Key Insights

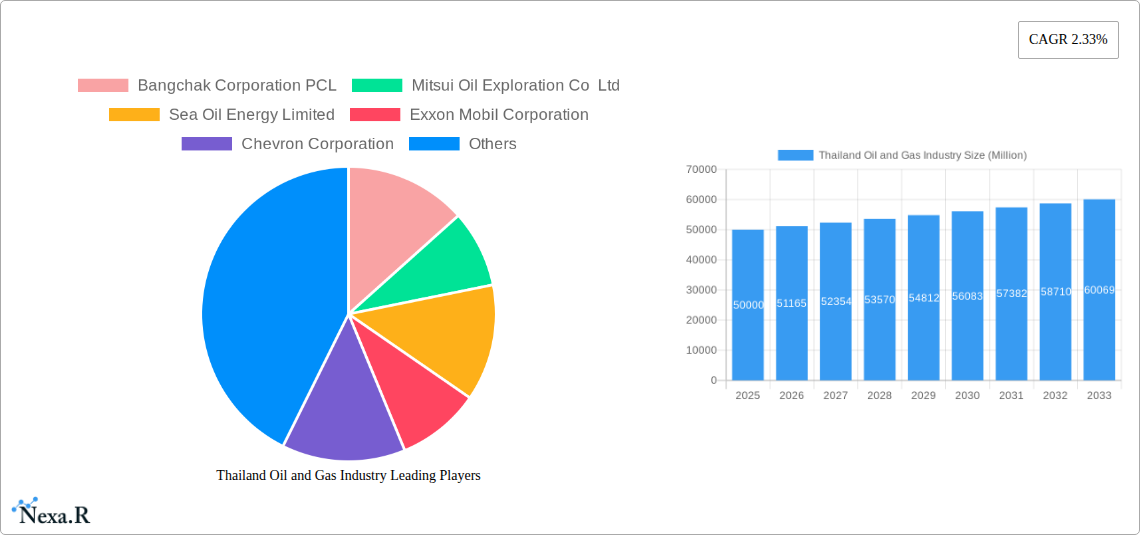

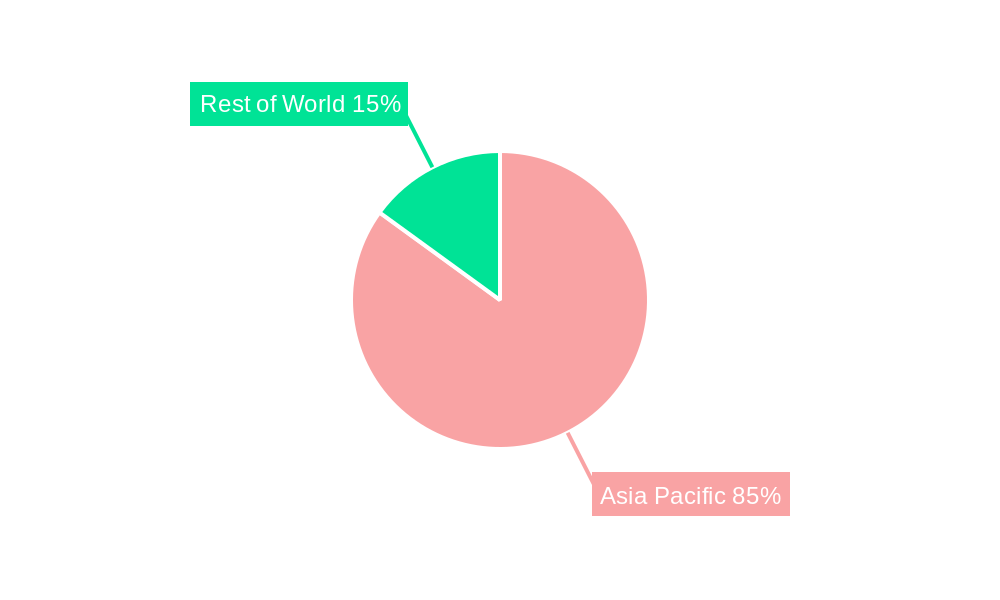

The Thailand oil and gas industry, while exhibiting a moderate Compound Annual Growth Rate (CAGR) of 2.33%, presents a complex market landscape shaped by diverse factors. The market size, although not explicitly stated, can be reasonably estimated based on regional trends and the presence of major international and national players like PTT Public Company Limited, Exxon Mobil Corporation, and Chevron Corporation. Given the significant industrial and transportation sectors in Thailand, a considerable portion of the market is likely driven by domestic energy consumption. Upstream activities, focusing on exploration and production, are influenced by global oil prices and government regulations regarding resource extraction. Midstream operations, encompassing refining and transportation, are key to ensuring energy security and meeting domestic demand. Downstream activities, primarily involving distribution and retail, are highly competitive, with both international and local companies vying for market share. Growth is propelled by increasing industrialization, infrastructure development (particularly transportation), and Thailand's role within regional energy trade. However, the industry faces constraints including fluctuating global oil prices, environmental concerns pushing for renewable energy adoption, and potential geopolitical instability impacting supply chains. Segmentation analysis reveals a strong concentration within the industrial and transportation sectors, highlighting the dependence of these key economic drivers on oil and gas. The Asia-Pacific region, particularly China, Japan, India, and South Korea, exerts considerable influence due to their energy needs and trade relationships with Thailand. The forecast period of 2025-2033 suggests continued growth, albeit at a moderate pace, potentially influenced by government policies promoting energy diversification and sustainability.

The competitive landscape is characterized by a mix of international energy giants and established domestic players. This blend contributes to both investment in exploration and production and efficient distribution networks within the country. Future growth hinges on successful navigation of environmental regulations, investments in cleaner energy technologies, and the ongoing need for reliable energy sources to support Thailand's economic development. The industry's capacity to adapt to evolving global energy dynamics and embrace sustainable practices will determine its long-term trajectory and overall contribution to Thailand's economic growth. Specific regional analyses, within the Asia-Pacific context, would offer even more granular insights into the market's potential and challenges.

Thailand Oil and Gas Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Thailand oil and gas industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is essential for industry professionals, investors, and strategic planners seeking to understand and capitalize on the opportunities within this dynamic sector. The report segments the market by Type (Upstream, Midstream, Downstream) and End User (Industrial sector, Transportation sector).

Thailand Oil and Gas Industry Market Dynamics & Structure

This section analyzes the competitive landscape of the Thai oil and gas market, examining market concentration, technological advancements, regulatory influences, and the impact of substitute products. The analysis incorporates quantitative data on market share and M&A activity, complemented by qualitative assessments of innovation barriers and other influencing factors.

- Market Concentration: The Thai oil and gas industry exhibits a moderately concentrated structure, with key players like PTT Public Company Limited holding significant market share. However, the presence of international giants like Chevron and Shell adds to the complexity of the competitive dynamics. The market share of PTT is estimated at xx% in 2025.

- Technological Innovation: The industry is witnessing continuous technological upgrades, particularly in exploration techniques and refining processes. However, barriers such as high capital investment and technological dependence on global players hinder rapid innovation.

- Regulatory Framework: Thailand's regulatory environment is constantly evolving, impacting investment decisions and operational strategies. Recent amendments to PSCs (Production Sharing Contracts) are examples of this evolution.

- Competitive Substitutes: The growth of renewable energy sources presents a significant challenge to the dominance of oil and gas, necessitating strategic adaptation from industry participants. The impact of renewable energy is predicted to reduce the overall oil and gas demand by xx% by 2033.

- End-User Demographics: The industrial and transportation sectors are the primary end-users, with demand patterns heavily influenced by economic activity and government policies. The industrial sector accounts for approximately xx% of the total demand.

- M&A Trends: The industry has seen a moderate level of M&A activity in recent years, primarily driven by strategic consolidation and expansion efforts. The total value of M&A deals in the last five years is estimated at xx Million.

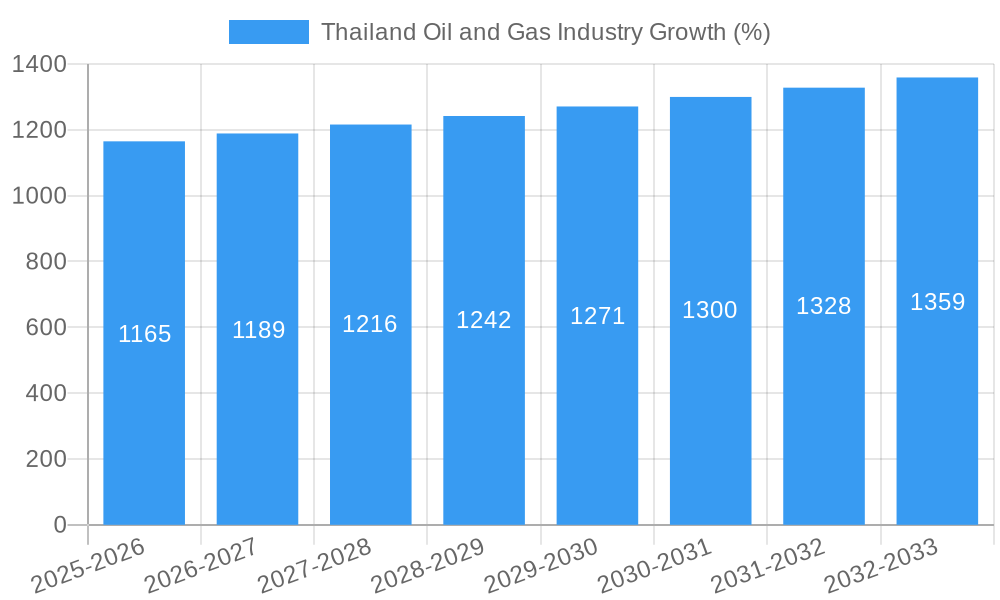

Thailand Oil and Gas Industry Growth Trends & Insights

This section provides a detailed analysis of the growth trajectory of the Thailand oil and gas industry, leveraging historical data and future projections. We will examine market size evolution, adoption rates of new technologies, and changes in consumer behavior that influence overall demand. The analysis will include key metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates.

The Thai oil and gas market experienced a CAGR of xx% during the historical period (2019-2024). This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), driven by factors such as increased energy demand and infrastructure development. However, the transition towards renewable energy sources is expected to moderate this growth rate in the later years of the forecast period. Market penetration of LNG is predicted to increase to xx% by 2033. The shift in consumer behavior toward greater energy efficiency will also influence the overall growth of the market.

Dominant Regions, Countries, or Segments in Thailand Oil and Gas Industry

This section identifies the leading regions, countries, or segments within the Thai oil and gas market, focusing on the factors driving their growth.

- Upstream Segment Dominance: The upstream segment, encompassing exploration and production, is anticipated to remain a dominant driver of market growth due to ongoing investment in offshore exploration and the development of new oil and gas fields. Government incentives and exploration successes will propel its continued dominance.

- Key Drivers:

- Favorable Government Policies: Supportive regulatory frameworks and attractive PSCs stimulate investment.

- Robust Infrastructure: Existing infrastructure facilitates exploration, production, and transportation.

- Strategic Investments: Significant investments by both domestic and international companies in exploration and production activities boost growth.

The Upstream segment is projected to contribute xx% to the overall market value in 2025, exhibiting a strong growth potential due to the factors mentioned above. The Downstream segment, though important, is anticipated to experience a slower growth rate compared to the Upstream sector due to factors such as increased competition and the rising adoption of renewable energy sources.

Thailand Oil and Gas Industry Product Landscape

The Thai oil and gas industry's product landscape includes a range of refined petroleum products, natural gas, and petrochemicals. Recent innovations include advancements in refining techniques to produce higher-quality fuels and the development of biofuels to diversify the energy mix. These innovations aim to enhance efficiency, reduce emissions, and meet evolving environmental regulations.

Key Drivers, Barriers & Challenges in Thailand Oil and Gas Industry

Key Drivers: Increased energy demand driven by economic growth; government initiatives to improve energy security; investments in infrastructure development; technological advancements in exploration and production.

Key Challenges: Dependence on global oil prices; environmental concerns and pressure to transition to cleaner energy sources; competition from renewable energy; regulatory uncertainties; potential supply chain disruptions. The impact of price volatility on profitability is estimated at xx% annually.

Emerging Opportunities in Thailand Oil and Gas Industry

Emerging opportunities include increased investment in renewable energy integration within the oil and gas infrastructure, the development of gas-to-power projects to address electricity demands, and exploration of unconventional resources like shale gas. Furthermore, opportunities exist in the expansion of the petrochemical industry and the development of biofuels.

Growth Accelerators in the Thailand Oil and Gas Industry Industry

Long-term growth will be driven by continued infrastructure investments, the implementation of innovative technologies in exploration and production, strategic partnerships between domestic and international players, and expansion into new market segments. Government policies promoting energy security and diversification will further accelerate growth.

Key Players Shaping the Thailand Oil and Gas Industry Market

- Bangchak Corporation PCL

- Mitsui Oil Exploration Co Ltd

- Sea Oil Energy Limited

- Exxon Mobil Corporation

- Chevron Corporation

- Pan Orient Energy (Siam) Ltd

- TotalEnergies SE

- Royal Dutch Shell PLC

- MedcoEnergi

- PTT Public Company Limited

Notable Milestones in Thailand Oil and Gas Industry Sector

- June 2023: PTTEP and Domestic Production Asset Group signed PSCs for Block G1/65 and Block G3/65, signifying expansion in offshore exploration.

- May 2023: PTT planned to import 6 million tonnes of LNG, reflecting rising domestic demand.

- May 2022: PTTEP shifted Oman crude production to Thai refineries, boosting domestic refining activity.

In-Depth Thailand Oil and Gas Industry Market Outlook

The future of the Thai oil and gas industry presents significant opportunities for growth, driven by sustained energy demand and strategic investments in infrastructure and technology. The industry's ability to adapt to the evolving energy landscape and embrace cleaner energy solutions will be key to realizing its long-term potential. The market is expected to maintain a steady growth trajectory, albeit at a moderated pace compared to the historical period, due to the increasing penetration of renewable energy sources. Strategic partnerships and technological advancements are critical factors for success in the coming years.

Thailand Oil and Gas Industry Segmentation

- 1. Upstream

- 2. Midstream

- 3. Downstream

Thailand Oil and Gas Industry Segmentation By Geography

- 1. Thailand

Thailand Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding the Asia's Largest Downstream Sector4.; Energy Transition from Coal to Natural Gas

- 3.3. Market Restrains

- 3.3.1. Government Policies to Shift Towards Cleaner Fuels

- 3.4. Market Trends

- 3.4.1. Downstream Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. China Thailand Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Thailand Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Thailand Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Thailand Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Thailand Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Thailand Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Thailand Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Bangchak Corporation PCL

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Mitsui Oil Exploration Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sea Oil Energy Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Exxon Mobil Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Chevron Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Pan Orient Energy (Siam) Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 TotalEnergies SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Royal Dutch Shell PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 MedcoEnergi

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 PTT Public Company Limited

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Bangchak Corporation PCL

List of Figures

- Figure 1: Thailand Oil and Gas Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Oil and Gas Industry Share (%) by Company 2024

List of Tables

- Table 1: Thailand Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Oil and Gas Industry Volume Thousand Forecast, by Region 2019 & 2032

- Table 3: Thailand Oil and Gas Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 4: Thailand Oil and Gas Industry Volume Thousand Forecast, by Upstream 2019 & 2032

- Table 5: Thailand Oil and Gas Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 6: Thailand Oil and Gas Industry Volume Thousand Forecast, by Midstream 2019 & 2032

- Table 7: Thailand Oil and Gas Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 8: Thailand Oil and Gas Industry Volume Thousand Forecast, by Downstream 2019 & 2032

- Table 9: Thailand Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Thailand Oil and Gas Industry Volume Thousand Forecast, by Region 2019 & 2032

- Table 11: Thailand Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Thailand Oil and Gas Industry Volume Thousand Forecast, by Country 2019 & 2032

- Table 13: China Thailand Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Thailand Oil and Gas Industry Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 15: Japan Thailand Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Thailand Oil and Gas Industry Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 17: India Thailand Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Thailand Oil and Gas Industry Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 19: South Korea Thailand Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Thailand Oil and Gas Industry Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 21: Taiwan Thailand Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Taiwan Thailand Oil and Gas Industry Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 23: Australia Thailand Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Thailand Oil and Gas Industry Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia-Pacific Thailand Oil and Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Asia-Pacific Thailand Oil and Gas Industry Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 27: Thailand Oil and Gas Industry Revenue Million Forecast, by Upstream 2019 & 2032

- Table 28: Thailand Oil and Gas Industry Volume Thousand Forecast, by Upstream 2019 & 2032

- Table 29: Thailand Oil and Gas Industry Revenue Million Forecast, by Midstream 2019 & 2032

- Table 30: Thailand Oil and Gas Industry Volume Thousand Forecast, by Midstream 2019 & 2032

- Table 31: Thailand Oil and Gas Industry Revenue Million Forecast, by Downstream 2019 & 2032

- Table 32: Thailand Oil and Gas Industry Volume Thousand Forecast, by Downstream 2019 & 2032

- Table 33: Thailand Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Thailand Oil and Gas Industry Volume Thousand Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Oil and Gas Industry?

The projected CAGR is approximately 2.33%.

2. Which companies are prominent players in the Thailand Oil and Gas Industry?

Key companies in the market include Bangchak Corporation PCL, Mitsui Oil Exploration Co Ltd, Sea Oil Energy Limited, Exxon Mobil Corporation, Chevron Corporation, Pan Orient Energy (Siam) Ltd, TotalEnergies SE, Royal Dutch Shell PLC, MedcoEnergi, PTT Public Company Limited.

3. What are the main segments of the Thailand Oil and Gas Industry?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding the Asia's Largest Downstream Sector4.; Energy Transition from Coal to Natural Gas.

6. What are the notable trends driving market growth?

Downstream Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Government Policies to Shift Towards Cleaner Fuels.

8. Can you provide examples of recent developments in the market?

June 2023: PTT Exploration and Production Public Company Limited (PTTEP) and Domestic Production Asset Group signed Production Sharing Contracts (PSCs) for Block G1/65 and Block G3/65 with the Minister of Energy. PTTEP was awarded the two offshore blocks in the 24th Thailand Petroleum Bidding Round.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Thailand Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence