Key Insights

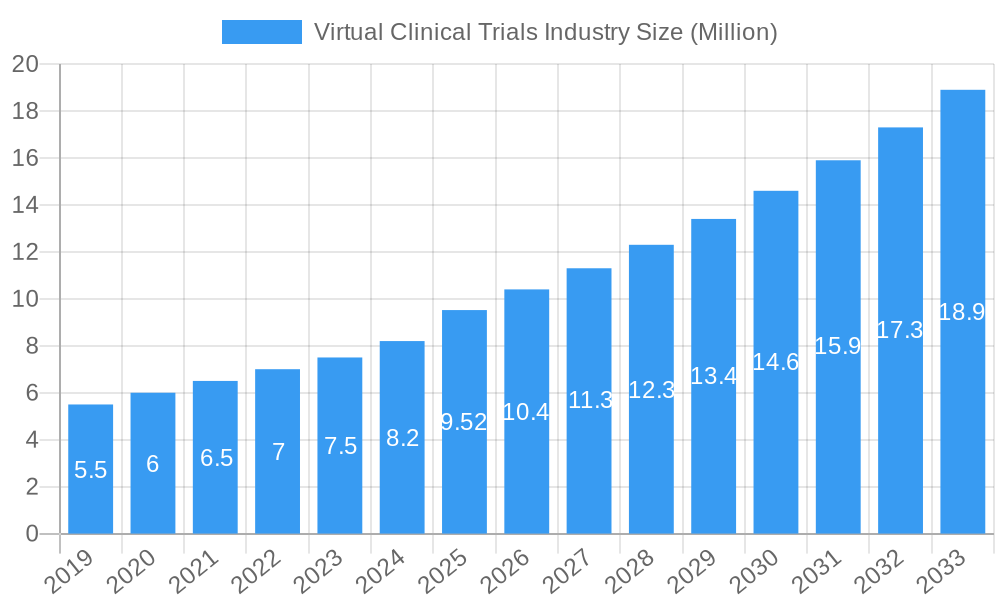

The Virtual Clinical Trials market is poised for substantial growth, projected to reach USD 9.52 Billion by 2025. This expansion is driven by an impressive Compound Annual Growth Rate (CAGR) of 9.34% from 2019 to 2033, indicating a robust and sustained upward trajectory. The adoption of virtual and decentralized clinical trial models is transforming research methodologies, enhancing patient accessibility, and improving data quality. Key drivers include the increasing prevalence of chronic diseases like cardiovascular conditions and oncology, necessitating more efficient and patient-centric trial designs. Furthermore, advancements in digital health technologies, wearable devices, remote monitoring, and telehealth platforms are providing the foundational infrastructure for successful virtual trials. The inherent benefits of reduced trial costs, faster recruitment, and improved patient retention are compelling pharmaceutical and biotechnology companies to invest heavily in these innovative approaches.

Virtual Clinical Trials Industry Market Size (In Million)

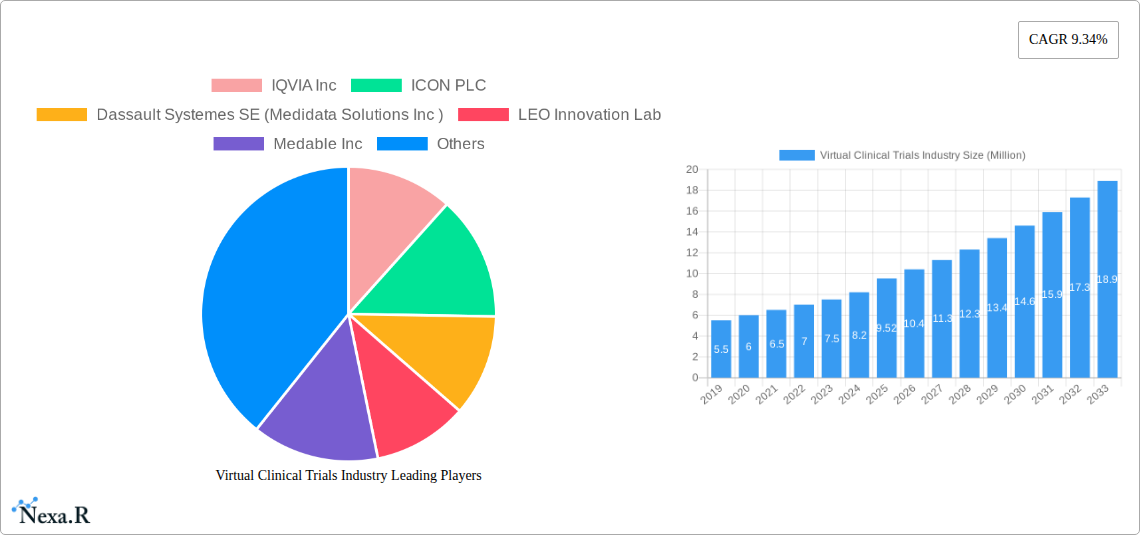

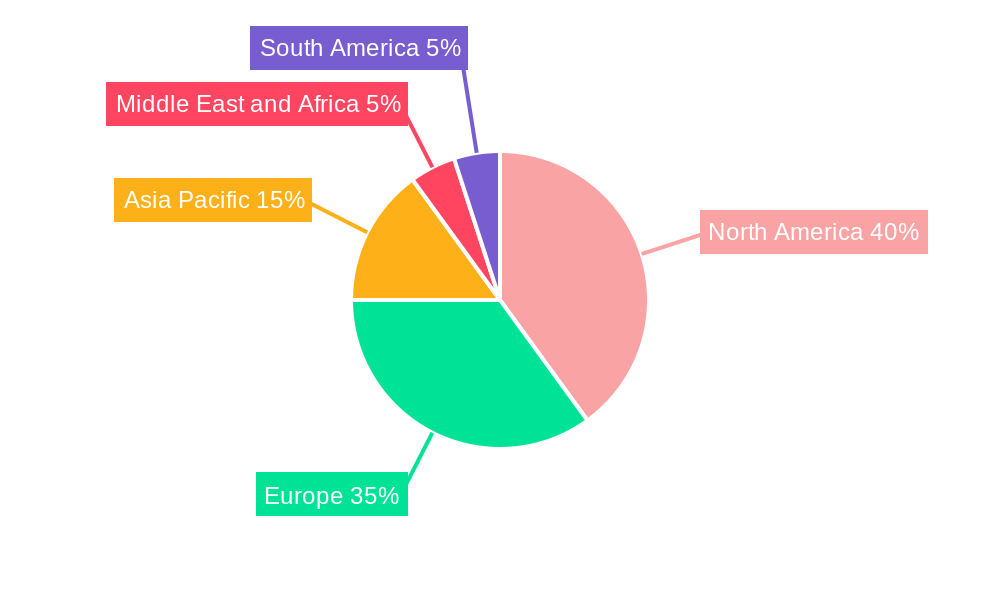

The market segmentation reveals a dynamic landscape. Observational and interventional study designs are both seeing increased integration of virtual components, with expanded access programs also benefiting from remote capabilities. While cardiovascular disease and oncology represent significant application areas, "Other Indication Types" also contribute to the overall market expansion, reflecting the broad applicability of virtual trial methodologies. Key players like IQVIA Inc., ICON PLC, and Dassault Systemes SE (Medidata Solutions Inc.) are at the forefront, offering comprehensive solutions and driving innovation. Geographically, North America and Europe are leading the adoption, with Asia Pacific showing significant growth potential. Restraints, such as regulatory hurdles for fully decentralized trials and data security concerns, are being actively addressed through evolving guidelines and robust cybersecurity measures, paving the way for even greater market penetration.

Virtual Clinical Trials Industry Company Market Share

Here's the SEO-optimized report description for the Virtual Clinical Trials Industry, meticulously crafted for maximum visibility and engagement:

Virtual Clinical Trials Industry Market Dynamics & Structure

The global Virtual Clinical Trials market is experiencing dynamic growth, driven by an accelerating shift towards decentralized and patient-centric research methodologies. This comprehensive market analysis delves into the intricate structure of this burgeoning sector, examining factors that influence its evolution. Market concentration is moderately fragmented, with key players like IQVIA Inc., ICON PLC, and Dassault Systemes SE (Medidata Solutions Inc.) holding significant sway through their established technology platforms and extensive service offerings. Technological innovation is the primary engine of growth, with advancements in remote monitoring devices, AI-driven data analytics, and secure cloud-based platforms enabling seamless data collection and analysis from dispersed patient populations. Regulatory frameworks are steadily adapting, with agencies increasingly supportive of decentralized trial models, thereby reducing barriers to adoption. Competitive product substitutes are emerging, but the unique benefits of virtual trials, such as enhanced patient recruitment and retention, reduced site burden, and faster trial timelines, offer a distinct advantage. End-user demographics are broad, encompassing pharmaceutical companies, biotechnology firms, contract research organizations (CROs), and academic institutions, all seeking greater efficiency and accessibility in clinical research. Mergers and acquisitions (M&A) are a significant trend, as larger entities acquire specialized technology providers or data analytics firms to expand their virtual trial capabilities. For instance, recent M&A activity in the digital health space is reshaping the competitive landscape.

- Market Concentration: Moderately fragmented, with a mix of large CROs and specialized technology providers.

- Technological Innovation Drivers: Remote patient monitoring, AI/ML for data analysis, wearable devices, telemedicine platforms.

- Regulatory Frameworks: Evolving but increasingly supportive of decentralized and hybrid trial models.

- Competitive Product Substitutes: Traditional in-person trials, hybrid models, but virtual trials offer distinct advantages.

- End-User Demographics: Pharmaceutical companies, biotech firms, CROs, academic research institutions.

- M&A Trends: Increasing consolidation and strategic acquisitions to build comprehensive virtual trial solutions.

Virtual Clinical Trials Industry Growth Trends & Insights

The Virtual Clinical Trials industry is poised for exponential growth, with a projected market size evolution from approximately $5,500 million in 2024 to an estimated $30,000 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 19.5%. This remarkable expansion is fueled by an escalating adoption rate of decentralized clinical trial (DCT) methodologies across various therapeutic areas. Technological disruptions are at the forefront, with the pervasive integration of digital health technologies such as wearable sensors, mobile health applications, and telehealth platforms transforming how clinical trials are conducted. These innovations are not only enhancing data collection accuracy and efficiency but also significantly improving the patient experience by reducing the need for frequent site visits. Consumer behavior shifts are also playing a pivotal role; patients are increasingly comfortable with and even prefer remote participation, driven by convenience and the desire to minimize disruptions to their daily lives. The COVID-19 pandemic acted as a significant accelerant, forcing the industry to rapidly embrace virtual and hybrid trial models, proving their viability and effectiveness. This has led to a fundamental reevaluation of traditional trial paradigms. The market penetration of virtual trial solutions continues to climb as sponsors recognize the tangible benefits, including faster trial timelines, reduced operational costs, broader patient access, and improved data quality. The increasing availability of advanced data analytics platforms further enhances the value proposition by enabling real-time insights and more proactive trial management. The parent market for virtual clinical trials, which encompasses the broader clinical research services industry, is also experiencing growth, with virtual trials carving out an increasingly significant share of this overall market. The child market segments, such as remote data capture and eConsent, are demonstrating particularly high growth rates as foundational components of successful virtual trials. Forecasts indicate sustained high growth driven by ongoing technological advancements and the inherent efficiencies offered by virtual trial designs.

Dominant Regions, Countries, or Segments in Virtual Clinical Trials Industry

North America, particularly the United States, currently stands as the dominant region driving the growth of the Virtual Clinical Trials industry. This leadership is attributed to a confluence of factors including a highly developed healthcare infrastructure, a strong presence of leading pharmaceutical and biotechnology companies, a favorable regulatory environment that has embraced technological innovation, and a significant patient population actively participating in clinical research. The market share within North America is substantial, with the U.S. alone accounting for an estimated 60% of global virtual trial spending. Key drivers in this region include robust government and private sector investments in digital health and clinical research technologies, the early adoption and widespread acceptance of remote monitoring and telemedicine solutions, and a proactive approach by regulatory bodies like the FDA in providing guidance and support for decentralized trial methodologies.

Within the Study Design segment, Interventional studies are a significant driver of virtual trial adoption, as they benefit immensely from remote monitoring of patient responses and adverse events, leading to more continuous and granular data. Observational studies also leverage virtual approaches for data collection, while Expanded Access programs are increasingly incorporating virtual elements to facilitate patient access to investigational therapies.

In terms of Indication Type, Oncology trials are leading the charge in virtual trial implementation. The complex nature of cancer treatments, the need for frequent monitoring of treatment efficacy and side effects, and the often geographically dispersed patient population make virtual solutions particularly attractive. Cardiovascular Disease trials are also a major segment, benefiting from wearable devices that can continuously monitor vital signs. Other Indication Types, including rare diseases and neurological disorders, are rapidly adopting virtual trial models to overcome geographical barriers and improve patient recruitment and retention.

- Dominant Region: North America (primarily the United States)

- Key Drivers in North America:

- Advanced healthcare and technology infrastructure.

- Presence of major pharmaceutical and biotech hubs.

- Favorable regulatory landscape (e.g., FDA guidance).

- High patient willingness to participate in virtual studies.

- Significant investment in digital health and clinical innovation.

- Dominant Study Design Segment: Interventional studies, followed by Observational and Expanded Access.

- Dominant Indication Type: Oncology, closely followed by Cardiovascular Disease, with growing adoption in Other Indication Types.

- Market Share (North America): Estimated 60% of global virtual trial spending.

- Growth Potential: High, fueled by ongoing technological advancements and increasing sponsor adoption across all segments.

Virtual Clinical Trials Industry Product Landscape

The Virtual Clinical Trials industry product landscape is characterized by a suite of innovative digital solutions designed to facilitate decentralized and remote research. Key products include sophisticated remote patient monitoring platforms, integrated wearable devices for continuous physiological data collection, secure e-consent solutions ensuring participant understanding and compliance, and advanced telehealth platforms enabling virtual patient visits and investigator interactions. These products are engineered to seamlessly collect, transmit, and analyze vast amounts of real-time data, offering unprecedented visibility into patient health and treatment response. Unique selling propositions lie in their ability to enhance patient convenience, improve data accuracy through continuous and objective measurements, reduce participant dropout rates, and accelerate trial timelines. Technological advancements are evident in the AI-powered analytics that extract meaningful insights from complex datasets, anomaly detection systems for early identification of safety concerns, and interoperable systems that integrate with existing healthcare IT infrastructure.

Key Drivers, Barriers & Challenges in Virtual Clinical Trials Industry

Key Drivers:

- Patient-Centricity: Growing demand for convenience and reduced burden on participants.

- Technological Advancements: Proliferation of wearable devices, AI, and telemedicine.

- Cost Efficiencies: Potential for reduced site overhead and operational expenses.

- Faster Trial Timelines: Accelerated patient recruitment and data collection.

- Regulatory Support: Evolving guidelines that embrace decentralized trial models.

Barriers & Challenges:

- Data Security and Privacy: Ensuring robust protection of sensitive patient information.

- Regulatory Harmonization: Navigating differing regulations across global regions.

- Digital Divide: Addressing access and literacy issues for certain patient demographics.

- Technology Integration: Seamlessly integrating diverse platforms and ensuring interoperability.

- Investigator Training and Acceptance: Educating and gaining buy-in from clinical site staff.

- Reimbursement Models: Establishing clear reimbursement pathways for virtual trial services.

- Supply Chain Issues: Ensuring timely and reliable delivery of remote monitoring equipment.

Emerging Opportunities in Virtual Clinical Trials Industry

Emerging opportunities in the Virtual Clinical Trials industry are vast and varied, driven by continuous innovation and evolving healthcare needs. The expansion of AI and machine learning applications for predictive analytics and personalized trial design presents a significant avenue for growth. Untapped markets include the increasing use of virtual trials in rare diseases and pediatric studies, where patient access is often a major hurdle. Innovative applications in areas like digital biomarkers for early disease detection and remote patient management post-treatment are also gaining traction. Evolving consumer preferences lean towards more convenient and home-based healthcare solutions, creating a fertile ground for further adoption of virtual trial models. The integration of blockchain technology for enhanced data integrity and security is another promising area.

Growth Accelerators in the Virtual Clinical Trials Industry Industry

Several key catalysts are accelerating the growth of the Virtual Clinical Trials industry. Technological breakthroughs in areas like advanced biosensors, decentralized diagnostics, and real-time data analytics are continuously improving the capabilities and reliability of virtual trial platforms. Strategic partnerships between technology providers, pharmaceutical companies, and contract research organizations are crucial for developing integrated solutions and expanding market reach. Furthermore, market expansion strategies, including the penetration into emerging economies and the adaptation of virtual trial models for a broader range of therapeutic areas, are significantly contributing to long-term growth. The increasing focus on real-world evidence (RWE) generation through virtual trials also acts as a powerful growth accelerator.

Key Players Shaping the Virtual Clinical Trials Industry Market

- IQVIA Inc.

- ICON PLC

- Dassault Systemes SE (Medidata Solutions Inc.)

- LEO Innovation Lab

- Medable Inc.

- Parexel International Corporation

- Oracle Corporation

- Signant Health

- Clinical Ink Inc.

- Medpace Holdings Inc.

- Laboratory Corporation of America Holdings (Covance Inc.)

Notable Milestones in Virtual Clinical Trials Industry Sector

- 2019: Increased adoption of ePRO (electronic patient-reported outcomes) and eCOA (electronic clinical outcome assessments) systems becomes more widespread.

- 2020 (March): Significant acceleration in the adoption of decentralized and virtual trial methodologies due to the COVID-19 pandemic.

- 2020 (Q3): FDA issues guidance on the use of decentralized clinical trials and remote regulatory activities.

- 2021: Emergence of specialized virtual trial platforms and service providers offering end-to-end solutions.

- 2021 (Q2): Increased investment rounds for digital health companies focused on clinical trial technology.

- 2022: Growing emphasis on hybrid trial models, combining in-person and virtual elements.

- 2022 (Q4): Introduction of advanced AI-powered analytics for virtual trial data interpretation.

- 2023: Expansion of virtual trial applications beyond oncology and cardiovascular diseases to other therapeutic areas.

- 2023 (Q3): Development of more sophisticated remote monitoring devices with enhanced sensing capabilities.

- 2024: Increased focus on interoperability between different virtual trial technology platforms.

In-Depth Virtual Clinical Trials Industry Market Outlook

The outlook for the Virtual Clinical Trials industry remains exceptionally strong, characterized by sustained high growth and transformative potential. Key growth accelerators, including continued technological innovation in areas like AI-driven data analysis and advanced biosensing, alongside strategic partnerships and market expansion into underserved geographies, will propel the industry forward. The increasing emphasis on patient-centricity and the demonstrable benefits of faster trial timelines and cost efficiencies will solidify virtual trials as a cornerstone of future clinical research. The industry is poised to not only capture a larger share of the overall clinical research market but also to redefine how new therapies are developed and brought to patients globally, offering significant strategic opportunities for stakeholders.

Virtual Clinical Trials Industry Segmentation

-

1. Study Design

- 1.1. Observational

- 1.2. Intervensional

- 1.3. Expanded Access

-

2. Indication Type

- 2.1. Cardiovascular Disease

- 2.2. Oncology

- 2.3. Other Indication Types

Virtual Clinical Trials Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Virtual Clinical Trials Industry Regional Market Share

Geographic Coverage of Virtual Clinical Trials Industry

Virtual Clinical Trials Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Digitization in Healthcare Sector; Technological Advancements in Virtual Clinical Trials; Prevalence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. Challenges Associated with the Virtual Clinical Trials

- 3.4. Market Trends

- 3.4.1. The Oncology Segment is Expected to Occupy a Significant Share of the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Virtual Clinical Trials Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Study Design

- 5.1.1. Observational

- 5.1.2. Intervensional

- 5.1.3. Expanded Access

- 5.2. Market Analysis, Insights and Forecast - by Indication Type

- 5.2.1. Cardiovascular Disease

- 5.2.2. Oncology

- 5.2.3. Other Indication Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Study Design

- 6. North America Virtual Clinical Trials Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Study Design

- 6.1.1. Observational

- 6.1.2. Intervensional

- 6.1.3. Expanded Access

- 6.2. Market Analysis, Insights and Forecast - by Indication Type

- 6.2.1. Cardiovascular Disease

- 6.2.2. Oncology

- 6.2.3. Other Indication Types

- 6.1. Market Analysis, Insights and Forecast - by Study Design

- 7. Europe Virtual Clinical Trials Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Study Design

- 7.1.1. Observational

- 7.1.2. Intervensional

- 7.1.3. Expanded Access

- 7.2. Market Analysis, Insights and Forecast - by Indication Type

- 7.2.1. Cardiovascular Disease

- 7.2.2. Oncology

- 7.2.3. Other Indication Types

- 7.1. Market Analysis, Insights and Forecast - by Study Design

- 8. Asia Pacific Virtual Clinical Trials Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Study Design

- 8.1.1. Observational

- 8.1.2. Intervensional

- 8.1.3. Expanded Access

- 8.2. Market Analysis, Insights and Forecast - by Indication Type

- 8.2.1. Cardiovascular Disease

- 8.2.2. Oncology

- 8.2.3. Other Indication Types

- 8.1. Market Analysis, Insights and Forecast - by Study Design

- 9. Middle East and Africa Virtual Clinical Trials Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Study Design

- 9.1.1. Observational

- 9.1.2. Intervensional

- 9.1.3. Expanded Access

- 9.2. Market Analysis, Insights and Forecast - by Indication Type

- 9.2.1. Cardiovascular Disease

- 9.2.2. Oncology

- 9.2.3. Other Indication Types

- 9.1. Market Analysis, Insights and Forecast - by Study Design

- 10. South America Virtual Clinical Trials Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Study Design

- 10.1.1. Observational

- 10.1.2. Intervensional

- 10.1.3. Expanded Access

- 10.2. Market Analysis, Insights and Forecast - by Indication Type

- 10.2.1. Cardiovascular Disease

- 10.2.2. Oncology

- 10.2.3. Other Indication Types

- 10.1. Market Analysis, Insights and Forecast - by Study Design

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IQVIA Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ICON PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dassault Systemes SE (Medidata Solutions Inc )

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LEO Innovation Lab

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Medable Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Parexel International Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oracle Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Signant Health

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Clinical Ink Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Medpace Holdings Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Laboratory Corporation of America Holdings (Covance Inc )

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 IQVIA Inc

List of Figures

- Figure 1: Global Virtual Clinical Trials Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Virtual Clinical Trials Industry Revenue (Million), by Study Design 2025 & 2033

- Figure 3: North America Virtual Clinical Trials Industry Revenue Share (%), by Study Design 2025 & 2033

- Figure 4: North America Virtual Clinical Trials Industry Revenue (Million), by Indication Type 2025 & 2033

- Figure 5: North America Virtual Clinical Trials Industry Revenue Share (%), by Indication Type 2025 & 2033

- Figure 6: North America Virtual Clinical Trials Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Virtual Clinical Trials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Virtual Clinical Trials Industry Revenue (Million), by Study Design 2025 & 2033

- Figure 9: Europe Virtual Clinical Trials Industry Revenue Share (%), by Study Design 2025 & 2033

- Figure 10: Europe Virtual Clinical Trials Industry Revenue (Million), by Indication Type 2025 & 2033

- Figure 11: Europe Virtual Clinical Trials Industry Revenue Share (%), by Indication Type 2025 & 2033

- Figure 12: Europe Virtual Clinical Trials Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Virtual Clinical Trials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Virtual Clinical Trials Industry Revenue (Million), by Study Design 2025 & 2033

- Figure 15: Asia Pacific Virtual Clinical Trials Industry Revenue Share (%), by Study Design 2025 & 2033

- Figure 16: Asia Pacific Virtual Clinical Trials Industry Revenue (Million), by Indication Type 2025 & 2033

- Figure 17: Asia Pacific Virtual Clinical Trials Industry Revenue Share (%), by Indication Type 2025 & 2033

- Figure 18: Asia Pacific Virtual Clinical Trials Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Virtual Clinical Trials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Virtual Clinical Trials Industry Revenue (Million), by Study Design 2025 & 2033

- Figure 21: Middle East and Africa Virtual Clinical Trials Industry Revenue Share (%), by Study Design 2025 & 2033

- Figure 22: Middle East and Africa Virtual Clinical Trials Industry Revenue (Million), by Indication Type 2025 & 2033

- Figure 23: Middle East and Africa Virtual Clinical Trials Industry Revenue Share (%), by Indication Type 2025 & 2033

- Figure 24: Middle East and Africa Virtual Clinical Trials Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Virtual Clinical Trials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Virtual Clinical Trials Industry Revenue (Million), by Study Design 2025 & 2033

- Figure 27: South America Virtual Clinical Trials Industry Revenue Share (%), by Study Design 2025 & 2033

- Figure 28: South America Virtual Clinical Trials Industry Revenue (Million), by Indication Type 2025 & 2033

- Figure 29: South America Virtual Clinical Trials Industry Revenue Share (%), by Indication Type 2025 & 2033

- Figure 30: South America Virtual Clinical Trials Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Virtual Clinical Trials Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Study Design 2020 & 2033

- Table 2: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Indication Type 2020 & 2033

- Table 3: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Study Design 2020 & 2033

- Table 5: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Indication Type 2020 & 2033

- Table 6: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Study Design 2020 & 2033

- Table 11: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Indication Type 2020 & 2033

- Table 12: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Study Design 2020 & 2033

- Table 20: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Indication Type 2020 & 2033

- Table 21: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Study Design 2020 & 2033

- Table 29: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Indication Type 2020 & 2033

- Table 30: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: GCC Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Study Design 2020 & 2033

- Table 35: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Indication Type 2020 & 2033

- Table 36: Global Virtual Clinical Trials Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Virtual Clinical Trials Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Virtual Clinical Trials Industry?

The projected CAGR is approximately 9.34%.

2. Which companies are prominent players in the Virtual Clinical Trials Industry?

Key companies in the market include IQVIA Inc, ICON PLC, Dassault Systemes SE (Medidata Solutions Inc ), LEO Innovation Lab, Medable Inc, Parexel International Corporation, Oracle Corporation, Signant Health, Clinical Ink Inc, Medpace Holdings Inc, Laboratory Corporation of America Holdings (Covance Inc ).

3. What are the main segments of the Virtual Clinical Trials Industry?

The market segments include Study Design, Indication Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Digitization in Healthcare Sector; Technological Advancements in Virtual Clinical Trials; Prevalence of Chronic Disease.

6. What are the notable trends driving market growth?

The Oncology Segment is Expected to Occupy a Significant Share of the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Challenges Associated with the Virtual Clinical Trials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Virtual Clinical Trials Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Virtual Clinical Trials Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Virtual Clinical Trials Industry?

To stay informed about further developments, trends, and reports in the Virtual Clinical Trials Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence