Key Insights

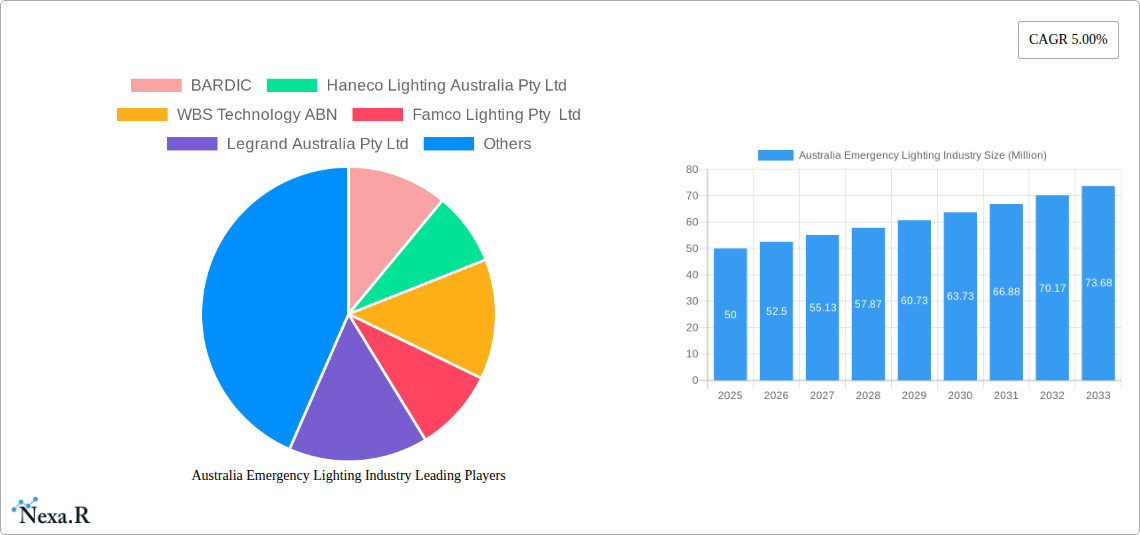

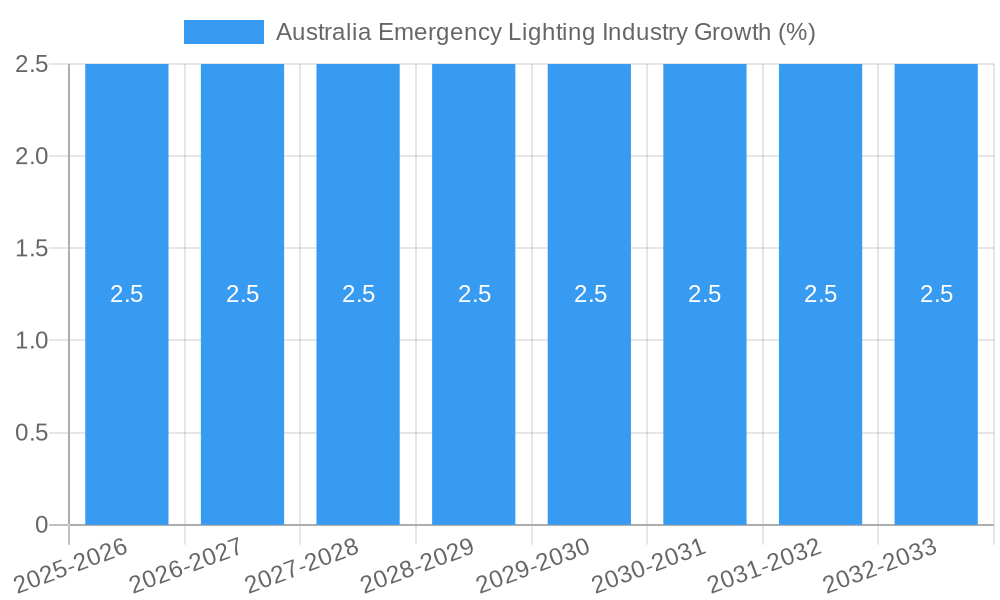

The Australian emergency lighting market, valued at approximately $50 million in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 5% from 2025 to 2033. This growth is driven by several key factors. Stringent building codes and regulations mandating the installation of emergency lighting systems across residential, commercial, and industrial sectors are a significant catalyst. Increasing awareness of safety and security concerns, particularly in high-rise buildings and public spaces, further fuels market demand. The rising adoption of technologically advanced emergency lighting solutions, such as LED-based systems offering longer lifespan, improved energy efficiency, and enhanced features like remote monitoring and smart control, is another major driver. Furthermore, government initiatives promoting energy efficiency and sustainable building practices contribute to the market's expansion. The market segmentation reveals a substantial share held by the commercial sector, followed by industrial and residential segments. Self-contained power systems dominate the power system segment due to their ease of installation and maintenance. Key players like Bardic, Haneco Lighting Australia, and ABB Australia are actively shaping the market landscape through innovation and strategic partnerships.

The competitive landscape is characterized by a mix of established international players and local businesses. While established companies leverage their brand recognition and extensive product portfolios, local players focus on providing customized solutions tailored to the Australian market. However, the market also faces certain restraints. High initial investment costs associated with installing and maintaining emergency lighting systems might hinder adoption, particularly among smaller businesses. Furthermore, the cyclical nature of the construction industry, which is a significant end-user for emergency lighting, can impact market growth in certain periods. Despite these challenges, the long-term outlook remains positive, driven by continuous advancements in technology, strengthening safety regulations, and the increasing focus on sustainable infrastructure development across Australia. The market is expected to surpass $75 million by 2033, presenting lucrative opportunities for existing and new entrants.

Australia Emergency Lighting Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australia emergency lighting industry, encompassing market dynamics, growth trends, key players, and future outlook. Covering the period 2019-2033, with a focus on 2025, this report is essential for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this crucial sector. The report segments the market by power system (self-contained and central) and end-user vertical (residential, commercial, and industrial), providing granular insights into market size and growth potential. With a predicted market value of xx Million in 2025, the industry is poised for significant expansion.

Australia Emergency Lighting Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Australian emergency lighting market. The market is characterized by a moderate level of concentration, with key players such as BARDIC, Haneco Lighting Australia Pty Ltd, and Legrand Australia Pty Ltd holding significant market share. However, the emergence of innovative startups and technological disruptions is fostering increased competition.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top 5 players holding approximately xx% of the market share in 2025.

- Technological Innovation: The adoption of LED technology, smart lighting solutions, and IoT integration is driving innovation. However, challenges remain in terms of cost, interoperability, and standardization.

- Regulatory Framework: Stringent building codes and safety regulations drive demand for compliant emergency lighting systems. These regulations are expected to remain a key driver for market growth.

- Competitive Product Substitutes: While direct substitutes are limited, the market faces indirect competition from alternative safety solutions.

- End-User Demographics: The commercial and industrial sectors represent the largest segments, driven by stringent safety requirements and increasing awareness of fire safety regulations. The residential segment shows modest growth potential.

- M&A Trends: The industry has witnessed a moderate level of mergers and acquisitions activity in recent years, with approximately xx deals recorded between 2019 and 2024. Consolidation is expected to continue as larger players seek to expand their market share.

Australia Emergency Lighting Industry Growth Trends & Insights

The Australian emergency lighting market has experienced steady growth over the past five years (2019-2024), driven by increasing construction activity, rising safety concerns, and the adoption of advanced technologies. The market size is projected to reach xx Million in 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is attributed to factors such as the increasing adoption of energy-efficient LED lighting, stringent government regulations, and rising awareness of safety standards. The market penetration rate is expected to reach xx% by 2033, with the commercial sector being the most significant driver.

Dominant Regions, Countries, or Segments in Australia Emergency Lighting Industry

The Commercial sector dominates the Australian emergency lighting market, followed by the Industrial sector. This dominance stems from the stringent safety regulations within these sectors and the large number of commercial and industrial buildings requiring compliant emergency lighting systems. New South Wales and Victoria are the leading states in terms of market share, driven by higher construction activity and a larger concentration of commercial buildings.

- Key Drivers for Commercial Sector Dominance:

- Stringent building codes and safety regulations.

- High concentration of commercial buildings.

- Increasing awareness of fire safety.

- Key Drivers for Industrial Sector Growth:

- Safety regulations specific to industrial environments.

- Demand for robust and reliable emergency lighting systems.

- Growing industrial infrastructure projects.

- Central Power Systems: This segment is experiencing a moderate growth rate due to its scalability and centralized control capabilities.

- Self-Contained Power Systems: This segment dominates in residential and smaller commercial settings due to its ease of installation and lower cost.

Australia Emergency Lighting Industry Product Landscape

The Australian emergency lighting market offers a range of products, from basic self-contained units to sophisticated networked systems. Key product innovations include the integration of LED technology for energy efficiency, wireless connectivity for remote monitoring and control, and smart features for improved safety and functionality. These advancements offer significant improvements in terms of lifespan, energy consumption, and overall system reliability.

Key Drivers, Barriers & Challenges in Australia Emergency Lighting Industry

Key Drivers:

- Increasing construction activity and infrastructure development.

- Stringent safety regulations and building codes.

- Growing awareness of fire safety and risk mitigation.

- Technological advancements in LED and smart lighting.

Key Challenges:

- High initial investment costs for advanced systems.

- Complexity of installation and integration for networked systems.

- Competition from cheaper, lower-quality imports.

- Maintaining the integrity of supply chains, particularly given recent global disruptions.

Emerging Opportunities in Australia Emergency Lighting Industry

- Growing demand for smart and connected emergency lighting systems.

- Expansion into the renewable energy sector with integration into solar powered solutions.

- Increased focus on remote monitoring and predictive maintenance.

- Development of specialized solutions for niche applications such as mining and healthcare.

Growth Accelerators in the Australia Emergency Lighting Industry Industry

The Australian emergency lighting market is poised for continued growth due to a confluence of factors: increasing demand for energy-efficient LED lighting, the integration of smart technologies such as IoT, and advancements in wireless communication, along with stricter safety standards. Strategic partnerships between manufacturers and installers, coupled with the implementation of innovative solutions tailored to specific sectors, are vital catalysts for future expansion.

Key Players Shaping the Australia Emergency Lighting Industry Market

- BARDIC

- Haneco Lighting Australia Pty Ltd

- WBS Technology ABN

- Famco Lighting Pty Ltd

- Legrand Australia Pty Ltd

- EnLighten Australia

- ABB Australia (ABB Ltd)

- E&E Lighting Australia

- Clevertronics Pty Ltd

Notable Milestones in Australia Emergency Lighting Industry Sector

- October 2021: Clevertronics partnered with Wirepas, enhancing its smart emergency lighting solutions. This collaboration significantly boosted the market’s potential for large-scale, cost-effective deployments.

- September 2022: MineGlow launched em-Control, a technologically advanced, interoperable emergency lighting system specifically designed for underground mines. This reflects a growing emphasis on safety in specialized sectors and showcases the industry's capacity for innovation.

In-Depth Australia Emergency Lighting Industry Market Outlook

The Australian emergency lighting market is expected to witness robust growth over the next decade. Driven by factors such as increasing urbanization, infrastructure development, and stringent safety regulations, the market is expected to experience continuous expansion. Opportunities for growth lie in the adoption of advanced technologies, strategic partnerships, and the exploration of niche market segments such as renewable energy integration and specialized industrial applications. Companies that can effectively leverage these trends will be well-positioned to capitalize on the significant growth potential within the Australian emergency lighting market.

Australia Emergency Lighting Industry Segmentation

-

1. Power System

- 1.1. Self-contained Power System

- 1.2. Central Power System

-

2. End-user Vertical

- 2.1. Residential

- 2.2. Industrial

- 2.3. Commercial

Australia Emergency Lighting Industry Segmentation By Geography

- 1. Australia

Australia Emergency Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supporting Government Regulations (Building Code of Australia (BCA))

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Amongst Non-data Center Applications

- 3.4. Market Trends

- 3.4.1. Commercial Segment in Australia is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Emergency Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power System

- 5.1.1. Self-contained Power System

- 5.1.2. Central Power System

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Residential

- 5.2.2. Industrial

- 5.2.3. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Power System

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BARDIC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haneco Lighting Australia Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WBS Technology ABN

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Famco Lighting Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Legrand Australia Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EnLighten Australia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ABB Australia (ABB Ltd)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 E&E Lighting Australia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Clevertronics Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 BARDIC

List of Figures

- Figure 1: Australia Emergency Lighting Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Emergency Lighting Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia Emergency Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Emergency Lighting Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Australia Emergency Lighting Industry Revenue Million Forecast, by Power System 2019 & 2032

- Table 4: Australia Emergency Lighting Industry Volume K Unit Forecast, by Power System 2019 & 2032

- Table 5: Australia Emergency Lighting Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Australia Emergency Lighting Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 7: Australia Emergency Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia Emergency Lighting Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Australia Emergency Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Australia Emergency Lighting Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Australia Emergency Lighting Industry Revenue Million Forecast, by Power System 2019 & 2032

- Table 12: Australia Emergency Lighting Industry Volume K Unit Forecast, by Power System 2019 & 2032

- Table 13: Australia Emergency Lighting Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 14: Australia Emergency Lighting Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 15: Australia Emergency Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Australia Emergency Lighting Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Emergency Lighting Industry?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Australia Emergency Lighting Industry?

Key companies in the market include BARDIC, Haneco Lighting Australia Pty Ltd, WBS Technology ABN, Famco Lighting Pty Ltd, Legrand Australia Pty Ltd, EnLighten Australia, ABB Australia (ABB Ltd), E&E Lighting Australia, Clevertronics Pty Ltd.

3. What are the main segments of the Australia Emergency Lighting Industry?

The market segments include Power System, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Supporting Government Regulations (Building Code of Australia (BCA)).

6. What are the notable trends driving market growth?

Commercial Segment in Australia is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Awareness Amongst Non-data Center Applications.

8. Can you provide examples of recent developments in the market?

September 2022: MineGlow has launched em-Control, a new technologically advanced, interoperable emergency lighting system designed to improve the safety of underground mines. The em-Control is an intelligent, network-based solution that warns and directs an underground workforce to safety with multi-directional light pulses and colors. The complete system comprises em-Lighting, the LED light strip, em-View, a web interface, and em-Controller, a network-based controller that integrates with third-party systems via an open application programming interface (API).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Emergency Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Emergency Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Emergency Lighting Industry?

To stay informed about further developments, trends, and reports in the Australia Emergency Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence