Key Insights

The South American e-commerce apparel market, valued at $7824.99 million in 2024, is projected for substantial growth. It is expected to expand at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2033. This growth is attributed to increasing internet and smartphone penetration, rising disposable incomes, and a growing preference for online shopping convenience, particularly among younger consumers. The market is segmented by platform type (third-party retailers, company websites), product type (formal, casual, sportswear, nightwear, others), and end-user (men, women, children). Key players, including global brands and local enterprises, are actively competing by employing strategic partnerships, personalized marketing, and enhanced logistics to improve customer reach and satisfaction. Brazil and Argentina are identified as significant contributors due to their large populations and developing e-commerce infrastructures. However, challenges such as intermittent internet access in certain areas, concerns regarding online security and payment methods, and high logistics costs require strategic attention for sustained market expansion.

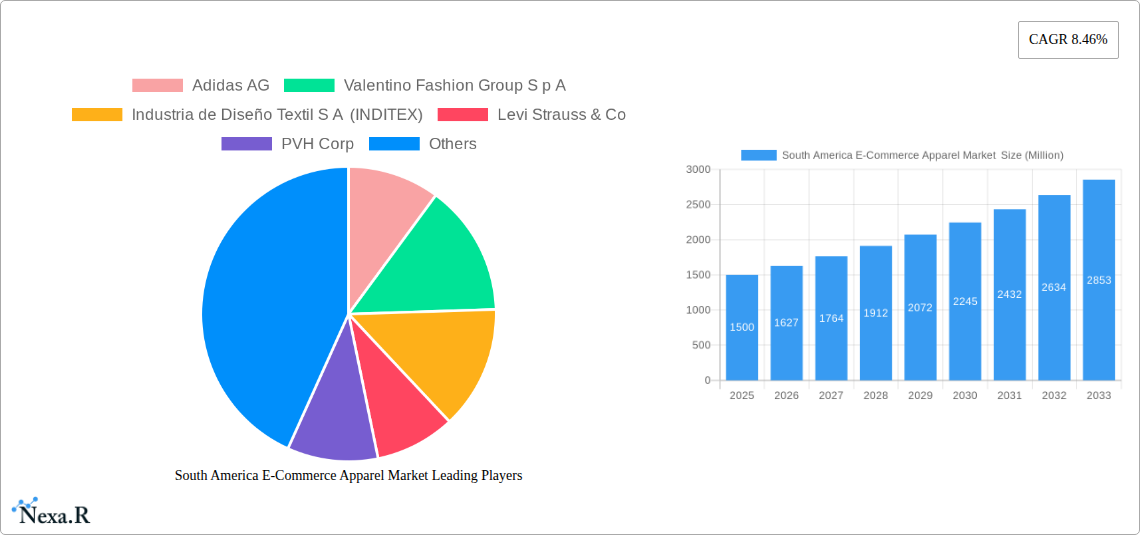

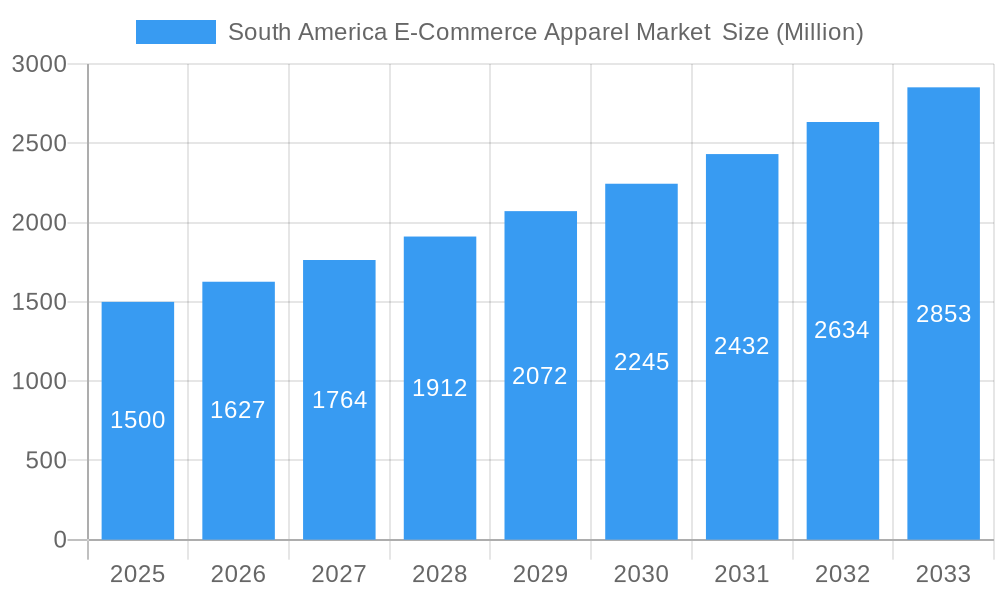

South America E-Commerce Apparel Market Market Size (In Billion)

The casual wear and sportswear segments are anticipated to drive significant growth within the South American e-commerce apparel market, fueled by the popularity of athleisure and a burgeoning fitness culture. The widespread adoption of mobile commerce and the expansion of digital payment solutions further support market advancement. While the market demonstrates positive momentum, companies must adopt region-specific strategies. Effective localization of online platforms, encompassing language and payment options, is crucial for market penetration. The competitive environment is dynamic, with both established international brands and agile local players vying for consumer engagement. Innovations such as augmented reality for virtual try-ons and personalized recommendations will be instrumental in shaping future market trajectories.

South America E-Commerce Apparel Market Company Market Share

This comprehensive report offers an in-depth analysis of the South America e-commerce apparel market, covering market dynamics, growth trends, key stakeholders, and future prospects. The analysis spans from 2019 to 2033, with 2024 serving as the base year. This research is invaluable for businesses, investors, and market analysts seeking a detailed understanding of this evolving sector.

South America E-Commerce Apparel Market Dynamics & Structure

The South American e-commerce apparel market is characterized by a moderately concentrated landscape, with key players like Adidas AG, Nike Inc, and INDITEX holding significant market share. Technological advancements, particularly in mobile commerce and social media marketing, are key drivers. However, regulatory frameworks surrounding data privacy and cross-border e-commerce present challenges. The market faces competition from traditional brick-and-mortar retailers and alternative product types such as secondhand apparel. Consumer demographics are shifting towards younger, digitally savvy populations, increasing the demand for online apparel shopping. M&A activity in the market has been moderate, with xx deals recorded in the period 2019-2024, representing a xx% market share consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- Technological Innovation: Mobile-first approach, AR/VR integration for virtual try-ons, personalized recommendations drive growth.

- Regulatory Framework: Varying regulations across countries regarding data privacy and import/export impact market growth.

- Competitive Substitutes: Traditional retail, secondhand apparel, and other online retail platforms present competition.

- End-User Demographics: Growing young population with high smartphone penetration fuels demand.

- M&A Trends: xx M&A deals during 2019-2024 leading to xx% market share consolidation.

South America E-Commerce Apparel Market Growth Trends & Insights

The South American e-commerce apparel market exhibited robust growth between 2019 and 2024, with a CAGR of xx%. This growth is attributed to factors such as increasing internet and smartphone penetration, rising disposable incomes, and a growing preference for online shopping convenience. Technological disruptions, like the rise of mobile-first platforms and personalized shopping experiences, have further accelerated adoption. Changing consumer behavior, reflecting a preference for faster delivery and flexible return policies, are also pivotal. Market penetration for e-commerce apparel is projected to reach xx% by 2033, driving market expansion.

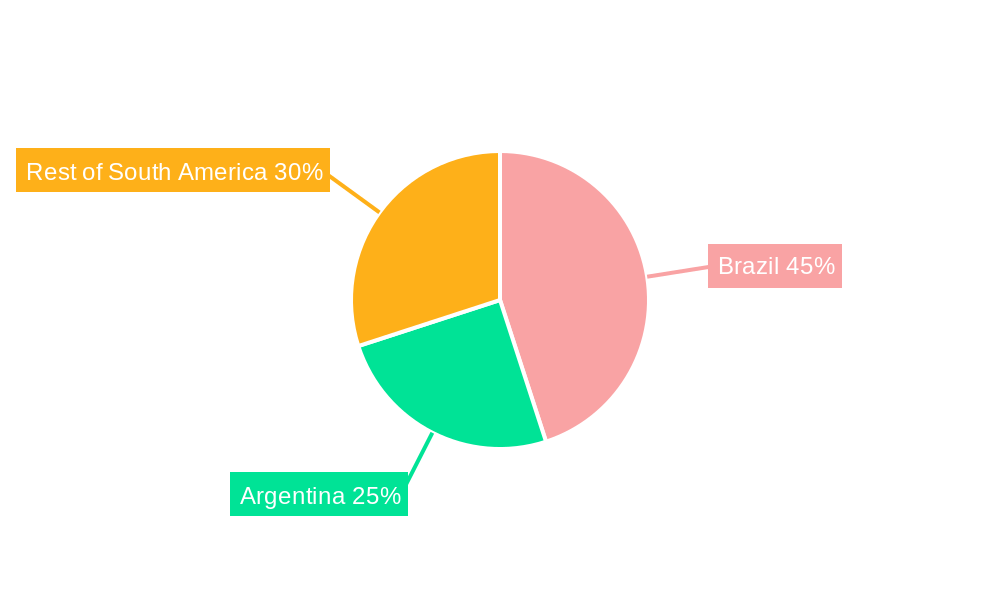

Dominant Regions, Countries, or Segments in South America E-Commerce Apparel Market

Brazil remains the dominant market for e-commerce apparel in South America, accounting for xx% of total market value in 2025, followed by xx% in Mexico and xx% in Argentina. Within the segment breakdown:

- Platform Type: Third-party retailers like MercadoLibre and Amazon dominate, accounting for xx million units (xx% market share) in 2025, while company-owned websites are expected to capture xx million units (xx% market share).

- Product Type: Casual wear holds the largest market share at xx million units (xx%), followed by sportswear with xx million units (xx%).

- End User: Women's apparel dominates with xx million units (xx% market share) in 2025, followed by men's wear (xx million units) and kids/children’s wear (xx million units).

Key drivers for this dominance include robust digital infrastructure in Brazil, supportive economic policies, and a large consumer base. Argentina and Mexico show strong growth potential driven by increasing internet penetration and rising disposable incomes.

South America E-Commerce Apparel Market Product Landscape

The South American e-commerce apparel market showcases a wide range of products across various styles and price points. Innovations include personalized fitting technologies and augmented reality applications for virtual try-ons. Sustainable and ethically produced apparel are gaining traction, reflecting evolving consumer preferences. Performance metrics focus on customer satisfaction, conversion rates, and return rates. Unique selling propositions frequently highlight fast shipping, easy returns, and exclusive brand collaborations.

Key Drivers, Barriers & Challenges in South America E-Commerce Apparel Market

Key Drivers:

- Increasing internet and smartphone penetration.

- Rising disposable incomes and changing consumer preferences.

- Technological advancements in e-commerce platforms.

- Government initiatives supporting digital commerce.

Challenges:

- High logistics costs and delivery times in certain regions.

- Payment infrastructure limitations in some countries.

- Counterfeit product issues and intellectual property concerns. This results in an estimated xx million units lost annually.

- Intense competition from established and emerging players.

Emerging Opportunities in South America E-Commerce Apparel Market

- Untapped Markets: Expansion into smaller cities and rural areas with growing internet access.

- Niche Products: Focus on sustainable, ethically sourced, and size-inclusive apparel.

- Personalized Experiences: Leveraging data analytics to offer tailored recommendations and experiences.

- Social Commerce: Integrating social media platforms for product discovery and sales.

Growth Accelerators in the South America E-Commerce Apparel Market Industry

The long-term growth of the South American e-commerce apparel market will be propelled by technological innovations like AI-powered personal stylists and improved mobile shopping experiences. Strategic partnerships between brands and influencers can significantly expand market reach. Government initiatives to improve logistics infrastructure and digital payment systems will play a vital role in fostering further growth.

Key Players Shaping the South America E-Commerce Apparel Market Market

Notable Milestones in South America E-Commerce Apparel Market Sector

- September 2021: Neymar Jr.'s partnership with Puma launched a successful lifestyle collection, boosting Puma's brand visibility and sales.

- August 2022: H&M's launch of its online store in Uruguay expanded its market reach and increased online apparel availability.

- February 2023: PVH Corp's Calvin Klein affiliate program boosted e-commerce sales in Brazil through wider online retailer participation.

In-Depth South America E-Commerce Apparel Market Market Outlook

The South American e-commerce apparel market is poised for significant growth in the coming years, driven by continued increases in internet and smartphone penetration, rising disposable incomes, and the adoption of innovative e-commerce technologies. Strategic partnerships, expansion into untapped markets, and a focus on personalized shopping experiences will be key to capturing this growth potential. The market is expected to reach xx million units by 2033.

South America E-Commerce Apparel Market Segmentation

-

1. Product Type

- 1.1. Formal Wear

- 1.2. Casual Wear

- 1.3. Sportswear

- 1.4. Nightwear

- 1.5. Other Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America E-Commerce Apparel Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America E-Commerce Apparel Market Regional Market Share

Geographic Coverage of South America E-Commerce Apparel Market

South America E-Commerce Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Influence of Social Media and Aggressive Marketing; Growing Popularity of Athleisure Apparel Across E-commerce Channels

- 3.3. Market Restrains

- 3.3.1. Competition From Brick-and-Mortar Retail Channel

- 3.4. Market Trends

- 3.4.1. Increased Influence of Social Media and Aggressive Marketing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Formal Wear

- 5.1.2. Casual Wear

- 5.1.3. Sportswear

- 5.1.4. Nightwear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Formal Wear

- 6.1.2. Casual Wear

- 6.1.3. Sportswear

- 6.1.4. Nightwear

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Formal Wear

- 7.1.2. Casual Wear

- 7.1.3. Sportswear

- 7.1.4. Nightwear

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Formal Wear

- 8.1.2. Casual Wear

- 8.1.3. Sportswear

- 8.1.4. Nightwear

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Adidas AG

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Valentino Fashion Group S p A

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Industria de Diseño Textil S A (INDITEX)

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Levi Strauss & Co

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 PVH Corp

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Puma SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 LVMH Moët Hennessy Louis Vuitton

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Salvatore Ferragamo S p A *List Not Exhaustive

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Nike Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 H & M Hennes & Mauritz AB

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Adidas AG

List of Figures

- Figure 1: South America E-Commerce Apparel Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America E-Commerce Apparel Market Share (%) by Company 2025

List of Tables

- Table 1: South America E-Commerce Apparel Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: South America E-Commerce Apparel Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: South America E-Commerce Apparel Market Revenue million Forecast, by End User 2020 & 2033

- Table 4: South America E-Commerce Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 5: South America E-Commerce Apparel Market Revenue million Forecast, by Platform Type 2020 & 2033

- Table 6: South America E-Commerce Apparel Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 7: South America E-Commerce Apparel Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: South America E-Commerce Apparel Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 9: South America E-Commerce Apparel Market Revenue million Forecast, by Region 2020 & 2033

- Table 10: South America E-Commerce Apparel Market Volume K Units Forecast, by Region 2020 & 2033

- Table 11: South America E-Commerce Apparel Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 12: South America E-Commerce Apparel Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 13: South America E-Commerce Apparel Market Revenue million Forecast, by End User 2020 & 2033

- Table 14: South America E-Commerce Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 15: South America E-Commerce Apparel Market Revenue million Forecast, by Platform Type 2020 & 2033

- Table 16: South America E-Commerce Apparel Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 17: South America E-Commerce Apparel Market Revenue million Forecast, by Geography 2020 & 2033

- Table 18: South America E-Commerce Apparel Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 19: South America E-Commerce Apparel Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: South America E-Commerce Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 21: South America E-Commerce Apparel Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 22: South America E-Commerce Apparel Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: South America E-Commerce Apparel Market Revenue million Forecast, by End User 2020 & 2033

- Table 24: South America E-Commerce Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 25: South America E-Commerce Apparel Market Revenue million Forecast, by Platform Type 2020 & 2033

- Table 26: South America E-Commerce Apparel Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 27: South America E-Commerce Apparel Market Revenue million Forecast, by Geography 2020 & 2033

- Table 28: South America E-Commerce Apparel Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: South America E-Commerce Apparel Market Revenue million Forecast, by Country 2020 & 2033

- Table 30: South America E-Commerce Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: South America E-Commerce Apparel Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 32: South America E-Commerce Apparel Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: South America E-Commerce Apparel Market Revenue million Forecast, by End User 2020 & 2033

- Table 34: South America E-Commerce Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 35: South America E-Commerce Apparel Market Revenue million Forecast, by Platform Type 2020 & 2033

- Table 36: South America E-Commerce Apparel Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 37: South America E-Commerce Apparel Market Revenue million Forecast, by Geography 2020 & 2033

- Table 38: South America E-Commerce Apparel Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: South America E-Commerce Apparel Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: South America E-Commerce Apparel Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America E-Commerce Apparel Market ?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the South America E-Commerce Apparel Market ?

Key companies in the market include Adidas AG, Valentino Fashion Group S p A, Industria de Diseño Textil S A (INDITEX), Levi Strauss & Co, PVH Corp, Puma SE, LVMH Moët Hennessy Louis Vuitton, Salvatore Ferragamo S p A *List Not Exhaustive, Nike Inc, H & M Hennes & Mauritz AB.

3. What are the main segments of the South America E-Commerce Apparel Market ?

The market segments include Product Type, End User, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7824.99 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Influence of Social Media and Aggressive Marketing; Growing Popularity of Athleisure Apparel Across E-commerce Channels.

6. What are the notable trends driving market growth?

Increased Influence of Social Media and Aggressive Marketing.

7. Are there any restraints impacting market growth?

Competition From Brick-and-Mortar Retail Channel.

8. Can you provide examples of recent developments in the market?

February 2023: PVH Corp announced the launch of the Calvin Klein affiliate program, a popular e-commerce affiliate program. The company offers e-retailers across Brazil an offer to join the Calvin Klein Affiliate Marketing Campaign and claims that on joining the program, the visitors of the e-commerce sites have access to online stores in Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America E-Commerce Apparel Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America E-Commerce Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America E-Commerce Apparel Market ?

To stay informed about further developments, trends, and reports in the South America E-Commerce Apparel Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence