Key Insights

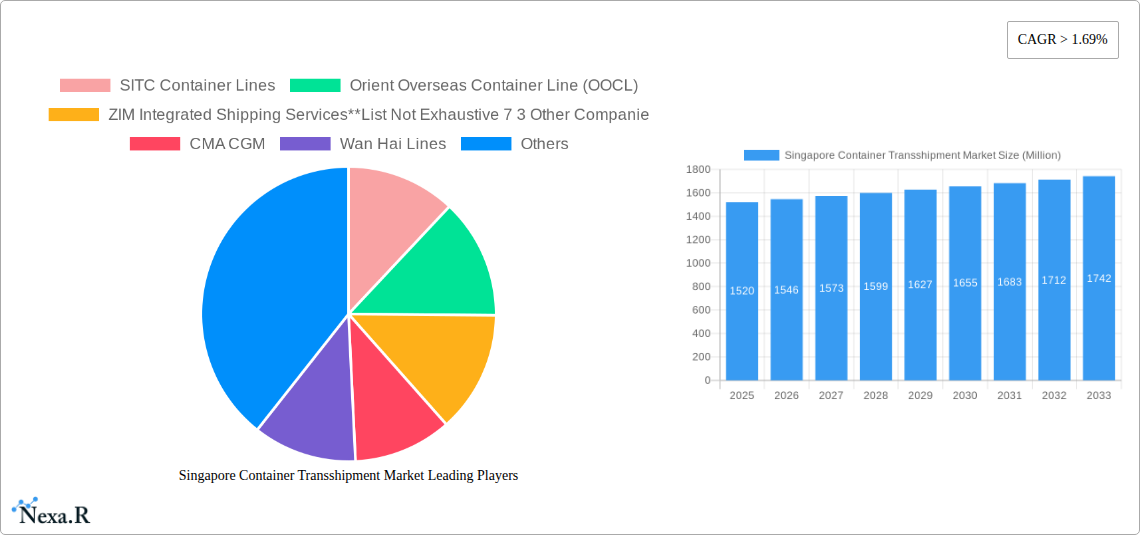

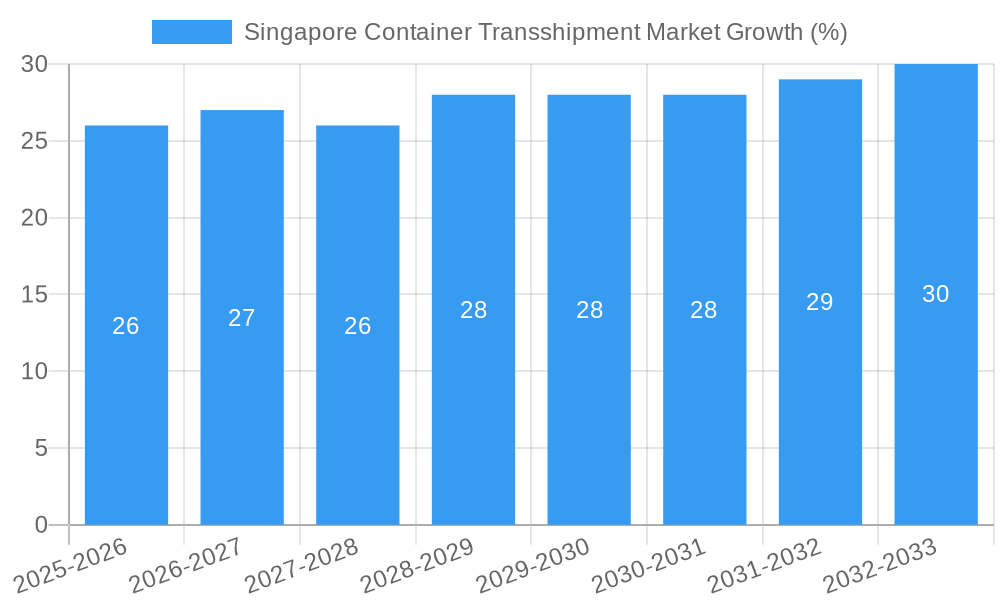

The Singapore container transshipment market, valued at $1.52 billion in 2025, is projected to experience robust growth, driven by the nation's strategic geographical location as a crucial hub within Asia's extensive maritime network. This prime position facilitates efficient trade routes connecting major economies across the globe. Increasing global trade volumes, particularly within the Asia-Pacific region, further fuel market expansion. The expanding e-commerce sector and growing demand for consumer goods contribute significantly to higher container throughput. Furthermore, ongoing investments in port infrastructure and technological advancements, such as automated container handling systems and improved digitalization, enhance operational efficiency and capacity, supporting the market's positive trajectory. Several key segments within the market, including refrigerated containers for perishable goods and those servicing the burgeoning food & beverage, pharmaceutical, and chemicals & petrochemicals sectors, are expected to demonstrate particularly strong growth. Competition among major players like Maersk, MSC, and CMA CGM, while intense, drives innovation and operational excellence, ultimately benefiting the overall market.

However, potential restraints include global economic uncertainties, geopolitical risks impacting trade flows, and fluctuations in fuel prices which can directly impact shipping costs. Furthermore, increasing environmental regulations aimed at reducing the carbon footprint of shipping operations might necessitate significant investments in cleaner technologies, potentially impacting profitability in the short term. Nevertheless, the long-term outlook for the Singapore container transshipment market remains positive, fueled by sustained growth in global trade and Singapore's commitment to maintaining its position as a leading maritime hub. The market's CAGR of 1.69% suggests steady and predictable growth throughout the forecast period (2025-2033), with minor variations expected due to aforementioned external factors. Careful monitoring of these external variables is crucial for companies operating within this dynamic market.

Singapore Container Transshipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Singapore container transshipment market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033. This crucial analysis will be invaluable for businesses, investors, and policymakers navigating this dynamic sector. The Singapore container transshipment market, a pivotal component of the broader Southeast Asian logistics landscape, is experiencing significant transformation driven by technological advancements, infrastructure investments, and evolving global trade patterns. This report analyzes the parent market (Southeast Asian Logistics) and the child market (Singapore Container Transshipment) to provide a complete understanding of market dynamics. The market value is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Singapore Container Transshipment Market Dynamics & Structure

The Singapore container transshipment market is characterized by a high level of concentration among major players. Market share is heavily influenced by factors such as operational efficiency, port infrastructure, and strategic alliances. Technological innovation, particularly in automation and digitalization, is a significant driver of market growth. The regulatory framework, governed by the Maritime and Port Authority of Singapore (MPA), plays a crucial role in shaping market competitiveness. The market faces competition from other regional transshipment hubs; however, Singapore maintains a strong competitive advantage due to its strategic location, robust infrastructure, and supportive government policies. Mergers and acquisitions (M&A) activities have played a role in consolidating market share, though the pace has varied across different timeframes.

- Market Concentration: High, with top 5 players controlling approximately 70% of the market.

- Technological Innovation: Driven by automation (e.g., automated guided vehicles, robotic cranes), data analytics, and digital platforms for improved efficiency and transparency.

- Regulatory Framework: Supportive, with a focus on efficiency, safety, and sustainability.

- Competitive Product Substitutes: Limited direct substitutes, but competition exists from other regional transshipment hubs.

- End-User Demographics: Diverse, encompassing various industries including Automotive, Mining & Minerals, Agriculture, Chemicals & Petrochemicals, Pharmaceuticals, Food & Beverages, and Retail.

- M&A Trends: Moderate activity, primarily focused on enhancing operational capabilities and expanding geographic reach. xx M&A deals were recorded between 2019 and 2024.

Singapore Container Transshipment Market Growth Trends & Insights

The Singapore container transshipment market has witnessed consistent growth over the historical period (2019-2024), fueled by the rise of global trade, particularly within the Asia-Pacific region. The market experienced a temporary slowdown in 2020 due to the COVID-19 pandemic, but quickly rebounded, demonstrating resilience. Technological disruptions, such as the implementation of digital platforms and automation systems, are driving efficiency improvements and streamlining operations. Consumer behavior shifts, such as a preference for faster delivery times and greater transparency in supply chains, are further influencing market growth. The market's CAGR from 2019-2024 was approximately x%, while the projected CAGR from 2025-2033 is estimated at y%. Market penetration of automated systems is currently at z%, projected to reach xx% by 2033.

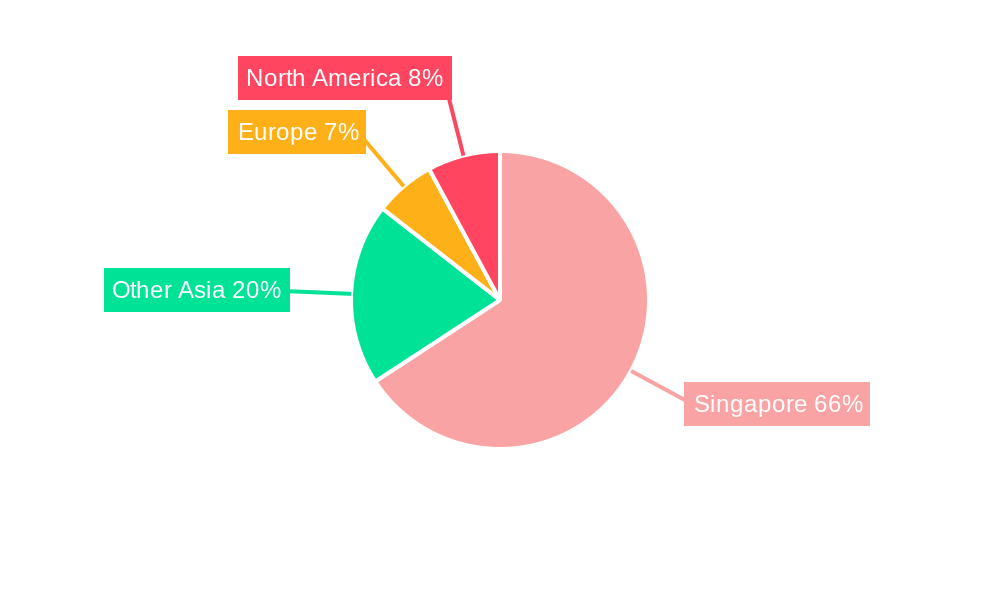

Dominant Regions, Countries, or Segments in Singapore Container Transshipment Market

The Port of Singapore, located in the main island of Singapore, is the dominant region driving market growth. Its strategic location, state-of-the-art infrastructure, and efficient operations make it a preferred transshipment hub for global shipping lines. Within the segments, the "General Cargo" container type holds the largest market share, followed by "Refrigerator" containers. In terms of end-users, the "Automotive" and "Chemicals & Petrochemicals" sectors are significant contributors to market growth.

- Key Drivers:

- Strategic location and excellent connectivity.

- World-class port infrastructure and efficiency.

- Supportive government policies and regulations.

- Growing regional and global trade volumes.

- Dominance Factors:

- High volume of container throughput.

- Extensive network of shipping lines and logistics providers.

- Advanced technologies and automation.

- Strong reputation for reliability and efficiency.

- Market share for General Cargo containers is approximately 60%, and Refrigerated containers hold approximately 15%.

Singapore Container Transshipment Market Product Landscape

The product landscape is characterized by diverse container types, including standard general-purpose containers, refrigerated containers (reefers), and specialized containers for handling specific cargo types. Innovations focus on improving container durability, security, and efficiency through features such as advanced tracking systems, improved material strength, and optimized design. Performance metrics emphasize factors such as container turnaround times, cargo damage rates, and overall operational efficiency. Unique selling propositions are often centered around sustainability, enhanced security, and efficient tracking capabilities.

Key Drivers, Barriers & Challenges in Singapore Container Transshipment Market

Key Drivers: Increased global trade, technological advancements driving automation and efficiency, supportive government policies, and Singapore's strategic location. Examples include the growth of e-commerce, boosting demand for fast and efficient logistics, and significant investments in port infrastructure enhancements.

Key Challenges: Intense competition from other regional transshipment hubs, rising labor costs, environmental regulations, and potential disruptions to global trade flows due to geopolitical uncertainties. For example, increased competition from ports in Malaysia and China exerts downward pressure on pricing.

Emerging Opportunities in Singapore Container Transshipment Market

Emerging opportunities lie in the expansion of e-commerce, necessitating advanced logistics solutions and last-mile delivery capabilities. Further investments in automation and digital technologies are poised for growth. Expanding into niche markets such as specialized cargo handling and cold chain logistics also presents significant opportunities.

Growth Accelerators in the Singapore Container Transshipment Market Industry

Long-term growth will be accelerated by continued investments in infrastructure modernization, promoting digitalization and automation, and fostering strategic partnerships to streamline operations. Furthermore, exploring sustainable practices and aligning with environmental regulations will support the industry's long-term growth.

Key Players Shaping the Singapore Container Transshipment Market Market

- SITC Container Lines

- Orient Overseas Container Line (OOCL)

- ZIM Integrated Shipping Services

- CMA CGM

- Wan Hai Lines

- NYK Line

- Hapag-Lloyd

- Pacific International Lines (PIL)

- Mediterranean Shipping Company (MSC)

- Maersk Line

- Evergreen Marine Corporation

Notable Milestones in Singapore Container Transshipment Market Sector

- February 2024: Maersk announced a USD 500 million investment to expand its Southeast Asian supply chain infrastructure, adding nearly 480,000 sqm of capacity by 2026. This significantly enhances its capacity and strengthens its position in the region.

- February 2024: HERE Technologies partnered with PSA Singapore to revolutionize the container truck ecosystem, boosting efficiency at the world's second busiest container port. This digital transformation improves logistics and reduces congestion.

In-Depth Singapore Container Transshipment Market Market Outlook

The Singapore container transshipment market is poised for continued growth, driven by sustained investments in infrastructure and technology. Strategic partnerships and a focus on sustainability will play a crucial role in maintaining Singapore's position as a leading global transshipment hub. The market's future potential is substantial, particularly considering the growth of e-commerce and the increasing demand for efficient and reliable supply chains in the Asia-Pacific region.

Singapore Container Transshipment Market Segmentation

-

1. Container Type

- 1.1. General

- 1.2. Refrigerator

-

2. End-User

- 2.1. Automotive

- 2.2. Mining & Minerals

- 2.3. Agriculture

- 2.4. Chemicals & Petrochemicals

- 2.5. Pharmaceuticals

- 2.6. Food & Beverages

- 2.7. Retail

- 2.8. Other End Users

Singapore Container Transshipment Market Segmentation By Geography

- 1. Singapore

Singapore Container Transshipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.69% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce is Booming the Market; Increasing Intra-Regional Trade

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor; Competition From the Global Players

- 3.4. Market Trends

- 3.4.1. Increasing Trade Activities are Boosting the Market Growth in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Container Transshipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Container Type

- 5.1.1. General

- 5.1.2. Refrigerator

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Mining & Minerals

- 5.2.3. Agriculture

- 5.2.4. Chemicals & Petrochemicals

- 5.2.5. Pharmaceuticals

- 5.2.6. Food & Beverages

- 5.2.7. Retail

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Container Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SITC Container Lines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orient Overseas Container Line (OOCL)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ZIM Integrated Shipping Services**List Not Exhaustive 7 3 Other Companie

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CMA CGM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wan Hai Lines

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NYK Line

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hapag-Lloyd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pacific International Lines (PIL)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mediterranean Shipping Company (MSC)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Maersk Line

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Evergreen Marine Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 SITC Container Lines

List of Figures

- Figure 1: Singapore Container Transshipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Singapore Container Transshipment Market Share (%) by Company 2024

List of Tables

- Table 1: Singapore Container Transshipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Singapore Container Transshipment Market Revenue Million Forecast, by Container Type 2019 & 2032

- Table 3: Singapore Container Transshipment Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Singapore Container Transshipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Singapore Container Transshipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Singapore Container Transshipment Market Revenue Million Forecast, by Container Type 2019 & 2032

- Table 7: Singapore Container Transshipment Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Singapore Container Transshipment Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Container Transshipment Market?

The projected CAGR is approximately > 1.69%.

2. Which companies are prominent players in the Singapore Container Transshipment Market?

Key companies in the market include SITC Container Lines, Orient Overseas Container Line (OOCL), ZIM Integrated Shipping Services**List Not Exhaustive 7 3 Other Companie, CMA CGM, Wan Hai Lines, NYK Line, Hapag-Lloyd, Pacific International Lines (PIL), Mediterranean Shipping Company (MSC), Maersk Line, Evergreen Marine Corporation.

3. What are the main segments of the Singapore Container Transshipment Market?

The market segments include Container Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.52 Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce is Booming the Market; Increasing Intra-Regional Trade.

6. What are the notable trends driving market growth?

Increasing Trade Activities are Boosting the Market Growth in the Country.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor; Competition From the Global Players.

8. Can you provide examples of recent developments in the market?

February 2024: A.P. Moller-Maersk (Maersk) announced more than USD 500 million in investment to expand its supply chain infrastructure to support Southeast Asia's emergence as a global production hub and a consumption powerhouse. Maersk’s planned three-year investment will target its Logistics & Services arm. Still, at the same time, a substantial amount of investment will also be channeled into its Ocean and Terminals infrastructure. By 2026, Maersk expects to add nearly 480,000 sqm capacity spread across Malaysia, Indonesia, Singapore, and the Philippines. With these investments, Maersk will be able to better serve customers with mega distribution centers that are strategically located, sustainable, and equipped with advanced automation to drive increased efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Container Transshipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Container Transshipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Container Transshipment Market?

To stay informed about further developments, trends, and reports in the Singapore Container Transshipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence