Key Insights

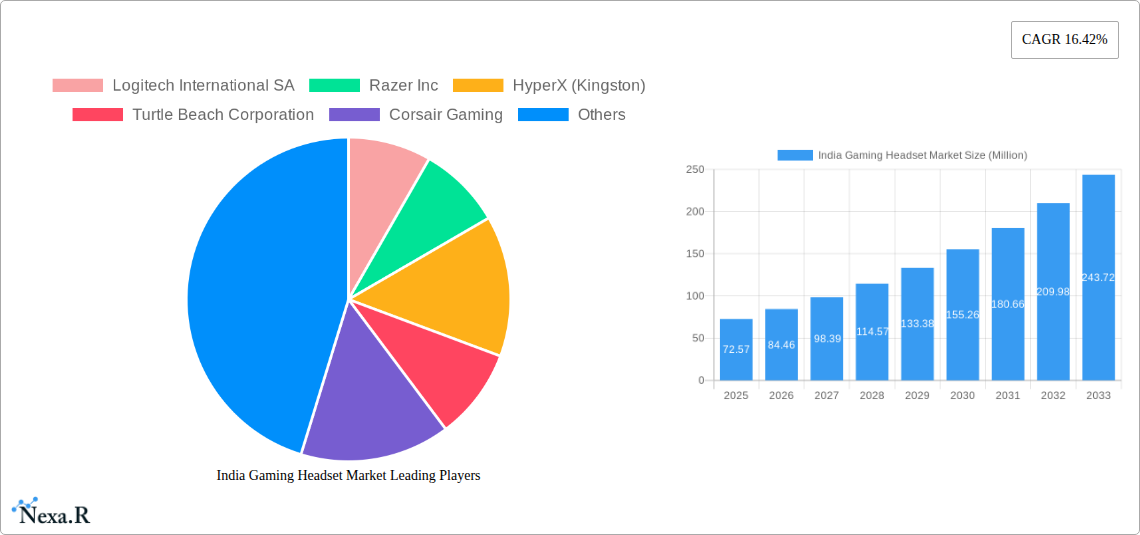

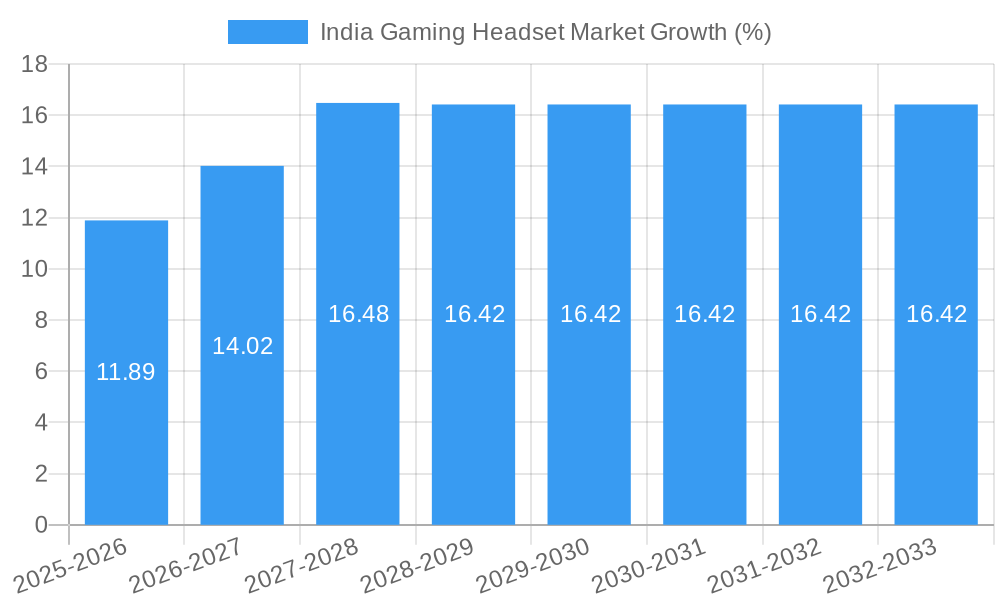

The India gaming headset market, valued at $72.57 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 16.42% from 2025 to 2033. This significant expansion is driven by several key factors. The burgeoning popularity of esports and online gaming in India, coupled with rising disposable incomes and increased smartphone penetration, fuels demand for high-quality audio peripherals. Furthermore, the introduction of innovative features like improved noise cancellation, customizable audio profiles, and enhanced comfort are attracting a wider consumer base. The market is segmented by product type (wired, wireless, etc.), price range, and platform compatibility (PC, console, mobile). Major players like Logitech, Razer, HyperX, and Corsair dominate the market, continuously releasing new models to cater to evolving consumer preferences. However, challenges remain, including potential price sensitivity among consumers and the prevalence of counterfeit products. Despite these restraints, the long-term outlook for the India gaming headset market remains positive, driven by increasing participation in competitive gaming and a growing appreciation for immersive gaming experiences. The market is expected to see a significant increase in both the number of users and the average revenue per user over the next decade, primarily due to the rising popularity of mobile gaming and the increased adoption of high-end gaming devices. This creates fertile ground for market expansion and continued innovation.

The competitive landscape is characterized by both established international brands and emerging domestic players. While established brands benefit from strong brand recognition and advanced technology, local manufacturers are leveraging cost advantages to penetrate the market. This competition is likely to intensify, driving innovation and price reductions. Successful strategies will require a balance of offering high-quality products with appealing price points and effective marketing campaigns targeted at India's diverse gaming community. Key growth opportunities lie in targeting the burgeoning mobile gaming segment and expanding into smaller cities and towns across the country.

India Gaming Headset Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Gaming Headset Market, covering market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this rapidly evolving market. The report covers both the parent market (India Consumer Electronics Market) and the child market (India Gaming Headset Market).

India Gaming Headset Market Dynamics & Structure

The Indian gaming headset market is characterized by moderate concentration, with key players holding significant market share. Technological innovation, particularly in audio quality, comfort, and connectivity, is a major driver. Regulatory frameworks, while not overly restrictive, influence pricing and import/export dynamics. The rise of e-sports and mobile gaming fuels demand, creating opportunities for both wired and wireless headsets. Substitutes, such as standard headphones, pose a competitive threat. The market exhibits a predominantly young demographic, driving demand for stylish and high-performance headsets. M&A activity remains moderate, with xx deals recorded in the historical period (2019-2024), indicating potential for future consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on improved audio fidelity, noise cancellation, lightweight designs, and advanced connectivity (Bluetooth 5.0, low-latency wireless).

- Regulatory Framework: Primarily focused on import duties and consumer protection regulations.

- Competitive Substitutes: Standard headphones and earbuds present a competitive challenge.

- End-User Demographics: Predominantly young adults (18-35 years) with a growing female segment.

- M&A Trends: xx M&A deals recorded between 2019-2024.

India Gaming Headset Market Growth Trends & Insights

The India Gaming Headset market witnessed significant growth during the historical period (2019-2024), expanding from xx million units in 2019 to xx million units in 2024. This growth is driven by increased gaming adoption, rising disposable incomes, and the proliferation of affordable smartphones and PCs. The market is expected to continue its upward trajectory, exhibiting a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. Market penetration is currently at xx% and is projected to reach xx% by 2033. Technological disruptions, such as the adoption of advanced audio codecs and wireless technologies, further fuel market expansion. Shifting consumer preferences towards premium features, including surround sound and noise cancellation, are also key growth drivers. The market is experiencing a transition from wired to wireless headsets, driven by the demand for enhanced convenience and portability.

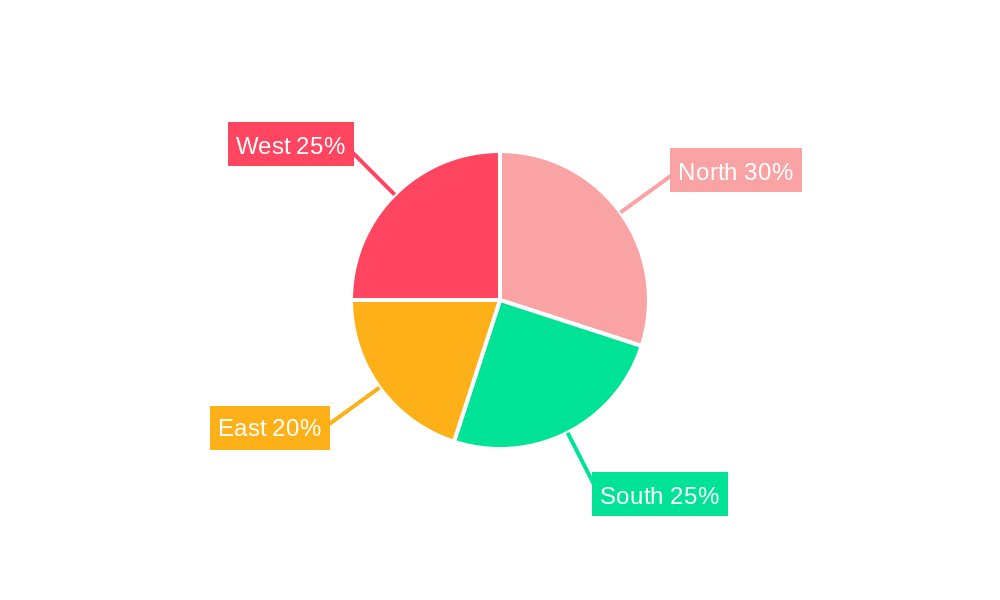

Dominant Regions, Countries, or Segments in India Gaming Headset Market

The metropolitan areas of major Indian cities (Mumbai, Delhi, Bengaluru, Chennai, Kolkata) dominate the India gaming headset market, driven by higher disposable incomes and greater access to high-speed internet. These regions account for xx% of the total market revenue in 2024. Strong economic growth in these areas combined with a thriving e-sports scene are key factors contributing to market dominance. Urbanization and increasing smartphone penetration in tier 2 and 3 cities present significant growth opportunities for the future.

- Key Drivers:

- High disposable incomes and rising spending power.

- Strong growth of the gaming industry (both mobile and PC).

- Increasing internet and mobile penetration.

- Growing popularity of e-sports.

- Favorable government policies promoting the digital economy.

- Dominance Factors: High population density, greater access to gaming infrastructure (internet cafes, e-sports arenas), strong consumer base with high purchasing power.

India Gaming Headset Market Product Landscape

The India gaming headset market offers a diverse range of products, including wired, wireless, and VR headsets catering to different budgets and preferences. Headsets with advanced features like 7.1 surround sound, noise cancellation, comfortable earcups, and durable build quality are gaining traction among premium users. Technological advancements in audio processing, microphone technology, and connectivity (Bluetooth, USB-C) constantly improve headset functionality and user experience. Unique selling propositions include superior audio immersion, comfortable design, and long battery life for wireless models.

Key Drivers, Barriers & Challenges in India Gaming Headset Market

Key Drivers: The rising popularity of online and mobile gaming, increasing smartphone penetration, growing adoption of high-speed internet, and the burgeoning e-sports industry are driving the growth of the India gaming headset market. Government initiatives promoting digital India are also boosting growth.

Key Challenges: Intense competition among established and emerging players, fluctuating component prices impacting production costs, counterfeiting and grey market imports, and the need for continuous innovation to meet evolving consumer demands. Supply chain disruptions can also significantly affect production and market availability, especially during periods of high demand.

Emerging Opportunities in India Gaming Headset Market

Untapped markets in tier 2 and 3 cities, expanding mobile gaming segment, increasing demand for affordable, high-quality headsets, and opportunities for customized gaming headsets tailored to specific gaming genres present significant growth opportunities. The integration of smart features, such as AI-powered noise cancellation or personalized audio profiles, could also enhance market appeal. Collaborations with gaming peripherals companies to bundle headsets with other gaming accessories offers additional growth potential.

Growth Accelerators in the India Gaming Headset Market Industry

Technological innovations like advanced audio codecs, improved microphone technologies, and comfortable ergonomic designs are driving long-term growth. Strategic partnerships between headset manufacturers and gaming companies enhance market penetration and brand visibility. The growing e-sports industry is fostering a culture of competitive gaming, driving demand for high-performance gaming headsets. Expanding into untapped rural markets through strategic distribution partnerships can further fuel long-term growth.

Key Players Shaping the India Gaming Headset Market Market

- Logitech International SA

- Razer Inc

- HyperX (Kingston)

- Turtle Beach Corporation

- Corsair Gaming

- SteelSeries

- Audio-Technica Ltd

- Sony Interactive Entertainment

- Creative Technology

- Skullcandy

- Sennheiser Electronic GmbH & Co KG

- ROCCA

Notable Milestones in India Gaming Headset Market Sector

- April 2024: DPVR launched the E4 Arc VR headset with hand-tracking support, featuring Ultraleap's Leap Motion Controller 2.

- April 2024: Pimax unveiled the Crystal Super and Crystal Light VR headsets, featuring changeable optical engines and high-resolution displays. The 60G Airlink module offering wireless PCVR via WiGig technology was also launched.

In-Depth India Gaming Headset Market Market Outlook

The India gaming headset market is poised for sustained growth, driven by technological advancements, increased gaming adoption, and favorable economic conditions. Strategic partnerships, market expansion into untapped segments, and a focus on innovative product features will shape the future of this dynamic market. The long-term potential is significant, particularly with the continuous evolution of gaming technologies and the expanding reach of the internet across the country.

India Gaming Headset Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

India Gaming Headset Market Segmentation By Geography

- 1. India

India Gaming Headset Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms such as E-sports Betting and Fantasy Sites

- 3.3. Market Restrains

- 3.3.1. Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms such as E-sports Betting and Fantasy Sites

- 3.4. Market Trends

- 3.4.1. Rising Internet Penetration and Emergence of Cloud Gaming Platforms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Gaming Headset Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Logitech International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Razer Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HyperX (Kingston)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Turtle Beach Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Corsair Gaming

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SteelSeries

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Audio-Technica Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sony Interactive Entertainment

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Creative Technology

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Skullcandy

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sennheiser Electronic GmbH & Co KG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ROCCA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Logitech International SA

List of Figures

- Figure 1: India Gaming Headset Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Gaming Headset Market Share (%) by Company 2024

List of Tables

- Table 1: India Gaming Headset Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Gaming Headset Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: India Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 4: India Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 5: India Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 6: India Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 7: India Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 8: India Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 9: India Gaming Headset Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India Gaming Headset Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: India Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 12: India Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 13: India Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 14: India Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 15: India Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: India Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 17: India Gaming Headset Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India Gaming Headset Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Gaming Headset Market?

The projected CAGR is approximately 16.42%.

2. Which companies are prominent players in the India Gaming Headset Market?

Key companies in the market include Logitech International SA, Razer Inc, HyperX (Kingston), Turtle Beach Corporation, Corsair Gaming, SteelSeries, Audio-Technica Ltd, Sony Interactive Entertainment, Creative Technology, Skullcandy, Sennheiser Electronic GmbH & Co KG, ROCCA.

3. What are the main segments of the India Gaming Headset Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms such as E-sports Betting and Fantasy Sites.

6. What are the notable trends driving market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms.

7. Are there any restraints impacting market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms such as E-sports Betting and Fantasy Sites.

8. Can you provide examples of recent developments in the market?

April 2024: DPVR announced the launch of the new E4 Arc VR headset with hand-tracking support. This variant of the DPVR E4 PC VR headset is equipped with the Leap Motion Controller 2 hand-tracking camera from Ultraleap. Ultraleap's Leap Motion 2 provides a tracking range of between 10 and 110 cm and a maximum field of view of 160° x 160°. The E4 Arc is also equipped with a "turbo cooling system," which features an improved fan model, optimized vapor chamber, and optimized fan operating logic. The headset also features easily replaceable cables for easier maintenance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Gaming Headset Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Gaming Headset Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Gaming Headset Market?

To stay informed about further developments, trends, and reports in the India Gaming Headset Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence