Key Insights

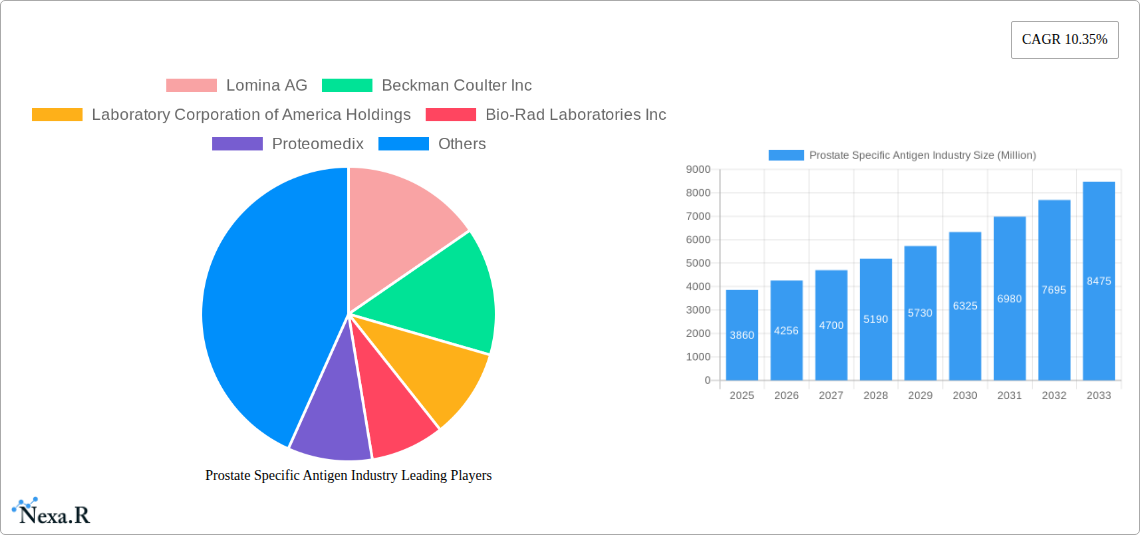

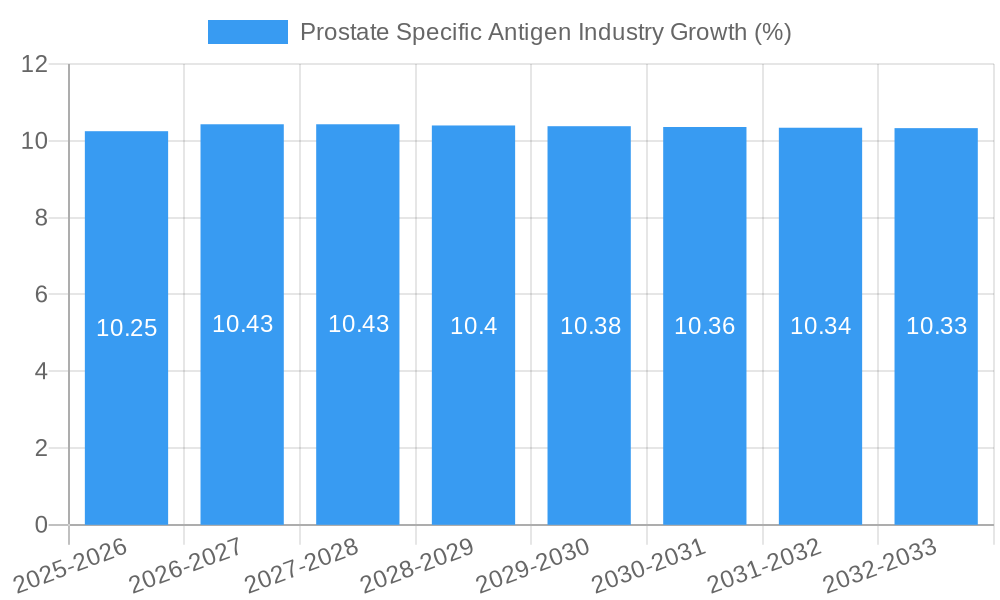

The global Prostate Specific Antigen (PSA) market is poised for substantial growth, projected to reach approximately $3.86 billion in value by 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 10.35% anticipated over the forecast period (2025-2033). A primary catalyst for this surge is the increasing global prevalence of prostate cancer, particularly among aging male populations and those with a family history of the disease. Enhanced awareness regarding early detection methods and the critical role of PSA testing in prostate cancer screening are fueling demand. Furthermore, advancements in diagnostic technologies, leading to more accurate and reliable PSA assays, are contributing significantly to market expansion. The growing adoption of minimally invasive diagnostic procedures and a greater emphasis on personalized medicine in cancer management also play a crucial role in shaping market dynamics.

The market's growth trajectory is further supported by the introduction of novel PSA detection methods and a rising investment in research and development by key industry players. Emerging economies, with their expanding healthcare infrastructure and increasing disposable incomes, present a significant opportunity for market penetration. Preliminary and confirmatory tests, including the PCA3 test, trans-rectal ultrasound (TRUS), and biopsy, are integral components of the PSA testing ecosystem. While the market is characterized by fierce competition among established players such as Beckman Coulter Inc., Laboratory Corporation of America Holdings, and Bayer AG, innovative startups and regional manufacturers are also contributing to market diversification. Strategic collaborations, mergers, and acquisitions are expected to continue as companies seek to broaden their product portfolios and geographical reach, ensuring a dynamic and competitive landscape in the years to come.

This in-depth report provides an exhaustive analysis of the global Prostate Specific Antigen (PSA) industry, offering a detailed understanding of market dynamics, growth trends, regional dominance, product landscape, and key players. With a forecast period extending to 2033, this study is an indispensable resource for stakeholders seeking to navigate the evolving landscape of prostate cancer diagnostics and management. Our analysis incorporates high-traffic keywords such as "prostate cancer screening," "PSA testing," "early prostate cancer detection," "prostate health," and "oncology diagnostics" to maximize search engine visibility and engagement among industry professionals, researchers, and healthcare providers. We explore both parent and child markets to provide a holistic view of the PSA ecosystem, with all values presented in Million Units for clarity.

Prostate Specific Antigen Industry Market Dynamics & Structure

The Prostate Specific Antigen (PSA) industry exhibits a moderately concentrated market structure, with a blend of established global diagnostic giants and emerging specialized players. Technological innovation is the primary driver, fueled by advancements in immunoassay platforms, liquid biopsy techniques, and multiplexed biomarker detection. Regulatory frameworks, particularly those established by the FDA and EMA, significantly influence market access and product approvals, creating both opportunities and barriers for new entrants. Competitive product substitutes include emerging genetic and genomic testing, as well as advanced imaging techniques. End-user demographics are broadly defined by aging male populations, increasing awareness of prostate health, and physician advocacy for early detection protocols. Merger and acquisition (M&A) trends are evident as larger companies seek to expand their diagnostic portfolios and acquire innovative technologies.

- Market Concentration: Dominated by a few key players, but with significant potential for niche market growth.

- Technological Innovation Drivers: Development of more sensitive and specific PSA assays, integration with AI for diagnostic interpretation, and exploration of novel biomarkers alongside PSA.

- Regulatory Frameworks: Strict approval processes for in-vitro diagnostics (IVDs) impact product launch timelines and market penetration.

- Competitive Product Substitutes: While PSA remains a cornerstone, advanced molecular diagnostics and improved imaging are gaining traction.

- End-User Demographics: Primarily males aged 50 and above, with a growing emphasis on proactive health screening.

- M&A Trends: Strategic acquisitions to bolster R&D pipelines and expand market reach.

Prostate Specific Antigen Industry Growth Trends & Insights

The Prostate Specific Antigen (PSA) industry is poised for substantial growth, driven by increasing global prevalence of prostate cancer, heightened awareness of early detection benefits, and continuous technological advancements in diagnostic tools. The market size evolution is characterized by a steady upward trajectory, projected to reach significant figures by 2033. Adoption rates of PSA testing, particularly in developing economies, are expected to rise as healthcare infrastructure improves and screening programs become more widespread. Technological disruptions, such as the development of more accurate PSA isoforms and the integration of PSA testing with other biomarkers for improved diagnostic accuracy, are reshaping the market. Consumer behavior shifts are also contributing, with a growing segment of the male population actively seeking regular health check-ups and demanding more personalized diagnostic approaches.

The base year of 2025 sets the stage for this expansion, with estimated figures for the year indicating robust current market performance. The forecast period from 2025 to 2033 will witness accelerated growth fueled by these underlying trends. Historical data from 2019 to 2024 provides a foundational understanding of past market performance and initial drivers of growth. For instance, the CAGR (Compound Annual Growth Rate) is anticipated to remain strong, reflecting sustained demand for reliable prostate cancer diagnostics. Market penetration is expected to deepen, especially in regions with historically lower screening rates, as access to advanced diagnostic technologies like those offered by companies such as Beckman Coulter Inc and Laboratory Corporation of America Holdings improves. The increasing focus on personalized medicine further propels the demand for accurate and efficient diagnostic tools, making PSA testing a critical component of early intervention strategies. The integration of digital health solutions and remote patient monitoring also presents new avenues for increased PSA testing and follow-up, enhancing overall patient care and disease management.

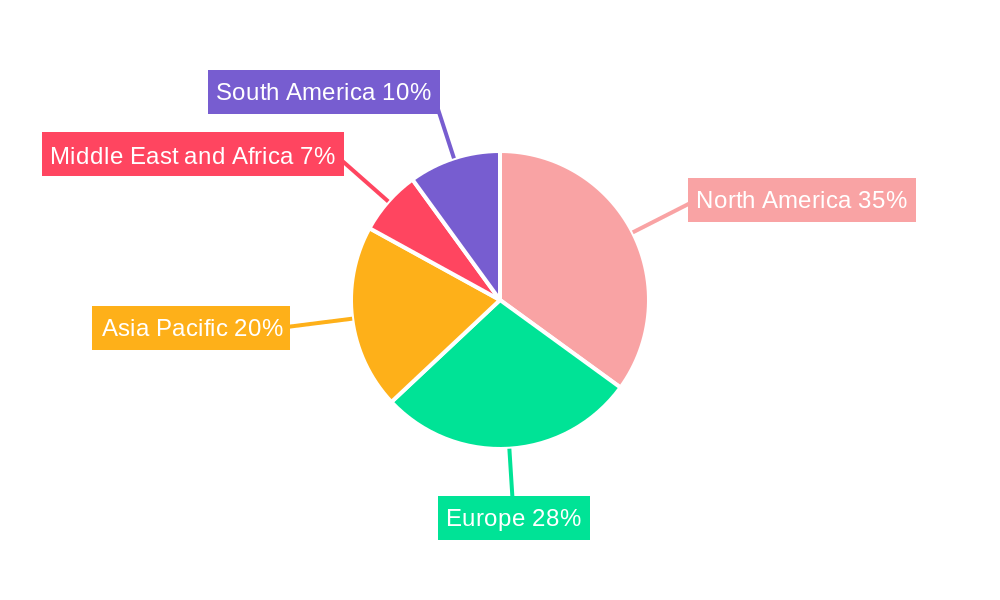

Dominant Regions, Countries, or Segments in Prostate Specific Antigen Industry

The Prostate Specific Antigen (PSA) industry's dominance is significantly shaped by regional healthcare infrastructure, demographic profiles, and the strategic implementation of screening programs. North America, particularly the United States, consistently emerges as a leading region due to high disposable incomes, advanced healthcare systems, well-established screening guidelines, and a robust presence of key industry players like Beckman Coulter Inc. and Laboratory Corporation of America Holdings. The country's proactive approach to cancer diagnostics and a large aging male population contribute to sustained high demand for PSA testing.

Within the test type segmentation, Confirmatory Tests are driving significant market growth, with Pca3 Test alongside traditional methods like Trans-Rectal Ultrasound and Biopsy, increasingly becoming crucial for accurate diagnosis and treatment planning. While Preliminary Tests like total PSA assays serve as initial screening tools, the growing emphasis on reducing unnecessary biopsies and improving diagnostic specificity is elevating the importance of more advanced confirmatory methods. The development of novel molecular markers and improved analytical techniques for these confirmatory tests is a key driver.

- North America (United States & Canada):

- Market Share: Holds a substantial portion of the global PSA market due to high healthcare spending and widespread adoption of screening protocols.

- Growth Potential: Continued demand driven by an aging population and ongoing research into advanced prostate cancer diagnostics.

- Key Drivers: Robust reimbursement policies, advanced research institutions, and strong presence of major diagnostic manufacturers.

- Europe:

- Market Share: A significant contributor, with variations across countries based on national healthcare policies and screening program implementations.

- Growth Potential: Increasing focus on early detection and personalized medicine is fueling growth.

- Key Drivers: Growing awareness, government initiatives for cancer screening, and presence of European-based companies like Bayer AG.

- Asia-Pacific:

- Market Share: Rapidly growing market driven by increasing healthcare expenditure, improving diagnostic accessibility, and rising awareness of prostate health.

- Growth Potential: Significant untapped potential in emerging economies with expanding middle classes and improving healthcare infrastructure.

- Key Drivers: Government investments in healthcare, increasing adoption of advanced diagnostic technologies from companies like Hanzhou Testsea biotechnology co LTD, and a large male population.

- Segment Dominance (Confirmatory Tests):

- Pca3 Test: Rising adoption due to its ability to differentiate between aggressive and indolent prostate cancer, reducing the need for invasive biopsies.

- Trans-Rectal Ultrasound (TRUS) & Biopsy: Remain vital for definitive diagnosis and staging, with advancements in imaging and sampling techniques enhancing their precision.

- Market Share: Confirmatory tests collectively represent a larger market share than preliminary tests due to their higher diagnostic utility in complex cases.

- Growth Potential: Continued innovation in these areas, including integrated molecular testing with imaging, will drive further market expansion.

Prostate Specific Antigen Industry Product Landscape

The Prostate Specific Antigen (PSA) industry is characterized by continuous product innovation aimed at enhancing diagnostic accuracy and clinical utility. Companies are developing highly sensitive and specific immunoassay kits for both total PSA and free PSA, enabling better differentiation between benign prostatic hyperplasia and prostate cancer. The advent of multiplex assays, combining PSA with other biomarkers such as PCA3 and TMPRSS2-ERG fusion genes, offers a more comprehensive diagnostic profile and aids in risk stratification. Innovations in liquid biopsy technologies are also emerging, promising less invasive methods for cancer detection and monitoring. These advancements aim to reduce false positives, minimize unnecessary biopsies, and ultimately improve patient outcomes by facilitating earlier and more precise diagnosis of prostate cancer.

Key Drivers, Barriers & Challenges in Prostate Specific Antigen Industry

Key Drivers: The Prostate Specific Antigen (PSA) industry is propelled by several key factors. The increasing global incidence of prostate cancer, particularly in aging male populations, creates sustained demand for diagnostic tools. Growing awareness of the importance of early detection and its impact on treatment efficacy and survival rates is a significant driver. Technological advancements leading to more accurate and sensitive PSA assays, alongside the development of companion diagnostic tests, further fuel market growth. The proactive involvement of healthcare providers in promoting routine screening also plays a crucial role.

Barriers & Challenges: Despite positive growth drivers, the PSA industry faces several challenges. The ongoing debate regarding the optimal screening protocols and the interpretation of PSA levels continues to pose a challenge, leading to variations in clinical practice. The issue of overdiagnosis and overtreatment of indolent prostate cancers remains a concern, prompting the development of more sophisticated diagnostic tools beyond total PSA. Regulatory hurdles for new diagnostic tests, supply chain disruptions affecting raw material availability, and intense competition among established and emerging players also present significant restraints. The cost of advanced diagnostic technologies can also be a barrier to widespread adoption in resource-limited settings.

Emerging Opportunities in Prostate Specific Antigen Industry

Emerging opportunities in the Prostate Specific Antigen (PSA) industry are centered around the development and integration of novel biomarkers and advanced diagnostic platforms. The growing interest in personalized medicine is driving the demand for tests that can accurately differentiate between aggressive and indolent prostate cancers, reducing the need for unnecessary biopsies. Liquid biopsy technologies, which offer the potential for less invasive cancer detection and monitoring, represent a significant untapped market. Furthermore, the integration of artificial intelligence (AI) and machine learning into diagnostic algorithms holds promise for improving the interpretation of PSA results and other biomarkers, leading to more precise risk stratification and personalized treatment decisions. Expanding access to these advanced diagnostic tools in underserved regions also presents a substantial growth opportunity.

Growth Accelerators in the Prostate Specific Antigen Industry Industry

The growth of the Prostate Specific Antigen (PSA) industry is significantly accelerated by several key factors. Technological breakthroughs in immunoassay development, leading to enhanced sensitivity and specificity of PSA assays, are continuously improving diagnostic accuracy. Strategic partnerships between diagnostic manufacturers and research institutions foster innovation and accelerate the development of new diagnostic panels, including those that combine PSA with other biomarkers. Market expansion strategies, particularly in emerging economies with growing healthcare infrastructure and increasing disposable incomes, are opening up new avenues for revenue generation. The rising emphasis on value-based healthcare and the demand for cost-effective screening solutions also act as growth accelerators, encouraging the adoption of efficient and accurate PSA testing protocols.

Key Players Shaping the Prostate Specific Antigen Industry Market

- Lomina AG

- Beckman Coulter Inc

- Laboratory Corporation of America Holdings

- Bio-Rad Laboratories Inc

- Proteomedix

- Bayer AG

- Hanzhou Testsea biotechnology co LTD

- Accuquik Test Kits

- OPKO Health Inc

- Abcam plc

- Fujirebio (H U Group company)

- General Electric Company

Notable Milestones in Prostate Specific Antigen Industry Sector

- April 2022: The Milton and Carroll Petrie Department of Urology at Mount Sinai launched the Mount Sinai Robert F. Smith Mobile Prostate Cancer Screening Unit, significantly impacting community health outreach for prostate cancer in the Black community.

- March 2022: miR Scientific and Leonie Hill Capital announced a collaboration agreement for the commercial launch of the miR Sentinel Prostate Cancer Test in Singapore and Southeast Asia, a move that promises to expand access to advanced prostate cancer diagnostics in these regions.

In-Depth Prostate Specific Antigen Industry Market Outlook

- April 2022: The Milton and Carroll Petrie Department of Urology at Mount Sinai launched the Mount Sinai Robert F. Smith Mobile Prostate Cancer Screening Unit, significantly impacting community health outreach for prostate cancer in the Black community.

- March 2022: miR Scientific and Leonie Hill Capital announced a collaboration agreement for the commercial launch of the miR Sentinel Prostate Cancer Test in Singapore and Southeast Asia, a move that promises to expand access to advanced prostate cancer diagnostics in these regions.

In-Depth Prostate Specific Antigen Industry Market Outlook

The future outlook for the Prostate Specific Antigen (PSA) industry remains highly promising, driven by sustained demand for accurate prostate cancer diagnostics and continuous innovation. Growth accelerators such as advancements in molecular diagnostics, the integration of AI for enhanced interpretation, and the expansion of liquid biopsy technologies will further refine early detection strategies and improve patient outcomes. Strategic partnerships and market expansion into emerging economies will unlock significant growth potential. The industry is moving towards a more personalized and precision-based approach to prostate cancer management, with PSA testing playing a pivotal role in risk stratification and treatment decision-making. Stakeholders can anticipate a dynamic market landscape with ongoing opportunities for technological development and market penetration.

Prostate Specific Antigen Industry Segmentation

-

1. Test Type

- 1.1. Preliminary Tests

-

1.2. Confirmatory Tests

- 1.2.1. Pca3 Test

- 1.2.2. Trans-Rectal Ultrasound

- 1.2.3. Biopsy

Prostate Specific Antigen Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Prostate Specific Antigen Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Prostate Cancer; Increasing Government Initiatives; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost Of Diagnosis

- 3.4. Market Trends

- 3.4.1. The Preliminary Test Segment is Expected to Hold a Major Market Share in the Prostate-Specific Antigen Test Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Prostate Specific Antigen Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Preliminary Tests

- 5.1.2. Confirmatory Tests

- 5.1.2.1. Pca3 Test

- 5.1.2.2. Trans-Rectal Ultrasound

- 5.1.2.3. Biopsy

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. North America Prostate Specific Antigen Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Test Type

- 6.1.1. Preliminary Tests

- 6.1.2. Confirmatory Tests

- 6.1.2.1. Pca3 Test

- 6.1.2.2. Trans-Rectal Ultrasound

- 6.1.2.3. Biopsy

- 6.1. Market Analysis, Insights and Forecast - by Test Type

- 7. Europe Prostate Specific Antigen Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Test Type

- 7.1.1. Preliminary Tests

- 7.1.2. Confirmatory Tests

- 7.1.2.1. Pca3 Test

- 7.1.2.2. Trans-Rectal Ultrasound

- 7.1.2.3. Biopsy

- 7.1. Market Analysis, Insights and Forecast - by Test Type

- 8. Asia Pacific Prostate Specific Antigen Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Test Type

- 8.1.1. Preliminary Tests

- 8.1.2. Confirmatory Tests

- 8.1.2.1. Pca3 Test

- 8.1.2.2. Trans-Rectal Ultrasound

- 8.1.2.3. Biopsy

- 8.1. Market Analysis, Insights and Forecast - by Test Type

- 9. Middle East and Africa Prostate Specific Antigen Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Test Type

- 9.1.1. Preliminary Tests

- 9.1.2. Confirmatory Tests

- 9.1.2.1. Pca3 Test

- 9.1.2.2. Trans-Rectal Ultrasound

- 9.1.2.3. Biopsy

- 9.1. Market Analysis, Insights and Forecast - by Test Type

- 10. South America Prostate Specific Antigen Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Test Type

- 10.1.1. Preliminary Tests

- 10.1.2. Confirmatory Tests

- 10.1.2.1. Pca3 Test

- 10.1.2.2. Trans-Rectal Ultrasound

- 10.1.2.3. Biopsy

- 10.1. Market Analysis, Insights and Forecast - by Test Type

- 11. North America Prostate Specific Antigen Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Prostate Specific Antigen Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Prostate Specific Antigen Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Prostate Specific Antigen Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Prostate Specific Antigen Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Lomina AG

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Beckman Coulter Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Laboratory Corporation of America Holdings

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Bio-Rad Laboratories Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Proteomedix

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Bayer AG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Hanzhou Testsea biotechnology co LTD

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Accuquik Test Kits

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 OPKO Health Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Abcam plc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Fujirebio (H U Group company)

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 General Electric Company

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Lomina AG

List of Figures

- Figure 1: Global Prostate Specific Antigen Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Prostate Specific Antigen Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Prostate Specific Antigen Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Prostate Specific Antigen Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Prostate Specific Antigen Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Prostate Specific Antigen Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Prostate Specific Antigen Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Prostate Specific Antigen Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Prostate Specific Antigen Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Prostate Specific Antigen Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Prostate Specific Antigen Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Prostate Specific Antigen Industry Revenue (Million), by Test Type 2024 & 2032

- Figure 13: North America Prostate Specific Antigen Industry Revenue Share (%), by Test Type 2024 & 2032

- Figure 14: North America Prostate Specific Antigen Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Prostate Specific Antigen Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Prostate Specific Antigen Industry Revenue (Million), by Test Type 2024 & 2032

- Figure 17: Europe Prostate Specific Antigen Industry Revenue Share (%), by Test Type 2024 & 2032

- Figure 18: Europe Prostate Specific Antigen Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Prostate Specific Antigen Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Prostate Specific Antigen Industry Revenue (Million), by Test Type 2024 & 2032

- Figure 21: Asia Pacific Prostate Specific Antigen Industry Revenue Share (%), by Test Type 2024 & 2032

- Figure 22: Asia Pacific Prostate Specific Antigen Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Prostate Specific Antigen Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Middle East and Africa Prostate Specific Antigen Industry Revenue (Million), by Test Type 2024 & 2032

- Figure 25: Middle East and Africa Prostate Specific Antigen Industry Revenue Share (%), by Test Type 2024 & 2032

- Figure 26: Middle East and Africa Prostate Specific Antigen Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East and Africa Prostate Specific Antigen Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: South America Prostate Specific Antigen Industry Revenue (Million), by Test Type 2024 & 2032

- Figure 29: South America Prostate Specific Antigen Industry Revenue Share (%), by Test Type 2024 & 2032

- Figure 30: South America Prostate Specific Antigen Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: South America Prostate Specific Antigen Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Test Type 2019 & 2032

- Table 3: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: GCC Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Africa Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Middle East and Africa Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Test Type 2019 & 2032

- Table 31: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Test Type 2019 & 2032

- Table 36: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Test Type 2019 & 2032

- Table 44: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Australia Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Asia Pacific Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Test Type 2019 & 2032

- Table 52: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: GCC Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Africa Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Middle East and Africa Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Test Type 2019 & 2032

- Table 57: Global Prostate Specific Antigen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Brazil Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Argentina Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of South America Prostate Specific Antigen Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Prostate Specific Antigen Industry?

The projected CAGR is approximately 10.35%.

2. Which companies are prominent players in the Prostate Specific Antigen Industry?

Key companies in the market include Lomina AG, Beckman Coulter Inc, Laboratory Corporation of America Holdings, Bio-Rad Laboratories Inc, Proteomedix, Bayer AG, Hanzhou Testsea biotechnology co LTD, Accuquik Test Kits, OPKO Health Inc, Abcam plc, Fujirebio (H U Group company), General Electric Company.

3. What are the main segments of the Prostate Specific Antigen Industry?

The market segments include Test Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Prostate Cancer; Increasing Government Initiatives; Technological Advancements.

6. What are the notable trends driving market growth?

The Preliminary Test Segment is Expected to Hold a Major Market Share in the Prostate-Specific Antigen Test Market.

7. Are there any restraints impacting market growth?

High Cost Of Diagnosis.

8. Can you provide examples of recent developments in the market?

In April 2022, The Milton and Carroll Petrie Department of Urology at Mount Sinai launched the Mount Sinai Robert F. Smith Mobile Prostate Cancer Screening Unit to support prostate health in the Black community.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Prostate Specific Antigen Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Prostate Specific Antigen Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Prostate Specific Antigen Industry?

To stay informed about further developments, trends, and reports in the Prostate Specific Antigen Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence