Key Insights

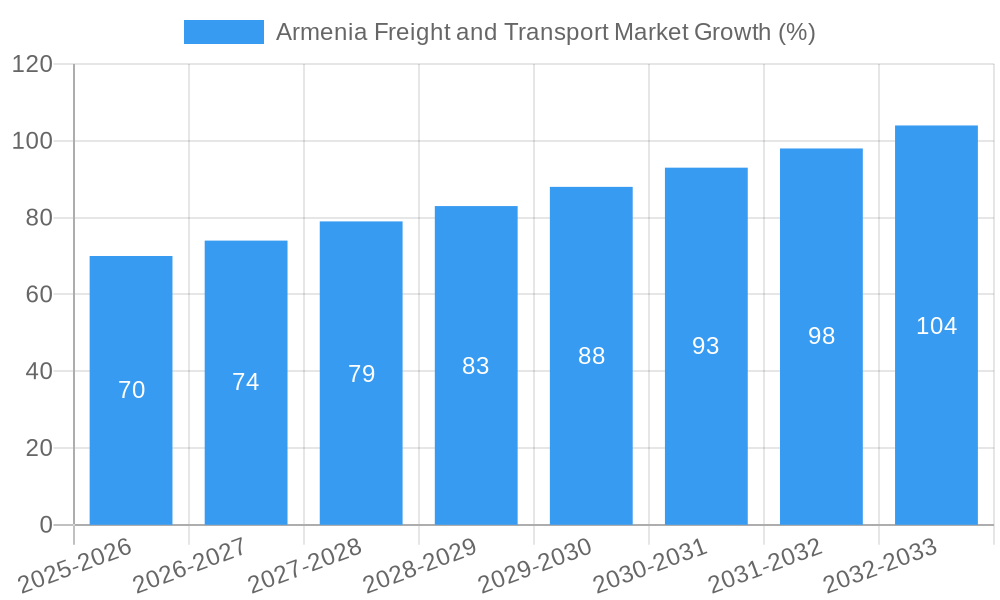

The Armenian freight and transport market, valued at $1.20 billion in 2025, is projected to experience robust growth, driven by increasing cross-border trade, infrastructure development, and the expansion of e-commerce. A Compound Annual Growth Rate (CAGR) of 5.43% is anticipated from 2025 to 2033, indicating a significant market expansion. Key growth drivers include the burgeoning manufacturing and automotive sectors, the rising demand for efficient logistics solutions within the agricultural and distributive trade (including FMCG) sectors, and the need for reliable transport services in the oil and gas, mining, and quarrying industries. The market is segmented by function (freight transport, air freight forwarding, warehousing, value-added services) and end-user (construction, oil and gas, mining, and quarrying, agriculture, fishing, and forestry, manufacturing and automotive, distributive trade, and other end-users). While challenges such as geopolitical instability and infrastructure limitations could potentially hinder growth, the overall outlook remains positive, fueled by government initiatives to improve logistics infrastructure and attract foreign investment. The presence of established international players like DHL and Hellmann Worldwide Logistics, alongside local companies like Mira Trans LLC and Unitrans LLC, indicates a competitive yet dynamic market landscape. Future growth is expected to be particularly influenced by technological advancements such as improved tracking systems, optimized route planning software, and the increasing adoption of digital freight forwarding platforms.

The market's segmentation provides valuable insights into specific growth opportunities. For instance, the growth in e-commerce is directly impacting the demand for warehousing and last-mile delivery services. Similarly, the increasing focus on sustainable logistics practices presents opportunities for companies offering environmentally friendly transport solutions. Growth within specific end-user sectors, such as the manufacturing and automotive sectors, will significantly influence the overall market trajectory. Companies looking to enter or expand their presence in the Armenian freight and transport market should carefully analyze these sector-specific trends and tailor their strategies accordingly, focusing on areas with the highest growth potential and adapting to the unique challenges of the region. Long-term growth will heavily depend on sustained economic growth in Armenia and the continuous improvement of its logistics infrastructure.

Armenia Freight and Transport Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Armenia freight and transport market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report segments the market by function (Freight Transport, Air Freight Forwarding, Warehousing, Value-added Services) and end-user (Construction, Oil and Gas, Mining and Quarrying, Agriculture, Fishing and Forestry, Manufacturing and Automotive, Distributive Trade (including FMCG), and Other End Users). This report is essential for businesses operating in or considering entry into this dynamic market. Market values are presented in Million units.

Armenia Freight and Transport Market Dynamics & Structure

The Armenian freight and transport market is characterized by a moderately concentrated landscape with several established players and emerging businesses. Technological innovation, particularly in digital logistics and supply chain management, is a key driver, though adoption rates vary. The regulatory framework influences operational costs and efficiency, while the availability of substitute transportation modes impacts market share. End-user demographics, particularly growth in manufacturing and e-commerce, shape demand. Mergers and acquisitions (M&A) activity has been relatively modest but reflects strategic positioning within the supply chain.

- Market Concentration: xx% of the market is controlled by the top 5 players.

- Technological Innovation: Adoption of GPS tracking, TMS (Transportation Management Systems) and route optimization software is gradually increasing, but faces challenges related to infrastructure and digital literacy.

- Regulatory Framework: Government regulations concerning transportation permits, safety standards, and customs procedures impact operational costs and efficiency. xx% of logistics companies are compliant with all current standards.

- Competitive Product Substitutes: Road transport dominates, but rail and air freight options are also available, although limited.

- End-User Demographics: Growth in e-commerce and manufacturing drives demand for reliable and efficient logistics services.

- M&A Trends: The number of M&A deals within the past 5 years has totaled xx. Consolidation is driven by access to technology, expanded service offerings, and geographic reach.

Armenia Freight and Transport Market Growth Trends & Insights

The Armenian freight and transport market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is attributed to factors including economic expansion, increased domestic trade, and improvements in infrastructure (though still limited). Technological disruptions are gradually increasing efficiency and reducing costs, while shifting consumer behavior towards e-commerce is bolstering demand for last-mile delivery solutions. Market penetration of digital logistics solutions is expected to reach xx% by 2033. Challenges include underdeveloped infrastructure in certain regions and fluctuating fuel prices. The market is projected to reach xx Million by 2025, demonstrating continued strong growth potential. The forecast period (2025-2033) anticipates continued growth, driven by factors such as government investment in infrastructure and increased cross-border trade.

Dominant Regions, Countries, or Segments in Armenia Freight and Transport Market

The Yerevan region dominates the Armenian freight and transport market due to its concentration of businesses, industrial activities, and access to major transportation arteries. The FMCG segment within Distributive Trade, and the construction sector are leading end-users, reflecting economic activity within the country. The Freight Transport segment, specifically road transport, holds the largest market share.

- Key Drivers:

- Economic policies that encourage business growth.

- Government investments in infrastructure development (though limited).

- Growth of e-commerce and related last-mile delivery services.

- Increased foreign investment in key sectors like construction and manufacturing.

- Dominance Factors:

- Yerevan’s central location and accessibility to transportation networks.

- High concentration of businesses and industries within the capital region.

- Robust demand from the construction and FMCG sectors.

- Increased use of Road Freight Transport.

Armenia Freight and Transport Market Product Landscape

The Armenian freight and transport market is characterized by a range of services including road freight, air freight forwarding, warehousing, and value-added services. Innovations are focused on enhancing efficiency and tracking capabilities through the adoption of technology such as GPS tracking and route optimization software. While the adoption rate is not yet widespread, it is expected to increase with improving infrastructure and digital literacy. Unique selling propositions among providers often focus on specialized services (e.g., temperature-controlled transport) and customer relationship management.

Key Drivers, Barriers & Challenges in Armenia Freight and Transport Market

Key Drivers: Increasing domestic and cross-border trade, government investment in infrastructure (though slowly), and the growth of the e-commerce sector are driving market growth. Technological advancements are also improving efficiency and reducing costs.

Challenges: Limited infrastructure in some regions, fluctuating fuel prices, bureaucratic hurdles, and a lack of skilled labor create significant challenges. These factors limit the ability of companies to scale operations and negatively impact the overall efficiency of the supply chain. Bureaucratic inefficiencies lead to an estimated xx% increase in operational costs.

Emerging Opportunities in Armenia Freight and Transport Market

The development of cold chain logistics to support the growing agricultural sector presents a significant opportunity. Expansion into specialized logistics sectors like pharmaceutical transportation offers untapped market potential. Investing in technology to improve supply chain visibility and efficiency can attract new clients and enhance competitiveness. Leveraging e-commerce growth to create more tailored last-mile delivery solutions also presents an opportunity.

Growth Accelerators in the Armenia Freight and Transport Market Industry

Strategic partnerships between logistics providers and technology companies can drive efficiency improvements and expansion into new markets. Government incentives to modernize infrastructure and improve connectivity can stimulate growth. Increased foreign investment in sectors such as manufacturing and agriculture will fuel demand for logistics services. The development of a skilled workforce equipped with the necessary technology and management expertise will ensure sustainable growth.

Key Players Shaping the Armenia Freight and Transport Market Market

- Hellmann Worldwide Logistics

- Mira Trans LLC

- ULS

- Spinnaker Logistics

- DHL

- PRIME LOGISTIC SERVICES LLC

- NT Logistics

- CEVA Logistics

- APAVEN CO LTD

- GMG Logistics

- Unitrans LLC

- Intertrans Armenia

- Lusar Trans LTD

Notable Milestones in Armenia Freight and Transport Market Sector

- August 2022: Lineage Logistics, LLC acquired Turvo Inc., impacting supply chain management software availability in Armenia.

- February 2023: Spinnaker SCA's acquisition of Accelogix strengthened supply chain execution capabilities within the region.

In-Depth Armenia Freight and Transport Market Market Outlook

The Armenian freight and transport market is poised for continued growth, driven by economic expansion, infrastructure development, and technological advancements. Strategic investments in digital logistics and efficient supply chain management will be crucial for success. Opportunities exist in expanding specialized services, optimizing last-mile delivery solutions, and leveraging partnerships to enhance competitiveness. The market's future hinges on addressing infrastructure limitations and fostering a skilled workforce.

Armenia Freight and Transport Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Rail

- 1.1.3. Air

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services

-

1.1. Freight Transport

-

2. End User

- 2.1. Construction

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Manufacturing and Automotive

- 2.5. Distribu

- 2.6. Other En

Armenia Freight and Transport Market Segmentation By Geography

- 1. Armenia

Armenia Freight and Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of Partnerships among Automobile Manufacturers and Logistics Partners; Growth in international trade

- 3.3. Market Restrains

- 3.3.1. Nature of Supply Chain Business

- 3.4. Market Trends

- 3.4.1. Increasing Trade with European countries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Armenia Freight and Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Rail

- 5.1.1.3. Air

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Construction

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Manufacturing and Automotive

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Armenia

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hellmann Worldwide Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mira Trans LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ULS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Spinnaker Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PRIME LOGISTIC SERVICES LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NT Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CEVA Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 APAVEN CO LTD**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GMG Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Unitrans LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Intertrans Armenia

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Lusar Trans LTD

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Hellmann Worldwide Logistics

List of Figures

- Figure 1: Armenia Freight and Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Armenia Freight and Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Armenia Freight and Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Armenia Freight and Transport Market Revenue Million Forecast, by Function 2019 & 2032

- Table 3: Armenia Freight and Transport Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Armenia Freight and Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Armenia Freight and Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Armenia Freight and Transport Market Revenue Million Forecast, by Function 2019 & 2032

- Table 7: Armenia Freight and Transport Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Armenia Freight and Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Armenia Freight and Transport Market?

The projected CAGR is approximately 5.43%.

2. Which companies are prominent players in the Armenia Freight and Transport Market?

Key companies in the market include Hellmann Worldwide Logistics, Mira Trans LLC, ULS, Spinnaker Logistics, DHL, PRIME LOGISTIC SERVICES LLC, NT Logistics, CEVA Logistics, APAVEN CO LTD**List Not Exhaustive, GMG Logistics, Unitrans LLC, Intertrans Armenia, Lusar Trans LTD.

3. What are the main segments of the Armenia Freight and Transport Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of Partnerships among Automobile Manufacturers and Logistics Partners; Growth in international trade.

6. What are the notable trends driving market growth?

Increasing Trade with European countries.

7. Are there any restraints impacting market growth?

Nature of Supply Chain Business.

8. Can you provide examples of recent developments in the market?

February 2023: Leading supply chain strategy, planning, and execution consulting firm Spinnaker SCA announced its acquisition of Accelogix. The opportunity to expand Spinnaker SCA's strengths in supply chain execution capabilities - enabled by Blue Yonder technology - made acquiring the established focused supply chain consultancy a strategic move. As part of the transition, Accelogix team members will join Spinnaker SCA's Supply Chain Execution practice.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Armenia Freight and Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Armenia Freight and Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Armenia Freight and Transport Market?

To stay informed about further developments, trends, and reports in the Armenia Freight and Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence