Key Insights

The biopharmaceutical logistics market is poised for substantial expansion, driven by escalating demand for temperature-controlled pharmaceuticals, the proliferation of biologics, and the global increase in clinical trials. Projected to achieve a Compound Annual Growth Rate (CAGR) of 12%, the market, currently valued at $140 billion as of 2025, will experience significant growth through 2033. Key growth catalysts include the rising incidence of chronic diseases, demanding reliable cold chain management for critical medications, and the increasing adoption of advanced therapies like cell and gene therapies, which require specialized logistics. Furthermore, the globalization of clinical trials and expansion of biopharmaceutical manufacturing in emerging markets are bolstering the need for efficient international logistics and supply chain solutions. The market is segmented by operational type (cold chain and non-cold chain) and service offerings (transportation, warehousing & distribution, and value-added services).

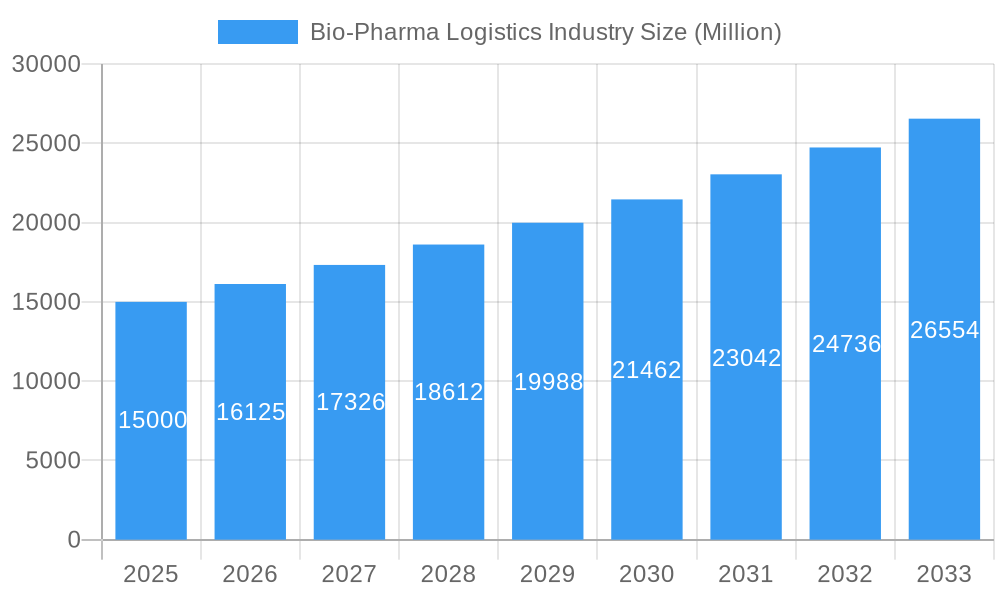

Bio-Pharma Logistics Industry Market Size (In Billion)

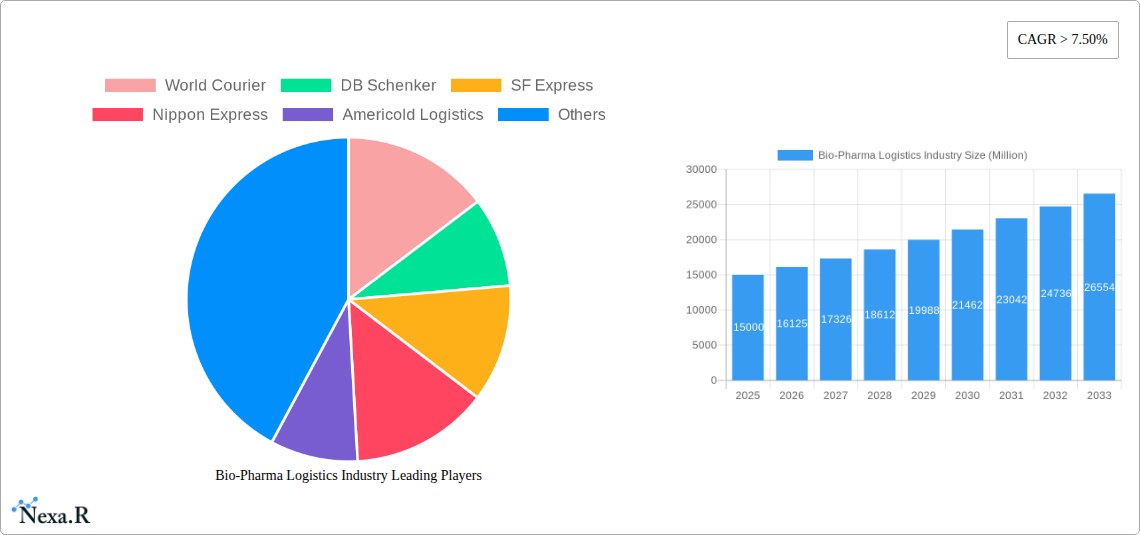

Leading industry participants such as World Courier, DB Schenker, and SF Express are actively deploying innovative technologies, including real-time tracking, blockchain for enhanced security, and AI-powered route optimization. Despite ongoing challenges like stringent regulatory compliance and substantial infrastructure investment requirements, the biopharmaceutical logistics sector anticipates sustained growth. This positive outlook is underpinned by the robust expansion of the biopharmaceutical industry and a heightened focus on ensuring patient access to essential medicines. Sustainability initiatives and advancements in last-mile delivery are also emerging as significant growth drivers. The competitive landscape is characterized by intense rivalry among established and new entrants, with strategic collaborations and acquisitions expected to reshape market dynamics.

Bio-Pharma Logistics Industry Company Market Share

Bio-Pharma Logistics Market Report: 2019-2033

This comprehensive report provides a deep dive into the global bio-pharma logistics market, analyzing its dynamics, growth trends, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategists seeking to navigate this rapidly evolving sector. The report examines both parent (Logistics) and child (Bio-Pharma Logistics) markets to offer a holistic view. Market values are presented in million units.

Bio-Pharma Logistics Industry Market Dynamics & Structure

This section analyzes the competitive landscape of the bio-pharma logistics market, encompassing market concentration, technological advancements, regulatory influences, and market forces impacting growth. We delve into the dynamics of mergers and acquisitions (M&A) and the impact of substitute products.

- Market Concentration: The bio-pharma logistics market exhibits a moderately concentrated structure, with key players such as World Courier, DB Schenker, SF Express, and Nippon Express holding significant market share (xx%). Smaller players, including numerous regional specialists, also contribute to overall market activity.

- Technological Innovation: Technological drivers include the adoption of IoT sensors for real-time monitoring, AI-powered predictive analytics for optimized routing, and blockchain technology for enhanced supply chain transparency. Barriers to innovation include high initial investment costs and regulatory compliance requirements.

- Regulatory Frameworks: Stringent regulations concerning temperature-sensitive drug transportation (e.g., GDP guidelines) and data security significantly influence market dynamics. Compliance costs represent a considerable expense for logistics providers.

- Competitive Product Substitutes: The emergence of specialized, niche logistics providers specializing in specific bio-pharmaceutical products and services poses competitive pressure.

- M&A Trends: The bio-pharma logistics sector has witnessed xx M&A deals in the past five years, driven by a desire for increased market share and geographical expansion (e.g., Lineage Logistics' acquisitions).

- End-User Demographics: The primary end-users are pharmaceutical manufacturers, biotech companies, clinical research organizations (CROs), and hospitals. Demand is influenced by factors such as research and development activities and growth in specific therapeutic areas.

Bio-Pharma Logistics Industry Growth Trends & Insights

This section analyzes historical and projected market growth, exploring drivers such as increasing pharmaceutical production, growing demand for temperature-sensitive products, and technological advancements.

The global bio-pharma logistics market experienced robust growth during the historical period (2019-2024), with an estimated CAGR of xx%. This growth trajectory is expected to continue throughout the forecast period (2025-2033), with a projected CAGR of xx%, driven by factors like increasing R&D expenditure in the pharmaceutical sector, an aging global population resulting in higher demand for pharmaceuticals, and an expansion of global supply chains. Market penetration of advanced technologies, such as real-time tracking and automated warehousing, is expected to increase significantly, further enhancing efficiency and reliability across the supply chain. The shift toward personalized medicine and the emergence of novel drug delivery systems are also influencing the demand for specialized logistics solutions. Consumer behavior changes, like a preference for direct-to-patient delivery, also shape the market. The ongoing impact of global events (such as pandemics) on the pharmaceutical supply chain is also a contributing factor, leading to a greater focus on resilience and diversification of logistics strategies.

Dominant Regions, Countries, or Segments in Bio-Pharma Logistics Industry

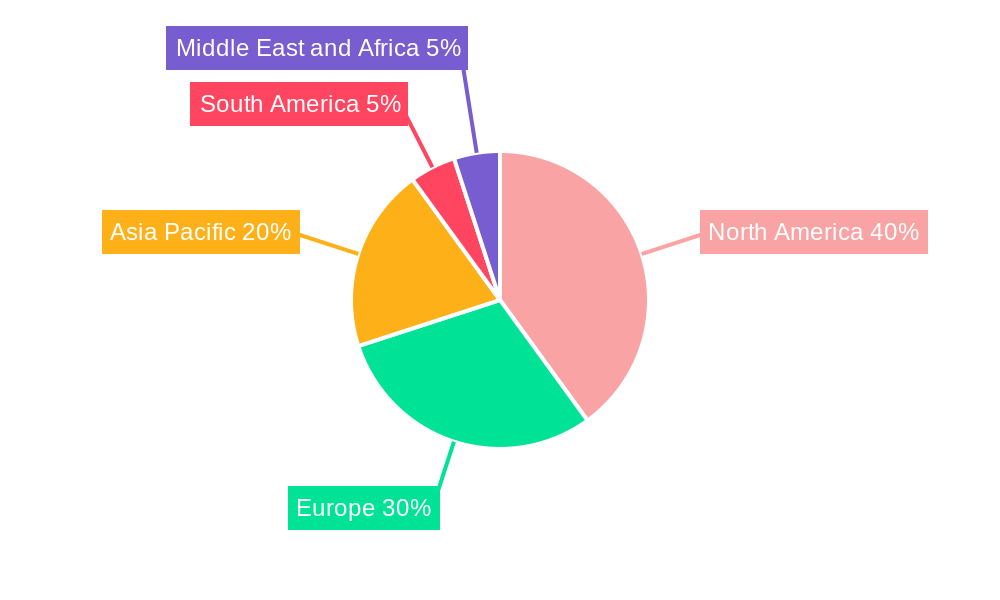

North America currently dominates the bio-pharma logistics market, holding an estimated xx% market share in 2025, followed by Europe (xx%) and Asia-Pacific (xx%). Growth is being driven by several factors.

By Type of Operation:

- Cold Chain: The cold chain segment is the largest and fastest-growing segment, driven by the increasing demand for temperature-sensitive pharmaceutical products.

- Non-Cold Chain: This segment maintains a significant market share, catering to the transportation and storage of non-temperature sensitive products within the pharmaceutical industry.

By Service:

- Transportation: Air freight continues to dominate due to speed and reliability requirements.

- Warehousing and Distribution: Growth in specialized cold storage facilities and advanced warehouse management systems (WMS) is a key driver in this segment.

- Value-Added Services: Demand for specialized services, such as clinical trial logistics, temperature mapping, and regulatory compliance support, is increasing.

Key Drivers:

- Robust pharmaceutical manufacturing base

- Favorable regulatory environment

- Development of advanced logistics infrastructure

Bio-Pharma Logistics Industry Product Landscape

The bio-pharma logistics industry offers a range of products, including specialized temperature-controlled containers, sophisticated tracking and monitoring systems, and advanced warehousing solutions. Recent innovations focus on improving efficiency, ensuring product integrity, and enhancing supply chain visibility. These include real-time GPS tracking, advanced sensor technologies capable of monitoring temperature and humidity fluctuations, and data analytics platforms that provide predictive insights into potential supply chain disruptions. The unique selling propositions (USPs) of many providers lie in their ability to offer customized solutions tailored to the specific needs of their clients, alongside robust regulatory compliance capabilities.

Key Drivers, Barriers & Challenges in Bio-Pharma Logistics Industry

Key Drivers:

- Rising demand for biopharmaceuticals globally

- Technological advancements (IoT, AI, blockchain)

- Increasing regulatory stringency (requiring sophisticated logistics)

Challenges & Restraints:

- Maintaining stringent temperature control throughout the supply chain is a major challenge, especially for long-distance transportation, leading to significant product losses (estimated xx million units annually).

- Regulatory compliance presents a hurdle, particularly regarding GDP, necessitating substantial investment in IT systems and training.

- Intense competition among logistics providers results in price pressures.

Emerging Opportunities in Bio-Pharma Logistics Industry

- Growth of personalized medicine: Tailored logistics solutions for personalized medications are creating new opportunities.

- Expansion into emerging markets: Untapped potential exists in developing economies with growing pharmaceutical markets.

- Development of innovative packaging and transportation solutions: Improvements in temperature control technology offer considerable potential.

Growth Accelerators in the Bio-Pharma Logistics Industry

Technological advancements, strategic partnerships, and the expansion into new markets are crucial accelerators for long-term growth. The integration of AI and machine learning in route optimization and predictive analytics improves efficiency and reduces costs. Strategic collaborations between logistics providers and pharmaceutical companies lead to greater synergy and improved service offerings. Expanding into emerging markets with growing healthcare sectors unlocks new avenues for market expansion.

Key Players Shaping the Bio-Pharma Logistics Industry Market

- World Courier

- DB Schenker

- SF Express

- Nippon Express

- Americold Logistics

- CH Robinson

- UPS (Marken)

- FedEx

- Kuehne + Nagel

- CEVA

- Agility

- Kerry Logistics

- Deutsche Post DHL Group

- Air Canada Cargo

- Lineage Logistics

- United States Cold Storage

- AGRO Merchants Group LLC

- Nichirei Logistics Group Inc

- Kloosterboer

- NewCold Advanced Cold Logistics

- VersaCold Logistics Services

- Cloverleaf Cold Storage Co

- DSV

Notable Milestones in Bio-Pharma Logistics Industry Sector

- 2020: Increased adoption of digital technologies in response to the COVID-19 pandemic.

- 2021: Several major M&A transactions reshaped the market landscape.

- 2022: Focus on sustainability and environmental responsibility within the supply chain increased.

- 2023: Significant investment in automation and AI-driven solutions.

In-Depth Bio-Pharma Logistics Industry Market Outlook

The bio-pharma logistics market is poised for continued strong growth, driven by the factors highlighted above. The increasing demand for biologics and specialized cold chain solutions, along with the ongoing adoption of innovative technologies, will continue to shape market dynamics. Companies that successfully adapt to evolving regulations, embrace technological advancements, and establish strategic partnerships will be best positioned to capitalize on the significant opportunities presented by this expanding sector. The focus on enhancing supply chain resilience and building robust, geographically diverse logistics networks will also be key success factors.

Bio-Pharma Logistics Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Distribution

- 1.3. Value Added Services

-

2. Type of Operation

- 2.1. Cold Chain

- 2.2. Non-cold Chain

Bio-Pharma Logistics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Bio-Pharma Logistics Industry Regional Market Share

Geographic Coverage of Bio-Pharma Logistics Industry

Bio-Pharma Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; The UAE government's efforts to diversify its economy away from oil dependency have led to increased investment4.; The UAE has been investing in manufacturing sectors such as aerospace

- 3.2.2 automotive

- 3.2.3 and pharmaceuticals.

- 3.3. Market Restrains

- 3.3.1 4.; The geopolitical situation in the Middle East can create security concerns for logistics operations

- 3.3.2 4.; Regulations and customs procedures can be complex and subject to change.

- 3.4. Market Trends

- 3.4.1. Temperature-sensitive Pharmaceutical Drugs Sales Driving the Cold Chain Logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bio-Pharma Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Distribution

- 5.1.3. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Type of Operation

- 5.2.1. Cold Chain

- 5.2.2. Non-cold Chain

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Bio-Pharma Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehousing and Distribution

- 6.1.3. Value Added Services

- 6.2. Market Analysis, Insights and Forecast - by Type of Operation

- 6.2.1. Cold Chain

- 6.2.2. Non-cold Chain

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Bio-Pharma Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehousing and Distribution

- 7.1.3. Value Added Services

- 7.2. Market Analysis, Insights and Forecast - by Type of Operation

- 7.2.1. Cold Chain

- 7.2.2. Non-cold Chain

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Bio-Pharma Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehousing and Distribution

- 8.1.3. Value Added Services

- 8.2. Market Analysis, Insights and Forecast - by Type of Operation

- 8.2.1. Cold Chain

- 8.2.2. Non-cold Chain

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. South America Bio-Pharma Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehousing and Distribution

- 9.1.3. Value Added Services

- 9.2. Market Analysis, Insights and Forecast - by Type of Operation

- 9.2.1. Cold Chain

- 9.2.2. Non-cold Chain

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East and Africa Bio-Pharma Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehousing and Distribution

- 10.1.3. Value Added Services

- 10.2. Market Analysis, Insights and Forecast - by Type of Operation

- 10.2.1. Cold Chain

- 10.2.2. Non-cold Chain

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 World Courier

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DB Schenker

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SF Express

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nippon Express

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Americold Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CH Robinson

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 UPS (Marken)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FedEx

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kuehne + Nagel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CEVA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Agility

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kerry Logistics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Deutsche Post DHL Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Air Canada Cargo**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Lineage Logistics United States Cold Storage AGRO Merchants Group LLC Nichirei Logistics Group Inc Kloosterboer NewCold Advanced Cold Logistics VersaCold Logistics Services and Cloverleaf Cold Storage Co

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 DSV

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 World Courier

List of Figures

- Figure 1: Global Bio-Pharma Logistics Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Bio-Pharma Logistics Industry Revenue (billion), by Service 2025 & 2033

- Figure 3: North America Bio-Pharma Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Bio-Pharma Logistics Industry Revenue (billion), by Type of Operation 2025 & 2033

- Figure 5: North America Bio-Pharma Logistics Industry Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 6: North America Bio-Pharma Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Bio-Pharma Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Bio-Pharma Logistics Industry Revenue (billion), by Service 2025 & 2033

- Figure 9: Europe Bio-Pharma Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe Bio-Pharma Logistics Industry Revenue (billion), by Type of Operation 2025 & 2033

- Figure 11: Europe Bio-Pharma Logistics Industry Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 12: Europe Bio-Pharma Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Bio-Pharma Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Bio-Pharma Logistics Industry Revenue (billion), by Service 2025 & 2033

- Figure 15: Asia Pacific Bio-Pharma Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Pacific Bio-Pharma Logistics Industry Revenue (billion), by Type of Operation 2025 & 2033

- Figure 17: Asia Pacific Bio-Pharma Logistics Industry Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 18: Asia Pacific Bio-Pharma Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Bio-Pharma Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Bio-Pharma Logistics Industry Revenue (billion), by Service 2025 & 2033

- Figure 21: South America Bio-Pharma Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: South America Bio-Pharma Logistics Industry Revenue (billion), by Type of Operation 2025 & 2033

- Figure 23: South America Bio-Pharma Logistics Industry Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 24: South America Bio-Pharma Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Bio-Pharma Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Bio-Pharma Logistics Industry Revenue (billion), by Service 2025 & 2033

- Figure 27: Middle East and Africa Bio-Pharma Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: Middle East and Africa Bio-Pharma Logistics Industry Revenue (billion), by Type of Operation 2025 & 2033

- Figure 29: Middle East and Africa Bio-Pharma Logistics Industry Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 30: Middle East and Africa Bio-Pharma Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Bio-Pharma Logistics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Type of Operation 2020 & 2033

- Table 3: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Type of Operation 2020 & 2033

- Table 6: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 8: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Type of Operation 2020 & 2033

- Table 9: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 11: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Type of Operation 2020 & 2033

- Table 12: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Type of Operation 2020 & 2033

- Table 15: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 17: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Type of Operation 2020 & 2033

- Table 18: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bio-Pharma Logistics Industry?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the Bio-Pharma Logistics Industry?

Key companies in the market include World Courier, DB Schenker, SF Express, Nippon Express, Americold Logistics, CH Robinson, UPS (Marken), FedEx, Kuehne + Nagel, CEVA, Agility, Kerry Logistics, Deutsche Post DHL Group, Air Canada Cargo**List Not Exhaustive 6 3 Other Companies (Key Information/Overview), Lineage Logistics United States Cold Storage AGRO Merchants Group LLC Nichirei Logistics Group Inc Kloosterboer NewCold Advanced Cold Logistics VersaCold Logistics Services and Cloverleaf Cold Storage Co, DSV.

3. What are the main segments of the Bio-Pharma Logistics Industry?

The market segments include Service, Type of Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 140 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The UAE government's efforts to diversify its economy away from oil dependency have led to increased investment4.; The UAE has been investing in manufacturing sectors such as aerospace. automotive. and pharmaceuticals..

6. What are the notable trends driving market growth?

Temperature-sensitive Pharmaceutical Drugs Sales Driving the Cold Chain Logistics.

7. Are there any restraints impacting market growth?

4.; The geopolitical situation in the Middle East can create security concerns for logistics operations. 4.; Regulations and customs procedures can be complex and subject to change..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bio-Pharma Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bio-Pharma Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bio-Pharma Logistics Industry?

To stay informed about further developments, trends, and reports in the Bio-Pharma Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence