Key Insights

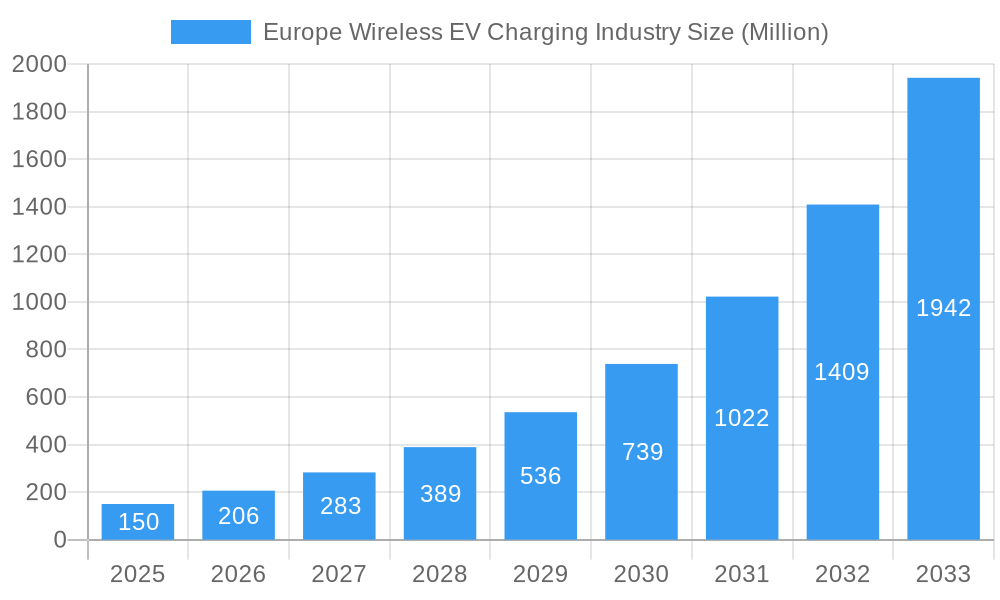

The European wireless electric vehicle (EV) charging market is experiencing substantial growth, propelled by increasing EV adoption, stringent emission regulations, and the inherent convenience of wireless charging solutions. With a projected Compound Annual Growth Rate (CAGR) of 18.3%, the market is expected to reach 1.87 billion by 2024. This expansion is driven by technological advancements enhancing efficiency and power transfer, coupled with decreasing costs. Leading automotive manufacturers and dedicated wireless charging companies are actively investing in research and development, further stimulating market growth. The market is segmented by country, with Germany, the United Kingdom, and France as key markets. Battery Electric Vehicles (BEVs) currently dominate this segment, though Plug-in Hybrid Vehicles (PHEVs) are expected to see increased adoption of wireless charging. Challenges include the initial infrastructure cost and the need for standardization, but the long-term outlook remains highly positive, aligning with the global shift towards sustainable and convenient transportation.

Europe Wireless EV Charging Industry Market Size (In Billion)

The market's growth trajectory is set to accelerate, supported by government incentives promoting EV adoption and charging infrastructure development across Europe. Germany's robust automotive sector and early EV adoption position it as a primary market driver, followed by the UK and France. Other European nations are also demonstrating growing interest due to ambitious climate targets and rising consumer demand for cleaner transport. The competitive landscape is characterized by collaborations between established automotive firms and specialized wireless charging technology providers. Enhancements in charging efficiency, power output, and range are critical for widespread market acceptance. The development of robust standardization practices will be essential for interoperability and ease of implementation, thereby accelerating market growth. The focus will increasingly be on optimizing the cost-effectiveness and scalability of wireless charging infrastructure to ensure broad adoption across all EV segments.

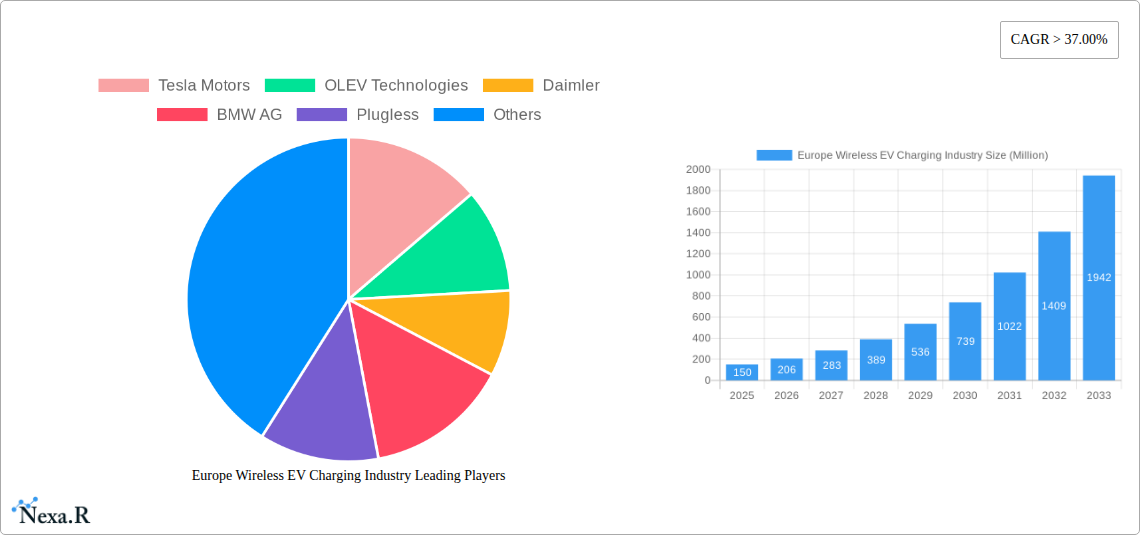

Europe Wireless EV Charging Industry Company Market Share

Europe Wireless EV Charging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Europe wireless EV charging market, encompassing market dynamics, growth trends, regional dominance, product landscape, challenges, opportunities, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the growth potential within this dynamic sector. The report analyzes the parent market of Electric Vehicle (EV) charging and the child market of Wireless EV charging, providing granular insights into market segmentation by country (Germany, United Kingdom, Italy, France, Spain, Rest of Europe) and vehicle type (Battery Electric Vehicle, Plug-in Hybrid Vehicle). The market size is presented in million units.

Europe Wireless EV Charging Industry Market Dynamics & Structure

This section delves into the intricate structure of the European wireless EV charging market, offering a 360-degree view of its dynamics. We analyze market concentration, revealing the market share held by key players like Tesla Motors, Daimler, and BMW AG. Technological innovation drivers, such as advancements in resonant inductive coupling and dynamic wireless charging, are meticulously examined. The report also investigates the impact of regulatory frameworks, the availability of competitive product substitutes (e.g., wired charging), and end-user demographics influencing market adoption. Furthermore, we analyze M&A trends, estimating the volume of deals in the historical period at xx and projecting xx for the forecast period, highlighting factors contributing to these activities.

- Market Concentration: Highly fragmented with xx% market share held by top 5 players in 2024, projected to consolidate slightly to xx% by 2033.

- Technological Innovation: Significant advancements in power transfer efficiency, range, and charging speed are driving market growth.

- Regulatory Landscape: Favorable government policies and incentives in several European countries are fostering market expansion.

- Competitive Landscape: Intense competition among established automakers and specialized wireless charging technology providers.

- M&A Activity: A significant increase in strategic partnerships and acquisitions is anticipated in the forecast period driven by the need for technology integration and market expansion.

- Innovation Barriers: High initial investment costs and the need for standardized infrastructure remain challenges.

Europe Wireless EV Charging Industry Growth Trends & Insights

This section provides a comprehensive analysis of the Europe wireless EV charging market's growth trajectory, leveraging extensive data and industry expertise. It meticulously traces the evolution of market size, quantifying the CAGR during the historical period at xx% and projecting a CAGR of xx% during the forecast period, reaching xx million units by 2033. The analysis deeply explores adoption rates across different segments, pinpointing the factors influencing consumer behavior and shifting preferences towards wireless charging. It also delves into the impact of technological disruptions, such as the introduction of dynamic wireless charging systems and improved charging efficiency, that are set to reshape the landscape. Market penetration will rise from xx% in 2024 to xx% in 2033, showcasing the burgeoning adoption of this technology.

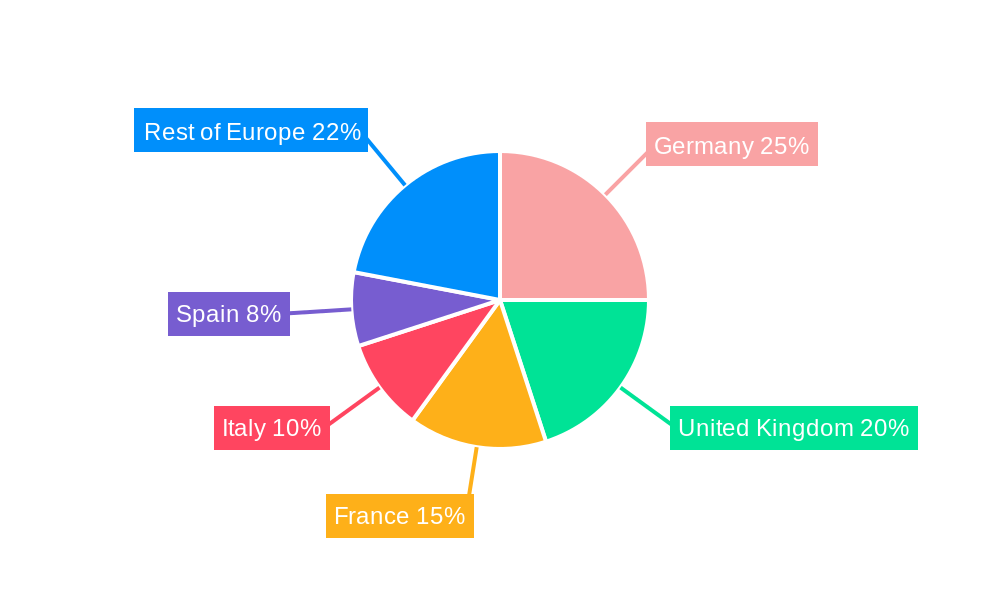

Dominant Regions, Countries, or Segments in Europe Wireless EV Charging Industry

This section pinpoints the leading regions, countries, and segments propelling the growth of the European wireless EV charging market. Germany, with its strong automotive industry and supportive government policies, is identified as a dominant region, followed by the United Kingdom and France. The report thoroughly analyzes the factors driving their market leadership, highlighting key drivers such as robust EV adoption rates, supportive government regulations, and the availability of supportive infrastructure. The analysis assesses the market share and growth potential of each region and segment, providing a granular understanding of the market's geographic distribution. The Battery Electric Vehicle (BEV) segment is expected to witness faster growth compared to Plug-in Hybrid Vehicles (PHEV) during the forecast period due to increasing BEV sales and longer charging times.

- Germany: Strong automotive industry, favorable government policies, and early adoption of EVs.

- United Kingdom: Growing EV infrastructure, supportive government initiatives, and increasing consumer awareness.

- France: Government investments in EV charging infrastructure and policies promoting electric mobility.

- BEV Segment: Higher growth potential due to increasing BEV sales and longer range requirements.

Europe Wireless EV Charging Industry Product Landscape

The European wireless EV charging market showcases a diverse product landscape featuring inductive and resonant charging systems. These systems vary in power output, charging speed, and range, catering to different EV types and user needs. Innovations focus on enhancing efficiency, maximizing power transfer, and integrating advanced features like automated parking and intelligent power management. Unique selling propositions (USPs) center around convenience, reduced charging time and environmental benefits. Technological advancements include higher power transfer efficiency and optimized coil designs to minimize charging times.

Key Drivers, Barriers & Challenges in Europe Wireless EV Charging Industry

Key Drivers:

- Growing EV Adoption: The rising popularity of electric vehicles is driving demand for convenient charging solutions.

- Government Incentives: Several European governments offer subsidies and tax breaks to encourage wireless charging infrastructure development.

- Technological Advancements: Improvements in efficiency, power transfer, and range are overcoming earlier limitations.

Key Challenges:

- High Initial Investment Costs: The expense of installing wireless charging infrastructure presents a significant barrier.

- Interoperability Issues: Lack of standardization across different wireless charging systems creates compatibility challenges.

- Regulatory Hurdles: Complex regulatory approvals and standards create delays in infrastructure deployment. This causes xx million units loss in projected sales by 2033.

Emerging Opportunities in Europe Wireless EV Charging Industry

Emerging opportunities include the expansion into commercial vehicle charging, integration with smart grids, and development of dynamic wireless charging roads. The untapped potential of public charging stations in underserved areas represents significant growth opportunities. Innovative applications such as wireless charging for e-buses and e-trucks also hold substantial promise.

Growth Accelerators in the Europe Wireless EV Charging Industry Industry

Technological breakthroughs in dynamic wireless charging and power transfer efficiency are pivotal growth accelerators. Strategic collaborations between automakers and charging infrastructure providers are crucial for market expansion. Market expansion strategies, such as focusing on underserved areas and developing cost-effective solutions, further boost industry growth.

Key Players Shaping the Europe Wireless EV Charging Industry Market

- Tesla Motors

- OLEV Technologies

- Daimler

- BMW AG

- Plugless

- Bombardier

- Nissan

- HEVO Power

- WiTricity

- Qualcomm

- Hella Aglaia Mobile Vision

- Toyota

Notable Milestones in Europe Wireless EV Charging Industry Sector

- June 2020: Jaguar partners with NorgesTaxi and Oslo to build wireless charging infrastructure for electric taxis.

- May 2020: HEVO plans US manufacturing of wireless EV chargers by 2024.

- March 2020: Electreon successfully tests dynamic wireless charging for a 40-ton truck in Sweden.

In-Depth Europe Wireless EV Charging Industry Market Outlook

The future of the European wireless EV charging market looks exceptionally promising, driven by accelerating EV adoption, continuous technological advancements, and supportive government policies. Strategic partnerships and innovations in dynamic wireless charging will unlock vast growth potential, leading to significant market expansion across various segments and geographies. The market is poised for substantial growth, presenting compelling opportunities for investors and industry players alike.

Europe Wireless EV Charging Industry Segmentation

-

1. Vehicle Type

- 1.1. Battery Electric Vehicle

- 1.2. Plug-in Hybrid Vehicle

Europe Wireless EV Charging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Wireless EV Charging Industry Regional Market Share

Geographic Coverage of Europe Wireless EV Charging Industry

Europe Wireless EV Charging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Sales of Electric Vehicles Aiding Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Installing Wireless Chargers

- 3.4. Market Trends

- 3.4.1. Increasing Sales of Electric Vehicles Driving the Wireless Charging Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Battery Electric Vehicle

- 5.1.2. Plug-in Hybrid Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tesla Motors

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OLEV Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daimler

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BMW AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Plugless

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bombardier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nissan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HEVO Powe

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 WiTricity

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Qualcomm

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hella Aglaia Mobile Vision

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Toyota

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Tesla Motors

List of Figures

- Figure 1: Europe Wireless EV Charging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Wireless EV Charging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Wireless EV Charging Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Wireless EV Charging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Wireless EV Charging Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Europe Wireless EV Charging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Wireless EV Charging Industry?

The projected CAGR is approximately 18.3%.

2. Which companies are prominent players in the Europe Wireless EV Charging Industry?

Key companies in the market include Tesla Motors, OLEV Technologies, Daimler, BMW AG, Plugless, Bombardier, Nissan, HEVO Powe, WiTricity, Qualcomm, Hella Aglaia Mobile Vision, Toyota.

3. What are the main segments of the Europe Wireless EV Charging Industry?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Sales of Electric Vehicles Aiding Market Growth.

6. What are the notable trends driving market growth?

Increasing Sales of Electric Vehicles Driving the Wireless Charging Demand.

7. Are there any restraints impacting market growth?

High Cost of Installing Wireless Chargers.

8. Can you provide examples of recent developments in the market?

In June 2020, Jaguar announced a collaboration with NorgesTaxi AS and the City of Oslo to build a wireless, high-powered charging infrastructure for electric taxis in the Norwegian capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Wireless EV Charging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Wireless EV Charging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Wireless EV Charging Industry?

To stay informed about further developments, trends, and reports in the Europe Wireless EV Charging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence