Key Insights

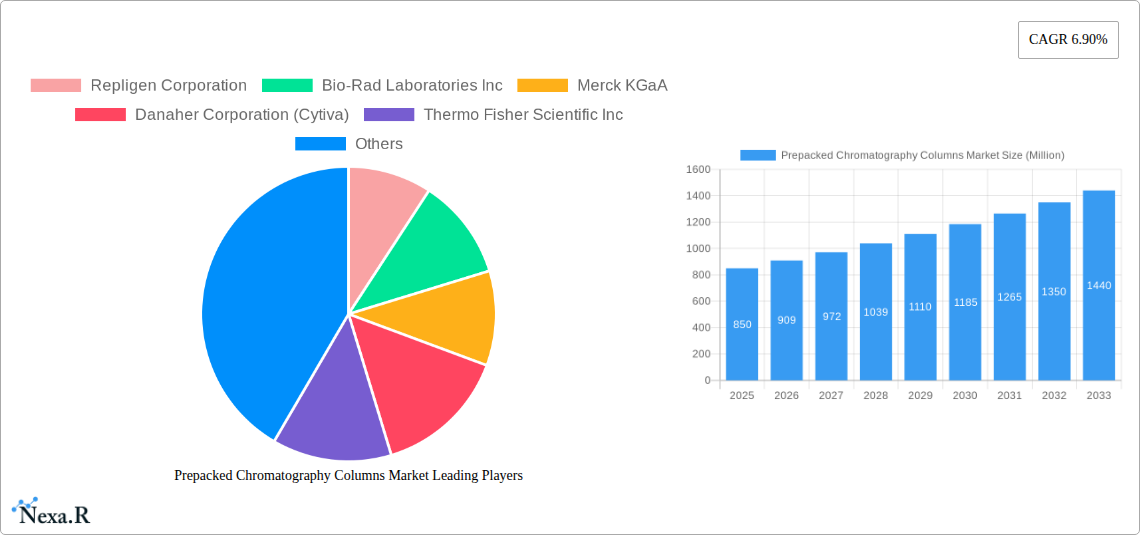

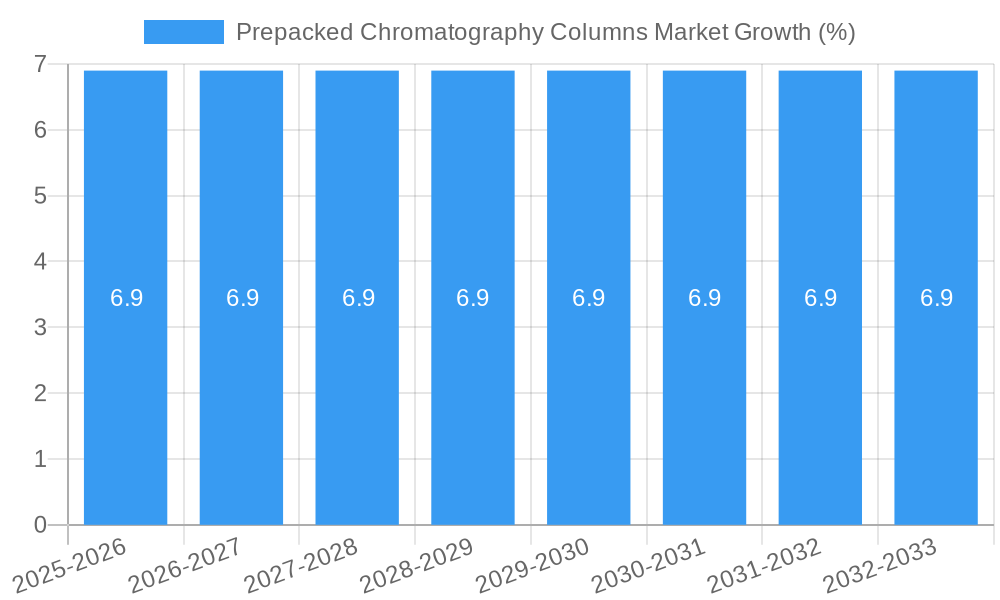

The global Prepacked Chromatography Columns Market is projected to experience robust growth, reaching an estimated market size of approximately $850 million by 2025, with a Compound Annual Growth Rate (CAGR) of 6.90% anticipated through 2033. This expansion is primarily fueled by the escalating demand for biopharmaceuticals and the continuous advancements in drug discovery and development processes. The pharmaceutical and biopharmaceutical industry stands out as the dominant end-user segment, driven by the critical need for efficient and high-purity separation techniques in the production of biologics, monoclonal antibodies, and vaccines. Academic research institutions also contribute significantly to market growth, leveraging prepacked columns for their convenience and reliability in experimental workflows. The market is witnessing a strong preference for Affinity and Ion Exchange resin types, which offer high specificity and binding capacity, crucial for isolating complex biomolecules.

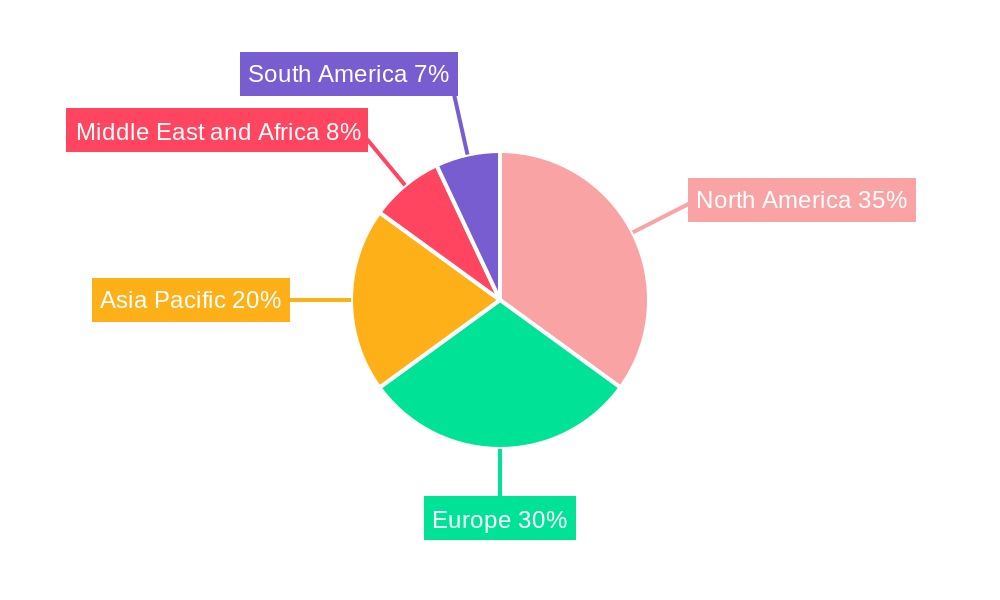

Key drivers propelling the market include the increasing prevalence of chronic diseases, leading to higher demand for novel therapeutics, and the growing investment in research and development by life science companies. The shift towards single-use chromatography solutions, particularly for smaller volume applications (10-1000 ml), is another significant trend, offering benefits like reduced cross-contamination and faster turnaround times. However, the market faces certain restraints, including the high initial cost of some advanced prepacked columns and the need for specialized expertise in their operation and maintenance. Geographically, North America and Europe are expected to lead the market in terms of revenue, owing to their well-established biopharmaceutical industries and significant R&D expenditures. The Asia Pacific region, particularly China and India, is poised for substantial growth, driven by a burgeoning biopharmaceutical sector and increasing government support for domestic manufacturing.

This in-depth market research report provides a comprehensive analysis of the global prepacked chromatography columns market, offering critical insights into market dynamics, growth trends, regional dominance, and key player strategies. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving landscape of chromatography solutions. The market is segmented by resin type, volume, and end-user, with detailed analysis of parent and child market segments to provide a holistic view. All values are presented in Million units.

Prepacked Chromatography Columns Market Market Dynamics & Structure

The prepacked chromatography columns market is characterized by a moderate to high level of concentration, with a few dominant players holding significant market share. Repligen Corporation, Bio-Rad Laboratories Inc, Merck KGaA, Danaher Corporation (Cytiva), Thermo Fisher Scientific Inc, and Sartorius AG are key entities driving innovation and market growth. Technological innovation is a primary driver, fueled by the increasing demand for high-purity biologics and pharmaceuticals. Advancements in resin chemistry, column hardware, and automation are constantly enhancing separation efficiency and throughput.

- Market Concentration: Dominated by a few major players, but with increasing fragmentation in niche segments.

- Technological Innovation Drivers:

- Development of novel affinity ligands for targeted biomolecule capture.

- Advancements in monolithic chromatography media for faster flow rates and higher capacities.

- Integration of prepacked columns with automated chromatography systems.

- Regulatory Frameworks: Stringent regulations in the pharmaceutical and biopharmaceutical industries, particularly concerning Good Manufacturing Practices (GMP), necessitate reliable and validated purification solutions. This favors the use of prepacked columns due to their consistency and reduced risk of contamination.

- Competitive Product Substitutes: While traditional bulk chromatography resins and manually packed columns exist, prepacked columns offer significant advantages in terms of speed, convenience, reproducibility, and reduced labor costs, making them increasingly preferred for downstream processing.

- End-User Demographics: The pharmaceutical and biopharmaceutical industries constitute the largest end-user segment, driven by the booming biologics market and increasing drug development pipelines. Academic research institutions also represent a significant segment, leveraging these columns for basic research and method development.

- M&A Trends: The market has witnessed strategic acquisitions and partnerships aimed at expanding product portfolios, enhancing technological capabilities, and gaining market access. For instance, acquisitions of companies with specialized resin technologies or established distribution networks are common.

Prepacked Chromatography Columns Market Growth Trends & Insights

The global prepacked chromatography columns market is poised for substantial growth, projected to reach $1,XXX Million by 2025 and $2,XXX Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period. This expansion is primarily driven by the escalating demand for biologics and biosimilars, a rapidly growing biopharmaceutical pipeline, and increasing investments in life sciences research. The shift towards more efficient and cost-effective purification methods further propels the adoption of prepacked columns, offering significant advantages over traditional manual packing methods.

The pharmaceutical and biopharmaceutical industry segment, a dominant force in the market, continues to be the primary consumer. The continuous development of novel therapeutic proteins, monoclonal antibodies, vaccines, and gene therapies requires sophisticated and reliable purification techniques. Prepacked chromatography columns, with their inherent consistency, reduced risk of error, and faster method development capabilities, are becoming indispensable tools in these highly regulated environments. The increasing complexity of these biomolecules also necessitates specialized resins and column formats, pushing innovation in the resin type segment, with affinity chromatography and ion exchange chromatography leading the charge.

Furthermore, the volume type segmentation reveals a strong demand for 10-1000 ml columns, catering to both process development and manufacturing scales. While smaller volumes (below 10 ml) are crucial for early-stage research and screening, and larger volumes (above 1000 ml) are essential for large-scale manufacturing, the mid-range volumes represent the sweet spot for flexibility and widespread application across various stages of drug discovery and production.

Technological disruptions are also playing a pivotal role. The development of novel chromatography media with enhanced binding capacities, higher resolution, and improved flow characteristics is a key trend. Innovations in single-use prepacked columns are gaining traction, addressing concerns around cross-contamination and cleaning validation, particularly in biopharmaceutical manufacturing. Consumer behavior shifts are evident as researchers and process engineers prioritize workflow efficiency, reproducibility, and reduced hands-on time, all of which are inherent benefits of prepacked chromatography columns.

The growing emphasis on personalized medicine and the development of complex therapeutic modalities like cell and gene therapies are further expanding the application scope for prepacked columns. The ability to quickly develop and scale up purification processes for these novel therapeutics is critical, making prepacked columns an attractive solution. Moreover, advancements in automation and integrated chromatography systems are seamlessly incorporating prepacked columns, enhancing their utility and driving higher adoption rates across the globe. The market penetration of prepacked chromatography columns is expected to continue its upward trajectory as their benefits become more widely recognized and integrated into standard laboratory and manufacturing practices. The market size evolution is a testament to the growing reliance on these advanced purification tools.

Dominant Regions, Countries, or Segments in Prepacked Chromatography Columns Market

The global prepacked chromatography columns market exhibits distinct regional dominance and segment leadership, primarily driven by the concentration of pharmaceutical and biopharmaceutical R&D and manufacturing activities. North America, particularly the United States, stands out as the leading region, owing to its robust biopharmaceutical industry, substantial investments in drug discovery and development, and a high concentration of academic research institutions. The region’s strong regulatory framework and its pioneering role in biotechnology innovation further solidify its position.

Within the resin type segmentation, Affinity chromatography columns command a significant market share. This dominance is attributed to the high specificity and efficiency of affinity resins in capturing target biomolecules, such as antibodies, proteins, and enzymes, which are crucial in the production of biologics. The ongoing advancements in designing highly selective affinity ligands are continuously expanding their applications and market penetration. Ion Exchange chromatography also holds a substantial share, offering a versatile and cost-effective method for purifying charged biomolecules, playing a critical role in downstream processing.

In terms of volume type, the 10-1000 ml segment is the dominant force. This volume range offers a balance of scalability and practicality, making it ideal for process development, pilot-scale production, and even routine manufacturing of smaller batch biologics. These columns cater to a wide array of applications, from early-stage purification studies to intermediate downstream processing steps. While Above 1000 ml columns are essential for large-scale commercial manufacturing, and Below 10 ml columns are vital for research and screening, the mid-range volume products provide the broadest utility across the drug development lifecycle.

The end-user landscape is unequivocally led by the Pharmaceutical and Biopharmaceutical Industry. This segment's insatiable demand for efficient, reproducible, and scalable purification solutions for a vast array of therapeutic proteins, monoclonal antibodies, vaccines, and gene therapies directly fuels the growth of the prepacked chromatography columns market. The continuous innovation in biologics, coupled with stringent quality control requirements, makes prepacked columns an indispensable component of their manufacturing processes. Academic research institutions also represent a considerable segment, utilizing these columns for fundamental research, method development, and training.

Dominant Region: North America

- Key Drivers: Strong biopharmaceutical R&D ecosystem, significant government funding for life sciences, presence of major pharmaceutical and biotechnology companies, robust academic research infrastructure.

- Market Share: Accounts for the largest share of the global prepacked chromatography columns market.

- Growth Potential: Continued innovation in biologics and the expanding drug pipeline ensure sustained demand.

Dominant Resin Type: Affinity Chromatography

- Key Drivers: High specificity for target biomolecules, enabling efficient capture and purification, continuous development of novel ligands.

- Application: Crucial for antibody purification, recombinant protein production, and enzyme isolation.

Dominant Volume Type: 10-1000 ml

- Key Drivers: Versatility for process development, pilot-scale, and small-to-medium scale manufacturing, offering a balance of capacity and usability.

- Applications: Widely used across various stages of downstream processing.

Dominant End-User: Pharmaceutical and Biopharmaceutical Industry

- Key Drivers: Increasing demand for biologics and biosimilars, expanding pipeline of novel therapeutics, stringent regulatory requirements for drug purity.

- Market Impact: Consumes the largest proportion of prepacked chromatography columns.

Prepacked Chromatography Columns Market Product Landscape

The prepacked chromatography columns market product landscape is defined by a continuous stream of innovations focused on enhancing performance, versatility, and ease of use. Manufacturers are developing columns packed with advanced media, including novel affinity ligands for highly specific biomolecule capture, high-performance ion exchange resins for efficient charge-based separations, and robust hydrophobic interaction chromatography (HIC) resins. Applications range from the purification of recombinant proteins and monoclonal antibodies to the isolation of viruses and the analysis of complex biological samples. Performance metrics such as binding capacity, resolution, flow rate, and column lifespan are continuously being improved. Unique selling propositions include pre-validated methods, single-use options for contamination control, and compatibility with automated chromatography systems, streamlining workflows and reducing processing times for researchers and manufacturers.

Key Drivers, Barriers & Challenges in Prepacked Chromatography Columns Market

The prepacked chromatography columns market is propelled by several key drivers and faces distinct barriers.

Key Drivers:

- Growing Biologics Market: The expanding demand for therapeutic proteins, antibodies, and vaccines necessitates advanced purification solutions.

- Technological Advancements: Innovations in chromatography media and column design enhance efficiency, capacity, and purity.

- Cost and Time Efficiency: Prepacked columns reduce labor, minimize errors, and accelerate method development compared to manual packing.

- Regulatory Compliance: The need for reproducible and validated purification processes in regulated industries favors the use of prepacked columns.

- Outsourcing Trends: The rise of contract development and manufacturing organizations (CDMOs) further fuels demand for convenient purification solutions.

Barriers & Challenges:

- High Initial Cost: Prepacked columns can have a higher upfront cost compared to bulk resins.

- Limited Customization: For highly specialized applications, off-the-shelf prepacked columns may not offer the required customization.

- Waste Generation (for non-single-use): Traditional prepacked columns, if not designed for reuse or recycling, contribute to waste.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of raw materials and finished products.

- Competition from Manual Packing: In certain niche applications or budget-constrained environments, manual packing may still be preferred.

- Scalability Limitations: While scalable, moving from very small to very large industrial scales with prepacked columns can sometimes present logistical challenges and require specialized solutions.

Emerging Opportunities in Prepacked Chromatography Columns Market

Emerging opportunities in the prepacked chromatography columns market lie in the burgeoning fields of gene and cell therapies, where rapid and highly pure isolation of genetic material and therapeutic cells is paramount. The development of specialized prepacked columns for exosome purification and for the separation of complex mixtures like circulating tumor DNA (ctDNA) also presents significant potential. Furthermore, the increasing adoption of single-use technologies in biopharmaceutical manufacturing opens avenues for disposable prepacked columns, reducing cleaning validation burdens and minimizing cross-contamination risks. The expansion of the biosimilars market, particularly in emerging economies, will also drive demand for cost-effective and efficient purification solutions.

Growth Accelerators in the Prepacked Chromatography Columns Market Industry

The prepacked chromatography columns market industry is experiencing significant growth acceleration driven by a confluence of factors. Continuous technological breakthroughs in chromatography media, such as improved binding capacities and higher selectivities, are enabling more efficient and purer separations, directly impacting product development timelines. Strategic partnerships between chromatography column manufacturers and biotechnology companies, as well as the increasing prevalence of mergers and acquisitions aimed at consolidating market share and expanding technological portfolios, are also acting as significant catalysts. Market expansion strategies, including increased penetration into emerging markets and the development of specialized solutions for rapidly growing therapeutic areas like gene and cell therapies, are further accelerating growth.

Key Players Shaping the Prepacked Chromatography Columns Market Market

- Repligen Corporation

- Bio-Rad Laboratories Inc

- Merck KGaA

- Danaher Corporation (Cytiva)

- Thermo Fisher Scientific Inc

- Sartorius AG

- Tosoh Corporation

- YMC Europe GmbH

- Astrea Bioseparations

- Proxcys BV

Notable Milestones in Prepacked Chromatography Columns Market Sector

- July 2022: Bio-Rad Laboratories launched EconoFit Low-Pressure Prepacked Chromatography Column Packs, significantly enhancing their product portfolio by offering convenient and efficient solutions for benchtop chromatography.

- June 2022: Bio-Rad Laboratories, Inc. launched CHT-prepacked Foresight Pro Columns, designed to support downstream process-scale chromatography applications across different stages of biological drug development and production, improving workflow efficiency and scalability.

In-Depth Prepacked Chromatography Columns Market Market Outlook

- July 2022: Bio-Rad Laboratories launched EconoFit Low-Pressure Prepacked Chromatography Column Packs, significantly enhancing their product portfolio by offering convenient and efficient solutions for benchtop chromatography.

- June 2022: Bio-Rad Laboratories, Inc. launched CHT-prepacked Foresight Pro Columns, designed to support downstream process-scale chromatography applications across different stages of biological drug development and production, improving workflow efficiency and scalability.

In-Depth Prepacked Chromatography Columns Market Market Outlook

The prepacked chromatography columns market is projected for robust future growth, fueled by ongoing innovations in biopharmaceutical development and the increasing complexity of therapeutic modalities. Growth accelerators include advancements in novel chromatography media for enhanced specificity and capacity, strategic collaborations, and the expansion of single-use chromatography solutions. The market’s outlook is bright, driven by the continuous need for efficient, reproducible, and scalable purification methods in the ever-evolving life sciences sector. Untapped markets in emerging economies and the burgeoning demand for personalized medicine offer significant strategic opportunities for market players to further solidify their positions and capitalize on future growth.

Prepacked Chromatography Columns Market Segmentation

-

1. Resin Type

- 1.1. Affinity

- 1.2. Ion Exchange

- 1.3. Other Resin Types

-

2. Volume Type

- 2.1. Below 10 ml

- 2.2. 10-1000 ml

- 2.3. Above 1000 ml

-

3. End-user

- 3.1. Pharmaceutical and Biopharmaceutical Industry

- 3.2. Academic Research

- 3.3. Other End-users

Prepacked Chromatography Columns Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of the Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of the South America

Prepacked Chromatography Columns Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Process Development and Affordable Purification; Technological Advancements in Prepacked Chromatography Columns

- 3.3. Market Restrains

- 3.3.1. Technical Limitations of the Column

- 3.4. Market Trends

- 3.4.1. Affinity Segment Expected to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Affinity

- 5.1.2. Ion Exchange

- 5.1.3. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Volume Type

- 5.2.1. Below 10 ml

- 5.2.2. 10-1000 ml

- 5.2.3. Above 1000 ml

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Pharmaceutical and Biopharmaceutical Industry

- 5.3.2. Academic Research

- 5.3.3. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. North America Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Affinity

- 6.1.2. Ion Exchange

- 6.1.3. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Volume Type

- 6.2.1. Below 10 ml

- 6.2.2. 10-1000 ml

- 6.2.3. Above 1000 ml

- 6.3. Market Analysis, Insights and Forecast - by End-user

- 6.3.1. Pharmaceutical and Biopharmaceutical Industry

- 6.3.2. Academic Research

- 6.3.3. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. Europe Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Affinity

- 7.1.2. Ion Exchange

- 7.1.3. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Volume Type

- 7.2.1. Below 10 ml

- 7.2.2. 10-1000 ml

- 7.2.3. Above 1000 ml

- 7.3. Market Analysis, Insights and Forecast - by End-user

- 7.3.1. Pharmaceutical and Biopharmaceutical Industry

- 7.3.2. Academic Research

- 7.3.3. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Asia Pacific Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Affinity

- 8.1.2. Ion Exchange

- 8.1.3. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Volume Type

- 8.2.1. Below 10 ml

- 8.2.2. 10-1000 ml

- 8.2.3. Above 1000 ml

- 8.3. Market Analysis, Insights and Forecast - by End-user

- 8.3.1. Pharmaceutical and Biopharmaceutical Industry

- 8.3.2. Academic Research

- 8.3.3. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Middle East and Africa Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Affinity

- 9.1.2. Ion Exchange

- 9.1.3. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by Volume Type

- 9.2.1. Below 10 ml

- 9.2.2. 10-1000 ml

- 9.2.3. Above 1000 ml

- 9.3. Market Analysis, Insights and Forecast - by End-user

- 9.3.1. Pharmaceutical and Biopharmaceutical Industry

- 9.3.2. Academic Research

- 9.3.3. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. South America Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Affinity

- 10.1.2. Ion Exchange

- 10.1.3. Other Resin Types

- 10.2. Market Analysis, Insights and Forecast - by Volume Type

- 10.2.1. Below 10 ml

- 10.2.2. 10-1000 ml

- 10.2.3. Above 1000 ml

- 10.3. Market Analysis, Insights and Forecast - by End-user

- 10.3.1. Pharmaceutical and Biopharmaceutical Industry

- 10.3.2. Academic Research

- 10.3.3. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. North America Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. MEA Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Repligen Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Bio-Rad Laboratories Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Merck KGaA

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Danaher Corporation (Cytiva)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Thermo Fisher Scientific Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Sartorius AG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Tosoh Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 YMC Europe GmbH

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Astrea Bioseparations

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Proxcys BV

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Repligen Corporation

List of Figures

- Figure 1: Global Prepacked Chromatography Columns Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Prepacked Chromatography Columns Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Prepacked Chromatography Columns Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Prepacked Chromatography Columns Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Prepacked Chromatography Columns Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Prepacked Chromatography Columns Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Prepacked Chromatography Columns Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Prepacked Chromatography Columns Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Prepacked Chromatography Columns Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Prepacked Chromatography Columns Market Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA Prepacked Chromatography Columns Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Prepacked Chromatography Columns Market Revenue (Million), by Resin Type 2024 & 2032

- Figure 13: North America Prepacked Chromatography Columns Market Revenue Share (%), by Resin Type 2024 & 2032

- Figure 14: North America Prepacked Chromatography Columns Market Revenue (Million), by Volume Type 2024 & 2032

- Figure 15: North America Prepacked Chromatography Columns Market Revenue Share (%), by Volume Type 2024 & 2032

- Figure 16: North America Prepacked Chromatography Columns Market Revenue (Million), by End-user 2024 & 2032

- Figure 17: North America Prepacked Chromatography Columns Market Revenue Share (%), by End-user 2024 & 2032

- Figure 18: North America Prepacked Chromatography Columns Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Prepacked Chromatography Columns Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Prepacked Chromatography Columns Market Revenue (Million), by Resin Type 2024 & 2032

- Figure 21: Europe Prepacked Chromatography Columns Market Revenue Share (%), by Resin Type 2024 & 2032

- Figure 22: Europe Prepacked Chromatography Columns Market Revenue (Million), by Volume Type 2024 & 2032

- Figure 23: Europe Prepacked Chromatography Columns Market Revenue Share (%), by Volume Type 2024 & 2032

- Figure 24: Europe Prepacked Chromatography Columns Market Revenue (Million), by End-user 2024 & 2032

- Figure 25: Europe Prepacked Chromatography Columns Market Revenue Share (%), by End-user 2024 & 2032

- Figure 26: Europe Prepacked Chromatography Columns Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Prepacked Chromatography Columns Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Prepacked Chromatography Columns Market Revenue (Million), by Resin Type 2024 & 2032

- Figure 29: Asia Pacific Prepacked Chromatography Columns Market Revenue Share (%), by Resin Type 2024 & 2032

- Figure 30: Asia Pacific Prepacked Chromatography Columns Market Revenue (Million), by Volume Type 2024 & 2032

- Figure 31: Asia Pacific Prepacked Chromatography Columns Market Revenue Share (%), by Volume Type 2024 & 2032

- Figure 32: Asia Pacific Prepacked Chromatography Columns Market Revenue (Million), by End-user 2024 & 2032

- Figure 33: Asia Pacific Prepacked Chromatography Columns Market Revenue Share (%), by End-user 2024 & 2032

- Figure 34: Asia Pacific Prepacked Chromatography Columns Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Prepacked Chromatography Columns Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Prepacked Chromatography Columns Market Revenue (Million), by Resin Type 2024 & 2032

- Figure 37: Middle East and Africa Prepacked Chromatography Columns Market Revenue Share (%), by Resin Type 2024 & 2032

- Figure 38: Middle East and Africa Prepacked Chromatography Columns Market Revenue (Million), by Volume Type 2024 & 2032

- Figure 39: Middle East and Africa Prepacked Chromatography Columns Market Revenue Share (%), by Volume Type 2024 & 2032

- Figure 40: Middle East and Africa Prepacked Chromatography Columns Market Revenue (Million), by End-user 2024 & 2032

- Figure 41: Middle East and Africa Prepacked Chromatography Columns Market Revenue Share (%), by End-user 2024 & 2032

- Figure 42: Middle East and Africa Prepacked Chromatography Columns Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Prepacked Chromatography Columns Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Prepacked Chromatography Columns Market Revenue (Million), by Resin Type 2024 & 2032

- Figure 45: South America Prepacked Chromatography Columns Market Revenue Share (%), by Resin Type 2024 & 2032

- Figure 46: South America Prepacked Chromatography Columns Market Revenue (Million), by Volume Type 2024 & 2032

- Figure 47: South America Prepacked Chromatography Columns Market Revenue Share (%), by Volume Type 2024 & 2032

- Figure 48: South America Prepacked Chromatography Columns Market Revenue (Million), by End-user 2024 & 2032

- Figure 49: South America Prepacked Chromatography Columns Market Revenue Share (%), by End-user 2024 & 2032

- Figure 50: South America Prepacked Chromatography Columns Market Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Prepacked Chromatography Columns Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 3: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Volume Type 2019 & 2032

- Table 4: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 5: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Belgium Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherland Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Nordics Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Phillipes Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Peru Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Chile Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Ecuador Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Venezuela Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United Arab Emirates Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Saudi Arabia Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Africa Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Middle East and Africa Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 48: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Volume Type 2019 & 2032

- Table 49: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 50: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: United States Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Canada Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Mexico Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 55: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Volume Type 2019 & 2032

- Table 56: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 57: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Germany Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: United Kingdom Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: France Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Italy Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Spain Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of the Europe Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 65: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Volume Type 2019 & 2032

- Table 66: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 67: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Country 2019 & 2032

- Table 68: China Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Japan Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: India Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Australia Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: South Korea Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Rest of the Asia Pacific Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 75: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Volume Type 2019 & 2032

- Table 76: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 77: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Country 2019 & 2032

- Table 78: GCC Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: South Africa Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Rest of Middle East and Africa Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 81: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 82: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Volume Type 2019 & 2032

- Table 83: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 84: Global Prepacked Chromatography Columns Market Revenue Million Forecast, by Country 2019 & 2032

- Table 85: Brazil Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Argentina Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 87: Rest of the South America Prepacked Chromatography Columns Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Prepacked Chromatography Columns Market?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the Prepacked Chromatography Columns Market?

Key companies in the market include Repligen Corporation, Bio-Rad Laboratories Inc, Merck KGaA, Danaher Corporation (Cytiva), Thermo Fisher Scientific Inc, Sartorius AG, Tosoh Corporation, YMC Europe GmbH, Astrea Bioseparations, Proxcys BV.

3. What are the main segments of the Prepacked Chromatography Columns Market?

The market segments include Resin Type, Volume Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Process Development and Affordable Purification; Technological Advancements in Prepacked Chromatography Columns.

6. What are the notable trends driving market growth?

Affinity Segment Expected to Witness Growth.

7. Are there any restraints impacting market growth?

Technical Limitations of the Column.

8. Can you provide examples of recent developments in the market?

July 2022: Bio-Rad Laboratories launched EconoFit Low-Pressure Prepacked Chromatography Column Packs. This significantly enhances their product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Prepacked Chromatography Columns Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Prepacked Chromatography Columns Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Prepacked Chromatography Columns Market?

To stay informed about further developments, trends, and reports in the Prepacked Chromatography Columns Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence