Key Insights

The Moroccan car market, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6% from 2019 to 2024, presents a dynamic landscape ripe with opportunity. Driven by factors such as rising disposable incomes, government initiatives promoting infrastructure development, and a burgeoning tourism sector, the market is poised for sustained expansion. Increased urbanization and a growing young population further fuel demand for personal vehicles. The market segmentation reveals a diverse range of vehicle types, encompassing passenger vehicles and commercial vehicles, and a shift towards modern drivetrains, including plug-in hybrids and battery electric vehicles (BEVs). While challenges remain, such as import tariffs and reliance on global economic stability, the overall trend indicates strong positive growth. Key players like Renault-Nissan, Peugeot, and Volkswagen are well-positioned to capitalize on these trends.

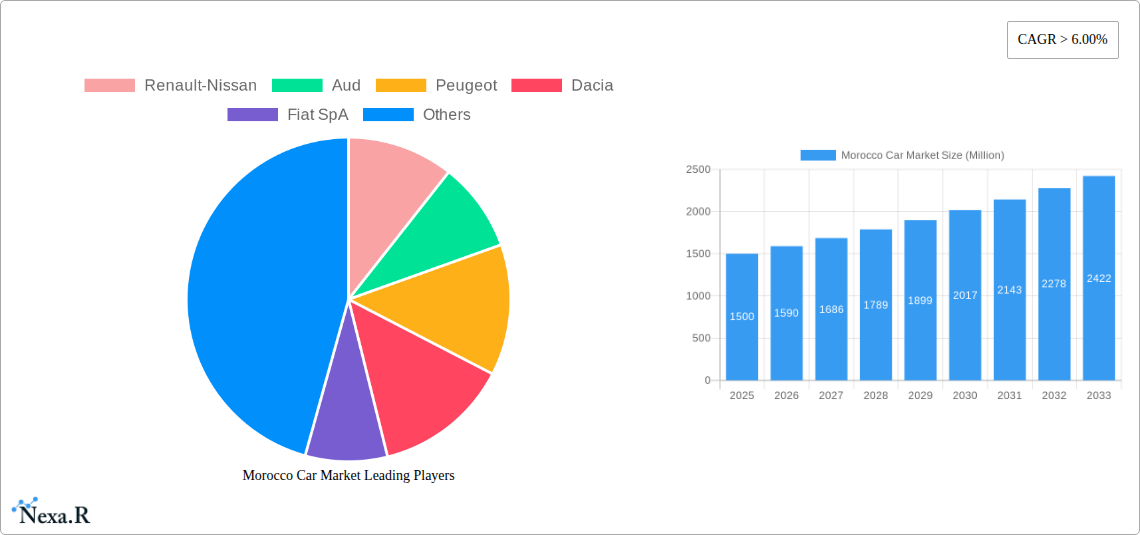

Morocco Car Market Market Size (In Billion)

Looking ahead to 2033, the Moroccan car market is projected to continue its upward trajectory. The adoption of electric vehicles will likely be a significant growth driver, influenced by government policies aimed at promoting sustainable transportation. However, the market's growth will be subject to fluctuations in global economic conditions and commodity prices, including those affecting essential vehicle components. The expansion of charging infrastructure and the improvement of the country's overall power grid will also be critical factors influencing the rate of EV adoption. Competition will remain fierce among established automakers, requiring a strategic focus on localized production, affordable pricing, and the ability to meet evolving consumer preferences. Segments such as commercial vehicles will benefit from ongoing investments in logistics and infrastructure across the country.

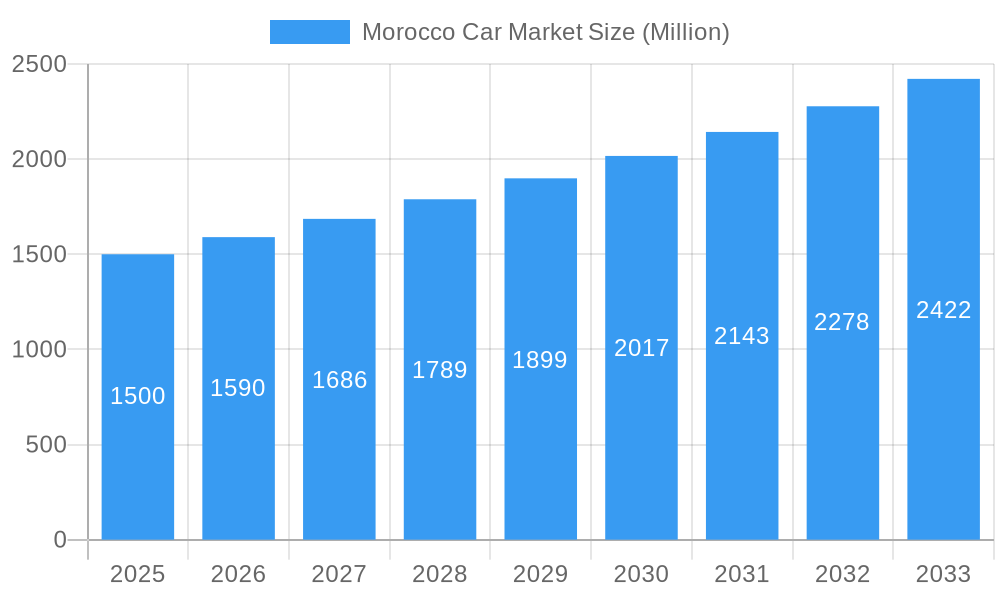

Morocco Car Market Company Market Share

Morocco Car Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Morocco car market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both passenger and commercial vehicles, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this dynamic market. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market sizes are presented in million units.

Morocco Car Market Dynamics & Structure

The Moroccan car market is characterized by a moderate level of concentration, with key players like Renault-Nissan, Peugeot, and Dacia holding significant market share. Technological innovation, while growing, faces barriers such as limited access to advanced technologies and infrastructure. The regulatory framework is undergoing evolution to support the transition to electric vehicles and improve safety standards. Competition from used vehicle imports poses a challenge, while the increasing affordability of new vehicles is driving market expansion. The market is also seeing increasing M&A activity, albeit at a moderate pace, primarily focused on strengthening local supply chains and technological capabilities.

- Market Concentration: xx% held by top 5 players (Renault-Nissan, Peugeot, Dacia, xx, xx) in 2024.

- Technological Innovation: Focus on fuel efficiency and safety features; limited EV adoption due to infrastructure and cost constraints.

- Regulatory Framework: Government initiatives promoting local manufacturing and electric vehicle adoption.

- Competitive Substitutes: Used vehicle imports and alternative transportation options (public transport).

- End-User Demographics: Growing middle class and increasing urbanization are key demand drivers.

- M&A Activity: xx deals recorded between 2019-2024, mainly focused on supply chain integration.

Morocco Car Market Growth Trends & Insights

The Moroccan car market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth was driven primarily by an expanding middle class, increasing urbanization, and government incentives for vehicle purchases. However, economic fluctuations and global supply chain disruptions impacted growth in certain years. Market penetration for passenger vehicles is estimated at xx% in 2024, while commercial vehicle penetration stands at xx%. Technological disruptions, particularly the rise of electric vehicles, are expected to reshape the market in the forecast period (2025-2033). Consumer behavior is shifting towards fuel-efficient and technologically advanced vehicles, influenced by rising fuel prices and environmental concerns. The CAGR for the forecast period (2025-2033) is projected at xx%, driven by government support for the automotive sector and increasing consumer demand. We anticipate a significant increase in EV adoption in the latter half of the forecast period, although ICE vehicles will likely remain dominant.

Dominant Regions, Countries, or Segments in Morocco Car Market

The urban centers of Casablanca, Rabat, and Marrakech dominate the Moroccan car market, driving the majority of sales. Within vehicle types, passenger vehicles constitute a larger segment compared to commercial vehicles, reflecting consumer preference for private transportation. The Internal Combustion Engine (ICE) segment currently holds the largest market share in the drive type category, although the Plug-in Hybrid and Battery Electric (BEV) segments are projected for significant growth in the forecast period due to government incentives and increasing consumer awareness of environmental issues.

- Key Drivers (Urban Centers): Higher purchasing power, better infrastructure, and increased accessibility to dealerships.

- Key Drivers (Passenger Vehicles): Rising middle class, increasing personal disposable income, and preference for individual mobility.

- Key Drivers (ICE): Lower initial cost and widespread charging infrastructure limitations for EVs.

- Growth Potential (BEV/PHEV): Government incentives, rising fuel prices, and growing environmental awareness.

Morocco Car Market Product Landscape

The Moroccan car market offers a diverse range of vehicles, from economical city cars to luxury SUVs. Product innovation focuses on enhanced fuel efficiency, safety features (ABS, airbags), and connectivity. Recent advancements include improved infotainment systems and the integration of advanced driver-assistance systems (ADAS). Unique selling propositions for many models include affordability, durability, and suitability for the local road conditions.

Key Drivers, Barriers & Challenges in Morocco Car Market

Key Drivers:

- Growing middle class and rising disposable incomes.

- Government initiatives supporting the automotive industry.

- Urbanization and improved infrastructure.

Key Challenges:

- Competition from used vehicle imports (xx million units in 2024).

- Limited access to advanced automotive technologies.

- Supply chain vulnerabilities (impact on production: xx% in 2022).

Emerging Opportunities in Morocco Car Market

- Increased demand for fuel-efficient and electric vehicles.

- Growth in the commercial vehicle segment driven by e-commerce and logistics.

- Expansion of car financing and leasing options.

Growth Accelerators in the Morocco Car Market Industry

Technological advancements in electric vehicle technology, coupled with government support for renewable energy and incentives for electric vehicle adoption, are expected to significantly accelerate market growth. Strategic partnerships between international and local players will also contribute to improving production capabilities and fostering technological transfer, driving efficiency gains and market expansion.

Key Players Shaping the Morocco Car Market Market

Notable Milestones in Morocco Car Market Sector

- July 2022: Renault Group and Managem Group sign MoU for cobalt sulfate supply for electric batteries (5,000 tonnes/year starting 2025).

- February 2022: Moroccan transport vehicle management software startup secures USD 4 million funding.

- February 2022: Rabat ATC secures USD 13.6 million loan for automotive testing center development.

In-Depth Morocco Car Market Market Outlook

The Moroccan car market is poised for sustained growth driven by a confluence of factors, including rising disposable incomes, government support for the automotive sector, and the increasing adoption of electric and hybrid vehicles. Strategic investments in infrastructure, coupled with technological advancements, present lucrative opportunities for both established and new market entrants to capitalize on this expanding market. The continued development of the local supply chain and the focus on environmentally friendly vehicles will further shape the market's trajectory in the coming years.

Morocco Car Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Drive Type

- 2.1. Internal Combustion Engine

- 2.2. Plug-In Hybrid

- 2.3. Battery Electric

Morocco Car Market Segmentation By Geography

- 1. Morocco

Morocco Car Market Regional Market Share

Geographic Coverage of Morocco Car Market

Morocco Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements In Vehicles Driving Demand; Others

- 3.3. Market Restrains

- 3.3.1. High Scan Tool Costs to Limit Growth; Others

- 3.4. Market Trends

- 3.4.1. Foreign Investments from Leading Auto Manufacturers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Internal Combustion Engine

- 5.2.2. Plug-In Hybrid

- 5.2.3. Battery Electric

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Renault-Nissan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aud

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Peugeot

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dacia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fiat SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Volkswagen AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hyundai Motor Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mercedes-Benz

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BMW

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ford Motor Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Renault-Nissan

List of Figures

- Figure 1: Morocco Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Morocco Car Market Share (%) by Company 2025

List of Tables

- Table 1: Morocco Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Morocco Car Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: Morocco Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Morocco Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Morocco Car Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: Morocco Car Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Car Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Morocco Car Market?

Key companies in the market include Renault-Nissan, Aud, Peugeot, Dacia, Fiat SpA, Volkswagen AG, Hyundai Motor Company, Mercedes-Benz, BMW, Ford Motor Company.

3. What are the main segments of the Morocco Car Market?

The market segments include Vehicle Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements In Vehicles Driving Demand; Others.

6. What are the notable trends driving market growth?

Foreign Investments from Leading Auto Manufacturers.

7. Are there any restraints impacting market growth?

High Scan Tool Costs to Limit Growth; Others.

8. Can you provide examples of recent developments in the market?

In July 2022, A memorandum of understanding (or "MoU") was signed between Renault Group and Managem Group, a Moroccan player in the mining and hydrometallurgy industries, to ensure the supply of low-carbon and ethical cobalt sulfate for use in electric batteries. In accordance with the conditions of the contract, Managem Group will deliver 5,000 tonnes of cobalt sulfate every year for seven years beginning in 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Car Market?

To stay informed about further developments, trends, and reports in the Morocco Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence