Key Insights

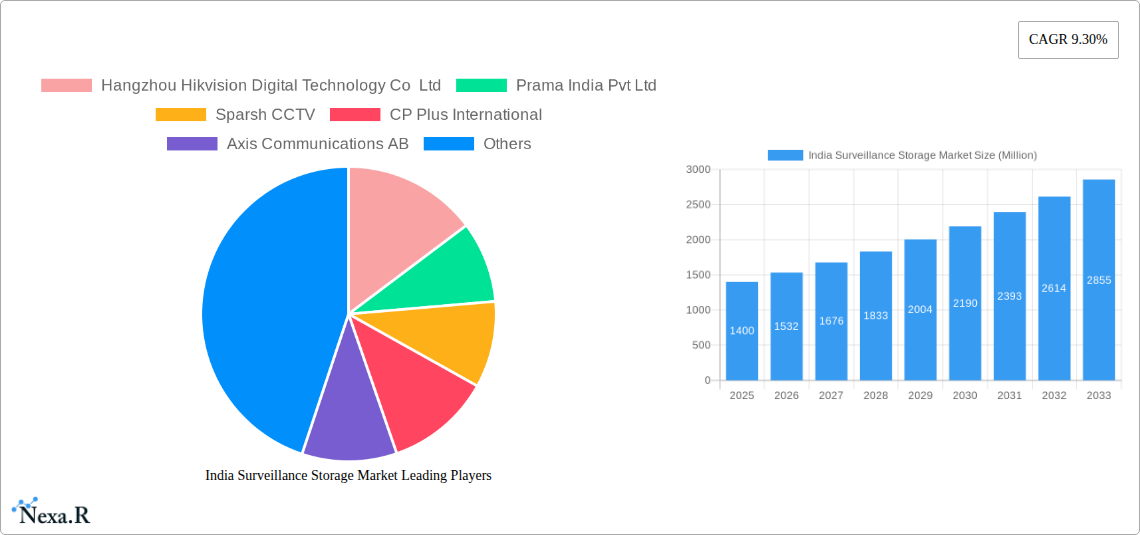

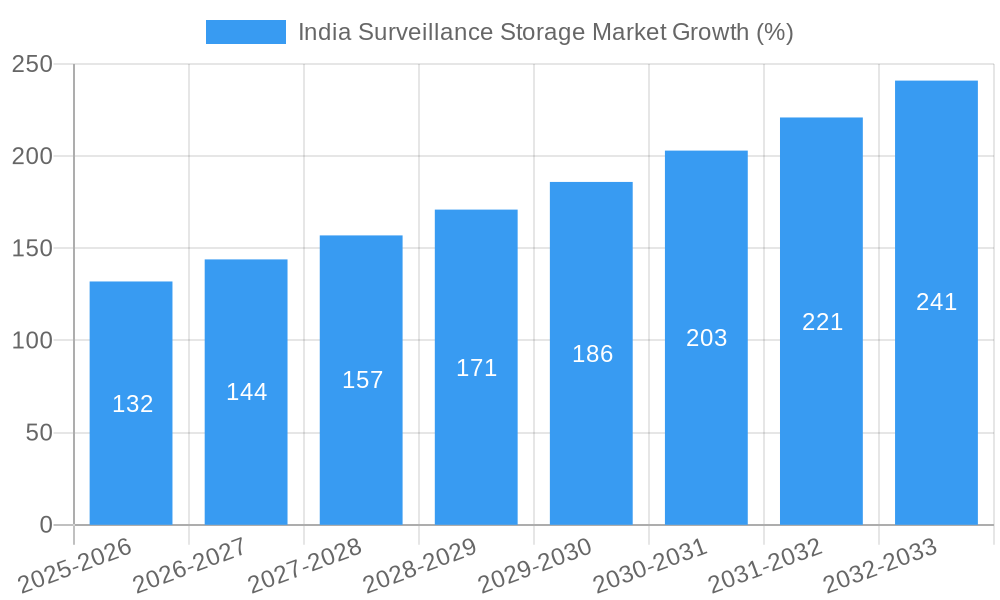

The India surveillance storage market is experiencing robust growth, projected to reach \$1.40 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.3% from 2025 to 2033. This expansion is fueled by several key factors. Increasing government initiatives focused on enhancing national security and public safety are driving significant demand for surveillance systems across various sectors, including law enforcement, transportation, and critical infrastructure. The rising adoption of smart cities and the expanding use of Internet of Things (IoT) devices are further contributing to the growth, as these technologies generate massive amounts of data that require efficient and secure storage solutions. Furthermore, the decreasing cost of storage hardware and the increasing availability of cloud-based storage options are making surveillance storage more accessible and cost-effective for organizations of all sizes. Competition among leading players like Hangzhou Hikvision, Dahua Technology, and CP Plus, alongside international players like Axis Communications and Honeywell, is driving innovation and pushing prices down, further stimulating market expansion.

However, certain challenges exist. Data privacy concerns and stringent data protection regulations are likely to impose restraints on market growth. The need for robust cybersecurity measures to protect sensitive surveillance data from unauthorized access and cyber threats presents another hurdle. Despite these challenges, the overall market outlook remains positive, driven by the increasing need for advanced security solutions and the ongoing digital transformation across various sectors in India. The market segmentation will likely see a rise in demand for higher capacity storage solutions capable of handling the ever-increasing volumes of video data generated by high-resolution cameras and advanced analytics. The focus will be on solutions offering enhanced scalability, reliability, and security features.

This comprehensive report provides a detailed analysis of the India surveillance storage market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the historical period (2019-2024), the base year (2025), and forecasts for the period 2025-2033. The parent market is the broader India data storage market, while the child market focuses specifically on surveillance storage solutions. Market values are presented in Million units.

India Surveillance Storage Market Dynamics & Structure

The India surveillance storage market is characterized by a moderately concentrated landscape, with key players vying for market share. Technological innovation, driven by advancements in cloud computing, artificial intelligence (AI), and edge computing, is a major growth driver. Government regulations focusing on data security and privacy significantly influence market dynamics. The emergence of alternative storage solutions, such as the cloud, presents both opportunities and challenges. End-user demographics, primarily driven by increasing government spending on security and growing private sector adoption, are vital factors. The market has witnessed a moderate number of M&A activities in recent years, with larger players looking to consolidate their positions.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: AI-powered video analytics, cloud storage integration, and edge computing are key drivers.

- Regulatory Framework: Data privacy regulations (e.g., the Personal Data Protection Bill) influence market growth.

- Competitive Substitutes: Cloud storage solutions and alternative data management platforms.

- End-User Demographics: Government agencies, private sector businesses, and residential users.

- M&A Activity: xx M&A deals recorded between 2019 and 2024.

India Surveillance Storage Market Growth Trends & Insights

The India surveillance storage market experienced significant growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to increasing demand for enhanced security, rising adoption of IP-based surveillance systems, and government initiatives promoting smart city development. Technological disruptions, such as the shift towards cloud-based storage and the adoption of AI-powered video analytics, have further accelerated market expansion. Consumer behavior is shifting towards more sophisticated surveillance solutions with advanced features and higher storage capacities. The market is expected to maintain a strong growth trajectory during the forecast period (2025-2033), with a projected CAGR of xx%, driven by continued technological advancements and increasing security concerns across various sectors. Market penetration is expected to reach xx% by 2033.

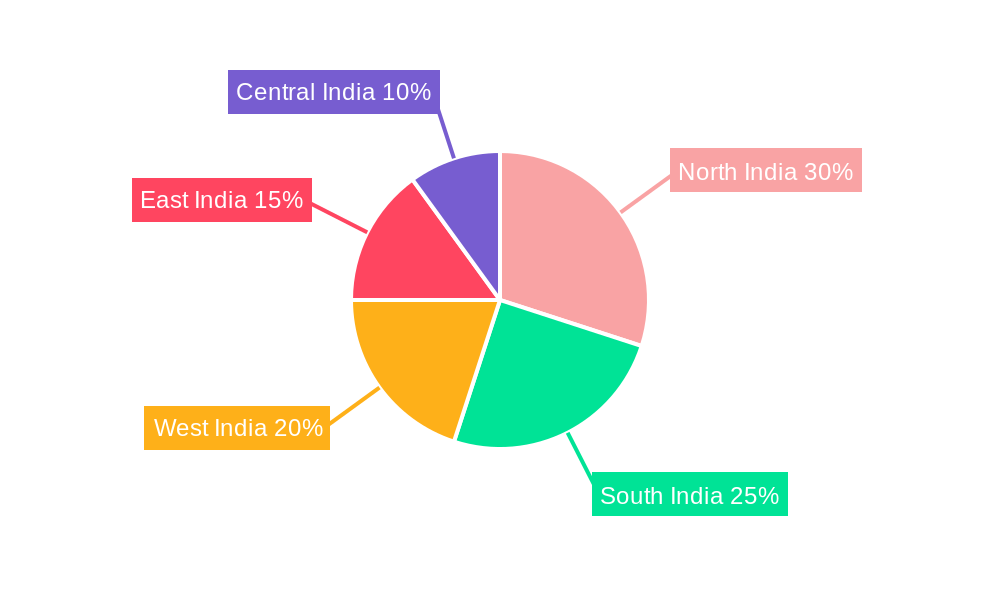

Dominant Regions, Countries, or Segments in India Surveillance Storage Market

Metropolitan areas in India, particularly those in the western and southern regions (Mumbai, Delhi, Bangalore, Chennai), are leading the market growth due to high infrastructure spending, increasing urbanization, and the concentration of major industries. Government initiatives to improve public safety and strengthen cybersecurity are significant drivers. Furthermore, the growth of the private sector, especially in IT and manufacturing, is significantly impacting surveillance technology adoption. The robust economic growth in these regions further fuels demand.

- Key Drivers:

- Government investment in smart city initiatives.

- Growing private sector adoption in IT and manufacturing.

- Rising urbanization and population density.

- Increasing concerns about security and safety.

- Dominance Factors:

- High infrastructure spending.

- Concentration of industries and businesses.

- Strong economic growth.

- Supportive government policies.

India Surveillance Storage Market Product Landscape

The India surveillance storage market offers a diverse range of products, from traditional Network Video Recorders (NVRs) and Digital Video Recorders (DVRs) to cloud-based storage solutions and edge devices. Innovations include high-capacity storage solutions optimized for video surveillance, enhanced data compression techniques, and integration with AI-powered analytics. These solutions are designed to address a wide range of surveillance applications, including security monitoring, traffic management, and retail analytics. The unique selling propositions include cost-effectiveness, scalability, ease of use, and improved security features.

Key Drivers, Barriers & Challenges in India Surveillance Storage Market

Key Drivers:

- Increasing adoption of IP-based surveillance systems.

- Growing demand for advanced video analytics.

- Government initiatives promoting smart city development.

- Rising concerns over security and safety.

Challenges and Restraints:

- High initial investment costs for advanced systems.

- Data privacy and security concerns.

- Complexity in managing large volumes of surveillance data.

- Lack of skilled professionals for system installation and maintenance. This results in an estimated xx% reduction in market growth annually.

Emerging Opportunities in India Surveillance Storage Market

Emerging opportunities lie in the integration of AI and machine learning to enhance video analytics capabilities, the expansion into rural areas with affordable solutions, the development of specialized solutions for various sectors (e.g., healthcare, transportation), and the growth of cloud-based surveillance storage as a more cost-effective and scalable solution. The untapped market in smaller cities and rural areas presents a significant opportunity for growth.

Growth Accelerators in the India Surveillance Storage Market Industry

Long-term growth is fueled by continuous technological advancements, strategic partnerships between surveillance equipment manufacturers and storage providers, and expansion into new market segments. The development of more efficient and cost-effective storage solutions tailored to the specific needs of the surveillance industry will further accelerate market expansion.

Key Players Shaping the India Surveillance Storage Market Market

- Hangzhou Hikvision Digital Technology Co Ltd

- Dell Technologies

- Seagate Technology Holding PLC

- Honeywell International Inc

- Cisco Systems

- Dahua Technology Co Ltd

- Axis Communications AB

- Prama India Pvt Ltd

- Sparsh CCTV

- CP Plus International

- VIVOTEK

- ADATA

- List Not Exhaustive

Notable Milestones in India Surveillance Storage Market Sector

- May 2024: Dell Technologies enhanced its Dell PowerStore, improving performance, efficiency, resiliency, and data mobility across multiple clouds. New Dell APEX offerings with AIOps features and multi-cloud management were also introduced.

- April 2024: Axis Communications launched Axis Cloud Connect, an open cloud platform for secure, flexible, and scalable security solutions. Integration with AXIS Camera Station Edge enables direct cam-to-cloud connectivity, eliminating the need for servers or NVRs.

In-Depth India Surveillance Storage Market Market Outlook

The India surveillance storage market exhibits significant long-term growth potential, driven by technological advancements, increasing security concerns, and government initiatives. Strategic partnerships and investments in R&D will further accelerate market expansion. The market is poised for substantial growth, with opportunities for both established players and new entrants to capitalize on the rising demand for advanced surveillance solutions.

India Surveillance Storage Market Segmentation

-

1. Product

- 1.1. NAS

- 1.2. SAN

- 1.3. DAS

-

2. Storage Media

- 2.1. HDD

- 2.2. SSD

-

3. Deployment

- 3.1. Cloud

- 3.2. On-premise

-

4. End-user Vertical

- 4.1. Government and Defense

- 4.2. Education

- 4.3. BFSI

- 4.4. Retail

- 4.5. Transportation and Logistics

- 4.6. Healthcare

- 4.7. Home Security

- 4.8. Other End-user Verticals

India Surveillance Storage Market Segmentation By Geography

- 1. India

India Surveillance Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Government Projects Associated with Security Camera Installations to Surge Public Protection; Growing Importance of Storage Solutions with Advancements in Surveillance Technologies such as Video Analytics

- 3.3. Market Restrains

- 3.3.1. Rising Government Projects Associated with Security Camera Installations to Surge Public Protection; Growing Importance of Storage Solutions with Advancements in Surveillance Technologies such as Video Analytics

- 3.4. Market Trends

- 3.4.1. The SSD Segment is Expected to Hold a Considerable Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Surveillance Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. NAS

- 5.1.2. SAN

- 5.1.3. DAS

- 5.2. Market Analysis, Insights and Forecast - by Storage Media

- 5.2.1. HDD

- 5.2.2. SSD

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. Cloud

- 5.3.2. On-premise

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. Government and Defense

- 5.4.2. Education

- 5.4.3. BFSI

- 5.4.4. Retail

- 5.4.5. Transportation and Logistics

- 5.4.6. Healthcare

- 5.4.7. Home Security

- 5.4.8. Other End-user Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Prama India Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sparsh CCTV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CP Plus International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Axis Communications AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dahua Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dell Technologies

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Seagate Technology Holding PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honeywell International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cisco Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 VIVOTEK

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ADATA*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

List of Figures

- Figure 1: India Surveillance Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Surveillance Storage Market Share (%) by Company 2024

List of Tables

- Table 1: India Surveillance Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Surveillance Storage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: India Surveillance Storage Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: India Surveillance Storage Market Volume Billion Forecast, by Product 2019 & 2032

- Table 5: India Surveillance Storage Market Revenue Million Forecast, by Storage Media 2019 & 2032

- Table 6: India Surveillance Storage Market Volume Billion Forecast, by Storage Media 2019 & 2032

- Table 7: India Surveillance Storage Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 8: India Surveillance Storage Market Volume Billion Forecast, by Deployment 2019 & 2032

- Table 9: India Surveillance Storage Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 10: India Surveillance Storage Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 11: India Surveillance Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: India Surveillance Storage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: India Surveillance Storage Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: India Surveillance Storage Market Volume Billion Forecast, by Product 2019 & 2032

- Table 15: India Surveillance Storage Market Revenue Million Forecast, by Storage Media 2019 & 2032

- Table 16: India Surveillance Storage Market Volume Billion Forecast, by Storage Media 2019 & 2032

- Table 17: India Surveillance Storage Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 18: India Surveillance Storage Market Volume Billion Forecast, by Deployment 2019 & 2032

- Table 19: India Surveillance Storage Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 20: India Surveillance Storage Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 21: India Surveillance Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: India Surveillance Storage Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Surveillance Storage Market?

The projected CAGR is approximately 9.30%.

2. Which companies are prominent players in the India Surveillance Storage Market?

Key companies in the market include Hangzhou Hikvision Digital Technology Co Ltd, Prama India Pvt Ltd, Sparsh CCTV, CP Plus International, Axis Communications AB, Dahua Technology Co Ltd, Dell Technologies, Seagate Technology Holding PLC, Honeywell International Inc, Cisco Systems, VIVOTEK, ADATA*List Not Exhaustive.

3. What are the main segments of the India Surveillance Storage Market?

The market segments include Product, Storage Media, Deployment, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Government Projects Associated with Security Camera Installations to Surge Public Protection; Growing Importance of Storage Solutions with Advancements in Surveillance Technologies such as Video Analytics.

6. What are the notable trends driving market growth?

The SSD Segment is Expected to Hold a Considerable Share in the Market.

7. Are there any restraints impacting market growth?

Rising Government Projects Associated with Security Camera Installations to Surge Public Protection; Growing Importance of Storage Solutions with Advancements in Surveillance Technologies such as Video Analytics.

8. Can you provide examples of recent developments in the market?

May 2024: Dell Technologies introduced enhancements to its Dell PowerStore, focusing on boosting performance, efficiency, resiliency, and data mobility across multiple clouds. Additionally, Dell broadened its Dell APEX offerings, introducing new AIOps features and bolstered management for multi-cloud and Kubernetes storage. Notably, Dell PowerStore, leveraging its highly flexible quad-level cell (QLC) storage, stands out for efficiently handling rising workload demands, further bolstered by notable performance upgrades.April 2024: Axis Communications unveiled Axis Cloud Connect, an open cloud platform aimed at delivering enhanced security solutions that are secure, flexible, and scalable. The platform integrates AXIS Camera Station Edge, harnessing the capabilities of Axis Edge devices with direct cam-to-cloud connectivity, eliminating the need for a server or NVR. This integration emphasizes video surveillance requirements, bolstered by edge-based AI, automatic notification functionalities, a user-friendly web client, and versatile storage selections.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Surveillance Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Surveillance Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Surveillance Storage Market?

To stay informed about further developments, trends, and reports in the India Surveillance Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence