Key Insights

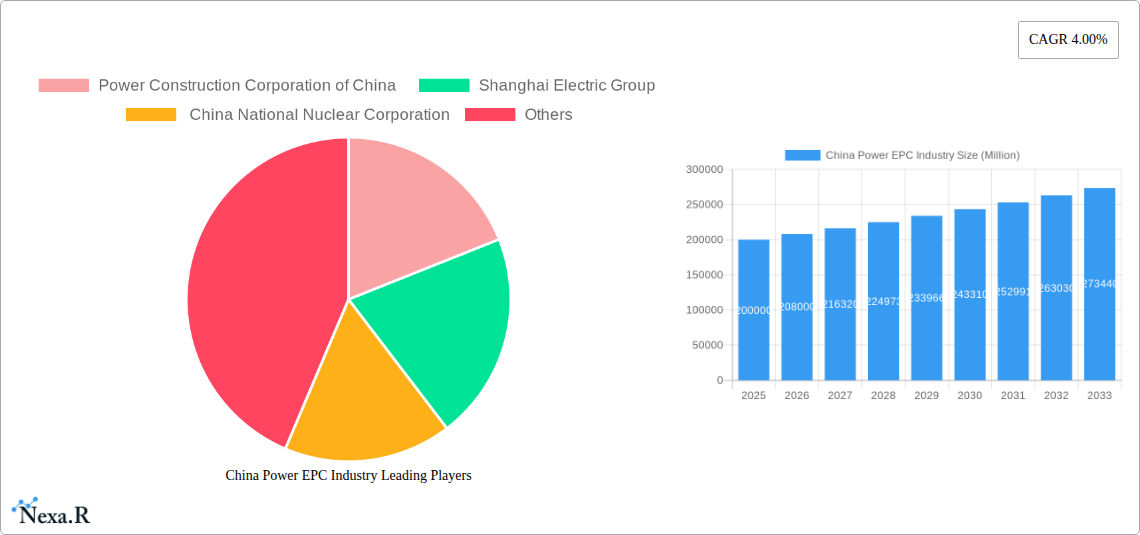

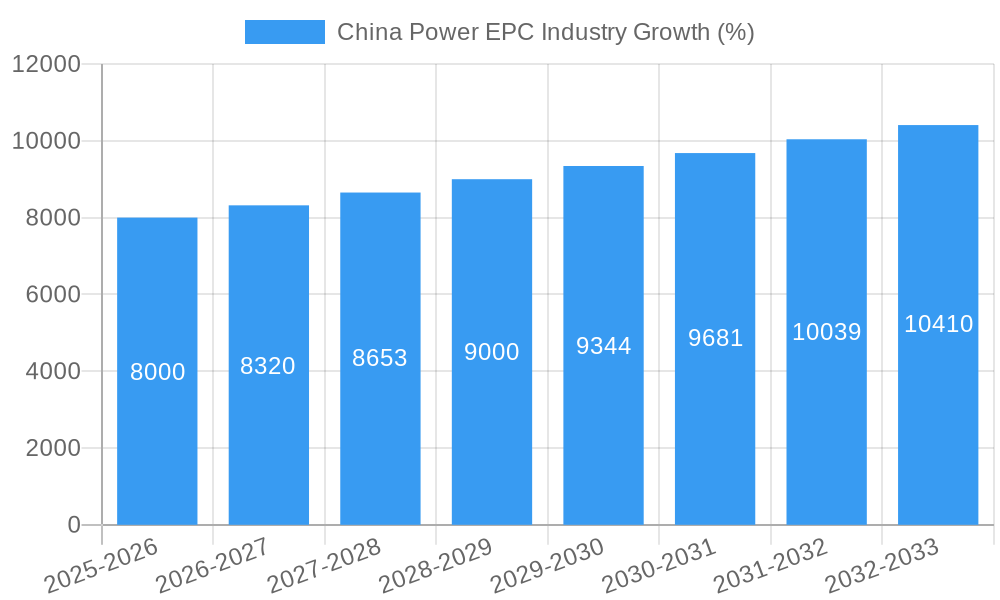

The China power EPC (Engineering, Procurement, and Construction) industry is experiencing robust growth, driven by the nation's ambitious renewable energy targets and ongoing modernization of its power infrastructure. The market, currently valued at approximately $XX million in 2025 (assuming a reasonable market size based on global trends and China's economic scale), is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033. This growth is fueled by significant investments in solar, wind, and hydro power projects, spurred by government policies aimed at reducing carbon emissions and enhancing energy security. Key players like Power Construction Corporation of China, Shanghai Electric Group, and China National Nuclear Corporation are leading the charge, leveraging their expertise and scale to secure major contracts. While the industry faces challenges such as fluctuating raw material prices and potential regulatory hurdles, the long-term outlook remains positive, particularly given China's commitment to transitioning to a cleaner energy mix. The "Other Types" segment, which likely encompasses thermal and nuclear power, will also contribute to growth, albeit potentially at a slower pace compared to renewables, depending on government policy shifts and technological advancements.

The sustained growth trajectory is underpinned by several factors. The increasing demand for electricity, fueled by rapid economic development and urbanization, necessitates substantial investments in power generation capacity. This, combined with the government’s strong emphasis on renewable energy integration and its "Made in China 2025" initiative, further stimulates the EPC market. However, potential restraints include the need for advanced technological adoption across the industry, particularly in areas like smart grids and energy storage, as well as competition from both domestic and international EPC firms. Navigating these challenges will be crucial for industry players to maintain their competitive edge and capitalize on the significant growth opportunities presented by the Chinese power sector's transformation. The forecast period of 2025-2033 offers considerable potential for growth, contingent upon sustained government support and technological advancements.

China Power EPC Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the China Power EPC (Engineering, Procurement, and Construction) industry, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). The report segments the market by type (Solar, Wind, Hydro, Other Types), offering granular insights for investors, industry professionals, and strategic decision-makers. Key players like Power Construction Corporation of China, Shanghai Electric Group, and China National Nuclear Corporation are analyzed to reveal market dynamics and future opportunities. Download now for a strategic advantage in this rapidly evolving sector.

China Power EPC Industry Market Dynamics & Structure

The China Power EPC market, valued at xx Million in 2025, is characterized by a moderately concentrated structure with Power Construction Corporation of China, Shanghai Electric Group, and China National Nuclear Corporation holding significant market share. Technological innovation, particularly in renewable energy technologies, is a major driver, spurred by government policies promoting clean energy. Stringent environmental regulations and increasing energy demand shape the competitive landscape. Mergers and acquisitions (M&A) activity is relatively high, driven by consolidation efforts and expansion into new segments.

- Market Concentration: Power Construction Corporation of China holds approximately xx% market share in 2025, followed by Shanghai Electric Group at xx% and China National Nuclear Corporation at xx%. Smaller players constitute the remaining xx%.

- Technological Innovation: Focus on smart grids, energy storage solutions, and improved efficiency in solar, wind, and hydro technologies.

- Regulatory Framework: Stringent environmental regulations and policies promoting renewable energy development are shaping industry practices.

- Competitive Substitutes: Limited direct substitutes, but competition exists from international EPC companies entering the Chinese market.

- End-User Demographics: Primarily government entities, large private energy producers, and increasingly, independent power producers (IPPs).

- M&A Trends: An average of xx M&A deals per year in the historical period, indicating consolidation and expansion strategies.

China Power EPC Industry Growth Trends & Insights

The China Power EPC market experienced robust growth between 2019 and 2024, driven by government investments in infrastructure development and a strong push towards renewable energy sources. The market size expanded from xx Million in 2019 to xx Million in 2024, representing a CAGR of xx%. This growth is projected to continue, although at a slightly moderated pace, reaching xx Million by 2033 with a projected CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as advancements in energy storage and smart grid technologies, are further accelerating adoption rates. Consumer behavior shifts towards environmentally conscious energy consumption support market expansion.

Dominant Regions, Countries, or Segments in China Power EPC Industry

The Eastern and Southern coastal regions of China dominate the Power EPC market due to higher energy demand, existing infrastructure, and favorable government policies. Within the segments, solar and wind power EPC projects are leading the growth, driven by significant government investment and supportive policies aimed at reducing carbon emissions. Hydropower remains significant, primarily in the western regions.

- Key Drivers (Solar & Wind):

- Government subsidies and feed-in tariffs.

- Large-scale renewable energy projects.

- Technological advancements leading to reduced costs.

- Increasing public and private investments.

- Dominance Factors:

- High concentration of renewable energy projects in coastal regions.

- Developed infrastructure facilitating project execution.

- Strong government support and favorable policies.

- High market share captured by leading EPC companies in these segments.

- Growth Potential: The Western regions hold considerable potential for hydropower and solar projects, driven by untapped resources.

China Power EPC Industry Product Landscape

The Power EPC industry offers a diverse range of products and services, including design, engineering, procurement, construction, and commissioning of power plants. Technological advancements focus on enhancing efficiency, reducing costs, and incorporating smart technologies for improved grid integration and operational efficiency. Unique selling propositions often include project financing capabilities, specialized expertise in specific renewable energy technologies, and robust project management systems.

Key Drivers, Barriers & Challenges in China Power EPC Industry

Key Drivers:

- Government support for renewable energy development.

- Increasing energy demand driven by economic growth.

- Technological advancements reducing costs and improving efficiency.

- Investments in smart grid infrastructure.

Key Challenges:

- Supply chain disruptions and material price volatility impacting project costs.

- Strict environmental regulations and permitting processes.

- Intense competition from both domestic and international players.

- Financing challenges for large-scale renewable energy projects in some regions.

Emerging Opportunities in China Power EPC Industry

- Growing demand for energy storage solutions to address intermittency in renewable energy sources.

- Expansion into off-grid and microgrid projects in rural areas.

- Increased focus on hybrid power plants combining different renewable energy sources.

- Opportunities in the development of smart grids and digital technologies.

Growth Accelerators in the China Power EPC Industry Industry

Technological breakthroughs in renewable energy technologies, particularly in solar and wind power, are significant growth accelerators. Strategic partnerships between EPC companies and technology providers further fuel innovation and cost reductions. Expansion into new markets, both domestically within less-developed regions and internationally, presents significant opportunities for growth.

Key Players Shaping the China Power EPC Market

- Power Construction Corporation of China

- Shanghai Electric Group

- China National Nuclear Corporation

Notable Milestones in China Power EPC Industry Sector

- 2020: Launch of several large-scale solar and wind power projects in the Xinjiang region.

- 2021: Significant investments in smart grid infrastructure development announced by the government.

- 2022: Merger of two leading EPC companies to create a larger, more integrated entity.

- 2023: Successful commissioning of several large hydropower projects in the southwest.

In-Depth China Power EPC Industry Market Outlook

The China Power EPC market is poised for continued strong growth over the next decade. The government’s commitment to renewable energy, technological innovation, and ongoing infrastructure investments will drive market expansion. Strategic partnerships, international collaboration, and a focus on developing efficient and sustainable energy solutions will shape the future of this dynamic sector. The market presents lucrative opportunities for both established players and new entrants willing to embrace innovation and adapt to the evolving energy landscape.

China Power EPC Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

China Power EPC Industry Segmentation By Geography

- 1. China

China Power EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Abundant Oil and Gas Reserves4.; Growing Investments in Natural Gas Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Vandalization and Threats By Militants On Oil And Gas Infrastructures

- 3.4. Market Trends

- 3.4.1. Conventional Thermal to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Power EPC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Power Construction Corporation of China

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shanghai Electric Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China National Nuclear Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.1 Power Construction Corporation of China

List of Figures

- Figure 1: China Power EPC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Power EPC Industry Share (%) by Company 2024

List of Tables

- Table 1: China Power EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Power EPC Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: China Power EPC Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: China Power EPC Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: China Power EPC Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: China Power EPC Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: China Power EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Power EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Power EPC Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: China Power EPC Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: China Power EPC Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: China Power EPC Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: China Power EPC Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: China Power EPC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Power EPC Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the China Power EPC Industry?

Key companies in the market include Power Construction Corporation of China , Shanghai Electric Group , China National Nuclear Corporation.

3. What are the main segments of the China Power EPC Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Abundant Oil and Gas Reserves4.; Growing Investments in Natural Gas Infrastructure.

6. What are the notable trends driving market growth?

Conventional Thermal to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Vandalization and Threats By Militants On Oil And Gas Infrastructures.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Power EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Power EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Power EPC Industry?

To stay informed about further developments, trends, and reports in the China Power EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence