Key Insights

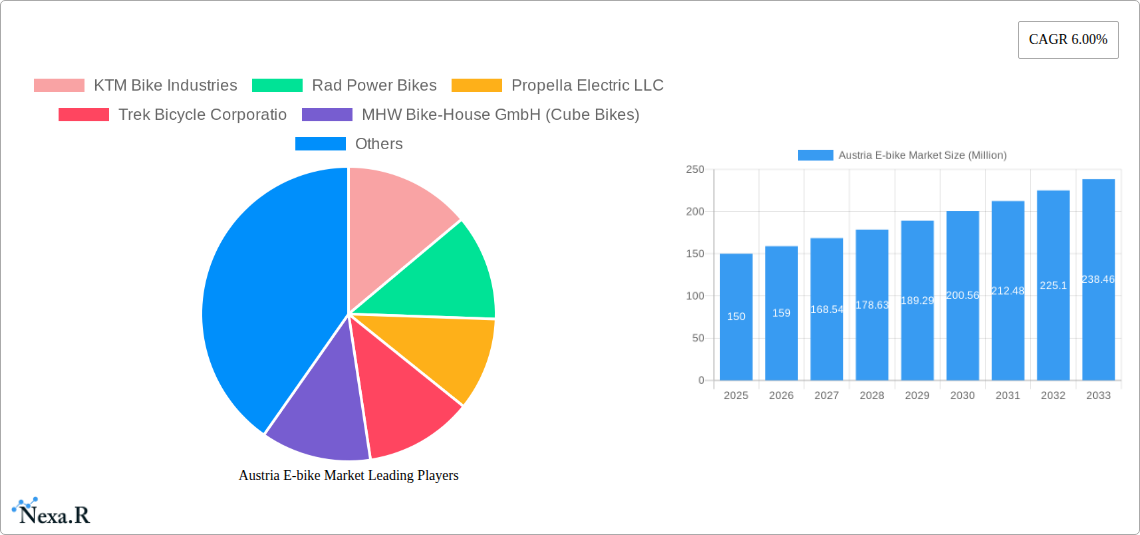

The Austrian e-bike market is projected for robust expansion, with a forecast CAGR of 12.4% from 2025 to 2033. The current market size stands at approximately $66.78 billion as of the base year 2024. This growth trajectory is propelled by escalating environmental consciousness and a growing preference for sustainable urban mobility solutions. Supportive government policies that champion cycling and e-mobility, alongside substantial enhancements in urban cycling infrastructure across Austria, are key demand drivers. The market's diversification across various e-bike types, including pedal-assist, throttle-assist, and specialized models for commuting, trekking, and cargo, further underpins its expansion. Innovations in battery technology, particularly the widespread adoption of high-performance lithium-ion batteries, are critical enablers. Key industry players such as KTM, Rad Power Bikes, and Trek, alongside prominent European manufacturers, are driving competition through continuous product innovation and sophisticated design, catering to evolving consumer expectations. Market segmentation by propulsion type, application, and battery technology reveals the market's intricate structure and advanced state.

Austria E-bike Market Market Size (In Billion)

The projected period from 2025 to 2033 anticipates sustained market growth, influenced by economic trends and technological breakthroughs. Ongoing investments in e-bike infrastructure and advancements in battery technology, enhancing range and performance, are expected to maintain this positive momentum. Potential challenges include the volatility of raw material costs and competition from alternative transport modes. Nevertheless, the Austrian e-bike market outlook remains highly favorable, buoyed by its intrinsic environmental advantages, governmental backing, and the increasing consumer demand for eco-friendly and efficient transportation. The detailed market segmentation offers significant opportunities for specialized manufacturers to address specific consumer needs and capitalize on niche markets within Austria.

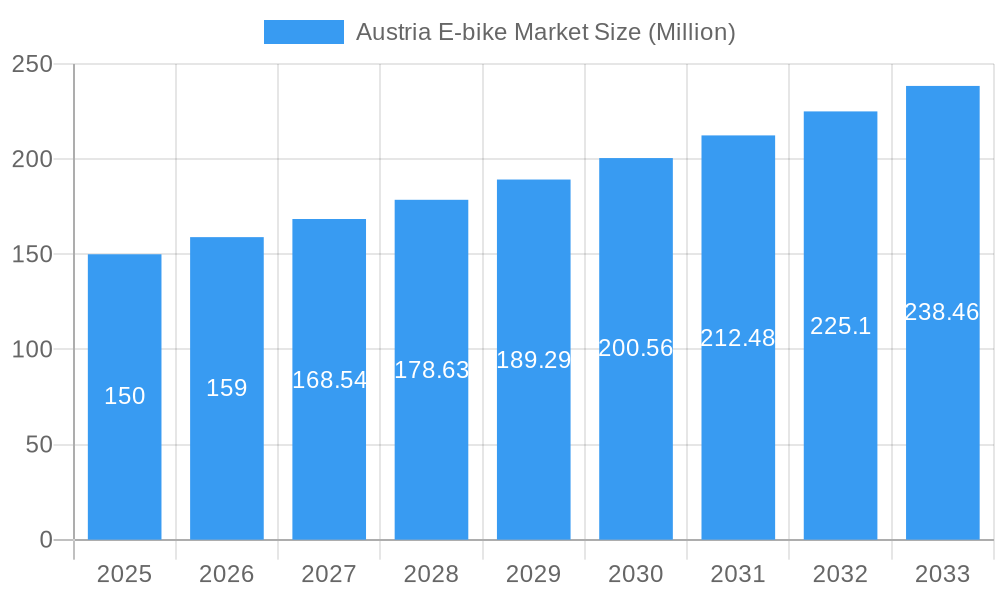

Austria E-bike Market Company Market Share

Austria E-bike Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Austria e-bike market, encompassing market dynamics, growth trends, key segments, competitive landscape, and future outlook. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The analysis considers various e-bike segments including propulsion type, application type, and battery type, offering valuable insights for industry professionals, investors, and policymakers. Market size is presented in million units.

Austria E-bike Market Market Dynamics & Structure

The Austrian e-bike market is characterized by moderate concentration, with key players like KTM Bike Industries, Giant Manufacturing Co Ltd, and others vying for market share. Technological innovation, particularly in battery technology and motor systems, is a major driver. Government initiatives promoting sustainable transportation, including e-bike subsidies, shape the regulatory landscape. Competition from traditional bicycles and other modes of transportation, such as scooters, forms a key competitive factor. Consumer demographics, especially the rising popularity among older adults and commuters, fuels market expansion. While significant M&A activity is not prominent in the Austrian market compared to larger markets, smaller acquisitions and partnerships are frequently observed, further strengthening the market structure.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on lightweight designs, improved battery range, and smart connectivity features.

- Regulatory Framework: Supportive government policies, including subsidies and cycling infrastructure development.

- Competitive Substitutes: Traditional bicycles, cars, public transport, and electric scooters.

- End-User Demographics: Growing adoption among commuters, older adults, and leisure cyclists.

- M&A Trends: Limited major M&A activity but strategic partnerships and smaller acquisitions are prevalent.

Austria E-bike Market Growth Trends & Insights

The Austrian e-bike market experienced significant growth during the historical period (2019-2024), driven by increasing environmental awareness, government incentives, and evolving consumer preferences towards sustainable and convenient commuting solutions. This trend is expected to continue during the forecast period (2025-2033), resulting in a CAGR of xx% during the forecast period. Technological advancements, such as longer battery life and improved motor efficiency, are further bolstering market expansion. The rising popularity of e-bikes for leisure activities, such as trekking and mountain biking, is also contributing to market growth. Consumer behavior is shifting towards prioritizing convenience, sustainability, and health benefits associated with e-bike usage.

Dominant Regions, Countries, or Segments in Austria E-bike Market

Within Austria, urban areas like Vienna and other major cities show the highest e-bike adoption rates due to factors like extensive cycling infrastructure and favorable urban planning. The City/Urban segment dominates the application type category due to its practicality for daily commutes, whereas Pedal Assisted propulsion type leads the market due to the efficiency and range it offers compared to other options. Lithium-ion batteries dominate the battery type category due to their higher energy density and longer lifespan.

- Key Drivers:

- Government Incentives: Subsidies and tax breaks for e-bike purchases.

- Cycling Infrastructure: Development of dedicated bike lanes and charging stations.

- Urban Density: Higher adoption in urban areas due to convenience and practicality.

- Dominant Segments:

- Propulsion Type: Pedal Assisted (xx million units in 2025).

- Application Type: City/Urban (xx million units in 2025).

- Battery Type: Lithium-ion Battery (xx million units in 2025).

Austria E-bike Market Product Landscape

The Austrian e-bike market showcases a diverse range of products catering to various needs and preferences. From lightweight city e-bikes to powerful mountain e-bikes, the market offers a wide array of choices. Manufacturers emphasize features like longer battery life, enhanced motor performance, integrated smart technology, and lightweight frame materials. Innovative features such as integrated lights, anti-theft systems, and GPS tracking are becoming increasingly popular. The market also sees a growing focus on aesthetically pleasing designs, with e-bikes now being increasingly seen as stylish transportation choices.

Key Drivers, Barriers & Challenges in Austria E-bike Market

Key Drivers:

- Increasing environmental awareness and a push for sustainable transportation.

- Government incentives and supportive policies.

- Growing popularity of e-bikes for leisure and recreational activities.

- Technological advancements leading to improved performance and longer battery life.

Key Challenges:

- High initial purchase cost of e-bikes compared to traditional bicycles.

- Range anxiety related to battery life and charging infrastructure.

- Competition from other modes of transportation, particularly cars and public transport.

- Potential safety concerns related to e-bike usage on shared roads and paths.

- Supply chain disruptions impacting the availability of components and finished products.

Emerging Opportunities in Austria E-bike Market

- Cargo e-bikes: Growing demand for cargo e-bikes for both commercial and personal use.

- Integration with smart city infrastructure: Smart connectivity features and integration with public transport systems.

- E-bike sharing programs: Expanding e-bike sharing schemes in urban areas.

- Specialized e-bike models: Targeting niche markets like senior citizens or delivery services.

Growth Accelerators in the Austria E-bike Market Industry

The long-term growth of the Austrian e-bike market is fueled by a confluence of factors. Continued technological innovations, leading to lighter, more efficient e-bikes with extended battery ranges, play a pivotal role. Strategic partnerships between e-bike manufacturers and local authorities in developing comprehensive cycling infrastructure further bolster market expansion. Government initiatives promoting sustainable commuting and ongoing investment in charging infrastructure will also contribute substantially to growth.

Key Players Shaping the Austria E-bike Market Market

- KTM Bike Industries

- Rad Power Bikes

- Propella Electric LLC

- Trek Bicycle Corporation

- MHW Bike-House GmbH (Cube Bikes)

- Peugeot Cycles

- myStromer AG (Stromer)

- Scott Corporation SA (Scott Sports)

- Giant Manufacturing Co Ltd

- GROUPE SPORTIF PTY LTD (Haibike)

Notable Milestones in Austria E-bike Market Sector

- September 2022: Haibike launched the Lyke, a lightweight e-MTB with a removable battery, targeting the growing lightweight e-MTB segment.

- November 2022: Giant unveiled the Stormguard E+, a full-suspension e-bike, priced at €7,999 (E+1) and €6,499 (E+2) for European release in 2023.

- December 2022: Scott Sports launched the Solace, a new electric road bike featuring TQ’s HPR550 motor system, expanding its drop-bar e-bike range.

In-Depth Austria E-bike Market Market Outlook

The Austrian e-bike market holds significant future potential. Continued government support, technological advancements, and evolving consumer preferences will drive substantial market growth in the coming years. Strategic partnerships and investments in charging infrastructure will further facilitate expansion. The market is poised for continued growth, particularly in urban areas, making it an attractive sector for investment and development.

Austria E-bike Market Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

Austria E-bike Market Segmentation By Geography

- 1. Austria

Austria E-bike Market Regional Market Share

Geographic Coverage of Austria E-bike Market

Austria E-bike Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Trend of Yacht Tourism

- 3.3. Market Restrains

- 3.3.1. Higher Rentals During Peak Season

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria E-bike Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KTM Bike Industries

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rad Power Bikes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Propella Electric LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Trek Bicycle Corporatio

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MHW Bike-House GmbH (Cube Bikes)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Peugeot Cycles

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 myStromer AG (Stromer)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Scott Corporation SA (Scott Sports)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Giant Manufacturing Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GROUPE SPORTIF PTY LTD (Haibike)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 KTM Bike Industries

List of Figures

- Figure 1: Austria E-bike Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Austria E-bike Market Share (%) by Company 2025

List of Tables

- Table 1: Austria E-bike Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 2: Austria E-bike Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Austria E-bike Market Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 4: Austria E-bike Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Austria E-bike Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 6: Austria E-bike Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 7: Austria E-bike Market Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 8: Austria E-bike Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria E-bike Market?

The projected CAGR is approximately 12.4%.

2. Which companies are prominent players in the Austria E-bike Market?

Key companies in the market include KTM Bike Industries, Rad Power Bikes, Propella Electric LLC, Trek Bicycle Corporatio, MHW Bike-House GmbH (Cube Bikes), Peugeot Cycles, myStromer AG (Stromer), Scott Corporation SA (Scott Sports), Giant Manufacturing Co Ltd, GROUPE SPORTIF PTY LTD (Haibike).

3. What are the main segments of the Austria E-bike Market?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Surge in Trend of Yacht Tourism.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Higher Rentals During Peak Season.

8. Can you provide examples of recent developments in the market?

December 2022: Scott sports has launched the Solace, a new electric road bike aimed new drop-bar electric bike range that is based on TQ’s HPR550 motor system.November 2022: The Stormguard E+, a full-suspension e-bike, is unveiled by Giant. The bicycles will be available for purchase in Europe in 2023 and will cost 7,999 Euros for the E+1 and 6,499 Euros for the E+2.September 2022: Haibike has launched the Lyke, a new e-MTB aimed at the emerging lightweight e-MTB category. The Lyke eMTB is offered with a removable Watt Hour Battery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria E-bike Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria E-bike Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria E-bike Market?

To stay informed about further developments, trends, and reports in the Austria E-bike Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence