Key Insights

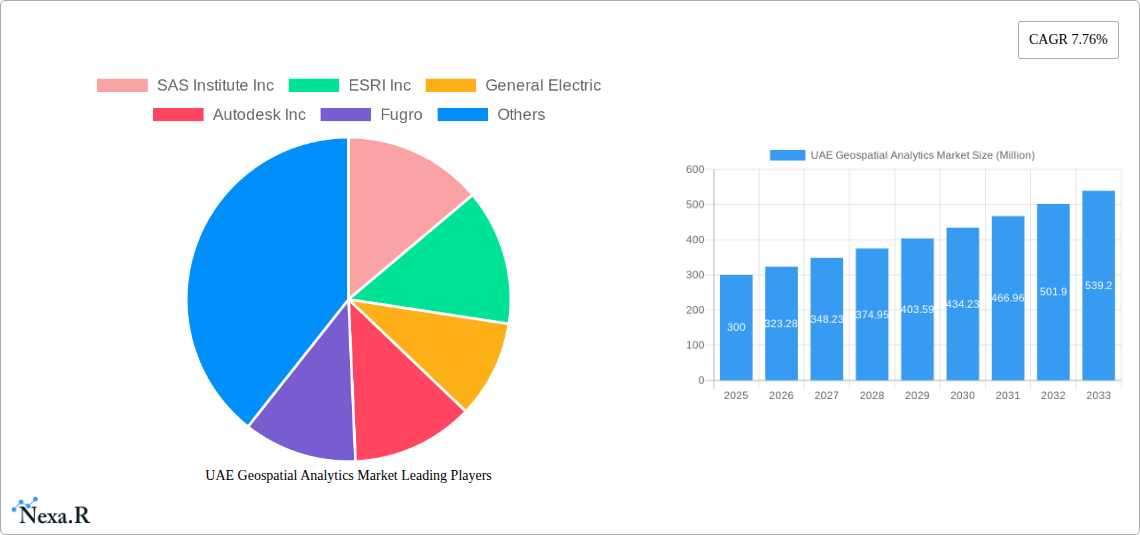

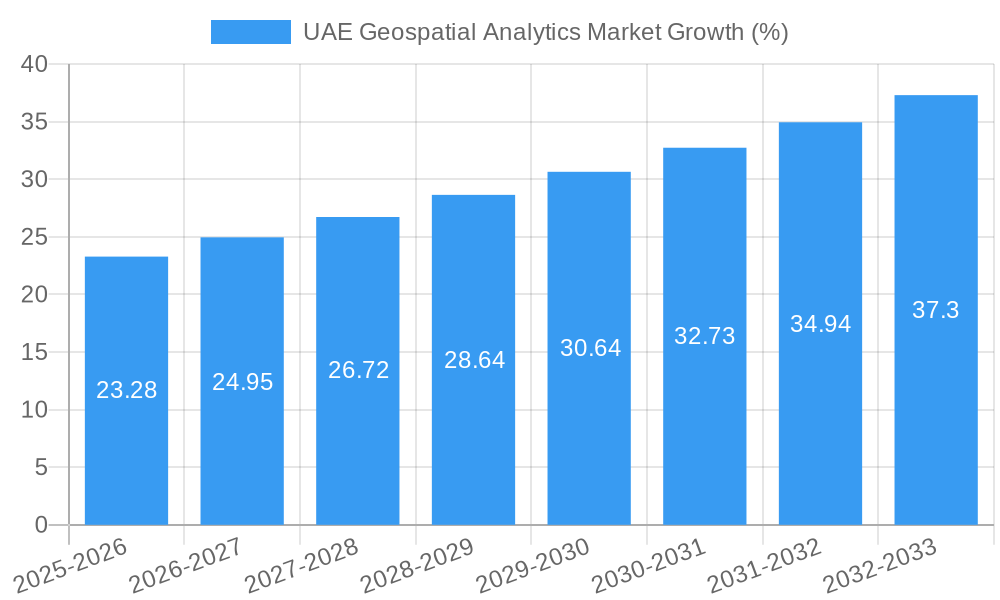

The UAE Geospatial Analytics market, valued at approximately $300 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.76% from 2025 to 2033. This expansion is fueled by several key drivers. The UAE's significant investments in infrastructure development, particularly smart city initiatives and advancements in transportation, necessitate sophisticated geospatial analysis for efficient planning and resource management. Furthermore, the burgeoning adoption of precision agriculture techniques, coupled with increasing government focus on environmental monitoring and resource optimization, significantly contributes to market growth. The increasing reliance on data-driven decision-making across various sectors, including defense and intelligence, further fuels demand for advanced geospatial analytics solutions. The market's segmentation reflects this diverse application, with strong growth anticipated across sectors like agriculture, utilities, and transportation. The presence of major players like SAS Institute, ESRI, and Google, along with regional companies, underscores a competitive landscape characterized by technological innovation and strategic partnerships.

Technological advancements, such as the proliferation of high-resolution satellite imagery, drone technology, and the development of sophisticated analytical tools, are key trends shaping the market. The integration of artificial intelligence (AI) and machine learning (ML) into geospatial analytics platforms is enhancing analytical capabilities and facilitating the extraction of actionable insights from vast datasets. However, challenges such as data security concerns, the high cost of advanced software and hardware, and a potential shortage of skilled professionals could pose restraints on market growth. Overcoming these hurdles through strategic investments in data infrastructure, talent development, and robust cybersecurity measures is crucial for sustained market expansion. The UAE government's ongoing digital transformation initiatives and supportive regulatory environment are expected to mitigate these challenges, further accelerating the adoption of geospatial analytics across sectors.

UAE Geospatial Analytics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE Geospatial Analytics Market, offering invaluable insights for businesses, investors, and researchers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, growth trends, dominant segments, and key players shaping the future of this rapidly evolving sector. The report also explores the parent market of Analytics and the child market of Geospatial Analytics.

UAE Geospatial Analytics Market Dynamics & Structure

The UAE Geospatial Analytics market is characterized by a moderate level of concentration, with a few major players dominating the landscape alongside several niche players. The market is driven by significant technological advancements, particularly in areas like AI, machine learning, and cloud computing, leading to more sophisticated geospatial analysis capabilities. Government initiatives promoting digital transformation and smart city development further fuel market expansion. Stringent data privacy regulations are a key consideration, shaping data management practices and requiring compliance. While readily available geographical data offers a competitive advantage, developing sophisticated analytical models and integrating them with existing infrastructure represents an innovation barrier. Mergers and acquisitions (M&A) activity remains relatively moderate, reflecting a preference for organic growth and strategic partnerships, although we predict xx M&A deals in the forecast period.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: AI, machine learning, cloud computing are major drivers.

- Regulatory Framework: Stringent data privacy regulations and open data initiatives influence market strategies.

- Competitive Substitutes: Limited, although traditional surveying methods remain competitive in niche applications.

- End-User Demographics: Government, Utility and Communication, and Real Estate & Construction are key end-user segments.

- M&A Trends: Moderate activity anticipated, primarily focused on strategic acquisitions and technology integration.

UAE Geospatial Analytics Market Growth Trends & Insights

The UAE Geospatial Analytics market is experiencing robust growth, fueled by increasing government investment in infrastructure projects and the widespread adoption of digital technologies across various sectors. The market size is projected to reach xx Million in 2025 and is expected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is attributed to the rising demand for location-based services, improved data accessibility, and the expanding applications of geospatial analytics across diverse industries, including infrastructure planning, urban development, and resource management. Market penetration is currently at approximately xx% in key sectors and is expected to significantly increase during the forecast period. Technological disruptions, such as the increasing adoption of IoT and the emergence of advanced analytics techniques, continue to reshape the market landscape.

Dominant Regions, Countries, or Segments in UAE Geospatial Analytics Market

Within the UAE, the major population centers such as Abu Dhabi and Dubai are driving market growth, owing to substantial infrastructure projects and smart city initiatives. The Utility and Communication sector constitutes the largest segment (xx% market share) in 2025, followed by Real Estate & Construction (xx%), and Government (xx%). The strong focus on smart city development in these regions is a key growth driver, supplemented by increasing government initiatives to digitize public services. High investments in infrastructure projects, coupled with the need for efficient resource management in these sectors, creates significant demand for geospatial analytics solutions. The Government segment showcases the highest projected CAGR (xx%) due to increased spending on smart city projects, national security, and resource management initiatives.

- Key Drivers:

- Government investment in smart city initiatives

- Infrastructure development projects

- Rising demand for location-based services

- Growing adoption of digital technologies

- Dominant Segments: Utility & Communication, Real Estate & Construction, Government.

- Growth Potential: High growth potential in the Defense & Intelligence, Agriculture, and Mining & Natural Resources segments.

UAE Geospatial Analytics Market Product Landscape

The UAE Geospatial Analytics market offers a diverse range of products, from basic GIS software to advanced AI-powered analytics platforms. These solutions cater to various applications, including urban planning, environmental monitoring, asset management, and precision agriculture. Key product innovations include cloud-based GIS solutions, enhanced visualization tools, and AI-driven predictive analytics capabilities that offer superior accuracy, speed, and ease of use compared to previous generations of software. The integration of these advanced functionalities delivers high ROI for customers across various industry sectors.

Key Drivers, Barriers & Challenges in UAE Geospatial Analytics Market

Key Drivers:

- Increasing government investments in infrastructure and smart city initiatives.

- Rising demand for accurate and timely geospatial data across various sectors.

- Technological advancements, such as AI and machine learning, improving the efficiency and accuracy of analysis.

Key Challenges and Restraints:

- High initial investment costs associated with implementing geospatial analytics solutions.

- Data security and privacy concerns related to the handling of sensitive geographical data.

- The need for skilled professionals to effectively utilize advanced geospatial technologies. A shortage of skilled professionals represents a significant obstacle for market growth.

Emerging Opportunities in UAE Geospatial Analytics Market

- Growing adoption of IoT devices and sensor networks generating large volumes of location-based data.

- Increased demand for real-time analytics and decision-making capabilities, especially in disaster management.

- Development of advanced analytics techniques, such as predictive modeling and machine learning, enabling more insightful analysis.

Growth Accelerators in the UAE Geospatial Analytics Market Industry

The UAE's strategic focus on technological advancement, coupled with strong government support for smart city development and digitization across all sectors, provides significant growth momentum. Continued innovation in AI-powered analytics and the integration of cloud technologies will streamline workflows, reduce costs, and enhance the accuracy and value of geospatial insights.

Key Players Shaping the UAE Geospatial Analytics Market Market

- SAS Institute Inc

- ESRI Inc

- General Electric

- Autodesk Inc

- Fugro

- Oracle Corporation

- Google LLC

- Trimble Inc

- Bentley Systems Inc

- Hexagon AB

Notable Milestones in UAE Geospatial Analytics Market Sector

- December 2022: Bayanat and the UAE Space Agency partnered to create a spatial analytics platform for the space data center, leveraging AI-based geospatial solutions for Earth observation applications.

- May 2022: Hexagon's Intergraph G/Technology GIS solution became available on the Oracle Cloud Marketplace, offering enhanced scalability and accessibility for utility operators.

In-Depth UAE Geospatial Analytics Market Market Outlook

The UAE Geospatial Analytics market is poised for sustained growth, driven by continuous technological innovation, government support, and the expanding applications of geospatial data across various sectors. Strategic partnerships and investments in research and development will further accelerate market expansion, creating lucrative opportunities for both established players and new entrants. The long-term outlook remains positive, with the market projected to experience significant expansion throughout the forecast period.

UAE Geospatial Analytics Market Segmentation

-

1. Type

- 1.1. Surface Analysis

- 1.2. Network Analysis

- 1.3. Geovisualization

-

2. End-user Vertical

- 2.1. Agriculture

- 2.2. Utility and Communication

- 2.3. Defense and Intelligence

- 2.4. Government

- 2.5. Mining and Natural Resources

- 2.6. Automotive and Transportation

- 2.7. Healthcare

- 2.8. Real Estate and Construction

- 2.9. Other End-user Verticals

UAE Geospatial Analytics Market Segmentation By Geography

- 1. UAE

UAE Geospatial Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing in Demand for Location Intelligence; Advancements of Big Data Analytics

- 3.3. Market Restrains

- 3.3.1. High Costs and Operational Concerns; Concerns related to Geoprivacy and Confidential Data

- 3.4. Market Trends

- 3.4.1. Surface Analysis is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. UAE Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Analysis

- 5.1.2. Network Analysis

- 5.1.3. Geovisualization

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Agriculture

- 5.2.2. Utility and Communication

- 5.2.3. Defense and Intelligence

- 5.2.4. Government

- 5.2.5. Mining and Natural Resources

- 5.2.6. Automotive and Transportation

- 5.2.7. Healthcare

- 5.2.8. Real Estate and Construction

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. UAE

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SAS Institute Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ESRI Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Electric

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Autodesk Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fugro

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oracle Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Google LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trimble Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bentley Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hexagon Ab

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SAS Institute Inc

List of Figures

- Figure 1: UAE Geospatial Analytics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: UAE Geospatial Analytics Market Share (%) by Company 2024

List of Tables

- Table 1: UAE Geospatial Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: UAE Geospatial Analytics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: UAE Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: UAE Geospatial Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: UAE Geospatial Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE Geospatial Analytics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: UAE Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 8: UAE Geospatial Analytics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Geospatial Analytics Market?

The projected CAGR is approximately 7.76%.

2. Which companies are prominent players in the UAE Geospatial Analytics Market?

Key companies in the market include SAS Institute Inc, ESRI Inc, General Electric, Autodesk Inc, Fugro, Oracle Corporation, Google LLC, Trimble Inc, Bentley Systems Inc, Hexagon Ab.

3. What are the main segments of the UAE Geospatial Analytics Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.3 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing in Demand for Location Intelligence; Advancements of Big Data Analytics.

6. What are the notable trends driving market growth?

Surface Analysis is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

High Costs and Operational Concerns; Concerns related to Geoprivacy and Confidential Data.

8. Can you provide examples of recent developments in the market?

December 2022 : Bayanat and the UAE Space Agency sign a partnership agreement to create a platform for spatial analytics for the space data center. Bayanat, a player in AI-based geospatial solutions, will use the capabilities of large-scale data management and processing to build an innovative ecosystem for Earth observation apps and produce analytical reports based on Earth observation satellites under the terms of this agreement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Geospatial Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Geospatial Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Geospatial Analytics Market?

To stay informed about further developments, trends, and reports in the UAE Geospatial Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence