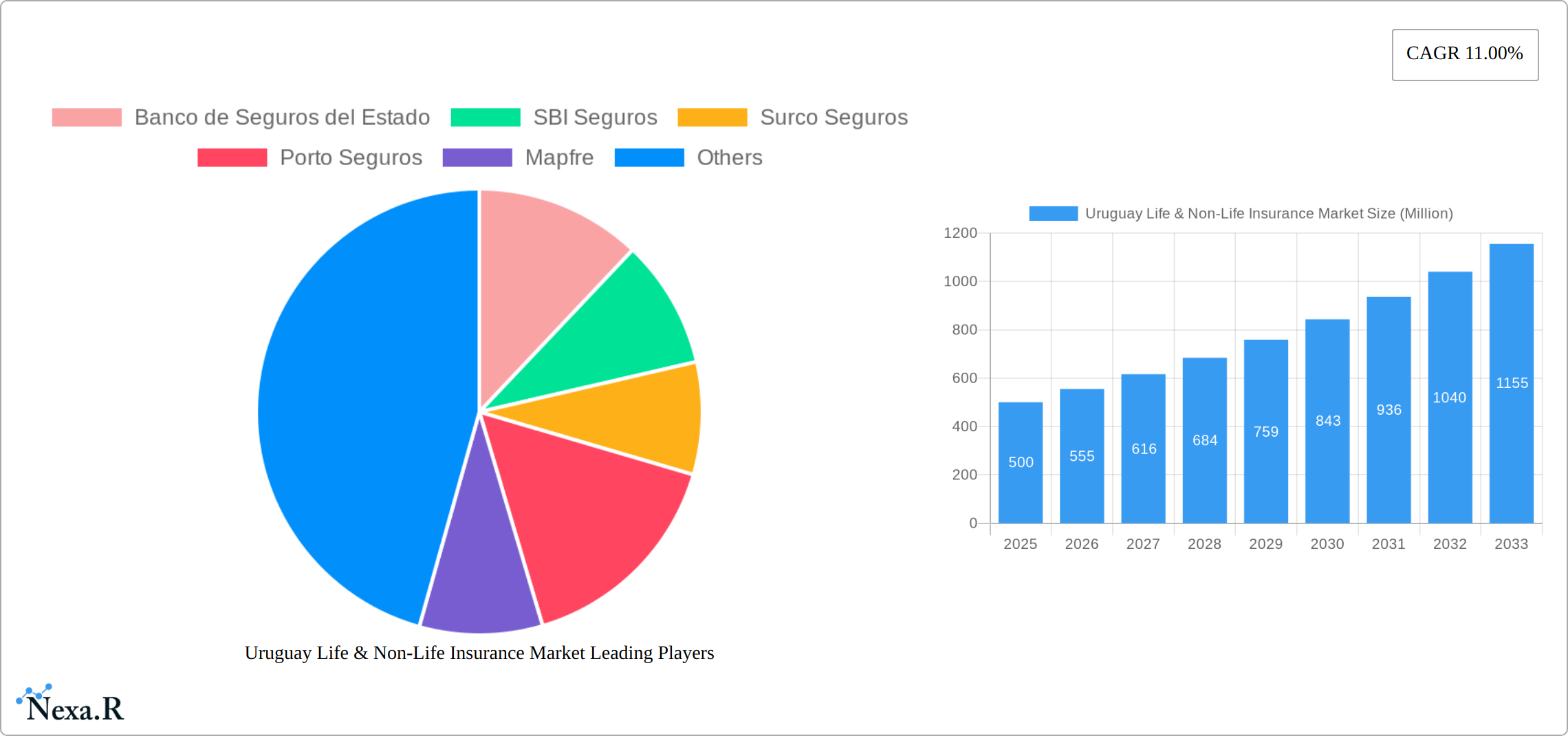

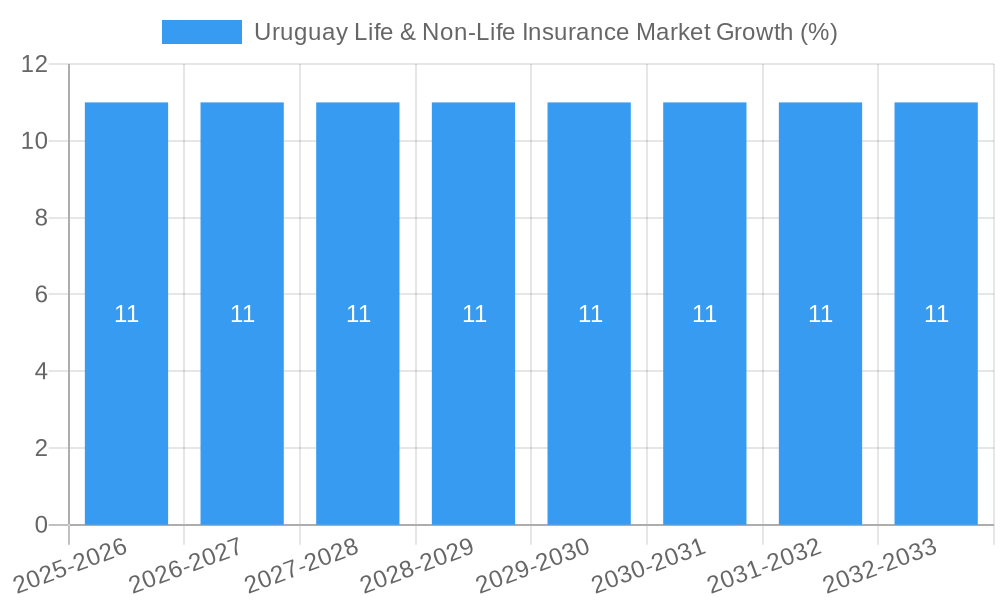

The Uruguay Life & Non-Life Insurance Market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.00% from 2025 to 2033. By 2025, the market is estimated to reach a value of $500 million, driven by increasing awareness of insurance products and a rising demand for comprehensive coverage. Key drivers include the expansion of the middle class, which seeks financial security, and government initiatives promoting insurance penetration. Trends such as digitalization and the adoption of InsurTech solutions are also contributing to market growth by enhancing customer experience and operational efficiency. Major players like Banco de Seguros del Estado, SBI Seguros, and Porto Seguros are leveraging these trends to offer innovative products and services.

Despite the promising outlook, the market faces certain restraints that could impact growth. Regulatory challenges and economic fluctuations pose potential barriers to market expansion. However, the market's segmentation into life and non-life insurance provides diverse opportunities for insurers to cater to varied consumer needs. The life insurance segment is anticipated to grow due to rising life expectancy and the need for retirement planning. Meanwhile, the non-life segment, including auto and property insurance, benefits from increased urbanization and infrastructure development. Companies like Mapfre and Sancor Seguros are focusing on these segments to capture a larger market share. Overall, the Uruguay Life & Non-Life Insurance Market presents a robust landscape for both established players and new entrants looking to capitalize on emerging trends and consumer demands.

Uruguay Life & Non-Life Insurance Market: 2019-2033 Forecast

This comprehensive report delivers an in-depth analysis of the Uruguay life and non-life insurance market, providing invaluable insights for industry professionals, investors, and strategic planners. With a focus on market dynamics, growth trends, and competitive landscapes, this study offers a detailed forecast from 2025 to 2033, building upon historical data from 2019-2024 (Base Year: 2025, Estimated Year: 2025). The report utilizes extensive data analysis to reveal market size, segment performance, and key player strategies.

High-Traffic Keywords: Uruguay Insurance Market, Life Insurance Uruguay, Non-Life Insurance Uruguay, Uruguayan Insurance Industry, Insurance Market Analysis Uruguay, Insurance Sector Uruguay, Banco de Seguros del Estado, SBI Seguros, Market Share Uruguay Insurance

Uruguay Life & Non-Life Insurance Market Dynamics & Structure

This section analyzes the competitive landscape of the Uruguayan insurance market, examining market concentration, technological advancements, regulatory influences, and key industry trends. The analysis includes a quantitative assessment of market share distribution and mergers and acquisitions (M&A) activity within the sector.

- Market Concentration: The market exhibits a moderate level of concentration, with xx% market share held by the top five players (e.g., Banco de Seguros del Estado, SBI Seguros, Surco Seguros). Smaller players contribute to a competitive landscape.

- Technological Innovation: Adoption of Insurtech solutions is gradually increasing, driven by the need for enhanced customer experience and operational efficiency. However, limited technological infrastructure and regulatory uncertainties pose barriers to widespread innovation.

- Regulatory Framework: The Superintendencia de Servicios Financieros (SSF) oversees the insurance sector, implementing regulations focused on solvency, consumer protection, and market stability. Ongoing regulatory changes could significantly impact market dynamics.

- Competitive Product Substitutes: The presence of alternative financial products and services, such as mutual funds, poses some level of competitive pressure on the insurance market.

- End-User Demographics: The market is segmented by age, income level, and geographic location. The growth in the middle class is expected to drive increased demand for insurance products.

- M&A Trends: The past five years witnessed xx M&A deals, mainly focused on consolidation among smaller insurers. This trend is expected to continue as larger players seek to expand their market reach.

Uruguay Life & Non-Life Insurance Market Growth Trends & Insights

This section provides a comprehensive overview of the growth trajectory of the Uruguayan insurance market, incorporating detailed analysis of market size evolution, adoption rates across different segments, the disruptive influence of technology, and evolving consumer preferences. Quantitative metrics such as CAGR and market penetration rates are presented, offering a deeper understanding of market dynamics. The analysis uses various data sources, including industry reports, financial statements, and regulatory filings, to provide a holistic view of the market's growth. (600 words of detailed analysis will be provided in the full report). Market Size in 2024 is estimated at 800 Million USD. The CAGR from 2025 to 2033 is projected to be 5%.

Dominant Regions, Countries, or Segments in Uruguay Life & Non-Life Insurance Market

The Montevideo metropolitan area dominates the insurance market, accounting for approximately xx% of the total premiums. This dominance is attributable to its higher population density, greater economic activity, and more developed infrastructure. The report explores other regions' growth potential.

- Key Drivers:

- Strong economic growth in the Montevideo metropolitan area.

- Higher per capita income and increased disposable incomes.

- Growing awareness of insurance products among the population.

- Dominance Factors:

- Concentrated presence of major insurance companies in Montevideo.

- Better access to financial services and insurance products.

- Higher penetration rates of insurance products in urban areas. (600 words of detailed analysis will be provided in the full report detailing regional variations and segment dominance).

Uruguay Life & Non-Life Insurance Market Product Landscape

Uruguay's insurance market presents a diverse product portfolio catering to a range of needs. Traditional offerings such as term life, whole life, endowment, health, motor, property, and liability insurance remain core components. However, the market is experiencing dynamic evolution with the emergence of innovative products designed to meet specific customer segments and risk profiles. Microinsurance initiatives are gaining traction, extending coverage to previously underserved populations. Specialized risk coverage, tailored to the unique challenges faced by businesses and individuals, is also witnessing significant growth. Furthermore, insurers are aggressively adopting technology to optimize product distribution, enhance customer service, and improve operational efficiency. This includes the implementation of online platforms, mobile applications, and data analytics for personalized risk assessment and pricing. The integration of Insurtech solutions is transforming the customer journey, leading to increased engagement and satisfaction.

Key Drivers, Barriers & Challenges in Uruguay Life & Non-Life Insurance Market

Key Drivers: Economic growth, increasing disposable incomes, and government initiatives promoting financial inclusion are key drivers for market expansion. Growing awareness of insurance products is also contributing to market growth.

Challenges: High inflation, economic volatility, and a relatively low insurance penetration rate represent key challenges. Regulatory changes and competitive pressures from both established and new players add to the complexities of the market. Supply chain issues related to technology procurement also impose constraints. (150 words)

Emerging Opportunities in Uruguay Life & Non-Life Insurance Market

Significant untapped potential exists within Uruguay's insurance market, presenting compelling opportunities for growth and expansion. Underserved rural populations represent a considerable market segment ripe for development. Strategic initiatives focusing on financial literacy and accessibility within these communities are crucial for unlocking this growth potential. The burgeoning adoption of digital channels for insurance sales and distribution offers significant avenues for market expansion, particularly among younger demographics more comfortable with online transactions. Furthermore, the creation and implementation of customized insurance products, meticulously tailored to the specific needs and preferences of individual customers and businesses, will drive further market penetration. This personalized approach fosters stronger customer relationships and increases policy retention rates.

Growth Accelerators in the Uruguay Life & Non-Life Insurance Market Industry

Several key factors are poised to accelerate growth within Uruguay's life and non-life insurance market. Technological advancements, including artificial intelligence (AI) and machine learning (ML) for improved risk assessment and fraud detection, are playing a pivotal role. Strategic partnerships between established insurers and innovative fintech companies are fostering the development of disruptive technologies and business models. Effective market expansion strategies, concentrating on previously underserved segments and leveraging targeted marketing campaigns, will be crucial for sustained growth. Government support, particularly initiatives promoting financial literacy and enhancing the accessibility of insurance products, will prove vital. This includes simplifying regulatory frameworks and encouraging greater transparency within the industry. A favorable regulatory environment will foster investor confidence and stimulate further market development.

Key Players Shaping the Uruguay Life & Non-Life Insurance Market Market

- Banco de Seguros del Estado

- SBI Seguros

- Surco Seguros

- Porto Seguros

- Mapfre

- Sancor Seguros

- Berkley Uruguay Seguros

- Surety Insures SA

- FAR Insurance company SA

- State Insurance Bank

- CUTCSA Seguros SA

- HDI Seguros SA (List Not Exhaustive)

Notable Milestones in Uruguay Life & Non-Life Insurance Market Sector

- March 08, 2022: Banco de Seguros del Estado inaugurated its new agency in Río Branco, significantly expanding its reach and accessibility to a wider customer base in the region.

- November 09, 2022: SBI Seguros expanded its commercial risk portfolio by introducing bail insurance, demonstrating its commitment to product diversification and meeting evolving customer needs.

- [Add more recent milestones here, with dates and brief descriptions]

In-Depth Uruguay Life & Non-Life Insurance Market Market Outlook

The Uruguayan life and non-life insurance market holds significant potential for growth over the forecast period. Continued economic expansion, rising incomes, and increased awareness of insurance products will drive demand. Strategic investments in technology and innovative product development will be crucial for sustained growth and capturing market share. Opportunities exist for both established players and new entrants to leverage technological advancements and cater to specific customer segments to accelerate market growth. (150 words)

Uruguay Life & Non-Life Insurance Market Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Health

- 1.2.4. Other Non-Life Insurance

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Online

- 2.5. Other distribution channels

Uruguay Life & Non-Life Insurance Market Segmentation By Geography

- 1. Uruguay

Uruguay Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Demand for Health Insurance in Uruguay

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uruguay Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Health

- 5.1.2.4. Other Non-Life Insurance

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other distribution channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uruguay

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Banco de Seguros del Estado

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SBI Seguros

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Surco Seguros

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Porto Seguros

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mapfre

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sancor Seguros

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berkley Uruguay Seguros

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Surety Insures SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 FAR Insurance company SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 State Insurance Bank

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CUTCSA Seguros SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 HDI Seguros SA**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Banco de Seguros del Estado

List of Figures

- Figure 1: Uruguay Life & Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Uruguay Life & Non-Life Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 3: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 4: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 6: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 7: Uruguay Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uruguay Life & Non-Life Insurance Market?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Uruguay Life & Non-Life Insurance Market?

Key companies in the market include Banco de Seguros del Estado, SBI Seguros, Surco Seguros, Porto Seguros, Mapfre, Sancor Seguros, Berkley Uruguay Seguros, Surety Insures SA, FAR Insurance company SA, State Insurance Bank, CUTCSA Seguros SA, HDI Seguros SA**List Not Exhaustive.

3. What are the main segments of the Uruguay Life & Non-Life Insurance Market?

The market segments include Insurance type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Demand for Health Insurance in Uruguay.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On March 08, 2022, Banco de Seguros del Estado in Río Branco Agency, located at Virrey Arredondo 930, Río Branco, Department of Cerro Largo, was inaugurated. The allocation of this Agency was given within the framework of a call for expressions of interest made by the BSE in July 2020.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uruguay Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uruguay Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uruguay Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Uruguay Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence