Key Insights

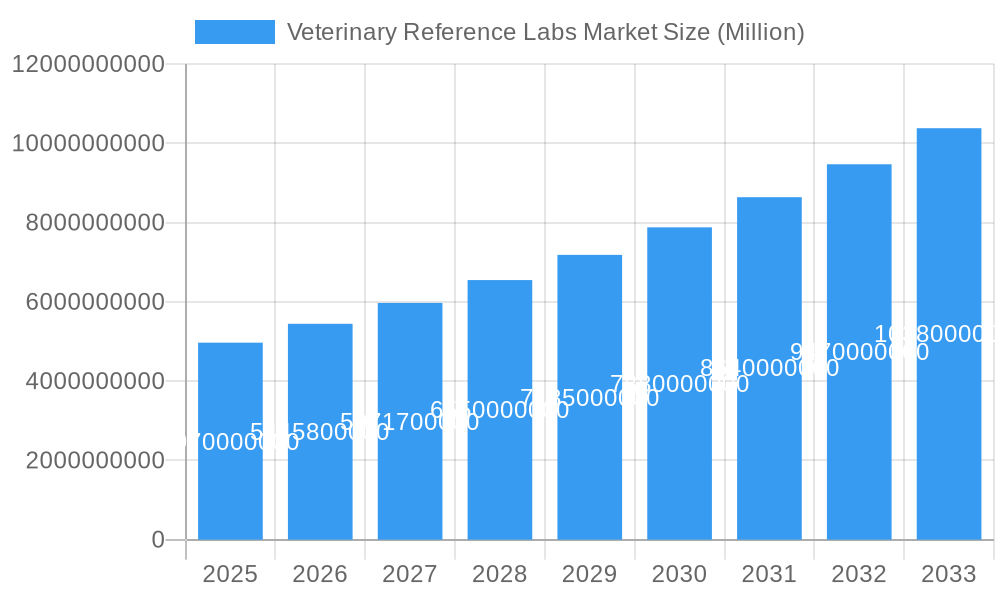

The global Veterinary Reference Labs Market is poised for significant expansion, with an estimated market size of USD 4.97 billion in 2025. The market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 9.58% during the forecast period of 2025-2033, reaching an estimated value of over USD 10 billion by the end of the forecast period. This remarkable growth is driven by a confluence of factors, including an increasing global pet population, a growing emphasis on animal welfare, and a rising trend among pet owners to treat their animals with the same level of medical care as humans. Furthermore, advancements in diagnostic technologies, such as molecular diagnostics and immunodiagnostics, are enhancing the accuracy and speed of disease detection, thereby fueling demand for sophisticated veterinary reference laboratory services. The expanding livestock industry, particularly in emerging economies, also contributes to market growth as stakeholders seek to ensure animal health for food security and economic stability.

Veterinary Reference Labs Market Market Size (In Billion)

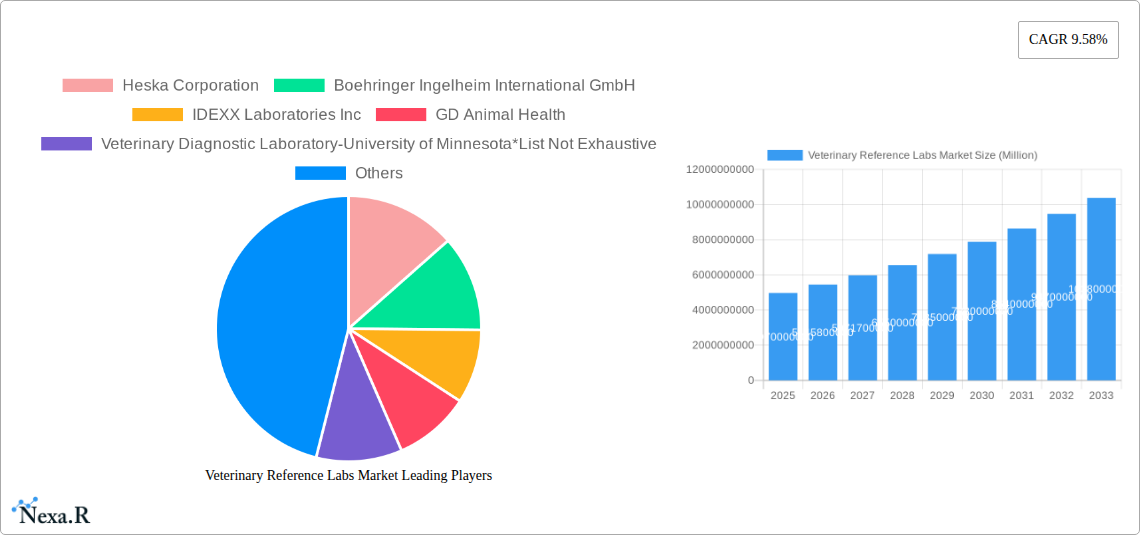

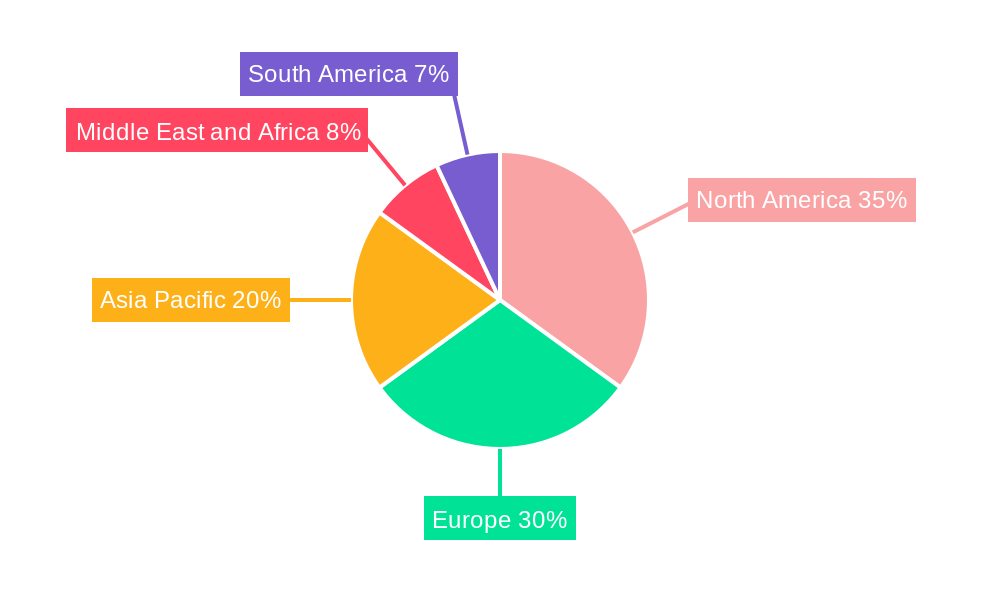

The market is segmented across various service types, applications, and animal types, offering diverse opportunities for stakeholders. Clinical chemistry, haematology, and immunodiagnostics represent key service segments, with molecular diagnostics emerging as a rapidly growing area due to its precision in identifying infectious diseases and genetic abnormalities. Applications span across pathology, bacteriology, and virology, reflecting the comprehensive diagnostic capabilities offered by reference labs. Companion animals, including dogs and cats, constitute a substantial segment, driven by the humanization of pets. However, livestock animals are also gaining importance due to the global demand for animal protein and the need for disease surveillance. Key players like IDEXX Laboratories Inc., Heska Corporation, and Boehringer Ingelheim International GmbH are at the forefront of this market, continuously innovating and expanding their service offerings to cater to the evolving needs of veterinary professionals and animal owners worldwide. Geographically, North America and Europe currently dominate the market, but the Asia Pacific region is expected to witness the fastest growth due to increasing disposable incomes and a burgeoning pet care industry.

Veterinary Reference Labs Market Company Market Share

Veterinary Reference Labs Market: Comprehensive Analysis and Future Outlook (2019–2033)

Report Description:

This in-depth report delivers a comprehensive analysis of the global veterinary reference labs market, meticulously examining market dynamics, growth trends, regional dominance, and key player strategies from 2019 to 2033. With a robust focus on veterinary diagnostics, animal health testing, and veterinary laboratory services, this study is an indispensable resource for stakeholders seeking to understand the evolving landscape of companion animal diagnostics and livestock health monitoring. We delve into critical segments including clinical chemistry, haematology, immunodiagnostics, and molecular diagnostics, alongside applications in pathology, bacteriology, and virology. The report highlights the significant growth driven by advancements in veterinary molecular diagnostics and the increasing demand for sophisticated veterinary pathology services. Explore the parent market and child market dynamics that are shaping the future of veterinary clinical diagnostics. Understand the impact of veterinary reference laboratory services on overall animal welfare and the burgeoning demand for veterinary disease diagnostics. This report provides crucial insights into the veterinary testing market, offering a detailed forecast for the veterinary reference laboratory market size and its projected trajectory.

Veterinary Reference Labs Market Market Dynamics & Structure

The veterinary reference labs market is characterized by a moderate to high level of market concentration, with a few key players holding a significant market share. This concentration is driven by substantial capital investment requirements for advanced diagnostic equipment and skilled personnel, creating barriers to entry for smaller entities. Technological innovation is a primary driver, with continuous advancements in veterinary molecular diagnostics, immunoassay technologies, and automation enhancing test accuracy, speed, and breadth. Regulatory frameworks, established by bodies like the FDA and EMA, ensure quality and safety standards, influencing product development and market access. Competitive product substitutes, though limited in direct comparison to specialized reference lab services, exist in the form of in-clinic diagnostic devices. End-user demographics are shifting towards a greater emphasis on proactive animal healthcare and disease prevention, fueled by increasing pet humanization and a growing awareness of zoonotic diseases among livestock. Mergers and Acquisitions (M&A) are a notable trend, with larger companies acquiring smaller labs or innovative technology providers to expand their service offerings, geographic reach, and market dominance. For instance, strategic acquisitions of veterinary diagnostic laboratories have been instrumental in consolidating market power and fostering innovation.

- Market Concentration: Dominated by a few large players, with ongoing consolidation.

- Technological Innovation Drivers: Advancements in veterinary molecular diagnostics, automation, and AI-powered diagnostic tools.

- Regulatory Frameworks: Strict adherence to quality control and accreditation standards.

- Competitive Product Substitutes: Limited, primarily in-clinic point-of-care testing.

- End-User Demographics: Growing demand from pet owners for advanced diagnostics and increased focus on herd health in livestock.

- M&A Trends: Frequent consolidation to gain market share and expand service portfolios.

Veterinary Reference Labs Market Growth Trends & Insights

The veterinary reference labs market is poised for robust growth, projected to expand from an estimated USD 6,500 Million in 2025 to reach USD 10,500 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.2% during the forecast period. This significant expansion is underpinned by several interwoven factors, including the escalating demand for accurate and timely veterinary diagnostics, the increasing prevalence of chronic diseases in animals, and the growing adoption of advanced veterinary testing methodologies. The "pet humanization" trend continues to be a powerful market stimulant, driving pet owners to invest more in their animals' healthcare, including comprehensive diagnostic services. This translates into higher demand for veterinary reference laboratory services for both routine wellness checks and specialized disease detection.

Technological disruptions are playing a pivotal role in shaping market evolution. The advent and refinement of veterinary molecular diagnostics, such as PCR and next-generation sequencing, are revolutionizing disease detection by offering unparalleled sensitivity and specificity. These technologies are increasingly integrated into veterinary reference laboratory services, enabling the identification of infectious agents and genetic predispositions with greater precision. Furthermore, advancements in immunodiagnostics and clinical chemistry are leading to the development of novel biomarkers and more efficient diagnostic panels. This technological leap is not only improving diagnostic capabilities but also driving down costs and increasing accessibility for a wider range of veterinary practices.

Consumer behavior shifts are also significant. Veterinarians and pet owners are becoming more proactive in managing animal health, moving away from reactive treatment to a more preventative and diagnostic-driven approach. This includes a greater reliance on specialized veterinary pathology services and veterinary disease diagnostics to identify potential health issues early. The increasing awareness of zoonotic diseases and their implications for public health is further bolstering the demand for comprehensive animal health testing. The veterinary reference labs market is thus benefiting from a confluence of enhanced diagnostic capabilities, heightened animal welfare awareness, and a proactive approach to animal healthcare. The estimated market penetration for advanced veterinary diagnostics is on an upward trajectory, reflecting the industry's commitment to adopting cutting-edge solutions.

Dominant Regions, Countries, or Segments in Veterinary Reference Labs Market

The North America region stands out as the dominant force in the veterinary reference labs market, driven by a confluence of robust economic conditions, a highly developed animal healthcare infrastructure, and a deeply ingrained culture of pet ownership. The United States, in particular, leads this regional dominance with a substantial market share, fueled by widespread adoption of advanced veterinary diagnostics and a high per capita spending on pet care. Key drivers of this dominance include the presence of leading veterinary diagnostic laboratories like IDEXX Laboratories Inc. and Heska Corporation, which are at the forefront of innovation in veterinary reference laboratory services. Furthermore, the region benefits from strong government initiatives supporting animal health research and a well-established network of veterinary clinics and hospitals that readily utilize veterinary laboratory services.

Within the service type segment, Immunodiagnostics and Molecular Diagnostics are emerging as significant growth engines, showcasing rapid adoption rates. The increasing prevalence of infectious diseases and the demand for rapid, accurate disease identification are propelling the growth of these advanced diagnostic segments. Molecular diagnostics, in particular, are transforming veterinary disease diagnostics by enabling the detection of pathogens at very low concentrations and identifying genetic predispositions to certain conditions.

In terms of application, Pathology and Bacteriology continue to hold substantial market share due to their foundational role in disease diagnosis and management across both companion and livestock animals. However, the application of Virology is witnessing accelerated growth, driven by emerging infectious diseases and the need for rapid epidemiological surveillance, particularly in livestock populations and during global health crises. The focus on veterinary pathology services remains critical for understanding disease mechanisms and aiding in treatment strategies.

Analyzing the Animal Type segment, Companion Animal diagnostics contribute a significantly larger share to the overall market. This is directly linked to the increasing trend of pet humanization, where owners view their pets as family members and are willing to invest heavily in their health and well-being, including access to sophisticated veterinary testing. The demand for veterinary reference laboratory services for common ailments, chronic conditions, and preventative care in dogs, cats, and other companion animals is exceptionally high. While Livestock Animal diagnostics are crucial for herd health, disease control, and food safety, the volume of individual diagnostic tests is often lower compared to the personalized care provided to companion animals. However, the economic impact of disease outbreaks in livestock can drive significant demand for outbreak-specific diagnostic services. The integration of advanced veterinary clinical diagnostics is becoming increasingly vital across all animal types to ensure optimal health outcomes and mitigate economic losses.

Veterinary Reference Labs Market Product Landscape

The veterinary reference labs market product landscape is defined by a continuous stream of innovative diagnostic solutions designed to enhance accuracy, efficiency, and accessibility of animal health testing. Leading companies are actively developing and deploying advanced platforms for clinical chemistry, haematology, immunodiagnostics, and molecular diagnostics. Unique selling propositions often lie in the speed of results, the breadth of tests offered, and the integration of proprietary algorithms for data interpretation, providing veterinarians with actionable insights for veterinary disease diagnostics. Technological advancements are focusing on miniaturization of equipment for point-of-care applications, development of multiplex assays to detect multiple analytes simultaneously, and the utilization of artificial intelligence for enhanced diagnostic accuracy in veterinary pathology services. The growing emphasis on proactive health management is driving demand for predictive diagnostic tools and genetic testing within the veterinary reference laboratory services sector.

Key Drivers, Barriers & Challenges in Veterinary Reference Labs Market

The veterinary reference labs market is propelled by several key drivers. The increasing humanization of pets, leading to greater investment in animal healthcare, is a significant factor. Advancements in veterinary molecular diagnostics and other sophisticated veterinary testing technologies are expanding diagnostic capabilities and demand. The growing awareness of zoonotic diseases and their public health implications also boosts the need for comprehensive animal health testing. Furthermore, a rising number of veterinary practitioners and clinics are recognizing the value of outsourcing complex diagnostics to specialized veterinary diagnostic laboratories.

However, the market faces certain barriers and challenges. High initial investment costs for advanced equipment and skilled personnel can be prohibitive for some veterinary practices, limiting their adoption of cutting-edge veterinary clinical diagnostics. Regulatory hurdles and the need for accreditation can also slow down market entry and product approval. Supply chain disruptions, as seen in recent global events, can impact the availability of reagents and consumables essential for veterinary reference laboratory services. Competitive pressures, particularly from in-clinic diagnostic solutions, necessitate continuous innovation and cost-effectiveness from reference labs. The consistent need for specialized expertise in areas like veterinary pathology services and veterinary disease diagnostics also presents a staffing challenge.

Emerging Opportunities in Veterinary Reference Labs Market

Emerging opportunities in the veterinary reference labs market are manifold, driven by evolving technological capabilities and changing consumer preferences. The expansion of veterinary molecular diagnostics into areas like companion animal oncology and pharmacogenomics presents a significant growth avenue. The increasing focus on proactive health management and preventative care is creating demand for novel biomarker discovery and personalized diagnostic panels within veterinary reference laboratory services. Untapped markets in developing regions, where awareness of advanced animal health testing is growing, offer substantial potential for expansion. Furthermore, the development of integrated diagnostic platforms that combine multiple testing modalities for a holistic approach to veterinary disease diagnostics is an area ripe for innovation. The rise of telemedicine in veterinary care is also creating opportunities for remote diagnostic interpretation and consultation facilitated by veterinary diagnostic laboratories.

Growth Accelerators in the Veterinary Reference Labs Market Industry

Several catalysts are accelerating the growth of the veterinary reference labs market. Technological breakthroughs in areas such as liquid biopsy for cancer detection in animals and advanced genomic sequencing are revolutionizing veterinary diagnostics. Strategic partnerships between veterinary reference laboratories and pharmaceutical companies for drug efficacy testing and development are fostering innovation and market expansion. The increasing adoption of digital pathology and AI-driven diagnostic tools within veterinary pathology services is enhancing efficiency and accuracy. Furthermore, market expansion strategies by leading players through mergers, acquisitions, and the establishment of new veterinary diagnostic laboratories are consolidating their positions and extending their service reach. The growing emphasis on One Health initiatives, recognizing the interconnectedness of human, animal, and environmental health, is also a significant growth accelerator for comprehensive animal health testing.

Key Players Shaping the Veterinary Reference Labs Market Market

- Heska Corporation

- Boehringer Ingelheim International GmbH

- IDEXX Laboratories Inc

- GD Animal Health

- Veterinary Diagnostic Laboratory-University of Minnesota

- Greencross Limited

- Mars Inc

- Neogen Corporation

- Zoetis Inc

Notable Milestones in Veterinary Reference Labs Market Sector

- November 2022: VolitionRx Limited launched its Nu.Q Vet Cancer Screening Test across the United States and Europe through Heska Corporations' veterinary diagnostic laboratories, enhancing cancer diagnostics.

- June 2022: IDEXX Laboratories Inc. launched new reference laboratory tests and services to help veterinarians gain insights during wellness screenings, develop treatment plans for cats with chronic kidney disease, and access fast, definitive answers for the most critical cases, thereby advancing veterinary diagnostics.

In-Depth Veterinary Reference Labs Market Market Outlook

The future outlook for the veterinary reference labs market is exceptionally promising, driven by ongoing advancements in veterinary molecular diagnostics, veterinary pathology services, and a persistent rise in the demand for comprehensive animal health testing. Strategic opportunities lie in the further development of predictive diagnostics, personalized medicine approaches for companion animals, and robust surveillance programs for livestock. The integration of artificial intelligence and machine learning into diagnostic workflows will continue to enhance accuracy and efficiency, while also creating new avenues for veterinary disease diagnostics. Market expansion into underserved geographical regions, coupled with the increasing acceptance of telehealth in veterinary medicine, will further bolster growth. Collaborations between veterinary diagnostic laboratories, academic institutions, and technology providers are expected to yield groundbreaking innovations, solidifying the market's trajectory towards improved animal welfare and enhanced food safety.

Veterinary Reference Labs Market Segmentation

-

1. Service Type

- 1.1. Clinical Chemistry

- 1.2. Haematology

- 1.3. Immunodiagnostics

- 1.4. Molecular Diagnostics

- 1.5. Other Service Types

-

2. Application

- 2.1. Pathology

- 2.2. Bacteriology

- 2.3. Virology

- 2.4. Parasitology

- 2.5. Other Applications

-

3. Animal Type

- 3.1. Companion Animal

- 3.2. Livestock Animal

Veterinary Reference Labs Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Veterinary Reference Labs Market Regional Market Share

Geographic Coverage of Veterinary Reference Labs Market

Veterinary Reference Labs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in Companion animal/Pet Adoption; Increasing Demand for Pet Insurance; Growing Animal Healthcare Expenditure; Growing Demand for PCR testing

- 3.2.2 Rapid Testing

- 3.2.3 and Other Testing Procedures

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Portable Devices for Point-of-care (POC) Services; High Pet Care Cost

- 3.4. Market Trends

- 3.4.1. Companion Animal Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Reference Labs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Haematology

- 5.1.3. Immunodiagnostics

- 5.1.4. Molecular Diagnostics

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pathology

- 5.2.2. Bacteriology

- 5.2.3. Virology

- 5.2.4. Parasitology

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Animal Type

- 5.3.1. Companion Animal

- 5.3.2. Livestock Animal

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Veterinary Reference Labs Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Clinical Chemistry

- 6.1.2. Haematology

- 6.1.3. Immunodiagnostics

- 6.1.4. Molecular Diagnostics

- 6.1.5. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Pathology

- 6.2.2. Bacteriology

- 6.2.3. Virology

- 6.2.4. Parasitology

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Animal Type

- 6.3.1. Companion Animal

- 6.3.2. Livestock Animal

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Veterinary Reference Labs Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Clinical Chemistry

- 7.1.2. Haematology

- 7.1.3. Immunodiagnostics

- 7.1.4. Molecular Diagnostics

- 7.1.5. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Pathology

- 7.2.2. Bacteriology

- 7.2.3. Virology

- 7.2.4. Parasitology

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Animal Type

- 7.3.1. Companion Animal

- 7.3.2. Livestock Animal

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Veterinary Reference Labs Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Clinical Chemistry

- 8.1.2. Haematology

- 8.1.3. Immunodiagnostics

- 8.1.4. Molecular Diagnostics

- 8.1.5. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Pathology

- 8.2.2. Bacteriology

- 8.2.3. Virology

- 8.2.4. Parasitology

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Animal Type

- 8.3.1. Companion Animal

- 8.3.2. Livestock Animal

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East and Africa Veterinary Reference Labs Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Clinical Chemistry

- 9.1.2. Haematology

- 9.1.3. Immunodiagnostics

- 9.1.4. Molecular Diagnostics

- 9.1.5. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Pathology

- 9.2.2. Bacteriology

- 9.2.3. Virology

- 9.2.4. Parasitology

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Animal Type

- 9.3.1. Companion Animal

- 9.3.2. Livestock Animal

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. South America Veterinary Reference Labs Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Clinical Chemistry

- 10.1.2. Haematology

- 10.1.3. Immunodiagnostics

- 10.1.4. Molecular Diagnostics

- 10.1.5. Other Service Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Pathology

- 10.2.2. Bacteriology

- 10.2.3. Virology

- 10.2.4. Parasitology

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Animal Type

- 10.3.1. Companion Animal

- 10.3.2. Livestock Animal

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Heska Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Boehringer Ingelheim International GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IDEXX Laboratories Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GD Animal Health

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Veterinary Diagnostic Laboratory-University of Minnesota*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Greencross Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mars Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Neogen Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zoetis Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Heska Corporation

List of Figures

- Figure 1: Global Veterinary Reference Labs Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Veterinary Reference Labs Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Veterinary Reference Labs Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Veterinary Reference Labs Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Veterinary Reference Labs Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Veterinary Reference Labs Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 7: North America Veterinary Reference Labs Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 8: North America Veterinary Reference Labs Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Veterinary Reference Labs Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Veterinary Reference Labs Market Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Europe Veterinary Reference Labs Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Europe Veterinary Reference Labs Market Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Veterinary Reference Labs Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Veterinary Reference Labs Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 15: Europe Veterinary Reference Labs Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Europe Veterinary Reference Labs Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Veterinary Reference Labs Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Veterinary Reference Labs Market Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Asia Pacific Veterinary Reference Labs Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Asia Pacific Veterinary Reference Labs Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Veterinary Reference Labs Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Veterinary Reference Labs Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 23: Asia Pacific Veterinary Reference Labs Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: Asia Pacific Veterinary Reference Labs Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Veterinary Reference Labs Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Veterinary Reference Labs Market Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Middle East and Africa Veterinary Reference Labs Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Middle East and Africa Veterinary Reference Labs Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Veterinary Reference Labs Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Veterinary Reference Labs Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 31: Middle East and Africa Veterinary Reference Labs Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 32: Middle East and Africa Veterinary Reference Labs Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Veterinary Reference Labs Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Veterinary Reference Labs Market Revenue (Million), by Service Type 2025 & 2033

- Figure 35: South America Veterinary Reference Labs Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 36: South America Veterinary Reference Labs Market Revenue (Million), by Application 2025 & 2033

- Figure 37: South America Veterinary Reference Labs Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Veterinary Reference Labs Market Revenue (Million), by Animal Type 2025 & 2033

- Figure 39: South America Veterinary Reference Labs Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 40: South America Veterinary Reference Labs Market Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Veterinary Reference Labs Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary Reference Labs Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Veterinary Reference Labs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Veterinary Reference Labs Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 4: Global Veterinary Reference Labs Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Veterinary Reference Labs Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Global Veterinary Reference Labs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Veterinary Reference Labs Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 8: Global Veterinary Reference Labs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Veterinary Reference Labs Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 13: Global Veterinary Reference Labs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Veterinary Reference Labs Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 15: Global Veterinary Reference Labs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Germany Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Veterinary Reference Labs Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 23: Global Veterinary Reference Labs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Veterinary Reference Labs Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 25: Global Veterinary Reference Labs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: India Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: China Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Veterinary Reference Labs Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 33: Global Veterinary Reference Labs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Veterinary Reference Labs Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 35: Global Veterinary Reference Labs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Veterinary Reference Labs Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 40: Global Veterinary Reference Labs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Veterinary Reference Labs Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 42: Global Veterinary Reference Labs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Veterinary Reference Labs Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Reference Labs Market?

The projected CAGR is approximately 9.58%.

2. Which companies are prominent players in the Veterinary Reference Labs Market?

Key companies in the market include Heska Corporation, Boehringer Ingelheim International GmbH, IDEXX Laboratories Inc, GD Animal Health, Veterinary Diagnostic Laboratory-University of Minnesota*List Not Exhaustive, Greencross Limited, Mars Inc, Neogen Corporation, Zoetis Inc.

3. What are the main segments of the Veterinary Reference Labs Market?

The market segments include Service Type, Application, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Companion animal/Pet Adoption; Increasing Demand for Pet Insurance; Growing Animal Healthcare Expenditure; Growing Demand for PCR testing. Rapid Testing. and Other Testing Procedures.

6. What are the notable trends driving market growth?

Companion Animal Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Rising Demand for Portable Devices for Point-of-care (POC) Services; High Pet Care Cost.

8. Can you provide examples of recent developments in the market?

In November 2022, VolitionRx Limited launched its Nu.Q Vet Cancer Screening Test across the United States and Europe through Heska Corporations' veterinary diagnostic laboratories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Reference Labs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Reference Labs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Reference Labs Market?

To stay informed about further developments, trends, and reports in the Veterinary Reference Labs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence