Key Insights

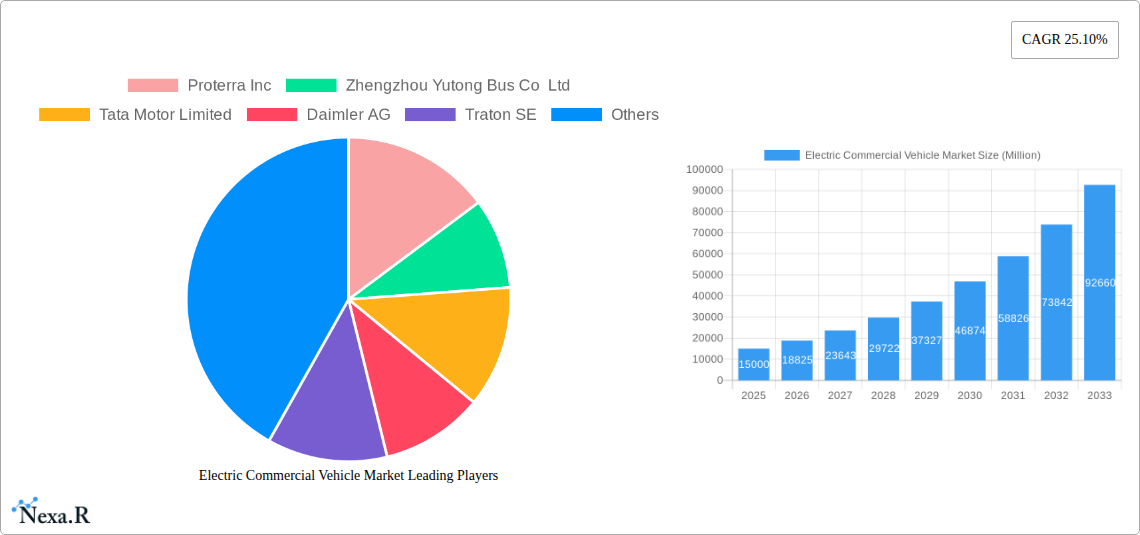

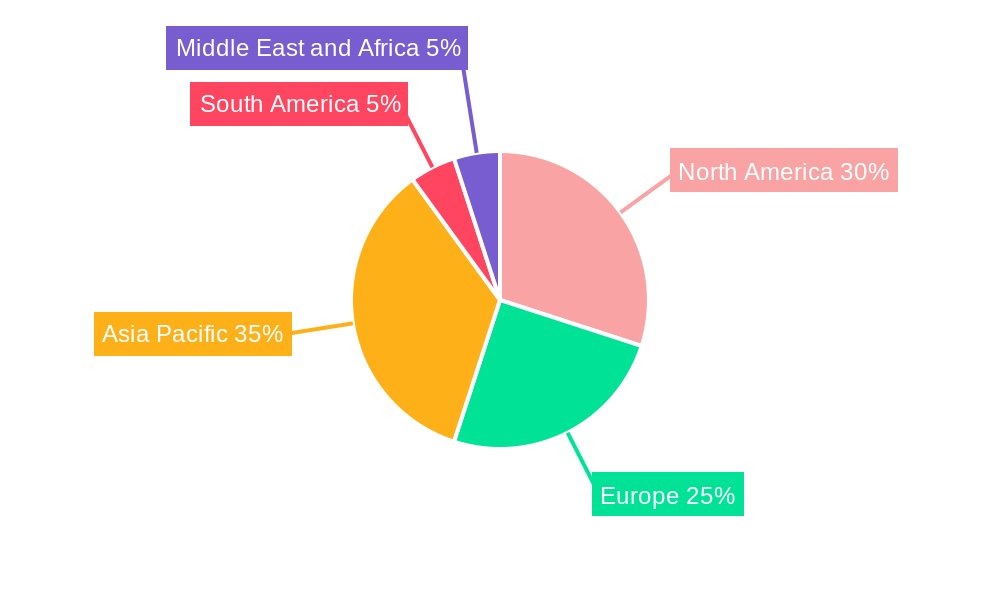

The electric commercial vehicle (ECV) market is experiencing explosive growth, driven by stringent emission regulations, increasing fuel costs, and the push for sustainable transportation solutions. A 25.10% CAGR indicates a significant expansion, transforming the logistics and transportation landscape. The market segmentation reveals diverse opportunities across vehicle types (buses, trucks, pick-up trucks, vans), propulsion systems (battery electric, plug-in hybrid, fuel cell), and power output ranges. The dominance of specific vehicle types varies regionally; for example, buses might hold a larger share in densely populated urban areas, while long-haul trucks are crucial in regions with extensive highway networks. Technological advancements in battery technology, charging infrastructure, and vehicle design are key drivers, continually improving range, efficiency, and payload capacity, thereby addressing concerns around operational practicality. Furthermore, government incentives, including subsidies and tax breaks, are accelerating market adoption. However, challenges remain, including high initial vehicle costs, limited charging infrastructure availability in certain regions, and concerns about battery lifespan and charging times. Major players like Proterra, BYD Auto, and Tesla are at the forefront of innovation, competing intensely to capture market share. Regional variations are significant, with North America and Europe leading in early adoption due to established infrastructure and supportive policies, while the Asia-Pacific region is poised for rapid growth, fueled by substantial government investments and a burgeoning e-commerce sector.

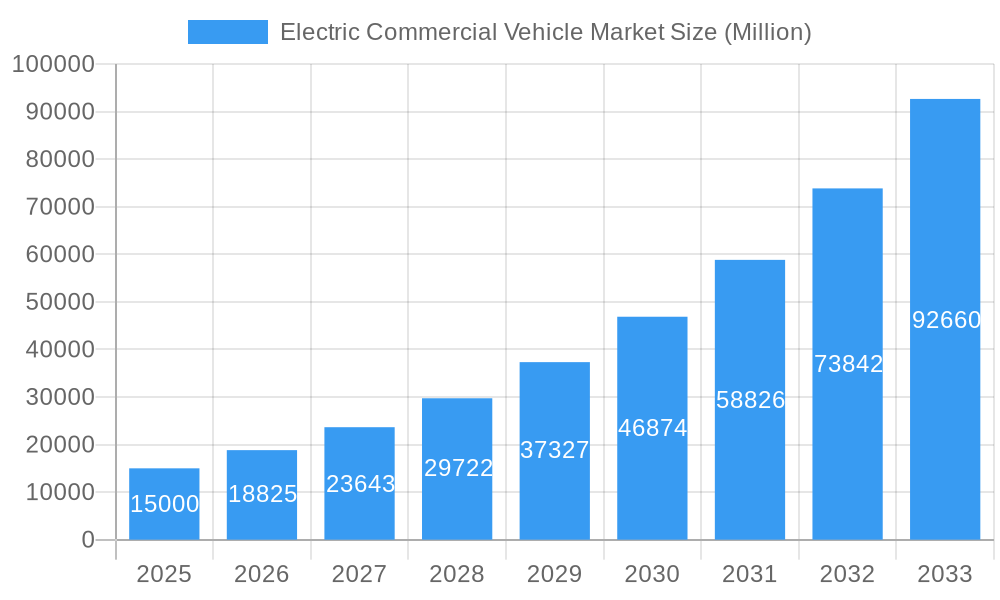

Electric Commercial Vehicle Market Market Size (In Billion)

The forecast period (2025-2033) promises sustained growth, particularly in developing economies where the adoption of ECVs contributes to improved air quality and reduced carbon emissions. While the initial investment for ECVs is higher compared to conventional vehicles, the long-term total cost of ownership, considering reduced fuel and maintenance expenses, presents a compelling value proposition for businesses. The market will likely see increased focus on battery swapping technologies, advanced charging solutions, and the development of purpose-built ECVs catering to specific industry needs, such as last-mile delivery and heavy-duty transportation. Continued research and development will likely focus on enhancing battery technology to extend range and reduce charging time, further increasing the appeal and practicality of ECVs for diverse applications and geographies.

Electric Commercial Vehicle Market Company Market Share

Electric Commercial Vehicle Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Electric Commercial Vehicle (ECV) market, encompassing its current dynamics, future trends, and key players. The study covers the parent market of commercial vehicles and the child markets of electric buses, trucks, pickup trucks, and vans, offering granular insights for businesses and investors. The report uses 2025 as the base year and projects the market up to 2033, analyzing historical data from 2019-2024. Market size is presented in million units.

Electric Commercial Vehicle Market Dynamics & Structure

The ECV market is experiencing significant growth driven by stringent emission regulations, increasing fuel costs, and advancements in battery technology. Market concentration is moderately high, with a few major players dominating, but a substantial number of emerging companies are also vying for market share. The report analyses the competitive landscape, including mergers and acquisitions (M&A) activities, which are expected to continue increasing in the forecast period, consolidating the market.

- Market Concentration: xx% of the market is controlled by the top 5 players in 2025.

- Technological Innovation: Rapid advancements in battery technology, charging infrastructure, and autonomous driving capabilities are key drivers. Barriers to innovation include high R&D costs and the need for robust charging infrastructure.

- Regulatory Framework: Government regulations promoting electric vehicle adoption, including subsidies and emission standards, significantly influence market growth.

- Competitive Substitutes: Conventional fuel-powered commercial vehicles remain a major competitor, but their dominance is progressively challenged by the ECV's cost-effectiveness and environmental benefits.

- End-User Demographics: Key end-users include logistics companies, delivery services, public transportation agencies, and construction firms. Their adoption rate varies depending on vehicle type and operational requirements.

- M&A Trends: The number of M&A deals in the ECV sector is expected to reach xx in 2033, driven by the need for strategic partnerships and technological integration.

Electric Commercial Vehicle Market Growth Trends & Insights

The global ECV market is exhibiting robust growth, projected to reach xx million units by 2033, with a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the increasing adoption of electric vehicles across various segments, governmental support through various incentives, and technological advancements that continuously improve battery range and charging times. The shift towards sustainability and a growing awareness of environmental concerns are also driving the market's trajectory. Consumer behavior is shifting towards eco-friendly options, particularly among businesses looking to reduce their carbon footprint and improve their brand image. Technological disruptions, such as the integration of autonomous driving and advanced driver-assistance systems (ADAS), are further accelerating market penetration. The report dives into regional variations in adoption rates and identifies key factors influencing market size evolution in each region. Market penetration is expected to reach xx% by 2033, showcasing substantial market expansion.

Dominant Regions, Countries, or Segments in Electric Commercial Vehicle Market

North America and Europe are currently the dominant regions for ECVs, driven by strong government support and well-established charging infrastructure. However, Asia-Pacific is expected to experience significant growth in the coming years due to increasing urbanization, rising disposable incomes, and government initiatives promoting electric vehicle adoption.

- By Vehicle Type: Trucks currently hold the largest market share, followed by buses and vans. Pickup trucks are a growing segment with significant potential.

- By Propulsion: Battery Electric Vehicles (BEVs) dominate the market, while Plug-in Hybrid Electric Vehicles (PHEVs) and Fuel Cell Electric Vehicles (FCEVs) are still in the early stages of development and adoption.

- By Power Output: The segment of 150-250 Kw is leading the market currently, with Above 250 Kw segment expected to witness faster growth in the forecast period.

Key growth drivers include:

- Stringent emission regulations: Governments worldwide are implementing increasingly stringent emission standards, forcing businesses to adopt cleaner transportation solutions.

- Government incentives: Subsidies, tax breaks, and other incentives are making electric commercial vehicles more affordable and attractive.

- Improving battery technology: Advancements in battery technology are leading to longer ranges and faster charging times.

- Developing charging infrastructure: The expansion of charging infrastructure is addressing range anxiety and making electric vehicles more practical for commercial use.

Electric Commercial Vehicle Market Product Landscape

The ECV market features a diverse range of vehicles tailored to specific applications, offering varying payload capacities, ranges, and charging capabilities. Technological advancements focus on enhancing battery efficiency, extending range, optimizing charging times, and integrating advanced driver-assistance systems (ADAS) and autonomous driving features. Key selling propositions include reduced operating costs, lower emissions, and improved driver comfort.

Key Drivers, Barriers & Challenges in Electric Commercial Vehicle Market

Key Drivers:

- Government regulations and incentives.

- Rising fuel prices and environmental concerns.

- Technological advancements in battery technology and charging infrastructure.

Key Challenges:

- High upfront cost of electric commercial vehicles.

- Limited range and charging infrastructure.

- Long charging times compared to refueling.

- Supply chain disruptions impacting battery production and vehicle manufacturing. (Quantifiable impact: xx% decrease in production in 2022)

Emerging Opportunities in Electric Commercial Vehicle Market

- Untapped markets in developing economies.

- Growth in last-mile delivery applications.

- Integration of electric vehicles into smart city initiatives.

- Expansion of charging infrastructure.

Growth Accelerators in the Electric Commercial Vehicle Market Industry

Strategic partnerships between automotive manufacturers and technology companies are driving innovation and accelerating market expansion. Technological breakthroughs, such as solid-state batteries and wireless charging, will further enhance the appeal of electric commercial vehicles. Continued governmental support, including investments in charging infrastructure and favorable policies, is crucial for sustained long-term growth.

Key Players Shaping the Electric Commercial Vehicle Market Market

- Proterra Inc

- Zhengzhou Yutong Bus Co Ltd

- Tata Motor Limited

- Daimler AG

- Traton SE

- Tesla Inc

- BYD Auto Co Ltd

- Olectra Greentech Limite

- Rivian

- AB Volvo

- Ford Motor Company

Notable Milestones in Electric Commercial Vehicle Market Sector

- October 2022: GMC unveiled the first-ever Sierra EV pickup truck, offering 400 miles of range.

- December 2022: Mercedes-Benz announced a new all-electric van production plant in Poland.

- December 2022: Mercedes-Benz and Rivian partnered to jointly produce electric vans.

- June 2023: Volkswagen Commercial Vehicles launched autonomous driving testing for its all-electric Volkswagen ID.

In-Depth Electric Commercial Vehicle Market Market Outlook

The future of the ECV market is bright, driven by technological advancements, supportive government policies, and growing environmental awareness. The market is poised for significant expansion, with substantial opportunities for innovation and market entry. Strategic partnerships and investments in infrastructure will be crucial in unlocking the full potential of this rapidly growing sector.

Electric Commercial Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Bus

- 1.2. Trucks

- 1.3. Pick-up Trucks

- 1.4. Vans

-

2. Propulsion

- 2.1. Battery Electric Vehicles

- 2.2. Plug-in Hybrid Electric Vehicles

- 2.3. Fuel Cell Electric Vehicles

-

3. Power Output

- 3.1. Less than 150 kW

- 3.2. 150-250 kW

- 3.3. Above 250 kW

Electric Commercial Vehicle Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Electric Commercial Vehicle Market Regional Market Share

Geographic Coverage of Electric Commercial Vehicle Market

Electric Commercial Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 28.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Emission Regulations are Fueling the Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Electric Commercial Vehicle May Hamper the Growth

- 3.4. Market Trends

- 3.4.1. Stringent Emission Regulations are Fueling the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Commercial Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Bus

- 5.1.2. Trucks

- 5.1.3. Pick-up Trucks

- 5.1.4. Vans

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. Battery Electric Vehicles

- 5.2.2. Plug-in Hybrid Electric Vehicles

- 5.2.3. Fuel Cell Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Power Output

- 5.3.1. Less than 150 kW

- 5.3.2. 150-250 kW

- 5.3.3. Above 250 kW

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Electric Commercial Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Bus

- 6.1.2. Trucks

- 6.1.3. Pick-up Trucks

- 6.1.4. Vans

- 6.2. Market Analysis, Insights and Forecast - by Propulsion

- 6.2.1. Battery Electric Vehicles

- 6.2.2. Plug-in Hybrid Electric Vehicles

- 6.2.3. Fuel Cell Electric Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Power Output

- 6.3.1. Less than 150 kW

- 6.3.2. 150-250 kW

- 6.3.3. Above 250 kW

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Electric Commercial Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Bus

- 7.1.2. Trucks

- 7.1.3. Pick-up Trucks

- 7.1.4. Vans

- 7.2. Market Analysis, Insights and Forecast - by Propulsion

- 7.2.1. Battery Electric Vehicles

- 7.2.2. Plug-in Hybrid Electric Vehicles

- 7.2.3. Fuel Cell Electric Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Power Output

- 7.3.1. Less than 150 kW

- 7.3.2. 150-250 kW

- 7.3.3. Above 250 kW

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Electric Commercial Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Bus

- 8.1.2. Trucks

- 8.1.3. Pick-up Trucks

- 8.1.4. Vans

- 8.2. Market Analysis, Insights and Forecast - by Propulsion

- 8.2.1. Battery Electric Vehicles

- 8.2.2. Plug-in Hybrid Electric Vehicles

- 8.2.3. Fuel Cell Electric Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Power Output

- 8.3.1. Less than 150 kW

- 8.3.2. 150-250 kW

- 8.3.3. Above 250 kW

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. South America Electric Commercial Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Bus

- 9.1.2. Trucks

- 9.1.3. Pick-up Trucks

- 9.1.4. Vans

- 9.2. Market Analysis, Insights and Forecast - by Propulsion

- 9.2.1. Battery Electric Vehicles

- 9.2.2. Plug-in Hybrid Electric Vehicles

- 9.2.3. Fuel Cell Electric Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Power Output

- 9.3.1. Less than 150 kW

- 9.3.2. 150-250 kW

- 9.3.3. Above 250 kW

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Middle East and Africa Electric Commercial Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Bus

- 10.1.2. Trucks

- 10.1.3. Pick-up Trucks

- 10.1.4. Vans

- 10.2. Market Analysis, Insights and Forecast - by Propulsion

- 10.2.1. Battery Electric Vehicles

- 10.2.2. Plug-in Hybrid Electric Vehicles

- 10.2.3. Fuel Cell Electric Vehicles

- 10.3. Market Analysis, Insights and Forecast - by Power Output

- 10.3.1. Less than 150 kW

- 10.3.2. 150-250 kW

- 10.3.3. Above 250 kW

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Proterra Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zhengzhou Yutong Bus Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tata Motor Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Daimler AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Traton SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tesla Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BYD Auto Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Olectra Greentech Limite

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rivian

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AB Volvo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ford Motor Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Proterra Inc

List of Figures

- Figure 1: Global Electric Commercial Vehicle Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Electric Commercial Vehicle Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 3: North America Electric Commercial Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Electric Commercial Vehicle Market Revenue (undefined), by Propulsion 2025 & 2033

- Figure 5: North America Electric Commercial Vehicle Market Revenue Share (%), by Propulsion 2025 & 2033

- Figure 6: North America Electric Commercial Vehicle Market Revenue (undefined), by Power Output 2025 & 2033

- Figure 7: North America Electric Commercial Vehicle Market Revenue Share (%), by Power Output 2025 & 2033

- Figure 8: North America Electric Commercial Vehicle Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Electric Commercial Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Electric Commercial Vehicle Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 11: Europe Electric Commercial Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Electric Commercial Vehicle Market Revenue (undefined), by Propulsion 2025 & 2033

- Figure 13: Europe Electric Commercial Vehicle Market Revenue Share (%), by Propulsion 2025 & 2033

- Figure 14: Europe Electric Commercial Vehicle Market Revenue (undefined), by Power Output 2025 & 2033

- Figure 15: Europe Electric Commercial Vehicle Market Revenue Share (%), by Power Output 2025 & 2033

- Figure 16: Europe Electric Commercial Vehicle Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Electric Commercial Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Electric Commercial Vehicle Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Electric Commercial Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Electric Commercial Vehicle Market Revenue (undefined), by Propulsion 2025 & 2033

- Figure 21: Asia Pacific Electric Commercial Vehicle Market Revenue Share (%), by Propulsion 2025 & 2033

- Figure 22: Asia Pacific Electric Commercial Vehicle Market Revenue (undefined), by Power Output 2025 & 2033

- Figure 23: Asia Pacific Electric Commercial Vehicle Market Revenue Share (%), by Power Output 2025 & 2033

- Figure 24: Asia Pacific Electric Commercial Vehicle Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Electric Commercial Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Electric Commercial Vehicle Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 27: South America Electric Commercial Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: South America Electric Commercial Vehicle Market Revenue (undefined), by Propulsion 2025 & 2033

- Figure 29: South America Electric Commercial Vehicle Market Revenue Share (%), by Propulsion 2025 & 2033

- Figure 30: South America Electric Commercial Vehicle Market Revenue (undefined), by Power Output 2025 & 2033

- Figure 31: South America Electric Commercial Vehicle Market Revenue Share (%), by Power Output 2025 & 2033

- Figure 32: South America Electric Commercial Vehicle Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America Electric Commercial Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Electric Commercial Vehicle Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 35: Middle East and Africa Electric Commercial Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Middle East and Africa Electric Commercial Vehicle Market Revenue (undefined), by Propulsion 2025 & 2033

- Figure 37: Middle East and Africa Electric Commercial Vehicle Market Revenue Share (%), by Propulsion 2025 & 2033

- Figure 38: Middle East and Africa Electric Commercial Vehicle Market Revenue (undefined), by Power Output 2025 & 2033

- Figure 39: Middle East and Africa Electric Commercial Vehicle Market Revenue Share (%), by Power Output 2025 & 2033

- Figure 40: Middle East and Africa Electric Commercial Vehicle Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Electric Commercial Vehicle Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Propulsion 2020 & 2033

- Table 3: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Power Output 2020 & 2033

- Table 4: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Propulsion 2020 & 2033

- Table 7: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Power Output 2020 & 2033

- Table 8: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Propulsion 2020 & 2033

- Table 14: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Power Output 2020 & 2033

- Table 15: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Propulsion 2020 & 2033

- Table 24: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Power Output 2020 & 2033

- Table 25: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: India Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: China Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Japan Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: South Korea Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Propulsion 2020 & 2033

- Table 33: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Power Output 2020 & 2033

- Table 34: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Brazil Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Argentina Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of South America Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 39: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Propulsion 2020 & 2033

- Table 40: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Power Output 2020 & 2033

- Table 41: Global Electric Commercial Vehicle Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: United Arab Emirates Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Saudi Arabia Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Africa Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of Middle East and Africa Electric Commercial Vehicle Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Commercial Vehicle Market?

The projected CAGR is approximately 28.8%.

2. Which companies are prominent players in the Electric Commercial Vehicle Market?

Key companies in the market include Proterra Inc, Zhengzhou Yutong Bus Co Ltd, Tata Motor Limited, Daimler AG, Traton SE, Tesla Inc, BYD Auto Co Ltd, Olectra Greentech Limite, Rivian, AB Volvo, Ford Motor Company.

3. What are the main segments of the Electric Commercial Vehicle Market?

The market segments include Vehicle Type, Propulsion, Power Output.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Stringent Emission Regulations are Fueling the Market Growth.

6. What are the notable trends driving market growth?

Stringent Emission Regulations are Fueling the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Electric Commercial Vehicle May Hamper the Growth.

8. Can you provide examples of recent developments in the market?

June 2023: Volkswagen Commercial Vehicles is expected to conduct autonomous driving testing using the self-driving all-electric Volkswagen ID. The testing program has already been launched in Texas, United States, at Volkswagen Group of America (VWGoA) alongside European centers. The company's aim is to expand commercially available transport services and the Volkswagen Group's mobility options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Commercial Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Commercial Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Commercial Vehicle Market?

To stay informed about further developments, trends, and reports in the Electric Commercial Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence