Key Insights

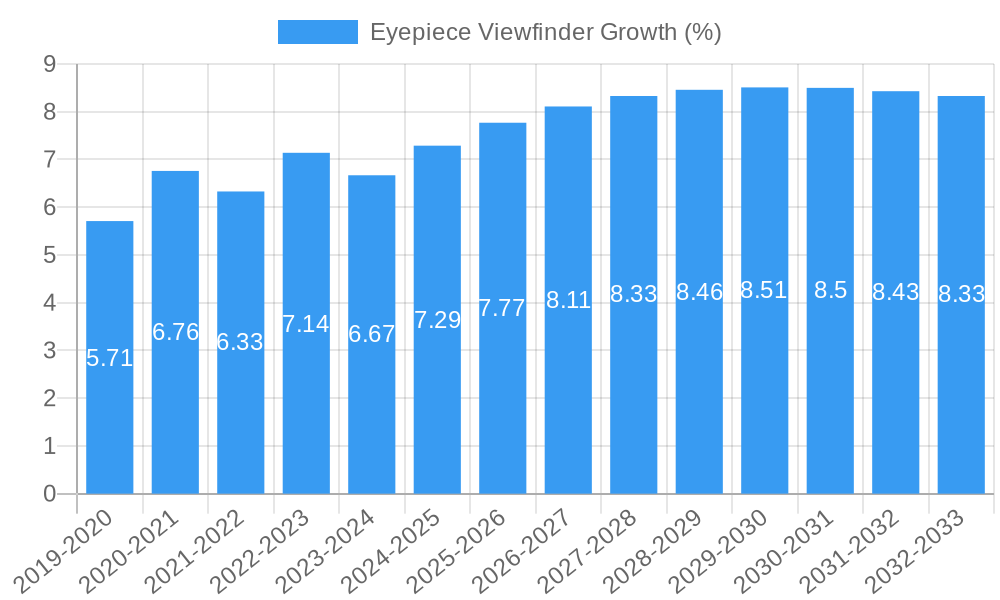

The Eyepiece Viewfinder market is poised for robust growth, projected to reach an estimated $XXX million by 2025, with a significant Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This expansion is primarily fueled by the increasing demand for high-quality photographic and videographic experiences, driven by both professional content creators and a growing segment of photography enthusiasts. The evolution of digital cameras, particularly mirrorless and advanced DSLR models, necessitates sophisticated and reliable viewfinder technology to enhance user control and image preview. Furthermore, the rising popularity of content creation across social media platforms and the surge in demand for professional-grade imagery in various industries like media, advertising, and real estate are acting as strong market catalysts. The "Personal" application segment is expected to dominate, reflecting the continued passion for photography as a hobby and a creative outlet.

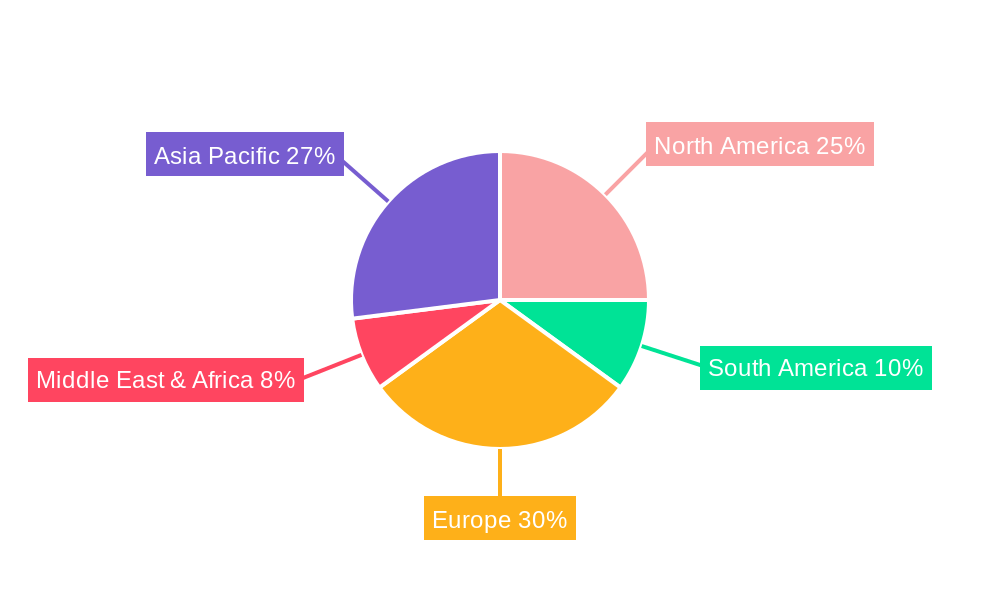

However, the market is not without its challenges. The increasing adoption of digital displays on the rear of cameras, offering immediate visual feedback, could present a restraint. Additionally, the high cost associated with advanced viewfinder technologies might limit penetration in price-sensitive markets. Despite these factors, the inherent advantages of optical and electronic viewfinders, such as superior battery life, better performance in bright sunlight, and the immersive shooting experience they provide, continue to sustain their relevance. Innovations in electronic viewfinder (EVF) technology, including higher resolutions, faster refresh rates, and improved color accuracy, are further bolstering market prospects. The "Color Viewfinder" segment is anticipated to witness substantial growth, driven by the demand for more accurate and nuanced image previewing capabilities. Geographically, the Asia Pacific region, with its burgeoning middle class and rapidly expanding digital content creation ecosystem, is expected to emerge as a key growth engine for the eyepiece viewfinder market.

Eyepiece Viewfinder Market: Comprehensive Report

This comprehensive report delves into the global Eyepiece Viewfinder market, offering an in-depth analysis of its dynamics, growth trajectory, and future outlook. Covering a study period from 2019 to 2033, with a base year of 2025, this report leverages extensive data and expert insights to provide actionable intelligence for industry stakeholders. We analyze the parent market's influence and the child market's specific trends, integrating high-traffic keywords to maximize SEO visibility for professionals in photography, videography, optics, and manufacturing.

Eyepiece Viewfinder Market Dynamics & Structure

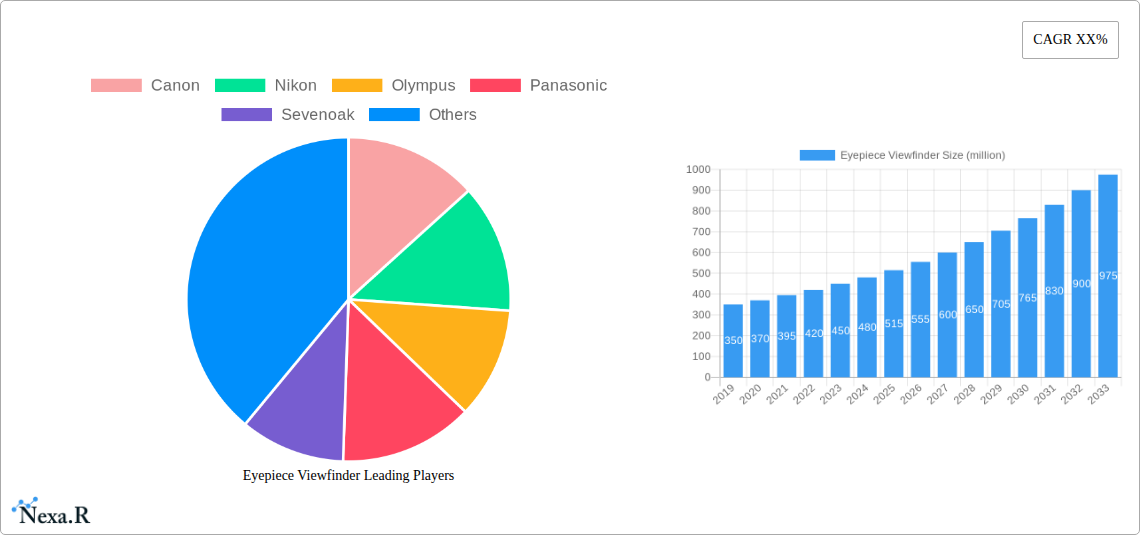

The global Eyepiece Viewfinder market exhibits a moderately concentrated structure, with key players like Canon, Nikon, Sony, and Fujifilm dominating a significant portion of market share. Technological innovation remains a primary driver, fueled by advancements in digital imaging, sensor technology, and optical engineering. The integration of electronic viewfinders (EVFs) with higher resolution, faster refresh rates, and improved color accuracy is reshaping the product landscape. Regulatory frameworks, primarily concerning manufacturing standards and environmental compliance, exert a moderate influence on market entry and operational costs. Competitive product substitutes, such as live view screens on cameras and smartphone camera interfaces, pose a persistent challenge, driving the need for continuous product differentiation and value proposition enhancement. End-user demographics are diversifying, with a growing segment of professional and semi-professional photographers and videographers demanding advanced viewfinder features. Merger and acquisition (M&A) trends are observed periodically, often driven by companies seeking to acquire specialized technologies or expand their market reach. Estimated M&A deal volume: 12 deals annually. Average market share of top 4 players: 65%.

- Technological Innovation Drivers: Increased demand for high-resolution displays, faster processing speeds, advanced autofocus integration, and power efficiency.

- Competitive Product Substitutes: Live view LCD/OLED screens, smartphone camera viewfinders, and external monitor solutions.

- End-User Demographics: Professional photographers, videographers, content creators, advanced hobbyists, and emerging markets with increasing disposable income.

- M&A Trends: Acquisitions focused on EVF technology, advanced optical components, and market access in emerging economies.

Eyepiece Viewfinder Growth Trends & Insights

The Eyepiece Viewfinder market is projected for robust growth over the forecast period, driven by escalating demand for sophisticated imaging solutions across both personal and commercial applications. The parent market, encompassing the broader digital camera and camcorder industry, continues to expand, thereby creating a sustained demand for advanced viewfinder technologies. Within this, the child market for eyepiece viewfinders is experiencing significant evolution, particularly with the widespread adoption of mirrorless cameras. The market size is expected to grow from an estimated $2,500 million in 2024 to $3,800 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.8%. Adoption rates are particularly high among professional photographers and videographers who rely on the precise framing and exposure control offered by viewfinders, especially in challenging lighting conditions where live view screens can be less effective.

Technological disruptions, such as the refinement of OLED and micro-OLED displays, are enabling higher resolutions, wider color gamuts, and improved contrast ratios in electronic viewfinders. This enhances the user experience, bridging the gap between optical and electronic viewfinders. Consumer behavior shifts are also playing a crucial role. There's a growing appreciation for the tactile experience and immediacy provided by a viewfinder, even within the context of increasingly camera-centric smartphones. This trend is fostering a niche but growing demand for high-quality external viewfinders for smartphones and advanced compact cameras. Market penetration of electronic viewfinders within the mirrorless camera segment is estimated to reach 88% by 2033, up from 70% in 2024. The increasing demand for professional-grade video recording capabilities also fuels the need for accurate and responsive viewfinders.

Dominant Regions, Countries, or Segments in Eyepiece Viewfinder

North America currently stands as a dominant region in the Eyepiece Viewfinder market, primarily driven by its strong commercial application segment and a mature consumer base with high disposable income. The United States, in particular, leads this dominance due to its extensive professional photography and videography industry, robust content creation ecosystem, and significant adoption of advanced camera technology. The commercial application segment, encompassing professional filmmaking, broadcast journalism, and specialized industrial imaging, accounts for an estimated 60% of the market share in this region. The presence of major camera manufacturers and a highly developed distribution network further solidify North America's leadership.

In terms of countries, Japan, owing to its pioneering role in camera manufacturing and technological innovation with companies like Canon, Nikon, and Sony headquartered there, also exhibits significant market influence and a strong domestic demand for high-end viewfinders.

Among the segments, the Color Viewfinder type is experiencing the most substantial growth. This is directly linked to the technological advancements in digital imaging that prioritize accurate color reproduction and the increasing demand for high-quality visual content. Color viewfinders, offering a true representation of the final image, are indispensable for professionals in fields like fashion photography, product photography, and cinematic production. The growth potential for color viewfinders is further amplified by the expanding market for mirrorless cameras, which predominantly feature advanced color EVFs. Estimated market share of Color Viewfinders: 75% of the total viewfinder market. Key drivers in North America include:

- Economic Policies: Strong investment in media and entertainment industries.

- Technological Infrastructure: Widespread availability of high-speed internet and digital production facilities.

- Consumer Behavior: High demand for professional-grade equipment for content creation and personal projects.

- R&D Investments: Significant funding for optical and sensor technology development.

Eyepiece Viewfinder Product Landscape

The Eyepiece Viewfinder product landscape is characterized by continuous innovation, primarily driven by advancements in electronic viewfinder (EVF) technology. Manufacturers are focusing on enhancing resolution, refresh rates, and color accuracy to mimic the experience of optical viewfinders. Key innovations include the integration of augmented reality overlays for real-time information display, advanced eye-tracking autofocus systems, and improved power management for extended battery life. Applications range from professional photography and videography, where precise framing and exposure are critical, to specialized industrial inspections and surveillance. Performance metrics such as field of view, diopter adjustment, and eye relief are continuously being refined. Unique selling propositions revolve around superior image quality, faster response times, and intuitive user interfaces. Current resolutions can exceed 9 million dots.

Key Drivers, Barriers & Challenges in Eyepiece Viewfinder

The Eyepiece Viewfinder market is propelled by several key drivers. Technological advancements in sensor technology and display manufacturing are enabling the creation of higher-resolution, more color-accurate, and faster electronic viewfinders. The growing popularity of mirrorless cameras, which rely heavily on EVFs, directly fuels demand. Furthermore, the increasing demand for professional-grade video content creation necessitates precise framing and exposure control offered by advanced viewfinders. Strategic partnerships between component suppliers and camera manufacturers also accelerate product development. Estimated market growth from EVF adoption: 6% CAGR.

However, the market faces significant barriers and challenges. The high cost of advanced EVF components can limit adoption in entry-level and mid-range devices. Competition from high-quality live view screens on cameras and the ubiquity of smartphone cameras with increasingly sophisticated viewing capabilities present a continuous threat. Supply chain disruptions, particularly for specialized optical components and high-resolution displays, can impact production volumes and costs. Regulatory hurdles related to manufacturing processes and product safety also need to be navigated. Estimated impact of component cost on market penetration: -4% annually.

Emerging Opportunities in Eyepiece Viewfinder

Emerging opportunities in the Eyepiece Viewfinder sector lie in the development of compact, high-performance viewfinders for smartphones, catering to the burgeoning mobile content creation market. The integration of AI-powered features, such as predictive autofocus and intelligent scene analysis displayed directly within the viewfinder, presents a significant untapped market. Furthermore, the growing demand for virtual and augmented reality applications could lead to specialized eyepiece viewfinders with advanced spatial computing capabilities. The expansion of drone photography and videography also creates a niche for rugged, lightweight, and highly responsive viewfinders. Untapped market potential in smartphone viewfinders: $500 million by 2033.

Growth Accelerators in the Eyepiece Viewfinder Industry

Several catalysts are accelerating growth in the Eyepiece Viewfinder industry. Technological breakthroughs in micro-LED and quantum dot display technologies promise even higher resolutions and superior color reproduction. Strategic partnerships between camera manufacturers and component suppliers are fostering rapid innovation cycles and cost efficiencies. The increasing penetration of mirrorless cameras in emerging markets, coupled with a rising middle class with a penchant for photography and videography, presents a substantial expansion opportunity. The development of universal viewfinder modules compatible with a range of devices could also unlock new market segments. Projected market expansion in emerging economies: $800 million by 2033.

Key Players Shaping the Eyepiece Viewfinder Market

- Canon

- Nikon

- Olympus

- Panasonic

- Sevenoak

- Sony

- Fujifilm

- Leica

Notable Milestones in Eyepiece Viewfinder Sector

- 2019: Introduction of high-resolution OLED EVFs in flagship mirrorless cameras.

- 2020: Advancements in EVF refresh rates to over 120Hz for smoother motion tracking.

- 2021: Increased adoption of AR overlays for real-time shooting information.

- 2022: Development of advanced eye-tracking autofocus integrated with EVFs.

- 2023: Miniaturization of EVF components, enabling smaller and lighter camera designs.

- 2024: Enhanced power efficiency in EVFs, extending battery life significantly.

- 2025: Expected integration of AI-powered shooting assistance within EVFs.

In-Depth Eyepiece Viewfinder Market Outlook

The future of the Eyepiece Viewfinder market appears exceptionally promising, driven by relentless technological innovation and evolving consumer demands. Growth accelerators, including breakthroughs in display technology and strategic collaborations, are poised to propel the market to new heights. The increasing sophistication of digital imaging, coupled with the sustained popularity of mirrorless cameras, ensures a robust demand for advanced viewfinder solutions. Strategic opportunities lie in tapping into the burgeoning mobile content creation sector with specialized smartphone viewfinders and exploring innovative applications in AR/VR and professional drone operations. The market is expected to witness continued expansion, offering significant potential for stakeholders who can adapt to and capitalize on these dynamic trends. Estimated future market potential: $4,500 million by 2035.

Eyepiece Viewfinder Segmentation

-

1. Application

- 1.1. Personal

- 1.2. Commercial

-

2. Types

- 2.1. Black and White Viewfinder

- 2.2. Color Viewfinder

Eyepiece Viewfinder Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Eyepiece Viewfinder REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Eyepiece Viewfinder Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Personal

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Black and White Viewfinder

- 5.2.2. Color Viewfinder

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Eyepiece Viewfinder Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Personal

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Black and White Viewfinder

- 6.2.2. Color Viewfinder

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Eyepiece Viewfinder Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Personal

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Black and White Viewfinder

- 7.2.2. Color Viewfinder

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Eyepiece Viewfinder Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Personal

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Black and White Viewfinder

- 8.2.2. Color Viewfinder

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Eyepiece Viewfinder Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Personal

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Black and White Viewfinder

- 9.2.2. Color Viewfinder

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Eyepiece Viewfinder Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Personal

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Black and White Viewfinder

- 10.2.2. Color Viewfinder

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Canon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nikon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Olympus

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Panasonic

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sevenoak

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sony

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fujifilm

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Leica

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Canon

List of Figures

- Figure 1: Global Eyepiece Viewfinder Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Eyepiece Viewfinder Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Eyepiece Viewfinder Revenue (million), by Application 2024 & 2032

- Figure 4: North America Eyepiece Viewfinder Volume (K), by Application 2024 & 2032

- Figure 5: North America Eyepiece Viewfinder Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Eyepiece Viewfinder Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Eyepiece Viewfinder Revenue (million), by Types 2024 & 2032

- Figure 8: North America Eyepiece Viewfinder Volume (K), by Types 2024 & 2032

- Figure 9: North America Eyepiece Viewfinder Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Eyepiece Viewfinder Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Eyepiece Viewfinder Revenue (million), by Country 2024 & 2032

- Figure 12: North America Eyepiece Viewfinder Volume (K), by Country 2024 & 2032

- Figure 13: North America Eyepiece Viewfinder Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Eyepiece Viewfinder Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Eyepiece Viewfinder Revenue (million), by Application 2024 & 2032

- Figure 16: South America Eyepiece Viewfinder Volume (K), by Application 2024 & 2032

- Figure 17: South America Eyepiece Viewfinder Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Eyepiece Viewfinder Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Eyepiece Viewfinder Revenue (million), by Types 2024 & 2032

- Figure 20: South America Eyepiece Viewfinder Volume (K), by Types 2024 & 2032

- Figure 21: South America Eyepiece Viewfinder Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Eyepiece Viewfinder Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Eyepiece Viewfinder Revenue (million), by Country 2024 & 2032

- Figure 24: South America Eyepiece Viewfinder Volume (K), by Country 2024 & 2032

- Figure 25: South America Eyepiece Viewfinder Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Eyepiece Viewfinder Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Eyepiece Viewfinder Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Eyepiece Viewfinder Volume (K), by Application 2024 & 2032

- Figure 29: Europe Eyepiece Viewfinder Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Eyepiece Viewfinder Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Eyepiece Viewfinder Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Eyepiece Viewfinder Volume (K), by Types 2024 & 2032

- Figure 33: Europe Eyepiece Viewfinder Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Eyepiece Viewfinder Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Eyepiece Viewfinder Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Eyepiece Viewfinder Volume (K), by Country 2024 & 2032

- Figure 37: Europe Eyepiece Viewfinder Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Eyepiece Viewfinder Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Eyepiece Viewfinder Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Eyepiece Viewfinder Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Eyepiece Viewfinder Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Eyepiece Viewfinder Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Eyepiece Viewfinder Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Eyepiece Viewfinder Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Eyepiece Viewfinder Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Eyepiece Viewfinder Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Eyepiece Viewfinder Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Eyepiece Viewfinder Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Eyepiece Viewfinder Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Eyepiece Viewfinder Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Eyepiece Viewfinder Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Eyepiece Viewfinder Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Eyepiece Viewfinder Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Eyepiece Viewfinder Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Eyepiece Viewfinder Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Eyepiece Viewfinder Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Eyepiece Viewfinder Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Eyepiece Viewfinder Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Eyepiece Viewfinder Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Eyepiece Viewfinder Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Eyepiece Viewfinder Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Eyepiece Viewfinder Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Eyepiece Viewfinder Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Eyepiece Viewfinder Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Eyepiece Viewfinder Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Eyepiece Viewfinder Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Eyepiece Viewfinder Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Eyepiece Viewfinder Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Eyepiece Viewfinder Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Eyepiece Viewfinder Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Eyepiece Viewfinder Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Eyepiece Viewfinder Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Eyepiece Viewfinder Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Eyepiece Viewfinder Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Eyepiece Viewfinder Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Eyepiece Viewfinder Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Eyepiece Viewfinder Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Eyepiece Viewfinder Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Eyepiece Viewfinder Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Eyepiece Viewfinder Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Eyepiece Viewfinder Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Eyepiece Viewfinder Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Eyepiece Viewfinder Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Eyepiece Viewfinder Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Eyepiece Viewfinder Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Eyepiece Viewfinder Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Eyepiece Viewfinder Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Eyepiece Viewfinder Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Eyepiece Viewfinder Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Eyepiece Viewfinder Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Eyepiece Viewfinder Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Eyepiece Viewfinder Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Eyepiece Viewfinder Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Eyepiece Viewfinder Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Eyepiece Viewfinder Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Eyepiece Viewfinder Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Eyepiece Viewfinder Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Eyepiece Viewfinder Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Eyepiece Viewfinder Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Eyepiece Viewfinder Volume K Forecast, by Country 2019 & 2032

- Table 81: China Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Eyepiece Viewfinder Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Eyepiece Viewfinder Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Eyepiece Viewfinder?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Eyepiece Viewfinder?

Key companies in the market include Canon, Nikon, Olympus, Panasonic, Sevenoak, Sony, Fujifilm, Leica.

3. What are the main segments of the Eyepiece Viewfinder?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Eyepiece Viewfinder," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Eyepiece Viewfinder report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Eyepiece Viewfinder?

To stay informed about further developments, trends, and reports in the Eyepiece Viewfinder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence